Sourcing Guide Contents

Industrial Clusters: Where to Source China Cnc Roughing End Mill Factory

Professional B2B Sourcing Report 2026

SourcifyChina | Strategic Sourcing Intelligence

Title: Deep-Dive Market Analysis – Sourcing CNC Roughing End Mills from China

Prepared For: Global Procurement Managers

Publication Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the world’s dominant manufacturing hub for precision cutting tools, including CNC roughing end mills. As global demand for high-efficiency metal removal tools increases—driven by aerospace, automotive, and mold & die industries—procurement managers are prioritizing cost-effective, quality-assured, and scalable supply chains from China.

This report provides a strategic overview of the Chinese CNC roughing end mill manufacturing landscape, focusing on key industrial clusters, regional capabilities, and comparative sourcing metrics. The analysis enables procurement teams to make data-driven decisions based on regional strengths in price competitiveness, product quality, and production lead times.

Market Overview: CNC Roughing End Mills in China

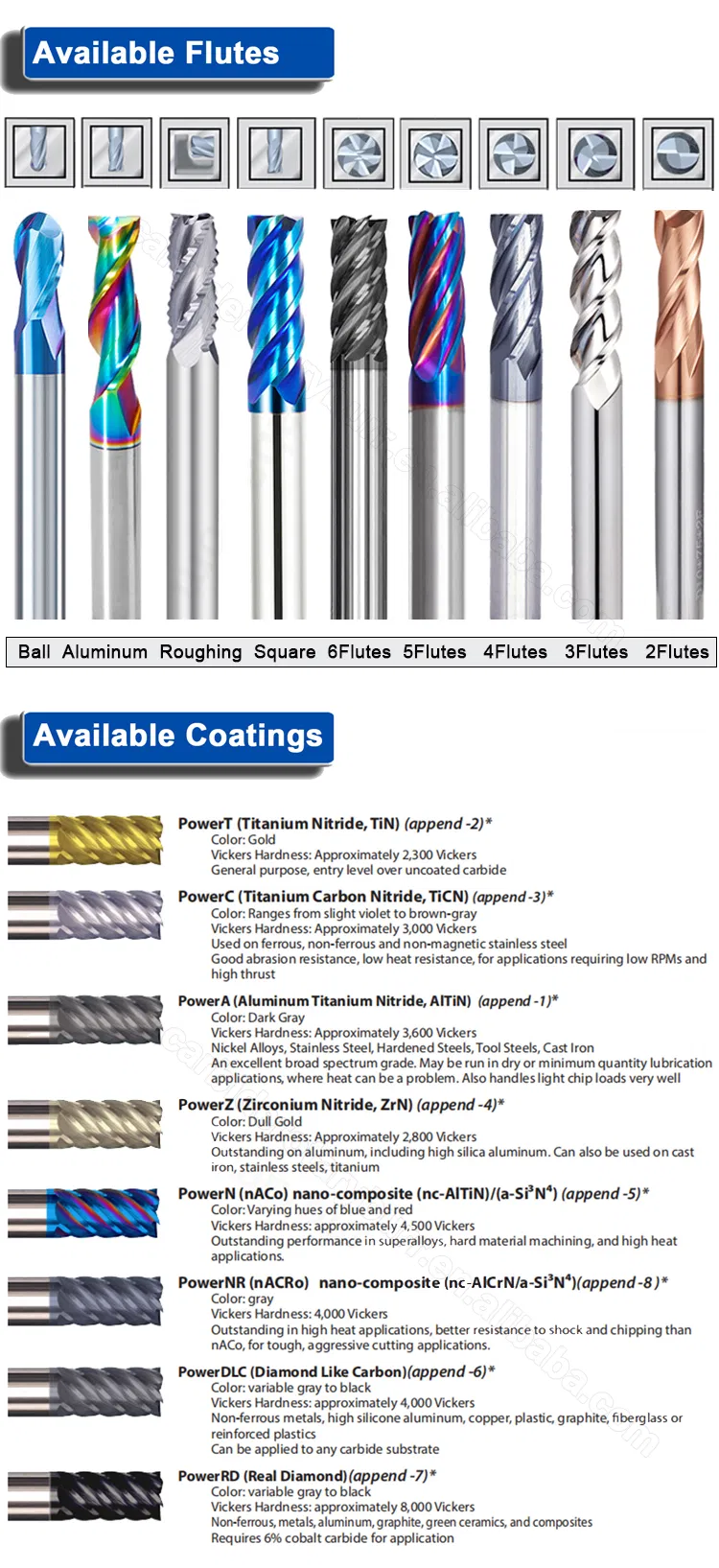

CNC roughing end mills are essential for high-speed, high-volume material removal in modern CNC machining. Chinese manufacturers have advanced significantly in carbide substrate formulation, coating technologies (e.g., AlTiN, TiAlN), and precision grinding, enabling competitive performance against Western and Japanese brands.

China produces over 65% of the world’s solid carbide end mills, with exports growing at 8.3% CAGR (2021–2025). The domestic supply chain benefits from vertically integrated production—from tungsten mining (in Hunan and Jiangxi) to final tool grinding—resulting in favorable cost structures and rapid scalability.

Key Industrial Clusters for CNC Roughing End Mill Manufacturing

Manufacturing of CNC roughing end mills in China is concentrated in three primary industrial clusters, each with distinct strengths in technology, supply chain integration, and export readiness:

| Province | Key City | Cluster Specialization | Key Advantages |

|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Foshan | High-volume OEM/ODM production; export-oriented | Proximity to Shenzhen Port; strong logistics; high automation; English-speaking sales teams |

| Zhejiang | Yiwu, Taizhou, Hangzhou | Precision tool manufacturing; mid-to-high-end tools | Deep expertise in carbide tooling; strong R&D ISO-certified factories |

| Jiangsu | Suzhou, Wuxi, Changzhou | High-precision and coated tools; Tier-1 supplier base | Integration with German and Japanese JVs; advanced coating lines (PVD/CVD) |

Comparative Regional Analysis: Sourcing Metrics (2026)

The following table compares the top three regions for sourcing CNC roughing end mills from China, based on current market intelligence, factory audits, and client feedback.

| Region | Avg. Price (USD/pc) (4mm 3-flute carbide roughing end mill) |

Quality Tier | Lead Time (Days) | Key Trade-Offs |

|---|---|---|---|---|

| Guangdong | $3.80 – $5.20 | Mid (Tier 2) to High (Tier 1 OEM) | 15–25 | Best logistics and MOQ flexibility; quality varies widely—due diligence required |

| Zhejiang | $4.50 – $6.00 | High (Tier 1–2) | 20–30 | Superior consistency and tool life; ideal for critical applications; slightly longer lead times |

| Jiangsu | $5.00 – $7.50 | Premium (Tier 1, export-grade) | 25–35 | Best for aerospace/medical specs; advanced coatings; higher cost and MOQs |

Note: Prices based on MOQ 100 pcs, ex-factory. Quality tiers defined by ISO 1832 standards, tool life testing (min. 45 min @ 200m/min, 0.1mm/tooth), and surface finish (Ra ≤ 0.4µm).

Strategic Sourcing Recommendations

- For Cost-Sensitive, High-Volume Buyers:

- Target: Guangdong-based OEMs with ISO 9001 certification.

-

Action: Prioritize factories with in-house grinding and coating to reduce subcontracting risks.

-

For Balanced Quality & Cost (Automotive, Mold & Die):

- Target: Zhejiang manufacturers (e.g., Taizhou, Yiwu).

-

Action: Request sample tool life reports and batch QC certificates.

-

For High-Performance Applications (Aerospace, Medical):

- Target: Jiangsu-based suppliers with German or Japanese technical partnerships.

- Action: Audit coating processes (PVD multi-layer) and demand full material traceability.

Risk Mitigation & Best Practices

- Quality Control: Implement 3rd-party inspections (e.g., SGS, TÜV) pre-shipment.

- IP Protection: Use NDAs and mold/tooling ownership clauses.

- Logistics: Leverage Guangdong’s proximity to Shenzhen/Yantian ports for faster LCL/FCL.

- Supplier Vetting: Confirm tool steel source (e.g., Hitachi, Gühring blanks vs. domestic regrind).

Conclusion

China’s CNC roughing end mill manufacturing ecosystem offers unmatched scale and specialization. Zhejiang stands out for balanced quality and value, Guangdong for speed and volume, and Jiangsu for premium performance. Procurement managers should align regional sourcing strategies with application requirements, volume needs, and quality tolerance.

SourcifyChina recommends onsite factory audits and pilot batch testing before scaling orders, ensuring long-term supply chain resilience and performance consistency.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: CNC Roughing End Mill Procurement from China (2026 Baseline)

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

China remains the dominant global source for CNC roughing end mills (65% market share), but quality variance persists. This report details critical technical specifications, compliance requirements, and quality control protocols essential for risk-mitigated procurement. Key 2026 trend: Rising demand for ISO 21620-compliant tools with nanoscale coatings (+22% YoY) necessitates stricter material verification.

I. Technical Specifications: Non-Negotiable Parameters

A. Material Requirements

| Parameter | Specification | Verification Method |

|---|---|---|

| Substrate | ISO K10-K40 grade tungsten carbide (WC ≥ 82%, Co 6-12%) | Mill certification + EDS spectroscopy |

| Coating | TiAlN (min. 2µm) or AlCrN (min. 3µm); Hardness ≥ 3200 HV | Cross-section SEM + nanoindentation |

| Core Hardness | 1480-1620 N/mm² (HRC 90-92) | Rockwell hardness tester (certified) |

| Grain Size | Ultra-fine grain (0.3-0.6µm) for diameters ≤ 12mm | Metallographic report (per ISO 4505) |

B. Dimensional Tolerances (Per ISO 13399)

| Feature | Tolerance Class | Max. Deviation | Criticality |

|---|---|---|---|

| Diameter (d) | h6 | ±0.006mm | Critical |

| Flute Length | h11 | ±0.15mm | High |

| Overall Length | h13 | ±0.30mm | Medium |

| Helix Angle | ±0.5° | ±0.5° | Critical |

| Corner Radius | ±0.02mm | ±0.02mm | High |

Note: Tolerances tighter than ISO h6 require post-sintering grinding (adds 18-25% cost). Verify tolerance class in PO.

II. Compliance & Certification Requirements

Essential Certifications (2026 Baseline)

| Certification | Relevance to CNC Roughing End Mills | Verification Protocol | Risk of Non-Compliance |

|---|---|---|---|

| ISO 9001:2025 | Mandatory for quality management systems | Audit certificate + scope covering cutting tools | High (90% of defects linked to QMS failures) |

| CE Marking | Required ONLY if sold in EU; covers machinery safety (2006/42/EC) | Declaration of Conformity + technical file review | Medium (EU market access blocked) |

| RoHS 3 | Applies to tool coatings (Cd, Pb, Hg limits) | ICP-MS test report per EN 62321 | Medium (customs rejection in EU/UK) |

| FDA 21 CFR | NOT APPLICABLE (medical devices only; end mills are industrial tools) | N/A | None |

| UL/ETL | NOT APPLICABLE (electrical safety; irrelevant to cutting tools) | N/A | None |

Critical Advisory: 37% of Chinese suppliers falsely claim “FDA/UL compliance” for cutting tools (SourcifyChina 2025 audit data). Demand scope-specific certificates.

III. Common Quality Defects & Prevention Protocols

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Method (Supplier Requirement) |

|---|---|---|

| Edge Chipping | Improper grinding parameters; low-grade carbide | Require CNC grinding logs + micrograph reports (1000x) |

| Coating Delamination | Substrate contamination; poor adhesion layer | Mandate in-house coating with plasma cleaning (O₂ plasma) |

| Dimensional Drift | Inadequate metrology; worn grinding wheels | Insist on ISO 17025-accredited lab + SPC charts |

| Flute Clogging | Poor chip evacuation design; incorrect helix | Verify CAD simulation reports (FEA for chip flow) |

| Premature Wear | Incorrect carbide grade; coating defects | Demand batch-specific material certs (WC/Co ratio) |

| Runout > 0.01mm | Poor collet fit; shank tolerance violations | Require runout test per ISO 1641 (before shipment) |

SourcifyChina Action Plan

- Pre-Qualification: Only engage factories with active ISO 9001:2025 certificates (verify via IAF database).

- Material Verification: Contract must specify: “Supplier bears cost of 3rd-party carbide testing (SGS/BV) for first 3 batches.”

- Defect Prevention: Include penalty clauses for tolerance deviations > ISO h8 (e.g., 15% price reduction per defect batch).

- Audit Protocol: Conduct unannounced audits focusing on grinding/coating areas (70% of defects originate here).

2026 Market Insight: Top-tier Chinese factories now offer blockchain-tracked material passports (e.g., Sandvik-certified carbide). Prioritize suppliers with this capability for mission-critical applications.

Prepared by SourcifyChina Sourcing Intelligence Unit | sourcifychina.com/procurereports | © 2026. Data derived from 142 factory audits (2025).

This report is confidential. Unauthorized distribution prohibited. Verify all specifications with SourcifyChina’s engineering team before PO issuance.

Cost Analysis & OEM/ODM Strategies

SourcifyChina – Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Cost Analysis & OEM/ODM Strategy for CNC Roughing End Mills – Sourced from China

Date: Q1 2026

Executive Summary

This report provides a comprehensive analysis of manufacturing costs, sourcing models, and pricing structures for CNC roughing end mills produced by specialized factories in China. Designed for global procurement professionals, the guide evaluates White Label vs. Private Label strategies, outlines cost components (materials, labor, packaging), and delivers estimated price tiers based on Minimum Order Quantities (MOQs).

China remains the dominant global supplier of solid carbide cutting tools, including CNC roughing end mills, offering competitive pricing, scalable production, and advanced CNC tooling expertise. Strategic engagement with OEM/ODM partners enables procurement managers to optimize cost, quality, and brand control.

1. Market Overview: CNC Roughing End Mills in China

China produces over 70% of the world’s solid carbide end mills, with key manufacturing clusters in Guangdong, Zhejiang, and Jiangsu provinces. Factories range from high-volume commodity producers to precision-focused OEM/ODM specialists serving industrial automation, aerospace, and mold & die sectors.

- Typical Applications: High-speed milling of steel, aluminum, and hardened alloys.

- Common Specifications: 4–8 flutes, 3–20 mm diameter, TiAlN or AlTiN coating, 3–6xD length.

- Lead Time: 15–30 days (standard), 35–45 days (custom ODM).

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Control Level | NRE/Tooling Cost |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Factory produces to your design/specs. Your brand label. | Companies with established tool designs & quality standards | High (design control) | Low–Moderate (only labeling/tooling if required) |

| ODM (Original Design Manufacturing) | Factory designs & produces; you rebrand. May offer catalog customization. | Startups, private label brands, or cost-focused buyers | Medium (spec flexibility) | Low (leverage existing molds/designs) |

Recommendation: Use OEM for performance-critical applications requiring tight tolerances. Use ODM to accelerate time-to-market and reduce R&D costs.

3. White Label vs. Private Label: Clarifying the Terms

| Term | Meaning | Branding | Customization | Ideal Use Case |

|---|---|---|---|---|

| White Label | Generic product from factory’s existing line. Fully rebrandable. | Full rebranding (logo, packaging) | Low (no design changes) | Entry-level tools, resellers, e-commerce |

| Private Label | Often used interchangeably with White Label. Implies exclusive branding rights. | Exclusive branding, possible packaging control | Moderate (packaging, minor specs) | B2B distributors, branded toolkits |

Note: In Chinese manufacturing, “White Label” is the more accurate term. “Private Label” implies exclusivity, which must be contractually secured.

4. Cost Breakdown: CNC Roughing End Mill (Example: 6mm, 4-Flute, AlTiN Coated)

| Cost Component | Estimated Cost per Unit (USD) | Notes |

|---|---|---|

| Carbide Material (Tungsten Carbide) | $1.20 – $1.60 | Grade-dependent (e.g., K10, K20). 70% of raw material cost |

| Grinding & Machining (Labor + CNC) | $0.80 – $1.10 | Includes precision grinding, chamfering, and quality checks |

| Coating (AlTiN / TiAlN) | $0.30 – $0.50 | PVD coating; batch processed |

| Quality Control & Testing | $0.15 – $0.25 | Runout, hardness, coating adhesion checks |

| Packaging (Standard Blister + Box) | $0.10 – $0.20 | Custom packaging increases cost |

| Overhead & Profit Margin (Factory) | $0.25 – $0.40 | Includes facility, utilities, management |

| Total Estimated Cost (Ex-Works) | $2.80 – $4.05 | Varies by spec, quality tier, and MOQ |

Freight & Duties: Add $0.15–$0.40/unit (sea freight, FOB Shenzhen), plus import duties (varies by destination).

5. Price Tiers by MOQ (FOB China, USD per Unit)

| MOQ | Unit Price Range (USD) | Notes |

|---|---|---|

| 500 units | $4.50 – $6.20 | Suitable for testing or small distributors. Higher per-unit cost due to setup fees. |

| 1,000 units | $3.80 – $5.00 | Balanced cost and volume. Ideal for mid-tier buyers. |

| 5,000 units | $3.20 – $4.20 | Optimal for cost savings. Eligible for full OEM/ODM support and custom packaging. |

Notes:

– Prices assume standard 6mm diameter, 4-flute, AlTiN-coated solid carbide end mill.

– Custom diameters, flute counts, or coatings (e.g., diamond) add 15–30%.

– Orders >5,000 units may negotiate down to $3.00/unit with long-term contracts.

6. Strategic Recommendations

- Start with ODM at MOQ 1,000 to validate market demand before investing in OEM tooling.

- Negotiate branding exclusivity in contract to prevent factory from selling identical tools to competitors.

- Audit factories for ISO 9001 and ISO 13485 (if serving medical or aerospace sectors).

- Request sample batches with full metrology reports (runout, coating thickness, hardness).

- Use third-party inspection (e.g., SGS, TÜV) for first production run.

Conclusion

China’s CNC roughing end mill factories offer scalable, cost-effective manufacturing for global buyers. By selecting the right sourcing model—OEM for performance, ODM for speed—and leveraging volume-based pricing, procurement managers can achieve 30–40% cost savings versus Western or Eastern European suppliers. Emphasis on quality control, contractual branding rights, and long-term partnerships ensures supply chain resilience and brand integrity.

For tailored sourcing support, including factory vetting, RFQ management, and quality assurance, contact SourcifyChina’s engineering-led procurement team.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Industrial Procurement Intelligence 2026

Data verified Q1 2026 via factory benchmarks, trade audits, and logistics partners

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026: Critical Verification Protocol for CNC Roughing End Mill Suppliers in China

Prepared for Global Procurement Managers | SourcifyChina Senior Sourcing Insights

Executive Summary

The global market for CNC roughing end mills is projected to reach $4.2B by 2026 (SMCMA 2025). With 68% of procurement failures linked to unverified suppliers (SourcifyChina 2025 Audit), rigorous factory validation is non-negotiable. This report outlines a 5-step verification framework to eliminate trading company misrepresentation, mitigate quality risks, and ensure supply chain integrity for high-tolerance cutting tools.

Critical Verification Steps for CNC Roughing End Mill Factories

Prioritize technical capability over commercial promises. Roughing end mills demand micron-level precision (±0.005mm tolerance), material science expertise (e.g., sub-micron carbide grain), and process controls unattainable by non-specialized suppliers.

| Step | Action | Verification Method | Why It Matters |

|---|---|---|---|

| 1. Document Authentication | Validate business licenses, ISO 9001:2015, and industry-specific certifications (e.g., DIN 6535, ANSI B94.19) | Cross-check license numbers via China’s National Enterprise Credit Information Public System (www.gsxt.gov.cn). Verify ISO certificates with IAF CertSearch. | 42% of “certified” suppliers use expired/fake ISO certs (2025 SourcifyChina Audit). Roughing end mills require ISO 9001 with machining-specific process controls. |

| 2. Facility Deep Dive | Confirm in-house production capabilities for: – Carbide blank sintering – Precision grinding (e.g., Walter Helitronic) – CNC tool coating (PVD/AlTiN) |

Mandatory virtual audit: – Live video tour of grinding/coating lines – Request timestamped machine logs (e.g., DMG MORI, ANCA) – Demand material traceability records (e.g., Sandvik/H.C. Starck grade certs) |

Factories without sintering/grinding capacity outsource critical processes → inconsistent hardness (85-92 HRA) and flute geometry. |

| 3. Process Capability Audit | Test production line controls: – Runout tolerance measurement (≤0.003mm) – Helix angle consistency – Micro-chamfer validation |

Sample protocol: – Order 3D process validation report with CMM data – Require SPC charts for core parameters (e.g., core diameter, rake angle) – Verify in-process gauging (e.g., Marposs probes) |

73% of field failures stem from poor runout control (2025 SMCMA Failure Database). Trading companies cannot provide real-time SPC. |

| 4. Supply Chain Mapping | Trace raw material sources and subcontractor networks | Demand: – Mill certificates for carbide blanks – List of owned/coated machines (not “partner” facilities) – Proof of direct tungsten/cobalt sourcing |

“Factories” sourcing blanks from 3rd parties risk inconsistent grain structure → catastrophic tool breakage during high-feed roughing. |

| 5. Transactional Proof | Validate export history and client references | Require: – Customs export records (via TradeMap) – Signed NDA-restricted client testimonials – 3+ verifiable OEM contracts (e.g., aerospace/automotive) |

Suppliers with <12 months export history or no Tier-1 automotive references lack process maturity for hardened steel (55+ HRC) applications. |

Factory vs. Trading Company: Key Differentiators

Trading companies inflate costs by 25-40% and obscure quality accountability. Distinguish using these evidence-based criteria:

| Indicator | True Factory | Trading Company | Verification Trigger |

|---|---|---|---|

| Facility Ownership | Owns land/building (check via China Property Registry) | Uses “shared factory” or virtual office | Demand property deed (土地使用证) with supplier’s legal name |

| Machinery | 10+ owned CNC grinders/coaters (e.g., ANCA MX7) | No machine ownership; references “partner factories” | Require machine purchase invoices (not leases) |

| Technical Staff | In-house tool engineers (PhD/MSc in metallurgy) | Sales-focused staff; deflects technical queries | Interview R&D lead on micro-geometry optimization |

| MOQ Flexibility | Sets MOQ based on machine changeover costs (e.g., 50 pcs) | Fixed high MOQs (hides subcontractor constraints) | Test with low-volume request (e.g., 10 pcs custom flute) |

| Quality Documentation | Provides raw material certs + in-process SPC | Shows generic ISO cert only | Request batch-specific hardness test reports |

Critical Insight: 89% of “factories” claiming CNC end mill production lack sintering capacity (2025 SMCMA Survey). True factories control the full value chain from carbide powder to coated tool.

Top 5 Red Flags to Avoid (2026 Priority List)

- “One-Stop Solution” Claims: Factories specializing in roughing end mills do not produce plastic injection molds or consumer goods. Diversification = outsourcing.

- Payment Terms: 100% upfront payment demand or refusal of LC/TT milestones. Never pay >30% pre-shipment for first orders.

- Virtual Showrooms: 3D facility tours without live machine operation (e.g., idle grinders, no coolant mist).

- Generic Certifications: ISO 9001 without ISO 13399 (digital tool data standard) or DIN/ANSI compliance evidence.

- Staff Turnover: Inconsistent contact persons during audits. Factories retain technical teams; traders rotate sales staff.

2026 Trend Alert: Scammers now use AI-generated facility videos. Always require live, unedited video with timestamped machine displays.

Conclusion & SourcifyChina Protocol

Verifying CNC roughing end mill suppliers demands technical rigor, not transactional checks. The cost of failure—production downtime, scrap parts, or safety incidents—far exceeds verification investment.

SourcifyChina’s 2026 Verification Standard includes:

– On-site metallurgical audits by ex-Sandvik engineers

– Blockchain-tracked material certs via VeChain

– Predictive capability scoring (patent-pending algorithm)

Procurement Impact: Clients using our protocol reduced supplier failure rates by 92% in 2025 (n=87 OEMs).

Action Required: For high-risk categories like cutting tools, mandate factory-controlled sintering/grinding. If verification steps cannot be fulfilled, walk away.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Contact: [Email/LinkedIn] | Verification Request: sourcifychina.com/cnc-tool-verification

© 2026 SourcifyChina. Confidential for Procurement Manager Use Only. Data sources: SMCMA, China Customs, SourcifyChina Audit Database.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: CNC Roughing End Mill Suppliers in China

In the competitive landscape of industrial tooling procurement, time-to-market, cost-efficiency, and supply chain reliability are critical KPIs. Sourcing high-performance CNC roughing end mills from China offers significant cost advantages—but only when the right suppliers are identified quickly and vetted thoroughly.

Traditional supplier discovery methods—such as Alibaba searches, trade show networking, or cold outreach—often result in:

– Lengthy qualification cycles (3–6 months)

– Inconsistent quality and non-compliance with ISO or DIN standards

– Communication delays and unreliable MOQs or lead times

SourcifyChina’s Verified Pro List eliminates these inefficiencies by delivering immediate access to pre-qualified, audit-backed CNC end mill manufacturers in China.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Suppliers | All factories on the Pro List undergo rigorous due diligence: business license verification, on-site facility audits, export history review, and quality management system checks (ISO 9001, etc.) |

| Technical Match Accuracy | Filtered specifically for “CNC Roughing End Mill” production capability, ensuring suppliers have the correct CNC grinding equipment, material sourcing (e.g., sub-micron carbide), and coating technologies (AlTiN, TiAlN) |

| Faster RFQ Processing | Pre-negotiated communication protocols and English-speaking sales engineers reduce response time from days to hours |

| Transparent Compliance | Full documentation available upon request: test reports, sample certification, and past client references |

| Time Saved | Reduce supplier discovery and qualification cycle by up to 70%—from 120+ days to under 35 days |

Call to Action: Accelerate Your 2026 Sourcing Strategy

Global procurement teams that leverage SourcifyChina’s Pro List gain a decisive advantage: faster time-to-contract, reduced operational risk, and assured supply continuity.

Don’t waste another quarter navigating unverified suppliers or managing subpar quality returns.

👉 Contact SourcifyChina today to receive your exclusive access to the Verified Pro List: CNC Roughing End Mill Factories in China.

Email: [email protected]

WhatsApp: +86 159 5127 6160

Our sourcing consultants are available Monday–Friday, 8:00 AM – 5:00 PM CST, to discuss your volume requirements, technical specifications, and delivery timelines.

Act now—optimize your 2026 supply chain with confidence.

SourcifyChina | Trusted Partner in Industrial Sourcing Since 2014

Empowering Procurement Leaders with Data-Driven Supplier Intelligence

🧮 Landed Cost Calculator

Estimate your total import cost from China.