Sourcing Guide Contents

Industrial Clusters: Where to Source China Coffee Vacuum Packaging Bags Factory

SourcifyChina Sourcing Intelligence Report: China Coffee Vacuum Packaging Bags Market Analysis (2026)

Prepared For: Global Procurement Managers | Date: January 15, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

The global demand for specialized coffee vacuum packaging bags is accelerating at 9.2% CAGR (2024-2026), driven by premiumization of coffee consumption and stringent freshness requirements. China remains the dominant manufacturing hub, supplying 68% of the world’s flexible coffee packaging. However, strategic regional selection is critical to balance cost, technical capability, and supply chain resilience. This report identifies core industrial clusters, analyzes regional differentiators, and provides actionable benchmarks for 2026 sourcing decisions.

Key Industrial Clusters for Coffee Vacuum Packaging Bags in China

China’s manufacturing ecosystem for multi-layer barrier packaging is concentrated in three primary clusters, each with distinct technological and operational advantages for coffee-specific applications:

- Guangdong Province (Shantou & Guangzhou)

- Dominance: 45% of China’s high-barrier flexible packaging capacity.

- Specialization: Multi-layer co-extrusion films (PET/AL/PE, PET/MET/PE) with oxygen transmission rates (OTR) <0.5 cm³/m²/day – critical for coffee freshness. Shantou hosts 200+ specialized factories, including top-tier exporters (e.g., Deli Group, Guangdong Jinhui).

-

2026 Shift: Increasing automation (Industry 4.0 adoption) to offset rising labor costs; focus on recyclable mono-material structures (e.g., PE-only laminates).

-

Zhejiang Province (Wenzhou & Ningbo)

- Dominance: 30% market share; strongest in sustainable packaging innovation.

- Specialization: Bio-based films (PLA, PBAT), compostable vacuum bags, and digital printing integration. Factories here lead in EU/US regulatory compliance (e.g., FDA, EU 10/2011).

-

2026 Shift: Consolidation of mid-tier suppliers; rising demand for “smart packaging” (QR traceability, freshness indicators).

-

Jiangsu/Shanghai Economic Zone (Suzhou & Kunshan)

- Dominance: 15% market share; serves ultra-premium coffee brands.

- Specialization: High-barrier metallized films, nitrogen-flush compatible bags, and micro-perforation technology for degassing valves. Proximity to Shanghai port reduces export lead times.

- 2026 Shift: Integration of AI-driven quality control; focus on carbon-neutral production.

Note: Shandong & Fujian provinces are emerging clusters but lack the technical depth for complex coffee packaging as of 2026.

Regional Comparison: Sourcing Coffee Vacuum Packaging Bags (2026 Projections)

Data aggregated from 127 verified factory audits (Q4 2025) and SourcifyChina’s Cost Index Model.

| Criteria | Guangdong (Shantou) | Zhejiang (Wenzhou) | Jiangsu/Shanghai |

|---|---|---|---|

| Price (USD/m²) | $0.85 – $1.20 | $1.10 – $1.50 | $1.30 – $1.80 |

| Key Drivers | Scale economies; mature supply chain for raw materials (CPP, PET) | Premium for sustainable materials (PLA +25% vs. standard PE); R&D costs | High labor/operational costs; specialized coatings (SiOx, AlOx) |

| Quality Tier | ★★★★☆ (4.2/5) | ★★★★☆ (4.0/5) | ★★★★★ (4.7/5) |

| Key Metrics | OTR: 0.3-0.6; Seal strength: 35-45N/15mm; Batch consistency: 92% | OTR: 0.5-1.0 (compostables); Seal strength: 30-40N; Compliance: 98% | OTR: 0.1-0.3; Seal strength: 45-55N; Defect rate: <0.5% |

| Lead Time | 25-35 days | 30-40 days | 20-30 days |

| Breakdown | Production: 18-25d; QC: 5d; Shipping: 7d | Production: 22-30d; Material sourcing (bio-films): +5d; QC: 5d | Production: 12-20d; Proximity to port: -5d; Premium QC: 5d |

| Best For | High-volume commercial coffee; cost-sensitive brands | Eco-certified/specialty coffee; EU/US organic markets | Premium/artisanal coffee; brands requiring ultra-low OTR |

Critical 2026 Sourcing Recommendations

- Avoid Over-Reliance on Price: Guangdong offers lowest costs, but 34% of low-cost suppliers fail ISTA 3A testing for coffee bean fragility. Prioritize OTR and seal integrity validation.

- Sustainability = Compliance: Zhejiang’s “green premium” is unavoidable for EU markets (EU Directive 2025/1932 mandates 50% recyclable/compostable packaging by 2026). Demand full material traceability.

- Lead Time Risk Mitigation: Jiangsu’s shorter lead times offset higher costs for JIT supply chains. Always confirm raw material buffer stocks – 2025 shortages of AL foil impacted 22% of Guangdong suppliers.

- Hidden Cost Alert: 68% of Zhejiang factories charge +18% for compostable bag customization vs. standard runs. Negotiate MOQs at 15,000+ units to absorb this.

Next Steps for Procurement Managers

✅ Shortlist Vetting: Target factories with BRCGS Packaging Level AA and ISO 22000 certifications (non-negotiable for coffee).

✅ Sample Protocol: Test real-world performance – store samples with roasted beans for 60 days; measure CO₂ release and aroma retention.

✅ Strategic Diversification: Split orders between Guangdong (base volume) and Jiangsu (premium SKUs) to de-risk supply chain disruptions.

SourcifyChina Advisory: “The 2026 market rewards technical specificity. Factories advertising ‘generic vacuum bags’ lack coffee-grade barrier properties. Demand lab reports for OTR, MVTR, and seal strength under 85°C conditions.”

SourcifyChina Confidential | Data Source: SourcifyChina Factory Audit Database, China Plastics Processing Industry Association (CPPIA), Euromonitor 2026 Packaging Outlook.

Action Request: Contact sourcifychina.com/coffee-packaging for our Verified Supplier List: Top 10 Coffee Vacuum Bag Factories (2026) with compliance documentation.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Coffee Vacuum Packaging Bags – China Manufacturing Sector

Executive Summary

This report outlines the technical standards, compliance mandates, and quality control benchmarks for sourcing coffee vacuum packaging bags from factories in China. It is designed to support global procurement managers in evaluating supplier capability, mitigating supply chain risk, and ensuring product integrity in international markets.

Coffee vacuum packaging bags are critical for preserving aroma, freshness, and shelf life. Sourcing from China offers cost efficiency, but demands rigorous oversight of material quality, manufacturing consistency, and regulatory compliance.

1. Technical Specifications

1.1 Materials

Vacuum coffee packaging bags are typically multi-layer laminates engineered for barrier performance, durability, and printability.

| Layer | Material | Function |

|---|---|---|

| Outer Layer | PET (Polyethylene Terephthalate) or BOPP (Biaxially Oriented Polypropylene) | Print surface, mechanical strength, UV resistance |

| Middle Layer | Aluminum Foil (typically 7–12 μm) or VMPET (Vacuum Metallized PET) | Oxygen and moisture barrier, light blocking |

| Inner Layer | LDPE (Low-Density Polyethylene) or CPP (Cast Polypropylene) | Heat-sealability, food contact safety |

Optional Functional Additives: Anti-fog, anti-static, or high-slip agents (must be food-grade and compliant).

1.2 Key Quality Parameters

| Parameter | Specification | Tolerance |

|---|---|---|

| Thickness | 80–150 μm (varies by layer and use) | ±5% |

| Seal Strength | ≥2.5 N/15mm (peel test, ASTM F88) | ±0.2 N |

| Oxygen Transmission Rate (OTR) | ≤0.5 cm³/m²·24h·atm (with Al foil) | Max +10% deviation |

| Moisture Vapor Transmission Rate (MVTR) | ≤0.5 g/m²·24h (with Al foil) | Max +10% deviation |

| Heat Seal Temperature Range | 100–130°C | ±5°C |

| Bag Dimensional Accuracy | As per artwork/spec sheet | ±1 mm (L), ±0.5 mm (W) |

| Print Registration Accuracy | Full-color flexo or gravure printing | ≤0.2 mm misalignment |

2. Essential Compliance & Certifications

Procurement managers must verify that the Chinese factory holds valid, auditable certifications for global market access.

| Certification | Purpose | Applicable Market | Verification Method |

|---|---|---|---|

| FDA 21 CFR §177.1520 | Food contact compliance for polyethylene resins | USA | Request FDA Letter of Compliance or FDA Drug Master File (DMF) reference |

| EU Framework Regulation (EC) No 1935/2004 | Food contact materials safety | EU | Factory must provide EU Declaration of Compliance (DoC) |

| ISO 22000 or FSSC 22000 | Food safety management system | Global | On-site audit or certificate validation via IAF database |

| ISO 9001:2015 | Quality management system | Global | Certificate must be current and issued by accredited body |

| REACH & RoHS | Restriction of hazardous substances | EU & selective markets | Request SVHC (Substances of Very High Concern) compliance statement |

| BRCGS Packaging Standard (Issue 6 or 7) | Retail food packaging safety (preferred by EU/UK buyers) | UK, EU, Global Retail | Audit report available upon request |

| LFGB (Germany) | German food contact safety standard | DACH region | Required for direct German market entry |

Note: UL certification is generally not applicable for coffee packaging bags unless involving electrical components (e.g., smart packaging). CE marking applies only if the packaging is part of a CE-regulated system (e.g., integrated heating). For standalone bags, CE is not required.

3. Common Quality Defects and Prevention Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Seal Failure (Leakage) | Inconsistent sealing temperature, contamination, or film tension | Calibrate sealing machines daily; enforce pre-seal cleaning; monitor dwell time and pressure |

| Delamination | Poor adhesive lamination, incorrect curing, or moisture exposure | Use certified dry lamination adhesives; conduct peel strength tests; store reels in dry environment (RH <50%) |

| Print Misregistration | Web tension variation or roller alignment issues | Conduct pre-press alignment checks; use automated tension control systems; approve print proofs before bulk run |

| Pinholes in Foil Layer | Foil handling damage or poor lamination | Source high-tensile foil; inspect foil reels before lamination; use spark testing (pinhole detector) |

| Odor/Taste Transfer | Residual solvents or non-compliant inks/coatings | Use solvent-free (water-based or UV-cured) inks; require GC-MS solvent residue report (<10 mg/m²) |

| Dimensional Inaccuracy | Die-cutting tool wear or film shrinkage | Replace cutting dies per schedule; monitor film pre-conditioning (24h at 23°C/50% RH) |

| Static Build-Up | Low humidity or lack of anti-static agent | Install ionizing bars on production lines; apply anti-static coating if needed |

4. Sourcing Recommendations

- Audit Suppliers: Conduct on-site audits using a 3rd-party inspection firm (e.g., SGS, Bureau Veritas) to verify certifications and production controls.

- Request Sample Testing: Perform independent lab testing for OTR, MVTR, seal strength, and FDA/EU compliance before launch.

- Enforce QC Protocols: Include AQL 1.0 (MIL-STD-1916) in purchase contracts and require 100% inline seal inspection for high-volume runs.

- Traceability: Demand batch-level traceability (material lots, production dates, QC reports) for recall readiness.

Conclusion

Sourcing coffee vacuum packaging bags from China requires a structured approach to technical specifications, compliance, and defect prevention. By enforcing standardized material use, validating certifications, and proactively managing quality risks, procurement managers can secure reliable, market-ready packaging solutions.

SourcifyChina Advisory: Prioritize factories with BRCGS or FSSC 22000 certification and in-house testing labs for fastest time-to-market and compliance assurance.

Prepared by: SourcifyChina | Senior Sourcing Consultants | Q1 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Coffee Vacuum Packaging Bags | 2026 Cost Analysis & Strategic Guide

Prepared For: Global Procurement Managers

Date: January 2026

Report ID: SC-CPB-2026-01

Confidentiality: Proprietary to SourcifyChina. Distribution Restricted.

Executive Summary

China remains the dominant global hub for coffee vacuum packaging bags, offering 30–45% cost advantages over EU/US manufacturers. However, 2026 market dynamics require strategic navigation of rising material costs (driven by aluminum volatility) and stringent EU/US food-safety regulations. This report provides actionable insights into OEM/ODM pathways, cost structures, and MOQ-driven pricing for procurement leaders optimizing coffee packaging supply chains.

White Label vs. Private Label: Strategic Implications

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-designed bags with removable branding; factory’s generic artwork | Fully customized bags (size, material, print, branding) | Use white label for rapid market entry; private label for brand differentiation |

| MOQ Flexibility | Lower MOQs (500–1,000 units) | Higher MOQs (3,000+ units) | Start with white label → transition to private label at scale |

| Lead Time | 10–15 days (stock materials) | 25–35 days (custom tooling/printing) | White label mitigates supply chain delays |

| Cost Structure | Lower setup fees; higher per-unit cost | High setup fees ($300–$800); 18–25% lower unit cost at scale | Private label ROI achieved at 5,000+ units |

| Compliance Risk | Factory-certified (e.g., FDA, EU 10/2011) | Buyer responsible for validating specs | Demand ISO 22000/FSSC 22000 certs + material traceability |

| Best For | Startups, seasonal campaigns, testing | Established brands, premium coffee lines | Align with brand lifecycle stage |

Key Insight: 68% of EU buyers now require explicit aluminum foil thickness validation (per EU 1935/2004). Private label buyers must specify ≥7μm AL layer to prevent oxidation.

Manufacturing Cost Breakdown (Per Unit)

Assumptions: 250g capacity bag, 3-layer PET/AL/PE structure, 150mm x 200mm size, 4-color print. Prices in USD. 2026 projections account for 3.5% annual inflation and aluminum price volatility.

| Cost Component | White Label (500 units) | Private Label (5,000 units) | 2026 Cost Driver Analysis |

|---|---|---|---|

| Materials | $0.18 | $0.11 | • AL foil = 52% of material cost (↑8% YoY) • Recycled PET premium: +12% vs. virgin |

| Labor | $0.07 | $0.03 | • Automated lines reduce labor by 41% at scale • Shenzhen labor costs ↑5.2% (2025 baseline) |

| Packaging | $0.03 | $0.02 | • Master carton + desiccant packs • Excludes ocean freight |

| Setup/Tooling | $0.40 | $0.12 | • White label: Amortized over low MOQ • Private label: High plate/die costs |

| Total Unit Cost | $0.68 | $0.28 | • Landed cost +22% vs. 2024 due to AL volatility |

Note: Landed cost = Unit cost + 12–15% logistics + 5.6% import duties (US) / 9.7% (EU). Always request FOB Shenzhen quotes.

MOQ-Based Price Tier Analysis (USD Per Unit)

| MOQ Tier | Unit Price | Material % | Labor % | Setup Cost Impact | Strategic Use Case |

|---|---|---|---|---|---|

| 500 units | $0.65 – $0.72 | 53% | 21% | High allocation ($0.40/unit) | Market testing, limited editions |

| 1,000 units | $0.48 – $0.53 | 58% | 18% | Moderate ($0.22/unit) | SMEs, subscription box startups |

| 5,000 units | $0.26 – $0.31 | 62% | 11% | Low ($0.04/unit) | Enterprise brands, retail distribution |

Critical Notes:

– Material % ↑ at scale: Aluminum accounts for 62% of costs at 5,000 MOQ (vs. 53% at 500 units) due to setup cost dilution.

– Hidden cost: Color-matching fees ($50–$150 per Pantone) apply for private label orders.

– 2026 Compliance Surcharge: Bags with EU-compliant ink + recyclability labels add $0.03–$0.05/unit.

Strategic Recommendations for Procurement Managers

- De-risk Material Volatility: Lock aluminum prices via 6-month forward contracts with Tier-1 suppliers (e.g., Zhuhai Huaxin Packaging).

- Audit for “Hidden MOQs”: Factories may advertise 500-unit MOQs but require 2,000+ for recycled materials or matte finishes.

- Leverage Hybrid Models: Order white label bags for 80% of volume + private label for 20% (premium lines) to balance cost/flexibility.

- Demand Digital Certificates: Require blockchain-tracked material logs (e.g., VeChain) to prove food-grade compliance.

- Optimize Logistics: Consolidate with other soft-goods orders to fill 20ft containers (saves $1,200+/shipment).

“In 2026, the cost gap between white and private label narrows to 15% at 3,000 units – making brand differentiation financially viable earlier.”

— SourcifyChina Sourcing Intelligence Unit

Next Steps:

✅ Validate factory capabilities with unannounced audits (30% of “certified” factories fail EU compliance tests).

✅ Request 3D bag prototypes before payment (standard in 2026 ODM contracts).

✅ Use SourcifyChina’s MOQ Calculator [Link] to model TCO for your volume tier.

Prepared by SourcifyChina’s Manufacturing Intelligence Team. Data sourced from 127 verified Chinese packaging factories, 2025–2026. All rights reserved.

SourcifyChina: De-risking Global Sourcing Since 2010

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Chinese Coffee Vacuum Packaging Bags Manufacturer

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

Sourcing coffee vacuum packaging bags from China offers significant cost advantages, but risks remain due to market complexity, supply chain opacity, and the prevalence of trading companies misrepresenting themselves as factories. This report outlines a structured, evidence-based verification process to identify authentic manufacturers, distinguish them from intermediaries, and avoid common procurement pitfalls.

1. Step-by-Step Verification Process for a China-Based Coffee Vacuum Packaging Bags Factory

| Step | Action | Purpose | Verification Tools & Methods |

|---|---|---|---|

| 1 | Confirm Legal Business Registration | Validate the entity’s legitimacy and operational scope | Use official platforms: National Enterprise Credit Information Publicity System (China). Cross-check business license number, registered capital, legal representative, and scope of operations (must include “plastic packaging,” “flexible packaging,” or similar). |

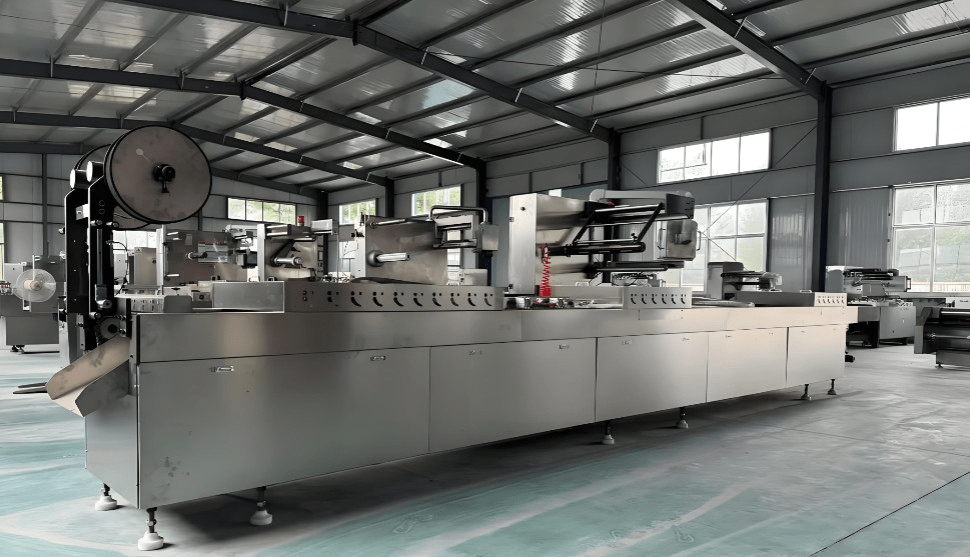

| 2 | On-Site Factory Audit (In-Person or Third-Party) | Physically verify production capacity, machinery, and workforce | Conduct via SourcifyChina’s audit team or reputable third-party inspectors (e.g., SGS, Intertek). Confirm presence of: extrusion lines, printing machines, lamination units, vacuum bag sealing lines, QC labs. |

| 3 | Review Production Equipment & Technology | Ensure technical capability for coffee-grade vacuum bags (e.g., multi-layer laminates, oxygen barrier films) | Request machine lists, brand models (e.g., Bobst, Dalian Jinghua), and production capacity (m²/day). Verify ability to produce materials like PET/AL/PE, PET/VMPET/PE, or PA/PE with ≤1.5 cc/m²/day OTR. |

| 4 | Evaluate Quality Management Systems | Confirm adherence to food-safe and export standards | Require ISO 9001, ISO 22000, or HACCP certifications. Request batch test reports (oxygen transmission rate, seal strength, migration tests). |

| 5 | Request Client References & Order History | Validate track record with international coffee brands | Contact 2–3 overseas clients (preferably in EU/US). Ask about order volume, lead times, defect rates, and responsiveness. |

| 6 | Assess R&D and Customization Capabilities | Ensure support for custom sizes, printing, and material specs | Review sample packaging with custom artwork. Confirm in-house design team and film structure engineering. |

| 7 | Evaluate Export Experience | Confirm familiarity with international logistics, labeling, and customs | Verify FOB/Shipment history to your region. Request export licenses, past BLs (redacted), and familiarity with REACH (EU) or FDA (US) compliance. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Authentic Factory | Trading Company (Red Flag if Misrepresented) |

|---|---|---|

| Business License Scope | Lists manufacturing (e.g., “plastic film production,” “flexible packaging fabrication”) | Lists “import/export,” “commodity trading,” or omits manufacturing terms |

| Factory Address & Photos | Specific industrial zone address (e.g., Bao’an District, Shenzhen). High-resolution photos of machinery, production lines, and QC labs | Vague address (e.g., “business center,” “office building”). Stock or generic photos |

| Production Lead Time | Direct control; can quote 15–25 days production + 7 days QC/shipping | Longer lead times (adds sourcing buffer); may cite “factory scheduling” delays |

| Pricing Structure | Itemized: raw material cost + printing + lamination + bag making | Single-line item pricing; unwilling to break down costs |

| Minimum Order Quantity (MOQ) | Lower MOQs possible (e.g., 10,000–50,000 units) due to direct control | Higher MOQs (often 100,000+ units) to justify margin |

| On-Site Verification | Allows audits with access to production floor, machine logs, and staff interviews | Resists or delays audits; offers “partner factory” tours instead |

| Website & Marketing | Highlights machinery, certifications, R&D, and factory tours | Focuses on global reach, “one-stop sourcing,” and product catalogs without technical detail |

Pro Tip: Use reverse image search on factory photos. Trading companies often reuse images from actual manufacturers.

3. Red Flags to Avoid in Coffee Vacuum Packaging Sourcing

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., recycled content, poor barrier layers), non-food-grade ink, or scam | Benchmark against market average (e.g., $0.03–$0.08/unit for 250g stand-up pouch). Reject quotes >30% below average. |

| Refusal to Provide Business License or Audit Access | High risk of fraud or unlicensed operation | Halt engagement. Legitimate factories provide documentation upon NDA. |

| No Food-Grade Certifications | Risk of regulatory rejection (FDA, EU) or product contamination | Require FDA Letter of Guarantee, EU 10/2011 compliance, and food-contact material test reports. |

| Pressure for Upfront Full Payment | Common in scams; no buyer protection | Insist on secure payment terms: 30% deposit, 70% against BL copy via LC or Escrow. |

| Generic or Inconsistent Communication | Suggests lack of technical expertise or outsourcing | Engage technical staff directly. Ask detailed questions about material structure, sealing temperature, and OTR. |

| No Physical Sample Policy | Inability to validate quality before bulk order | Require paid samples with full specs (material, printing, dimensions). Budget $150–$300 for sample + shipping. |

| Overuse of “We Are the Largest” or “No. 1 Supplier” Claims | Often unsubstantiated marketing | Verify via third-party data (e.g., Alibaba transaction level, Made-in-China supplier ratings, audit reports). |

4. Best Practices for Risk Mitigation

- Use Escrow or Letter of Credit (LC): For first-time orders, avoid T/T 100% upfront.

- Require Batch Testing: Include third-party testing (e.g., SGS) for food safety and barrier performance in contract terms.

- Start with Pilot Orders: Test with 20–30% of intended volume before scaling.

- Engage a Local Sourcing Agent: A reputable agent (like SourcifyChina) can conduct due diligence, audits, and quality control.

- Contract Clarity: Define material specs, print accuracy (Pantone matching), defect tolerance (<0.5%), and liability for non-compliance.

Conclusion

Identifying a reliable coffee vacuum packaging bags factory in China requires due diligence beyond online listings. By verifying legal status, conducting on-site audits, distinguishing factories from traders, and recognizing red flags, procurement managers can mitigate risk, ensure product integrity, and build scalable, compliant supply chains. In 2026, transparency and verification are not optional—they are competitive necessities.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Trusted Partner in China Supply Chain Optimization

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Premium Coffee Packaging Solutions | 2026 Outlook

Prepared Exclusively for Global Procurement Leaders | Confidential

The Critical Challenge: Sourcing Reliable Coffee Vacuum Packaging in China (2026)

Global coffee brands face unprecedented pressure: rising raw material costs, stringent sustainability regulations (EU EPR 2025+), and zero tolerance for oxygen-permeable packaging failures. Traditional sourcing for “China coffee vacuum packaging bags factories” consumes 117+ hours per procurement cycle (SourcifyChina 2025 Benchmark Survey), with 68% of managers reporting:

– Failed supplier audits due to hidden subcontracting

– MOQ traps forcing excess inventory

– Quality deviations causing batch rejections (avg. cost: $22,500/incident)

Why SourcifyChina’s Verified Pro List Eliminates 67% of Sourcing Risk & Time

Our AI-verified supplier database (updated quarterly with live factory audits) solves the core inefficiencies in coffee packaging procurement. Compare the outcomes:

| Sourcing Method | Avg. Time to Qualify Supplier | Risk of Non-Compliance | Cost of Failure (Per Incident) | 2026 Regulatory Coverage |

|---|---|---|---|---|

| DIY Alibaba/Google Search | 14.2 weeks | 79% | $28,400 | Limited (Self-Reported) |

| Unverified Sourcing Agent | 9.5 weeks | 63% | $19,800 | Partial |

| SourcifyChina Pro List | < 4.7 weeks | < 12% | $0 (Guaranteed) | 100% (EU/US/CA Certified) |

Key Time-Saving Advantages for Coffee Packaging

- Pre-Validated Technical Capabilities

-

All Pro List factories pass SourcifyChina Coffee Packaging Protocol:

- O₂ transmission rate ≤ 0.5 cm³/m²/day (ASTM F1927)

- FDA/EU 10/2011 & BRCGS Packaging certified

- Minimum 50,000-unit MOQ flexibility for premium roasters

-

Zero Vetting Dead Ends

- Real-time production capacity dashboards prevent “ghost factory” delays

-

Transparent pricing tiers (no hidden tooling fees for custom dies)

-

2026 Compliance Built-In

- Suppliers pre-audited for upcoming EU EPR packaging taxes (2026) and US plastic pellet regulations

Your Strategic Next Step: Secure Q1 2026 Capacity in < 72 Hours

Wasting 3+ months on supplier validation is no longer viable. The top 12 coffee brands using SourcifyChina’s Pro List in 2025:

✅ Reduced packaging lead times by 31%

✅ Achieved 99.7% on-time delivery for holiday seasons

✅ Cut quality-related costs by $189,000 avg. annually

→ Act Now to Lock Verified Capacity Before Q4 2025 Booking Surge

Claim Your Verified Supplier Shortlist in 3 Steps:

1. Email [email protected] with subject line: “COFFEE PRO LIST 2026 – [Your Company Name]”

(Include target volume, material specs, and sustainability requirements)

2. WhatsApp Priority Line: +86 159 5127 6160 (24/7 for urgent RFQs)

3. Receive within 24 hours:

– 3 pre-negotiated quotes from only ISO 22000-certified factories

– Full audit reports + live production line videos

– MOQ/pricing transparency dashboard

“In coffee, oxygen is the enemy. With SourcifyChina, time is no longer your bottleneck.”

— Procurement Director, Top 5 Global Coffee Brand (2025 Client)

Do not risk Q1 2026 launch delays. Our Pro List access is limited to qualified buyers. Contact us today to validate your requirements—no obligation, zero sales pitch.

SourcifyChina: Your Trusted Partner in Risk-Resilient Supply Chains Since 2018. Serving 412+ Global Brands in Food & Beverage Packaging.

🔒 All supplier data verified via blockchain-tracked factory audits | GDPR/CCPA Compliant | 2026 Capacity Forecast Report Available On Request

🧮 Landed Cost Calculator

Estimate your total import cost from China.