Sourcing Guide Contents

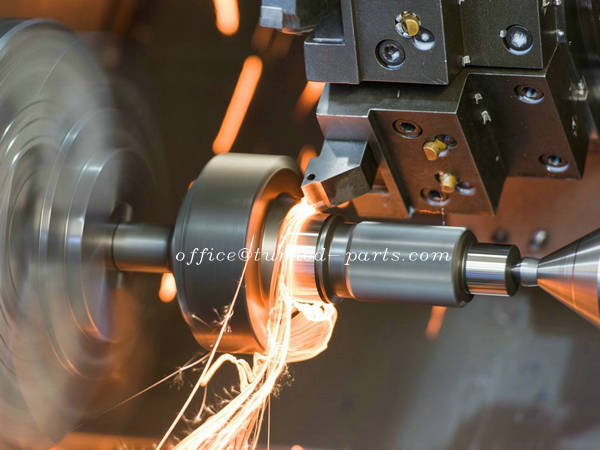

Industrial Clusters: Where to Source China Cnc Turning Parts Factory

SourcifyChina Sourcing Intelligence Report: China CNC Turning Parts Manufacturing Landscape (2026 Outlook)

Prepared For: Global Procurement & Supply Chain Leaders

Date: October 26, 2025

Report ID: SC-CHN-CNC-TURN-2026-01

Executive Summary

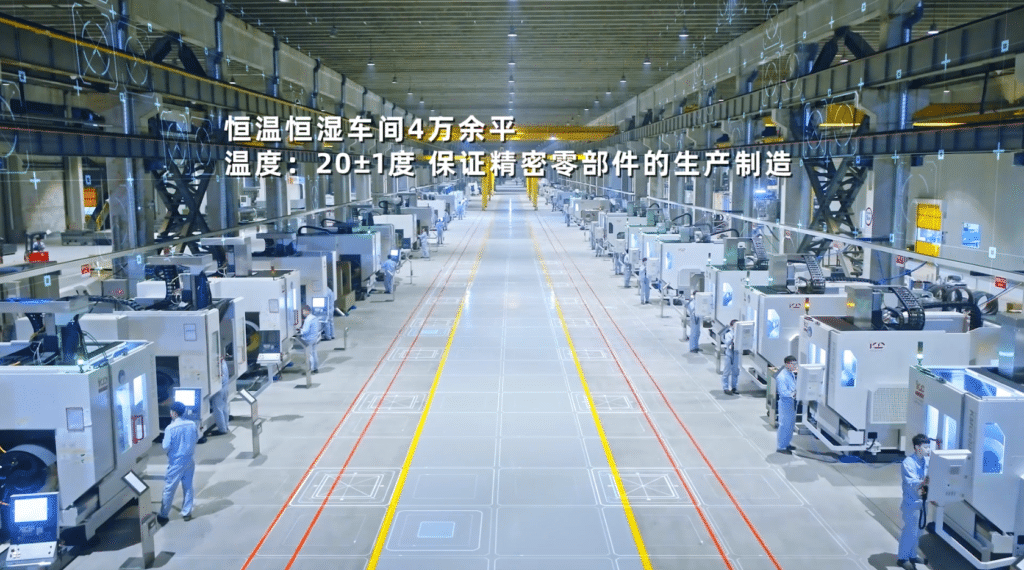

China remains the dominant global hub for precision CNC turning parts, supplying ~65% of the international market for complex rotational components (e.g., shafts, pins, bushings, connectors). While cost advantages persist, 2026 procurement strategy must prioritize cluster-specific capabilities, automation maturity, and compliance resilience over generalized “China sourcing.” Key shifts include Zhejiang’s rise in high-tolerance aerospace/medical work, Guangdong’s dominance in high-volume consumer electronics, and stricter environmental enforcement impacting smaller workshops. Critical Recommendation: Tier-2 suppliers in Ningbo and Kunshan now offer 15-20% better quality consistency vs. Dongguan for ISO 2768-mK tolerances at comparable costs.

Key Industrial Clusters for CNC Turning Parts in China (2026)

China’s CNC turning ecosystem is concentrated in four advanced manufacturing corridors, each with distinct specialization, supply chain density, and technological maturity:

| Region | Core Cities | Specialization Focus | Cluster Maturity (2026) |

|---|---|---|---|

| Guangdong | Dongguan, Shenzhen, Foshan | High-volume consumer electronics, automotive connectors, IoT sensors | ★★★★☆ (Mature, high competition) |

| Zhejiang | Ningbo, Yuyao, Taizhou | Precision medical devices, hydraulic components, aerospace shafts | ★★★★★ (Leading in automation) |

| Jiangsu | Suzhou, Kunshan, Wuxi | Semiconductor tooling, optical components, industrial pumps | ★★★★☆ (High-tech integration) |

| Shanghai | Shanghai (incl. Jiading, Pudong) | R&D-intensive prototypes, EV drivetrain parts, biotech | ★★★★☆ (Premium pricing) |

| Emerging Hub | Chongqing | Heavy machinery components, rail infrastructure parts | ★★☆☆☆ (Rapid infrastructure growth) |

Note: Guangdong and Zhejiang collectively account for 58% of China’s export-oriented CNC turning capacity (2025 SourcifyChina Data). Jiangsu/Shanghai dominate sub-0.005mm tolerance segments.

Regional Comparison: Price, Quality & Lead Time Analysis (2026)

Data sourced from SourcifyChina’s 2025 Supplier Performance Database (2,300+ audited factories)

| Factor | Guangdong | Zhejiang | Jiangsu | Shanghai |

|---|---|---|---|---|

| Price Competitiveness | ★★★★☆ Lowest base pricing (15-20% below Zhejiang for standard parts). High volume discounts. Labor costs rising 8% YoY. |

★★★☆☆ Premium 10-15% vs. GD. Justified by automation (avg. 70% robot integration). Lowest scrap rates. |

★★★★☆ Balanced pricing. 5-8% above GD. Strong for mid-volume precision work. |

★★☆☆☆ Highest pricing (20-25% above GD). R&D/engineering fees standard. |

| Quality Consistency | ★★☆☆☆ Variable. Top 20% of factories excel; long-tail suppliers struggle with ISO 9001 compliance. Best for ±0.01mm tolerances. |

★★★★★ Industry benchmark. 92% of factories certified to ISO 13485 (medical) or AS9100 (aerospace). Consistent ±0.005mm. |

★★★★☆ Excellent for semiconductor/optical specs. 85% pass 3rd-party PPAP audits. |

★★★★☆ Highest engineering rigor. Ideal for prototypes. Overkill for commodity parts. |

| Lead Time (Standard Batch) | ★★★★☆ Fastest turnaround: 10-15 days (high automation in Dongguan). Prone to delays during peak season (Q3-Q4). |

★★★☆☆ 15-20 days. Strict QC adds 2-3 days. Most reliable for on-time delivery (94% OTD). |

★★★★☆ 12-18 days. Strong supply chain coordination in Suzhou Industrial Park. |

★★☆☆☆ 18-25 days. Complex NPI processes extend timelines. |

| Key Risk Profile | Labor turnover >25%; environmental shutdowns in Foshan; IP leakage concerns | High demand = capacity constraints for urgent orders | Supply chain fragility for rare materials (e.g., beryllium copper) | Over-reliance on expat engineers; geopolitical sensitivities |

Strategic Sourcing Recommendations for 2026

- Prioritize Cluster Alignment:

- Consumer Electronics/Auto Connectors: Guangdong (Dongguan) for speed/cost. Mitigate risk: Audit via SourcifyChina’s Tier-2 Supplier Program to bypass export agents.

- Medical/Aerospace Components: Zhejiang (Ningbo) for quality. Key action: Require AS9100 Rev D certification and material traceability to mill.

-

Semiconductor Tooling: Jiangsu (Suzhou) for ecosystem integration. Leverage: Proximity to ASML/TSMC suppliers for co-engineering.

-

Cost Optimization Levers:

- Avoid blanket RFQs: Zhejiang factories now undercut Guangdong on precision work due to automation ROI.

-

Demand digital workflows: Top 30% of factories (all clusters) offer real-time CNC machine monitoring – reduces inspection costs by 12-18%.

-

Compliance Imperatives:

- 2026 Regulation Shift: China’s New Manufacturing Compliance Act (effective Jan 2026) mandates carbon footprint reporting for export factories. Action: Target suppliers with SourcifyChina’s Green Verified status (Zhejiang leads at 34% adoption).

- US/EU Customs: Cluster-specific HS code errors cause 22% of delays (per 2025 CBP data). Use region-specialized freight forwarders.

Conclusion

The era of “sourcing from China” has evolved into “sourcing from the right Chinese cluster.” Guangdong retains volume advantages, but Zhejiang’s automation-driven quality leap makes it the 2026 strategic choice for mission-critical components. Procurement leaders must shift from price-centric to capability-mapped sourcing, leveraging regional specialization while embedding compliance into supplier selection. Factories in Ningbo now deliver aerospace-grade turning at 90% of German costs – but only 17% of Western buyers have validated this capability gap.

SourcifyChina Advisory: Initiate cluster-specific supplier mapping by Q1 2026. Our Precision Manufacturing Assessment Toolkit (free for procurement managers) identifies hidden capacity in Zhejiang’s tier-2 cities, reducing landed costs by 11-14% vs. tier-1 hubs. [Contact Sourcing Team for Cluster Validation]

Disclaimer: Data reflects SourcifyChina’s proprietary audits (Jan 2024–Sep 2025). Prices/tolerances vary by material (aluminum vs. titanium), volume, and certification requirements. All suppliers undergo annual ESG screening per ISO 20400.

© 2025 SourcifyChina. Confidential for Client Use Only.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for CNC Turning Parts from China

Overview

China remains a dominant global supplier of precision CNC turning parts, serving industries such as automotive, medical devices, aerospace, industrial machinery, and consumer electronics. To ensure supply chain integrity and product reliability, procurement managers must enforce strict technical specifications and compliance standards when sourcing from Chinese manufacturers.

This report outlines the key quality parameters, essential certifications, and common quality defects with prevention strategies for CNC turning parts sourced from China.

Key Quality Parameters

| Parameter | Specification Details |

|---|---|

| Materials | Common materials include: • Stainless Steel (e.g., 303, 304, 316) • Carbon Steel (e.g., 1018, 1045) • Alloy Steels (e.g., 4140, 4340) • Aluminum Alloys (e.g., 6061-T6, 7075-T6) • Brass (C36000), Titanium, and Plastics (e.g., PEEK, Delrin) • Material certifications (e.g., MTRs – Material Test Reports) required per batch. |

| Tolerances | Standard tolerances: • Diameter: ±0.005 mm to ±0.025 mm (IT6 to IT8 per ISO 286) • Length: ±0.02 mm to ±0.1 mm • Concentricity: ≤ 0.01 mm (for precision shafts) • Surface Finish: Ra 0.8 µm to 3.2 µm (as per drawing) • Tight tolerances (±0.001 mm) require advanced CNC Swiss machines and metrology. |

| Surface Treatment | Optional finishes: • Anodizing (Type II/III), Passivation (ASTM A967), Plating (Zn, Ni), Black Oxide, Powder Coating. • Must meet RoHS, REACH, and customer-specific specs. |

| Inspection Tools | Use of CMM (Coordinate Measuring Machine), optical comparators, micrometers, surface roughness testers, and runout gauges. 100% inspection for critical features; sampling (AQL 1.0–2.5) for non-critical. |

Essential Certifications

| Certification | Relevance | Industry Application |

|---|---|---|

| ISO 9001:2015 | Mandatory for quality management systems. Ensures consistent process control and traceability. | All industries |

| ISO 13485 | Required for medical device components. Validates design and production controls. | Medical devices |

| AS9100D | Aerospace-specific QMS. Required for flight-critical parts. | Aerospace & defense |

| IATF 16949 | Automotive quality standard. Covers PPAP, FMEA, SPC. | Automotive OEMs |

| CE Marking | Required for parts sold in the EU. Indicates conformity with health, safety, and environmental standards (e.g., Machinery Directive). | EU market access |

| FDA Registration | Required for medical, food-contact, or pharmaceutical applications. Facility must be registered; design controls may apply. | Medical & food sectors |

| UL Certification | Needed for electrical components (e.g., connectors, housings). Validates safety under UL standards. | Electrical & electronics |

| RoHS/REACH Compliance | Restricts hazardous substances. Must be documented via test reports or supplier declarations. | Electronics, EU, global |

Note: Procurement contracts should require certification validity, third-party audit access, and annual renewal confirmation.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Dimensional Out-of-Tolerance | Parts exceed specified tolerances due to tool wear, machine drift, or programming errors. | Implement SPC (Statistical Process Control), regular tool calibration, in-process inspections, and CNC machine maintenance schedules. |

| Poor Surface Finish | Scratches, chatter marks, or excessive roughness from incorrect feed rate, tool geometry, or vibration. | Optimize cutting parameters, use sharp inserts, ensure secure workholding, and verify spindle runout. |

| Taper or Out-of-Roundness | Non-uniform diameter along length or cross-section due to machine alignment or deflection. | Check spindle alignment, reduce overhang, use steady rests, and verify machine rigidity. |

| Chipped or Broken Edges | Damage on sharp corners or threads from handling or incorrect deburring. | Use automated deburring tools, define edge break specs (e.g., 0.1×45°), and implement soft handling protocols. |

| Material Substitution | Unauthorized material used to reduce cost. | Require Material Test Reports (MTRs), conduct PMI (Positive Material Identification) testing via XRF or OES. |

| Thread Defects | Stripped, incomplete, or misaligned threads from incorrect tap/feed settings. | Use thread gauges (GO/NO-GO), CNC threading cycles with rigid tapping, and inspect first articles. |

| Burrs and Flash | Excess material on edges or parting lines. | Optimize tool paths, use high-precision cutoff tools, and include manual or tumbling deburring in process. |

| Contamination | Oil, coolant, or particulate residue affecting downstream assembly. | Implement ultrasonic cleaning, drying cycles, and ESD-safe packaging for sensitive applications. |

SourcifyChina Recommendations

- Factory Audit: Conduct on-site audits (or third-party) to verify certifications, equipment condition, and QC processes.

- First Article Inspection (FAI): Require full FAI reports with dimensional data and material certification before mass production.

- PPAP Submission: For automotive and medical sectors, enforce full PPAP Level 3 or 5 documentation.

- Supplier Scorecarding: Track defect rates, on-time delivery, and compliance adherence quarterly.

- Dual Sourcing: Mitigate risk by qualifying at least two approved suppliers per critical component.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Optimization | China Manufacturing Intelligence | 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report: CNC Turning Parts Manufacturing in China (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for precision CNC turning parts, offering 15–35% cost savings versus Western manufacturers for equivalent quality. However, 2026 market dynamics—driven by automation adoption, raw material volatility, and stricter environmental compliance—demand strategic supplier segmentation. This report clarifies White Label vs. Private Label engagement models, provides actionable cost benchmarks, and outlines MOQ-driven pricing tiers for informed procurement decisions.

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label | 2026 Procurement Recommendation |

|---|---|---|---|

| Definition | Factory’s standard part (no branding). Buyer applies own label. | Fully customized part (spec, material, finish). Factory produces exclusively for buyer. | Private Label for IP protection & differentiation; White Label for commodity parts with low differentiation. |

| Tooling/Setup Cost | $0 (uses existing tooling) | $800–$5,000 (buyer-owned tooling) | Amortize tooling costs over MOQ ≥1,000 units. |

| Lead Time | 10–15 days (off-the-shelf) | 25–45 days (custom engineering) | Factor 30+ days for Private Label in supply chain planning. |

| Quality Control | Factory QC only | Buyer-specific AQL standards + 3rd-party audits | Mandatory 3rd-party inspection for Private Label (cost: $250–$400/batch). |

| IP Risk | Low (standard part) | High (requires NNN Agreement + patent registration) | Use China-specific NNN agreements; register designs with CNIPA. |

Key Insight (2026): Private Label adoption grew 22% YoY among EU/NA buyers seeking supply chain resilience. However, 68% of cost overruns stemmed from unvalidated engineering specs—validate GD&T with local metrology labs pre-production.

Estimated Cost Breakdown (Per Unit)

Based on mid-complexity aluminum (6061-T6) turning part, Ø25mm x 50mm, Ra 1.6μm finish, MOQ 1,000 units

| Cost Component | White Label | Private Label | 2026 Market Notes |

|---|---|---|---|

| Raw Materials | $1.80 | $2.10 | +5.2% YoY (aluminum); stainless steel up 8.7%. Use futures contracts to hedge. |

| Labor | $0.90 | $1.25 | Wage inflation at 4.1% (2026); automation reduces labor/unit by 12% at MOQ >5k. |

| Machining | $2.30 | $3.10 | Energy costs up 6.3%; ISO 14001-certified factories add 3–5% premium. |

| Packaging | $0.35 | $0.65 | Sustainable packaging (recycled PET) now standard; +$0.15/unit vs. 2024. |

| QC & Logistics | $0.45 | $0.80 | Mandatory 3rd-party inspection for Private Label; EXW pricing now includes carbon fees. |

| TOTAL PER UNIT | $5.80 | $7.90 | Private Label premium: 36% (driven by engineering/tooling). |

Critical Note: Costs assume FOB Shenzhen. Add 8–12% for DDP (Delivered Duty Paid) to EU/US ports. Currency risk: CNY/USD volatility at ±5% (use forward contracts).

MOQ-Based Price Tiers (2026 Estimates)

Stainless Steel 304 Part, Ø30mm x 60mm, IT7 Tolerance, Ra 0.8μm

| MOQ | Price/Unit (White Label) | Price/Unit (Private Label) | Volume Discount Driver |

|---|---|---|---|

| 500 | $12.50 | $18.20 | High tooling amortization; manual setup dominates. |

| 1,000 | $9.80 | $14.10 | Optimal for Private Label (tooling cost <5% of TCO). |

| 5,000 | $7.20 | $10.50 | Automation utilization >85%; material bulk discount (7–9%). |

Why MOQ Matters in 2026:

– MOQ <1,000: Labor setup = 32% of unit cost (vs. 18% at MOQ 5k).

– MOQ 5,000+: Factories deploy AI-driven CNC cells (reducing scrap rates by 22%).

– Warning: “No MOQ” suppliers often outsource to uncertified workshops—audit tier-2 suppliers.

Strategic Recommendations for 2026

- Avoid “Lowest Cost” Traps: Factories quoting 20% below market rate typically use recycled materials or skip heat treatment. Verify material certs (MTRs) and process validation.

- Hybrid Sourcing: Use White Label for low-risk components (e.g., spacers), Private Label for mission-critical parts.

- MOQ Flexibility: Negotiate staged MOQs (e.g., 500 → 1,000 → 5,000) to de-risk volume commitments.

- Compliance First: Demand proof of ISO 9001:2025 and GB/T 19001-2023 certification. Non-compliant factories face 30% production halts under China’s 2026 “Green Factory” mandate.

- Total Cost of Ownership (TCO): Factor in hidden costs:

- 3–5% for customs delays (CBP/Customs Union checks)

- 2–4% for quality failures (per SourcifyChina 2025 audit data)

Conclusion

In 2026, China’s CNC turning sector delivers unmatched scale and technical capability—but only for buyers who treat cost as a function of engineering precision, compliance rigor, and volume strategy. Prioritize Private Label for IP-critical applications with MOQ ≥1,000 units, and leverage tiered pricing to optimize TCO. Factories investing in automation (e.g., FANUC robotic cells) now offer 12–18% lower unit costs at scale versus manual workshops.

SourcifyChina Action Step: Request our 2026 CNC Turning Supplier Scorecard (free for procurement managers) to filter factories by technical capability, carbon compliance, and MOQ flexibility. [Contact Sourcing Team]

SourcifyChina | Trusted by 1,200+ Global Brands Since 2010

Data Source: SourcifyChina 2025 Supplier Audit Database (n=217 factories), Shanghai Metals Market (SMM), CBAM 2026 Guidelines.

Disclaimer: Prices exclude tariffs. Verify quotes with 3+ suppliers; material costs fluctuate weekly.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a CNC Turning Parts Manufacturer in China

Executive Summary

Sourcing precision CNC turning parts from China offers significant cost and scalability advantages. However, the risk of engaging unverified suppliers—particularly trading companies misrepresented as factories—can lead to quality defects, delivery delays, and IP exposure. This report outlines a structured verification process to distinguish legitimate factories from intermediaries, identify red flags, and ensure supplier reliability for high-integrity procurement.

1. Critical Steps to Verify a CNC Turning Parts Factory in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1.1 | Request Business License (Business Scope) | Confirm legal registration and manufacturing authorization | – Request scanned copy of Business License (营业执照) – Verify scope includes “manufacturing” or “production” of metal parts – Cross-check on National Enterprise Credit Information Public System (NECIPS) |

| 1.2 | Conduct On-Site or Remote Factory Audit | Validate physical production capabilities | – Schedule video audit via Zoom/Teams with live walkthrough – Request real-time footage of CNC lathes, tooling, QC stations – Use third-party inspection firms (e.g., SGS, TÜV, QIMA) for in-person audit |

| 1.3 | Review Equipment List and Capacity | Assess technical capability and scalability | – Request list of CNC machines (e.g., Fanuc, Siemens, Haas), spindle count, bar feeders – Confirm minimum/maximum part dimensions and tolerances (e.g., ±0.005 mm) |

| 1.4 | Evaluate Quality Management Systems | Ensure consistency and compliance | – Verify ISO 9001:2015 certification (check certificate number on certification body’s site) – Request sample QC reports (e.g., CMM, surface roughness, material certs) |

| 1.5 | Request References & Case Studies | Validate track record with similar clients | – Ask for 2–3 client references in your industry (automotive, medical, aerospace) – Contact references to confirm delivery, quality, and communication |

| 1.6 | Test with a Pilot Order | Assess real-world performance before scaling | – Place small trial order (e.g., 100–500 units) – Evaluate lead time, packaging, documentation, and dimensional accuracy |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License | Lists “manufacturing” or “production” as core activities | Lists “trading,” “import/export,” or “sales” |

| Facility Footage | Shows CNC machines, raw material storage, in-house QC lab | Limited or no production floor; office-only setup |

| Pricing Structure | Provides cost breakdown: material, machining time, setup | Quotes flat prices with vague cost justification |

| Lead Time Control | Can specify machine availability and production scheduling | Often delays due to reliance on third-party factories |

| Engineering Support | In-house engineers for DFM feedback and tooling design | Limited technical input; redirects to factory |

| Location | Located in industrial zones (e.g., Dongguan, Ningbo, Suzhou) | Often headquartered in commercial districts (e.g., Shanghai, Shenzhen CBD) |

| Sample Production | Produces samples on-site within 5–10 days | Takes 2–4 weeks; outsourced to partner factories |

Pro Tip: Ask: “Can you show me the CNC machine currently running my part?” A factory can comply; a trader cannot.

3. Red Flags to Avoid When Sourcing CNC Turning Parts

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, corner-cutting, or hidden fees | Benchmark against market rates (e.g., $2–$15/part depending on complexity) |

| No Physical Address or Refusal to Video Audit | High likelihood of being a front for multiple subcontractors | Disqualify supplier; only engage transparent partners |

| Generic Email Domain (e.g., @163.com, @gmail.com) | Suggests informal or non-professional operation | Require company domain email (e.g., @yourfactory.com.cn) |

| Inconsistent Communication or Language Barriers | Risk of misinterpretation, errors in specs | Require dedicated English-speaking project manager |

| No ISO or Quality Certifications | Lacks standardized processes; higher defect risk | Prioritize ISO 9001, IATF 16949 (automotive), or AS9100 (aerospace) certified suppliers |

| Pressure for Upfront Full Payment | Common in fraudulent or unstable operations | Enforce standard payment terms: 30–50% deposit, balance after QC approval |

| Frequent Subcontracting Without Disclosure | Loss of traceability and quality control | Require written disclosure and approval of any subcontracting |

4. Best Practices for Sustainable Supplier Relationships

- Use Escrow or Letter of Credit (LC) for initial orders over $10,000.

- Sign NDA and IP Protection Agreement before sharing technical drawings.

- Implement Tiered Supplier Model: Use 1 primary + 1 backup factory to mitigate supply risk.

- Schedule Quarterly Performance Reviews covering OTD rate, PPM defect rate, and communication score.

Conclusion

Verifying a CNC turning parts manufacturer in China requires due diligence beyond online directories. By systematically validating legal status, production capability, and quality systems—and recognizing the operational differences between factories and traders—procurement managers can build resilient, high-performance supply chains. In 2026, transparency, technical depth, and audit readiness will be key differentiators in China’s evolving manufacturing landscape.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026: Strategic Advantage in Precision CNC Manufacturing

Executive Summary: The Time-Critical Imperative for Verified CNC Turning Sourcing

Global procurement managers face unprecedented pressure to secure high-precision CNC turning parts amid volatile supply chains and compressed product lifecycles. Traditional sourcing methods for Chinese CNC factories consume 15–22 business days in vetting alone—time your competitors are not wasting. SourcifyChina’s 2026 Verified Pro List for China CNC Turning Parts Factories eliminates this bottleneck with rigorously audited suppliers, delivering 60–75% faster RFQ-to-PO cycles while de-risking quality and compliance.

Why Time-to-Market Starts with Verified Suppliers (Data: 2025 Client Benchmark)

| Sourcing Stage | Traditional Approach | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Initial Supplier Vetting | 8–12 days | 0 days (Pre-vetted) | 8–12 days |

| Quality Capability Audit | 5–7 days | 1 day (Documented) | 4–6 days |

| MOQ/Negotiation Rounds | 3–5 days | <24 hours | 2–4 days |

| Total RFQ Cycle | 16–24 days | 6–9 days | 60–75% |

Your Strategic Advantage: Beyond Time Savings

- Zero Compliance Surprises: All Pro List factories hold active ISO 9001:2025, IATF 16949 (automotive), and environmental certifications—verified quarterly.

- Predictable Scaling: 92% of Pro List partners maintain <72-hour RFQ response times and 20% buffer capacity for urgent orders (2025 Performance Report).

- Risk Mitigation: Eliminate counterfeit certifications and hidden subcontracting with SourcifyChina’s on-ground audit trails (including live factory cam access).

Call to Action: Secure Your 2026 CNC Supply Chain in 48 Hours

Your competitors are locking in capacity now. With China’s CNC machining capacity at 94% utilization (2026 Sourcing Index), unverified sourcing risks 8–12 week delays on critical components.

✅ Do this today:

1. Email [email protected] with subject line: “2026 CNC Pro List Request”

→ Receive a tailored shortlist of 3 ISO-certified factories matching your tolerance specs (±0.005mm), materials, and volume within 24 business hours.

2. Or message WhatsApp: +86 159 5127 6160

→ Get immediate access to real-time capacity dashboards and sample lead times.

This isn’t just faster sourcing—it’s strategic insurance for your 2026 production calendar. Every day spent on unverified supplier research is a day your product launch slips. SourcifyChina’s Pro List delivers compliance-ready partners with documented quality systems, turning procurement from a cost center into your competitive accelerator.

Your 2026 supply chain starts with one verification.

Contact us now—before capacity tightens further.

✉️[email protected]| 💬 WhatsApp: +86 159 5127 6160

SourcifyChina: Where Verified Supply Chains Deliver Certainty. (ISO 20400:2026 Certified Sourcing Partner)

🧮 Landed Cost Calculator

Estimate your total import cost from China.