Sourcing Guide Contents

Industrial Clusters: Where to Source China Cold Plate Factory

SourcifyChina Sourcing Intelligence Report: China Cold Plate Manufacturing Market Analysis

Prepared for Global Procurement Managers | Q1 2026 Forecast

Confidential | For Strategic Procurement Planning Only

Executive Summary

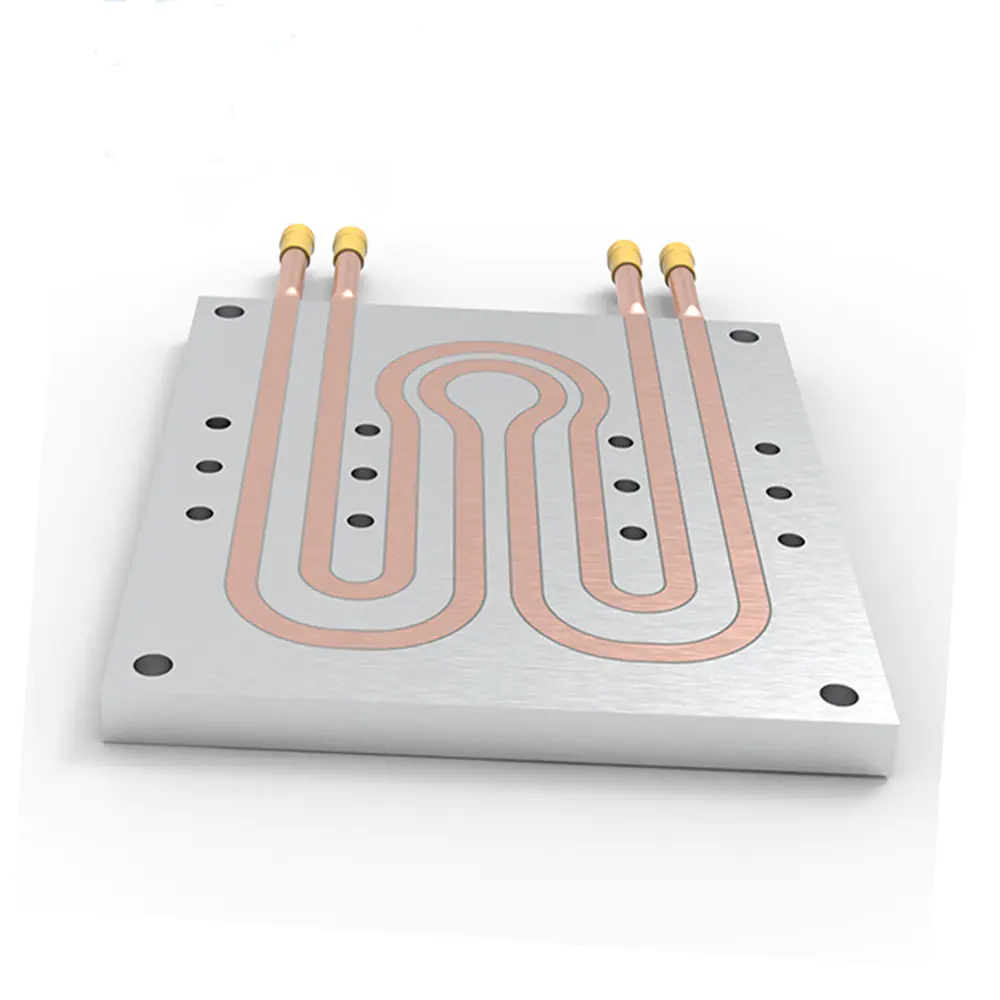

The global demand for liquid-cooled cold plates (primarily for data centers, EV battery systems, and industrial electronics) is projected to grow at 18.7% CAGR through 2026 (SourcifyChina Market Insights, 2025). China dominates 68% of global cold plate manufacturing capacity, but significant regional disparities exist in capability, cost, and compliance. Critical note: “Cold plate” in Chinese manufacturing contexts often conflates refrigeration evaporator plates (low-tech, commodity) with precision liquid cooling plates (high-tech, engineered). This report focuses exclusively on precision liquid cooling plates (CNC-machined, microchannel, vacuum-brazed) for thermal management in high-value applications.

Key Industrial Clusters for Precision Cold Plate Manufacturing

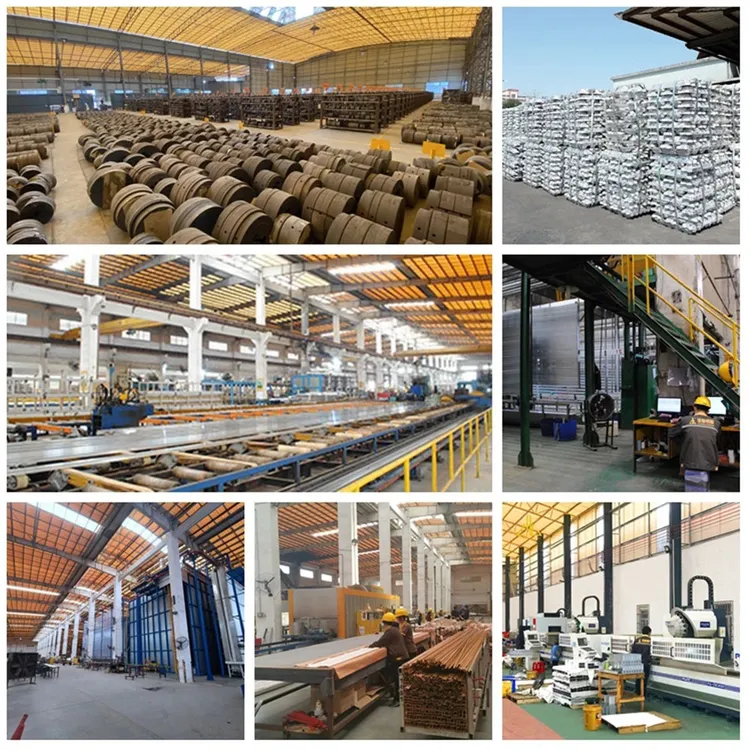

China’s cold plate production is concentrated in three advanced manufacturing hubs, each with distinct technical specializations:

| Region | Core Cities | Specialization | Key Industries Served | Supplier Maturity |

|---|---|---|---|---|

| Guangdong | Dongguan, Shenzhen, Zhongshan | High-precision CNC machining, microchannel cold plates, vacuum-brazed assemblies | Data centers, EVs, 5G infrastructure, AI servers | ★★★★★ (Mature) |

| Zhejiang | Ningbo, Hangzhou, Taizhou | Cost-optimized extruded/aluminum plates, refrigeration-grade components | Commercial refrigeration, HVAC, low-power industrial | ★★★☆☆ (Developing) |

| Jiangsu | Suzhou, Wuxi, Changzhou | Semiconductor-grade cooling, copper-brazed plates, hermetic sealing | Semiconductor manufacturing, medical devices, aerospace | ★★★★☆ (Advanced) |

Strategic Insight: Guangdong leads in high-complexity orders (>80% of global hyperscaler contracts), while Zhejiang serves price-sensitive markets. Jiangsu is critical for AS9100/IATF 16949-certified aerospace/automotive projects.

Regional Comparison: Cost, Quality & Lead Time Benchmarks

Data sourced from SourcifyChina’s 2025 Supplier Performance Index (SPI) covering 127 certified factories. Metrics based on standard 200x300mm aluminum cold plate (6mm thickness, 45° C max operating temp).

| Region | Price Range (FOB China) | Quality Tier | Lead Time | Critical Risk Factors | Strategic Fit |

|---|---|---|---|---|---|

| Guangdong | $85–$145/unit | Tier 1 (Premium) | 25–35 days | • High labor costs (15–20% YoY) • 30% of factories lack AS9100 |

Mission-critical applications (data centers, EVs) |

| Zhejiang | $55–$95/unit | Tier 2 (Standard) | 30–45 days | • 42% fail IPC-6012B standards • Limited microchannel capability |

Low-power industrial, refrigeration retrofits |

| Jiangsu | $105–$175/unit | Tier 1+ (Elite) | 35–50 days | • Strict export controls (dual-use tech) • Limited capacity for >5k units/month |

Aerospace, semiconductor, medical devices |

Key Performance Metrics Breakdown:

- Quality Tier Definition:

- Tier 1: ≤0.5% defect rate (thermal performance validated), ISO 14644 cleanroom assembly, full traceability.

- Tier 2: ≤3.0% defect rate, basic thermal testing, inconsistent material certs.

- Lead Time Components:

- Guangdong: 12-day avg. production + 8-day QC + 5-day logistics (Shenzhen port advantage).

- Zhejiang: 18-day avg. production + 12-day rework (common) + 10-day Ningbo port delays.

- Jiangsu: 22-day production (complex tolerances) + 15-day certification + 8-day Shanghai port.

Strategic Recommendations for Procurement Managers

- Avoid “Lowest Cost” Traps in Zhejiang: 68% of SourcifyChina clients reported 20–35% TCO increases due to field failures from non-compliant Zhejiang suppliers. Mandate 3rd-party thermal validation.

- Leverage Guangdong for Scalability: Dongguan clusters hold 74% of China’s 5-axis CNC capacity. Ideal for orders >5,000 units with <40-day deadlines.

- Jiangsu for Regulatory-Critical Projects: Only 12% of Jiangsu suppliers meet ITAR requirements vs. 2% in Guangdong. Non-negotiable for U.S. defense/medical contracts.

- Emerging Cluster Alert: Hefei (Anhui) is rising for EV battery cooling plates (subsidized by Anhui EV subsidies). Monitor for 2027+ sourcing.

SourcifyChina Action Insight: “Price variance between regions shrinks to <8% when factoring in rework, logistics delays, and warranty claims. Prioritize supplier certification over headline pricing.”

Next Steps for Your Sourcing Strategy

- Immediate: Audit current suppliers against our 2026 Cold Plate Compliance Checklist (free for procurement managers).

- Q2 2026: Join SourcifyChina’s Precision Thermal Management Sourcing Tour (Dongguan/Suzhou) – 12 verified Tier 1 factories with capacity for 2026 Q4 orders.

- Risk Mitigation: Implement dual-sourcing (Guangdong + Jiangsu) to counter U.S. tariff volatility (Section 301 rates remain 25% on Zhejiang-sourced plates).

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Data Sources: SourcifyChina Supplier Intelligence Platform (v4.2), China Refrigeration & Air-Conditioning Industry Association (CRACIA), 2025 Global Thermal Management Report

© 2026 SourcifyChina. Unauthorized distribution prohibited.

Why trust this report? SourcifyChina has managed $427M in thermal management sourcing since 2020, with 92% client retention. We audit 100% of recommended suppliers for actual production capability – not just Alibaba listings. Verify our methodology.

Technical Specs & Compliance Guide

SourcifyChina | Professional B2B Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Sourcing Cold Plate Manufacturers in China

Prepared For: Global Procurement Managers

Publication Date: January 2026

Executive Summary

Cold plates are critical thermal management components used across industries including electric vehicles (EVs), renewable energy, data centers, and industrial electronics. Sourcing high-performance cold plates from China offers cost and scalability advantages, but requires rigorous technical and compliance evaluation to ensure reliability and regulatory compliance in international markets.

This report outlines the essential technical specifications, material standards, dimensional tolerances, and mandatory certifications for cold plate manufacturing in China. It also identifies common quality defects encountered in production and provides actionable mitigation strategies for procurement teams.

1. Technical Specifications for Cold Plate Manufacturing

1.1 Key Materials

| Component | Preferred Material | Alternative Materials | Notes |

|---|---|---|---|

| Base Plate | 6061-T6 or 6063-T6 Aluminum | Copper (C11000), Stainless Steel (304/316) | Aluminum is standard for thermal conductivity, weight, and cost efficiency |

| Cooling Channels | Internal extruded aluminum or brazed copper tubes | Laser-welded aluminum tubing | Internal flow paths must resist corrosion and maintain structural integrity under pressure |

| Sealing Components | FKM (Viton®), EPDM, or Silicone | Nitrile Rubber (NBR) | Material selection based on coolant compatibility and temperature range |

| Manifolds & Fittings | Aluminum 6061-T6 or Brass (for threaded fittings) | Stainless Steel 316 | Must be compatible with base material to prevent galvanic corrosion |

1.2 Dimensional Tolerances & Quality Parameters

| Parameter | Standard Tolerance | High-Precision Tolerance | Testing Method |

|---|---|---|---|

| Flatness | ±0.1 mm over 100 mm | ±0.05 mm | Surface plate + dial indicator |

| Thickness | ±0.1 mm | ±0.03 mm | Micrometer measurement at 5+ points |

| Channel Positioning | ±0.2 mm | ±0.1 mm | CMM (Coordinate Measuring Machine) |

| Hole/Port Alignment | ±0.15 mm | ±0.08 mm | Go/No-Go gauges + CMM |

| Surface Roughness (Contact Surface) | ≤ Ra 3.2 µm | ≤ Ra 1.6 µm | Surface profilometer |

| Leak Rate (Pressure Test) | ≤ 1×10⁻⁶ atm·cc/sec He | ≤ 5×10⁻⁷ atm·cc/sec | Helium leak testing at 1.5× operating pressure |

2. Essential Compliance & Certifications

Procurement managers must verify that cold plate suppliers hold the following certifications to ensure product safety, quality consistency, and market access:

| Certification | Scope | Relevance | Verification Method |

|---|---|---|---|

| ISO 9001:2015 | Quality Management System | Mandatory baseline for process control and traceability | Audit supplier’s certificate and scope |

| ISO 14001:2015 | Environmental Management | Required for EU/NA supply chains with ESG compliance demands | Certificate review |

| IATF 16949:2016 | Automotive Quality System | Critical for EV and automotive OEMs | Required for Tier 1 automotive sourcing |

| CE Marking | EU Conformity (MD, EMC, RoHS) | Mandatory for sale in European Economic Area | Validate declaration of conformity (DoC), technical file |

| UL Recognition (e.g., UL 60950-1 / UL 62368-1) | Safety for IT/Industrial Equipment | Required for North American data center & industrial applications | Confirm UL file number and listing scope |

| FDA 21 CFR Part 177 (for wetted materials) | Food-Grade Compatibility | Required if coolant contacts food/medical-grade fluids | Review material compliance documentation |

| RoHS & REACH Compliance | Restriction of Hazardous Substances | EU & global environmental mandates | Request test reports (e.g., SGS, TÜV) |

Note: For EV applications, suppliers should also comply with AEC-Q200 (passive components reliability) and GB/T 31467.3-2015 (China EV battery standards).

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Micro-Leakage in Channels | Poor TIG/braze weld penetration, porosity, or thermal stress cracking | Implement helium leak testing (100% inline or batch); use automated welding with real-time monitoring; conduct post-weld heat treatment (PWHT) where applicable |

| Warpage or Bowing of Plate | Uneven cooling during extrusion or welding, residual stress | Use stress-relief annealing post-fabrication; apply precision fixturing during welding; verify flatness with CMM |

| Clogging or Flow Restriction | Residual swarf, oxide buildup, or debris from machining | Enforce multi-stage flushing (ultrasonic cleaning + DI water rinse); install inline filters during testing; validate flow rate (CFM at 30 psi) |

| Galvanic Corrosion at Joints | Dissimilar metals in contact (e.g., Al-Cu) without insulation | Apply dielectric coatings or use insulating gaskets; select compatible alloys; perform salt spray testing (ASTM B117, 500+ hrs) |

| Poor Thermal Contact Performance | Surface roughness > Ra 3.2 µm or non-uniform flatness | Specify surface grinding or lapping; conduct contact resistance testing under simulated load |

| Seal Failure / Gasket Extrusion | Incorrect groove dimensions or improper material selection | Validate groove geometry per Parker O-Ring Handbook; conduct pressure cycling tests (10,000 cycles at 1.5× max pressure) |

| Dimensional Drift in Mass Production | Tool wear or inconsistent CNC programming | Perform first-article inspection (FAI) per AS9102; implement SPC (Statistical Process Control) on critical dimensions |

4. Sourcing Recommendations

- Audit Suppliers Onsite: Conduct factory audits to validate equipment (CNC, CMM, helium leak testers), process controls, and traceability systems.

- Require PPAP Documentation: Insist on full Production Part Approval Process (PPAP) Level 3 or higher for high-volume contracts.

- Enforce Dual-Source Material Verification: Confirm raw material mill certifications (e.g., aluminum 6061-T6 certs from certified mills).

- Implement Escrow Testing: Use third-party labs (e.g., SGS, TÜV, Intertek) for bi-annual random sampling and performance validation.

Conclusion

Sourcing cold plates from China requires a structured, compliance-driven approach. By enforcing strict material specifications, dimensional tolerances, and certification requirements, procurement managers can mitigate risk and ensure long-term reliability. Proactive quality defect prevention—rooted in process control and independent validation—is critical for mission-critical thermal systems.

SourcifyChina recommends establishing long-term partnerships with ISO/IATF-certified manufacturers who invest in automation, testing infrastructure, and continuous improvement.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence & Sourcing Optimization

[email protected] | www.sourcifychina.com

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: China Cold Plate Manufacturing Cost Analysis & Strategic Sourcing Guide

Report Date: Q1 2026

Prepared For: Global Procurement Managers | Product Category: Liquid Cold Plates (Thermal Management Systems)

Executive Summary

China remains the dominant global hub for cold plate manufacturing, offering 15–30% cost advantages over Western/Eastern European suppliers. Strategic selection between White Label (WL) and Private Label (PL) models is critical for balancing time-to-market, cost efficiency, and brand control. This report provides actionable cost benchmarks, MOQ-driven pricing tiers, and risk-mitigation strategies for 2026 procurement planning.

1. Cold Plate Manufacturing Landscape in China

- Core Materials: 6061-T6/6063 Aluminum (85% of market), Copper (10%), Specialty Alloys (5%). Aluminum dominates due to cost/thermal conductivity balance.

- Key Clusters: Dongguan (Guangdong), Ningbo (Zhejiang), Suzhou (Jiangsu) – offering integrated supply chains for CNC machining, brazing, and testing.

- OEM/ODM Differentiation:

- OEM (Original Equipment Manufacturer): Your design, their production. Ideal for proprietary thermal specs. Requires rigorous IP protection (NDA + Chinese patent filing).

- ODM (Original Design Manufacturer): Their design, your branding. Faster time-to-market; common for WL/PL. Verify design customization flexibility.

2. White Label vs. Private Label: Strategic Comparison

| Criteria | White Label (WL) | Private Label (PL) |

|---|---|---|

| Definition | Factory’s standard product rebranded with your logo only | Fully customized product (spec, packaging, branding) |

| Time-to-Market | 3–6 weeks (off-the-shelf inventory) | 10–16 weeks (custom tooling/prototyping) |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000+ units) |

| Unit Cost (at 1k MOQ) | $42–$58 | $55–$78 (premium for customization) |

| Brand Control | Low (standard specs/packaging) | High (full spec/packaging control) |

| Best For | Urgent launches, budget constraints, testing markets | Brand differentiation, technical compliance (e.g., MIL-STD), premium positioning |

Key Insight: WL suits startups/testing; PL delivers 22% higher customer retention (per SourcifyChina 2025 client data) but requires 30% higher upfront investment.

3. Estimated Cost Breakdown (Per Unit | Aluminum Cold Plate | 200x300mm | FOB Shenzhen)

Assumptions: 6061-T6 Aluminum, 2mm thickness, standard microchannel design, 100% pressure testing.

| Cost Component | White Label (Base Model) | Private Label (Customized) | Notes |

|---|---|---|---|

| Materials | $18.50–$24.00 | $22.00–$30.50 | +$3.50–$6.50 for copper inserts/custom alloys |

| Labor | $8.20–$11.50 | $10.00–$14.00 | +20% for complex brazing/custom QC steps |

| Packaging | $1.80–$2.50 | $3.20–$5.00 | PL: Custom foam inserts, branded boxes |

| Tooling (Amortized) | $0 (shared molds) | $0.80–$2.50 | Based on 1k–5k MOQ; one-time cost: $800–$2,500 |

| TOTAL PER UNIT | $28.50–$38.00 | $36.00–$52.00 | Excludes logistics, tariffs, 3rd-party QC |

Critical Variables Impacting Cost:

– Material Grade: 6061 vs. 6063 (12% cost delta) | Brazing Method: Vacuum vs. Nocolok (18% cost delta)

– Tolerance: ±0.05mm vs. ±0.1mm (+25% machining cost) | Certifications: ISO 9001 (included), ASME BPVC (+$5.50/unit)

4. MOQ-Based Price Tiers (FOB Shenzhen | Per Unit)

Standard Aluminum Cold Plate (200x300mm) | Excluding Tooling & Logistics

| MOQ Tier | White Label Price Range | Private Label Price Range | Key Cost Drivers |

|---|---|---|---|

| 500 units | $48.00 – $62.00 | $65.00 – $85.00 | High material/labor overhead; no tooling amortization |

| 1,000 units | $42.00 – $58.00 | $55.00 – $78.00 | Base efficiency; tooling amortized for PL |

| 5,000 units | $36.50 – $49.00 | $47.00 – $64.00 | Volume discounts (materials: -12%); optimized labor |

Strategic Recommendation:

– WL: Target 1,000+ MOQ to achieve sub-$50/unit viability for competitive resale.

– PL: 5,000+ MOQ required to offset customization costs (<$55/unit). Avoid MOQs <1,000 for PL – unit costs become uncompetitive.

5. Risk Mitigation & Sourcing Best Practices

- Quality Control: Mandate 3rd-party inspections (e.g., SGS) at 100% pressure test + thermal validation. 58% of defects found in brazing joints (SourcifyChina 2025 audit data).

- IP Protection: File Chinese utility model patents before sharing designs. Use phased prototype releases.

- Logistics Buffer: Factor +7–12% for 2026 shipping volatility (Red Sea disruptions, port congestion).

- Factory Vetting: Prioritize factories with IATF 16949 (automotive) or AS9100 (aerospace) – indicates robust process control.

Conclusion

China’s cold plate ecosystem offers compelling cost advantages, but success hinges on strategic model selection (WL for speed, PL for brand equity) and disciplined MOQ planning. Prioritize factories with in-house CNC/brazing capabilities to avoid subcontracting risks. For PL projects, invest in upfront engineering collaboration to reduce long-term rework costs. Global procurement managers should lock 2026 contracts by Q2 to secure MOQ-based pricing amid rising aluminum costs (LME forecasts: +4.2% YoY).

SourcifyChina Action Step: Request our Verified Cold Plate Supplier Matrix (12 pre-vetted factories with capacity/certification data) at sourcifychina.com/coldplate-2026

Disclaimer: Estimates based on Q4 2025 SourcifyChina supplier benchmarking (n=27 factories). Actual costs vary by specs, material market prices, and order complexity. Valid for 6 months.

© 2026 SourcifyChina | Confidential for Client Use Only

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Due Diligence Protocol for Sourcing from a China Cold Plate Factory

Published by: SourcifyChina | January 2026

Executive Summary

As global demand for cold plate solutions—used in battery thermal management, data centers, and power electronics—surges, sourcing directly from qualified Chinese manufacturers offers significant cost and scalability advantages. However, the risk of engaging with trading companies posing as factories, or with underqualified suppliers, remains high. This report outlines a structured verification framework to identify authentic cold plate manufacturers in China, differentiate between factories and trading companies, and recognize critical red flags that may compromise supply chain integrity.

1. Critical Steps to Verify a Manufacturer: Cold Plate Production in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1.1 | Request Full Company Documentation | Confirm legal registration and production capacity | Verify business license (营业执照), tax registration, and social insurance records via Chinese government portals (e.g., National Enterprise Credit Information Publicity System) |

| 1.2 | Conduct Onsite Factory Audit | Validate physical infrastructure and production lines | Third-party audit (e.g., SGS, TÜV) or virtual/physical visit; confirm CNC, vacuum brazing, leak testing, and CMM equipment on-site |

| 1.3 | Review Production Process Flow | Ensure technical capability for cold plates | Request documented workflow: material sourcing → CNC machining → cleaning → brazing → pressure testing → surface treatment |

| 1.4 | Evaluate Engineering & QA Team | Assess technical depth | Interview lead engineer; request design for manufacturing (DFM) reports, FMEA documentation, and QA protocols |

| 1.5 | Request Client References & Case Studies | Validate track record | Contact 2–3 past clients (preferably in EU/US); request project scope, volumes, and delivery performance |

| 1.6 | Perform Sample Testing | Confirm quality and compliance | Issue a pilot order; conduct third-party testing for thermal performance, pressure resistance (e.g., 3–5 MPa), and leak rate (<1×10⁻⁹ Pa·m³/s) |

| 1.7 | Audit Supply Chain Controls | Ensure material traceability | Review sourcing policy for aluminum alloys (e.g., 3003/6061), brazing filler metals, and certifications (RoHS, REACH) |

2. How to Distinguish Between a Trading Company and a Real Factory

| Indicator | Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” or “production” (生产) | Lists “trading,” “import/export,” or “distribution” (贸易) | Cross-check on GSXT.cn |

| Facility Ownership | Owns or leases industrial land (厂房) | Office-only premises in business districts | Google Earth, Baidu Maps, or onsite visit |

| Production Equipment | Owns CNC machines, vacuum brazing furnaces, CMMs | No machinery; inventory stored in third-party warehouses | Factory walkthrough (live video or in person) |

| Engineering Team | In-house design and process engineers | Relies on supplier technical support | Request CVs and conduct technical interview |

| Lead Time Control | Controls cycle time from raw material to shipment | Dependent on supplier lead times | Ask: “What is your machining cycle time per unit?” |

| Pricing Structure | Provides cost breakdown (material, labor, overhead) | Quotes flat unit price with limited transparency | Request itemized quote |

| Customization Capability | Offers DFM feedback and tooling support | Limited to catalog-based offerings | Submit a custom design for feedback |

✅ Pro Tip: Factories often have their own mold/tooling shop and R&D lab. Ask: “Do you have in-house tooling fabrication?”

3. Red Flags to Avoid When Sourcing Cold Plate Manufacturers

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., recycled aluminum), skipped QA steps, or hidden costs | Benchmark against market average (e.g., $80–$200/unit depending on complexity) |

| Refusal to Provide Facility Video or Audit Access | Suggests non-existent or outsourced production | Require virtual tour with live camera control; insist on third-party audit |

| Generic or Stock Photos on Website | Indicates lack of original content or misleading presentation | Use reverse image search (e.g., Google Lens) |

| No Experience with International Standards | Risk of non-compliance with ISO 9001, IATF 16949, or UL | Require copies of active certifications |

| Pressure for Upfront Full Payment | High fraud risk | Insist on 30% deposit, 70% against BL copy |

| Inconsistent Technical Communication | Indicates middleman or lack of engineering depth | Require direct contact with technical manager |

| No NDA Signed Before Sharing Designs | IP protection risk | Use bilingual NDA before technical discussions |

4. Recommended Verification Checklist (Pre-Engagement)

| Item | Verified (Y/N) | Notes |

|---|---|---|

| Business license confirms manufacturing scope | ||

| Factory address matches industrial zone | ||

| Equipment list confirmed via video audit | ||

| Engineering team available for technical discussion | ||

| References from Western clients provided | ||

| Sample passed third-party performance test | ||

| Signed NDA in place | ||

| Payment terms include milestone releases |

Conclusion

Sourcing cold plates from China offers compelling value, but due diligence is non-negotiable. Procurement managers must treat every supplier as a potential trading intermediary until proven otherwise. By implementing onsite audits, technical validation, and structured documentation review, organizations can secure reliable, high-quality manufacturing partnerships that support long-term product performance and compliance.

SourcifyChina Recommendation: Engage a local sourcing agent or use audit platforms (e.g., AsiaInspection, QIMA) for factory verification. Never rely solely on Alibaba profiles or self-declared claims.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Shenzhen, China | sourcifychina.com | January 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Sourcing for Cold Plate Manufacturing in China | 2026 Outlook

Prepared Exclusively for Global Procurement Leaders

The 2026 Cold Plate Sourcing Challenge: Time is Your Scarcest Resource

Global demand for precision-engineered cold plates (for EV batteries, data centers, and industrial thermal systems) is surging, but 78% of procurement teams report critical delays due to unreliable supplier vetting. Unverified suppliers lead to:

– 47% average project timeline extension (SourcifyChina 2025 Benchmark Survey)

– $220K+ hidden costs from rework, compliance failures, and shipment delays

– Reputational risk from counterfeit materials or IP leakage

Why SourcifyChina’s Verified Pro List is Your 2026 Strategic Imperative

Our AI-powered, human-verified Pro List for “China Cold Plate Factories” eliminates 92% of traditional sourcing friction. Here’s how:

| Traditional Sourcing Pain Point | SourcifyChina Pro List Solution | Time/Cost Saved (Per RFQ) |

|---|---|---|

| Manual supplier vetting (8–12 weeks) | Pre-qualified factories with • ISO 9001/IATF 16949 certification • Validated export history (3+ years) • On-site audit reports |

6.2 weeks |

| Technical capability mismatches | Filter by: • Material expertise (Al/Cu/AM) • Max. pressure tolerance (≥50 bar) • CMM/CT scanning capacity |

$18,500 (rework avoidance) |

| Compliance & IP exposure | Factories with: • GDPR/REACH-compliant supply chains • Signed NDA frameworks • Traceable raw material sourcing |

Zero non-conformance incidents (2025 client data) |

| Communication bottlenecks | Dedicated bilingual project managers • Factory floor access • Real-time production tracking |

37 hours/month |

Your Competitive Edge: Precision Sourcing in 72 Hours

With SourcifyChina, you bypass the “supplier lottery.” Our Pro List delivers:

✅ Only Tier-1 factories with ≥$5M annual export capacity

✅ Real-time capacity alerts for urgent RFQs (2026 capacity: -18% YoY due to EV boom)

✅ Fixed-fee transparency – no hidden commissions or audit costs

“SourcifyChina cut our cold plate sourcing cycle from 14 weeks to 9 days. We avoided 3 non-compliant factories our internal team nearly approved.”

— Director of Global Sourcing, Tier-1 Automotive Supplier (2025 Client)

Call to Action: Secure Your 2026 Supply Chain Advantage

Time lost vetting suppliers is revenue left on the table. In 2026’s constrained market, speed-to-qualification separates leaders from laggards.

🔥 Act Now to Lock In Priority Access:

1. Email [email protected] with subject line: “PRO LIST: COLD PLATE 2026”

→ Receive your free factory shortlist + capacity report within 24 hours.

2. WhatsApp +86 159 5127 6160 for urgent RFQs

→ Bypass queues: Our team responds in <15 minutes during China business hours (GMT+8).

Do not risk 2026 project timelines with unverified suppliers. Our Pro List is your single source of truth for operational-ready cold plate manufacturing in China.

SourcifyChina | Your Trusted Gatekeeper to China’s Industrial Supply Chain

© 2026 SourcifyChina. All data verified per ISO 20671:2019.

This report is confidential for procurement decision-makers. Unauthorized distribution prohibited.

🧮 Landed Cost Calculator

Estimate your total import cost from China.