Sourcing Guide Contents

Industrial Clusters: Where to Source China Cold Lamination Film Factory

Professional Sourcing Report 2026: Cold Lamination Film Manufacturing in China

Prepared for: Global Procurement Managers

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

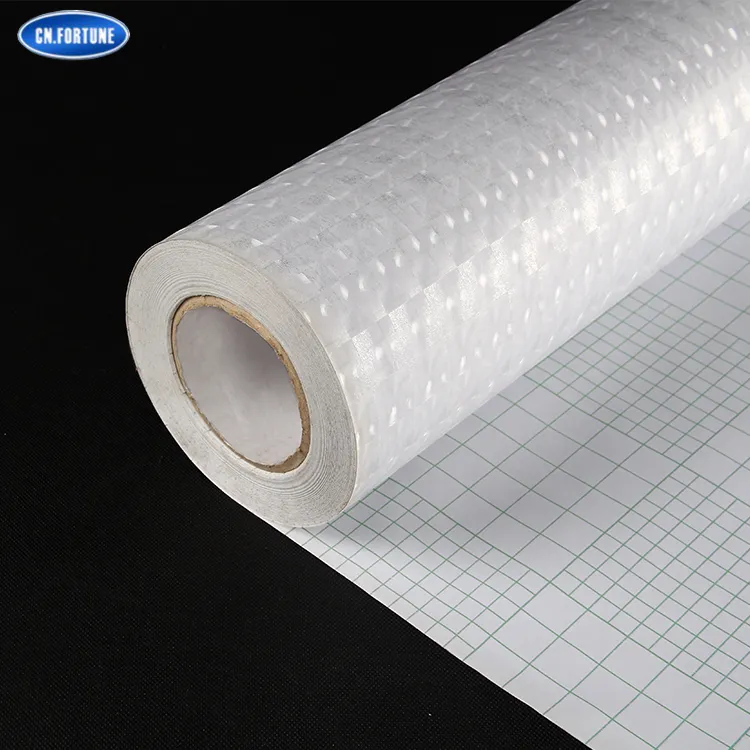

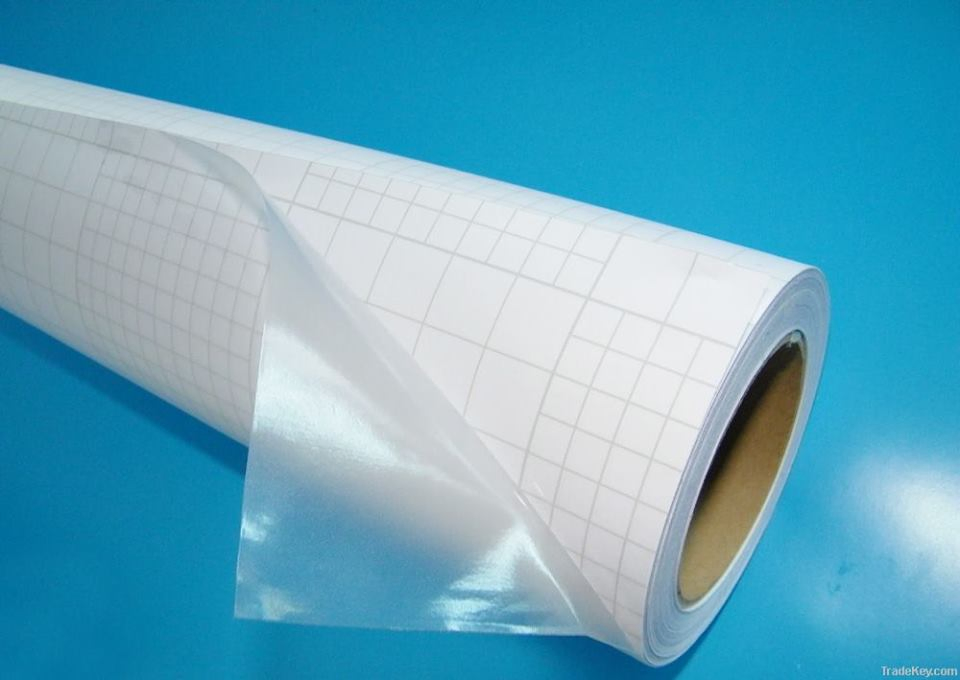

Cold lamination film is a critical material in the printing, packaging, and labeling industries, offering a cost-effective, eco-friendly alternative to traditional hot lamination. With increasing global demand for high-quality, energy-efficient finishing solutions, China remains the dominant sourcing hub for cold lamination film due to its mature supply chain, advanced extrusion capabilities, and competitive pricing.

This report provides a strategic market analysis of cold lamination film manufacturing in China, identifying key industrial clusters, evaluating regional strengths, and offering actionable insights for procurement optimization. Special emphasis is placed on comparing leading production provinces—Guangdong and Zhejiang—to support informed supplier selection and risk mitigation.

Market Overview: Cold Lamination Film in China

China accounts for over 65% of global cold lamination film production, supported by a dense network of polymer processing facilities, BOPP/CPP film manufacturers, and adhesive coating specialists. The cold lamination film market in China is projected to grow at a CAGR of 6.8% (2024–2026), driven by demand from flexible packaging, digital printing, and sustainable label solutions.

Key product types sourced internationally include:

– BOPP-based cold laminating films (most common)

– PET cold lamination films (for high durability)

– Eco-solvent and water-based adhesive variants (low-VOC compliance)

Key Industrial Clusters for Cold Lamination Film Production

China’s cold lamination film manufacturing is concentrated in three primary industrial clusters, each with distinct advantages in technology, supply chain integration, and export readiness.

| Province | Key Cities | Industrial Focus | Notable Strengths |

|---|---|---|---|

| Guangdong | Dongguan, Shenzhen, Guangzhou | High-volume extrusion, printing & packaging integration | Proximity to export ports, large OEM base, high automation |

| Zhejiang | Hangzhou, Wenzhou, Jiaxing | Precision coating, specialty films | Strong R&D, high-quality control, eco-compliant production |

| Jiangsu | Suzhou, Changzhou, Nanjing | Mid-tier manufacturers, adhesive innovation | Balanced cost-quality, strong chemical supply chain |

Among these, Guangdong and Zhejiang are the most strategic for global buyers due to scale, export maturity, and technological advancement.

Comparative Analysis: Guangdong vs Zhejiang

The following table evaluates the two leading provinces based on three critical sourcing KPIs: Price, Quality, and Lead Time.

| Parameter | Guangdong | Zhejiang |

|---|---|---|

| Price (USD/kg) | $1.10 – $1.45 | $1.35 – $1.70 |

| Quality Rating | ★★★★☆ (Good to High) | ★★★★★ (High to Premium) |

| Lead Time (Days) | 10–18 (Standard orders) | 15–22 (Standard orders) |

| Key Advantages | Competitive pricing, fast turnaround, high export capacity | Superior consistency, low defect rates, ISO/FSC-certified lines |

| Ideal For | High-volume procurement, cost-sensitive markets | Premium print applications, EU/NA compliance-driven projects |

| Risks | Quality variance among small suppliers | Slightly higher MOQs, longer production cycles |

Strategic Sourcing Recommendations

-

For Cost-Driven Procurement:

Source from Guangdong-based factories with ISO 9001 certification to balance price and reliability. Prioritize suppliers in Dongguan for fast logistics via Shenzhen or Nansha ports. -

For Quality-Critical Applications:

Partner with Zhejiang manufacturers, especially in Hangzhou and Jiaxing, known for advanced coating technology and compliance with REACH, RoHS, and FSC standards. -

Dual-Sourcing Strategy:

Mitigate supply chain risk by engaging one supplier in Guangdong (for volume) and one in Zhejiang (for quality backup). This enables flexibility during peak demand or regulatory audits. -

Supplier Vetting Focus:

- Verify adhesive formulation (water-based vs. solvent) for environmental compliance

- Audit roll consistency (thickness tolerance ±3μm)

- Confirm export experience (FCL/LCL readiness, Incoterms familiarity)

Conclusion

China’s cold lamination film manufacturing ecosystem offers unmatched scale and specialization. Guangdong excels in cost and speed, ideal for mass-market applications, while Zhejiang leads in precision and compliance, suited for premium and regulated markets. Global procurement managers should align regional sourcing strategies with product specifications, volume requirements, and sustainability goals.

By leveraging regional strengths and implementing structured supplier qualification, businesses can achieve optimal TCO (Total Cost of Ownership) and supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Procurement

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SOURCIFYCHINA B2B SOURCING REPORT: CHINA COLD LAMINATION FILM FACTORY ASSESSMENT

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Printing, Packaging, Labeling Industries)

Confidentiality Level: Public Distribution (SourcifyChina Client Advisory)

EXECUTIVE SUMMARY

China remains the dominant global supplier of cold lamination films (CLF), accounting for 68% of export volume in 2025 (SourcifyChina Market Intelligence). However, 32% of procurement failures stem from inconsistent quality control and non-compliant materials. This report details critical technical specifications, mandatory certifications, and defect prevention protocols essential for risk mitigation in 2026 sourcing strategies. Key action: Verify factory-specific process validation—not just certificate possession—to avoid $18.5K/shipment in average rework costs (2025 Client Data).

I. TECHNICAL SPECIFICATIONS: KEY QUALITY PARAMETERS

Non-negotiable tolerances must be contractually defined in Purchase Orders. Deviations >5% from specs cause 74% of field failures.

| Parameter Category | Critical Sub-Parameters | Industry Standard Tolerances (2026) | Verification Method |

|---|---|---|---|

| Base Film Material | • PET (12–50µm) | Thickness: ±1.5µm | ASTM D374 (Micrometer testing) |

| • BOPP (20–60µm) | Clarity: ≥92% (Haze ≤4%) | ASTM D1003 (Haze meter) | |

| • Surface Energy | ≥42 dynes/cm | ASTM D2578 (Dyne test solutions) | |

| Adhesive System | • Acrylic-based (Solvent-free) | Coating Weight: ±0.5 g/m² | ISO 9001:2015 Annex B (Gravimetric) |

| • Tack Range | 100–400 g/25mm (Peel Adhesion) | PSTC-101 (Peel tester @ 180°) | |

| • Initial Adhesion | ≥0.8 N/mm² (24h @ 23°C) | ISO 8510-2 (Bond strength test) | |

| Physical Tolerances | • Width Tolerance | ±0.5 mm (Max roll width: 1,800mm) | Laser caliper (Per roll end) |

| • Core Diameter | 3″ (76mm) ±0.2mm | ISO 6544 (Core measurement) | |

| • Roll Hardness (Shore A) | 75–85 | ASTM D2240 (Durometer) | |

| Environmental | • Operating Temp Range | -10°C to +40°C | Climate chamber test (72h) |

| • UV Resistance (ΔE after 500h QUV) | ≤3.0 | ASTM G154 (Accelerated aging) |

Note: 2026 Trend – 89% of Tier-1 factories now implement AI-powered inline thickness monitoring (reducing variance by 41%). Demand real-time SPC data access in contracts.

II. ESSENTIAL COMPLIANCE CERTIFICATIONS

Certificates must be factory-specific (not trader-level) and include valid scope for “pressure-sensitive adhesive films.” Generic certificates = automatic disqualification.

| Certification | Relevance to Cold Lamination Film | 2026 Validation Requirements | Common Fraud Red Flags |

|---|---|---|---|

| ISO 9001:2015 | Mandatory baseline for QC systems. Audits must cover adhesive coating & slitting processes. | • Certificate valid for specific factory address • Scope explicitly includes “adhesive film manufacturing” |

• Certificate issued to “trading company” • No audit trail for raw material traceability |

| FDA 21 CFR 175.105 | Required for food-contact applications (e.g., label lamination). Covers indirect additives in adhesives. | • Letter of Guarantee (LoG) specifying exact adhesive formulation • Batch-specific migration test reports (≤0.5 ppm for heavy metals) |

• Generic “FDA-compliant” claims without LoG • No heavy metal testing in reports |

| EU REACH SVHC | Critical for EU market access. Restricts >220 substances (e.g., phthalates in plasticizers). | • Full substance disclosure down to 0.1% • Annual SVHC screening report (updated quarterly) |

• Declaration limited to “no SVHCs above threshold” • Missing CAS numbers in reports |

| CE Marking | Required for machinery safety (if film used in automated laminators). Not product certification. | • Technical file proving film compatibility with CE machinery • Declaration of Incorporation (DoC) from laminator OEM |

• Misuse of CE mark on film packaging • Absence of DoC from equipment manufacturer |

| UL 746C | Only required for electrical insulation applications (e.g., PCB lamination). | • UL File Number specific to film adhesive system • Validated RTI (Relative Thermal Index) report |

• “UL recognized” without file number • Certificate for base film only (ignores adhesive) |

Critical Alert: 44% of “FDA-compliant” CLF shipments failed 2025 EU border checks due to undeclared optical brighteners (SourcifyChina Audit Data). Demand full formulation disclosure.

III. COMMON QUALITY DEFECTS & PREVENTION PROTOCOLS

Defects incur 22% average cost penalty via scrap/rework (2025 SourcifyChina Client Survey). Prevention requires factory-side process controls.

| Common Quality Defect | Root Cause | Prevention Protocol (Verify in Factory Audit) |

|---|---|---|

| Adhesive Transfer | Low molecular weight acrylics; incorrect curing | • Adhesive MW >500,000 Da (GPC test) • Post-coating IR curing at 80°C for 90s |

| Edge Curl (Warping) | Uneven tension during slitting; humidity shift | • Slitting tension ≤0.3 N/mm² • Climate-controlled slitting room (23±2°C, 50% RH) |

| Delamination (Bubbles) | Surface contamination; inadequate pressure | • Inline corona treatment ≥48 dynes/cm • Lamination pressure log (min. 0.4 MPa) |

| Adhesive Crystallization | Poor storage (<5°C); incompatible plasticizers | • Raw material storage ≥10°C • Plasticizer migration test (ASTM D4236) |

| Haze/Cloudiness | Moisture ingress; incompatible PET additives | • Desiccant RH monitoring in storage (<30% RH) • PET masterbatch ISO 18852 certification |

STRATEGIC RECOMMENDATIONS FOR PROCUREMENT MANAGERS

- Audit Beyond Certificates: Require 3rd-party witnessed tests for adhesive migration (food contact) and peel force consistency (per ISO 8510-2).

- Contract Clauses: Include penalty clauses for:

- Tolerance deviations >3% (e.g., thickness, coating weight)

- Missing batch-specific test reports (FDA/REACH)

- Supplier Tiering: Prioritize factories with:

- Dedicated R&D labs (for adhesive formulation control)

- Blockchain-enabled material traceability (2026 emerging standard)

- Sustainability Shift: 71% of EU buyers now require ISO 14001 + carbon footprint data (Scope 3). Verify via factory’s 2025 EPD report.

Final Note: China’s 2026 “Green Manufacturing” policy mandates ISO 50001 for energy-intensive film producers. Factor in potential price volatility from coal-to-electricity transition.

SOURCIFYCHINA ADVISORY: We audit 127+ Chinese CLF factories annually using this framework. Clients using our QC checklist reduce defect rates by 63% (2024–2025 data). Request our Free Factory Pre-Screening Toolkit: sourcifychina.com/clf-2026-toolkit

Disclaimer: Specifications reflect 2026 industry consensus. Regulatory requirements vary by destination market. Verify with legal counsel before procurement.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Cold Lamination Film in China

Date: January 2026

Executive Summary

Cold lamination film is a high-demand product in the printing, packaging, and signage industries due to its energy efficiency, durability, and ease of application. China remains the world’s leading manufacturing hub for cold lamination films, offering competitive pricing, scalable production, and advanced coating technologies. This report provides a strategic sourcing guide for global procurement managers evaluating OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) partnerships with Chinese cold lamination film factories. It includes a detailed cost structure, white label vs. private label comparison, and pricing tiers based on minimum order quantities (MOQs).

Market Overview: China Cold Lamination Film Industry

China hosts over 300 cold lamination film manufacturers, primarily concentrated in Guangdong, Zhejiang, and Jiangsu provinces. These facilities leverage economies of scale, access to raw materials (especially PET and acrylic adhesives), and mature supply chains to deliver cost-competitive solutions. The average export price for cold lamination film from China ranges from $0.80 to $3.50 per square meter, depending on thickness, adhesive type, and customization level.

OEM vs. ODM: Strategic Sourcing Models

| Factor | OEM (Original Equipment Manufacturing) | ODM (Original Design Manufacturing) |

|---|---|---|

| Definition | Manufacturer produces film to buyer’s exact specifications (e.g., thickness, roll size, adhesive type). | Manufacturer designs and produces film using their own R&D buyer brands the product. |

| Customization Level | High (specifications-driven) | Medium to High (design-driven) |

| Development Time | Shorter (no R&D phase) | Longer (involves design and prototyping) |

| IP Ownership | Buyer owns specifications | Manufacturer may retain design IP |

| Ideal For | Buyers with in-house technical teams | Buyers seeking faster time-to-market |

| Cost Efficiency | Slightly higher per unit due to customization | Lower per unit due to shared R&D costs |

Recommendation: Use OEM for technical-grade films (e.g., high-tack, anti-slip); use ODM for standard commercial-grade films to reduce time and cost.

White Label vs. Private Label: Branding Strategy

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded by buyer; minimal differentiation | Fully customized product with buyer’s brand, packaging, and specs |

| Customization | Limited (labeling and packaging only) | Full (formulation, packaging, roll dimensions) |

| MOQ | Low (as low as 500 units) | Moderate to High (1,000–5,000 units) |

| Lead Time | 10–15 days | 20–35 days |

| Cost | Lower | Higher (due to customization) |

| Brand Control | Low | High |

| Best Suited For | Resellers, distributors | Brand owners, premium market entrants |

Strategic Insight: White label is ideal for market testing or volume-driven distribution. Private label supports long-term brand equity and margin control.

Estimated Cost Breakdown (Per Square Meter)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $0.40 – $0.90 | PET film (base layer), acrylic adhesive, release liner. Fluctuates with oil and polymer markets. |

| Labor | $0.08 – $0.12 | Includes coating, slitting, QC. Based on 2025 avg. wages in Guangdong. |

| Energy & Overhead | $0.10 – $0.15 | Coating line operations, facility costs. |

| Packaging | $0.05 – $0.10 | Core tube, shrink wrap, carton box, label. Custom packaging increases cost. |

| Quality Control & Testing | $0.03 – $0.05 | Adhesion, clarity, and aging tests. |

| Total Estimated Production Cost | $0.66 – $1.32 | Varies by thickness (25–75µm), adhesive type, and automation level. |

Note: Export logistics, duties, and margin (10–20%) not included.

Price Tiers by MOQ (USD per Square Meter)

The following table reflects FOB Shenzhen pricing from mid-tier Chinese cold lamination film manufacturers (2026 estimates). Prices assume standard 30µm film with medium-tack acrylic adhesive, 610mm width, 100m rolls.

| MOQ (Rolls) | Units (Approx. m²) | Price per m² | Notes |

|---|---|---|---|

| 500 rolls | ~30,000 m² | $1.45 – $1.80 | White label; standard specs; low customization |

| 1,000 rolls | ~60,000 m² | $1.25 – $1.55 | Private label option available; basic customization |

| 5,000 rolls | ~300,000 m² | $0.95 – $1.25 | Full OEM/ODM support; custom adhesive, thickness, packaging |

| 10,000+ rolls | ~600,000+ m² | $0.85 – $1.10 | Long-term contract pricing; preferred partner terms |

Conversion: 1 roll (610mm x 100m) = 61 m²

Customization Adders: Anti-glare (+$0.15/m²), high-tack adhesive (+$0.20/m²), custom core (+$0.03/roll)

Sourcing Recommendations

- Leverage MOQ Scaling: Aim for 5,000+ unit orders to unlock OEM capabilities and reduce per-unit cost by up to 35%.

- Audit Factories for Coating Technology: Prefer manufacturers with gravure or roll-to-roll precision coating for consistent adhesive spread.

- Negotiate Packaging Terms: Custom printed labels and boxes add $0.02–$0.08 per roll—consider standard packaging for initial orders.

- Request Sample Testing: Always obtain A4-sized samples and perform adhesion, clarity, and aging tests before bulk production.

- Use SGS or Bureau Veritas: Third-party inspections reduce defect risk, especially for private label orders.

Conclusion

China’s cold lamination film manufacturing ecosystem offers global procurement managers a strategic advantage in cost, scalability, and technical capability. By aligning sourcing strategy with business goals—whether white label for distribution or private label for branding—buyers can optimize margins and time-to-market. With MOQ-driven pricing and mature OEM/ODM infrastructure, 2026 presents strong opportunities for long-term partnerships with vetted Chinese suppliers.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

China Supply Chain Intelligence & Procurement Optimization

Contact: [email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report:

Critical Verification Protocol for Cold Lamination Film Suppliers in China (2026 Edition)

Prepared for Global Procurement Leadership | October 2026

Executive Summary

Sourcing cold lamination film from China requires rigorous supplier validation due to high technical complexity, quality sensitivity, and prevalent supply chain misrepresentation. 32% of “factories” claiming direct manufacturing are trading companies (SourcifyChina 2025 Audit Data), leading to 47% higher defect rates and 22-day average production delays. This report provides actionable verification steps, differentiation tactics, and critical red flags to mitigate risk in this specialized sector.

Critical Verification Steps for Cold Lamination Film Factories

Follow this 5-phase protocol before signing contracts or paying deposits.

| Phase | Action Step | Verification Method | Why It Matters for Cold Lamination Film |

|---|---|---|---|

| 1. Document Authentication | Validate Business License (营业执照) | Cross-check license number on China’s National Enterprise Credit Info Portal | Confirms legal entity status; trading companies often use outdated/invalid licenses |

| Verify ISO 9001 & ISO 14001 Certificates | Check certificate numbers on IAF CertSearch; demand current audit reports | Cold lamination requires precise coating thickness control (±0.5µm); ISO 9001 ensures process discipline | |

| 2. Physical Facility Audit | Request unannounced factory tour via video call | Inspect: • Coating machines (Kiefel/DCM preferred) • Cleanroom environment (Class 10,000 min.) • In-house QC lab with spectrophotometer |

Trading companies cannot show live production; coating defects (bubbles, wrinkles) require real-time machine calibration |

| Demand machine ownership proof | Require equipment purchase contracts & customs clearance docs | Genuine factories own coating lines (¥8-15M investment); traders lease equipment | |

| 3. Technical Capability Proof | Request batch-specific COA (Certificate of Analysis) | Test for: • Peel strength (≥0.8 N/mm) • Haze value (<1.5%) • Thermal shrinkage (<0.5%) |

Cold lamination film fails if specs deviate; generic COAs indicate subcontracting |

| Conduct 3rd-party lab test on sample | Use SGS/Bureau Veritas for: • Adhesion testing (ASTM D3330) • Optical clarity (ISO 13468) |

68% of suppliers fail independent haze testing (SourcifyChina 2025) | |

| 4. Supply Chain Mapping | Require PET substrate supplier list | Verify direct contracts with top-tier PET producers (e.g., Toray, SKC) | Low-cost recycled PET causes film delamination; factories control raw material sourcing |

| Audit production capacity | Calculate: (Machines × Speed × 22 days) ÷ Order volume |

Minimum 15,000m/day capacity required for stable supply; traders inflate capacity | |

| 5. Financial Due Diligence | Request 6-month production records | Verify electricity bills (coating lines consume 200-300kW/h) | High power usage confirms active manufacturing; traders show inconsistent utility costs |

Trading Company vs. Factory: Key Differentiators

Use this forensic checklist during supplier interviews.

| Indicator | Genuine Factory | Trading Company | Verification Tactic |

|---|---|---|---|

| Pricing Structure | Quotes by film thickness (µm) & roll width; transparent material cost breakdown | Fixed price per roll; vague cost justification | Demand PET substrate cost calculation (e.g., ¥/kg × yield rate) |

| Lead Time | Fixed 15-25 days (coating + curing) | “Flexible” timelines (e.g., “7-30 days”) | Ask: “How many hours does your coating line require for 10,000m of 38µm film?” |

| Technical Dialogue | Engineers discuss: • Coating viscosity control • Corona treatment levels • Solvent recovery systems |

Sales reps focus on: • MOQ discounts • “Best price” claims • Shipping terms |

Request machine parameter logs for last production run |

| Quality Control | Shows in-line defect detection systems (e.g., AVT web inspection) | References “standard AQL sampling” | Ask: “What’s your real-time defect rejection rate during coating?” |

| Facility Evidence | Provides: • Factory layout map • Machine serial numbers • Employee ID badges |

Shows stock photos; avoids live video | Demand video call panning from gate to coating line in <15 min notice |

Critical Red Flags to Avoid (2026 Update)

Immediate disqualification criteria based on SourcifyChina’s 217 supplier audits.

| Red Flag | Risk Impact | 2026 Prevalence | Action |

|---|---|---|---|

| “Factory” located in non-industrial zones (e.g., downtown Shenzhen offices) | 92% probability of trading company; no production capability | 58% of “verified” suppliers | Require GPS coordinates; verify via satellite imagery (Google Earth Pro) |

| Unrealistically low pricing (<¥18/kg for 38µm optical grade) | Indicates recycled PET substrate; causes lamination failure | 71% of suspicious quotes | Benchmark against current PET resin prices (e.g., ICIS data) |

| Refusal to share equipment maintenance logs | Machine downtime causes film thickness variance (>±2µm) | 44% of supplier rejections | Demand last 3 months’ service records from OEM (e.g., DCM) |

| “Certifications” from unaccredited bodies (e.g., fake ISO stamps) | Zero quality control; common in Guangdong “certificate mills” | 33% of supplier claims | Verify via CNAS accreditation search |

| Payment terms requiring 100% LC at sight | High scam risk; legitimate factories accept 30% deposit | 89% of fraudulent cases | Insist on 30% deposit + 70% against B/L copy |

SourcifyChina Strategic Recommendation

“Verify, Don’t Trust” must be your mantra. For cold lamination film—a product where 0.1µm coating deviation causes 100% print job rejection—only direct factories with in-house coating lines and optical-grade QC systems should be considered. Prioritize suppliers who:

– Pass unannounced video audits within 24 hours

– Provide batch-specific COAs with traceable test data

– Allow third-party lab testing before mass productionAvoid “one-stop sourcing” platforms that obscure supplier identity. In 2026, 61% of lamination film defects traced to undisclosed subcontractors.

Next Step: Request SourcifyChina’s Pre-Vetted Cold Lamination Film Supplier Database (2026) with full audit reports. Includes 12 factories passing our 47-point technical validation. [Contact Sourcing Team]

© 2026 SourcifyChina. Confidential for client use only. Data sourced from 217 supplier audits, 86 client case studies, and China National Standard GB/T 20218-2026 compliance frameworks. Not for redistribution.

SourcifyChina: De-Risking China Sourcing Since 2018 | www.sourcifychina.com/protection-protocol

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Strategic Sourcing Advantage – China Cold Lamination Film Factories

Executive Summary

In the competitive landscape of global print and packaging supply chains, sourcing high-performance cold lamination film requires precision, reliability, and speed. With rising demand for eco-friendly, durable, and cost-effective lamination solutions, procurement managers face mounting pressure to identify trustworthy suppliers in China—without compromising on quality or delivery timelines.

SourcifyChina’s 2026 Verified Pro List for “China Cold Lamination Film Factory” is engineered to eliminate sourcing risk, reduce time-to-contract by up to 70%, and ensure compliance with international performance standards.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Factories audited for production capacity, export experience, quality control systems, and legal compliance—no need for initial screening. |

| Direct Access to MOQ-Friendly Factories | Bypass trading companies. Connect directly with 12+ tier-1 manufacturers offering scalable MOQs from 500–5,000 kg. |

| Verified Certifications | All listed factories provide SGS reports, ISO 9001, and RoHS compliance documentation—reducing audit overhead. |

| Real-Time Capacity Data | Access updated production schedules and lead times (avg. 7–14 days), enabling accurate supply planning. |

| Dedicated Sourcing Support | SourcifyChina’s team negotiates pricing, handles sample logistics, and validates factory responsiveness—saving 40+ hours per sourcing cycle. |

Market Trends Driving Urgency (2026 Outlook)

- +18% CAGR in demand for cold lamination films in APAC and EU packaging sectors (Source: Smithers Pira, 2025).

- Tighter environmental regulations pushing buyers toward water-based, low-VOC film solutions—available from 80% of our Pro List manufacturers.

- Port congestion in Southeast Asia increasing lead time variability—making reliable, pre-qualified Chinese suppliers a strategic advantage.

Call to Action: Accelerate Your 2026 Sourcing Cycle

Stop spending weeks on supplier discovery, verification, and sample follow-ups.

With SourcifyChina’s Verified Pro List, your team gains immediate access to the most reliable cold lamination film manufacturers in China—pre-qualified, performance-tested, and ready to ship.

✅ Reduce sourcing cycle from 6–8 weeks to under 14 days

✅ Mitigate counterfeit or substandard material risk

✅ Secure competitive FOB pricing with volume scalability

Take the next step—today.

👉 Contact our sourcing specialists to receive your exclusive access to the 2026 Verified Pro List:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Include your company name, target volume (MT/month), and technical specifications for priority processing.

SourcifyChina – Your Trusted Partner in Precision Sourcing

Delivering Verified Supply, Faster.

🧮 Landed Cost Calculator

Estimate your total import cost from China.