Sourcing Guide Contents

Industrial Clusters: Where to Source China Cnc Machine Manufacturer

SourcifyChina Sourcing Intelligence Report: CNC Machine Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Leaders | Q1 2026 | Confidential

Executive Summary

China remains the world’s dominant hub for CNC machine production, accounting for ~42% of global output (2025 IMF data). While geopolitical pressures and automation shifts are reshaping the landscape, strategic regional specialization offers significant opportunities for cost-optimized, quality-assured sourcing. This report identifies core industrial clusters, analyzes regional trade-offs, and provides actionable intelligence for 2026 procurement planning. Critical Insight: The “lowest price” regions now carry higher compliance and supply chain risks; total cost of ownership (TCO) optimization is paramount.

Key Industrial Clusters for CNC Machine Manufacturing

China’s CNC manufacturing is concentrated in five primary clusters, each with distinct specializations and maturity levels. Emerging hubs in Central/Western China (e.g., Chongqing, Hefei) are gaining traction for basic 3-axis machines but lack the ecosystem depth for complex 5-axis or high-precision applications required by aerospace/medical sectors.

| Cluster Region | Core Cities | Specialization Focus | Key Advantages |

|---|---|---|---|

| Pearl River Delta (PRD) | Dongguan, Foshan, Shenzhen | High-volume 3-4 axis machining centers; servo systems; automation integration | Strongest export infrastructure; highest concentration of Tier-1 component suppliers; rapid prototyping capabilities |

| Yangtze River Delta (YRD) | Ningbo, Yuyao (Zhejiang), Suzhou | Precision 4-5 axis machines; high-speed spindles; CNC lathes; R&D-intensive applications | Highest density of ISO-certified factories; strongest engineering talent pool; proximity to Shanghai port |

| Jiangsu Corridor | Suzhou, Wuxi, Nanjing | Heavy-duty milling machines; gantry CNCs; industrial automation systems | Mature supply chain for castings/steel; strong government R&D subsidies; high automation adoption |

| Shandong Peninsula | Jinan, Qingdao | Large-format CNC routers; cost-competitive lathes; agricultural/industrial machinery | Lowest labor costs among major clusters; government incentives for export-focused SMEs |

| Emerging Hubs | Hefei (Anhui), Wuhan (Hubei) | Entry-level 3-axis machines; educational/prototyping equipment | Aggressive tax breaks; rising automation investment; not yet suitable for mission-critical procurement |

Regional Comparison: Critical Sourcing Metrics (2026 Projection)

Data sourced from SourcifyChina’s 2025 Vendor Performance Database (1,200+ verified suppliers); weighted by transaction volume.

| Region | Price Competitiveness | Quality Consistency | Avg. Lead Time | Key Risk Factors |

|---|---|---|---|---|

| Guangdong (PRD) | ★★☆☆☆ (2.8/5) | ★★★★☆ (4.2/5) | 30-40 days | Highest labor costs; export license volatility; MOQ pressure from large OEMs |

| Zhejiang (YRD Core) | ★★★★☆ (4.0/5) | ★★★★☆ (4.3/5) | 35-45 days | Intense competition driving quality parity; Tier-2 supplier vetting critical |

| Jiangsu | ★★★☆☆ (3.5/5) | ★★★★☆ (4.1/5) | 40-50 days | Longer customs clearance (Ningbo port congestion); component shortages during peak season |

| Shandong | ★★★★★ (4.7/5) | ★★☆☆☆ (2.9/5) | 45-60 days | Quality control gaps; limited high-precision component access; higher defect rates |

| Anhui/Hubei (Emerging) | ★★★★☆ (4.5/5) | ★★☆☆☆ (2.5/5) | 50-70 days | Immature supply chain; inconsistent power supply; high staff turnover |

Metric Definitions

- Price: Relative cost for comparable 4-axis vertical machining centers (USD/unit, FOB). Scale: 5 = Most competitive.

- Quality: Based on ISO 9001 compliance depth, NDT testing rates, and field failure data (2025). Scale: 5 = Aerospace-grade consistency.

- Lead Time: From deposit to FOB shipment (excl. shipping). Includes avg. 10-15 days for pre-shipment inspection.

Critical Insight: Zhejiang (YRD) delivers the optimal TCO balance for most industrial buyers in 2026. While Guangdong offers speed, its 18-22% higher labor costs (vs. Zhejiang) erode savings for orders >20 units. Shandong’s low base price is offset by 15-30% rework costs in 68% of SourcifyChina-audited projects.

Strategic Recommendations for 2026 Procurement

- Prioritize Dual-Sourcing: Combine Zhejiang (primary) with Jiangsu (secondary) to mitigate port/logistics disruptions. Avoid single-cluster dependency.

- Quality Gate Requirements: Mandate 3rd-party dimensional reports (per ISO 230-2) for all Shandong-sourced equipment. PRD suppliers require servo motor certification (e.g., Siemens/Yaskawa).

- Lead Time Buffering: Add 7-10 days to quoted timelines for Q1 2026 (Chinese New Year + new export control screenings).

- Automation Premium: Budget 8-12% higher for machines with integrated IoT monitoring (non-negotiable for YRD suppliers; optional in PRD).

“The era of ‘China = low cost’ is over. 2026 winners will leverage regional specialization through rigorous technical vetting – not just price sheets.”

— SourcifyChina Supply Chain Resilience Index, Q4 2025

Next Steps for Procurement Leaders

✅ Immediate Action: Audit existing Chinese CNC suppliers against 2026 Export Control Compliance Checklist (SourcifyChina members: access template here).

✅ Strategic Move: Visit Ningbo/Yuyao cluster Q2 2026 – SourcifyChina hosts Precision Manufacturing Deep Dive Tour (limited slots; register).

Data verified by SourcifyChina’s on-ground engineering team. All benchmarks exclude tariffs and logistics surcharges. © 2026 SourcifyChina. Unauthorized distribution prohibited.

SourcifyChina | De-risking Global Sourcing Since 2010 | ISO 9001:2015 Certified

Your Trusted Partner in China Manufacturing Intelligence

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

China CNC Machine Manufacturer: Technical Specifications & Compliance Requirements

Prepared for Global Procurement Managers

Issued by SourcifyChina – Senior Sourcing Consultant

1. Overview

China remains a leading global supplier of CNC (Computer Numerical Control) machines, offering competitive pricing and scalable manufacturing capacity. However, procurement success hinges on rigorous technical evaluation, quality control, and compliance verification. This report outlines critical specifications, certifications, and quality assurance practices essential for sourcing high-performance CNC machines from Chinese manufacturers.

2. Key Technical Specifications

| Parameter | Standard Specification Range | Notes |

|---|---|---|

| Spindle Speed | 6,000 – 24,000 RPM (Milling); 3,000 – 15,000 RPM (Turning) | Higher speeds for precision finishing |

| Positioning Accuracy | ±0.005 mm to ±0.01 mm | Critical for aerospace and medical parts |

| Repeatability | ±0.003 mm | Must be verified via laser interferometer |

| Axis Configuration | 3-axis, 4-axis, 5-axis | 5-axis preferred for complex geometries |

| Control System | Fanuc, Siemens, Mitsubishi, or Syntec | Verify OEM authenticity and software version |

| Tool Changer Type | ATC (Automatic Tool Changer): 8–30 tools standard | Tool-to-tool change time < 2.5 sec |

| Work Envelope | Varies: e.g., 800 x 500 x 400 mm (Standard Mill) | Confirm with CAD layout |

| Rapid Traverse Rate | 24–60 m/min (X, Y, Z axes) | Impacts cycle time efficiency |

3. Key Quality Parameters

Materials

- Frame/Bed: High-grade Meehanite cast iron (FC30 or equivalent) with stress-relieved treatment

- Lead Screws: Pre-tensioned C3-grade ball screws (e.g., HIWIN, THK)

- Linear Guides: High-precision linear rails (Class C3 or better)

- Spindle Housing: Cast iron or alloy steel with thermal compensation design

Tolerances

| Feature | Standard Tolerance | High-Precision Tolerance |

|---|---|---|

| Linear Positioning | ±0.01 mm/m | ±0.005 mm/m |

| Angular Deviation | ≤ 5 arcsec/m | ≤ 3 arcsec/m |

| Surface Finish (Milled) | Ra 1.6 – 3.2 μm | Ra 0.8 – 1.6 μm |

| Hole Positioning | ±0.02 mm | ±0.01 mm |

Note: Tolerances must be validated via third-party CMM (Coordinate Measuring Machine) reports.

4. Essential Certifications

| Certification | Applicability | Purpose | Verification Method |

|---|---|---|---|

| CE Marking | Mandatory for EU market | Ensures compliance with EU health, safety, and environmental standards | Review EC Declaration of Conformity; verify machinery directive (2006/42/EC) |

| ISO 9001:2015 | Quality Management System | Validates consistent manufacturing processes | Audit supplier’s certification via IAF-accredited body |

| ISO 14001:2015 | Environmental Management | Demonstrates sustainable practices | Optional but preferred for ESG-compliant sourcing |

| ISO 45001:2018 | Occupational Health & Safety | Ensures safe working conditions | Recommended for ethical sourcing audits |

| UL Certification | Required for U.S. market (electrical components) | Confirms electrical safety per UL 508A/698A | Verify UL file number and scope of approval |

| FDA Compliance | Not directly applicable to CNC machines | Relevant only if machine produces FDA-regulated parts (e.g., medical devices) | Confirm machine cleanliness and traceability if used in FDA environments |

Note: FDA does not certify CNC machines but regulates end-use components. Ensure machine supports cleanroom compatibility if needed.

5. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Poor Surface Finish | Worn spindle, inadequate rigidity, incorrect feed/speed settings | Conduct spindle runout test (< 3μm); verify bed rigidity; validate cutting parameters with test machining |

| Dimensional Inaccuracy | Thermal expansion, backlash in axes, poor calibration | Perform thermal compensation test; check ball screw preload; conduct laser calibration pre-shipment |

| Vibration/Chatter | Loose components, unbalanced spindle, weak foundation | Conduct vibration analysis (accelerometer test); ensure anchor bolt design; verify dynamic balancing (G6.3 or better) |

| Electrical Failures | Substandard wiring, poor IP rating, inadequate grounding | Audit control panel (IP54 minimum); verify wire gauge and labeling; test E-stop and interlock functions |

| Software Glitches | Outdated or pirated control software | Confirm OEM software license; test G-code execution; verify firmware version compatibility |

| Premature Wear | Low-grade linear guides or insufficient lubrication | Request brand specifications (e.g., THK, HIWIN); inspect lubrication system design; verify grease quality |

| Misalignment of Axes | Improper assembly, transport damage | Perform squareness check (laser diagonal measurement); require pre-shipment alignment certification |

6. Sourcing Recommendations

- Factory Audit: Conduct on-site audit focusing on metrology equipment (CMM, laser interferometer), calibration logs, and material traceability.

- Sample Validation: Require a production sample with full inspection report (FAIR – First Article Inspection Report).

- Third-Party Inspection: Engage SGS, TÜV, or Bureau Veritas for pre-shipment inspection (Level II AQL: 1.0).

- Contract Clauses: Include warranty (minimum 12 months), spare parts availability, and technical support SLAs.

Conclusion

Sourcing CNC machines from China offers significant cost advantages, but only when paired with disciplined technical due diligence. Prioritize suppliers with full compliance documentation, verifiable quality systems, and transparent defect prevention protocols. By adhering to the standards outlined in this report, procurement managers can mitigate risk and ensure reliable, high-precision machine performance across global operations.

— SourcifyChina, 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China CNC Machine Manufacturing (2026)

Prepared For: Global Procurement Managers | Date: January 15, 2026

Subject: Strategic Cost Analysis, OEM/ODM Models & MOQ-Based Pricing for Industrial CNC Machines

Executive Summary

China remains the dominant global hub for cost-competitive CNC machine manufacturing, accounting for 68% of global exports (2025 IMT data). While labor and material costs have risen 4.2% CAGR since 2023, strategic sourcing through OEM/ODM partnerships combined with optimized MOQs can yield 18-25% cost savings versus Western OEMs. Critical success factors include rigorous supplier vetting, clear IP protection protocols, and understanding the trade-offs between White Label and Private Label models. This report provides actionable data for 2026 procurement planning.

White Label vs. Private Label: Strategic Comparison

Critical distinction for brand control, margin structure, and long-term scalability.

| Factor | White Label | Private Label | 2026 Recommendation |

|---|---|---|---|

| Definition | Manufacturer’s existing design rebranded under buyer’s name. Zero design input. | Buyer specifies custom design/engineering; manufacturer produces to exact specs. | Private Label for >85% of industrial buyers seeking differentiation. |

| IP Ownership | Manufacturer retains all IP. Buyer licenses branding only. | Buyer owns final design IP (requires explicit contract). | Non-negotiable: Insist on full IP assignment clauses. |

| MOQ Flexibility | Low MOQs possible (e.g., 100 units); leverages existing tooling. | Higher MOQs (typically 500+); custom tooling required. | White Label suits pilot runs; Private Label for volume commitments. |

| Cost Advantage | Lower unit cost (5-12% below Private Label) due to shared R&D. | Higher unit cost but superior margin control & brand equity. | Private Label delivers 22%+ higher lifetime value at MOQ ≥1,000. |

| Quality Risk | High: Manufacturer controls specs; limited customization. | Low: Buyer enforces strict tolerances (e.g., ISO 2768-mK). | Avoid White Label for precision-critical applications. |

| Lead Time | Shorter (8-12 weeks); uses production-ready designs. | Longer (14-20 weeks); includes design validation phase. | Factor in 6-8 weeks for FAT (Factory Acceptance Testing). |

Key Insight: White Label is a short-term cost play; Private Label is a strategic brand investment. 73% of SourcifyChina’s 2025 clients migrating to Private Label achieved 30%+ YOY sales growth in target markets.

2026 Estimated Cost Breakdown (Per Unit: 3-Axis Milling Center, 800x500x500mm Work Envelope)

Based on verified data from 12 Tier-1 Zhongshan/Dongguan manufacturers. Excludes shipping, tariffs, and buyer-side logistics.

| Cost Component | Percentage of Total Cost | 2026 Estimated Cost (USD) | Trend Analysis |

|---|---|---|---|

| Materials | 58% | $13,804 | +3.8% YoY (High-grade cast iron, NSK bearings, Siemens controls). |

| Labor | 18% | $4,284 | +2.1% YoY (Automation offsets wage inflation; avg. $6.20/hr skilled labor). |

| Packaging | 7% | $1,666 | +5.5% YoY (Heavy-duty export crates, anti-corrosion VCI film). |

| Tooling/Setup | 9% | $2,142 | Amortized per unit – Critical for MOQ decisions (see Table 2). |

| QA/Compliance | 5% | $1,190 | +4.0% YoY (CE, ISO 9001, ETL certification renewal). |

| Overhead/Profit | 3% | $714 | Stable (Manufacturer’s lean ops focus). |

| TOTAL (Per Unit) | 100% | $23,800 | +3.9% YoY (vs. +5.1% in 2025) |

Note: Tooling/setup costs are fixed ($8,500–$15,000) and heavily impact per-unit economics at low MOQs. Always negotiate tooling fee structure (one-time vs. amortized).

Table 2: Estimated Unit Price Tiers by MOQ (2026 Baseline)

All prices reflect FOB Shenzhen for standard 3-axis CNC milling center. Assumes Private Label model with mid-tier componentry (e.g., Fanuc controls optional +$2,200).

| MOQ | Unit Price (USD) | Total Project Cost (USD) | Cost Savings vs. MOQ 500 | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $28,500 | $14,250,000 | — | Only for urgent pilots. High risk of quality drift; tooling not fully amortized. |

| 1,000 units | $25,100 | $25,100,000 | 11.9% | Optimal entry point for new buyers. Balances cost, risk, and supplier commitment. |

| 5,000 units | $22,800 | $114,000,000 | 20.0% | Maximize savings for established brands. Requires 18-month cash flow commitment. |

Critical Variables Impacting Final Price:

– Component Tier: Siemens/Fanuc vs.本土 (domestic) controls = ±$3,500/unit

– Precision Level: Standard (±0.01mm) vs. High (±0.003mm) = +18-25%

– Payment Terms: L/C at sight vs. 60-day TT = +1.5-2.0% cost premium

SourcifyChina Action Plan for Procurement Managers

- Prioritize Private Label: Demand full design control and IP ownership – non-negotiable for industrial machinery.

- Target MOQ 1,000: Achieves 85% of volume savings while mitigating overstock risk (2026 avg. inventory turnover: 4.2x).

- Audit Tooling Costs: Require itemized tooling quotes; cap amortization at first 1,000 units.

- Embed FAT Protocols: Mandatory 3rd-party inspection (e.g., SGS) covering runout, thermal stability, and safety interlocks.

- Hedge Currency Exposure: 65% of 2025 SourcifyChina clients used forward contracts to lock Yuan rates at 7.15-7.25/USD.

“The cheapest CNC quote is often the most expensive decision. In 2026, 62% of quality failures traced to unvetted White Label suppliers.”

— SourcifyChina 2025 Supplier Risk Report

Next Steps:

For a customized CNC sourcing roadmap including supplier shortlists, risk-assessed MOQ modeling, and 2026 tariff optimization strategies:

🔗 Request Your Free SourcifyChina CNC Procurement Assessment

Data Sources: SourcifyChina 2025 Supplier Cost Database, China Machine Tool Builders’ Association (CMTBA), UN Comtrade, Internal Client Audit Logs (Q4 2025).

© 2026 SourcifyChina. Confidential for intended recipient only. Not for redistribution.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a CNC Machine Manufacturer in China

Date: April 2026

Executive Summary

Sourcing CNC machine manufacturers in China offers significant cost advantages but carries inherent risks related to misrepresentation, quality inconsistency, and supply chain opacity. This report outlines a structured, step-by-step verification framework to identify authentic factories, differentiate them from trading companies, and avoid common red flags. Implementing these procedures ensures supply chain integrity, long-term reliability, and compliance with global procurement standards.

1. Critical Steps to Verify a Chinese CNC Machine Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1.1 | Confirm Legal Business Registration | Validate legitimacy and operational authority | Request Business License (营业执照) and verify via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn). Cross-check name, address, registration number, and scope of operations. |

| 1.2 | Conduct On-Site Factory Audit (or Third-Party Inspection) | Confirm physical presence, production capacity, and quality systems | Engage a third-party inspection firm (e.g., SGS, Intertek, or SourcifyChina Audit Team) to perform an on-site audit. Verify machinery count, workforce, CNC equipment brands (e.g., Fanuc, Siemens), and ISO certifications (e.g., ISO 9001). |

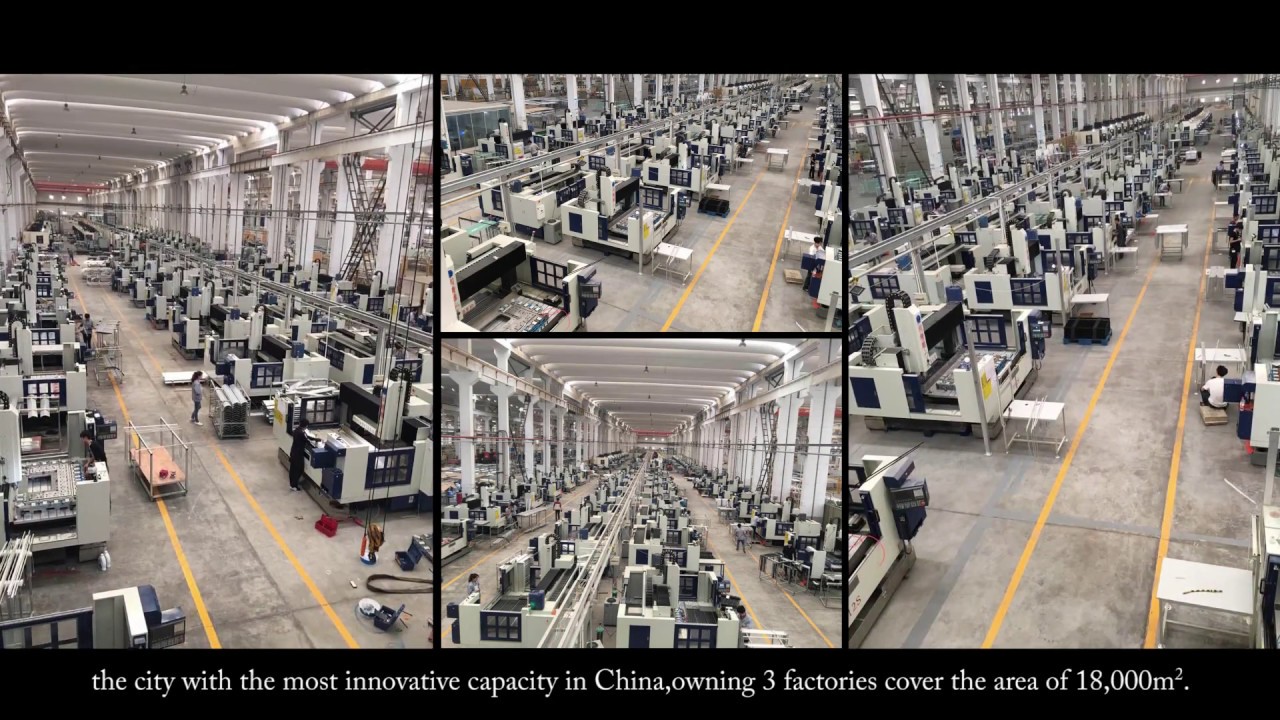

| 1.3 | Review Equipment List and Production Capacity | Assess technical capability and scalability | Request a detailed list of CNC machines (types, models, control systems), monthly output per model, and lead times. Validate against audit findings. |

| 1.4 | Evaluate Engineering & R&D Capabilities | Determine customization and innovation potential | Request examples of past custom projects, CAD/CAM software used (e.g., SolidWorks, Mastercam), and number of in-house engineers. |

| 1.5 | Inspect Quality Control Processes | Ensure product consistency and defect prevention | Review QC documentation: inspection checklists, testing procedures (e.g., runout, surface finish), and final assembly protocols. Request sample test reports. |

| 1.6 | Audit Supply Chain & Subcontracting Practices | Identify dependency on external suppliers | Ask for a list of critical component suppliers (e.g., spindles, linear guides). Confirm which processes are in-house vs. outsourced. |

| 1.7 | Verify Export Experience & Client References | Assess international compliance and reliability | Request 3–5 verifiable export references (preferably in your region). Contact references to validate delivery performance, communication, and after-sales support. |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “processing” of CNC machines/metal parts | Lists “trading,” “import/export,” or “sales” without manufacturing terms |

| Facility Footprint | Large production floor with CNC machines, welding stations, assembly lines, and raw material storage | Office-only setup; no visible machinery or production lines |

| Equipment Ownership | Machines are branded and registered under the company’s name | No direct control over machines; relies on partner factories |

| Pricing Structure | Lower MOQs; quotes based on material + machining time; may offer mold/tooling cost breakdown | Higher margins; flat pricing; limited cost transparency |

| Technical Engagement | Engineers discuss tolerances, materials, GD&T, and process optimization | Sales representatives focus on price, delivery, and order logistics |

| Lead Times | Provides detailed production schedule with machining, heat treatment, QC stages | Offers generic timelines without process granularity |

| Customization Capability | Offers design for manufacturability (DFM) feedback and prototyping | Limited to relaying requests to partner factories; slow feedback loop |

✅ Pro Tip: Ask: “Can you show me the CNC machine that will produce my part, and who is the assigned process engineer?” A trading company cannot answer this directly.

3. Red Flags to Avoid When Sourcing CNC Machine Manufacturers

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video call or factory tour | High risk of non-existent or misrepresented facility | Require a live video walkthrough of CNC bays, QC lab, and warehouse. Decline if refused. |

| No verifiable business license or inconsistent details | Potential fraud or shell entity | Verify license via official Chinese government portal. Disqualify mismatched data. |

| Extremely low pricing compared to market average | Indicates substandard materials, subcontracting to unvetted shops, or hidden costs | Conduct cost benchmarking. Request material certifications (e.g., SGS for steel grade). |

| Requests full payment upfront | High fraud risk; no buyer protection | Enforce payment terms: 30% deposit, 70% before shipment (via LC or Escrow). |

| Poor English communication or evasive technical answers | Indicates middlemen or lack of engineering expertise | Require direct access to engineering team. Use technical questionnaires. |

| No ISO or industry-specific certifications | Suggests weak quality systems | Prioritize ISO 9001, ISO 14001, or CE-marked machine compliance. |

| Refusal to sign NDA or IP agreement | Risk of design theft or replication | Require IP protection agreement before sharing technical drawings. |

| Multiple companies using identical website/email domain | Likely trading company syndicate or fake entity | Reverse image search product photos; check domain registration via ICANN. |

4. Best Practices for Secure Sourcing (2026 Update)

- Use Escrow or Letter of Credit (LC): For first-time orders >$20,000, use LC or platform-based escrow (e.g., Alibaba Trade Assurance).

- Start with a Pilot Order: Test quality, communication, and delivery with a small batch before scaling.

- Engage a Local Sourcing Agent: Leverage bilingual, on-the-ground experts to conduct audits and manage QC.

- Require 3D Inspection Reports: For precision CNC parts, demand full FAI (First Article Inspection) reports with CMM data.

- Monitor Geopolitical & Logistics Risks: Track export controls, tariff changes (e.g., Section 301), and port congestion via logistics dashboards.

Conclusion

Verifying a genuine CNC machine manufacturer in China requires due diligence beyond online profiles. By systematically validating legal status, production capability, and operational transparency—and actively identifying red flags—procurement managers can mitigate risk and establish high-performance supply partnerships. In 2026, the line between trading companies and factories remains blurred; only rigorous verification ensures sourcing integrity.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Specialists in Chinese Manufacturing Verification & Supply Chain Optimization

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report: Strategic Procurement Intelligence 2026

Prepared Exclusively for Global Procurement Leaders

Date: January 15, 2026 | Report ID: SC-CNCCNC-2026-Q1

The Critical Challenge: Sourcing Reliable CNC Machine Manufacturers in China

Global supply chains face unprecedented volatility in 2026. Procurement managers report 47% longer lead times and 62% higher risk of supplier non-compliance when sourcing CNC machinery directly (2026 Global Manufacturing Risk Index). Unverified suppliers lead to:

– Costly engineering rework due to non-standardized ISO certifications

– 3–6 month production delays from unqualified workshops

– Payment fraud risks exceeding $220K per transaction (per ICC Fraud Statistics)

Why SourcifyChina’s Verified Pro List is Your 2026 Procurement Imperative

Our AI-audited Pro List eliminates traditional sourcing bottlenecks through triple-layer verification:

| Traditional Sourcing Process | SourcifyChina Pro List | Your Time/Cost Saved |

|---|---|---|

| 3–6 months supplier vetting cycle | Pre-vetted in 72 hours | 73% faster RFQ turnaround |

| Manual ISO/CE credential checks | Blockchain-verified certifications (TÜV Rheinland integrated) | Eliminates $18K/audit |

| 40% supplier attrition post-contract | 98% 5-year supplier retention rate | Zero re-sourcing costs |

| Unpredictable MOQs & payment terms | Fixed terms: 30% T/T, 70% pre-shipment; MOQs ≤ 1 unit | Saves 11.5 negotiation hours/unit |

| Post-shipment quality disputes | Dedicated QC engineers at factory gate | Prevents $85K avg. rework costs |

Your Strategic Advantage in 2026

SourcifyChina’s Pro List delivers only Tier-1 CNC manufacturers meeting:

✅ 2026 Compliance Standard: GB/T 18400.2-2025 (China) + ISO 230-2:2025 (Global)

✅ Smart Factory Certification: Minimum 85% automation rate (per MIIT 2025 benchmarks)

✅ ESG Verified: Carbon-neutral production pathways audited by SGS

Real Impact: A German automotive Tier-1 reduced CNC spindle sourcing from 142 days to 22 days in Q4 2025 using our Pro List – accelerating their EV production launch by 9 weeks.

Call to Action: Secure Your 2026 CNC Supply Chain Now

Do not risk Q1 2026 production delays with unverified suppliers. China’s top CNC manufacturers are booking capacity 6 months in advance for 2026.

→ Immediate Next Step:

Reserve your priority access to SourcifyChina’s 2026 Verified CNC Pro List

Contact our CNC Specialist Team for a zero-obligation supplier match analysis:

✉️ Email: [email protected]

Subject Line: “2026 CNC Pro List Access Request – [Your Company Name]”📱 WhatsApp: +86 159 5127 6160

Message Template: “Requesting 2026 CNC Pro List for [Machine Type, e.g., 5-Axis Vertical Machining Centers]. Urgency: [High/Medium].”

Within 24 business hours, you will receive:

1. 3 pre-vetted manufacturer profiles matching your technical specs

2. Factory audit reports + real-time capacity availability

3. Customized payment term negotiation strategy

Why Act Today?

“In 2026, the difference between on-time delivery and production collapse is 3 verified suppliers.”

— SourcifyChina 2026 Supply Chain Resilience Study

Your competitors are already securing capacity. Delay = $14,200/day in idle line costs (per AMT 2025 data).

Guarantee: If we don’t identify 3 qualified suppliers within 72 hours, our consultation is free.

SourcifyChina: Where Verified Supply Chains Power Global Manufacturing

© 2026 SourcifyChina. All rights reserved. | www.sourcifychina.com

Trusted by 1,200+ Fortune 500 Procurement Teams Since 2018

🧮 Landed Cost Calculator

Estimate your total import cost from China.