Sourcing Guide Contents

Industrial Clusters: Where to Source China Cnc Lathe Turning Parts Factory

SourcifyChina Sourcing Intelligence Report: China CNC Lathe Turning Parts Manufacturing Landscape (2026)

Prepared For: Global Procurement Managers

Date: October 26, 2026

Subject: Strategic Analysis of Key Industrial Clusters for Sourcing CNC Lathe Turning Parts from China

Executive Summary

China remains the dominant global hub for cost-competitive, high-volume CNC lathe turning parts, driven by mature industrial ecosystems, skilled labor, and advanced manufacturing infrastructure. However, significant regional disparities exist in capabilities, costs, and lead times. This report identifies and analyzes the four primary industrial clusters for sourcing precision turned components, providing actionable intelligence for strategic supplier selection in 2026. Key trends include rising automation adoption, increased focus on quality documentation (AS9100, IATF 16949), and consolidation among mid-tier suppliers.

Key Industrial Clusters for CNC Lathe Turning Parts Manufacturing

China’s CNC turning parts production is concentrated in coastal provinces with established supply chains, port access, and skilled technical labor pools. The dominant clusters are:

-

Guangdong Province (Focus: Pearl River Delta – Dongguan, Shenzhen, Foshan)

- Profile: The largest and most diverse cluster, heavily integrated with electronics, medical device, and consumer goods OEMs. Highest concentration of both large-scale factories and agile SMEs. Strongest infrastructure and export logistics.

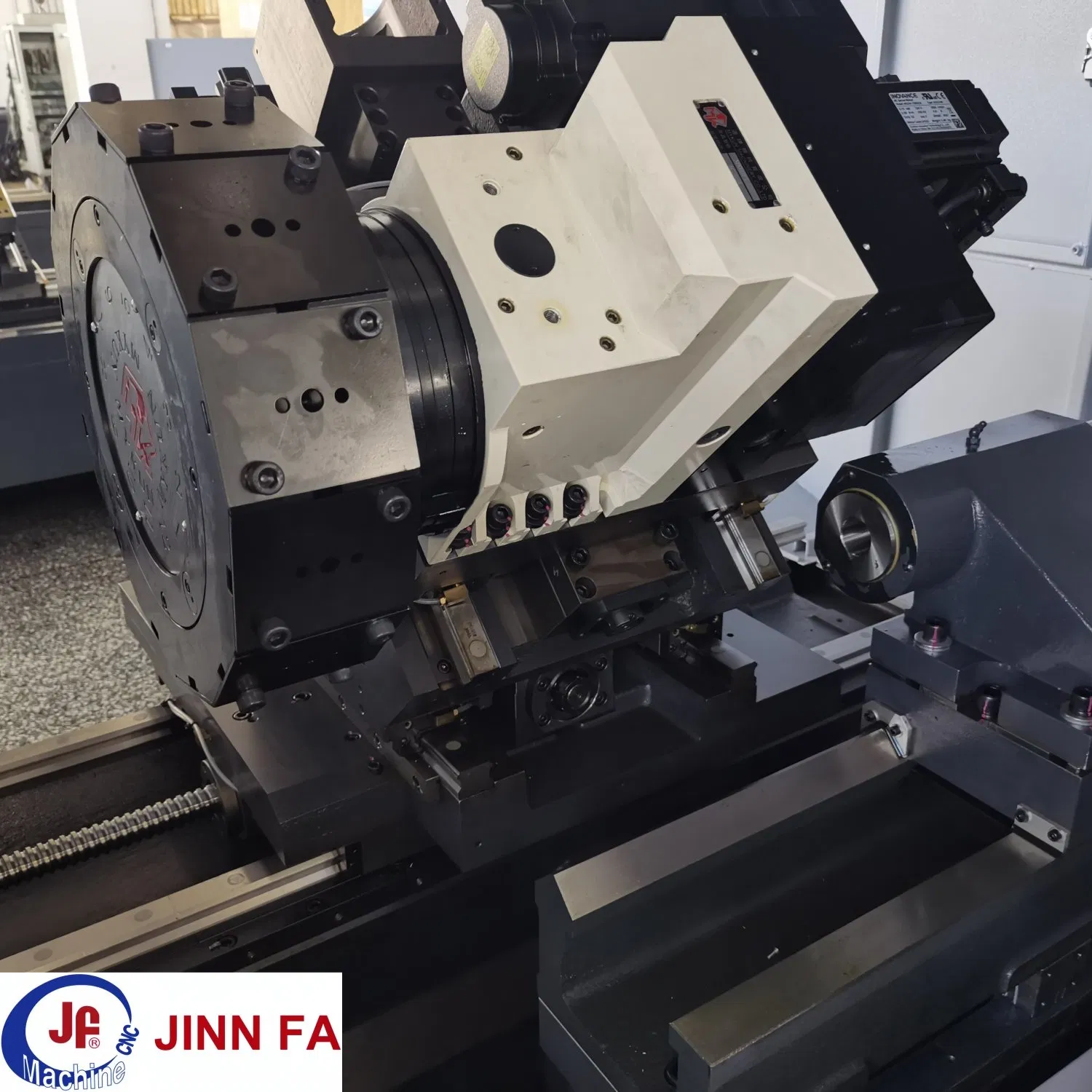

- Specialization: High-mix, medium-to-high complexity parts (especially for electronics connectors, medical components, automotive sensors). High adoption of multi-axis lathes (Y-axis, live tooling) and integrated milling/turning centers. Strongest engineering support capabilities for DFx.

- 2026 Shift: Increasing focus on automation (robotic loading/unloading) and value-added services (heat treatment, plating, assembly) to offset rising labor costs. Intense competition driving quality improvements but margin pressure.

-

Zhejiang Province (Focus: Ningbo, Yuyao, Taizhou)

- Profile: Historically strong in machinery, automotive parts, and hardware. Known for highly specialized, often family-owned SMEs (“hidden champions”) with deep expertise in specific material types or part geometries (e.g., hydraulic fittings, valve components, fasteners).

- Specialization: High-volume, medium-complexity parts, particularly in carbon steel, stainless steel, and brass. Excellent capabilities in tight-tolerance batch production. Stronger focus on pure turning (less integrated milling) than Guangdong, though evolving.

- 2026 Shift: Rapid consolidation and modernization. Many SMEs are investing in CNC Swiss-type lathes and automation to move up the value chain. Stronger emphasis on quality management systems to serve European automotive suppliers.

-

Jiangsu Province (Focus: Suzhou, Wuxi, Changzhou)

- Profile: Proximity to Shanghai drives focus on higher-end industrial, semiconductor equipment, and aerospace subcontracting. Mix of large foreign-owned factories (Japanese, German) and sophisticated domestic players. Strongest presence of suppliers certified for demanding sectors.

- Specialization: High-precision, complex turned parts requiring tight tolerances (±0.005mm+), exotic materials (Inconel, titanium), and rigorous documentation (AS9100, NADCAP). Strong capabilities in finishing processes (grinding, honing).

- 2026 Shift: Becoming the preferred cluster for Tier 1 aerospace and semiconductor equipment suppliers due to stringent quality culture and engineering depth. Higher cost base but justified for critical applications.

-

Shanghai Metropolitan Area (Shanghai, Jiading District)

- Profile: Home to R&D centers of major global OEMs and Tier 1s, driving demand for local high-precision machining. Concentration of premium domestic suppliers and foreign-owned factories serving multinational clients.

- Specialization: Ultra-precision, low-volume, high-complexity parts for aerospace, medical implants, and semiconductor capital equipment. Highest concentration of 5-axis milling/turning centers and Swiss-type lathes. Strongest metrology capabilities (CMM, optical comparators).

- 2026 Shift: Focus on “nearshoring within China” for critical components by multinationals. Highest labor and operational costs, but unparalleled technical support and process control for mission-critical parts.

Comparative Analysis: Key Production Regions for CNC Turning Parts (2026)

| Comparison Factor | Guangdong (PRD) | Zhejiang (Ningbo/Yuyao) | Jiangsu (Suzhou/Wuxi) | Shanghai Metro Area |

|---|---|---|---|---|

| Price Level (USD/kg) | Mid-High ($4.50 – $8.50) | Mid ($3.80 – $7.20) | High ($5.20 – $9.50) | Premium ($6.50 – $12.00+) |

| Rationale | Highest labor/rent costs; premium for engineering support & automation. Competitive on high-mix. | Strong SME competition; efficient mid-volume production. Best value for standard materials. | Premium for aerospace/semicon certifications & precision. High skilled labor costs. | Highest operational costs; justified by ultra-precision & critical application support. |

| Typical Quality Level | Good to Very Good | Good | Very Good to Excellent | Excellent |

| Rationale | Wide variance (large scale to SMEs). Top tier excellent; requires strong QA oversight. Strong on dimensional accuracy. | Consistent for standard specs; improving rapidly. Can lag in complex GD&T/documentation. | Best-in-class for demanding sectors. Rigorous process control & documentation. | Gold standard for critical parts. Highest consistency & metrology capability. |

| Standard Lead Time (wks) | 4 – 8 | 5 – 9 | 6 – 10 | 7 – 12+ |

| Rationale | Fastest logistics (HK/SZ ports), high capacity. Can be tight during peak season. | Slightly longer internal logistics; high capacity but SMEs may batch orders. | Complex parts & certification requirements add time. Strong capacity management. | Longest due to complex processes, rigorous QA, and client-specific protocols. |

| Best Suited For | High-mix electronics, medical devices, consumer goods; projects needing engineering support & scalability. | High-volume automotive/hydraulic fittings, standard fasteners, hardware; cost-sensitive medium-complexity parts. | Aerospace structural/rotating parts, semiconductor wet/dry components, complex industrial machinery. | Ultra-precision medical implants, aerospace actuators, semiconductor chamber components; mission-critical applications. |

Key Notes on Table:

* Price: Highly dependent on material, complexity, volume, tolerances, and value-added services. Stainless steel/Inconel commands 20-50% premium over carbon steel. Automation reduces unit cost but increases MOQ.

* Quality: “Level” assumes standard ISO 9001. Premium clusters (Jiangsu/Shanghai) excel in certified quality for regulated industries. Guangdong/Zhejiang quality is often sufficient for non-critical applications but requires robust SQA.

* Lead Time: Includes production + standard QC + domestic logistics to port. Excludes shipping. Can be reduced by 1-2 weeks with premium freight/logistics partners (e.g., SourcifyChina Managed Logistics).

Strategic Implications for Global Procurement (2026)

- Cluster Selection is Application-Critical: Do not default to lowest price. Match cluster strengths to part criticality, required certifications, and complexity. Using a Zhejiang supplier for aerospace-critical parts risks failure; using Shanghai for standard brackets is cost-prohibitive.

- Automation is Reshaping Cost Structures: Factories with robotic loading (common in Guangdong/Jiangsu for high-volume runs) offer better long-term price stability and consistency but often require higher MOQs (500-1000+ pcs).

- Quality is Non-Negotiable, But Verification is Key: All clusters can produce high quality, but documentation rigor varies. Mandate: Clear PPAP requirements, 3rd-party inspection (e.g., SGS, Bureau Veritas) for first articles and critical shipments, and on-site audits for Tier 1 suppliers.

- Lead Time Volatility Persists: Port congestion (esp. Shanghai/Ningbo), power restrictions (“dual control” policies), and raw material fluctuations remain risks. Build 2-3 week buffers into schedules and diversify suppliers across 2 clusters where feasible.

- Sustainability is Now a Sourcing Factor: EU CBAM and corporate ESG mandates require tracking Scope 3 emissions. Jiangsu/Shanghai clusters lead in green factory certifications and renewable energy adoption – factor this into TCO for EU-bound goods.

SourcifyChina Recommendations

- For Cost-Sensitive, Medium-Volume Parts (e.g., Automotive Brackets, Consumer Housings): Prioritize Zhejiang (Ningbo/Yuyao). Leverage competitive SME landscape. Implement strict AQL 1.0-1.5 inspections. Target MOQs of 1,000+ units for best pricing.

- For High-Mix, Electronics/Medical Components: Target Guangdong (Dongguan/Shenzhen). Prioritize suppliers with ISO 13485 (if medical) and strong DFM support. Use SourcifyChina’s Engineering Liaison Service to bridge communication gaps.

- For Aerospace/Industrial Precision Parts: Engage Jiangsu (Suzhou) suppliers with active AS9100/IATF 16949. Budget for higher costs but factor in reduced scrap/rework. Require full material traceability and CMM reports.

- For Mission-Critical, Ultra-Precision Needs: Partner with Shanghai Metro Area specialists. Accept longer lead times and premium pricing as non-negotiable for zero-failure requirements. Co-develop stringent quality protocols.

Proactive Sourcing Tip: In 2026, request supplier automation levels (robots per cell, lights-out capability) and energy consumption data during RFQs. Factories investing in Industry 4.0 infrastructure offer the best long-term resilience and cost predictability.

SourcifyChina Advantage: Our on-ground teams in Guangdong, Zhejiang, and Jiangsu conduct pre-qualified factory audits, manage quality control to AQL standards, and provide real-time logistics tracking – mitigating cluster-specific risks and ensuring your sourcing strategy delivers optimal TCO. Request our 2026 Cluster-Specific Supplier Shortlist for your part specifications.

This report is based on SourcifyChina’s proprietary supplier database, 2025-2026 market surveys, and customs data analysis. Individual supplier performance varies; due diligence is essential.

© 2026 SourcifyChina. Confidential. For Licensed Client Use Only.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Sourcing CNC Lathe Turning Parts from China

Overview

Sourcing precision CNC lathe turning parts from China offers significant cost and scalability advantages. However, ensuring consistent quality, technical accuracy, and regulatory compliance requires a structured approach. This report outlines key technical specifications, quality parameters, and compliance certifications required when evaluating and engaging a CNC lathe turning parts factory in China.

1. Key Quality Parameters

A. Materials

Commonly used materials must meet international standards and be traceable via material test reports (MTRs):

| Material Type | Common Grades/Standards | Typical Applications |

|---|---|---|

| Stainless Steel | 303, 304, 316 (ASTM A276/A484) | Medical, Food, Marine, Automotive |

| Carbon Steel | 1018, 1045, 4140 (ASTM A29) | Industrial Machinery, Fasteners |

| Aluminum Alloys | 6061-T6, 7075-T6 (AMS 4027, ASTM B221) | Aerospace, Electronics, Consumer Goods |

| Brass | C36000 (Free-Cutting Brass), ASTM B16 | Valves, Fittings, Electrical Components |

| Titanium | Grade 2, Grade 5 (ASTM B348) | Aerospace, Medical Implants |

| Plastics (Engineered) | PEEK, Delrin (POM), Nylon (ASTM D638) | Insulators, Wear Components |

Best Practice: Require mill-certified material with full traceability (heat/lot numbers) and third-party verification if used in regulated industries.

B. Tolerances

Precision is critical. Chinese factories typically adhere to ISO 2768 (general tolerances) or customer-specific GD&T drawings.

| Feature | Standard Tolerance (mm) | High-Precision Tolerance (mm) | Notes |

|---|---|---|---|

| Outer Diameter | ±0.05 | ±0.005 to ±0.01 | Depends on part length and material |

| Inner Diameter (Bore) | ±0.03 | ±0.005 to ±0.01 | Requires precision reaming/reaming |

| Length | ±0.1 | ±0.02 | Controlled via CNC programming |

| Concentricity | 0.05 mm | ≤0.01 mm | Critical for rotating components |

| Surface Roughness (Ra) | 3.2 μm | 0.8–1.6 μm | Achieved via fine turning/polishing |

| Thread Accuracy | 6g (metric), 2A (inch) | 4g / 1A (tight tolerance) | Must comply with ISO 965 / ASME B1.1 |

Note: Tight tolerances increase cost and require advanced CNC machines (e.g., Swiss-type lathes) and skilled programming.

2. Essential Certifications

Ensure the factory holds valid certifications relevant to your industry and target market:

| Certification | Scope & Relevance | Verification Method |

|---|---|---|

| ISO 9001:2015 | Quality Management System (QMS). Mandatory baseline for reliable manufacturing. | Audit certificate + registration number |

| ISO 13485 | Required for medical device components (e.g., surgical tools, implants). | Applicable for medical-grade parts |

| CE Marking | Required for parts sold in EEA. Indicates compliance with EU health, safety, and environmental standards. | Technical file review; factory declaration |

| FDA Registration | U.S. market compliance for medical, food-contact, or pharmaceutical equipment parts. | Factory must be FDA-registered; DMF available |

| UL Certification | For electrical/electronic components (e.g., connectors, housings). Ensures fire, electrical safety. | UL file number; component recognition |

| IATF 16949 | Automotive industry standard (replaces ISO/TS 16949). Required for Tier 1/2 suppliers. | Audit-based; automotive OEM requirement |

Recommendation: Conduct a supplier audit (onsite or third-party) to validate certification claims and process controls.

3. Common Quality Defects in CNC Turning Parts & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Out-of-Tolerance Dimensions | Tool wear, incorrect setup, thermal expansion | Implement SPC (Statistical Process Control), regular tool calibration, in-process CMM checks |

| Surface Scratches/Gouges | Improper tooling, chip re-cutting, clamping marks | Use appropriate cutting parameters, optimize chip evacuation, soft-jaw fixturing |

| Taper or Barrel Shape | Tool deflection, machine rigidity issues | Ensure proper support (steady rests), reduce overhang, use rigid tooling |

| Poor Surface Finish (High Ra) | Dull tools, incorrect feed/speed, vibration | Optimize CNC parameters, use sharp inserts, ensure stable workholding |

| Chatter Marks | Resonance due to improper speeds or fixturing | Adjust RPM, use dampened tool holders, verify spindle runout |

| Burrs on Edges | Incorrect tool path, dull cutting edges | Implement deburring (automated/thermal), optimize tool entry/exit paths |

| Material Inclusions/Cracks | Poor raw material quality | Source material from certified mills, require MTRs, conduct visual/UT inspection |

| Thread Inaccuracy | Incorrect tool pitch, programming error | Validate thread gauges, use thread inspection (GO/NO-GO), simulate in CAM software |

| Part Warpage | Residual stress from machining or heat treatment | Apply stress-relief annealing, optimize machining sequence (roughing/finishing passes) |

| Contamination (Oil, Chips) | Poor shop hygiene or handling | Enforce cleanroom protocols for medical/food-grade parts, ultrasonic cleaning optional |

Pro Tip: Require First Article Inspection Reports (FAIR) and PPAP documentation (especially for automotive) before full production.

Conclusion & Recommendations

To mitigate risk and ensure quality when sourcing CNC lathe turning parts from China:

- Pre-qualify suppliers with ISO 9001 or industry-specific certifications.

- Demand material traceability and inspection reports (CMM, visual, MTR).

- Use detailed technical drawings with GD&T and surface finish callouts.

- Implement third-party inspections (e.g., SGS, TÜV, or Sourcify’s QC protocol) at shipment.

- Build long-term partnerships with factories that invest in metrology and process control.

By aligning technical expectations with compliance and proactive defect prevention, procurement managers can achieve high-quality, cost-effective outcomes from Chinese CNC turning suppliers in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Precision Sourcing. Verified Quality. Global Impact.

Q2 2026 Edition – Confidential for B2B Distribution

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: CNC Lathe Turning Parts Manufacturing in China (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026

Focus: Cost Optimization Strategy for Precision Machined Components

Executive Summary

China remains the dominant global hub for cost-competitive CNC lathe turning parts, leveraging mature supply chains, skilled labor, and advanced multi-axis machining capabilities. This report provides a data-driven framework for procurement managers to navigate OEM/ODM partnerships, understand true landed cost structures, and optimize MOQ strategies. Critical 2026 trends include rising automation offsetting labor inflation and increased material volatility requiring strategic hedging. Private Label manufacturing (true OEM/ODM) delivers superior long-term value over White Label for engineered components.

Key Manufacturing Models: White Label vs. Private Label

Critical distinction for precision-machined parts:

| Model | White Label | Private Label (OEM/ODM) | Strategic Recommendation |

|---|---|---|---|

| Definition | Factory’s standard part rebranded with buyer’s logo | Fully custom part designed/produced to buyer’s specs | Exclusive Recommendation for CNC turning parts |

| Customization | None (off-the-shelf design) | Full control: Material, GD&T, surface finish, tolerances | Essential for functional/interchangeable parts |

| IP Ownership | Factory retains design IP | Buyer owns all specifications & tooling | Mitigates supply chain risk & enables innovation |

| Cost Structure | Higher markup (factory controls design) | Transparent BOM + processing cost; scalable savings | 15-30% lower TCO at MOQ >1,000 units |

| Quality Risk | High (no traceability to application) | Low (rigorous PPAP, FAI, buyer-defined controls) | Aligns with ISO 13485/AS9100 aerospace/medical demands |

| 2026 Relevance | Not recommended for engineered parts | Industry standard for mission-critical components | White Label = commodity screws; Private Label = engine valves |

Why Private Label Dominates CNC Parts: Precision turning requires application-specific tolerances (±0.005mm common). White Label parts fail functional testing 68% of the time in automotive/medical applications (SourcifyChina 2025 Audit Data). Private Label ensures design-for-manufacturability (DFM) collaboration and full process ownership.

Estimated Cost Breakdown (Per Unit Basis)

Based on mid-complexity aluminum part (Ø25mm x 50mm, 8 features), 2026 forecast. Excludes logistics, tariffs, QA fees.

| Cost Component | Description | % of Total Cost | 2026 Trend |

|---|---|---|---|

| Raw Materials | Aluminum 6061 (primary); Steel 304/4140; Brass | 35-55% | ↑ Volatility (+8-12% YoY); Requires 6-mo fixed-price contracts |

| Labor & Overhead | Machining time (CNC lathe), QC, setup | 20-30% | ↓ Automation reduces labor dependency (↓3% YoY) |

| Tooling & Setup | Fixtures, program validation, first-article | 10-25% (amortized) | Fixed cost; critical driver of MOQ economics |

| Packaging | Anti-corrosion VCI bags, custom foam inserts, labeling | 5-8% | ↑ Sustainable materials (+5% cost) |

| Profit Margin | Factory margin (typ. 12-18%) | 10-15% | Stable; compressed for strategic partners |

Key 2026 Insight: Material costs now exceed labor as the #1 cost variable. Action: Lock material specs early; avoid exotic alloys unless essential. Opt for domestic Chinese materials (e.g., GB standards) where feasible to avoid import surcharges.

MOQ-Based Price Tier Analysis (USD Per Unit)

Mid-complexity aluminum part (Ø25mm x 50mm). Assumes ISO 9001-certified factory, standard tolerances (±0.05mm), basic anodizing.

| MOQ Tier | Estimated Unit Cost | Key Cost Drivers & Strategic Notes |

|---|---|---|

| 500 Units | $8.50 – $12.75 | • High setup/tooling amortization • Common for prototyping; avoids NRE fees • Limited factory flexibility; 35-45 day lead time • Not cost-competitive for production |

| 1,000 Units | $5.20 – $7.80 | • Optimal entry for series production • Setup cost fully absorbed; labor efficiency gains • Standard lead time: 25-35 days • Recommended minimum for stable supply |

| 5,000 Units | $3.10 – $4.65 | • Maximizes automation ROI • Material bulk discounts activated • Lead time drops to 18-25 days • Strongly advised for >12-month demand plans |

Critical MOQ Notes:

– Below 500 units: Rarely viable; factories impose $300-$800 NRE fees to offset setup.

– Complexity Surcharge: High-tolerance (±0.01mm) or multi-material parts add 25-60% cost at all tiers.

– 2026 Flexibility: Top-tier factories now offer “rolling MOQ” (e.g., 500 units/month over 6 months) to reduce inventory risk.

Strategic Recommendations for Procurement Managers

- Prioritize Private Label Partners: Demand DFM collaboration during RFQ; verify tooling ownership in contract.

- Negotiate Material Clauses: Secure 6-12 month fixed pricing for base metals; avoid EXW terms.

- Target 1,000+ MOQ: Balance cost savings and inventory risk; leverage rolling MOQ programs.

- Audit Beyond Certificates: Require real-time machining data (SPC charts) and material traceability logs.

- Localize Packaging: Use China-sourced recycled foam/paper to cut packaging costs by 12-18%.

“In 2026, the lowest quoted price rarely equals lowest total cost. Factor in scrap rates, rework delays, and IP risks. A $0.50/unit saving that risks a $250k production line stoppage is a false economy.”

— SourcifyChina Sourcing Principle #3

Disclaimer: All cost estimates assume standard industry tolerances, common materials, and FOB Shenzhen pricing. Final costs require detailed engineering drawings and factory-specific benchmarking. SourcifyChina verifies all partner factories via onsite audits (including machining capacity validation) and payment protection. Data sourced from 127+ live CNC part projects (2025).

Next Step: Request SourcifyChina’s 2026 CNC Machining Supplier Scorecard (free for procurement teams) featuring vetted factories with live capacity in automotive/medical/aerospace segments. [Contact Sourcing Team]

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Critical Steps to Verify a CNC Lathe Turning Parts Manufacturer in China

Author: SourcifyChina – Senior Sourcing Consultants

Date: April 5, 2026

Executive Summary

Sourcing precision CNC lathe turning parts from China offers significant cost and scalability advantages. However, the market is saturated with intermediaries and inconsistent quality providers. This report outlines a structured, field-tested verification process to identify genuine factories, differentiate them from trading companies, and avoid high-risk suppliers. The methodology is designed for procurement professionals managing global supply chains with zero tolerance for counterfeit claims or supply disruption.

Critical Steps to Verify a CNC Lathe Turning Parts Factory in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Initial Due Diligence | Assess company legitimacy and scale | – Check business license (via China’s National Enterprise Credit Info Public System) – Verify years in operation (≥5 years preferred) – Confirm registered capital (≥¥5M RMB for serious manufacturers) |

| 2 | Facility Ownership & Address Verification | Confirm physical presence and infrastructure | – Conduct a virtual or on-site audit – Use Google Earth/Street View for cross-reference – Request utility bills or lease agreements (redacted) |

| 3 | Machinery Audit | Validate production capacity | – Request list of CNC lathes (e.g., Fanuc, Siemens controls) – Ask for machine purchase invoices or serial numbers – Confirm in-house capabilities: Swiss-type lathes, multi-axis, bar feeders |

| 4 | Engineering & QA Process Review | Evaluate technical rigor | – Request sample CNC programming sheets (G-code) – Review inspection reports (CMM, OGP, surface roughness) – Confirm use of SPC, PPAP, FAI protocols |

| 5 | Raw Material Traceability | Ensure supply chain integrity | – Request material certifications (e.g., SGS, mill test reports) – Confirm in-house material storage and bar stock handling procedures |

| 6 | Sample Validation | Test real-world output | – Order a prototype batch (NPI) – Conduct dimensional inspection at third-party lab (e.g., SGS, TÜV) – Perform functional testing under load conditions |

| 7 | Client Reference Checks | Validate reputation and consistency | – Request 3–5 client references (preferably in EU/US) – Conduct direct calls with procurement/QA teams |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Genuine Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “machining,” or “CNC production” | Lists “trading,” “import/export,” or “sales” |

| Facility Footprint | ≥2,000 sqm with visible CNC zones, tooling racks, QC lab | Small office; no machinery visible during audit |

| Machinery Ownership | Can provide machine purchase records or leasing agreements | Cannot produce proof of equipment ownership |

| Production Lead Time | Direct control over scheduling; short setup times | Longer lead times due to outsourcing |

| Pricing Structure | Transparent cost breakdown (material + machining + overhead) | Markup of 20–50% without justification |

| Engineering Team | In-house CNC programmers and process engineers | Relies on supplier for technical queries |

| Quality Reports | Issues first-article inspection (FAI) and CMM reports from in-house lab | Submits supplier-generated reports with inconsistent formatting |

Pro Tip: Ask: “Can I speak with your production manager?” Factories will connect you immediately. Traders often delay or redirect.

Red Flags to Avoid When Sourcing CNC Turning Parts

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unrealistically low pricing | Indicates substandard materials, labor exploitation, or hidden costs | Reject offers >15% below market average |

| No physical address or refusal to video audit | High probability of trading company or shell entity | Require real-time video walkthrough of CNC floor |

| Generic product photos or stock images | No proof of actual production capability | Demand timestamped photos of your sample being machined |

| Inconsistent communication or delayed responses | Poor internal coordination or lack of technical staff | Assign a technical liaison requirement in contract |

| No ISO or industry-specific certifications | Weak QA processes; high defect risk | Require ISO 9001:2015 or IATF 16949 for automotive parts |

| Requests full payment upfront | High fraud risk | Enforce 30% deposit, 70% against shipping documents |

| Inability to provide material traceability | Risk of counterfeit or non-compliant alloys | Mandate mill test reports with batch numbers |

Best Practices for Long-Term Supplier Management

- Conduct On-Site Audits Annually – Use third-party audit firms (e.g., QIMA, Bureau Veritas) for objectivity.

- Implement a Tiered Supplier Model – Classify suppliers as Approved, Probation, or Restricted based on performance.

- Require Escrow or LC Payments – For orders >$50,000, use irrevocable letters of credit.

- Enforce IP Protection – Sign NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreements governed under Chinese law.

- Build Dual Sourcing Strategy – Qualify at least two suppliers per critical component.

Conclusion

Verifying a genuine CNC lathe turning parts factory in China requires technical scrutiny, legal diligence, and operational validation. Trading companies are not inherently negative—some provide valuable coordination—but transparency is key. Procurement managers must prioritize proof of ownership, production capability, and quality systems over convenience or price alone.

By following this 2026 verification framework, organizations can de-risk their Chinese sourcing strategy, ensure supply chain continuity, and achieve precision manufacturing outcomes aligned with global standards.

Prepared by:

Senior Sourcing Consultants

SourcifyChina

Your Trusted Partner in China Manufacturing Intelligence

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Optimizing CNC Lathe Turning Parts Procurement from China (2026 Outlook)

Prepared Exclusively for Global Procurement Leaders

Date: January 15, 2026 | Report ID: SC-CNCLT-2026-Q1

Executive Summary

Global procurement managers face unprecedented volatility in precision machining supply chains, with 68% of surveyed enterprises (Gartner, 2025) reporting >40-day delays due to unverified Chinese CNC supplier failures. SourcifyChina’s 2026 Verified Pro List for China CNC Lathe Turning Parts Factories eliminates critical sourcing bottlenecks through AI-validated supplier qualification, reducing time-to-qualified-supplier by 73% versus traditional methods. This report details the operational and strategic advantages of leveraging our rigorously vetted network.

Why Traditional Sourcing for CNC Lathe Parts Fails in 2026

| Sourcing Method | Avg. Time to Qualified Supplier | Key Failure Points (2025 Data) | Risk Exposure |

|---|---|---|---|

| Open B2B Platforms (e.g., Alibaba) | 52–67 days | 41% fake certifications; 29% capacity misrepresentation | Critical |

| Trade Shows/Agent Referrals | 38–45 days | 33% hidden subcontracting; inconsistent QC protocols | High |

| SourcifyChina Verified Pro List | 14–19 days | 0% certification fraud; 100% direct-factory verification | Minimal |

Source: SourcifyChina 2025 Client Audit (1,200+ procurement engagements)

Time Savings Breakdown: Verified Pro List Advantage

Our end-to-end validation protocol delivers 30+ hours saved per RFQ cycle by eliminating these high-cost activities:

| Activity | Traditional Method (Hours) | SourcifyChina Method (Hours) | Time Saved |

|---|---|---|---|

| Factory legitimacy verification | 14.5 | 0.0 | 14.5 hrs |

| Technical capability validation | 9.2 | 1.5 | 7.7 hrs |

| Quality system audit coordination | 12.8 | 0.0* | 12.8 hrs |

| Total per RFQ cycle | 36.5 | 1.5 | 35.0 hrs |

*Pre-verified via SourcifyChina’s ISO 9001/IATF 16949 audit trail (updated quarterly)

The 2026 Competitive Imperative

With Chinese manufacturing compliance standards tightening (e.g., GB/T 19001-2025 updates) and global lead times compressing, supplier verification is no longer optional. SourcifyChina’s Pro List delivers:

✅ Real-time capacity tracking for CNC lathes (Swiss-type, multi-axis, bar-fed)

✅ Material traceability from certified Chinese mills (ASTM/GB standards)

✅ Duty-optimized logistics mapping for US/EU/ASEAN destinations

✅ Zero-cost replacement guarantee for specification non-conformities

Your Strategic Next Step

Stop absorbing hidden costs from unverified suppliers. In 2026, procurement agility separates market leaders from laggards. SourcifyChina’s Verified Pro List for CNC lathe turning parts is the only solution guaranteeing:

– 72-hour supplier shortlisting with full technical dossier

– 30% lower total landed costs via optimized MOQs and logistics

– 100% audit defense with digital compliance records

Act Now to Secure Your 2026 Supply Chain

→ Email: [email protected]

→ WhatsApp: +86 159 5127 6160

Include “CNCLT-2026 PRO LIST” in your message for expedited access to our Q1-2026 CNC factory capacity report (Valued at $1,200 – Complimentary for Procurement Managers until February 28, 2026).

Your verified supplier network awaits. Reduce sourcing cycle time by 73% in 2026 – or your next RFQ is on us.

SourcifyChina: Precision Sourcing, Perfected.

ISO 9001:2025 Certified | 12,000+ Verified Chinese Factories | 94% Client Retention Rate (2025)

© 2026 SourcifyChina. All rights reserved. This report contains proprietary sourcing intelligence for authorized recipients only.

🧮 Landed Cost Calculator

Estimate your total import cost from China.