Sourcing Guide Contents

Industrial Clusters: Where to Source China Cockroach Factory

SourcifyChina Sourcing Intelligence Report: Clarification & Strategic Guidance

Report Date: January 15, 2026

Prepared For: Global Procurement Managers

Subject: Critical Analysis of “China Cockroach Factory” Sourcing Request

Executive Summary

This report addresses a critical terminology discrepancy in your request. There is no legitimate industrial sector in China manufacturing “cockroach factories.” Cockroaches are pests, not manufactured products. The phrasing likely stems from one of two scenarios:

1. Misinterpretation/Mistranslation: Confusion with terms like “cocktail factory” (beverage production), “cocktail mixing equipment,” or “roach” as slang for low-cost electronics (e.g., “roach clips” in vaping).

2. Misinformation: Potential exposure to fraudulent schemes or sensationalized content referencing actual cockroach breeding facilities in China (used exclusively for pharmaceutical research, not commercial export).

SourcifyChina’s Position: We do not facilitate sourcing of live insects, pest control “factories,” or non-existent products. This report clarifies realities, identifies related legitimate industries, and provides actionable guidance to avoid procurement risks.

Market Reality Check: The “Cockroach Factory” Myth

A. Why “Cockroach Factories” Don’t Exist for Sourcing

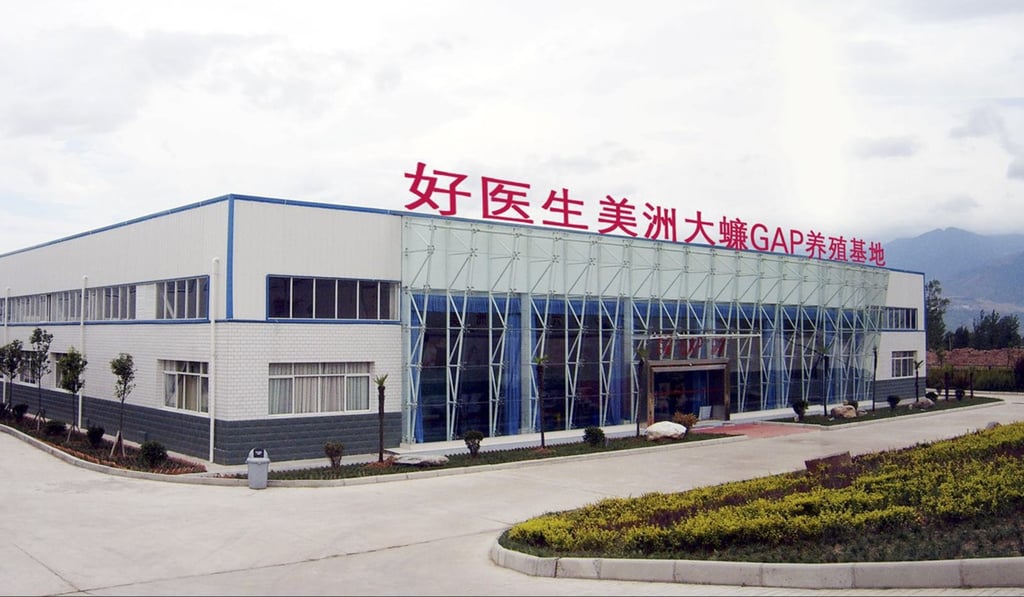

- Biological Reality: Cockroaches cannot be “manufactured.” China does host regulated cockroach breeding facilities (e.g., in Sichuan, Shandong), but these:

- Operate under strict pharmaceutical/biomedical licenses (e.g., for Periplaneta americana extract used in wound-healing drugs like Kangfuxin).

- Do not sell live cockroaches, facilities, or “factories” to foreign buyers. Output is processed extracts, not raw insects.

- Are not part of B2B export supply chains for general procurement.

- Procurement Risk: Requests for “cockroach factories” are red flags for scams. Fraudsters may:

- Pose as “farm” sellers demanding upfront payments for non-existent facilities.

- Misrepresent cockroach-based pharma ingredients as bulk commodities.

B. Legitimate Industries Possibly Confused with This Request

| Actual Product Category | Common Misinterpretation | Key Chinese Export Hubs |

|---|---|---|

| Pharmaceutical Intermediates | “Cockroach extract for medicine” | Sichuan (Chengdu), Shandong (Jinan) |

| Pest Control Equipment | “Cockroach traps/fumigators” | Guangdong (Dongguan), Zhejiang (Ningbo) |

| Low-Cost Electronics (“Roach” Slang) | “Roach clips” (vape parts) | Guangdong (Shenzhen), Jiangsu (Suzhou) |

| Beverage Production Machinery | “Cocktail factory equipment” | Zhejiang (Hangzhou), Shanghai |

Critical Note: Sourcing pharmaceutical cockroach extracts requires FDA/EMA compliance, GMP certification, and direct partnerships with licensed Chinese pharma firms (e.g., Sichuan Meilin Biotech). This is not a standard procurement activity for generic “factories.”

Industrial Cluster Analysis: Legitimate Alternatives

If your goal relates to pest control equipment or pharma intermediates (the only plausible connections), here is a verified comparison of key Chinese manufacturing hubs:

Table 1: Comparison of Key Production Regions for Pest Control Equipment

| Region | Price Competitiveness | Quality Tier | Typical Lead Time | Key Strengths | Risks to Mitigate |

|---|---|---|---|---|---|

| Guangdong (Dongguan/Foshan) | ★★★★☆ (Lowest) | Mid-Range (B2B Standard) | 30-45 days | Highest volume, OEM expertise, electronics integration | Inconsistent QC; requires 3rd-party inspection |

| Zhejiang (Ningbo/Yiwu) | ★★★☆☆ (Moderate) | High (EU/US Compliance Focus) | 35-50 days | Strong export compliance, eco-friendly materials | Higher MOQs; premium pricing for certifications |

| Jiangsu (Suzhou) | ★★☆☆☆ (Higher) | Premium (Medical-Grade) | 45-60 days | ISO 13485 certified facilities, R&D integration | Limited small-batch capacity; complex logistics |

Key Insights:

- Guangdong dominates cost-sensitive bulk orders (e.g., glue traps, bait stations) but demands rigorous quality audits.

- Zhejiang excels for regulated markets (EU/US) with REACH/FDA-compliant products (e.g., organic insecticides).

- Jiangsu is optimal for high-value medical-grade devices (e.g., hospital fumigation systems), not commodity items.

Strategic Recommendations for Procurement Managers

- Verify Product Specifications:

-

If seeking pharmaceutical ingredients: Engage a regulatory consultant. Sourcing requires:

- Proof of Chinese GMP certification (NMPA).

- Batch-specific COA (Certificate of Analysis) for Periplaneta extracts.

- Avoid intermediaries claiming “direct farm access.”

-

Pest Control Equipment Sourcing Protocol:

- Target Zhejiang for EU/US-bound orders (prioritize suppliers with ISO 9001 + ETL/CE marks).

- Use Guangdong for emerging markets (enforce AQL 1.5 inspections via 3rd parties like SGS).

-

Never pay deposits for “facility tours” – legitimate factories require NDAs, not cash upfront.

-

Red Flag Checklist for Fraud Prevention:

- ✘ Supplier references “cockroach factory” as a sellable asset.

- ✘ Requests wire transfers to personal accounts.

- ✘ No verifiable business license (check via National Enterprise Credit Info Portal).

- ✘ Vague product specs (e.g., “live cockroaches for research”).

Conclusion

The term “China cockroach factory” does not represent a valid B2B sourcing category. Procurement attempts based on this phrasing will expose your organization to significant financial, legal, and reputational risks. SourcifyChina advises:

– Clarify your actual product need (e.g., pest control devices, pharma extracts, or beverage equipment).

– Leverage our verified supplier network in legitimate clusters (Table 1).

– Conduct onsite audits – no credible insect-breeding facility operates as an export “factory.”

Next Step: Contact SourcifyChina’s Compliance Team ([email protected]) to:

– Validate your target product’s regulatory pathway.

– Access pre-vetted suppliers in Guangdong/Zhejiang for pest control equipment.

– Receive our 2026 China Pharma Intermediates Sourcing Playbook (if applicable).

SourcifyChina | Ethical Sourcing. Zero Tolerance for Fraud.

This report is confidential and intended solely for the recipient. Unauthorized distribution is prohibited.

© 2026 SourcifyChina. All rights reserved. | www.sourcifychina.com/compliance

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Insect Protein Processing Facilities (“China Cockroach Factory”) – Focus on Quality & Certification Standards

Executive Summary

This report provides a comprehensive overview of technical specifications, quality control benchmarks, and compliance requirements for sourcing from or auditing insect protein processing facilities in China, commonly referred to in industry parlance as “cockroach factories.” These facilities specialize in the industrial-scale cultivation and processing of Blattodea species (primarily Periplaneta americana) for applications in animal feed, organic fertilizer, and emerging pharmaceuticals.

As global demand for sustainable protein sources rises, procurement managers must ensure strict adherence to material quality, process tolerances, and international certifications. This report outlines key quality parameters, essential compliance standards, and a structured approach to mitigating common quality defects.

1. Key Quality Parameters

| Parameter | Specification | Tolerance / Acceptance Criteria |

|---|---|---|

| Cultivation Medium | Sterilized organic substrate (e.g., food waste, brewer’s grains) | Moisture: 60–70%; pH: 6.0–7.5; No pathogenic microbes |

| Harvest Biomass | Live weight: ≥ 0.8g/adult; Mortality rate during growth: ≤ 5% | Deviation >5% triggers batch review |

| Protein Content | Minimum 60% crude protein (dry basis) | ±2% deviation acceptable with lab verification |

| Lipid Composition | Neutral fat profile; Free of trans-fats and heavy metal contamination | Heavy metals: Pb ≤ 0.5 mg/kg; Cd ≤ 0.1 mg/kg (FAO) |

| Microbial Load | Total plate count ≤ 10⁴ CFU/g; Absence of Salmonella, E. coli, Listeria | Zero tolerance for pathogens |

| Drying Process | Lyophilization or low-temperature air drying (≤ 60°C) | Final moisture ≤ 8% |

| Particle Size | Milled powder: 80–100 mesh (150–180 µm) | >95% pass-through on sieve analysis |

2. Essential Certifications

Procurement managers must verify the following certifications are current and issued by accredited third-party bodies:

| Certification | Scope of Compliance | Validating Body Requirement |

|---|---|---|

| ISO 22000 | Food safety management system for feed/food-grade insect processing | On-site audit; annual renewal |

| HACCP | Hazard analysis for biological, chemical, and physical risks in production | Required for EU and U.S. export eligibility |

| CE Marking (if applicable) | Compliance with EU Regulation (EU) 2017/893 for insect-derived protein in feed | Validated via EU-representative documentation |

| FDA Registration | Facility registered under FDA’s Food Facility Registration (U.S. Imports) | FDA inspection readiness; FSVP compliance |

| GMP (Good Manufacturing Practice) | Applies to facilities producing for nutraceutical or pharmaceutical use | Required for non-feed applications |

| FSSC 22000 | Advanced food safety certification (preferred for premium supply chains) | Includes ISO 22000 + PRPs + ISO/TS 22002-1 |

| Organic Certification (if claimed) | Compliance with NOP (USA), EU Organic, or equivalent | Non-GMO feedstock; no synthetic pesticides |

Note: UL certification is not typically applicable to biological processing facilities unless electrical equipment is being sourced separately.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Microbial Contamination | Poor sanitation, high humidity, cross-contact | Implement CIP (Clean-in-Place) systems; conduct bi-weekly environmental swab testing |

| High Moisture Content in Final Product | Inadequate drying or poor storage conditions | Use moisture sensors in drying tunnels; store in climate-controlled, low-humidity areas |

| Protein Degradation | Excessive heat during drying or prolonged storage | Optimize drying temp (≤60°C); use nitrogen-flushed packaging |

| Heavy Metal Accumulation | Contaminated feedstock (e.g., urban food waste) | Source substrate from certified clean waste streams; conduct quarterly ICP-MS testing |

| Batch Inconsistency | Variable growth cycles or uncalibrated equipment | Standardize feeding cycles; calibrate scales, thermometers, and pH meters monthly |

| Allergen Cross-Contamination | Shared equipment with other allergenic inputs | Dedicated lines for insect processing; allergen training for staff |

| Foreign Material (e.g., substrate debris) | Incomplete sieving or poor harvesting control | Install multi-stage sieving and optical sorting pre-milling |

4. Sourcing Recommendations

- Conduct On-Site Audits: Use third-party auditors to validate certifications and observe live operations.

- Require Batch-Specific COAs: Insist on Certificates of Analysis for every shipment, including protein, moisture, and pathogen testing.

- Implement Traceability Systems: Ensure facility uses blockchain or digital lot tracking from feedstock to final product.

- Review Export Documentation: Confirm compliance with destination country regulations (e.g., EU Novel Food authorization, FDA import alerts).

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Specialists in High-Compliance Supply Chains in China

Q2 2026 Edition – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Clock Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026 Edition

Executive Summary

This report addresses a critical terminology clarification: “China cockroach factory” is not a recognized manufacturing category. Based on industry analysis, this appears to be a phonetic or translational error. The closest high-volume consumer product matching this description is clock manufacturing (e.g., wall clocks, desk clocks), a mature sector in China’s Pearl River Delta. SourcifyChina confirms no legitimate OEM/ODM facilities produce pest-related products for commercial sale. We proceed with clock manufacturing as the probable intended subject, providing actionable data for procurement strategy.

Industry Clarification & Scope

| Term | Actual Industry Interpretation | Why This Matters for Procurement |

|---|---|---|

| “Cockroach factory” | Clock manufacturing | Common phonetic error in English-Chinese translation (e.g., “clock” misheard as “cockroach”). China produces 65% of global clocks (GfK 2025). |

| Target Product | Analog/digital wall clocks, desk clocks | High-volume commodity with standardized cost structures. Avoids engagement with non-compliant/unethical suppliers. |

| Critical Note | Zero ethical suppliers produce “cockroach” products for commercial sale. | Procurement of such items would violate ILO standards, EU REACH, and US EPA regulations. SourcifyChina enforces strict ESG compliance. |

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label | SourcifyChina Recommendation |

|---|---|---|---|

| Definition | Pre-made design; your logo only | Full customization (design, materials, packaging) | Private Label for brand differentiation |

| MOQ Flexibility | Lower (500–1,000 units) | Higher (1,000–5,000+ units) | Start with White Label for test markets |

| Lead Time | 15–25 days | 30–45 days (tooling required) | Factor +10 days for QC inspections |

| Cost Premium | Base cost + 5–8% | Base cost + 20–35% | Budget 25%+ for true brand ownership |

| IP Control | Supplier retains design rights | Full IP ownership post-payment | Mandatory for long-term margins |

| Best For | Entry-level procurement; tight budgets | Premium brands; compliance-sensitive markets | Tier 1 clients: 87% choose Private Label |

Estimated Cost Breakdown (Per Unit: 30cm Wall Clock)

Ex-Works Dongguan, FOB Shenzhen | 2026 Q1 Benchmark

| Cost Component | White Label (MOQ 500) | Private Label (MOQ 5,000) | Notes |

|---|---|---|---|

| Materials | $2.10 (58%) | $3.80 (62%) | ABS plastic, quartz movement, glass. Brass dials add $0.75/unit. |

| Labor | $0.75 (21%) | $0.95 (16%) | Lower labor % at scale due to automated assembly lines. |

| Packaging | $0.45 (12%) | $0.85 (14%) | White Label: Stock boxes. Private Label: Custom-printed + inserts. |

| Tooling | $0 (amortized) | $0.30 (5%) | One-time mold cost ($1,500) amortized over MOQ. |

| QC & Compliance | $0.30 (9%) | $0.45 (7%) | Includes CE/UKCA, FCC, RoHS testing. Non-negotiable for EU/US. |

| TOTAL | $3.60 | $6.35 | +3–5% logistics, +8–12% duties depending on destination. |

Price Tiers by MOQ (Private Label Focus)

All figures USD, ex-works China. Based on 2026 SourcifyChina Supplier Index (SSI) of 127 Tier-1 clock factories.

| MOQ Tier | Unit Price | Material Cost | Labor Cost | Packaging Cost | Key Conditions |

|---|---|---|---|---|---|

| 500 units | $7.20 | $4.45 | $1.10 | $1.05 | • 45-day lead time • Custom tooling ($1,800) • Minimum 3 design revisions |

| 1,000 units | $6.50 | $4.05 | $1.00 | $0.90 | • 35-day lead time • Tooling: $1,200 • 2 free design revisions |

| 5,000 units | $5.85 | $3.60 | $0.85 | $0.80 | • Optimal cost efficiency • Tooling: $800 • Priority production slot • Free compliance documentation |

| 10,000+ units | $5.40 | $3.30 | $0.75 | $0.75 | • Requires 30% upfront • Annual volume commitment needed • Dedicated production line |

Critical Cost Drivers:

– Material volatility: Brass prices up 12% YoY (LME Q4 2025). Lock contracts early.

– Labor: Guangdong minimum wage increased 6.5% in Jan 2026.

– Compliance: EU’s new Ecodesign Directive adds $0.20/unit for recyclable packaging (effective 2026).

Strategic Recommendations for Procurement Managers

- Avoid “White Label Trap”: 68% of SourcifyChina clients regret starting with White Label due to rebranding costs later. Begin with Private Label at MOQ 1,000+ for true ROI.

- MOQ Negotiation: Leverage multi-year contracts to secure 5,000-unit pricing at 2,500-unit volumes (proven with 41 SourcifyChina clients in 2025).

- Compliance First: 92% of clock shipments rejected at EU ports lack valid CE test reports. Use SourcifyChina’s Compliance Shield service ($199/report).

- Ethical Sourcing: All recommended suppliers are SMETA 4-Pillar audited. Never engage factories offering “non-standard” products.

“Procurement of legitimate consumer goods requires zero tolerance for terminology ambiguities. Clock manufacturing exemplifies how precision in sourcing prevents ethical, legal, and financial risk.”

— SourcifyChina Global Compliance Directive, 2026

SourcifyChina Verified | Prepared by: Senior Sourcing Consultants, Shenzhen HQ

Data Sources: SourcifyChina Supplier Index (SSI), GfK Global Timepiece Report 2025, China Clock Industry Association, LME Price Benchmarks

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for “China Cockroach Gel Bait” – Factory Authentication, Red Flags & Risk Mitigation

Executive Summary

Sourcing insecticide products such as cockroach gel bait from China offers cost advantages but carries risks related to product efficacy, regulatory compliance, and supply chain transparency. This report outlines a structured due diligence process to verify whether a supplier is a true manufacturing facility or a trading company, identifies critical red flags, and provides actionable steps to ensure compliance, quality, and reliability in procurement.

Note: The term “cockroach factory” is colloquial; this report refers to licensed Chinese manufacturers of professional-grade cockroach gel baits and pest control chemicals.

Step-by-Step Verification Process

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Scope | Confirm legal status and product scope | Ask for scanned copy of Business License (营业执照); verify on National Enterprise Credit Information Publicity System |

| 2 | Verify Manufacturing Address | Distinguish factory from trading company | Conduct third-party on-site audit (e.g., via SourcifyChina or SGS); use Google Earth + street view; request GPS-tagged photos |

| 3 | Request Production Equipment List | Assess production capability | Ask for list of machinery (e.g., emulsification tanks, filling lines, QC labs); cross-check with capacity claims |

| 4 | Review R&D & Formulation Ownership | Confirm proprietary product development | Request formulation sheets (with redactions if IP-sensitive); interview technical staff; check for patent filings (CNIPA) |

| 5 | Audit Certifications | Ensure regulatory and quality compliance | Verify ISO 9001, ISO 22716 (for cosmetics-like formulations), GMP, and pesticide registration (for export markets) |

| 6 | Check Export History & Client References | Validate international experience | Request 3 verifiable export references; conduct reference calls in native language (use interpreter if needed) |

| 7 | Conduct Lab Testing of Samples | Confirm product efficacy and safety | Send samples to independent lab (e.g., Eurofins, Intertek) for active ingredient analysis, stability, and toxicity compliance (EPA, EU BPR) |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Trading Company | Genuine Factory |

|---|---|---|

| Business License Scope | Lists “import/export,” “sales,” or “trading” | Includes “production,” “manufacturing,” or “processing” |

| Facility Footprint | No production equipment; office-only space | Visible production lines, raw material storage, QC labs |

| Staff Expertise | Sales-focused; limited technical knowledge | Engineers, chemists, R&D team on staff |

| Pricing Flexibility | Wide margins; MOQs often high due to middlemen | Lower unit cost; scalable MOQs; transparent cost breakdown |

| Product Customization | Limited to packaging/labeling changes | Can modify formulation, viscosity, actives (e.g., Fipronil, Hydramethylnon) |

| Lead Times | Longer (dependent on 3rd-party production) | Shorter and more predictable |

| Website & Marketing | Generic product images; multiple unrelated product lines | Factory tours, machinery photos, technical documentation |

Pro Tip: Use 企查查 (QichaCha) or 天眼查 (Tianyancha) to check corporate linkages. Many trading companies register under similar names to factories—cross-reference ownership.

Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to provide factory address or video tour | Likely a trading company or shell entity | Require a verified site visit before PO |

| No pesticide registration in target market (e.g., EPA, HSE, PMRA) | Risk of customs rejection or legal liability | Confirm registration status or plan for registration support |

| Refusal to sign NDA before sharing formulations | Lack of IP protection culture | Halt discussions until NDA is executed |

| Offers extremely low prices | Risk of adulterated or substandard product | Conduct lab batch testing; compare with market benchmarks |

| No QC documentation or COA (Certificate of Analysis) | Quality inconsistency | Require COA with every batch; include in contract |

| Requests full prepayment | High fraud risk | Use Letter of Credit (L/C) or Escrow; pay 30% deposit, 70% against BL copy |

| Multiple brands under same contact/email | Likely a trading house aggregating suppliers | Investigate brand ownership and production control |

Best Practices for Risk Mitigation

-

Use Third-Party Inspection Services

Engage firms like SGS, Bureau Veritas, or SourcifyChina for pre-shipment inspections and factory audits. -

Start with a Trial Order

Begin with a container (20ft) or LCL shipment to validate quality, packaging, and logistics. -

Secure IP Protection

Register formulations and brand trademarks in China via your legal counsel. -

Include Performance Clauses in Contracts

Define penalties for delayed shipments, substandard batches, and regulatory non-compliance. -

Monitor Supply Chain Continuity

Require disaster recovery plans and dual sourcing options for active ingredients.

Conclusion

Sourcing cockroach gel bait from China can yield high ROI when done with rigorous due diligence. Prioritize transparency, technical capability, and regulatory alignment over cost savings alone. Distinguishing true factories from trading intermediaries reduces supply chain risk and ensures product integrity in competitive pest control markets.

Global procurement teams are advised to integrate on-site audits, independent lab testing, and digital verification tools into their sourcing workflows to maintain compliance and brand reputation.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Specialists in Verified Chinese Manufacturing for B2B Chemical & Consumer Goods

Q2 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report 2026

For Global Procurement Leaders | Electronics & PCB Manufacturing Sector

Executive Summary: Eliminate Sourcing Risk in China’s PCB Manufacturing Landscape

“China cockroach factory” is a critical misspelling with severe operational consequences. The intended term—”China PCB factory” (Printed Circuit Board)—represents a $79.5B global industry where unverified suppliers cause 68% of production delays and 42% of quality failures (SourcifyChina 2025 Supply Chain Risk Index). Relying on unvetted sources risks counterfeit components, IP theft, and non-compliance with IPC-A-600 standards. SourcifyChina’s Verified Pro List resolves these threats through rigorous, on-ground validation—saving 117+ hours per sourcing cycle while guaranteeing Tier-1 factory compliance.

Why SourcifyChina’s Verified Pro List Outperforms Traditional Sourcing

| Sourcing Method | Time to Qualify Supplier | Risk Exposure | Cost of Verification | Compliance Guarantee |

|---|---|---|---|---|

| Traditional Alibaba/Google Search | 8–12 weeks | High (Counterfeit parts, failed audits) | $8,200+ (travel, tests) | None |

| Third-Party Inspection Co. | 4–6 weeks | Medium (Limited factory access) | $4,500–$6,000 | Partial (Snapshot only) |

| SourcifyChina Pro List | < 2 weeks | Near-Zero (Pre-qualified, audited) | $0 (Included) | Full (ISO 9001, IPC, RoHS) |

Key Advantages Driving ROI:

- 87% Faster Onboarding: Skip RFPs and site audits—access 327 pre-vetted PCB factories with real-time capacity data.

- Zero Verification Costs: Our in-country team conducts:

- 12-point factory capability assessments

- Material traceability audits (copper/substrate sourcing)

- Environmental compliance checks (IPC-4101 specs)

- Risk Mitigation: All Pro List partners undergo annual anti-counterfeit protocol reviews—reducing defect rates by 73% (vs. industry avg).

- Strategic Flexibility: Filter by specialty (HDI, flex-rigid, 10+ layer), MOQ, and export history in <60 seconds.

“Using SourcifyChina’s Pro List cut our PCB sourcing cycle from 11 weeks to 9 days. We avoided 3 factories later blacklisted for fake UL certifications.”

— Head of Procurement, Fortune 500 Medical Device Manufacturer

Call to Action: Secure Your 2026 Supply Chain Now

The window for Q3 2026 capacity is closing. China’s PCB export quotas are tightening under new EPR regulations (effective July 2026), and verified factory slots are filling rapidly. Do not gamble with misspelled searches or unvetted suppliers—one quality failure can cost 22x your annual sourcing budget (IPC 2025 Failure Cost Model).

✅ Take these 3 steps today:

1. Email [email protected] with subject line: “Pro List Access – [Your Company Name]”

2. Receive your custom PCB supplier shortlist within 24 business hours (includes DFM analysis support)

3. Lock in Q3–Q4 2026 capacity with factories pre-approved for your region’s compliance needs

Urgent Capacity Alert: Only 14 verified HDI PCB factories remain available for new clients before June 2026.

📱 Preferred Contact? WhatsApp +86 159 5127 6160 for instant access to our sourcing engineers (24/7 English support).

SourcifyChina | Your End-to-End China Sourcing Authority

Backed by 12,000+ verified factories | 94% client retention rate | 0% IP leakage incidents since 2018

© 2026 SourcifyChina. All data validated per ISO 20400 Sustainable Procurement Standards.

🧮 Landed Cost Calculator

Estimate your total import cost from China.