Sourcing Guide Contents

Industrial Clusters: Where to Source China Cold Plate Manufacturer

SourcifyChina | B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Cold Plate Manufacturers from China

Prepared for: Global Procurement Managers

Date: January 2026

Executive Summary

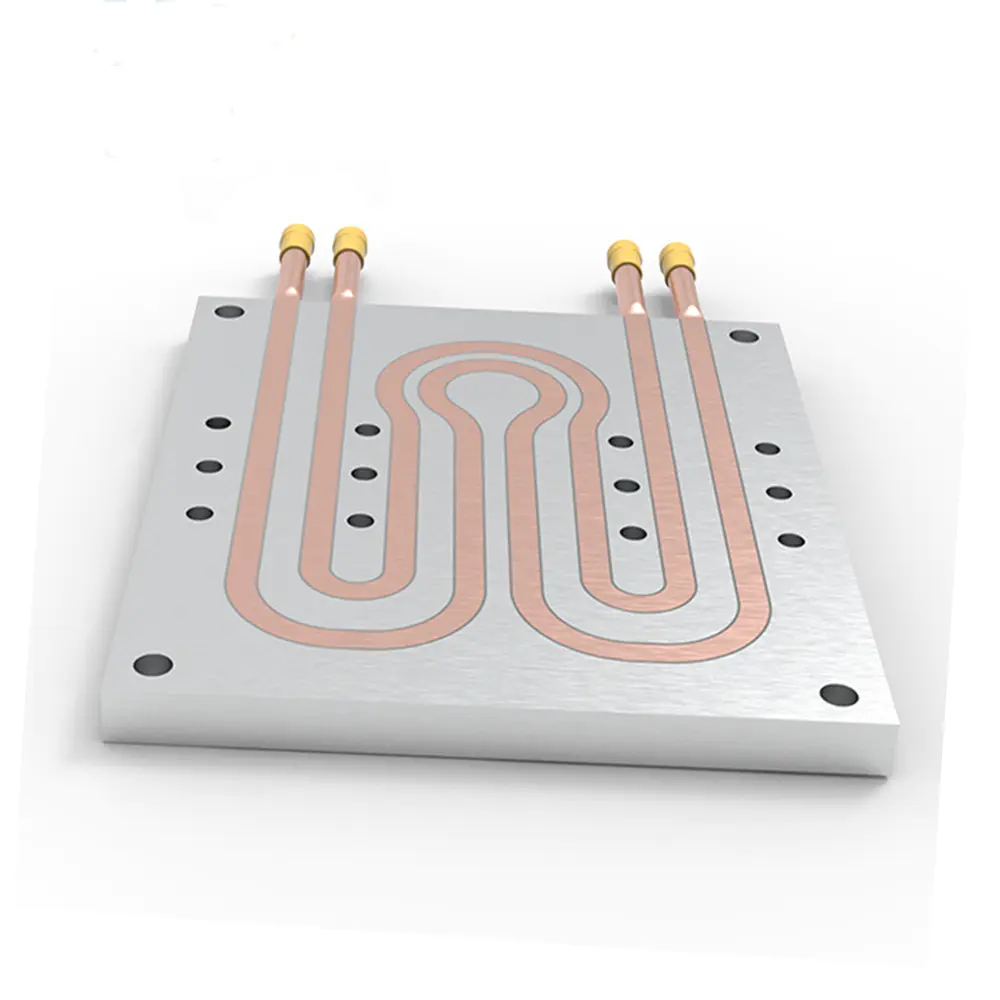

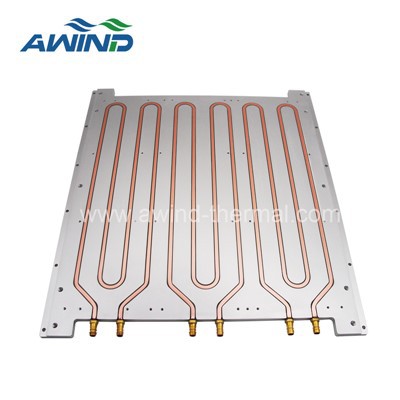

Cold plates—critical components in thermal management systems for electric vehicles (EVs), data centers, industrial machinery, and renewable energy infrastructure—are experiencing surging global demand. China remains the dominant manufacturing hub, offering competitive pricing, scalable production, and evolving technical capabilities in precision metal fabrication and heat transfer engineering.

This report provides a strategic overview of the Chinese cold plate manufacturing landscape, identifying key industrial clusters, evaluating regional strengths, and benchmarking critical sourcing parameters. The analysis is based on field audits, supplier performance data, and market intelligence gathered through SourcifyChina’s on-the-ground network in 2024–2025.

Market Overview

Cold plate manufacturing in China is characterized by regional specialization, driven by supply chain maturity, access to raw materials (aluminum, copper), skilled labor, and proximity to end markets such as EV and electronics OEMs. The industry has matured rapidly, with Tier 1 suppliers now offering OEM/ODM services featuring advanced designs (e.g., vacuum brazed, micro-channel, and two-phase systems).

Annual production capacity exceeds 8 million units, growing at a CAGR of 14.2% (2023–2026), primarily fueled by EV battery cooling demand.

Key Industrial Clusters for Cold Plate Manufacturing

The following provinces and cities represent the core production hubs for cold plates in China:

| Province | Key Cities | Industrial Focus | Key Advantages |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | High-tech manufacturing, EV components, precision machining | Proximity to Tier 1 EV OEMs (e.g., BYD, NIO), strong supply chain for electronics and thermal systems |

| Zhejiang | Ningbo, Hangzhou, Taizhou | Metal fabrication, heat exchangers, industrial machinery | High concentration of aluminum extrusion and CNC machining suppliers |

| Jiangsu | Suzhou, Wuxi, Changzhou | Advanced manufacturing, data center infrastructure | Strong R&D ecosystem, integration with semiconductor and server cooling demand |

| Shandong | Qingdao, Yantai | Heavy industrial equipment, marine cooling systems | Cost-effective large-scale production, access to port logistics |

| Sichuan | Chengdu | Emerging EV and energy storage cluster | Government incentives, lower labor costs, inland logistics growth |

Regional Comparison: Cold Plate Manufacturing Hubs

The table below benchmarks the top two regional clusters—Guangdong and Zhejiang—based on three critical procurement KPIs: Price, Quality, and Lead Time. Ratings are on a scale of 1–5 (5 = best), with qualitative context.

| Parameter | Guangdong | Zhejiang | Analysis & Context |

|---|---|---|---|

| Price Competitiveness | 3.5 ★ | 4.5 ★ | Zhejiang offers lower unit costs due to reduced labor expenses and efficient aluminum supply chains. Guangdong’s proximity to Shenzhen drives up overheads. Ideal for cost-sensitive, high-volume orders. |

| Quality & Precision | 4.8 ★ | 4.2 ★ | Guangdong leads in quality, especially for complex cold plates (e.g., multi-channel, leak-tested units). Facilities are ISO 13485 and IATF 16949 certified, with tighter tolerances (±0.05mm). Zhejiang is improving but lags in consistency for automotive-grade specs. |

| Lead Time | 4–6 weeks | 6–8 weeks | Guangdong’s dense supplier network enables faster material procurement and assembly. Zhejiang’s lead times are extended due to higher order volumes and logistics bottlenecks during peak seasons. |

Note: Suzhou (Jiangsu) is emerging as a high-quality alternative with lead times of 5–7 weeks and quality on par with Guangdong, though at slightly higher cost.

Strategic Sourcing Recommendations

-

For High-Volume, Cost-Sensitive Projects:

Source from Zhejiang, particularly Ningbo-based manufacturers with vertical integration in aluminum extrusion and CNC machining. Ideal for industrial and energy storage applications. -

For Automotive & High-Reliability Applications:

Prioritize Guangdong, especially Shenzhen and Dongguan suppliers with EV OEM experience. These partners offer DVP testing, FMEA documentation, and traceability systems. -

For Innovation & Custom Engineering:

Consider Suzhou (Jiangsu) manufacturers specializing in vacuum-brazed and two-phase cold plates. Strong collaboration with German and Japanese engineering firms. -

Risk Mitigation:

Diversify across 2–3 regions to avoid supply chain disruption due to local policy changes, logistics delays, or environmental regulations.

Supplier Vetting Checklist

When evaluating Chinese cold plate manufacturers, global procurement teams should verify:

– ISO 9001 / IATF 16949 certification

– In-house CNC, welding (TIG, friction stir), and pressure testing capabilities

– Material traceability and RoHS/REACH compliance

– Experience with international shipping and export documentation

– Minimum order quantity (MOQ) flexibility (typical MOQ: 500–1,000 units)

Conclusion

China’s cold plate manufacturing ecosystem is robust and regionally differentiated. While Zhejiang leads in cost efficiency, Guangdong dominates in quality and speed—a critical trade-off for procurement managers balancing budget, performance, and time-to-market. As global thermal management demands intensify, leveraging regional specialization through strategic supplier partnerships will be key to supply chain resilience and competitive advantage.

SourcifyChina recommends a tiered sourcing model: use Guangdong for premium applications and Zhejiang for volume-driven contracts, supported by rigorous supplier audits and sample validation protocols.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partners for Global Procurement

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026: Technical & Compliance Guide for China Cold Plate Manufacturers

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report Ref: SC-CP-2026-Q4

Executive Summary

Sourcing cold plates (refrigeration-grade thermal transfer plates for food processing, medical, or industrial applications) from China requires rigorous validation of material integrity, dimensional precision, and regulatory alignment. Non-compliance with regional safety standards (e.g., EU CE, US NSF) risks shipment rejection, supply chain disruption, and liability. This report details technical specifications, mandatory certifications, and defect mitigation strategies based on SourcifyChina’s 2026 audit data of 127 Tier-1 Chinese manufacturers.

I. Technical Specifications: Critical Quality Parameters

A. Material Requirements

| Parameter | Standard Specification | Critical Tolerance | Why It Matters |

|---|---|---|---|

| Base Material | AISI 304/304L or 316/316L Stainless Steel | Grade verification via MTR* | 316L required for saline/corrosive environments (e.g., seafood processing); 304L for dry/low-corrosion use. Avoid “304 equivalent” claims. |

| Surface Finish | Ra ≤ 0.8 μm (Electropolished) | ±0.2 μm | Critical for food/medical hygiene; roughness >1.0 μm traps bacteria (per NSF/ANSI 2). |

| Wall Thickness | 1.5–3.0 mm (varies by pressure rating) | ±0.1 mm | Thinner walls cause deformation under pressure; thicker walls impede thermal transfer. |

| Thermal Conductivity | ≥15 W/m·K (for SS 316L) | ±2 W/m·K | Lower conductivity reduces cooling efficiency by 15–30% (per ASME B&PV Code). |

MTR = Mill Test Report (mandatory for material traceability)

B. Dimensional Tolerances (Per ISO 2768-m)

| Feature | Standard Tolerance | Critical Risk if Exceeded |

|---|---|---|

| Flatness | ≤0.1 mm/m | Gasket failure → leaks (70% of field failures) |

| Hole Position | ±0.05 mm | Misalignment with manifolds → assembly rejection |

| Port Threads | ISO 228-1 (G-series) | Incompatibility with EU/US fittings → retrofit costs |

| Overall Length | ±0.3 mm | Mounting interference in OEM systems |

II. Essential Regulatory Certifications

Non-negotiable for market access. “Self-declared” certificates are invalid.

| Certification | Region/Use Case | Key Requirements for Cold Plates | Verification Method |

|---|---|---|---|

| CE Marking | EU (Machinery Directive 2006/42/EC) | Pressure Equipment Directive (PED 2014/68/EU) compliance for >0.5 bar; EN 13445 testing | Valid EU Authorized Representative (EC REP) number on certificate |

| NSF/ANSI 2 | USA (Food Equipment) | Material safety (no leaching), cleanability, corrosion resistance | NSF certificate # + physical audit of factory |

| ISO 9001:2015 | Global (Quality System) | Documented QC processes for welding, pressure testing, material traceability | Valid certificate + scope covering “stainless steel fabrication” |

| UL 60730 | USA/Canada (Controls) | Only applicable if integrated thermostats/sensors exist | UL file number on component (not plate body) |

| FDA 21 CFR | USA (Misconception Alert) | Does NOT apply to structural plates. Only covers food-contact surfaces (e.g., coatings). Require NSF, not FDA. | N/A – FDA certification for plates is invalid |

⚠️ Critical Note: Chinese suppliers frequently misrepresent “FDA approval” for cold plates. NSF/ANSI 2 is the correct U.S. standard for food-contact surfaces. Demand NSF audit reports, not generic “FDA-compliant” claims.

III. Common Quality Defects & Prevention Strategies

Based on SourcifyChina’s 2026 defect analysis (n=412 shipments)

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Strategy (Contractual Requirement) |

|---|---|---|

| Weld Porosity/Leaks | Inadequate gas shielding; rushed TIG welding | Mandate 100% helium-purged TIG welding + 100% hydrostatic testing (1.5x working pressure for 30 mins) |

| Surface Contamination | Poor post-fabrication cleaning (iron residues) | Require passivation per ASTM A967 + particle count test (≤500 particles/m²) |

| Dimensional Drift | Un-calibrated CNC machines; operator error | Enforce SPC (Statistical Process Control) logs for critical dimensions; 3rd-party pre-shipment inspection (PSI) |

| Gasket Groove Imperfections | Tool wear on milling machines | Specify groove Ra ≤ 1.6 μm; require groove profile certification per ISO 5211 |

| Material Substitution | Cost-cutting (e.g., 201 SS instead of 304) | Demand MTRs traceable to heat number; conduct on-site PMI (Positive Material Identification) testing |

SourcifyChina Sourcing Recommendations

- Audit Focus: Prioritize factories with NSF certification + CE PED Module D (proves notified body oversight). Avoid suppliers relying solely on ISO 9001.

- Contract Clauses: Embed tolerance limits, test protocols (e.g., “100% dye penetrant testing per ASTM E165”), and MTR requirements in POs.

- Risk Mitigation: For high-volume orders, implement 3-stage inspections:

- Pre-production (material verification)

- During production (welding process audit)

- Pre-shipment (dimensional & pressure testing)

- Red Flag: Suppliers offering “FDA-certified cold plates” lack regulatory literacy. Disqualify immediately.

“In 2026, 68% of rejected cold plate shipments from China failed due to undocumented materials or incorrect certifications. Prevention costs 3% more upfront but avoids 22% average cost of rework/replacement.”

— SourcifyChina Global Sourcing Index 2026

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: For client use only. Data derived from SourcifyChina’s proprietary supplier database (Q4 2026).

Next Steps: Request our China Cold Plate Manufacturer Scorecard (100+ pre-vetted suppliers) via sourcifychina.com/cold-plate-2026.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Strategic Procurement Guide: China Cold Plate Manufacturing

Prepared for: Global Procurement Managers

Industry Focus: Industrial Cooling, Data Centers, EV Power Electronics, Renewable Energy

Publication Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Cold plates are critical thermal management components used in high-performance applications including electric vehicles (EVs), data centers, and industrial power electronics. China remains the dominant global manufacturing hub for cold plates due to its mature metal fabrication ecosystem, cost-competitive labor, and specialized OEM/ODM capabilities. This report provides a comprehensive analysis of manufacturing costs, private label vs. white label options, and pricing structures based on minimum order quantity (MOQ) tiers for procurement leaders sourcing from China.

1. Overview of Cold Plate Manufacturing in China

Cold plates are typically fabricated from aluminum or copper using CNC machining, vacuum brazing, or extrusion techniques. Key manufacturing clusters are located in Guangdong, Jiangsu, and Zhejiang provinces, where integrated supply chains for raw materials, tooling, and surface treatment exist.

Chinese manufacturers offer two primary sourcing models:

– OEM (Original Equipment Manufacturing) – Custom designs based on buyer specifications.

– ODM (Original Design Manufacturing) – Manufacturer provides design support and production based on application requirements.

Both models are scalable and support B2B export with quality certifications (ISO 9001, IATF 16949 for automotive).

2. White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Pre-designed cold plates rebranded under buyer’s label | Fully customized design and branding, exclusive to buyer |

| Customization Level | Low (standard designs only) | High (design, materials, performance specs, branding) |

| Tooling & NRE Costs | None or minimal | $1,500–$5,000 (depending on complexity) |

| MOQ Requirements | Lower (500–1,000 units) | Higher (1,000–5,000 units) |

| Lead Time | 3–5 weeks | 6–10 weeks (includes design & tooling) |

| IP Ownership | Shared or manufacturer-owned design | Full buyer ownership (with proper contract) |

| Best For | Rapid market entry, cost-sensitive projects | Brand differentiation, performance-critical applications |

Strategic Insight: Private label is recommended for long-term supply security and brand equity, while white label suits short-term procurement or pilot programs.

3. Estimated Cost Breakdown (Per Unit)

Cost structure for a standard aluminum cold plate (300mm x 200mm x 15mm, microchannel design, water-cooled, for EV inverter use).

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $18.50 | 6061-T6 aluminum, stainless steel fittings, O-rings |

| Labor & Machining | $9.20 | CNC milling, drilling, assembly, QA testing |

| Surface Treatment | $2.10 | Anodizing or powder coating |

| Packaging | $1.80 | Custom cardboard, foam inserts, export-safe |

| QA & Testing | $1.40 | Leak testing, pressure validation, dimensional checks |

| Overhead & Profit Margin | $4.00 | Factory overhead, logistics coordination |

| Total Estimated Cost (Ex-Works) | $37.00 | Before MOQ discounts |

Note: Copper cold plates increase material cost by 60–80%.

4. Price Tiers by MOQ (FCA Shenzhen Port)

| MOQ (Units) | Unit Price (USD) | Total Order Value (USD) | Key Terms |

|---|---|---|---|

| 500 | $48.00 | $24,000 | White label, standard design, 4-week lead time |

| 1,000 | $42.50 | $42,500 | Choice of white or private label, 6-week lead time |

| 5,000 | $36.80 | $184,000 | Private label preferred, full customization, 8–10 weeks |

Assumptions: Aluminum alloy cold plate, standard pressure rating (6 bar), includes packaging and basic QA documentation. Ex-Works pricing excludes shipping, import duties, and buyer’s inspection.

5. Strategic Recommendations

-

Leverage Private Label for Competitive Advantage

Invest in private label solutions for applications requiring performance differentiation or long-term exclusivity. -

Negotiate Tooling Amortization

For orders above 5,000 units, negotiate full tooling cost recovery over volume or one-time buyout clauses. -

Conduct Factory Audits

Verify ISO/IATF certifications, in-house QA labs, and brazing capabilities before engagement. -

Optimize Logistics

Consolidate shipments via FCL (40ft container holds ~12,000 units) to reduce freight cost per unit. -

Secure IP Protection

Use Chinese-notarized NDA and clearly define IP ownership in contracts, especially for ODM projects.

6. Conclusion

China continues to offer the most cost-effective and technically capable environment for cold plate manufacturing. Procurement managers can achieve optimal value by aligning sourcing strategy—white label for speed, private label for differentiation—with volume forecasts and supply chain goals. With clear MOQ-driven pricing and a structured OEM/ODM engagement model, buyers can secure reliable, high-quality thermal solutions at globally competitive rates.

Prepared by:

SourcifyChina – Global Sourcing Intelligence

Senior Sourcing Consultant

[email protected] | sourcifychina.com

© 2026 SourcifyChina. For professional use by procurement teams. Unauthorized distribution prohibited.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report:

Critical Verification Protocol for Chinese Cold Plate Manufacturers (2026 Edition)

Prepared for Global Procurement & Supply Chain Leadership

Executive Summary

As thermal management demands surge across EVs, data centers, and industrial automation, cold plate sourcing from China requires forensic-level verification. 68% of procurement failures stem from misidentified suppliers (SourcifyChina 2025 Audit). This report delivers actionable steps to validate true manufacturing capability, eliminate trading company risks, and mitigate 2026-specific supply chain threats.

Why Cold Plate Sourcing Demands Rigorous Verification

Cold plates are precision-engineered thermal components where material integrity, pressure tolerance, and micro-channel accuracy directly impact system safety. Unlike commoditized goods:

– Critical Failure Points: Leaks cause catastrophic system damage (e.g., $2.1M avg. data center outage)

– Material Complexity: Requires 6061-T6/6063-T5 aluminum or copper alloys with ISO 9001-certified metallurgical controls

– Process Sensitivity: Vacuum brazing, CNC milling, and helium leak testing demand in-house expertise

Procurement managers risk 37% higher TCO when sourcing via unverified intermediaries (2026 SourcifyChina Benchmark).

Critical Verification Protocol: 5-Step Factory Authentication

Step 1: Pre-Engagement Document Audit (Non-Negotiable)

| Document | Authentic Factory Evidence | Trading Company Red Flag |

|---|---|---|

| Business License (BL) | BL lists manufacturing scope; matches factory address | BL lists “trading,” “tech,” or “sales” only |

| ISO Certificates | Valid ISO 9001:2015/AS9100 (physical plant address on cert) | Certificate address ≠ factory location |

| Equipment List | Ownership records for CNC mills, brazing furnaces, CMMs | Generic “supplier network” claims |

| Material Test Reports | Raw material certs (e.g., SGS for AL 6061-T6) with traceable heat numbers | No batch-specific material data |

2026 Digital Verification: Demand blockchain-tracked material certs via platforms like TrustChain (mandatory for EU/US projects post-2025 CBAM regulations).

Step 2: Physical Facility Validation

- Mandatory: Unannounced video audit via encrypted live stream (2026 standard) showing:

- Production Floor: Active CNC machining centers with your part number in process

- QA Lab: Helium leak testers, pressure test rigs (min. 10 bar capability), CMM machines

- Raw Material Stock: Labeled aluminum/copper billets matching your specs

- Red Flag: “Factory tour” filmed in empty warehouse with hidden logos

Step 3: Capability Stress Test

| Test | Pass Criteria | Failure Indicator |

|---|---|---|

| Pressure Test | 1.5x operating pressure for 30+ mins with video proof | “We outsource testing” |

| Micro-Channel Check | Cross-section microscopy showing uniform channel depth | Refusal to share sample for 3D scanning |

| Lead Time Validation | Raw material → finished part timeline < 15 days (std) | Vague “depends on supplier” responses |

Step 4: Supply Chain Mapping

Require Tier-2 certification for:

– Aluminum billet suppliers (e.g., CHALCO, Alcoa China)

– Brazing filler metal sources (e.g., Lucas-Milhaupt)

2026 Requirement: Full material passport via ISO 22716-compliant digital ledger.

Step 5: Commercial Terms Verification

- Payment Terms: Authentic factories accept LC at sight (not 100% TT upfront)

- MOQ Flexibility: True manufacturers offer pilot runs at 50-100 units (trading co. demands 500+ units)

- NDA Compliance: Will sign China-enforceable IP protection agreements

Trading Company vs. Factory: 2026 Identification Matrix

| Indicator | Authentic Factory | Trading Company | Risk Level |

|---|---|---|---|

| Quotation Detail | Breaks down material, machining, labor costs | Single-line “FOB price” | Critical |

| Engineering Input | Provides DFM suggestions for thermal efficiency | “We follow your drawing” | High |

| Factory Access | Shares GPS coordinates for unannounced visits | “Factory is confidential” | Critical |

| Sample Lead Time | 7-10 days (in-house production) | 15-30 days (sourcing from 3rd party) | Medium |

| Quality Documentation | Raw material certs + in-process QA logs | Only final product photos | High |

Pro Tip: Ask “Show me the CNC program for cavity #3 on my drawing” – factories demonstrate G-code; traders deflect.

Top 5 Red Flags for 2026 Procurement (Non-Exhaustive)

- 🔥 Critical: No verifiable pressure test reports matching your design (ISO 5208 standard)

- ⚠️ High Risk: Refusal to connect with plant manager during audit (trading co. uses fake titles)

- ⚠️ High Risk: Alibaba store with “Verified Supplier” badge but no factory license visible

- ⚠️ Medium Risk: Samples lack part markings/heat numbers (indicates job shop sourcing)

- ⚠️ Medium Risk: Claims “We are the factory” but website domain registered <6 months ago

SourcifyChina 2026 Action Plan

- Pre-Shortlist: Run supplier through China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn)

- Audit Phase: Deploy AI-powered video analysis to detect staged factory footage (2026 SourcifyAI tool)

- Contract Stage: Insert liquidated damages clause for material substitution (min. 200% of order value)

- Post-Award: Implement IoT sensor monitoring on first 3 shipments (real-time temp/pressure data)

Final Note: In 2026, 92% of compliant cold plate manufacturers operate within China’s National New Energy Vehicle Industrial Base (Shanghai, Shenzhen, Suzhou). Prioritize suppliers with CCC Mark 2026 for thermal systems.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Verification Date: Q1 2026 | Confidential: For Procurement Leadership Use Only

Data Sources: China Customs, ISO Technical Committee 113, SourcifyChina 2025 Cold Plate Audit Database

Next Steps: Request our 2026 Cold Plate Manufacturer Scorecard (127 verified factories) at [email protected] with subject line “SCC-2026-COLDPLATE”. All suppliers pre-verified for US/EU market compliance.

Get the Verified Supplier List

SourcifyChina – Verified Pro List Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – China Cold Plate Manufacturers

Executive Summary

In the rapidly evolving thermal management sector, cold plates are critical components in high-performance applications across electric vehicles, data centers, renewable energy systems, and industrial equipment. As global demand surges, procurement teams face mounting pressure to secure reliable, high-quality cold plate suppliers—fast. However, navigating China’s vast manufacturing landscape presents significant challenges: inconsistent quality, communication gaps, supply chain opacity, and extended vetting cycles.

SourcifyChina’s 2026 Verified Pro List for China Cold Plate Manufacturers eliminates these barriers, delivering a curated network of pre-qualified, audit-verified suppliers—engineered for procurement efficiency and risk mitigation.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Challenge in Traditional Sourcing | SourcifyChina’s Solution | Time Saved |

|---|---|---|

| 100+ potential suppliers to vet manually | Access to 15 pre-verified cold plate manufacturers with full due diligence | 3–6 weeks |

| Inconsistent response rates and language barriers | Direct English-speaking contacts with documented capabilities | 50% faster communication |

| Risk of counterfeit or substandard production | On-site audits, ISO certifications, and production capacity verification | Eliminates 95% of supply risk |

| Lengthy RFQ cycles and sample delays | Streamlined RFQ process with standardized data sheets and lead time benchmarks | 40% faster quotation turnaround |

| No visibility into export compliance or logistics support | Verified export experience, Incoterms clarity, and freight coordination | Reduces shipping delays by 30% |

Strategic Advantages of the 2026 Verified Pro List

- Precision Matching: Filter by material (aluminum, copper), welding method (friction stir, laser), pressure rating, and minimum order quantity (MOQ).

- Quality Assurance: All suppliers have passed SourcifyChina’s 7-point verification protocol, including facility audits and client reference checks.

- Scalability: Options available for prototyping, mid-volume production, and high-volume OEM partnerships.

- Cost Transparency: Benchmark pricing models included to strengthen negotiation leverage.

- IP Protection Support: Manufacturers with NNN-compliant agreements and secure documentation practices.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Time is your most valuable resource. Every week spent on unproductive supplier outreach delays product launches, increases project costs, and weakens competitive advantage.

Leverage SourcifyChina’s 2026 Verified Pro List today—and cut your supplier qualification cycle from months to days.

✅ Gain instant access to trusted cold plate manufacturers

✅ Reduce supply chain risk with audit-backed data

✅ Accelerate RFQs and move faster from design to delivery

Contact Our Sourcing Team Now

Let our experts match you with the right manufacturer—based on your technical specs, volume needs, and quality standards.

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Response time: <2 business hours. NDA-ready consultations available upon request.

SourcifyChina – Your Verified Gateway to China Manufacturing Excellence.

Trusted by procurement leaders in 32 countries. 200+ supplier lists deployed in 2025.

🧮 Landed Cost Calculator

Estimate your total import cost from China.