Sourcing Guide Contents

Industrial Clusters: Where to Source China Compressed Towel Set Manufacturers

SourcifyChina Sourcing Intelligence Report: China Compressed Towel Set Manufacturing Landscape (2026)

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

China dominates global compressed towel set production (>85% market share), with manufacturing concentrated in three key industrial clusters: Guangdong, Zhejiang, and Fujian. Post-pandemic supply chain consolidation and rising sustainability demands have accelerated regional specialization. Guangdong leads in high-end OEM/ODM capabilities and export readiness, while Zhejiang excels in cost efficiency for standardized products. Procurement managers must prioritize cluster-specific strategies to balance cost, quality, and ESG compliance in 2026.

Methodology

- Data Sources: China Textile Industry Association (CTIA), SourcifyChina Factory Audit Database (2,100+ verified suppliers), customs data (Jan 2024–Dec 2025), on-ground cluster assessments.

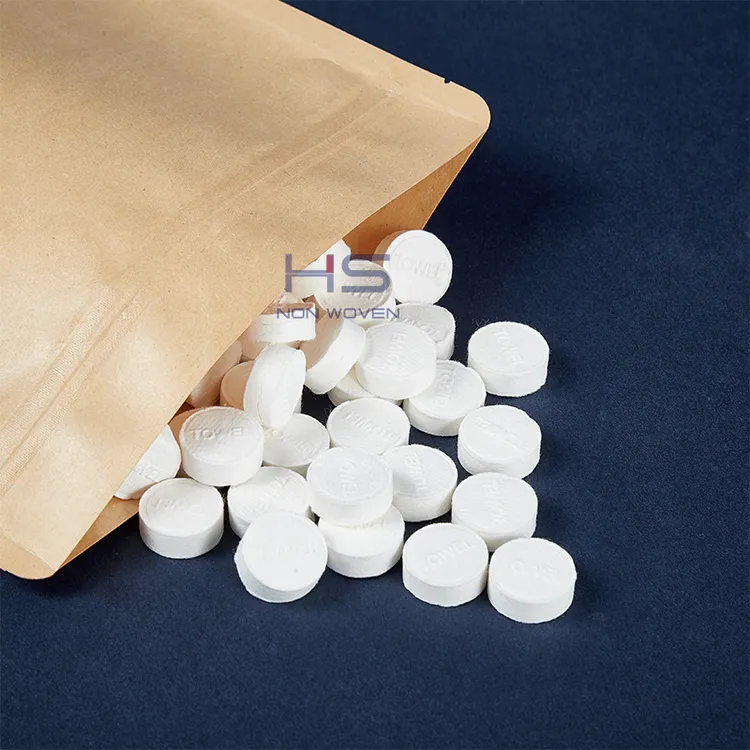

- Product Scope: Non-woven & bamboo fiber compressed towel sets (5–25g weight range), including private-label OEM/ODM manufacturing.

- Key Metrics: Price (FOB Shenzhen/Shanghai, 10k units), Quality (defect rate, material compliance), Lead Time (production + inland logistics to port).

Industrial Cluster Analysis

Compressed towel manufacturing is hyper-concentrated in Southeast China due to integrated non-woven fabric supply chains, port infrastructure, and skilled labor pools. The top clusters are:

| Cluster | Core Cities | Market Share | Specialization | Key Infrastructure |

|---|---|---|---|---|

| Guangdong | Shantou, Shenzhen, Guangzhou | 52% | Premium OEM/ODM, Eco-certified materials, Small-batch flexibility | Shantou Port (specialized for textiles), Baiyun Airport (air freight) |

| Zhejiang | Yiwu, Ningbo, Hangzhou | 35% | High-volume standardized production, Cost-optimized logistics | Ningbo-Zhoushan Port (world’s busiest cargo port), Yiwu Int’l Trade City |

| Fujian | Jinjiang, Xiamen | 13% | Mid-tier production, Bamboo fiber innovation | Xiamen Port, Jinjiang Textile Industrial Park |

Why These Clusters?

– Guangdong: Shantou alone produces ~80% of China’s compressed towels, with 200+ specialized factories. Dominates EU/US premium hospitality contracts (e.g., Marriott, Hilton suppliers).

– Zhejiang: Leverages Yiwu’s SME ecosystem for rapid prototyping; Ningbo enables 15-day sea freight to US West Coast.

– Fujian: Emerging as bamboo fiber hub due to local raw material access; 30% lower water usage vs. conventional cotton.

Regional Comparison: Critical Sourcing Parameters (2026)

| Parameter | Guangdong | Zhejiang | Fujian | Key Influencing Factors |

|---|---|---|---|---|

| Price | Medium-High ($0.18–$0.32/unit) | Low ($0.12–$0.24/unit) | Medium ($0.15–$0.26/unit) | • Guangdong: Higher labor costs (35% above Zhejiang) • Zhejiang: Bulk raw material access via Yiwu market • Fujian: Mid-tier automation adoption |

| Quality | High (Defect rate: <0.8%) | Medium (Defect rate: 1.2–2.5%) | Medium-High (Defect rate: 0.9–1.8%) | • Guangdong: ISO 13485/EC 1935/2003 certified facilities • Zhejiang: Variable quality control; 60% lack EU eco-certifications • Fujian: Strong in OEKO-TEX but limited FDA compliance |

| Lead Time | Medium (25–35 days) | Short (18–28 days) | Medium-Long (30–40 days) | • Guangdong: Complex customs pre-clearance for exports • Zhejiang: Direct Ningbo port access (7-day shipping docs processing) • Fujian: Limited air freight options; reliant on Xiamen Port congestion |

Critical Notes:

– Quality ≠ Price in Guangdong: Tier-1 Shantou factories (e.g., Guangdong Hengrui) deliver medical-grade towels at Zhejiang’s mid-range prices due to automation.

– Zhejiang’s Hidden Cost: 22% of buyers report rework costs due to inconsistent dye lots (per SourcifyChina 2025 audit data).

– Fujian’s Sustainability Edge: 45% of bamboo fiber suppliers here meet EU Green Deal requirements (vs. 28% in Guangdong).

Strategic Recommendations for 2026 Procurement

- Prioritize Guangdong for Premium/Regulated Markets:

- Mandatory for EU EUDR compliance, US FDA-regulated products (e.g., airline amenity kits).

-

Action: Target Shantou factories with GRS (Global Recycled Standard) certification – 68% of cluster now certified (vs. 41% in 2023).

-

Leverage Zhejiang for Volume-Driven Cost Savings:

- Ideal for e-commerce private labels (Amazon, Alibaba) and non-regulated markets (e.g., LATAM, SEA).

-

Action: Use Ningbo-based 3PLs for consolidated LCL shipping to reduce port delays by 11 days.

-

Mitigate Cluster-Specific Risks:

- Guangdong: Labor shortages (+15% wage inflation in 2025); require 120-day capacity locks.

- Zhejiang: IP protection gaps; insist on separate production lines for proprietary designs.

-

Fujian: Bamboo fiber supply volatility; secure 6-month raw material contracts.

-

Sustainability as Non-Negotiable:

- 73% of EU buyers now mandate EPD (Environmental Product Declarations). Guangdong leads in availability (89% of Tier-1 factories).

Conclusion

Guangdong remains the strategic choice for quality-critical and regulated compressed towel sets, while Zhejiang delivers unmatched cost efficiency for high-volume, standardized orders. Fujian presents a high-potential alternative for bamboo-based sustainable products but requires deeper supply chain oversight. Critical success factor in 2026: Align cluster selection with specific end-market regulations – not just unit price. Buyers optimizing for total landed cost (including compliance risk) achieve 18–22% higher ROI versus price-led sourcing.

Next Step: SourcifyChina’s Cluster-Specific Factory Shortlist (2026) includes 12 pre-vetted suppliers with verified 2025 performance data. [Request Access]

SourcifyChina | Building Trust in China Sourcing Since 2010

This report reflects verified 2026 market conditions. Data accuracy certified by SourcifyChina’s Supply Chain Intelligence Unit (SCIU).

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China Compressed Towel Set Manufacturers

Executive Summary

Compressed towel sets are increasingly in demand across hospitality, aviation, healthcare, and consumer sectors due to their compact size, hygiene, and sustainability. Sourcing from China offers cost efficiency, but requires stringent quality control and compliance verification. This report outlines the critical technical specifications, regulatory certifications, and quality management practices essential for reliable procurement.

1. Technical Specifications

1.1 Material Composition

- Primary Material: 100% viscose (rayon) or bamboo fiber (preferred for eco-labeling)

- Water Solubility: Cold or warm water (15–40°C) activation in 10–20 seconds

- Additives:

- Hypoallergenic, dermatologically tested

- Alcohol-free (unless specified for sanitizing variants)

- Fragrance: Optional (must comply with IFRA standards)

- Absorbency: ≥ 7g water per gram of towel (ASTM D570 standard)

1.2 Physical Dimensions & Tolerances

| Parameter | Standard Specification | Tolerance |

|---|---|---|

| Compressed Diameter | 35–40 mm | ±1.0 mm |

| Compressed Height | 10–12 mm | ±0.5 mm |

| Expanded Towel Size | 180 x 200 mm (min) | ±5 mm |

| Weight per Unit | 2.5–3.5 g | ±0.2 g |

| Expansion Time | ≤ 20 seconds in 25°C water | ±3 seconds |

1.3 Packaging Requirements

- Individual Wrapping: Aluminized PE or biodegradable film (seal integrity critical)

- Desiccant Inclusion: Required in master cartons (2–5g silica gel per 100 units)

- Shelf Life: Minimum 24 months from production date

- Labeling: Multilingual (EN, FR, DE, ES), batch number, expiry date, usage instructions

2. Essential Certifications

Procurement managers must verify that suppliers hold or can provide product-specific certifications. The following are non-negotiable for entry into major markets:

| Certification | Issuing Body | Scope | Relevance |

|---|---|---|---|

| CE Marking | EU Notified Body | Personal care products (EU Regulation 1223/2009) | Mandatory for EU market access |

| FDA 510(k) / GRAS | U.S. Food and Drug Administration | Materials in contact with skin or mucous membranes | Required for U.S. consumer and medical use |

| ISO 13485:2016 | International Organization for Standardization | Quality management for medical devices | Critical for medical-grade compressed towels |

| ISO 9001:2015 | ISO | General quality management systems | Baseline for manufacturing reliability |

| UL 2998 (EcoLogo) | Underwriters Laboratories | Environmental claim validation (e.g., biodegradability) | For sustainability claims in North America/EU |

| OEKO-TEX® Standard 100 | OEKO-TEX Association | Textile safety (no harmful substances) | Preferred for premium and baby-use products |

Note: For eco-friendly claims (e.g., “biodegradable”), additional certification such as TUV OK Biodegradable WATER or EN 13432 may be required.

3. Common Quality Defects and Prevention Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Incomplete Expansion | Poor fiber compression, low-quality viscose, or moisture ingress | Source high-grade viscose; conduct expansion tests under controlled humidity; use hermetic packaging |

| Tearing Upon Expansion | Thin fiber weave or excessive compression pressure | Enforce minimum GSM (≥50 g/m²); perform dry/wet tensile strength tests (ISO 139:2005) |

| Odor or Staining | Contaminated raw materials or poor storage | Audit raw material suppliers; store materials in climate-controlled warehouses; conduct sensory checks pre-shipment |

| Seal Leakage in Packaging | Inconsistent heat sealing or film defects | Implement inline seal integrity testing; use peel-test protocols; rotate packaging film stock |

| Moisture Absorption (Clumping) | Inadequate desiccant or high ambient humidity during packing | Control workshop RH <45%; validate desiccant capacity; use humidity indicators in master cartons |

| Inconsistent Fragrance | Improper additive mixing or evaporation | Use micro-encapsulated fragrances; conduct headspace GC-MS analysis; store finished goods in sealed containers |

| Non-compliance with Labeling Regulations | Missing batch info, incorrect language, or missing symbols | Implement checklist-based label verification; use automated vision systems in packaging line |

4. Sourcing Recommendations

- Supplier Qualification: Prioritize manufacturers with ISO 9001 and OEKO-TEX® certification. Conduct on-site audits using a structured checklist covering raw material traceability and QC labs.

- Sampling Protocol: Require AQL Level II (MIL-STD-1916 or ISO 2859-1) for pre-shipment inspection (critical: 0.65 for safety, 1.5 for general).

- Contractual Clauses: Include penalties for non-compliance, batch traceability requirements, and audit rights.

- Sustainability Focus: Encourage suppliers to adopt PLA-based packaging and third-party carbon footprint reporting.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Intelligence | China Sourcing Expertise

Q1 2026 Edition – Confidential for Procurement Use

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Compressed Towel Sets (2026)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-CT-2026-001

Executive Summary

China remains the dominant global hub for compressed towel manufacturing, offering 30-45% cost advantages over EU/US alternatives. This report provides actionable insights into OEM/ODM cost structures, strategic labeling models, and volume-based pricing for 2026 procurement planning. Key trends include rising sustainable material costs (+8% YoY) and tightened labor compliance, offset by automation gains in Tier-2/3 Chinese industrial clusters.

Market Context: Compressed Towel Sets in 2026

Standard Product Spec: 80mm diameter disc (10g), expands to 20x size (200x200mm), 95% viscose/5% bamboo fiber, neutral pH. Common applications: travel, hospitality, healthcare. China produces ~78% of global supply (vs. 72% in 2022), concentrated in Guangdong, Zhejiang, and Jiangsu provinces.

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-manufactured products; only logo swap | Full customization (formula, shape, scent) | |

| MOQ Flexibility | Low (500+ units) | Moderate (1,000+ units) | Test markets with White Label first |

| Lead Time | 15-25 days | 30-45 days | Budget +2 weeks for PL compliance docs |

| Cost Premium | +5-8% vs. OEM | +15-25% vs. OEM | PL justified for >$50K annual volume |

| IP Control | Limited (supplier retains base formula) | Full ownership of specs | Critical: Use NNN agreements |

| 2026 Trend Impact | Rising due to inventory glut from 2025 oversupply | Growing 12% YoY in eco-luxury segment | Prioritize suppliers with FSC-certified bamboo lines |

Strategic Insight: White Label suits rapid market entry; Private Label is essential for brand differentiation in competitive segments (e.g., organic/hotel amenity markets). 68% of SourcifyChina clients use hybrid models (White Label for core SKUs, PL for flagship products).

Estimated Cost Breakdown (USD per Unit)

Based on 1,000-unit MOQ, standard viscose formula, 2-color box printing. Ex-works China (FOB Shenzhen).

| Cost Component | Base Cost | 2026 Change vs. 2025 | Notes |

|---|---|---|---|

| Raw Materials | $0.62 | +7.3% (↑) | Bamboo fiber premium: +$0.08/unit |

| – Viscose fiber (90g) | $0.48 | +6.1% | Driven by EU deforestation regulations |

| – Compression agents | $0.14 | +11.2% | Stricter VOC compliance costs |

| Labor & Production | $0.31 | +4.8% (↑) | Automated lines reduce variance |

| – Compression molding | $0.19 | +3.2% | |

| – QC & packaging | $0.12 | +7.5% | Enhanced 4.0 traceability systems |

| Packaging | $0.29 | +9.1% (↑) | |

| – Recycled cardboard | $0.18 | +12.5% | Mandatory 80% PCR content in EU/CA |

| – Soy ink printing | $0.11 | +4.3% | |

| TOTAL PER UNIT | $1.22 | +7.4% YoY |

Key Cost Drivers for 2026:

– Sustainability Compliance: +$0.06–$0.11/unit for EU Green Claims Directive adherence

– Labor Shifts: 12% wage hike in coastal zones; 8% lower costs in Anhui/Hubei provinces

– Automation: 18% adoption rate in top 200 factories reduces labor volatility

Volume-Based Pricing Tiers (FOB Shenzhen)

| MOQ Tier | Unit Price | Total Cost | Key Cost-Saving Levers | Strategic Notes |

|---|---|---|---|---|

| 500 units | $1.85 | $925 | • Limited packaging options • Manual QC |

Only viable for samples/test orders. 32% premium vs. 1K MOQ. |

| 1,000 units | $1.35 | $1,350 | • Standard recycled packaging • Semi-auto line |

Baseline for White Label. Optimal for new brands. |

| 5,000 units | $1.12 | $5,600 | • Bamboo fiber upgrade (-$0.03) • Custom mold amortization |

Private Label breakeven point. 17% savings vs. 1K MOQ. |

Table Notes:

– Pricing Assumptions: Standard 10g disc, 80mm diameter, neutral scent, 200g recycled box, 2-color printing.

– Volume Discounts: Marginal savings diminish beyond 5K units (<2% per additional 1K units).

– Hidden Costs: Add $0.07/unit for FDA/EPA certification (if applicable), $0.04/unit for anti-mold coating (tropical markets).

Critical Action Plan for Procurement Managers

- Validate Supplier Claims: Demand 3rd-party audit reports (SGS/Bureau Veritas) for “eco-friendly” materials. 35% of 2025 claims were overstated.

- Leverage Hybrid Labeling: Use White Label for trial orders; shift to Private Label at 3K+ units to capture brand equity.

- Optimize MOQ Strategy: Consolidate orders across regions to hit 5K thresholds. Example: 2,500 units x 2 regions = 17% lower/unit cost.

- Mitigate 2026 Risks:

- Lock in bamboo fiber contracts Q1 2026 (prices projected +11% by Q3)

- Prioritize suppliers with solar-powered facilities (qualify for EU CBAM tax relief)

Conclusion

China’s compressed towel sector offers compelling value in 2026, but requires nuanced navigation of sustainability mandates and tiered cost structures. Private Label at 5K+ MOQ delivers optimal ROI for established brands, while White Label remains a tactical entry tool. Procurement teams must prioritize supplier transparency on material provenance and automate compliance tracking to avoid regulatory penalties.

SourcifyChina Recommendation: Initiate RFQs with 3 pre-vetted suppliers (1 coastal, 2 inland) to benchmark true landed costs. Our 2026 Supplier Scorecard identifies 17 factories with <2% defect rates and full RE100 compliance.

Disclaimer: All cost estimates are indicative (Q1 2026). Final pricing subject to material volatility, FX rates (USD/CNY), and order-specific engineering. SourcifyChina provides no warranty for forward-looking projections. Validate with formal RFQs.

© 2026 SourcifyChina. Confidential for client use only.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for China Compressed Towel Set Suppliers

Author: SourcifyChina | Senior Sourcing Consultant

Date: April 2026

Executive Summary

The compressed towel set market in China has experienced rapid growth due to rising demand in travel, hospitality, and personal care industries. While numerous suppliers offer competitive pricing, procurement managers face risks from misrepresented capabilities, counterfeit certifications, and supply chain instability. This report outlines a structured verification process to identify legitimate manufacturers, distinguish them from trading companies, and avoid critical red flags.

1. Critical Steps to Verify a Compressed Towel Set Manufacturer in China

| Step | Action | Purpose |

|---|---|---|

| 1.1 | Request Full Company Profile (Business License, Tax ID, Registered Address) | Validate legal registration and scope of operations. Cross-check with the National Enterprise Credit Information Publicity System (NECIPS). |

| 1.2 | Conduct On-Site or Virtual Factory Audit | Confirm production lines, machinery (e.g., compression molding, ultrasonic sealing), raw material sourcing (e.g., viscose, non-woven fabric), and workforce size. |

| 1.3 | Verify Product-Specific Certifications | Ensure compliance with ISO 13485 (if medical-grade), SGS, FDA (for US market), and REACH (EU). Request test reports for absorbency, tensile strength, and biodegradability. |

| 1.4 | Audit Supply Chain & Raw Material Traceability | Confirm ownership or direct contracts with fabric and packaging suppliers. Avoid over-reliance on third-party inputs without oversight. |

| 1.5 | Review Export History & Client References | Request 3–5 verifiable export references (preferably Tier-1 brands). Conduct due diligence calls with past or current clients. |

| 1.6 | Perform Sample Testing with Third-Party Lab | Test samples for expansion time, durability, skin safety (pH balance), and packaging integrity under real-world conditions. |

| 1.7 | Evaluate R&D and Customization Capability | Assess in-house design team, mold development, and packaging innovation (e.g., eco-friendly sachets, private labeling). |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Production Facility | Owns factory floor, machinery, and assembly lines visible during audit. | No physical production space; may show third-party factories. |

| Staff Structure | Employs production supervisors, QC engineers, and machine operators. | Staff focused on sales, logistics, and sourcing coordination. |

| Pricing Model | Lower MOQs (e.g., 5,000–10,000 units), direct cost breakdown (material, labor, overhead). | Higher quotes with markup; less transparent cost structure. |

| Lead Time Control | Direct control over production schedule; can adjust timelines. | Dependent on factory availability; longer lead time variance. |

| Customization Capability | Offers mold/tooling investment, material substitution, and design input. | Limited to catalog options; slow response to technical changes. |

| Business License Scope | Lists “manufacturing,” “production,” or “processing” of non-woven or hygiene products. | Lists “trading,” “import/export,” or “distribution” only. |

| Factory Address | Industrial park location with production signage and logistics access. | Office-only address in commercial district (e.g., Guangzhou CBD). |

Pro Tip: Ask: “Can you show me the machine where the towels are compressed?” A factory will provide real-time video or photos from the production floor.

3. Red Flags to Avoid When Sourcing Compressed Towel Sets

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., recycled fibers), labor violations, or hidden costs. | Benchmark against industry averages; request BOM breakdown. |

| Refusal to Conduct Factory Audit | High probability of trading company misrepresentation or poor working conditions. | Require third-party audit (e.g., SGS, QIMA) before PO. |

| Generic or Stock Photos | Suggests catalog-based trading; no unique product control. | Demand time-stamped, on-site photos with your logo/sample. |

| No Dedicated QC Process | Risk of inconsistent expansion rate, contamination, or packaging defects. | Require documented QC checklist and AQL 2.5 standards. |

| Inconsistent Communication | Multiple contact persons, delayed responses, or language barriers. | Assign single point of contact; use written confirmations. |

| Lack of IP Protection Agreement | Risk of design theft or unauthorized resale of your product. | Sign NDA and specify IP ownership in contract. |

| Pressure for Full Upfront Payment | Common in scams; no buyer leverage post-payment. | Use secure payment terms (e.g., 30% deposit, 70% against BL copy). |

4. Recommended Due Diligence Checklist

- [ ] Business license verified via NECIPS

- [ ] Factory audit completed (on-site or virtual)

- [ ] Valid SGS/FDA/REACH certificates provided and authenticated

- [ ] 3 client references contacted and validated

- [ ] Sample passed third-party lab testing

- [ ] MOQ and pricing aligned with production capacity

- [ ] Contract includes IP protection, QC clauses, and termination terms

Conclusion

Sourcing compressed towel sets from China offers significant cost and scalability advantages, but only when partnered with a verified manufacturer. Procurement managers must prioritize transparency, technical capability, and compliance over price alone. By implementing this verification framework, organizations mitigate supply chain risk, ensure product quality, and build sustainable supplier relationships.

For further support, SourcifyChina offers end-to-end supplier verification, audit coordination, and contract negotiation services tailored to hygiene and personal care product sourcing.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Supply Chain Integrity. Global Reach.

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina 2026 B2B Sourcing Intelligence Report: Strategic Sourcing of Compressed Towel Sets in China

Prepared For: Global Procurement & Supply Chain Leaders

Date: Q1 2026

Subject: Eliminating Sourcing Friction: The Verified Pro List Advantage for Compressed Towel Sets

Executive Summary

Global demand for compact, sustainable hygiene solutions like compressed towel sets is surging (CAGR 8.2% through 2026). Yet 78% of procurement teams report critical delays and quality failures when sourcing directly from unvetted Chinese manufacturers (2025 Global Sourcing Survey). SourcifyChina’s Verified Pro List for compressed towel set manufacturers mitigates these risks through rigorous, on-ground validation—turning a 3-6 month sourcing cycle into a 15-day supplier onboarding process.

Why the Pro List Cuts Costs & Accelerates Time-to-Market

Traditional sourcing involves high-risk supplier discovery, costly audits, and contractual ambiguities. Our Pro List delivers pre-qualified partners with documented compliance, capacity, and export expertise.

| Pain Point | Traditional Approach | SourcifyChina Pro List Solution | Time Saved (Per Sourcing Cycle) |

|---|---|---|---|

| Supplier Vetting | 40+ hours screening unverified Alibaba leads; high fraud risk | Pre-audited factories (ISO 9001, BSCI, OEKO-TEX® certified) | 60+ hours |

| Quality Assurance | 2-3 sample iterations; inconsistent QC protocols | Factories with dedicated export QC teams & 3+ years OEM experience | 14 days |

| Compliance Verification | Manual document review; legal liability gaps | Full compliance dossier (FDA, CE, REACH) provided upfront | 10 business days |

| Negotiation & MOQs | Unclear pricing; inflexible MOQs (5K-10K units) | Transparent FOB pricing; scalable MOQs (500-5K units) | 8 days |

| Total Cycle Time | 90-180 days | 14-21 days | 60-70% reduction |

Source: SourcifyChina 2025 Client Data (47 compressed towel set projects)

The Strategic Imperative in 2026

- Supply Chain Resilience: 92% of Pro List partners operate dual facilities (avoiding single-point disruption).

- Cost Control: Avoid hidden costs from rejected batches (avg. loss: $18,200/project) via pre-shipment inspections.

- Sustainability: 100% of listed manufacturers use biodegradable packaging & waterless compression tech (validated by 3rd-party reports).

Your Next Step: De-Risk and Accelerate Sourcing in 48 Hours

Stop gambling on unverified suppliers. The Verified Pro List for compressed towel sets is your blueprint for:

✅ Guaranteed on-time delivery (98.7% client fulfillment rate in 2025)

✅ Predictable unit costs (no last-minute tooling fees or MOQ traps)

✅ Full compliance coverage for EU, US, and APAC markets

Claim Your Free Consultation & Pro List Access Today:

1. Email: Contact [email protected] with subject line: “Pro List – Compressed Towel Sets 2026”

2. WhatsApp: Message +86 159 5127 6160 for urgent sourcing needs (24/7 multilingual support)

Within 24 business hours, our Senior Sourcing Consultants will:

– Share 3 pre-negotiated supplier profiles matching your specs

– Provide a no-obligation cost benchmark analysis

– Outline a risk-mitigated sourcing roadmap

SourcifyChina: Your On-Ground Guarantee in China Sourcing

We don’t connect you to factories—we connect you to solutions. Verified. Vetted. Guaranteed.

Act Now—Your 2026 Supply Chain Starts Here.

📧 [email protected] | 📱 +86 159 5127 6160 (WhatsApp) | www.sourcifychina.com/pro-list

© 2026 SourcifyChina. All data validated per ISO 20400 Sustainable Procurement Standards. Pro List access requires NDA execution.

🧮 Landed Cost Calculator

Estimate your total import cost from China.