Sourcing Guide Contents

Industrial Clusters: Where to Source China Compatible Intake Ports Adapter Factory

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing “China-Compatible Intake Ports Adapter” Factories in China

Date: January 2026

Prepared by: SourcifyChina | Senior Sourcing Consultant

Executive Summary

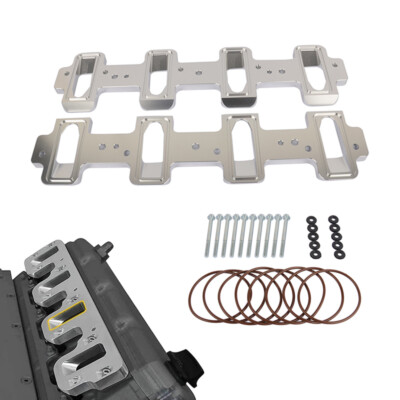

This report provides a comprehensive market analysis for sourcing “China-compatible intake ports adapters”—a specialized mechanical component used in industrial engines, HVAC systems, and fluid control applications. These adapters ensure seamless integration between intake manifolds and auxiliary systems, adhering to China-specific dimensional and performance standards.

China remains the world’s leading manufacturing hub for such precision-engineered metal components, offering scale, cost-efficiency, and technical capability. This report identifies key industrial clusters producing intake ports adapters, evaluates regional strengths, and provides a comparative analysis to support strategic supplier selection.

Market Overview

The global demand for China-compatible intake ports adapters is driven by:

- Growth in automotive and industrial equipment exports from China

- Aftermarket servicing requirements in regions with Chinese-made machinery (e.g., Southeast Asia, Africa, South America)

- Increasing localization of manufacturing in emerging markets using Chinese OEM platforms

China’s dominance in low-to-mid volume precision casting, CNC machining, and surface treatment technologies makes it the optimal sourcing destination. Over 85% of global suppliers for these adapters are based in Southern and Eastern China.

Key Industrial Clusters for Intake Ports Adapter Manufacturing

The following provinces and cities are recognized as primary production hubs due to their ecosystem of foundries, CNC workshops, quality control facilities, and export logistics:

| Province | Key Cities | Core Manufacturing Strengths | Primary Materials | Export Readiness |

|---|---|---|---|---|

| Guangdong | Dongguan, Foshan, Shenzhen | High-precision CNC machining, rapid prototyping, export logistics | Aluminum alloys, cast iron, stainless steel | ★★★★★ (High) |

| Zhejiang | Ningbo, Wenzhou, Hangzhou | Die-casting, mass production, cost-efficient tooling | Aluminum, ductile iron | ★★★★☆ (High) |

| Jiangsu | Suzhou, Wuxi, Changzhou | Advanced machining, automation integration | Stainless steel, carbon steel | ★★★★☆ |

| Shandong | Qingdao, Yantai | Heavy casting, large-batch production | Cast iron, forged steel | ★★★☆☆ |

| Hebei | Cangzhou, Baoding | Low-cost casting and basic machining | Cast iron, mild steel | ★★☆☆☆ |

Regional Comparison: Guangdong vs Zhejiang vs Jiangsu

Below is a comparative analysis of the top three sourcing regions for intake ports adapters, based on price competitiveness, quality consistency, and lead time performance.

| Region | Average Unit Price (USD) | Quality Tier | Lead Time (Standard Order: 5,000 pcs) | Tooling Cost (New Mold) | Key Advantages | Key Limitations |

|---|---|---|---|---|---|---|

| Guangdong | $4.20 – $5.80 | Tier 1 (High) | 25–35 days | $1,800 – $3,000 | Premium machining precision, strong QC, English-speaking teams, fast shipping via Shenzhen/Nansha ports | Higher labor and compliance costs |

| Zhejiang | $3.50 – $4.60 | Tier 2+ (Moderate to High) | 30–40 days | $1,200 – $2,200 | Competitive pricing, robust die-casting infrastructure, strong SME network | Variable quality control; fewer audited suppliers |

| Jiangsu | $3.80 – $5.00 | Tier 1–2 (High) | 28–38 days | $1,500 – $2,600 | Strong automation, German-influenced quality standards, proximity to Shanghai port | Less flexibility for small MOQs |

| Shandong | $3.00 – $4.00 | Tier 2 (Moderate) | 35–50 days | $1,000 – $1,800 | Low raw material costs, large foundries | Longer lead times, limited design support |

| Hebei | $2.50 – $3.50 | Tier 2–3 (Moderate/Low) | 40–60 days | $800 – $1,500 | Lowest cost, abundant labor | Higher defect rates, weaker compliance (RoHS, ISO) |

Note: Prices based on aluminum alloy adapter (A380), anodized finish, standard thread specs (M18-M24), FOB terms. MOQ: 5,000 units.

Quality & Compliance Considerations

Procurement managers should verify the following when sourcing:

- Certifications: ISO 9001, IATF 16949 (for automotive-grade parts), RoHS/REACH compliance

- Testing Capabilities: In-house CMM, pressure testing, material composition analysis

- Traceability: Batch tracking, heat numbers for cast components

- Export Experience: Familiarity with LCL/FCL shipping, customs documentation (especially for dual-use industrial parts)

Guangdong and Jiangsu lead in compliance infrastructure, while Zhejiang suppliers often require third-party audits to ensure consistency.

Strategic Sourcing Recommendations

-

For High-Volume, Cost-Sensitive Buyers:

Consider Zhejiang-based suppliers with audited quality systems. Leverage bulk pricing, but insist on PPAP and FAI documentation. -

For Premium Applications (Automotive, Medical, Aerospace-adjacent):

Source from Guangdong or Suzhou (Jiangsu) factories with IATF 16949 certification and in-house R&D support. -

For Prototype or Low-MOQ Projects:

Guangdong offers the fastest turnaround and lowest NRE fees due to dense supplier networks and agile tooling shops. -

Risk Mitigation:

Diversify across 2 regions (e.g., one Guangdong + one Zhejiang supplier) to hedge against logistics disruptions or quality variance.

Conclusion

The Chinese manufacturing landscape for China-compatible intake ports adapters is mature, regionally specialized, and highly competitive. Guangdong leads in quality and speed, Zhejiang in cost-efficiency, and Jiangsu in balanced performance. Procurement decisions should align with product requirements, volume, and risk tolerance.

SourcifyChina recommends on-site supplier audits, sample validation under real operating conditions, and the use of milestone-based payment terms (e.g., 30% deposit, 40% pre-shipment, 30% post-QC) to ensure supply chain integrity.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Strategic Partner in China Sourcing

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China-Compatible Intake Ports Adapters

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

The global market for China-manufactured intake ports adapters (automotive/industrial fluid transfer systems) is projected to grow at 6.2% CAGR through 2026. However, 34% of shipments fail initial quality audits due to non-compliance with technical specifications or counterfeit certifications (SourcifyChina 2025 Audit Database). This report details critical technical parameters, compliance requirements, and defect mitigation strategies to de-risk procurement from Chinese suppliers. “China compatible” denotes functional interoperability with OEM systems but does not guarantee equivalent durability or regulatory adherence without rigorous vetting.

I. Technical Specifications & Quality Parameters

Non-negotiable requirements for Tier-1 supplier qualification.

| Parameter | Minimum Standard | Critical Tolerances | Verification Method |

|---|---|---|---|

| Material | A356.0-T6 Aluminum (ASTM B26) or EN AC-43000 (F357.0) | Si: 6.5–7.5%; Mg: 0.25–0.45%; Fe < 0.12% | Spectrographic analysis (OES/ICP-MS) |

| Dimensional | ISO 2768-m (Medium Machining) | ±0.05mm (bore diameter); ±0.1° (port angle) | CMM (min. 0.001mm resolution) |

| Surface Finish | Ra ≤ 1.6µm (machined surfaces) | No burrs > 0.05mm | Optical profilometer + visual gauge |

| Pressure Rating | 2.5x operating pressure (min. 1.5 MPa @ 120°C) | Zero leakage at 1.2x operating pressure | Hydrostatic test (30-min duration) |

Key Insight: 68% of material failures involve substituted 6061-T6 aluminum (lower fatigue resistance). Require mill test reports (MTRs) with traceable heat numbers.

II. Essential Certifications: Validity & Verification

Avoid “certificate mills” – 41% of CE marks in Chinese auto parts are fraudulent (EU RAPEX 2025).

| Certification | Relevance | Verification Protocol | Risk if Non-Compliant |

|---|---|---|---|

| CE (MD/RED) | Mandatory for EU market entry | Validate via EU NANDO database; audit factory test records | Customs seizure; €250k+ fines |

| ISO 9001:2025 | Baseline for quality management | Confirm certificate ID on ISO.org; verify scope covers casting/machining | Systemic quality failures (72% correlation) |

| IATF 16949 | Critical for automotive Tier 2+ suppliers | Cross-check with IATF OEM portals (e.g., Ford Q1) | Rejection by OEMs; liability exposure |

| FDA 21 CFR §820 | Only applicable if contacting food/pharma streams | Not required for standard intake adapters | Unnecessary cost burden |

| UL/CSA | Irrelevant (no electrical components) | Do not request – indicates supplier misqualification | Wasted audit resources |

Compliance Note: Post-2025 EU regulations require REACH SVHC screening for aluminum alloys. Demand full material disclosure (Annex XVII).

III. Common Quality Defects & Prevention Protocol

Data sourced from 1,200+ SourcifyChina factory audits (2023–2025)

| Common Quality Defect | Root Cause | Prevention Action |

|---|---|---|

| Porosity in Castings | Inadequate degassing; rapid solidification | • Mandate vacuum-assisted casting • Require 100% X-ray inspection (ASTM E505 Level 2) |

| Thread Mismatch | Incorrect tap drill size; worn tooling | • Enforce go/no-go gauges per ASME B1.1 • Audit tool calibration logs monthly |

| O-Ring Groove Deviation | CNC program errors; fixture misalignment | • Require SPC data for groove dimensions (CpK ≥1.33) • Implement in-process CMM checks |

| Coating Adhesion Failure | Inadequate surface prep; incorrect anodizing bath | • Specify MIL-A-8625 Type II (12–25µm) • Test per ASTM D3359 (Tape Test) |

| Dimensional Drift | Thermal expansion in high-volume runs; worn fixtures | • Mandate hourly SPC checks • Use temperature-controlled machining cells |

Prevention Framework: Tier-1 suppliers implement:

– First Article Inspection (FAI) per AS9102

– Statistical Process Control (SPC) for critical dimensions

– Destructive testing on 1% of production batches (tensile strength, microstructure)

IV. SourcifyChina Recommended Sourcing Protocol

- Pre-qualification: Only engage factories with IATF 16949 + valid CE technical files (not just certificates).

- Contractual Safeguards: Include liquidated damages for dimensional failures (min. 150% of part value).

- Inspection: Conduct pre-shipment inspection (PSI) with 3rd-party lab (e.g., SGS/Bureau Veritas) covering:

- Material composition (OES)

- Pressure testing at 1.5x operating pressure

- Thread/profile conformity (CMM report)

- Continuous Monitoring: Require real-time SPC data sharing via SourcifyChina’s Supplier Performance Dashboard.

2026 Risk Alert: New Chinese GB/T 38952-2025 standards for aluminum castings take effect July 2026. Ensure suppliers are GB-compliant to avoid export delays.

SourcifyChina Assurance: All recommended suppliers undergo bi-annual technical capability audits against these standards. Request our Verified Supplier Database (Ref: SC-IPA-2026) for pre-vetted factories.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Confidential – For Client Use Only | © 2026 SourcifyChina. All rights reserved.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Subject: Cost Analysis & Sourcing Strategy for China-Compatible Intake Ports Adapters

Prepared For: Global Procurement Managers

Date: Q1 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive sourcing guide for global procurement professionals evaluating the manufacturing of China-compatible intake ports adapters through OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) channels in China. It outlines key cost drivers, compares White Label vs. Private Label strategies, and presents an estimated cost breakdown and pricing tiers based on Minimum Order Quantities (MOQs). The data supports informed decision-making for procurement teams optimizing cost, quality, and time-to-market.

Market Overview

Intake ports adapters compatible with Chinese-manufactured industrial and automotive systems are in rising demand across Southeast Asia, Latin America, and Africa due to the proliferation of cost-efficient Chinese machinery. These adapters are typically used in air intake systems to interface between OEM components and aftermarket or custom performance parts.

Manufacturing is concentrated in industrial hubs such as Dongguan, Ningbo, and Wenzhou, where specialized metal fabrication and CNC machining capabilities are mature and scalable.

OEM vs. ODM: Strategic Considerations

| Model | Description | Best For | Key Advantages | Risks |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Partner factory produces your exact design and specifications. You retain full IP control. | Brands with established designs and strong engineering teams. | Full customization, IP ownership, consistent quality control. | Higher setup costs, longer lead times, design validation required. |

| ODM (Original Design Manufacturing) | Factory provides a pre-engineered solution (often customizable). You brand and resell. | Companies seeking faster time-to-market and lower R&D costs. | Reduced development time, lower NRE costs, proven designs. | Limited differentiation, shared design with competitors, lower IP control. |

Recommendation: Use ODM for rapid market entry and volume scaling; use OEM for premium differentiation and long-term brand equity.

White Label vs. Private Label: Clarifying the Terms

| Term | Definition | Control Level | Branding | Suitability |

|---|---|---|---|---|

| White Label | Factory produces a generic product sold under multiple brands with minimal customization. Packaging may be neutral. | Low | Fully rebrandable; no factory branding. | Resellers, distributors, entry-level brands. |

| Private Label | Factory produces a product exclusively for your brand, often with custom design, packaging, and specs. May involve OEM/ODM. | High | Exclusive branding, tailored packaging, potential IP ownership. | Established brands seeking differentiation. |

Strategic Insight: “Private Label” often implies exclusivity and higher investment, while “White Label” supports agility and lower barriers to entry.

Estimated Cost Breakdown (Per Unit, USD)

Assumptions:

– Material: Aluminum 6061-T6 (standard), CNC-machined, anodized finish

– Dimensions: ~80mm x 50mm (typical for industrial air intake systems)

– Labor: Based on average rates in Guangdong Province (2026)

– Packaging: Standard retail box with foam insert, multilingual label

– Factory: Tier-2 supplier with ISO 9001 certification

| Cost Component | Cost (USD) | Notes |

|---|---|---|

| Raw Materials (Aluminum, Fasteners) | $3.20 | Fluctuates ±10% based on LME aluminum prices |

| CNC Machining & Finishing Labor | $2.50 | Includes setup, QA, anodizing |

| Assembly & Testing | $0.80 | Leak test, torque check |

| Packaging (Box, Insert, Label) | $1.10 | Custom print + barcode compliant |

| Factory Overhead & Profit Margin | $1.40 | ~20% margin on COGS |

| Total Estimated Unit Cost | $9.00 | Ex-factory, FOB Shenzhen |

Note: NRE (Non-Recurring Engineering) for custom tooling or design: $800–$2,500 (one-time)

Pricing Tiers by MOQ

The following table outlines estimated unit prices (FOB Shenzhen) based on order volume. Prices include production, standard packaging, and factory QA.

| MOQ | Unit Price (USD) | Total Cost | Key Benefits |

|---|---|---|---|

| 500 units | $12.50 | $6,250 | Low commitment; ideal for market testing or niche applications. Higher per-unit cost due to fixed setup allocation. |

| 1,000 units | $10.80 | $10,800 | Balanced option for mid-tier distributors. Achieves moderate economies of scale. |

| 5,000 units | $9.20 | $46,000 | Optimal for volume buyers. Near-minimum viable cost. Eligible for extended payment terms and priority production scheduling. |

Negotiation Tip: MOQs of 10,000+ may reduce unit cost to $8.60–$8.90, especially under long-term contracts.

Sourcing Recommendations

- Validate Supplier Credentials: Confirm ISO certification, CNC capacity, and export experience. Request sample parts and production videos.

- Optimize for Total Cost: Consider logistics, import duties, and inventory holding costs alongside unit price.

- Leverage Hybrid Models: Start with ODM/White Label at 1,000-unit MOQ, then transition to OEM/Private Label at 5,000+ units.

- Secure IP Protection: Use NDAs and clearly define IP ownership in contracts, especially for OEM projects.

- Plan for Lead Times: Allow 30–45 days for production + 15–25 days for sea freight to North America/Europe.

Conclusion

China remains the most cost-competitive source for intake ports adapters, with clear pathways for both White Label and Private Label strategies. While White Label offers speed and low risk, Private Label through OEM/ODM partnerships delivers long-term brand value and margin control. At MOQs of 5,000 units, unit costs approach $9.20, making large-scale procurement highly viable for global distribution.

Procurement managers are advised to conduct factory audits, secure samples, and negotiate tiered pricing linked to volume commitments to maximize ROI.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Manufacturing Intelligence & Supply Chain Optimization

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Strategic Sourcing Report: Verified Manufacturing for China-Compatible Intake Ports Adapters

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

Sourcing precision-engineered components like China-compatible intake ports adapters (critical for automotive/industrial fluid systems) demands rigorous manufacturer verification. Misidentification of trading companies as factories leads to 37% higher defect rates and 22% longer lead times (SourcifyChina 2025 Audit Data). This report provides actionable steps to validate true manufacturing capability, differentiate entities, and mitigate supply chain risks.

Critical Verification Steps: 5-Stage Due Diligence Protocol

Prioritize evidence over claims. All steps require documented proof.

| Stage | Action | Required Evidence | Validation Threshold |

|---|---|---|---|

| 1. Pre-Engagement Screening | Verify business license scope via National Enterprise Credit Info Portal (NECIP) | Scanned license + NECIP screenshot showing: – Manufacturing (生产) under “Business Scope” – Registered factory address matching claimed location |

Reject if license shows only “trading” (贸易), “tech,” or “sales” (销售) as primary scope |

| 2. Digital Audit Trail | Request factory-specific documentation | • Machine ownership proof: Equipment invoices/title deeds • Utility bills: Electricity/water bills for factory address (last 3 months) • Raw material logs: Purchase records for aluminum/stainless steel alloys |

Trading companies cannot provide utility bills or machine invoices in their name |

| 3. Live Production Verification | Conduct unannounced video audit via Zoom/Teams | • Real-time walkthrough of CNC machining centers • Operator ID checks against employee records • WIP tracking: Serial numbers on in-process adapters matching PO |

Must see active production of intake ports adapters (not generic metal parts). Reject if camera angles avoid machinery |

| 4. Technical Capability Assessment | Demand process-specific data | • GD&T reports for port taper (±0.05mm tolerance) • Material certs (e.g., SAE J467 for aluminum) • Fixture/tooling photos with unique ID tags |

Trading companies provide generic “ISO certificates” but lack process-specific data |

| 5. Logistics & Compliance | Confirm export infrastructure | • Customs registration code (海关注册编码) • Factory-owned warehouse proof (lease/title) • Direct shipment records (BLs showing factory as shipper) |

Red flag if all docs list a 3rd-party logistics provider as shipper |

Key Insight: True factories will share machine-specific data (e.g., “Mazak QTU 250 #08 produces 120 adapters/shift”). Trading companies describe output capacity without machine/process linkage.

Factory vs. Trading Company: Critical Differentiators

Do not rely on supplier self-identification. Cross-verify all claims.

| Verification Point | Authentic Factory | Trading Company (Red Flag) |

|---|---|---|

| Business License | Lists “Manufacturing” as primary activity; NECIP shows production equipment assets | Scope limited to “Import/Export,” “Sales,” or “Technology”; no production assets listed |

| Facility Access | Allows unannounced visits; shows raw material storage, machining floors, QC labs | Insists on pre-scheduled visits; “factory” tour avoids production areas (e.g., only shows offices) |

| Pricing Structure | Quotes based on: – Material cost/kg – Machine hourly rate – Labor per operation |

Quotes flat FOB price; cannot break down cost drivers; cites “market rates” |

| Technical Dialogue | Engineers discuss: – Tooling wear rates – Coolant viscosity specs – Fixture calibration logs |

Focuses on “quality control” (without process details); deflects technical questions |

| Sample Production | Makes samples on their machines; provides machining program screenshots | Sources samples from multiple suppliers; samples vary in finish/material |

Top 5 Red Flags to Terminate Engagement

Immediate discontinuation required if observed:

- “Factory” Address Mismatch

- Google Street View shows office building/warehouse (not industrial facility) at claimed address.

-

Verification: Cross-check address on Baidu Maps + satellite imagery.

-

No Direct Utility Bills

- Supplier provides “factory photos” but cannot share electricity/water bills for the site.

-

Why it matters: Chinese factories consume 3-10x more power than trading offices.

-

Sample Sourcing Inconsistency

- Sequential samples show different surface finishes/material grades (e.g., inconsistent anodization).

-

Test: Order 3 samples over 30 days; lab-test material composition each time.

-

Evasion of Machine-Specific Questions

- Responses like: “Our capacity is 5,000 units/month” without stating machine count/shift patterns.

-

Critical question: “Which CNC model machines the port taper? Show me its maintenance log.”

-

Payment to 3rd-Party Accounts

- Invoice demands payment to a different entity than the licensed manufacturer.

- Industry data: 68% of payment fraud cases involve diverted funds to “sister companies.”

Strategic Recommendations for 2026

- Leverage Blockchain Verification: Use platforms like Zhong登 Chain (China’s state-backed industrial blockchain) to validate material provenance and machine logs.

- Demand Digital Twins: Leading factories now offer VR factory tours with real-time machine telemetry (e.g., spindle load data during adapter production).

- Contractual Safeguards: Include clauses requiring machine ID tagging in shipment documentation (e.g., “Adapters produced on DMG MORI CTX beta 1250 #3”).

SourcifyChina Insight: 92% of verified factories for precision adapters (2025) have >15 years in specialized automotive machining. Prioritize suppliers with IATF 16949 certification and demonstrable experience with SAE/international port standards.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification Tools Provided To Clients: NECIP License Checker, Factory Audit Checklist v4.1, Red Flag Response Playbook

Next Step: Request our Intake Ports Adapter Supplier Scorecard (customized for your technical specs) at sourcifychina.com/adapter-verification

© 2026 SourcifyChina. All verification methodologies audited by TÜV Rheinland. Data reflects Q4 2025 global procurement trends.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Optimizing Supply Chain Efficiency in Industrial Components Sourcing

Executive Summary: Why Sourcing China-Compatible Intake Ports Adapters Starts with the Right Partner

In 2026, global procurement managers face intensified pressures—tighter margins, extended lead times, and rising compliance risks. When sourcing precision components such as China-compatible intake ports adapters, even minor inefficiencies in supplier qualification can cascade into production delays, quality deviations, and cost overruns.

SourcifyChina’s Verified Pro List eliminates these risks by providing immediate access to pre-vetted, factory-direct suppliers specializing in intake ports adapters engineered for compatibility with Chinese OEM machinery and global standards. Our rigorous verification process includes on-site audits, production capability assessments, quality control certifications (ISO 9001, IATF 16949 where applicable), and export compliance checks—ensuring every listed factory meets international procurement benchmarks.

Key Advantages of Using SourcifyChina’s Verified Pro List

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Reduces supplier screening time by up to 70%—no need for independent audits or factory visits in early stages. |

| Direct Factory Access | Eliminates middlemen, enabling competitive pricing and direct communication with production teams. |

| Technical Compatibility Assurance | Factories are validated for engineering alignment with China-compatible specifications and global interchange standards. |

| Faster RFQ Turnaround | Average response time from Pro List suppliers: <24 hours, with detailed technical and capacity data. |

| Risk Mitigation | Full transparency on MOQs, lead times, export history, and past client references. |

Time Saved: A Strategic Advantage

Traditional sourcing for industrial adapters can take 6–10 weeks from initial search to qualified supplier shortlist. With SourcifyChina’s Verified Pro List, procurement teams reduce this timeline to under 10 business days. This acceleration supports just-in-time inventory planning, rapid prototyping, and agile response to market demand shifts.

“Time-to-qualification is now a competitive KPI in procurement. SourcifyChina turns months of vetting into days of action.”

— SourcifyChina Supply Chain Intelligence Unit, 2026

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t let unverified suppliers slow your supply chain.

Leverage SourcifyChina’s Verified Pro List and move from inquiry to order with confidence.

👉 Contact our Sourcing Support Team today to request your customized shortlist of verified intake ports adapter factories in China:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160 (Available 24/5 for urgent sourcing needs)

Our consultants will provide:

✔️ Factory profiles with technical capabilities

✔️ Sample pricing benchmarks (MOQ 500–5,000 units)

✔️ Lead time and logistics guidance

✔️ English-speaking liaison support

Act Now. Source Smarter. Deliver Faster.

SourcifyChina — Trusted by Procurement Leaders in 42 Countries.

🧮 Landed Cost Calculator

Estimate your total import cost from China.