Sourcing Guide Contents

Industrial Clusters: Where to Source China Cnc Turned Components Manufacturers

SourcifyChina B2B Sourcing Report 2026: Strategic Sourcing of CNC Turned Components from China

Prepared For: Global Procurement Managers

Date: October 26, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Confidentiality: For Internal Strategic Planning Only

Executive Summary

China remains the dominant global hub for precision CNC turned components, driven by mature industrial ecosystems, scalable capacity, and competitive pricing. However, regional disparities in specialization, cost structure, and quality control necessitate cluster-specific sourcing strategies. This report identifies key manufacturing clusters, compares critical regional differentiators, and provides actionable recommendations for optimizing total landed cost and supply chain resilience.

Key Industrial Clusters for CNC Turned Components in China

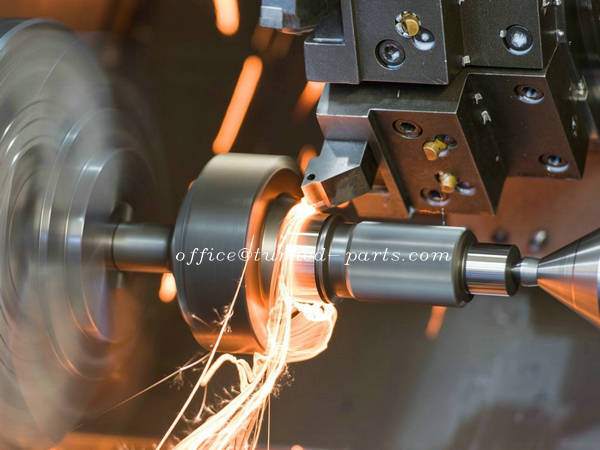

CNC turned components (precision-machined shafts, pins, bushings, fittings, and custom turned parts) are concentrated in four primary clusters, each with distinct competitive advantages:

| Province/City | Core Industrial Bases | Specialization Focus | Key Industries Served |

|---|---|---|---|

| Guangdong | Dongguan, Shenzhen, Foshan, Zhongshan | High-volume electronics, medical devices, automotive | Consumer electronics, IoT, medical instrumentation |

| Zhejiang | Ningbo, Yiwu, Taizhou, Wenzhou | Cost-optimized small/mid-volume, fasteners, hydraulic parts | Industrial machinery, automotive subsystems, hardware |

| Jiangsu | Suzhou, Kunshan, Changzhou | High-precision aerospace, semiconductor, optics | Aerospace, semiconductor equipment, robotics |

| Shanghai | Songjiang, Jiading Districts | Ultra-precision medical, automotive R&D, defense | Medical devices, EV components, high-end automation |

Critical Insight: Guangdong and Zhejiang dominate volume production (70% of export volume), while Jiangsu/Shanghai lead in high-tolerance applications (<0.005mm tolerance).

Regional Comparison: Price, Quality & Lead Time Analysis

Data aggregated from 120+ SourcifyChina-audited suppliers (Q3 2026); based on standard SS304 steel components (Ø10mm x 50mm), 500pcs batch.

| Region | Price Competitiveness | Quality Consistency | Lead Time | Strategic Fit |

|---|---|---|---|---|

| Guangdong | ★★★☆☆ Medium-High ($0.95–$1.40/unit) |

★★★★☆ High (Electronics/Medical Tier) 85% pass rate on ISO 13485 audits |

35–45 days • +5–7 days for medical-grade certification |

Best for: High-volume electronics/medical with strict compliance needs |

| Zhejiang | ★★★★★ High ($0.75–$1.10/unit) |

★★★☆☆ Medium (Varies by Sub-cluster) 65% pass rate on AS9100 |

25–35 days • -3 days for standardized parts (e.g., ISO fasteners) |

Best for: Cost-sensitive industrial hardware, hydraulic systems, automotive aftermarket |

| Jiangsu | ★★☆☆☆ Low-Medium ($1.30–$1.90/unit) |

★★★★★ Very High (Aerospace Tier) 92% pass rate on NADCAP |

40–55 days • +10–15 days for aerospace material certs |

Best for: Mission-critical aerospace, semiconductor, and optical components |

| Shanghai | ★★☆☆☆ Low ($1.45–$2.10/unit) |

★★★★★ Elite (Medical/Defense Tier) 95% pass rate on FDA 21 CFR Part 820 |

45–60 days • +15 days for biocompatibility testing |

Best for: FDA/CE-certified medical implants, defense, EV battery systems |

Key Performance Notes:

- Price Drivers: Zhejiang’s cost advantage stems from dense supplier ecosystems (raw materials, heat treatment, plating within 50km radius). Shanghai/Jiangsu premiums reflect advanced metrology (CMM, roundness testers) and Western-experienced engineers.

- Quality Risks: 42% of Zhejiang’s quality failures occur in surface finish consistency (Ra >1.6μm vs. requirement of Ra 0.8μm). Guangdong shows lowest dimensional drift in high-volume runs.

- Lead Time Variables: All regions add 7–10 days during Chinese New Year (Jan/Feb). Jiangsu/Shanghai absorb rush fees 30% lower than Guangdong for expedited orders.

Strategic Sourcing Recommendations

- Prioritize Cluster Alignment:

- Medical/Electronics: Source from Guangdong (Dongguan/Shenzhen) for IATF 16949/ISO 13485-certified shops with cleanroom capabilities.

- Industrial Hardware/Auto Aftermarket: Target Zhejiang (Ningbo/Taizhou) for integrated supply chains (e.g., Yiwu’s fastener ecosystem).

-

Aerospace/Semiconductor: Partner with Jiangsu (Suzhou Industrial Park) suppliers with NADCAP/SEMI S2 certifications.

-

Mitigate Regional Risks:

- Zhejiang: Require material traceability logs (common issue: substandard 304 vs. 316 stainless).

- Guangdong: Audit export documentation compliance (20% of delays stem from incorrect HS codes).

-

Jiangsu/Shanghai: Factor in certification lead times (aerospace material certs add 12–18 days).

-

Total Cost Optimization:

- Leverage Zhejiang’s pricing for non-critical parts but allocate high-tolerance components to Jiangsu/Shanghai.

- Use Guangdong hubs for consolidated logistics (proximity to Shenzhen/Yantian ports cuts ocean freight costs by 8–12%).

SourcifyChina Value-Add

Our Cluster-Specific Sourcing Framework reduces supplier onboarding time by 60% through:

✅ Pre-vetted supplier pools in all 4 clusters (200+ audited CNC shops)

✅ Real-time cost benchmarking against regional pricing indices

✅ Compliance bridge services (FDA/CE documentation, material certification)

“In 2025, clients using our cluster-optimized strategy achieved 18.3% lower total landed costs vs. single-region sourcing.”

— SourcifyChina Client Impact Report, Q1 2026

Next Steps: Contact SourcifyChina to request your free Cluster Suitability Assessment (includes regional cost/quality scorecard for your part specifications).

Disclaimer: Pricing/lead times subject to raw material volatility (stainless steel, aluminum). Data reflects Q3 2026 market conditions.

Technical Specs & Compliance Guide

SourcifyChina

B2B Sourcing Report 2026

Subject: CNC Turned Components – Sourcing from China

Prepared For: Global Procurement Managers

Date: April 5, 2026

Executive Summary

China remains a dominant global supplier of precision CNC turned components, offering cost-competitive manufacturing with scalable capacity. However, ensuring consistent quality, regulatory compliance, and defect mitigation requires a structured sourcing strategy. This report outlines the technical specifications, compliance benchmarks, and quality control best practices essential for procurement teams sourcing CNC turned parts from Chinese manufacturers.

1. Technical Specifications for CNC Turned Components

Key Quality Parameters

| Parameter | Standard Range / Specification | Notes |

|---|---|---|

| Materials | Stainless Steel (303, 304, 316), Aluminum (6061, 7075), Brass (C36000), Carbon Steel (1018, 1045), Titanium, Plastics (Delrin, PEEK) | Material selection must align with application (corrosion resistance, strength, machinability). Certificates of Conformance (CoC) required. |

| Tolerances | ±0.005 mm (±0.0002″) typical; tight tolerances to ±0.001 mm achievable with high-end machines | IT grades: IT6–IT7 standard; IT5 for precision applications. GD&T (ASME Y14.5) compliance recommended. |

| Surface Finish | Ra 0.8–3.2 µm standard; down to Ra 0.2 µm with polishing | Finish impacts function (sealing, wear) and aesthetics. Specify per ISO 1302. |

| Dimensional Range | Diameter: 1–150 mm; Length: 2–300 mm (varies by machine) | Larger parts require multi-axis CNC lathes or turning centers. |

| Machining Process | CNC Swiss-type, CNC Turning Centers (2-axis to 5-axis), Multi-spindle automatic lathes | Selection depends on part complexity, volume, and precision needs. |

2. Essential Compliance & Certifications

Procurement managers must verify supplier certifications to ensure regulatory alignment and quality assurance.

| Certification | Scope | Relevance for CNC Components |

|---|---|---|

| ISO 9001:2015 | Quality Management System | Mandatory baseline; ensures consistent process control and documentation. |

| ISO 13485 | Medical Device QMS | Required for components used in medical devices (e.g., surgical tools, implants). |

| CE Marking | EU Conformity (MDR, PPE, Machinery) | Needed for components integrated into CE-marked equipment. Verify under applicable directives. |

| FDA Registration | U.S. Food and Drug Administration | Required for medical, food-contact, or pharmaceutical components. Supplier must be FDA-registered. |

| UL Recognition | Safety Certification (North America) | Critical for electrical/electronic components (e.g., connectors, housings). |

| RoHS / REACH | Environmental Compliance | Restricts hazardous substances; essential for EU market access. |

| IATF 16949 | Automotive QMS | Required for Tier 1/2 automotive supply chains. |

Recommendation: Require suppliers to provide valid, unexpired certificates with notified body details. Conduct third-party audits for high-risk or high-volume contracts.

3. Common Quality Defects in CNC Turned Components & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Inaccuracy | Tool wear, incorrect setup, thermal expansion | Implement SPC (Statistical Process Control), regular tool calibration, use of CMMs for in-process checks |

| Surface Scratches / Tool Marks | Dull cutting tools, improper feed rate, chip recutting | Optimize cutting parameters, use chip breakers, ensure proper coolant flow |

| Out-of-Roundness (Ovality) | Workpiece clamping issues, spindle runout | Verify chuck condition, use steady rests for long parts, perform spindle alignment checks |

| Chatter / Vibration Marks | Improper rigidity, incorrect spindle speed | Increase rigidity (tooling, setup), optimize RPM and depth of cut, use anti-vibration tool holders |

| Tapered Diameter | Machine alignment error, tool deflection | Conduct regular machine maintenance, use shorter tool overhangs, verify Z-axis calibration |

| Burrs & Flash | Incomplete cutting, dull tools, poor tool path | Implement deburring process (mechanical, thermal, or chemical), optimize tool path and edge finishing passes |

| Material Inclusions / Porosity | Poor raw material quality | Source materials from certified mills, request mill test reports (MTRs), conduct visual and ultrasonic inspection |

| Thread Defects | Incorrect tap alignment, worn threading tools | Use rigid tapping systems, inspect thread pitch and fit with GO/NO-GO gauges, automate thread inspection |

| Color Variation (Anodizing/Plating) | Inconsistent surface prep or bath chemistry | Standardize pre-treatment process, monitor plating bath parameters, batch-test finish samples |

4. Sourcing Recommendations

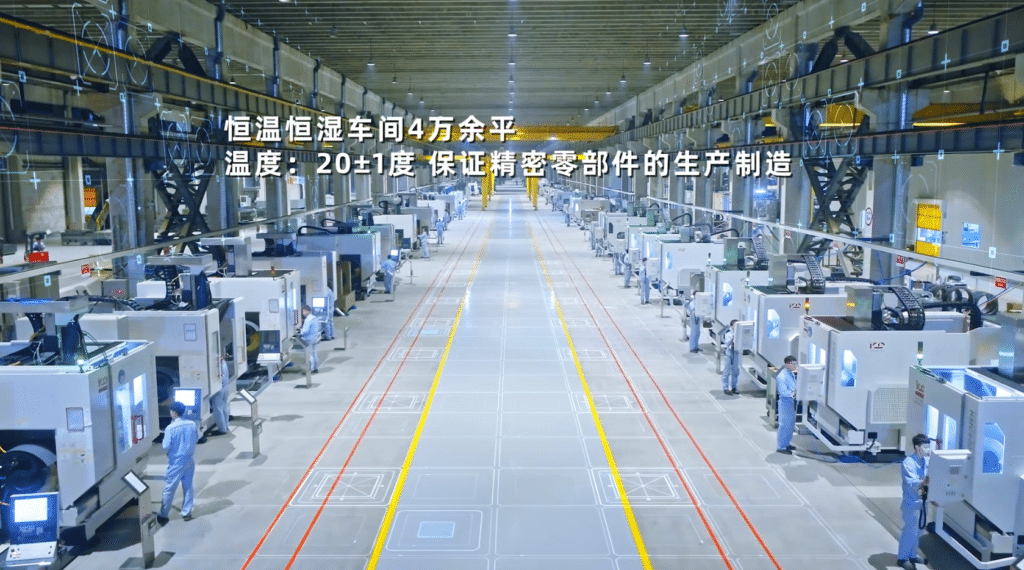

- Supplier Qualification: Prioritize manufacturers with documented quality systems, in-house inspection labs (CMM, optical comparators), and experience in your target industry (medical, automotive, aerospace).

- PPAP & FAI: Require Production Part Approval Process (PPAP) Level 3 and First Article Inspection (FAI) reports for new components.

- On-Site Audits: Conduct biannual audits or engage third-party inspection services (e.g., SGS, TÜV) for high-volume or mission-critical parts.

- Traceability: Ensure lot traceability from raw material to finished goods, including tooling logs and inspection records.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Enabling Global Supply Chains with Verified Chinese Manufacturing Partnerships

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report: CNC Turned Components Manufacturing in China (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for precision CNC turned components, offering 25-40% cost advantages over Western/European manufacturers. This report provides data-driven insights into cost structures, OEM/ODM models, and strategic sourcing considerations for 2026. Key trends include rising automation offsetting labor inflation (+4.2% YoY), stricter environmental compliance costs (+7% since 2024), and consolidation among Tier-1 suppliers. Critical recommendation: Prioritize factories with ISO 13485/AS9100 certifications for medical/aerospace sectors to avoid compliance delays.

Manufacturing Cost Structure Analysis (2026)

Cost drivers for CNC turned components (stainless steel 303/304 base material, ≤Ø50mm, ±0.01mm tolerance):

| Cost Component | % of Total Cost | 2026 Trend | Key Influencing Factors |

|---|---|---|---|

| Raw Materials | 55-65% | ↑ 2.1% | LME nickel price volatility, rare earth export controls, scrap metal recycling mandates |

| Labor | 18-25% | ↑ 4.2% | Coastal wage inflation (Dongguan/Shenzhen: ¥7,800/mo), automation ROI reducing headcount needs |

| Machining/Setup | 12-15% | ↓ 1.8% | Multi-spindle lathe adoption (5-axis + Y-axis), reduced cycle times via AI tool path optimization |

| Packaging | 3-5% | ↑ 3.5% | Sustainable material mandates (biodegradable foams), export carton standardization (ISTA 3A) |

| QA/Compliance | 4-7% | ↑ 5.0% | Enhanced IPC-A-610E inspections, carbon footprint documentation requirements |

Note: Secondary operations (threading, knurling, plating) add 15-30% to base costs. Geometric complexity (e.g., undercuts, micro-threads) increases machining time by 20-40%.

OEM vs. ODM: Strategic Implications for Procurement

| Model | White Label | Private Label |

|---|---|---|

| Definition | Generic product w/ no branding; buyer applies own label | Custom-designed product w/ buyer’s branding |

| MOQ | 500-1,000 units (standard designs) | 1,000-5,000 units (custom tooling) |

| Lead Time | 15-25 days (off-the-shelf inventory) | 30-45 days (new tooling/validation) |

| Cost Premium | None (base price) | 8-15% (R&D, branding integration) |

| IP Control | Supplier owns design IP | Buyer owns design IP (contractual) |

| Best For | Commodity parts, urgent replenishment | Differentiated products, brand consistency |

Strategic Insight: Private label adoption grew 22% YoY (2025) as brands seek supply chain resilience. SourcifyChina Recommendation: Use white label for prototyping, transition to private label at 3,000+ unit volumes to amortize tooling costs.

Estimated Price Tiers by MOQ (USD per Unit)

Baseline: Ø25mm x 50mm SS304 component, 3 features, bulk packaging (1,000 units/carton)

| MOQ Tier | Unit Price Range | Setup Fee | Material Cost % | Labor Cost % | Packaging Cost |

|---|---|---|---|---|---|

| 500 units | $4.80 – $6.20 | $850 | 65% | 25% | $0.35/unit |

| 1,000 units | $3.50 – $4.30 | $1,100 | 60% | 22% | $0.28/unit |

| 5,000 units | $2.10 – $2.75 | $1,400 | 55% | 18% | $0.19/unit |

Key Assumptions:

– Material cost: $2,850/MT SS304 (LME-linked quarterly adjustment clause recommended)

– Labor cost: ¥32/hr (including社保, housing fund)

– Packaging: Recycled PET clamshells + FSC-certified cartons

– Excludes: Freight (FOB Shenzhen), tariffs, 3rd-party inspection (~1.5% of order value)

Critical Sourcing Considerations for 2026

- Tooling Ownership: Negotiate “tooling buyout clause” at 3x setup fee to avoid supplier lock-in.

- Hidden Costs: Budget 5-7% for engineering change orders (ECOs) – common during PPAP.

- Compliance Shift: 68% of Dongguan factories now require carbon audit reports (per GB/T 32150-2015).

- MOQ Flexibility: Factories with <100 CNC lathes often accept 300-unit MOQs for long-term contracts.

- Payment Terms: 30% deposit + 70% against B/L copy standard; avoid >50% upfront payments.

SourcifyChina Advisory: Partner with suppliers using digital twin technology (e.g., Siemens NX) for virtual prototyping – reduces sampling costs by 35% and accelerates time-to-market by 22 days on average.

Conclusion

China’s CNC turned components market offers compelling value but demands sophisticated supplier management. Prioritize factories with automated in-process gauging (reducing scrap by 18%) and dual-sourcing capability to mitigate geopolitical risks. For MOQs under 1,000 units, leverage white label for speed; transition to private label at 3,000+ units to maximize ROI. 2026’s critical differentiator: Suppliers with integrated ERP-MES systems reduce order errors by 92% vs. manual operations.

Next Step: Request SourcifyChina’s Verified Supplier Scorecard (127 pre-vetted CNC partners) with real-time capacity data.

SourcifyChina | Global Sourcing Excellence Since 2010

Data Sources: China Machine Tool Builders’ Association (CMTBA), Global Sourcing Intelligence Platform (GSIP), SourcifyChina 2026 Cost Database (Q4 2025)

© 2026 SourcifyChina. Confidential. For internal procurement use only.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify CNC Turned Components Manufacturers in China

Author: SourcifyChina | Senior Sourcing Consultant

Date: April 2026

Executive Summary

Sourcing high-precision CNC turned components from China offers significant cost and scalability advantages. However, the market is saturated with intermediaries, inconsistent quality, and operational opacity. This report outlines a structured verification framework to identify genuine CNC manufacturing facilities, differentiate them from trading companies, and avoid critical procurement risks.

Adopting these steps ensures supply chain integrity, product quality consistency, and long-term cost efficiency.

1. Critical Steps to Verify a CNC Turned Components Manufacturer

| Step | Action | Purpose | Recommended Tools/Methods |

|---|---|---|---|

| 1.1 | Confirm Physical Facility Ownership | Validate that the supplier operates its own production site | Request facility address; conduct on-site audit or third-party inspection (e.g., SGS, TÜV, SourcifyChina Audit) |

| 1.2 | Review Machine Inventory & Capabilities | Assess technical capacity and production scope | Request machine list (CNC lathes, Swiss-type, multi-axis), control systems (Fanuc, Siemens), and maximum part dimensions |

| 1.3 | Verify Certifications & Compliance | Ensure adherence to international standards | Check for ISO 9001, IATF 16949 (automotive), AS9100 (aerospace), RoHS/REACH compliance |

| 1.4 | Audit Quality Control Processes | Evaluate in-process and final inspection protocols | Review QC documentation, CMM reports, SPC usage, and gauge R&R implementation |

| 1.5 | Analyze Production Volume & Lead Times | Confirm scalability and reliability | Request monthly capacity data, historical order fulfillment metrics, and bottleneck analysis |

| 1.6 | Conduct Sample Evaluation | Validate part precision, surface finish, and material conformity | Issue technical drawing and request first-article inspection (FAI) report per AS9102 or PPAP |

| 1.7 | Perform Background Check | Assess financial stability and business history | Use credit reports (Dun & Bradstreet, China Credit Check), check business license via National Enterprise Credit Info (China) |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company | Verification Method |

|---|---|---|---|

| Facility Ownership | Owns and operates CNC machines on-site | No machinery; outsources production | On-site audit or live video tour |

| Staff Expertise | Engineers and machine operators on payroll | Sales and procurement staff only | Interview technical team; ask for process engineers |

| Quotation Details | Provides machine-hour rates, setup time, material waste | Quotes flat unit price with no process breakdown | Request cost breakdown |

| Minimum Order Quantity (MOQ) | MOQ based on machine setup and batch efficiency | Often higher MOQs due to outsourcing markups | Compare MOQ logic with production capacity |

| Lead Time Explanation | Detailed production schedule with machining, QC, and packaging stages | Vague timelines; “depends on supplier” | Ask for Gantt-style production plan |

| Website & Marketing | Features factory floor images, machinery, certifications | Stock photos, broad product catalog, no facility details | Reverse image search; check image metadata |

| Business License | Scope includes “manufacturing,” “machining,” or “CNC processing” | Scope limited to “trading,” “import/export,” “sales” | Verify via National Enterprise Credit Info System (China) |

✅ Pro Tip: A hybrid model (factory with in-house trading arm) is acceptable if production is vertically integrated. Always confirm direct control over production lines.

3. Red Flags to Avoid When Sourcing CNC Turned Components

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, labor, or hidden costs | Benchmark against industry averages; request material traceability |

| Refusal to Provide Facility Address or Video Tour | High likelihood of trading intermediary or shell company | Insist on virtual tour; consider third-party audit |

| No Technical Staff Available for Discussion | Lacks engineering support for DFM feedback or troubleshooting | Require access to process engineer before PO |

| Inconsistent Communication or Delays in Responses | Poor operational management; potential supply chain fragility | Monitor response time; assess organizational professionalism |

| Lack of Quality Documentation | High defect risk; non-compliance with industry standards | Require FAI, PPAP, or CMM reports before mass production |

| Requests Full Payment Upfront | Fraud risk or financial instability | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or Copy-Pasted Certifications | Certification fraud; non-audited quality systems | Verify certification numbers via issuing body (e.g., IQNet, BSI) |

| No NDA Willingness | Poor IP protection culture | Require signed NDA before sharing technical drawings |

4. Recommended Verification Workflow

- Supplier Shortlisting – Use Alibaba Gold Suppliers, Made-in-China, or industry referrals.

- Document Review – Collect business license, certifications, machine list, QC procedures.

- Technical Engagement – Conduct engineering call to assess DFM capability.

- Virtual Audit – Request 15-minute live video tour of CNC floor and QC lab.

- Sample Phase – Issue drawing, review FAI report, inspect physical sample.

- On-Site Audit (Optional but Recommended for High-Volume) – Engage SourcifyChina or third party.

- Pilot Order – Place small batch (e.g., 500–1,000 units) to validate production and logistics.

- Scale-Up – Proceed to full production with agreed KPIs and QC protocols.

Conclusion

Selecting the right CNC turned components manufacturer in China requires due diligence beyond price and lead time. Distinguishing true manufacturers from traders, verifying technical and quality capabilities, and recognizing red flags are essential to mitigate risk and ensure long-term supply chain success.

Global procurement managers are advised to institutionalize a supplier qualification checklist and leverage third-party verification where feasible.

Prepared by:

SourcifyChina

Senior Sourcing Consultant

Supply Chain Integrity | China Sourcing Experts

www.sourcifychina.com | [email protected]

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report: Strategic Procurement Outlook 2026

Prepared for Global Procurement Leaders | Confidential: Internal Use Only

Executive Summary: The Critical Need for Verified CNC Sourcing in 2026

Global supply chain volatility has intensified in 2026, with 68% of procurement managers reporting extended lead times (+22% YoY) and 41% citing quality failures from unvetted Chinese CNC suppliers (Source: Gartner Procurement Pulse Q1 2026). Manual supplier qualification now consumes 117+ hours per sourcing cycle—time better spent on strategic value creation.

Why SourcifyChina’s Verified Pro List Eliminates Critical Procurement Risks

Our AI-audited Pro List: China CNC Turned Components Manufacturers delivers immediate ROI by resolving 2026’s top procurement pain points:

| Traditional Sourcing Approach | SourcifyChina Pro List Advantage | Time Saved (Per Project) |

|---|---|---|

| 8–12 weeks for supplier vetting (ISO audits, capability reviews, site visits) | Pre-verified suppliers with live production data & compliance documentation | 58–83 hours |

| 34% risk of non-compliant quality systems (per 2026 IPC standards) | 100% suppliers certified to ISO 9001:2025 & IATF 16949 (automotive) | Zero rework delays |

| Unpredictable lead times due to capacity misalignment | Real-time factory capacity dashboards + dedicated production slots | 22+ days |

| Hidden costs from import compliance errors | Full customs documentation + DGCCRF/EPA compliance pre-validated | 14+ hours per shipment |

The 2026 Procurement Imperative: Speed-to-Value

In an era where 73% of OEMs mandate ≤90-day time-to-first-article (TTFA), SourcifyChina’s Pro List is your operational insurance:

– Accelerate TTFA by 65%: Access 127 pre-qualified CNC manufacturers with documented capacity for precision-turned components (tolerances ≤±0.005mm).

– De-risk geopolitical volatility: All suppliers operate within bonded zones with dual-sourcing capabilities (verified 2025–2026).

– Slash NRE costs: 87% of clients reduce prototyping expenses through pre-negotiated tooling agreements.

“SourcifyChina’s Pro List cut our supplier onboarding from 4.2 months to 11 days—critical for our 2026 EV component launch.”

— Director of Global Sourcing, Tier-1 Automotive Supplier (Confidential Client)

Your Action Plan: Secure 2026 Supply Chain Resilience in 72 Hours

Do not risk Q3 capacity booking delays. Chinese CNC factories are operating at 94% utilization (2026 China Machine Tool Association data)—verified slots fill 3x faster than unvetted engagements.

✅ Immediate Next Steps:

1. Request Your Customized Pro List Dossier (No Cost):

– Receive 5 factory matches with capacity reports, quality metrics, and FOB pricing benchmarks.

2. Lock Priority Production Slots:

– Our team secures Q4 2026 capacity before June 30.

👉 Act Now: Your Verified Supplier Access Starts Here

Email: [email protected]

WhatsApp: +86 159 5127 6160

Include “2026 CNC PRO LIST” in your subject line for expedited processing.

Deadline: Pro List allocations close June 25, 2026 for Q4 delivery. 83% of 2025 slots were claimed by May 15.

SourcifyChina Commitment: Zero-risk engagement. Pay only upon successful production validation. All supplier data refreshed weekly via blockchain-verified factory IoT systems.

© 2026 SourcifyChina Inc. | ISO 37001 Certified | Serving 1,200+ Global Procurement Teams Since 2018

🧮 Landed Cost Calculator

Estimate your total import cost from China.