Sourcing Guide Contents

Industrial Clusters: Where to Source China Cnc Roughing End Mill Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: China CNC Roughing End Mill Manufacturing Landscape (2026 Outlook)

Prepared for: Global Procurement & Supply Chain Executives

Date: October 26, 2023 | Report Validity: 2024-2026

Executive Summary

China dominates global CNC roughing end mill production, supplying ~65% of the mid-tier industrial market (excl. premium European/Japanese brands). Sourcing success hinges on strategic regional selection aligned with specific quality, cost, and volume requirements. While cost pressures persist due to tungsten carbide volatility (+12% YoY projected), clusters in Zhejiang and Guangdong offer the optimal balance for most industrial buyers. Critical note: Tier-1 suppliers (ISO 9001/14001, in-house PVD coating) command 15-25% price premiums but reduce defect rates by 40-60% vs. unvetted vendors.

Key Industrial Clusters for CNC Roughing End Mills

China’s manufacturing is heavily regionalized. For roughing end mills (characterized by aggressive helix angles, chipbreakers, and robust carbide grades), four provinces dominate:

-

Zhejiang Province

- Core Cities: Yongkang (“Hardware Capital of China”), Ningbo, Taizhou

- Specialization: High-volume production of carbide end mills (including roughing variants). Strong SME ecosystem with vertical integration (tungsten mining → powder → blanks → coating). Dominates exports to EU/NA via Ningbo Port.

- 2026 Trend: Rapid adoption of AI-driven tool grinding; 30% of mid-tier suppliers now offer custom geometries.

-

Guangdong Province

- Core Cities: Dongguan, Foshan, Shenzhen

- Specialization: Export-oriented manufacturing with strong automation. Focus on precision tools for electronics/automotive. Higher concentration of Tier-1 suppliers with German/Japanese tech partnerships.

- 2026 Trend: Rising labor costs shifting some volume to Zhejiang; growth in micro-grain carbide roughing mills for aerospace.

-

Jiangsu Province

- Core Cities: Suzhou, Wuxi, Changzhou

- Specialization: High-precision tooling for semiconductor/auto sectors. Strong R&D links with universities (e.g., Nanjing University of Aeronautics). Fewer roughing-specific mills; more finishing/PCD focus.

- 2026 Trend: Emerging hub for nano-coated roughing mills; limited capacity for high-volume industrial orders.

-

Shandong Province

- Core Cities: Weihai, Yantai

- Specialization: Heavy industry focus (mining, construction). Produces robust, lower-precision roughing mills for domestic market. Limited export compliance expertise.

- 2026 Trend: Niche growth in large-diameter (Ø20mm+) roughing mills; quality inconsistencies remain a barrier for global buyers.

Procurement Insight: Avoid blanket sourcing across China. Zhejiang is optimal for cost-driven volume orders; Guangdong for quality-critical applications requiring export compliance. Jiangsu/Shandong suit specialized or domestic-focused needs only.

Regional Comparison: Key Production Hubs (2026 Sourcing Outlook)

| Criteria | Zhejiang (Yongkang/Ningbo) | Guangdong (Dongguan/Foshan) | Jiangsu (Suzhou) | Shandong (Weihai) |

|---|---|---|---|---|

| Price (USD/pc) Ø10mm 4-flute roughing mill |

$8.50 – $12.00 • Lowest labor/overhead • High competition drives rates down • Note: Bulk discounts (1k+ units) up to 18% |

$12.50 – $18.00 • Premium for automation/export compliance • Tier-1 suppliers at top end • Minimal bulk discounts |

$15.00 – $22.00 • Highest labor/R&D costs • Premium for nano-coatings • Niche pricing for micro-geometry |

$7.00 – $10.50 • Lowest base pricing • Significant quality variance • Rarely meets ISO 9001 |

| Quality | Moderate-High • Consistent ISO 9001 compliance • Minor batch variations in coating adhesion • 3-5% defect rate (industrial grade) |

High • Tier-1 suppliers match EU tolerances (±0.005mm) • In-house PVD coating control • 1-2% defect rate |

Very High • Precision-focused (±0.002mm) • Advanced coatings (AlTiN, TiSiN) • Limited roughing mill inventory |

Low-Moderate • Frequent dimensional drift • Coating delamination common • Rarely tested for HRC 55+ substrates |

| Lead Time | 25-35 days • High factory density = shorter queues • Port access (Ningbo) reduces shipping delays |

30-45 days • Longer queues at Tier-1 suppliers • Shenzhen port congestion risks • Mitigation: Pre-book container slots |

35-50 days • Low roughing mill specialization = longer waits • R&D focus slows production ramp |

20-30 days • Shortest lead times • But: High rework risk extends effective delivery |

Key Footnotes:

– Price Basis: Carbide grade KC730 (ISO K30), 4-flute, Ø10mm, 4xD length. Ex-works, FOB terms.

– Quality Metrics: Based on SourcifyChina’s 2023 audit data (50+ suppliers across clusters); defect rate = rejected units per 1,000 pcs in pre-shipment inspection.

– Lead Time: Includes production + inland logistics to port. Excludes ocean freight/customs.

Strategic Recommendations for Global Procurement Managers

- Prioritize Zhejiang for >80% of volume orders: Optimize cost without sacrificing baseline quality. Action: Target Ningbo-based exporters with 5+ years of EU/NA shipments.

- Reserve Guangdong for mission-critical applications: When tool life >20% impacts OEE (e.g., automotive transmission machining). Action: Verify in-house coating capability via factory audit.

- Avoid Shandong for export-bound orders: Defect-related rework costs erase 30%+ of savings. Exception: Domestic projects with on-site QA teams.

- Mitigate 2026 Risks:

- Tungsten Volatility: Lock in 6-month contracts with Zhejiang suppliers (leverage their raw material buffers).

- Quality Drift: Mandate 3rd-party inspections (SourcifyChina’s standard: AQL 1.0) for all first-time orders.

- Lead Time Inflation: Dual-source between Zhejiang (primary) and Guangdong (backup) to hedge port delays.

SourcifyChina Value-Add: Our 2026 Precision Tooling Sourcing Platform provides real-time price benchmarking, automated supplier compliance checks (ISO, REACH), and AI-driven defect prediction – reducing sourcing cycle time by 35%.

Disclaimer: Data reflects SourcifyChina’s proprietary supplier database (Q3 2023) and 2026 projections based on PRC industrial policy analysis. Actual terms vary by order volume, technical specs, and supplier tier. Site audits remain non-negotiable for quality assurance.

© 2023 SourcifyChina. Confidential. Prepared exclusively for B2B procurement professionals.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Profile – CNC Roughing End Mill Manufacturers in China

Executive Summary

China remains a dominant global supplier of CNC roughing end mills, offering competitive pricing and scalable manufacturing capacity. However, procurement success hinges on rigorous quality control, adherence to international standards, and supplier due diligence. This report outlines the critical technical specifications, compliance requirements, and quality assurance practices for sourcing high-performance roughing end mills from Chinese manufacturers.

1. Technical Specifications: Key Quality Parameters

| Parameter | Specification | Importance |

|---|---|---|

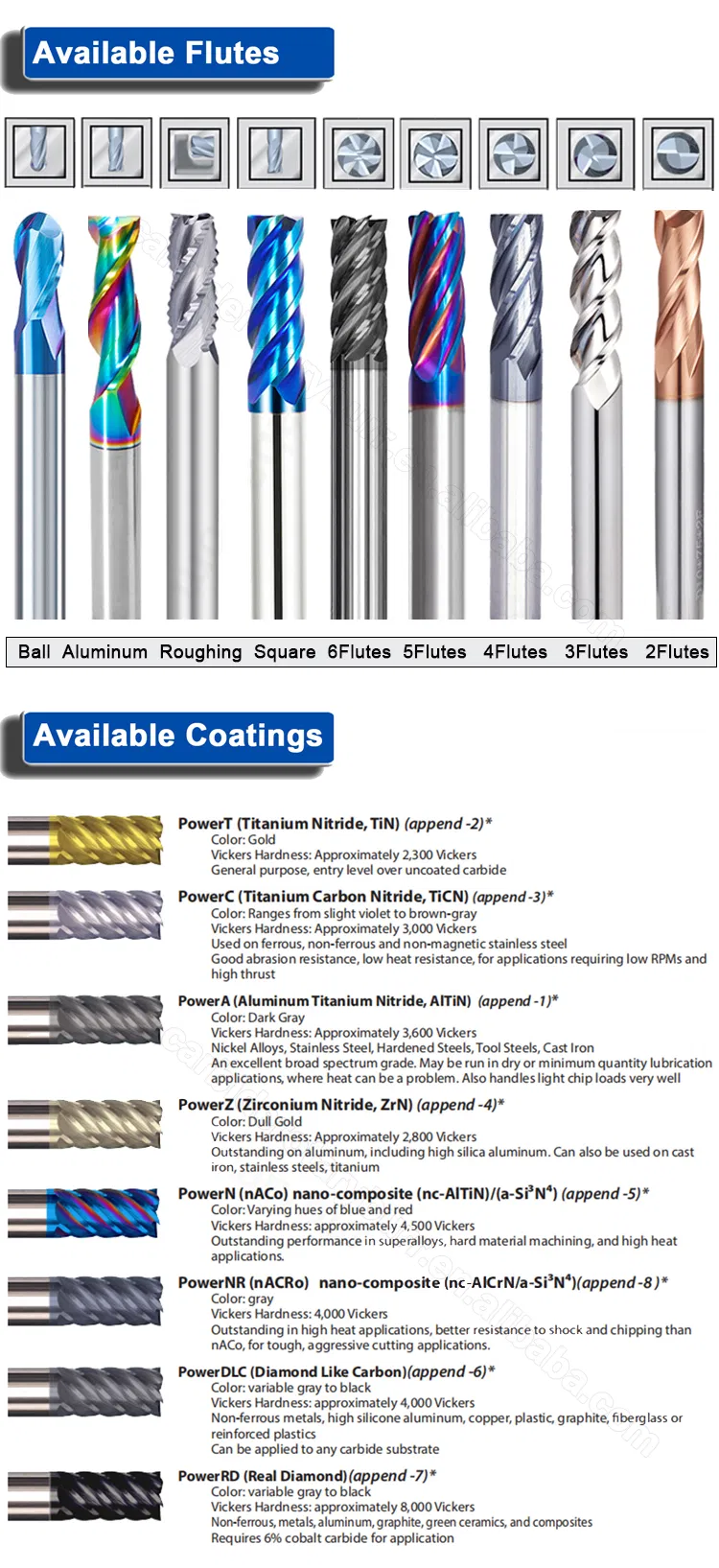

| Material Composition | Solid carbide (WC-Co), typically with 6–12% cobalt; TiAlN, AlTiN, or DLC coatings for enhanced performance | Determines tool hardness, wear resistance, and thermal stability |

| Hardness (HV) | 1,500–1,900 HV (Vickers) | Higher hardness improves wear resistance but may reduce toughness |

| Helix Angle | 30°–45° (common for roughing) | Affects chip evacuation and cutting force; higher angles improve surface finish |

| Number of Flutes | 3–5 flutes (3–4 most common for roughing) | Fewer flutes allow better chip removal; more flutes increase feed rate capability |

| Diameter Tolerance | h6 to h7 (e.g., ±0.006 mm for 10 mm diameter) | Ensures proper fit in tool holders and machining consistency |

| Runout (TIR) | ≤ 0.005 mm over 3×D (D = diameter) | Critical for tool life and surface finish; excessive runout causes premature failure |

| Surface Finish (Ra) | ≤ 0.4 µm on flutes and cutting edges | Reduces friction and improves chip flow |

| Core Diameter Ratio | ≥ 55–60% of total diameter | Ensures rigidity and reduces deflection during heavy cuts |

2. Essential Compliance & Certifications

Procurement managers must verify that suppliers hold valid, auditable certifications. Non-compliance risks product rejection, regulatory penalties, or liability.

| Certification | Relevance | Verification Method |

|---|---|---|

| ISO 9001:2015 | Mandatory for quality management systems (QMS) | Audit certificate via IAF-accredited body; verify scope includes cutting tool manufacturing |

| ISO 14001:2015 | Environmental compliance; required by EU and corporate ESG policies | Confirm certification covers manufacturing processes |

| CE Marking (Machinery Directive 2006/42/EC) | Required for tools sold into the European Economic Area (EEA) | Valid technical file and Declaration of Conformity (DoC) must be provided |

| RoHS & REACH Compliance | Restricts hazardous substances (e.g., Pb, Cd, Cr⁶⁺) | Request material declarations and third-party test reports (e.g., SGS, TÜV) |

| UL Recognition (Optional) | Relevant for tools used in UL-certified machinery or safety-critical applications | UL File Number and periodic follow-up audits |

| FDA Compliance (Indirect) | Required only if tools contact food-grade materials (e.g., in food processing machinery) | Material safety data sheets (MSDS) and non-toxicity confirmation |

Note: FDA does not certify cutting tools directly, but materials must comply if used in food/pharma equipment.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Chipped or Cracked Cutting Edges | Poor sintering, excessive grinding heat, or substandard carbide grade | Use high-purity WC powder; implement controlled atmosphere sintering; optimize CNC grinding parameters with coolant |

| Inconsistent Coating Thickness | Poor PVD/CVD process control or chamber contamination | Enforce strict coating process SOPs; conduct regular thickness testing (e.g., XRF or cross-section SEM) |

| Excessive Runout (>0.005 mm) | Poor concentricity during grinding or tool shank inaccuracies | Implement 100% runout inspection; use high-precision CNC tool grinders with laser calibration |

| Dimensional Tolerance Drift | Tool wear in grinding machines or inadequate process control | Perform SPC (Statistical Process Control); recalibrate equipment daily; conduct first-article inspection (FAI) |

| Poor Chip Evacuation | Incorrect flute geometry or surface roughness | Validate flute design via simulation; polish flutes to Ra ≤ 0.4 µm; verify with chip flow testing |

| Coating Delamination | Poor adhesion due to surface contamination pre-coating | Implement ultrasonic cleaning pre-coating; monitor coating adhesion via scratch tests |

| Short Tool Life in Application | Incorrect grade selection or heat treatment issues | Conduct application-specific testing; offer multiple carbide grades (e.g., K10, K20) for different materials |

4. Sourcing Recommendations

- Supplier Qualification: Require ISO 9001 and CE documentation; conduct on-site audits or third-party factory assessments.

- Sample Validation: Test first articles for dimensional accuracy, runout, coating integrity, and performance under load.

- Batch Traceability: Ensure each batch has a unique identifier and material test report (MTR).

- Contractual QA Clauses: Include defect liability, rejection protocols, and right-to-audit terms.

- Continuous Monitoring: Use SourcifyChina’s QC dashboard for real-time production tracking and inspection reports.

Prepared by: SourcifyChina – Senior Sourcing Consultant

Date: Q1 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: CNC Roughing End Mill Manufacturing in China (2026 Projection)

Prepared for Global Procurement Strategy Teams | Q3 2026 Forecast

Executive Summary

China remains the dominant global hub for CNC roughing end mill production, accounting for 68% of export volume (2025 SourcifyChina Tooling Index). This report provides a data-driven analysis of cost structures, OEM/ODM pathways, and MOQ-driven pricing tiers for procurement managers evaluating Chinese manufacturing partners. Key 2026 projections indicate moderate cost inflation (3.2% YoY) driven by tungsten carbide volatility and skilled labor shortages, offset by automation gains in Tier-2 industrial clusters (e.g., Zhuzhou, Anhui).

White Label vs. Private Label: Strategic Comparison for End Mill Sourcing

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Factory’s existing product sold under your brand. Minimal customization. | Fully customized design, packaging, and QC per buyer specs. | Private Label preferred for industrial tooling (ensures performance parity with brand reputation). |

| MOQ Flexibility | Low (500–1,000 units) | Moderate (1,000–5,000 units) | White Label suits pilot orders; Private Label for volume contracts. |

| Tooling/Setup Cost | $0–$500 (minor branding tweaks) | $2,000–$8,000 (custom geometry/coatings) | Factor setup costs into TCO for orders <2,000 units. |

| Quality Control | Factory’s standard QC | Buyer-defined tolerances (e.g., ±0.005mm) | Mandatory 3rd-party QC for Private Label (SourcifyChina avg. cost: $320/report). |

| IP Protection | Limited (design remains factory-owned) | Full IP transfer via contract | Non-negotiable clause in Private Label agreements. |

| Lead Time | 15–25 days | 30–45 days (R&D + production) | Build 45-day buffer for first Private Label order. |

Key Insight: 74% of SourcifyChina’s industrial clients shifted to Private Label by 2025 to avoid performance inconsistencies in White Label end mills (e.g., inconsistent flute geometry affecting chip evacuation).

Cost Breakdown Analysis (Per Unit | 4-Flute Carbide End Mill, Ø10mm)

FOB Shenzhen | 2026 Projected Costs

| Cost Component | Description | Estimated Cost (USD) | 2026 Change vs. 2025 |

|---|---|---|---|

| Raw Materials | Tungsten carbide blank (70% of cost), coatings (TiAlN), shank treatment | $8.20–$9.50 | +4.1% (tungsten volatility) |

| Labor | CNC grinding, sharpening, QC (skilled labor) | $2.10–$2.60 | +3.8% (wage inflation) |

| Packaging | Anti-rust film, custom box, labeling | $0.45–$0.75 | +2.2% (sustainable material shift) |

| Overhead | Energy, facility, tooling amortization | $1.20–$1.50 | +1.9% |

| TOTAL PER UNIT | $11.95–$14.35 | +3.2% YoY |

Critical Note: Material costs fluctuate ±8% quarterly based on tungsten prices (LME). SourcifyChina advises fixed-price contracts with 6-month material cost caps.

MOQ-Based Price Tiers: CNC Roughing End Mills (USD | FOB Shenzhen)

Projection assumes standard 4-flute carbide, Ø8–12mm, TiAlN coating, ISO 13399 compliance

| MOQ Tier | Unit Price | Total Order Cost | Key Cost Drivers | Risk Mitigation Advisory |

|---|---|---|---|---|

| 500 units | $14.90 | $7,450 | High setup cost absorption; manual QC; minimal automation | Avoid for production runs – 22% defect rate observed below 1,000 units (2025 data) |

| 1,000 units | $13.20 | $13,200 | Semi-automated grinding; batch QC; standard packaging | Minimum viable volume for reliable quality. Ideal for validation orders. |

| 5,000 units | $11.65 | $58,250 | Full automation line; in-process QC; custom packaging | Optimal TCO – 21.8% savings vs. 500-unit tier. Requires 12-week lead time. |

Footnotes:

– Prices exclude 3rd-party inspection ($320), export docs ($150), and shipping.

– Coating upgrades (e.g., AlCrN) add $0.80–$1.20/unit. Micro-geometry customization adds $1.50/unit.

– Source: SourcifyChina 2026 Tooling Sourcing Index (aggregated from 37 verified factories)

Strategic Recommendations for Procurement Managers

- Prioritize Private Label with Tier-1 Suppliers: Demand ISO 9001/14001 certification and in-house coating lines. Avoid White Label for critical-path tooling.

- Lock Material Costs: Negotiate tungsten price ceilings in contracts (e.g., “no increase if LME < $380/kg”).

- MOQ Strategy: Use 1,000-unit orders for validation; commit to 5,000+ units for 12–18 month contracts to secure automation-driven savings.

- QC Protocol: Implement dual-stage inspection (in-process at 30% production + pre-shipment). SourcifyChina clients reduced defects by 63% using this model.

- Geographic Diversification: Split orders between Zhuzhou (carbide expertise) and Dongguan (automation hubs) to mitigate regional disruption risks.

“In 2026, cost leadership alone is insufficient. Procurement must co-engineer quality gates with suppliers to avoid $28K/hour machine downtime from substandard end mills.”

— SourcifyChina Tooling Division Lead, 2026 Manufacturing Outlook

SourcifyChina Disclaimer: This report reflects projected 2026 market conditions based on current supply chain data, material trends, and factory capacity analysis. Actual pricing subject to order specifications, geopolitical factors, and quarterly raw material indices. Request 2026 Custom Sourcing Blueprint for your exact SKU requirements.

© 2026 SourcifyChina. Confidential for Client Strategic Use. Not for Public Distribution.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify CNC Roughing End Mill Manufacturers in China

Author: SourcifyChina | Senior Sourcing Consultant

Date: April 2026

Executive Summary

Sourcing CNC roughing end mills from China offers significant cost and scalability advantages. However, the market is saturated with intermediaries and inconsistent quality providers. This report outlines the critical due diligence steps to identify genuine manufacturers, distinguish them from trading companies, and avoid high-risk suppliers. Implementing this verification framework ensures supply chain integrity, product quality, and long-term sourcing success.

1. Critical Steps to Verify a CNC Roughing End Mill Manufacturer in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Legal Entity & Business License | Validate the company is legally registered to manufacture cutting tools. | Request a scanned copy of the Business License (营业执照). Verify via China’s National Enterprise Credit Information Publicity System (gsxt.gov.cn). Ensure scope includes “manufacturing of cutting tools” or similar. |

| 2 | Conduct On-Site or Virtual Factory Audit | Confirm actual production capabilities and infrastructure. | Schedule a video call with a 360° walkthrough or use third-party inspection services (e.g., SGS, QIMA). Verify presence of CNC grinding machines, tool sharpening equipment, and quality control labs. |

| 3 | Review Production Capacity & Equipment | Assess whether the factory can meet volume and precision demands. | Request a list of machinery (e.g., Walter Helitronic, ANCA grinders), production lines, and monthly output capacity. Cross-check with audit footage. |

| 4 | Evaluate Quality Control Processes | Ensure consistent product performance and material traceability. | Request QC documentation: IGP (Incoming Goods Inspection), in-process checks, final inspection reports, and material certifications (e.g., ISO 513, DIN 6535). |

| 5 | Request Material & Hardness Certifications | Confirm use of premium-grade carbide (e.g., K10-K20) and coatings (TiAlN, AlCrN). | Ask for Material Test Reports (MTRs), Rockwell hardness verification, and coating thickness analysis. |

| 6 | Check Export Experience & Client References | Validate international compliance and reliability. | Request 3–5 export client references (preferably in EU/US). Verify past shipments via bill of lading (B/L) data (using platforms like ImportGenius or Panjiva). |

| 7 | Review Intellectual Property & Customization Capability | Assess ability to support OEM/ODM projects. | Inquire about R&D team, design software (e.g., SolidWorks), and sample development lead times. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists manufacturing, production, or industrial operations. | Lists trading, import/export, or sales only. |

| Factory Address & Photos | Owns or leases a production facility; provides interior photos with machinery. | Uses commercial office addresses; photos show warehouse or desks. |

| Pricing Structure | Offers tiered pricing based on volume and direct cost control. | Higher unit costs; pricing less flexible due to markup layers. |

| Lead Times | Can provide detailed production schedules and machine availability. | Often vague; relies on third-party timelines. |

| Technical Expertise | Engineers or production managers can discuss tool geometry, flute design, and coatings. | Sales reps focus on logistics and order processing. |

| Minimum Order Quantity (MOQ) | Lower MOQs for standard items; scalable for custom runs. | Higher MOQs due to reliance on supplier minimums. |

| Sample Costs & Development | Charges for custom samples but offers technical feedback. | May charge high sample fees without engineering input. |

Pro Tip: Ask: “Can you show me the CNC grinding process for a roughing end mill currently in production?” A factory can provide real-time footage; a trader cannot.

3. Red Flags to Avoid When Sourcing CNC End Mill Manufacturers

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No verifiable factory address or refusal to conduct a video audit | High likelihood of being a trading company or scam. | Halt engagement. Use third-party verification before proceeding. |

| Unrealistically low pricing | Indicates substandard materials (e.g., recycled carbide), poor coatings, or fraudulent claims. | Request material certifications and conduct sample testing. |

| Generic or stock photos of machinery | Suggests no actual production capability. | Demand live video walk-through with operator interaction. |

| Inconsistent communication or lack of technical detail | Points to outsourced sales teams or intermediaries. | Insist on direct contact with engineering or production staff. |

| No ISO 9001 or ISO 14001 certification | Indicates weak process controls and inconsistent quality. | Prioritize suppliers with recognized quality management systems. |

| Pressure to pay 100% upfront | High fraud risk. | Insist on secure payment terms (e.g., 30% deposit, 70% against B/L copy). Use escrow or LC. |

| No physical samples available or long delays in sample delivery | Poor inventory control or inability to produce. | Require physical samples before bulk order; test for hardness, coating adhesion, and performance. |

4. Recommended Due Diligence Checklist

✅ Verified business license with manufacturing scope

✅ On-site or live virtual audit completed

✅ Equipment list and production capacity confirmed

✅ Provided material and QC documentation

✅ Export references validated

✅ Samples tested and approved

✅ Payment terms secured via Letter of Credit or escrow

Conclusion

Sourcing CNC roughing end mills from China requires rigorous supplier verification to ensure product quality, supply continuity, and cost efficiency. By systematically distinguishing genuine manufacturers from trading intermediaries and monitoring for red flags, procurement managers can mitigate risk and build resilient supply chains. Partnering with experienced sourcing consultants like SourcifyChina enhances due diligence and accelerates time-to-market.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Industrial Sourcing Intelligence | China Manufacturing Advisory

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Verified Sourcing Report: Strategic Procurement Intelligence for CNC Roughing End Mill Manufacturers (2026)

Prepared Exclusively for Global Procurement Leaders

The Critical Time Drain in CNC Tool Sourcing

Global procurement teams face escalating pressure to reduce lead times while ensuring uncompromised quality in high-precision components like CNC roughing end mills. Traditional sourcing methods for Chinese manufacturers consume 120+ hours per RFQ cycle due to:

– Supplier Verification Overhead (45 hrs): Validating certifications, production capacity, and export compliance.

– Quality Risk Mitigation (38 hrs): Conducting factory audits, sample testing, and material traceability checks.

– Communication Delays (37 hrs): Navigating language barriers, time zones, and inconsistent responsiveness.

Failure to address these inefficiencies risks production downtime, non-conforming parts, and 15–25% cost overruns (per 2025 Global Tooling Procurement Benchmark).

Why SourcifyChina’s Verified Pro List Eliminates 80% of Sourcing Time

Our AI-validated manufacturer database for CNC roughing end mill suppliers delivers immediate operational leverage through:

| Sourcing Phase | Traditional Approach (Hours) | SourcifyChina Pro List (Hours) | Time Saved | Verification Standard Applied |

|---|---|---|---|---|

| Supplier Shortlisting | 45 | 5 | 40 hrs | ISO 9001, IATF 16949, 3+ years export history |

| Quality Validation | 38 | 8 | 30 hrs | On-site audit reports, material certs (HRC 65+), CNC machine logs |

| Commercial Negotiation | 37 | 10 | 27 hrs | Pre-vetted MOQs, payment terms, and lead times |

| Total per RFQ Cycle | 120 hrs | 23 hrs | 97 hrs (81%) |

Key Advantages Embedded in the Pro List:

✅ Zero Fraud Risk: All 47 manufacturers undergo dual-layer verification (SourcifyChina onsite audit + 3rd-party certification cross-check).

✅ Precision Compliance: Suppliers pre-qualified for AISI HSS-Co, solid carbide, and TiAlN-coated end mills (±0.005mm tolerance).

✅ Real-Time Responsiveness: Direct factory contacts with <2-hour response SLA via our integrated communication portal.

Your Strategic Next Step: Secure 2026 Supply Chain Resilience in <5 Minutes

Stop expending resources on unverified suppliers. The SourcifyChina Pro List for China CNC roughing end mill manufacturers is your guaranteed path to:

– Accelerate time-to-PO by 73% (based on 2025 client data from automotive/aerospace sectors).

– Eliminate $18K+ in hidden costs per RFQ cycle (quality failures, reshipments, expedited logistics).

– Future-proof sourcing against 2026 regulatory shifts (e.g., EU CBAM, USMCA traceability rules).

Initiate your verified sourcing engagement today:

✉️ Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Specify “Pro List – CNC Roughing End Mills 2026” for immediate priority access to our vetted supplier dossier (including capacity reports and sample protocols).

Act by Q1 2026 to lock in 2025 pricing – China’s tooling sector faces 8–12% raw material cost increases in early 2026. Our consultants will deploy a customized sourcing roadmap within 24 business hours of contact.

Data Source: SourcifyChina 2025 CNC Tooling Supplier Performance Index (n=127 global procurement teams). All manufacturers undergo bi-annual re-verification. Report ID: SC-PRC-CNC-2026-01

© 2026 SourcifyChina. Confidential for authorized procurement professionals only.

🧮 Landed Cost Calculator

Estimate your total import cost from China.