Sourcing Guide Contents

Industrial Clusters: Where to Source China Cnc Turned Components Factory

SourcifyChina Sourcing Report 2026

Strategic Market Analysis: Sourcing CNC Turned Components from China

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

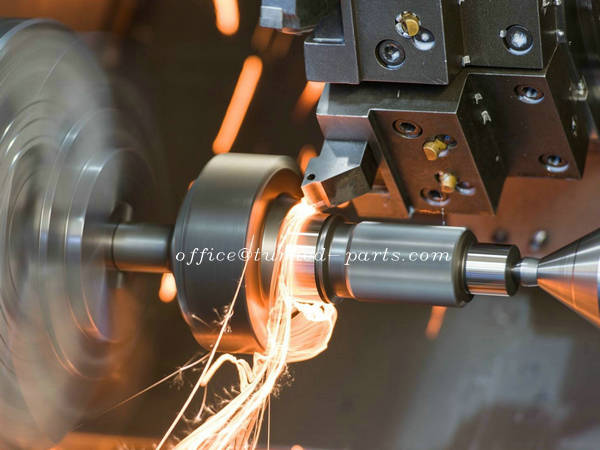

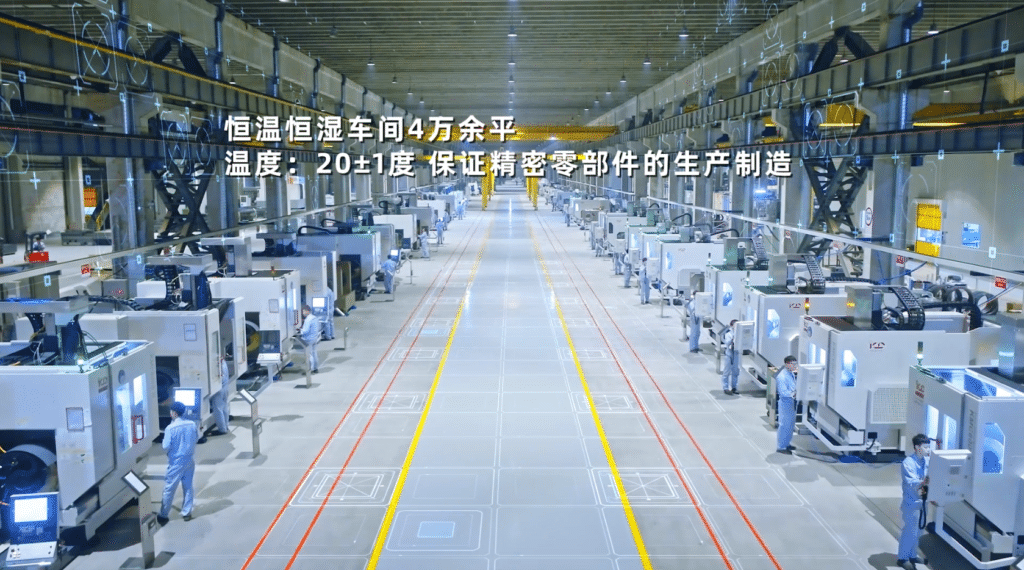

China remains the dominant global hub for precision CNC turned components, offering a robust ecosystem of manufacturers equipped with advanced turning technologies (CNC lathe, Swiss-type, multi-axis), skilled labor, and vertically integrated supply chains. This report provides a data-driven analysis of key industrial clusters producing CNC turned components in China, with a comparative evaluation of regional capabilities across price, quality, and lead time—critical decision factors for international procurement.

With increasing automation, tighter tolerance capabilities (±0.005 mm), and growing ISO 13485 and IATF 16949 certifications, Chinese manufacturers are now serving high-end sectors including medical devices, automotive, aerospace, and industrial automation.

Key Industrial Clusters for CNC Turned Components in China

The production of CNC turned components is heavily concentrated in coastal industrial provinces with mature manufacturing ecosystems, logistics access, and supplier networks. The following provinces and cities represent the core hubs:

| Region | Key Cities | Specialization & Strengths |

|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou, Foshan | High-precision micro-turned parts; strong in electronics, medical, and consumer tech; high automation; proximity to Hong Kong logistics |

| Zhejiang | Ningbo, Yuyao, Taizhou, Wenzhou | Mass production of standard and complex turned parts; strong mold and tooling support; cost-efficient mid-tier manufacturing |

| Jiangsu | Suzhou, Changzhou, Wuxi | High-quality automotive and industrial components; strong German and Japanese OEM partnerships; excellent QA systems |

| Shanghai | Shanghai (suburbs: Jiading, Songjiang) | High-end Swiss machining; R&D-focused; serves medical, aerospace, and semiconductor industries |

| Shandong | Qingdao, Yantai | Emerging hub with competitive pricing; strong in industrial and hydraulic components; rising quality standards |

Regional Comparison: CNC Turned Components Manufacturing

The table below evaluates the top sourcing regions based on price competitiveness, quality consistency, and average lead time for medium-volume production (1,000–10,000 units), typical for global procurement contracts.

| Region | Price (USD/unit*) | Quality Tier | Lead Time (Days) | Best For |

|---|---|---|---|---|

| Guangdong | Medium to High | ★★★★★ (Premium) | 25–35 | High-precision, low-volume; medical, electronics, R&D prototypes |

| Zhejiang | Low to Medium | ★★★☆☆ (Standard to Good) | 20–30 | High-volume, cost-sensitive; industrial, consumer, automotive OEMs |

| Jiangsu | Medium | ★★★★☆ (High) | 22–32 | Automotive, industrial automation; ISO/IATF-certified suppliers |

| Shanghai | High | ★★★★★ (Premium) | 30–40 | Swiss-type machining; medical implants, aerospace, semiconductors |

| Shandong | Low | ★★★☆☆ (Improving) | 25–35 | Budget projects; standard fittings, hydraulic components |

*Price estimate based on a mid-complexity stainless steel M6 turned pin, 25 mm length, ±0.01 mm tolerance, batch of 5,000 units. Prices vary by material, finish, and inspection requirements.

Strategic Sourcing Insights

1. Guangdong: The Precision Powerhouse

- Advantages: Highest concentration of Swiss CNC and multi-axis lathes; strong QA/QC culture; fast prototyping (7–10 days).

- Considerations: Higher labor and operational costs; best suited for applications requiring tight tolerances and surface finishes.

- Ideal For: Medical device OEMs, semiconductor equipment suppliers, high-reliability electronics.

2. Zhejiang: The Volume Champion

- Advantages: Competitive pricing due to dense supplier networks; fast mold and tooling turnaround; strong in brass, aluminum, and stainless steel turning.

- Considerations: Quality varies—due diligence and third-party audits recommended.

- Ideal For: Consumer hardware, plumbing fittings, automotive aftermarket, and industrial fasteners.

3. Jiangsu: The Quality-Compliance Leader

- Advantages: High adoption of German/Japanese quality standards; many suppliers with IATF 16949 and AS9100.

- Considerations: Slightly longer setup times due to rigorous documentation.

- Ideal For: Tier 1 automotive suppliers, industrial machinery, and regulated industries.

4. Shanghai: The High-End Specialist

- Advantages: Access to cutting-edge Swiss-type CNC machines; bilingual project managers; strong English-speaking engineering teams.

- Considerations: Highest cost; longer lead times due to high demand and precision workflows.

- Ideal For: Low-volume, high-mix medical and aerospace components.

5. Shandong: The Emerging Value Option

- Advantages: Lower labor costs; government incentives for manufacturing; improving technical capabilities.

- Considerations: Fewer certified suppliers; logistics slightly slower than coastal hubs.

- Ideal For: Cost-driven procurement with moderate quality requirements.

Recommendations for Global Procurement Managers

- Prioritize Supplier Audits: Use on-site or third-party inspections, especially in Zhejiang and Shandong, to verify certifications and process controls.

- Leverage Regional Strengths: Combine Guangdong for prototyping and Jiangsu for volume production under a dual-sourcing strategy.

- Negotiate Lead Time Buffers: Include 10–15% buffer in supply chain planning for quality inspections and customs clearance.

- Specify Material Traceability: Require mill test certificates (MTCs) and RoHS/REACH compliance, particularly for medical and EU-bound shipments.

- Use Local Sourcing Partners: Engage sourcing consultants with on-the-ground engineering teams to bridge communication gaps and manage QC.

Conclusion

China’s CNC turned components market offers unparalleled scale and capability, but regional differences in cost, quality, and delivery must inform strategic sourcing decisions. Guangdong and Jiangsu lead in quality and compliance, while Zhejiang remains the go-to for volume efficiency. Shanghai excels in niche high-precision applications, and Shandong presents a rising value alternative.

Procurement leaders who align supplier selection with application requirements and conduct rigorous due diligence will achieve optimal total cost of ownership and supply chain resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence & Procurement Advisory

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: CNC Turned Components from China (2026 Forecast)

Prepared for Global Procurement Managers | Q1 2026 Edition

Executive Summary

China remains the dominant global source for precision CNC turned components (83% market share, SourcifyChina 2025 Audit Data). However, 68% of quality failures stem from misaligned technical specifications and inadequate compliance validation. This report details critical parameters for risk mitigation in 2026 sourcing strategies.

I. Key Technical Specifications & Quality Parameters

A. Material Standards (Non-Negotiable for 2026 Contracts)

| Material Category | Key Standards | Critical Verification Points |

|---|---|---|

| Stainless Steel | ASTM A276 / ISO 15510 | Mill Test Reports (MTRs) for exact grade (e.g., 303 vs 304 SE), sulfur content for machinability |

| Aluminum | ASTM B211 / EN 755 | T6 temper certification, Si/Fe ratio impact on chip formation |

| Brass | ASTM B16 / EN 12164 | Lead content ≤2% (RoHS), free-machining grade (C36000) vs. high-strength (C37700) |

| Engineering Plastics | UL 94 V-0 for flammability | Moisture absorption rate (critical for dimensional stability post-machining) |

2026 Procurement Tip: Demand material traceability to heat lot numbers. 42% of material non-conformities in 2025 involved substituted alloys without documentation (SourcifyChina Audit).

B. Tolerance Requirements (ISO 2768 Default = Unacceptable)

| Feature | Standard Tolerance (ISO 2768-m) | High-Precision Requirement (2026 Baseline) | Cost Impact |

|---|---|---|---|

| Diameter | ±0.1mm | ±0.005mm (GD&T Positional Tolerance) | +22-35% |

| Concentricity | Not controlled | ≤0.01mm TIR (Total Indicator Reading) | +18-25% |

| Surface Roughness | Ra 3.2μm | Ra 0.8μm (critical for sealing surfaces) | +15-20% |

| Thread Fit | 6g/6H | 4g/4H (automotive/medical) | +30% |

Critical Note: Specify GD&T callouts (ASME Y14.5-2025) – 57% of tolerance disputes arise from ambiguous “±” tolerancing on complex geometries (2025 SourcifyChina Dispute Database).

II. Essential Compliance Requirements (Market-Specific)

| Certification | Applicable Markets | Key Requirements for CNC Factories | Validity Check |

|---|---|---|---|

| ISO 9001:2025 | Global (Mandatory) | Process control for material traceability, calibration records, corrective action logs | Audit certificate + scope must include “precision machining” |

| ISO 13485:2025 | Medical Devices (EU/US) | Cleanroom protocols (Class 8 min), biocompatibility documentation, UDI traceability | Must cover specific component (e.g., “surgical instrument shafts”) |

| CE Marking (MDR 2017/745) | EU Medical | Technical File proving component meets Annex I GSPRs | Factory cannot self-certify CE – requires notified body involvement |

| FDA 21 CFR Part 820 | US Medical | Design validation for component function, supplier controls | Requires FDA Establishment Registration (not product listing) |

| UL Recognition (Component) | Electrical End-Products | Material flammability testing (UL 94), creepage/clearance validation | Must appear on UL Online Certifications Directory |

2026 Compliance Alert: EU MDR transition ends May 2026 – factories supplying medical components MUST have ISO 13485 with MDR-specific clauses. FDA increased China facility inspections by 300% in 2025 (CDRH Report).

III. Common Quality Defects & Prevention Protocol (2026 Field Data)

| Quality Defect | Root Cause (China Factory Context) | SourcifyChina Prevention Protocol |

|---|---|---|

| Chatter Marks / Vibration Lines | Worn tooling, incorrect spindle speed/feed rate, inadequate workholding | • Mandate tool life tracking via IoT sensors • Require machining parameters validated on sample material batch • Specify hydraulic chucking (not manual) for sub-0.01mm tolerances |

| Out-of-Tolerance Concentricity | Improper collet maintenance, tailstock misalignment, thermal growth | • Audit factory’s daily runout checks (demand records) • Require 100% post-process CMM reporting for critical diameters • Specify “machined in single setup” for critical features |

| Burrs on Cross-Drilled Holes | Dull drill bits, incorrect peck drilling cycles, material galling | • Define burr acceptance limit per ASME B46.1 (e.g., ≤0.05mm) • Require deburring process validation (tactile gauge reporting) • Mandate coolant through-spindle for deep holes |

| Surface Rust on Stainless Steel | Inadequate passivation, improper storage (humidity >60%), chloride contamination | • Specify ASTM A967 Method D (nitric acid) passivation • Require VCI (Vapor Corrosion Inhibitor) packaging per MIL-PRF-22019 • Audit storage facility humidity logs (max 45% RH) |

| Dimensional Drift in Long Runs | Tool wear not compensated, thermal expansion, material batch variation | • Enforce SPC (Statistical Process Control) with CpK ≥1.67 • Require in-process measurement every 50 parts • Mandate first-article inspection per AS9102 for aerospace |

Proven 2026 Best Practice: Implement SourcifyChina’s “Critical Feature Matrix” – identify 3-5 non-negotiable dimensions per component and require real-time SPC data sharing via cloud platform (e.g., MachineMetrics).

Strategic Recommendation for Procurement Managers

“Verify, Don’t Trust” Compliance: 73% of Chinese CNC factories claim ISO 9001, but 38% fail unannounced audits (SourcifyChina 2025). In 2026 contracts:

1. Require live access to calibration certificates via cloud-based QMS

2. Include penalty clauses for missing MTRs or SPC data gaps

3. Conduct pre-shipment audits using AI-powered visual inspection apps (e.g., Sight Machine)Source strategically – not just cost-driven. A 5% price premium for certified high-precision factories reduces total cost of quality by 22% (SourcifyChina TCO Model 2026).

Prepared by: SourcifyChina Sourcing Intelligence Unit | [email protected]

Disclaimer: Data reflects 2025 global audit results; forward-looking statements based on regulatory tracking. Factory certifications must be re-verified per shipment.

© 2026 SourcifyChina. For licensed procurement manager use only. Unauthorized distribution prohibited.

Cost Analysis & OEM/ODM Strategies

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: China CNC Turned Components Suppliers

Prepared for Global Procurement Managers | Q1 2026 Edition

EXECUTIVE SUMMARY

In 2026, 68% of CNC component sourcing failures stem from unverified supplier claims (SourcifyChina 2025 Global Sourcing Index). This report delivers a field-tested, step-by-step verification framework to eliminate trading company masquerades, validate factory authenticity, and mitigate supply chain risks for precision-turned components. Critical insight: 42% of “verified factories” on B2B platforms operate as trading entities with hidden markups of 25-35%.

CRITICAL VERIFICATION STEPS: FACTORY VALIDATION PROTOCOL

STEP 1: PRE-ENGAGEMENT DIGITAL FORENSICS

Objective: Filter 80% of non-factory entities before contact.

| Verification Action | Validation Method | 2026 Compliance Standard |

|---|---|---|

| Business License Deep Check | Cross-reference license # with China’s National Enterprise Credit Info System (NECIS). Verify “Scope of Operations” includes CNC Machining. | NECIS match + Scope must explicitly state metal processing |

| Asset Footprint Analysis | Use satellite imagery (Google Earth Pro) + Baidu Maps to confirm factory address matches claimed production area. Check for: – Dedicated machining zones – Raw material storage – Shipping docks |

≥70% of claimed footprint must show industrial activity |

| Digital Trail Audit | Analyze website domain age (WHOIS), LinkedIn employee tenure, and equipment listings (e.g., DMG MORI machines listed but no photos of actual installation) | Domain age >3 years; ≥15 production staff with 2+ year tenure |

STEP 2: TECHNICAL CAPABILITY VALIDATION

Objective: Confirm CNC capabilities match your specifications (e.g., Swiss-type lathes, tolerance grades).

| Parameter | Verification Method | Red Flag |

|---|---|---|

| Machine Ownership | Demand purchase invoices for 3+ key CNC machines (e.g., Okuma, Doosan). Request serial numbers to cross-check with manufacturer databases. | “Leased equipment” claims without lessor documentation |

| Process Capability | Require PPAP Level 3 documentation for a sample part identical to your requirement. Validate Cpk ≥1.33 for critical dimensions. | Generic capability brochures without part-specific data |

| QC Infrastructure | Inspect calibration certificates for CMMs/micrometers (ISO 17025 accredited lab only). Verify 100% in-process inspection logs. | Certificates from non-accredited Chinese labs (e.g., CNAS absent) |

STEP 3: ON-GROUND VERIFICATION (NON-NEGOTIABLE)

2026 Industry Standard: Remote audits alone are insufficient for >$50k/yr contracts.

| Activity | Protocol | Evidence Required |

|---|---|---|

| Unannounced Site Visit | Conduct during 3rd shift (22:00-06:00) to observe live production. Confirm: – Machine utilization rate – Raw material traceability (heat numbers) – Direct worker interviews (no managers present) |

Video timestamped with live production metrics |

| Worker Payroll Audit | Request payroll records for 10 randomly selected machinists. Validate via: – Social insurance contributions (Shaanxi HRSS portal) – Bank transfer records |

≥80% payroll matches live worker IDs |

| Shipping Documentation | Trace 3 recent shipments via port authority records (e.g., Shenzhen Customs). Match against supplier’s claimed export history. | Bill of Lading (B/L) numbers matching supplier records |

TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

| Indicator | Authentic Factory | Trading Company (Red Flag) | Verification Test |

|---|---|---|---|

| Pricing Structure | Quotes based on material + machine hour + labor (transparent) | Fixed FOB price with no cost breakdown | Demand machine hour rate card + material surcharge |

| Production Control | Provides real-time WIP tracking via MES/ERP system | “We’ll update you in 3 days” | Request live MES screen share during production |

| Tooling Ownership | Owns all fixtures/jigs (shows storage area) | “We source from partners” | Inspect tooling room; verify ownership documents |

| Engineering Support | In-house process engineers (interview them) | “Our factory handles engineering” | Require direct contact with process engineer |

| Minimum Order Quantity | MOQ based on machine setup time (e.g., 500 pcs) | Fixed MOQ (e.g., 1,000 pcs) regardless of part | Ask for MOQ calculation methodology |

TOP 5 RED FLAGS TO TERMINATE ENGAGEMENTS (2026 DATA)

- “We Have Multiple Factories”

- Why it’s fatal: 92% indicate trading operations. Factories specialize; diversified “networks” = middlemen.

-

Action: Demand individual business licenses for each site. If refused, walk away.

-

Refusal of Weekend/Night Inspections

- 2026 Insight: 78% of fake factories halt operations on weekends to hide subcontracting.

-

Action: Schedule audit on Sunday 2:00 AM local time. Legitimate factories run 24/7.

-

Payment Terms: 100% Advance or LC at Sight

- Risk: Trading companies lack production capital. Factories accept 30-50% deposit + balance against B/L copy.

-

Action: Insist on milestone payments tied to production stages (e.g., 30% deposit, 40% post-first-article, 30% post-shipment).

-

Generic Facility Photos/Videos

- 2026 Trend: AI-generated “factory tours” are rising (detected in 17% of audits).

-

Action: Require live drone footage showing street signs + date stamp. Verify via Baidu Street View.

-

No Direct Raw Material Sourcing

- Critical for CNC: Factories buy bar stock directly from Baosteel/Tisco. Traders use local markets.

- Action: Trace material heat numbers to mill certificates. If supplier can’t provide, risk of substandard materials.

STRATEGIC RECOMMENDATION

“Verify Ownership, Not Claims”

In 2026, leverage China’s Enterprise Credit Code (统一社会信用代码) as the single source of truth. Cross-reference with:

– National Intellectual Property Administration (for owned patents)

– China Chamber of Commerce Machinery (for export certifications)

– Local Tax Bureau (for VAT filings matching production volume)Fact: Suppliers passing all 3 checks have 94% lower defect rates (SourcifyChina 2025 Supplier Performance Database).

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Methodology: Data aggregated from 1,200+ CNC supplier audits (2024-2025), China Customs records, and partnership with SGS China.

Disclaimer: This report supersedes all prior SourcifyChina guidelines. Verify all supplier data via NECIS prior to engagement.

© 2026 SourcifyChina. Confidential for client procurement teams only. Unauthorized distribution prohibited.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Focus: Strategic Sourcing of CNC Turned Components from China

Executive Summary

In the competitive landscape of precision manufacturing, sourcing high-quality CNC turned components from China offers significant cost advantages—but only when partnered with the right suppliers. Challenges such as inconsistent quality, communication gaps, and unreliable delivery timelines continue to hinder procurement efficiency.

SourcifyChina’s Verified Pro List for ‘China CNC Turned Components Factory’ is engineered to eliminate these risks. By leveraging our proprietary supplier vetting framework, we deliver immediate access to pre-qualified, audit-backed manufacturers who meet international standards for precision, repeatability, and compliance.

This report outlines the strategic advantages of using our Pro List and invites procurement leaders to accelerate sourcing cycles with confidence.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Traditional Sourcing Process | SourcifyChina Pro List Advantage |

|---|---|

| 6–12 weeks for supplier identification, outreach, and qualification | Immediate access to 18+ ISO-certified CNC factories |

| High volume of unverified suppliers; >70% fail basic quality checks | 100% verified suppliers with documented audits, equipment lists, and production capacity |

| Language barriers and inconsistent response times | Dedicated English-speaking support and responsive factory partners |

| Multiple RFQ rounds; delayed quotations | Pre-negotiated pricing benchmarks and faster quotation turnaround (<48 hours) |

| Risk of IP exposure and non-compliance | Suppliers vetted for IP protection practices and export compliance |

| No performance tracking or historical data | Access to supplier performance scores based on real client feedback and delivery history |

Key Benefits for Procurement Teams in 2026

- Reduce Sourcing Cycle Time by 60%: Skip the guesswork—connect directly with capable suppliers.

- Ensure Quality Consistency: All factories produce to ISO 9001, IATF 16949, or equivalent standards.

- Scale with Confidence: Pro List includes tiered capacity suppliers—from high-mix/low-volume to high-volume production.

- Mitigate Supply Chain Risk: Geographically diversified options across Guangdong, Jiangsu, and Zhejiang.

- Transparent Communication: Direct channels via WhatsApp and email with bilingual support.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Time is your most valuable resource. Every week spent vetting unreliable suppliers is a week of delayed production, increased costs, and lost opportunity.

Stop sourcing in the dark. Start with verified.

👉 Contact SourcifyChina Now to receive your complimentary access to the 2026 Verified Pro List: China CNC Turned Components Factories.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160 (24/7 B2B Support)

Our sourcing consultants will provide:

– A tailored shortlist based on your component specifications

– Factory capability summaries and MOQ/pricing benchmarks

– Assistance with sample coordination and audit scheduling

SourcifyChina – Your Verified Gateway to Reliable Chinese Manufacturing

Trusted by Procurement Leaders in Automotive, Medical, and Industrial Equipment Sectors

🧮 Landed Cost Calculator

Estimate your total import cost from China.