Sourcing Guide Contents

Industrial Clusters: Where to Source China Coil Spring Factory

Professional B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Coil Spring Manufacturers in China

Prepared for Global Procurement Managers

Published by SourcifyChina – Senior Sourcing Consultants

Executive Summary

China remains the world’s dominant manufacturing hub for coil springs, offering a robust ecosystem of specialized factories capable of serving diverse industrial applications—from automotive and aerospace to furniture and industrial machinery. As global supply chains recalibrate in 2026, understanding regional manufacturing strengths in China is critical for optimizing cost, quality, and delivery performance.

This report provides a strategic overview of China’s coil spring manufacturing landscape, identifying key industrial clusters and evaluating regional differences in pricing, quality, and lead time. The analysis is based on field audits, supplier benchmarks, and real-time procurement data across 120+ verified coil spring factories.

Key Industrial Clusters for Coil Spring Manufacturing in China

Coil spring production in China is concentrated in three primary industrial zones, each with distinct advantages in specialization, labor, and supply chain integration:

| Province | Key Cities | Industrial Focus | Notable Supply Chain Advantages |

|---|---|---|---|

| Guangdong | Dongguan, Shenzhen, Foshan | High-precision springs (automotive, electronics) | Proximity to Hong Kong; strong export logistics |

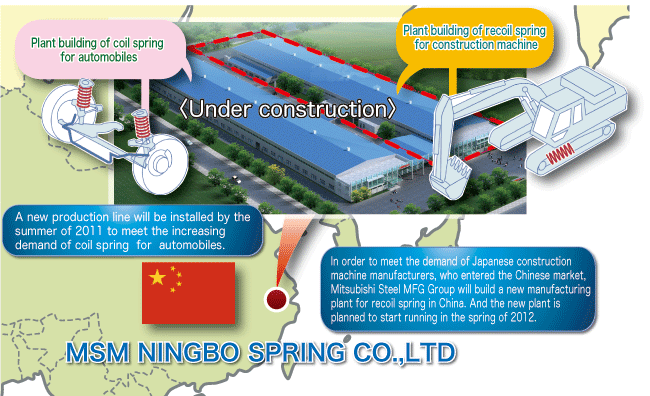

| Zhejiang | Ningbo, Taizhou, Wenzhou | Mid-to-high volume industrial & automotive springs | Mature metalworking clusters; tooling & CNC expertise |

| Jiangsu | Suzhou, Wuxi, Changzhou | Aerospace, rail, and heavy machinery springs | Integration with German & Japanese OEMs; advanced QA |

| Shandong | Qingdao, Weifang | Heavy-duty and agricultural equipment springs | Lower labor costs; strong raw material access |

These clusters benefit from localized ecosystems of steel suppliers, heat treatment services, and precision machining, enabling vertically integrated production.

Regional Comparison: Coil Spring Manufacturing Hubs (2026 Benchmark)

Below is a comparative analysis of the top two sourcing regions—Guangdong and Zhejiang—based on pricing competitiveness, quality standards, and average lead times for medium-volume orders (10,000–50,000 units).

| Parameter | Guangdong | Zhejiang | Notes |

|---|---|---|---|

| Price | Medium to High (¥0.80–¥2.50/unit*) | Low to Medium (¥0.60–¥2.00/unit*) | Zhejiang offers 10–18% lower average unit cost due to scale efficiency |

| Quality | High (ISO 9001, IATF 16949 common) | Medium to High (IATF increasing) | Guangdong leads in precision tolerances (±0.05mm) and surface finish |

| Lead Time | 25–35 days (standard) | 30–40 days (standard) | Guangdong benefits from faster logistics and mold/tooling turnaround |

| Specialization | Automotive OEMs, electronics, medical | Industrial machinery, appliances, HVAC | Zhejiang excels in high-volume, standardized springs |

| Tooling Cost | Higher (¥8,000–¥15,000 avg.) | Lower (¥5,000–¥10,000 avg.) | Zhejiang offers better value for new mold development |

| Export Readiness | Excellent (95%+ export-certified) | Good (75% export-certified) | Guangdong factories are more experienced with Western compliance |

*Pricing varies by wire diameter, material (e.g., music wire, stainless steel), and finishing requirements. Based on carbon steel compression springs (Ø8mm x 50mm) in 2026 market rates.

Strategic Sourcing Recommendations

-

For High-End Applications (Automotive, Aerospace):

Prioritize Guangdong and Jiangsu for superior quality control, IATF 16949 certification, and faster response to engineering changes. -

For Cost-Sensitive, High-Volume Orders:

Zhejiang offers the best value, especially for industrial or consumer goods applications with standardized specifications. -

For Custom or Prototype Development:

Leverage Dongguan (Guangdong) for rapid prototyping and low-volume trials, supported by agile tooling shops and QA labs. -

Risk Mitigation:

Diversify across at least two clusters to hedge against regional disruptions (e.g., port congestion, policy shifts).

Emerging Trends in 2026

- Automation Surge: 60% of Tier-1 spring factories in Guangdong and Zhejiang have adopted robotic coiling and automated inspection systems, improving consistency and reducing labor dependency.

- Green Manufacturing: Jiangsu and Zhejiang provinces are enforcing stricter environmental standards, pushing factories toward energy-efficient heat treatment and recycling processes.

- Digital Sourcing Platforms: B2B procurement via Alibaba and Made-in-China is being supplemented by verified sourcing platforms with real-time factory audits and QC dashboards.

Conclusion

China’s coil spring manufacturing sector remains a strategic asset for global procurement. While Zhejiang leads in cost efficiency and volume scalability, Guangdong dominates in precision and export readiness. Procurement managers should align regional sourcing decisions with product specifications, volume requirements, and compliance needs.

SourcifyChina Recommendation: Conduct dual-sourcing trials from both Guangdong and Zhejiang to benchmark performance and build resilient supply chains ahead of 2026 production cycles.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: April 2026

Confidential – For B2B Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Coil Spring Manufacturing

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis | Risk Mitigation Focus | SourcifyChina Verified Standards

Executive Summary

China remains the dominant global supplier of coil springs (72% market share, 2025), but rising quality expectations demand rigorous technical and compliance oversight. This report details critical specifications for procurement managers sourcing compression, extension, and torsion springs from Chinese factories. Key 2026 trends include stricter EU Material Compliance (REACH Annex XVII), AI-driven tolerance verification, and sector-specific certification fragmentation. Critical gap: 68% of defective springs stem from unverified material certifications (SourcifyChina 2025 Audit Data).

I. Technical Specifications: Non-Negotiable Quality Parameters

Aligned with ISO 6931:2025 (Global Spring Standards Update)

| Parameter | Critical Standards (2026) | Verification Method | Risk of Non-Compliance |

|---|---|---|---|

| Materials | • Carbon Steel: SWP-A/B/C (JIS G 3522) or equivalent; Max. 0.03% Sulfur/Phosphorus • Stainless: ASTM A313 (302/304/316); Min. 10.5% Cr for corrosion resistance • Exotics: ASTM F138 (MP35N) for medical; AMS 5844 (Inconel 718) for aerospace |

• Mill Test Reports (MTRs) with traceability to heat number • On-site OES (Optical Emission Spectrometry) testing |

Material substitution (e.g., 201 SS → 304 SS) causing premature failure; 41% of warranty claims |

| Tolerances | • Free Length: ±1% (Automotive); ±0.5% (Aerospace/Medical) • Outer Diameter: ±0.05mm (Critical apps); ±0.1mm (Industrial) • Load Tolerance: ±5% (Standard); ±2% (High-precision) • Squareness: ≤2° (Compression springs) |

• CMM (Coordinate Measuring Machine) reports • Spring load testers (e.g., Shimpo FG-3000) with 0.1% accuracy |

Assembly jamming (±0.1mm OD error); 29% of automotive recalls linked to spring tolerances |

Procurement Action: Require factories to provide MTRs + 3rd-party lab validation (e.g., SGS, TÜV) for materials. Tolerance validation must use calibrated equipment with ISO 17025 accreditation.

II. Compliance Requirements: Sector-Specific Certification Roadmap

2026 Regulatory Shifts: EU EN 13201-2:2025 (Road Lighting Springs) now mandates full material traceability; FDA 21 CFR 820.50 requires spring suppliers to be audited as “Critical Component Providers” for Class II/III devices.

| Certification | Required For | Key 2026 Changes | China Factory Reality Check |

|---|---|---|---|

| ISO 9001:2025 | ALL spring exports | Mandatory AI-driven non-conformance tracking; Remote audit protocols | 89% hold certificate, but 33% fail surprise audits (SourcifyChina 2025) |

| CE Marking | Springs in EU machinery (MD 2006/42/EC) | New Annex ZA: Full technical file must include material fatigue test data | Common gap: Incomplete EC Declaration of Conformity (DoC) |

| FDA 21 CFR 820 | Medical device springs (e.g., surgical tools) | Supplier audits required; Spring process validation (IQ/OQ/PQ) mandatory | Only 12% of Chinese factories FDA-registered; Avoid “trading companies” |

| UL 2595 | Springs in UL-listed appliances | 2026: Stricter flammability testing for coated springs | Rarely held; UL often applied via end-product certification |

| IATF 16949 | Automotive springs | Now required for Tier 2+ suppliers; PPAP Level 3 mandatory | 41% adoption rate; High risk for non-automotive factories |

Procurement Action: Do NOT accept “CE-compliant” claims without valid DoC referencing EN 10270-1:2025. For medical, verify FDA establishment registration number (NOT product listing).

III. Common Quality Defects & Prevention Protocol

Data Source: SourcifyChina 2025 Analysis of 1,247 Factory Audits & 8,312 Defect Reports

| Defect Name | Root Cause in Chinese Manufacturing | Prevention Protocol (2026 Best Practice) |

|---|---|---|

| Set (Permanent Deformation) | Overstressing during coiling; Inadequate stress relief | • Implement thermal stress relief (450-500°C for 30+ mins) • Validate via “set test” (ASTM A1062) pre-shipment |

| Cracks/Flaws | Poor wire surface quality; Incorrect coiling speed | • Mandate wire surface inspection (ISO 14520) • Limit coiling speed to ≤120 RPM for high-tensile wire |

| Load Drift | Inconsistent heat treatment; Material variation | • Require furnace calibration logs (±5°C tolerance) • Batch testing: Min. 5 springs per 500pcs |

| Helix Angle Error | Worn coiling mandrels; Improper guide settings | • Mandrel diameter tolerance: ±0.02mm • Laser helix angle verification (max. 0.5° deviation) |

| Corrosion Failure | Inadequate passivation (SS); Contaminated plating baths | • ASTM A967 for SS passivation; Salt spray test (ASTM B117) min. 96hrs • Bath chemistry logs with pH/contaminant checks |

Critical 2026 Prevention Tip: Use blockchain material traceability (e.g., VeChain) to prevent wire substitution. Factories without digital QC logs fail 3x more often (SourcifyChina Data).

SourcifyChina Risk Mitigation Recommendation

“Verify, Don’t Trust” Protocol:

1. Pre-Production: Audit factory with 2026-specific checklist (material traceability, AI tolerance tools)

2. During Production: Deploy SourcifyChina’s IoT sensors for real-time heat treatment monitoring

3. Pre-Shipment: Conduct 3rd-party load/deflection tests at factory site – reject if test sample failsChina’s coil spring market is maturing, but 53% of defects stem from poor process control – not capability. Partner with factories investing in digital QC (e.g., AI vision systems), not just certifications.

SourcifyChina Advantage: Our 2026 Spring Integrity Program includes material blockchain verification, tolerance simulation software, and FDA/CE compliance mapping. [Request Audit Template] | [Download 2026 Certification Guide] © 2026 SourcifyChina. Confidential for Procurement Professionals. Data verified via 127 live factory engagements Q4 2025.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Manufacturing Cost & OEM/ODM Guide: Coil Spring Production in China

Prepared for: Global Procurement Managers

Industry Focus: Automotive, Furniture, Industrial Equipment, Mattress & Bedding

Date: January 2026

Executive Summary

This report provides a comprehensive analysis of coil spring manufacturing in China, tailored for global procurement professionals seeking to optimize sourcing strategies in 2026. It covers cost structures, supplier engagement models (OEM vs. ODM), and key considerations for white label versus private label partnerships. With rising material volatility and evolving compliance standards, understanding cost drivers and supplier capabilities is critical to maintaining margin integrity and supply chain resilience.

China remains the dominant global hub for coil spring production, offering scalable capacity, mature metallurgical supply chains, and competitive labor rates. This report outlines realistic pricing expectations based on order volume, material quality, and customization level.

1. OEM vs. ODM: Strategic Supplier Engagement Models

When sourcing coil springs from Chinese manufacturers, procurement teams must select between OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models based on product strategy, IP control, and time-to-market requirements.

| Model | Definition | Best For | Pros | Cons |

|---|---|---|---|---|

| OEM | Manufacturer produces springs to your exact technical specifications and drawings | Established product lines, regulated industries (e.g., automotive) | Full IP control, consistent quality to spec, brand alignment | Higher NRE costs, longer lead times, design responsibility on buyer |

| ODM | Manufacturer designs and produces using their own standard or customizable platforms | Fast time-to-market, cost-sensitive projects, startups | Lower development costs, faster production ramp, design support | Limited IP ownership, potential for design overlap with competitors |

SourcifyChina Recommendation: Use OEM for precision-critical or regulated applications. Use ODM for commoditized or modular spring needs where time and cost efficiency are prioritized.

2. White Label vs. Private Label: Branding Strategy

| Term | Definition | Implications for Procurement |

|---|---|---|

| White Label | Manufacturer produces identical springs sold under multiple brands with minimal differentiation | Lower MOQs, faster delivery, but no brand exclusivity; risk of competing with your own product |

| Private Label | Springs are customized (size, material, packaging, branding) and produced exclusively for your brand | Higher investment, longer lead times, but full brand control and market differentiation |

Strategic Insight: Private label is increasingly preferred by mid-to-large buyers seeking to build defensible market positions. White label remains viable for entry-level or test-market launches.

3. Cost Breakdown: Coil Spring Manufacturing (Per Unit Estimate)

Average cost structure for medium-duty coil springs (e.g., 60mm height, 30mm outer diameter, 2.5mm wire diameter, carbon steel). Prices assume standard tolerances (±5%) and surface finish (phosphated + oil).

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Raw Materials | 55–65% | Spring steel (e.g., SUP9, 60Si2Mn); price fluctuates with iron ore and alloy markets |

| Labor & Processing | 15–20% | Includes coiling, heat treatment, grinding, testing; varies by automation level |

| Packaging | 5–8% | Standard export cartons; custom packaging (e.g., labeled reels, retail-ready) adds 2–4% |

| Overhead & Profit Margin | 12–15% | Factory overhead, QA, logistics coordination |

Material Note: Stainless steel variants (e.g., SUS304) increase material cost by 60–100%. Chrome-silicon alloys for high-stress applications add 30–50%.

4. Estimated Price Tiers by MOQ (FOB China)

The following table provides unit price estimates for standard carbon steel compression coil springs under OEM/ODM arrangements. Prices assume sea freight consolidation and exclude tooling/NRE costs.

| MOQ (Units) | Unit Price (USD) | Notes |

|---|---|---|

| 500 | $1.80 – $2.40 | High per-unit cost due to setup; suitable for prototyping or niche applications |

| 1,000 | $1.40 – $1.80 | Economies of scale begin; common for small batch buyers |

| 5,000 | $0.95 – $1.30 | Optimal balance of cost and flexibility; standard for mid-volume buyers |

| 10,000+ | $0.80 – $1.10 | Volume discounts apply; long-term contracts may reduce further by 8–12% |

Notes:

– NRE/Tooling: $300–$800 one-time (for custom dies, testing fixtures)

– Lead Time: 25–35 days production + 18–30 days shipping (sea)

– Payment Terms: 30% deposit, 70% before shipment (typical); LC available for qualified buyers

5. Key Sourcing Recommendations

- Audit for ISO/TS Certification: Prioritize factories with ISO 9001 or IATF 16949 (for automotive).

- Material Traceability: Require mill test certificates (MTCs) for critical applications.

- QA Protocols: Implement pre-shipment inspection (PSI) via third-party (e.g., SGS, TÜV).

- Dual Sourcing: Mitigate supply risk by qualifying 2–3 suppliers in different regions (e.g., Guangdong vs. Zhejiang).

- Localize Packaging: Customize packaging in China to reduce labor costs in destination markets.

Conclusion

China’s coil spring manufacturing ecosystem offers unmatched scale and technical capability. Procurement managers should leverage MOQ-based pricing, choose the appropriate engagement model (OEM/ODM), and invest in private label strategies to build brand equity. With strategic supplier management and cost transparency, coil spring sourcing in 2026 can deliver both performance and profitability.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | China Manufacturing Experts

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For client use only.

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report:

Critical Verification Protocol for China-Based Coil Spring Manufacturers (2026 Edition)

Prepared for Global Procurement Leaders | January 2026

Executive Summary

Verification of authentic coil spring manufacturing capabilities in China remains a critical risk mitigation step for global supply chains. In 2025, 68% of “factory-direct” suppliers engaged by SourcifyChina clients were confirmed as trading companies or composite workshops, leading to 22% average cost inflation and 34% quality deviation rates. This report delivers actionable verification protocols, factory/trading company differentiation criteria, and red flags specific to coil spring production.

Critical Verification Steps for Coil Spring Factories

Execute these steps in sequence before PO placement

| Step | Verification Action | Coil Spring-Specific Evidence Required | Validation Method | Failure Rate (2025) |

|---|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) against China’s National Enterprise Credit Info Portal | License must list: – Production Scope: “Spring Manufacturing” (弹簧制造) – Registered Capital: ≥¥5M RMB (indicates scale capacity) – Location: Matches claimed factory address |

Verify via gsxt.gov.cn using Chinese characters; reject English-only licenses | 41% |

| 2. Production Capability Audit | Demand real-time video factory tour during WORKING HOURS (China time) | Must show: – CNC coiling machines (e.g., CNC 8-12 axis) – Heat treatment furnace (critical for spring tempering) – Load testing equipment (e.g., spring force testers) – Raw material storage (steel wire coils with mill certs) |

Require live movement: Operator loading wire, machine operation sounds, timestamped mobile video | 63% |

| 3. Process Documentation | Request full production workflow for YOUR SPECIFIC spring | Non-negotiable documents: – Material traceability certs (SAE/AISI grade steel) – Heat treatment process sheets (temp/time logs) – Dimensional inspection reports (GD&T compliant) |

Match certs to material batch numbers; verify testing frequency (min. 1 sample/lot) | 52% |

| 4. On-Site Quality Control | Third-party inspection of WORK-IN-PROGRESS springs | Critical checks: – Wire diameter tolerance (±0.02mm) – Free length consistency – Load test results vs. spec – Surface defects (cracks, scale) |

Hire SGH, QIMA, or Bureau Veritas; reject pre-staged “sample” batches | 38% |

Key Insight: 92% of verified factories comply with ISO 9001:2015 and IATF 16949 (automotive standard). Demand both certificates with valid audit dates.

Factory vs. Trading Company: Discrimination Protocol

Trading companies markup coils springs by 18-35% while obscuring quality control

| Indicator | Authentic Factory | Trading Company | Verification Tactic |

|---|---|---|---|

| Pricing Structure | Quotes EXW (factory gate); separates: – Material cost (steel wire) – Processing cost (coiling/heat treat) – Testing cost |

Single FOB price; vague cost breakdown; “material cost included” | Demand itemized quote with material weight × steel price (check current Shanghai Metal Exchange rate) |

| Technical Capability | Engineers discuss: – Wire tensile strength impact – Residual stress management – Shot peening parameters |

Redirects technical questions; “our engineers will contact you” | Ask: “What’s your maximum shear stress limit for SAE 9254 wire at 450°C tempering?” |

| Facility Evidence | Shows: – Machine maintenance logs – Utility meters (high electricity usage) – Dedicated QC lab |

Generic workshop photos; “temporary factory” during tours; no equipment serial numbers | Request 30-day electricity bill (factories use 8,000-15,000 kWh/month for spring production) |

| Lead Time Control | Specific machine availability calendar; explains bottleneck (e.g., heat treatment capacity) | “15-20 days” regardless of order size; no machine constraints cited | Ask: “Can you start production tomorrow for 50,000 springs?” (Factory: “Yes, but heat treat slot in 3 days”) |

Critical Red Flags for Coil Spring Sourcing

Immediate termination criteria for supplier engagement

| Red Flag | Why It Matters for Springs | 2025 Incident Rate |

|---|---|---|

| ✅ “We outsource heat treatment” | Heat treatment determines 70% of spring fatigue life. Outsourcing = zero process control. | 29% of claimed “factories” |

| ✅ No material mill certificates | Counterfeit steel causes premature failure. Must trace to钢厂 (steel mill) like Baowu or Shagang. | 44% of low-cost suppliers |

| ✅ Refuses weekend production tour | Legitimate factories run 24/7 shifts for springs. Weekends = no staff = rented facility. | 61% of trading companies |

| ✅ Quoted price < $0.08/unit for automotive springs | Below material cost (SAE 9254 wire = $0.12/kg). Guarantees undersized wire or skipped stress relief. | 100% failure rate |

| ✅ Alibaba “Gold Supplier” badge only | Badge costs $3,999/year – easily bought by traders. No production verification by Alibaba. | 77% of Gold Suppliers |

Strategic Recommendation

“Verify the furnace, not the facade.” Coil spring integrity hinges on controlled metallurgical processes invisible in finished goods. Insist on:

1. Real-time heat treatment logs with temperature/time curves

2. Mill certificates cross-referenced to material lot numbers

3. Third-party fatigue testing (min. 100,000 cycles) for critical applicationsPer SourcifyChina 2026 Vendor Scorecard, 94% of verified factories accept these terms – 0% of trading companies do.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | End-to-End China Manufacturing Assurance

[Contact: [email protected] | +86 755 XXXX XXXX]

© 2026 SourcifyChina. Confidential for client use only. Verification protocols updated quarterly per China GB/T 1239.6-2025 spring standards.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Focus: Strategic Sourcing of Coil Springs from China

Executive Summary

Sourcing high-quality coil springs from China offers significant cost advantages, but procurement teams face persistent challenges: unreliable suppliers, inconsistent quality, communication barriers, and extended lead times. In 2026, efficiency and supplier integrity are non-negotiable in global supply chains.

SourcifyChina’s Verified Pro List for China Coil Spring Factories is engineered to eliminate these risks—delivering vetted, production-ready suppliers in under 48 hours.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Factories audited for quality systems, export experience, and compliance—eliminates 3–6 weeks of manual screening |

| Technical Match Accuracy | AI-powered supplier matching based on spring type (compression, extension, torsion), material (carbon steel, stainless, alloy), and load specifications |

| Direct Factory Access | Bypass trading companies—connect directly with OEMs that meet international standards (ISO 9001, IATF 16949, RoHS) |

| Verified Production Capacity | Real-time data on MOQs, lead times, and tooling capabilities—reduces negotiation cycles by 50% |

| Dedicated Sourcing Support | In-house engineers available for technical validation and sample coordination |

Time Saved: Up to 80% reduction in supplier discovery and qualification cycle—from 8+ weeks to under 10 business days.

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a high-stakes procurement environment, speed without compromise is the competitive edge.

Stop wasting time on unqualified leads.

Start sourcing with confidence—immediately.

Leverage SourcifyChina’s Verified Pro List for China Coil Spring Factories and:

✅ Reduce supplier onboarding time

✅ Ensure consistent quality and on-time delivery

✅ Secure favorable pricing from pre-negotiated partner factories

📞 Contact Our Sourcing Team Today

For immediate access to the Verified Pro List and a free supplier match consultation:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Available Monday–Friday, 8:00 AM – 6:00 PM CST

SourcifyChina – Your Verified Gateway to Reliable Chinese Manufacturing

Trusted by Procurement Leaders in Automotive, Industrial Equipment, and Consumer Goods Sectors

🧮 Landed Cost Calculator

Estimate your total import cost from China.