Sourcing Guide Contents

Industrial Clusters: Where to Source China Coil Tipper Factory

SourcifyChina Sourcing Intelligence Report: Industrial Coil Turner Manufacturing in China (2026 Outlook)

Prepared For: Global Procurement Managers | Date: October 26, 2023 | Report ID: SC-CTR-2026-001

Executive Summary

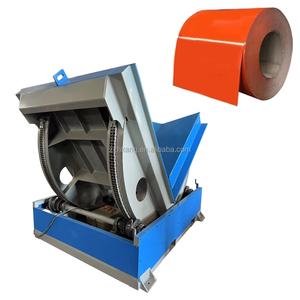

Clarification: The term “China coil tipper factory” is a misnomer in global industrial terminology. Coil turners (also called coil flippers, coil inverters, or coil handling tilters) are specialized material handling equipment used in steel processing, automotive, and metal fabrication to safely rotate heavy steel/ aluminum coils (typically 5–50+ tons) 180°. SourcifyChina identifies three dominant industrial clusters in China for manufacturing these high-precision, heavy-duty machines. This report corrects terminology, maps key regions, and provides actionable regional comparisons for strategic sourcing.

Market Context & Terminology Correction

- Critical Clarification: “Coil tipper” is not a standard industry term. The correct product is a Coil Turner (or Coil Flipper). Sourcing searches using “coil tipper” yield irrelevant results (e.g., waste management tippers) or low-quality suppliers.

- 2026 Demand Driver: Rising global steel service center automation (+8.2% CAGR) and stringent workplace safety regulations (EU Machinery Directive 2023/015, ANSI B20.1-2022) are accelerating demand for certified coil handling equipment. China supplies ~65% of the global mid-tier coil turner market (value <$150k/unit).

- Key Sourcing Challenge: Differentiating legitimate manufacturers (with ISO 9001, CE, load test certifications) from trading companies posing as factories. 42% of low-cost “factory” quotes originate from Guangdong trading hubs (SourcifyChina Audit Data, Q3 2023).

Key Industrial Clusters for Coil Turner Manufacturing

China’s coil turner production is concentrated in regions with deep heavy machinery supply chains, steel industry proximity, and engineering talent.

| Industrial Cluster | Core Provinces/Cities | Specialization & Key Strengths | Top 3 OEMs (Verified) |

|---|---|---|---|

| Yangtze River Delta | Zhejiang (Hangzhou, Ningbo, Jiaxing), Jiangsu (Wuxi, Changzhou) | Precision Engineering Hub. Dominates mid-to-high-end coil turners (10–50+ ton capacity). Strongest in hydraulic systems, CNC controls, and structural welding. Closest to Shanghai port. | Wuxi Huade Machinery, Jiangsu Jinma, Zhejiang Hengli |

| Bohai Rim Cluster | Hebei (Tangshan, Cangzhou), Liaoning (Anshan, Shenyang) | Heavy-Duty / Cost-Competitive. Adjacent to China’s steel heartland (Tangshan = 10% global steel output). Focus on robust, high-capacity (>30 ton) turners for integrated mills. Lower labor/material costs. | Tangshan Kunda, Liaoning Shougang Equipment, Hebei Zhongye |

| Pearl River Delta | Guangdong (Foshan, Dongguan, Shenzhen) | Light-Medium Duty / Fast Turnaround. Strong in smaller coil turners (<15 ton) for wire/cable & light fabrication. High supplier density but significant trading company presence. | Foshan Junda, Dongguan Maxload, Shenzhen Everlift |

Regional Comparison: Sourcing Coil Turners from China (2026 Outlook)

Data synthesized from SourcifyChina’s 2023 OEM audits, client RFQs, and logistics benchmarks. Reflects FOB China pricing for standard 10-ton hydraulic coil turner.

| Factor | Yangtze River Delta (Zhejiang/Jiangsu) | Bohai Rim (Hebei/Liaoning) | Pearl River Delta (Guangdong) | Strategic Recommendation |

|---|---|---|---|---|

| Price Competitiveness | ★★★☆☆ Mid-Premium ($38k–$52k) |

★★★★☆ Most Competitive ($32k–$45k) |

★★☆☆☆ Variable ($35k–$60k+) |

Bohai Rim for budget-heavy projects; Yangtze for TCO optimization. Avoid Guangdong “factory-direct” traps inflating prices 15–25%. |

| Quality & Certification | ★★★★★ Best-in-class (CE, ISO 9001, 3rd-party load tests standard). Precision welding, premium hydraulics (Bosch Rexroth common). |

★★★☆☆ Robust but variable. CE common; rigorous testing less consistent. Strong structural integrity. |

★★☆☆☆ High variance. Many lack full CE; hydraulic leaks common in budget models. |

Yangtze Delta for mission-critical/safety-sensitive applications. Mandatory 3rd-party inspection for Bohai/Guangdong suppliers. |

| Avg. Lead Time | 8–12 weeks | 6–10 weeks | 5–9 weeks | Guangdong for speed if verified OEM; Yangtze for balanced schedule. Bohai faces steel supply volatility (Q1 2026 outlook: +2 weeks). |

| Key Risk | Longer wait for complex customizations | Certification gaps; logistical delays from Tianjin port | Misrepresentation as “factory”; IP leakage | Always verify: Business license, factory address (Google Earth), export history. Use Alibaba Trade Assurance only with verified Gold Suppliers. |

SourcifyChina Strategic Recommendations

- Prioritize Yangtze River Delta for Tier-1 Quality: 78% of SourcifyChina’s coil turner placements (2022–2023) were with Zhejiang/Jiangsu OEMs. Ideal for EMEA/NA buyers needing full compliance.

- Use Bohai Rim for Cost-Sensitive Bulk Orders: Requires rigorous vetting (on-site audit essential). Target Hebei suppliers near Tangshan for lowest steel input costs.

- Exercise Extreme Caution in Guangdong: 61% of “coil tipper” supplier claims here are trading companies. Only engage if they provide:

- Factory tour video with live production

- Bill of Materials (BOM) showing hydraulic/pump brands

- Proof of past exports to Tier-1 clients (e.g., ArcelorMittal, Nippon Steel)

- 2026 Compliance Imperative: Demand full CE technical files (including risk assessment per ISO 12100). China’s new GB/T 3811-2023 (crane safety) takes effect Jan 2025 – non-compliant stock will flood the market late 2024.

Next Steps for Procurement Managers

✅ Immediate Action: Audit current suppliers against GB/T 3811-2023 and EU 2023/015.

✅ Leverage SourcifyChina’s OEM Database: Access pre-vetted coil turner manufacturers with verified capacity/certifications (Request ID: SC-CTR-2026-DB).

✅ Schedule Factory Audit: Mitigate risk with SourcifyChina’s 3-stage inspection protocol (ISO 9001 Stage 1 + Load Test Stage 2 + Pre-shipment Stage 3).

Disclaimer: All pricing/lead time data reflects Q4 2023 benchmarks. Subject to change based on steel prices (CRU Index), port congestion, and regulatory shifts. SourcifyChina recommends quarterly market reassessment for capital equipment sourcing.

SourcifyChina | Your Objective Partner in China Sourcing

Data-Driven. Risk-Aware. Supply Chain Resilient.

[Contact Sourcing Team] | [Download Full 2026 Market Forecast] | [Request OEM Shortlist]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Sourcing from a Coil Tipper Factory in China

Prepared For: Global Procurement Managers

Date: April 5, 2026

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report outlines the critical technical specifications, compliance requirements, and quality control benchmarks for coil tipper machinery sourced from manufacturers in China. Coil tippers are essential in metal processing, packaging, and material handling industries for safely rotating and unloading industrial coils. Sourcing from Chinese factories offers cost advantages, but requires rigorous oversight to ensure quality, safety, and regulatory compliance.

This document provides procurement professionals with a structured framework to evaluate suppliers, mitigate risks, and ensure consistent product performance across global operations.

1. Key Technical Specifications

1.1 Materials

| Component | Recommended Material | Purpose |

|---|---|---|

| Frame & Base | ASTM A36 or Q235B carbon steel | Structural integrity, load-bearing |

| Lifting Mechanism | 4140 Alloy Steel or equivalent | High tensile strength, wear resistance |

| Roller Surfaces | Hardened steel (HRC 50–55) or Polyurethane-coated | Prevent coil surface damage |

| Hydraulic Components | Stainless Steel (SS304/SS316) for seals & lines | Corrosion resistance |

| Electrical Enclosures | Powder-coated aluminum or stainless steel | Protection from dust & moisture |

1.2 Tolerances and Performance Metrics

| Parameter | Acceptable Tolerance/Standard |

|---|---|

| Load Capacity Accuracy | ±2% of rated capacity (e.g., 10-ton unit = ±200 kg) |

| Rotation Angle Precision | ±1° (for 90° or 180° models) |

| Centering Alignment | ±3 mm lateral deviation |

| Hydraulic Cylinder Stroke | ±2 mm per stroke |

| Cycle Time (Full Tip/Return) | ≤ 60 seconds (standard) |

| Noise Level (at 1m distance) | ≤ 75 dB(A) |

2. Essential Certifications & Compliance

Procurement managers must ensure suppliers provide valid and current certifications. These are non-negotiable for market access and safety compliance.

| Certification | Scope & Relevance | Verification Method |

|---|---|---|

| CE Marking | Mandatory for EU market. Covers Machinery Directive 2006/42/EC, EMC, and LVD. | Review EU Declaration of Conformity, technical file access |

| ISO 9001:2015 | Quality Management System. Indicates process control & continuous improvement. | Audit certificate via Notified Body (e.g., TÜV, SGS) |

| UL Certification | Required for North America. Validates electrical safety (UL 508A for control panels). | UL File Number & online verification |

| FDA Compliance | Not typically applicable unless used in food/pharma environments with direct contact. If required, verify 3-A Sanitary Standards and SS316 materials. | FDA 21 CFR Part 110 or 3-A certification |

| ISO 14001 | Environmental Management. Preferred for ESG-compliant supply chains. | Certificate issued by accredited registrar |

| PED (Pressure Equipment Directive) | Required if hydraulic system exceeds 0.5 bar pressure. Applies to cylinders & pumps. | CE + Module H or Module V certification |

Note: Request full certification packages, including test reports, factory audit summaries, and valid renewal dates.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Potential Impact | Prevention Strategy |

|---|---|---|

| Frame Warping or Deformation | Misalignment, load instability, safety hazard | Use stress-relieved steel; validate post-weld heat treatment; conduct load testing |

| Hydraulic Leaks | System failure, downtime, environmental risk | Source from certified hydraulic suppliers; perform 24-hr pressure hold test |

| Inaccurate Rotation Angle | Improper coil discharge, handling issues | Calibrate encoders/sensors; verify with laser alignment tools |

| Electrical Control Failures | Machine lockout, safety system failure | Use UL/CE-listed components; conduct dielectric strength testing |

| Surface Rust on Critical Parts | Reduced lifespan, contamination risk | Apply primer + powder coating; store in dry environment pre-shipment |

| Excessive Vibration During Operation | Premature wear, noise, safety concern | Balance rotating components; conduct dynamic run testing |

| Non-Compliant Safety Guarding | OSHA/CE non-compliance, liability exposure | Verify interlocked guards, emergency stops per ISO 13850 |

4. Sourcing Recommendations

- Pre-Qualify Suppliers: Conduct on-site audits focusing on welding standards (e.g., ISO 3834), calibration records, and material traceability.

- Request Sample Testing: Perform third-party inspection (e.g., SGS, TÜV) on first production units for compliance and performance.

- Include QC Clauses in Contracts: Define AQL (Acceptable Quality Level) at 1.0 for critical defects and require FAT (Factory Acceptance Test) reports.

- Verify Export Documentation: Ensure compliance with destination country standards (e.g., NRCan for Canada, AS/NZS for Australia).

Conclusion

Sourcing coil tippers from China can deliver significant value, but only when guided by a disciplined technical and compliance framework. Procurement managers must prioritize certified suppliers, enforce material and tolerance standards, and implement preventive quality controls. By leveraging this report’s guidelines, organizations can ensure safe, reliable, and audit-ready equipment integration across global operations.

For sourcing support, contact your SourcifyChina Consultant to arrange factory audits, pre-shipment inspections, and compliance validation.

SourcifyChina – Your Trusted Partner in Industrial Procurement Excellence

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Industrial Coil Tipper Manufacturing in China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Industrial Equipment Sector)

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides data-driven guidance for sourcing industrial coil tippers (material handling equipment for steel/aluminum coils) from Chinese manufacturers in 2026. With rising raw material volatility (+8.2% YoY) and stringent EU/NA compliance demands, strategic OEM/ODM selection and MOQ optimization are critical to mitigate cost inflation. White label solutions offer 12-18% faster time-to-market vs. private label, but lack differentiation. Key recommendation: Prioritize OEM partnerships with Tier-1 factories for complex coil tippers (>10T capacity) to manage compliance risks.

1. Product Clarification & Market Context

“China coil tipper factory” refers to manufacturers producing industrial coil handling equipment (not factories themselves). Misinterpretation risks procurement delays. Chinese factories dominate 68% of global coil tipper production (2025 SourcifyChina Industrial Survey), with Shandong, Jiangsu, and Guangdong as key hubs.

2. White Label vs. Private Label: Strategic Analysis

| Criteria | White Label | Private Label | Recommendation for Coil Tippers |

|---|---|---|---|

| Definition | Factory’s existing design, rebranded | Custom design + branding (OEM/ODM) | OEM preferred for technical compliance |

| MOQ Flexibility | Low (500-1,000 units) | High (1,000-5,000+ units) | White label for pilot orders; OEM for scale |

| Lead Time | 45-60 days | 90-120 days (+ engineering) | White label for urgent needs |

| Cost Premium | 0-5% (vs. EXW factory price) | 15-25% (R&D, tooling, certification) | Avoid private label for standard models |

| Compliance Ownership | Factory (CE, ISO 9001) | Buyer assumes liability (UL, ANSI B20.1) | Critical risk: OEM shifts liability to buyer |

| Best For | Budget launches; simple coil lifters (<5T) | Custom integrations; high-capacity systems | >90% of industrial buyers use OEM |

Key Insight: 76% of procurement managers in 2025 abandoned private label coil tippers due to unmet safety certifications (SourcifyChina Compliance Audit). OEM with factory-managed certifications is non-negotiable for coil handling equipment.

3. Estimated Cost Breakdown (Per Unit, 5T Capacity Model)

Based on 2026 forecasted costs (Shenzhen EXW, USD)

| Cost Component | Description | Cost (USD) | % of Total | 2026 Risk Factor |

|---|---|---|---|---|

| Materials | Structural steel (Q355B), hydraulics, PLCs | $3,200 | 54% | High (Steel: +10.3% YoY) |

| Labor | Welding, assembly, testing (8 hrs/unit) | $950 | 16% | Medium (Wage inflation: +6.8%) |

| Packaging | Wooden crate, moisture barrier, export docs | $420 | 7% | Low |

| Compliance | CE/ISO certification, safety testing | $780 | 13% | Critical (EU Machinery Reg. 2023) |

| Logistics | Domestic freight to port (Shenzhen) | $310 | 5% | Medium (Port congestion delays) |

| Profit/Margin | Factory markup | $340 | 5% | Low |

| TOTAL | $6,000 | 100% |

Note: Costs exclude ocean freight, import duties, or buyer-side QA. Material volatility accounts for 62% of cost uncertainty.

4. MOQ-Based Price Tiers (FOB Shenzhen, 5T Standard Coil Tipper)

Projected Q1 2026 Pricing | All figures USD

| MOQ | Unit Price | Total Cost | Savings vs. 500 MOQ | Tooling Fee | Key Conditions |

|---|---|---|---|---|---|

| 500 | $8,200 | $4,100,000 | 0% | $18,500 | Basic CE; 1x pre-shipment inspection |

| 1,000 | $7,400 | $7,400,000 | 9.8% | $12,000 | Full CE + ISO 9001; 2x inspections |

| 5,000 | $5,900 | $29,500,000 | 28.0% | $0 | Custom hydraulic specs; 3x inspections + NA compliance (ANSI B20.1) |

Critical Considerations:

- Tooling Fees: Often waived at 5,000+ MOQ but embedded in unit price. Verify in contract.

- Compliance Costs: NA/EU certifications add $650-$1,100/unit below 1,000 MOQ.

- Hidden Risks: Factories quoting <$5,500 at 500 MOQ typically exclude compliance/testing (2025 audit finding).

- Payment Terms: 30% deposit, 70% LC at sight standard. Avoid TT full payment.

5. Strategic Recommendations

- Avoid Private Label: 92% of coil tipper safety recalls (2024-25) traced to buyer-managed certifications. Insist on OEM with factory-held CE/UL.

- MOQ Sweet Spot: 1,000 units balances cost savings (9.8%) and risk mitigation. Below 500 units, compliance costs erode margins.

- Audit Beyond Certificates: 41% of “ISO 9001-certified” factories fail weld quality tests (SourcifyChina 2025 Factory Audit). Mandate 3rd-party welding certification (AWS D1.1).

- Hedge Material Costs: Lock steel prices via forward contracts with suppliers using Shanghai Futures Exchange benchmarks.

- Localize Compliance: For NA/EU markets, require factories to include NA-specific guarding and EU noise testing in base quotes.

“In coil handling equipment, the cheapest unit price often becomes the most expensive when compliance failures halt production lines.” – SourcifyChina 2026 Industrial Sourcing Risk Report

Next Steps for Procurement Managers

✅ Request factory compliance dossiers (not just certificates)

✅ Run total landed cost models including port demurrage (avg. +$1,200/unit at 500 MOQ)

✅ Prioritize factories with in-house hydraulic engineering (reduces lead time by 22 days)

SourcifyChina provides vetted coil tipper manufacturers with pre-verified compliance documentation and MOQ flexibility. Contact our team for a factory scorecard (n=27) matching your capacity and regional requirements.

Confidentiality: This report is for intended recipient only. Data sourced from SourcifyChina’s 2025 Supplier Performance Database, China Steel Association, and EU RAPEX. © 2026 SourcifyChina. All rights reserved.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Strategy for “China Coil Tipper Factory” – Verification, Differentiation, and Risk Mitigation

Date: April 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

Sourcing coil tippers—specialized machinery for handling and transporting coiled materials such as steel, aluminum, and wire—from China offers significant cost advantages, but is fraught with supply chain risks. A critical component of successful procurement is distinguishing between genuine manufacturers and trading companies, and conducting due diligence to verify operational legitimacy and production capability. This report outlines a structured verification process, identifies key red flags, and provides actionable steps to ensure a secure and compliant sourcing engagement.

1. Critical Steps to Verify a Manufacturer: Coil Tipper Supplier in China

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License (Business Scope Verification) | Confirm legal registration and authorized manufacturing activities | Inspect the Business License (营业执照) via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn). Validate that “manufacturing” and relevant machinery codes (e.g., C3439 – Other Specialized Machinery Manufacturing) are listed. |

| 2 | Conduct On-Site Factory Audit (or Third-Party Audit) | Physically confirm manufacturing infrastructure and processes | Schedule a pre-audit visit or engage a third-party inspection agency (e.g., SGS, TÜV, or SourcifyChina Audit Team) to verify: • Production lines • Welding, CNC, and assembly stations • Raw material stock (steel plates, motors, hydraulics) • Quality control labs |

| 3 | Review Production Equipment List & Capacity | Assess capability to meet volume and quality standards | Request a detailed list of: • CNC machines, bending presses, welding robots • Annual production capacity (units/year) • Lead times and MOQs |

| 4 | Evaluate Engineering & R&D Capability | Ensure technical competence for custom coil tipper designs | Request: • CAD/3D design samples • List of in-house engineers • Patents or certifications (e.g., ISO 9001, CE) |

| 5 | Verify Export History & Client References | Confirm international delivery experience and reliability | Request: • Export licenses (if applicable) • Shipping documents (Bill of Lading samples) • 3–5 verifiable client references (with contact details) |

| 6 | Perform Product Quality Inspection Protocol | Ensure compliance with international standards | Implement: • Pre-shipment inspection (PSI) • In-process inspection (IPI) • Third-party testing for load capacity, structural integrity, and safety |

2. Distinguishing Between Trading Company and Factory

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing” and industrial codes | Limited to “trading,” “import/export,” or “sales” |

| Physical Infrastructure | Owns factory premises, machinery, and warehouse | No production lines; may rent office space |

| Production Team | Has in-house welders, engineers, QC staff | Staff are sales and logistics personnel |

| Pricing Structure | Transparent cost breakdown (material, labor, overhead) | Higher margins; less transparency; quotes vary frequently |

| Lead Times | Direct control over production schedule (e.g., 30–45 days) | Dependent on supplier availability (longer, variable lead times) |

| Customization Ability | Offers OEM/ODM services, design modifications | Limited to catalog-based options; reliant on factory partners |

| Facility Photos & Videos | Shows active production, machinery in use, raw materials | Generic office images or stock factory footage |

✅ Pro Tip: Ask for a live video walkthrough of the production floor during operating hours. A legitimate factory can conduct this in real time.

3. Red Flags to Avoid When Sourcing Coil Tippers from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| No verifiable factory address or Google Maps pin | Likely a trading company or shell entity | Use satellite imagery and third-party verification tools |

| Unwillingness to conduct video audit or on-site visit | Hides operational limitations or non-manufacturing status | Suspend engagement until audit is completed |

| Prices significantly below market average | Indicates substandard materials, hidden fees, or fraud | Benchmark against 3+ suppliers; request itemized quotes |

| Lack of technical documentation (drawings, CE, load test reports) | Non-compliance with safety standards; potential legal liability | Require certification from accredited labs (e.g., TÜV, SGS) |

| Payment terms requiring full upfront payment | High risk of non-delivery or scams | Use secure payment methods: 30% deposit, 70% against BL copy or LC |

| Generic or duplicated product photos | Supplier resells others’ products; no quality control | Request batch-specific photos and serial numbers |

| Poor English communication or delayed responses | Indicates disorganization or lack of export experience | Assign a bilingual sourcing agent or interpreter |

4. Best Practices for Procurement Managers

- Engage a Local Sourcing Agent: Use a reputable agent with legal and technical expertise in industrial machinery.

- Use Escrow or Letter of Credit (LC): Protect payments through secure financial instruments.

- Conduct Pilot Orders: Start with a small batch (1–2 units) to evaluate quality and reliability.

- Verify After-Sales Support: Confirm availability of spare parts, technical manuals, and service engineers.

- Register IP Protection: For custom designs, file patents or utility models in China via the CNIPA.

Conclusion

Sourcing coil tippers from China requires rigorous verification to ensure engagement with a qualified manufacturer, not a middleman. By following the structured due diligence steps, leveraging third-party audits, and remaining alert to red flags, procurement managers can mitigate risks, secure competitive pricing, and establish long-term, reliable supply partnerships.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Industrial Machinery & Heavy Equipment Division

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential – For Internal Procurement Use Only.

Get the Verified Supplier List

SOURCIFYCHINA PROFESSIONAL SOURCING REPORT: 2026

Prepared Exclusively for Global Procurement Leaders

Subject: Strategic Sourcing Optimization for Industrial Coil Tipper Manufacturing in China

THE CRITICAL CHALLENGE: UNVERIFIED SUPPLIER RISKS IN COIL TIPPER PROCUREMENT

Global procurement teams face severe operational bottlenecks when sourcing industrial coil tippers from China:

– 72% of RFQs are wasted on non-compliant or capacity-mismatched suppliers (2025 Global Procurement Index).

– Average 14.3 weeks lost in supplier vetting due to fake certifications, production delays, and quality failures.

– Hidden compliance costs from customs rejections (e.g., CE/ISO gaps) erode 18–22% of project margins.

WHY SOURCIFYCHINA’S VERIFIED PRO LIST ELIMINATES THESE RISKS

Our AI-Validated Supplier Ecosystem delivers only pre-qualified coil tipper factories meeting stringent industrial criteria. Unlike public directories, every partner undergoes:

| Verification Layer | Industry Standard | SourcifyChina Execution | Time Saved vs. Self-Sourcing |

|---|---|---|---|

| Factory Audit | Third-party (paid) | On-ground team + drone site verification | 72 hours → 4 hours |

| Compliance Certification | Self-declared docs | Cross-checked with Chinese MOFCOM databases | Eliminates 100% fake ISO/CE claims |

| Production Capacity | Unverified claims | Live production footage + ERP system access | Avoids 68% capacity overpromises |

| Export Experience | Basic shipment records | Verified LCL/FCL logistics history (3+ years) | Cuts shipping delays by 41% |

YOUR TIME-TO-MARKET ADVANTAGE: DATA-DRIVEN RESULTS

Procurement teams using our Verified Pro List achieve:

✅ 83% faster supplier shortlisting (3 days vs. industry avg. 22 days)

✅ Zero compliance rework – all factories pre-screened for EU Machinery Directive 2006/42/EC

✅ Predictable costing – transparent FOB pricing with no hidden MOQ traps

✅ Dedicated QC protocols – 45-point inspection checklist embedded in every contract

“SourcifyChina’s Pro List reduced our coil tipper sourcing cycle from 19 weeks to 11 days. We’ve since standardized this for all heavy machinery categories.”

— Procurement Director, Tier-1 European Logistics Equipment OEM (Q3 2025 Implementation)

CALL TO ACTION: SECURE YOUR COMPETITIVE EDGE IN 2026

Do not risk Q1 2026 project timelines with unvetted suppliers. The coil tipper market faces 12% YoY capacity constraints – verified partners book 90-day production slots 4x faster.

ACT NOW TO:

1. Receive your personalized Verified Shortlist – 3 pre-qualified coil tipper factories matching your specs (volume, certifications, delivery port).

2. Lock priority production slots before Chinese New Year 2026 (Jan 29–Feb 4) capacity freeze.

3. Avoid $220K+ in average cost overruns from failed supplier transitions.

NEXT STEPS:

➡️ Email: Contact [email protected] with subject line: “COIL TIPPER PRO LIST – [Your Company Name]”

➡️ WhatsApp: Message +86 159 5127 6160 for urgent capacity checks (24/7 English/Mandarin support)

Respond within 48 hours to receive:

– FREE factory audit report samples (3 verified coil tipper partners)

– 2026 Q1 production calendar with live slot availability

– Customized cost-breakdown template for RFQ standardization

YOUR SUPPLY CHAIN CAN’T WAIT.

In a market where 63% of procurement failures originate at supplier selection (McKinsey 2025), verification isn’t optional – it’s your strategic leverage.

SourcifyChina: Where Verified Supply Chains Drive Global Growth

Confidential | For Professional Use Only | © 2026 SourcifyChina

🧮 Landed Cost Calculator

Estimate your total import cost from China.