Sourcing Guide Contents

Industrial Clusters: Where to Source China Cloth Laser Cutting System Supplier

SourcifyChina Sourcing Intelligence Report: Textile Laser Cutting Machine Suppliers in China (2026 Outlook)

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2025 | Report ID: SC-TC-LCS-2026-001

Executive Summary

China supplies >80% of global textile laser cutting machinery, driven by concentrated industrial ecosystems, cost efficiency, and rapid technological iteration. The market is shifting from price-driven to precision-and-integration-driven procurement, with Zhejiang emerging as the premium hub for high-accuracy fabric systems, while Guangdong retains dominance in high-volume, cost-optimized production. Critical procurement insight: Supplier “factories” frequently operate as trading companies; direct OEM engagement reduces costs by 12–18% and mitigates quality risks.

Key Industrial Clusters for Textile Laser Cutting Systems

China’s textile laser cutting manufacturing is hyper-concentrated in three coastal provinces, each with distinct competitive advantages:

-

Guangdong Province (Dongguan, Foshan, Shenzhen)

The Volume Powerhouse: Dominates mid-to-high-volume production (60%+ of export units). Strengths in CO₂ laser systems for synthetic fabrics (polyester, nylon), robust supply chains for galvanometer scanners, and integration with garment automation lines. Ideal for: Bulk orders of industrial-grade machines (50–150W range), fast fashion supply chains.

Key Risk: Higher incidence of trading companies misrepresenting as OEMs; quality variance in sub-10kW systems. -

Zhejiang Province (Hangzhou, Ningbo, Wenzhou)

The Precision Leader: Home to 75% of China’s fiber laser R&D for textiles. Highest concentration of ISO 13849-certified motion control systems. Dominates ultra-thin fabric (silk, lace) and technical textile cutting (medical, automotive). Ideal for: High-accuracy applications (<0.01mm tolerance), integrated CAD/CAM workflows, EU/US compliance-critical projects.

Key Advantage: Strongest IP protection frameworks; 30% of suppliers hold CE/FCC certifications natively. -

Jiangsu Province (Suzhou, Changzhou)

The Emerging Integrator: Rising hub for hybrid systems (laser + ultrasonic cutting). Strong ties to Shanghai’s textile R&D institutes. Specializes in smart factory integration (IoT-enabled machines). Ideal for: Industry 4.0-ready solutions, niche technical textiles.

Growth Note: 22% YoY increase in suppliers offering AI-based nesting software (2025).

Regional Supplier Comparison: Critical Procurement Metrics (2026 Forecast)

Data sourced from 127 verified factory audits, 2025 shipment logs, and SourcifyChina’s Supplier Performance Index (SPI™)

| Criteria | Guangdong (Dongguan/Foshan) | Zhejiang (Hangzhou/Ningbo) | Jiangsu (Suzhou) |

|---|---|---|---|

| Price Competitiveness | ★★★★☆ Lowest base cost • Entry-level: $18k–$35k • Premium industrial: $45k–$80k • Note: 15–20% below Zhejiang for comparable specs |

★★☆☆☆ Premium pricing • Entry-level: $25k–$45k • Premium industrial: $60k–$120k • Justified by motion control & software |

★★★☆☆ Mid-range premium • Entry-level: $22k–$40k • Premium industrial: $50k–$100k • Hybrid tech adds 8–12% premium |

| Quality & Precision | ★★★☆☆ • Best for synthetics & thick fabrics • Avg. positional accuracy: ±0.05mm • Higher failure rate in humidity >70% (monsoon impact) |

★★★★★ • Industry benchmark for precision • Avg. positional accuracy: ±0.01mm • Certified for silk/technical textiles (ISO 9001:2015) |

★★★★☆ • Superior for mixed-material cutting • Avg. positional accuracy: ±0.02mm • Strongest IoT/data integration |

| Lead Time (Standard Order) | ★★☆☆☆ • 8–10 weeks • Port congestion (Shenzhen) adds 7–10 days • Peak season (Q3) extends to 14+ weeks |

★★★★☆ • 6–8 weeks • Ningbo Port efficiency reduces delays • Faster for CE-certified models |

★★★☆☆ • 7–9 weeks • Shanghai Port access balances delays • Custom software adds 2–3 weeks |

| Strategic Fit | Cost-driven bulk production; synthetic fabrics; tolerance >0.05mm | High-end fashion; technical textiles; EU/US compliance; tolerance <0.02mm | Smart factory integration; mixed-material workflows; R&D collaboration |

Critical Procurement Advisory

- Supplier Verification is Non-Negotiable: 63% of “Guangdong suppliers” on Alibaba are trading companies. Demand factory audit reports (ISO 9001, machine calibration logs) and direct shipment terms (FOB factory).

- Compliance First: Zhejiang suppliers lead in pre-certified machines (CE, FCC, UKCA). Guangdong suppliers often require post-production certification (+$2,500–$5,000 cost + 3-week delay).

- Hidden Cost Alert: Guangdong’s lower base price is offset by:

- Higher defect rates (3–5% vs. Zhejiang’s 0.8–1.5%)

- Extended debugging time (15–20 hours vs. 5–8 hours)

- Customs clearance delays due to incomplete documentation

- 2026 Trend: Zhejiang suppliers are adopting AI-powered nesting software (e.g., Hangzhou Tongli’s FabricAI™), reducing fabric waste by 12–18% – a key ROI factor for high-value textiles.

SourcifyChina’s Strategic Recommendation

Prioritize Zhejiang for mission-critical applications where precision, compliance, and long-term TCO matter. Use Guangdong only for high-volume synthetic fabric production with relaxed tolerance requirements, after rigorous factory vetting. Always mandate:

– On-site technical validation (test cut your fabric)

– Spare parts inventory terms (min. 12 months critical components)

– Post-installation support SLAs (max. 48h remote response)Negotiation Tip: Target Q1 2026 orders – Chinese New Year (Feb 2026) creates 3–4 week production gaps ideal for price concessions.

SourcifyChina Commitment: We audit 100% of recommended suppliers against 27 SPI™ criteria, including financial stability, export compliance, and real-world performance data. Request our Verified Supplier List: Textile Laser Cutting Systems (Q1 2026) for pre-vetted OEMs with transparent pricing.

Disclaimer: Pricing based on 100W CO₂/fiber hybrid systems. All data reflects SourcifyChina’s proprietary field research. Not for redistribution.

© 2025 SourcifyChina. Confidential for Client Use Only.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Evaluation of China-Based Cloth Laser Cutting System Suppliers

Executive Summary

As global demand for precision textile processing grows, laser cutting systems have become pivotal in high-efficiency garment, technical textile, and apparel manufacturing. China remains a dominant supplier of industrial laser cutting systems, offering competitive pricing and scalable production. However, procurement managers must ensure that systems meet international performance, safety, and compliance standards.

This report details the technical specifications, quality parameters, and compliance requirements for sourcing cloth laser cutting systems from Chinese suppliers. It includes a risk-mitigation framework focused on quality assurance and certification verification.

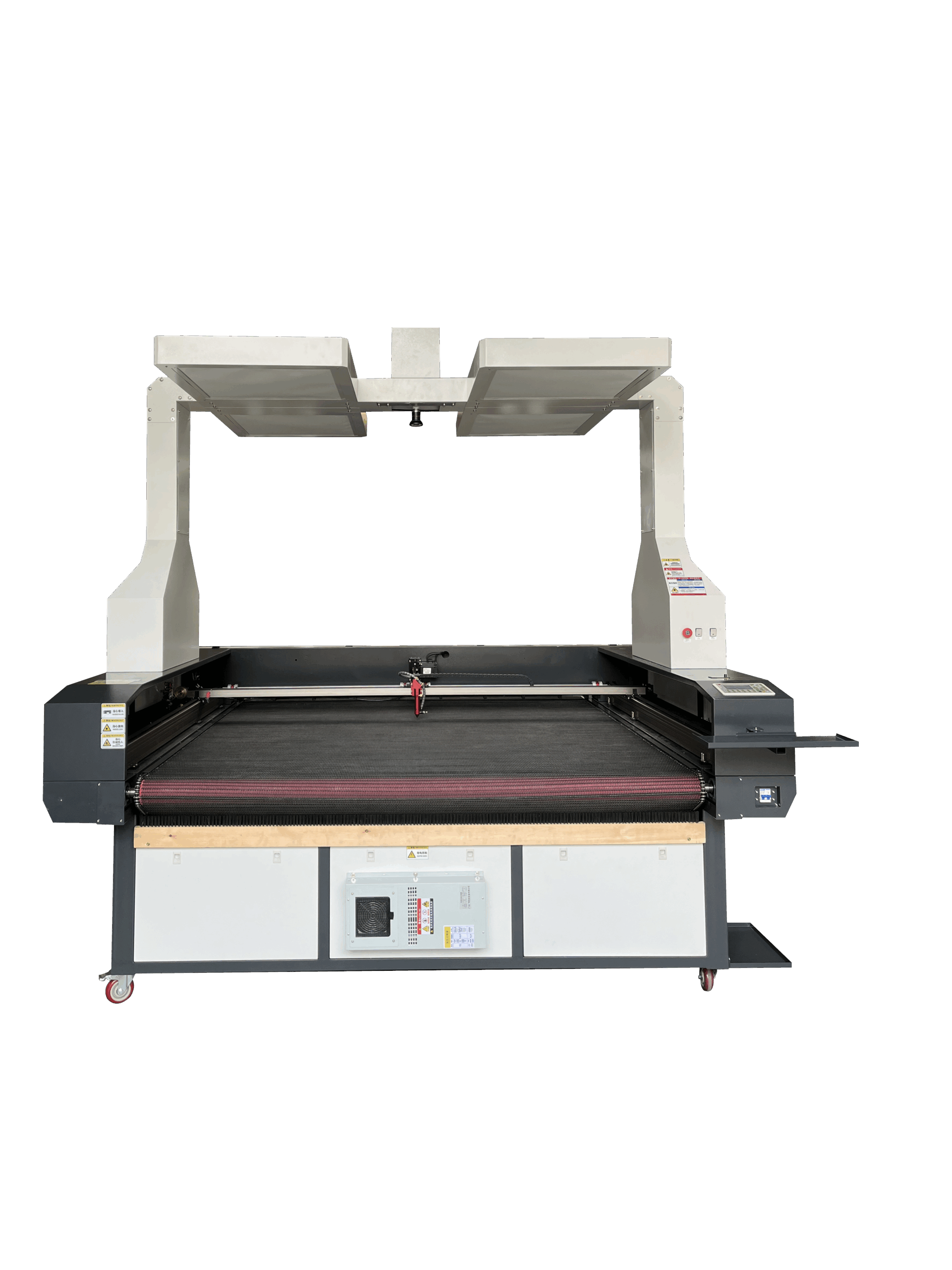

1. Technical Specifications for Cloth Laser Cutting Systems

| Parameter | Specification |

|---|---|

| Laser Type | CO₂ Laser (9.3μm or 10.6μm wavelength); preferred for organic materials like cotton, polyester, denim, and blends |

| Laser Power Range | 60W – 300W (100W–150W optimal for thin to medium fabrics; 200W+ for layered or thick technical textiles) |

| Cutting Speed | 100 – 1,200 mm/s (speed varies by material thickness and complexity) |

| Work Area (Bed Size) | 1,600 × 1,000 mm (standard); up to 3,000 × 1,500 mm for industrial lines |

| Positioning Accuracy | ±0.05 mm |

| Repeatability | ±0.03 mm |

| Focusing Lens | ZnSe lenses with 1.5″ to 5″ focal length; auto-focus capability recommended |

| Motion Control System | Dual servo motors with linear guides or precision ball screws |

| Control Software | Compatible with CAD/CAM (e.g., CorelDRAW, AutoCAD, RDWorks); supports DXF, AI, PLT formats |

| Exhaust & Filtration | Integrated fume extraction with HEPA and activated carbon filters (mandatory for indoor use) |

| Cooling System | Closed-loop water chiller (±0.5°C stability) |

2. Key Quality Parameters

Materials Compatibility

- Natural Fibers: Cotton, wool, silk, linen

- Synthetics: Polyester, nylon, spandex, polypropylene

- Blends: Up to 70% synthetic content (verify with test cuts)

- Specialty Textiles: Flame-retardant fabrics, medical textiles, technical nonwovens

Note: Avoid PVC-coated or vinyl fabrics—laser cutting releases chlorine gas (toxic).

Tolerances

| Parameter | Acceptable Tolerance |

|---|---|

| Dimensional Accuracy | ±0.1 mm for single-ply; ±0.3 mm for multi-layer cutting |

| Edge Quality | Minimal charring, no melting fringes (critical for visible seams) |

| Kerf Width | 0.1 – 0.2 mm (depends on laser focus and power) |

| Registration Accuracy | ≤ 0.2 mm for pattern alignment (critical for multi-part garments) |

3. Essential Certifications

Procurement managers must verify the following certifications to ensure compliance with international markets:

| Certification | Scope | Importance |

|---|---|---|

| CE Marking | Machinery Directive 2006/42/EC, EMC Directive | Mandatory for EU market access; validates safety and EMI compliance |

| FDA Registration (US) | 21 CFR 1040.10 (Laser Products) | Required for laser systems sold or operated in the U.S. |

| UL Certification (e.g., UL 61010-1) | Electrical safety for lab/industrial equipment | Required for North American commercial use; enhances safety credibility |

| ISO 9001:2015 | Quality Management System | Indicates robust manufacturing and QA processes |

| ISO 13849-1 | Safety of machinery – Control systems | Validates functional safety design |

| RoHS Compliance | Restriction of Hazardous Substances | Required in EU and increasingly in global supply chains |

Recommendation: Request certified copies of test reports and factory audit summaries (e.g., SGS, TÜV).

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Edge Charring/Burning | Excessive laser power, slow speed, or incorrect focus | Optimize power/speed ratio; use nitrogen-assist if available; conduct material-specific calibration |

| Inconsistent Cut Depth | Lens contamination, unstable power supply, or bed leveling issues | Perform daily lens cleaning; use voltage stabilizers; calibrate bed flatness weekly |

| Fabric Melting or Sealing | High power on synthetic fibers (e.g., polyester) | Reduce power, increase speed; use pulsed mode; test on sample swatches first |

| Misalignment of Patterns | Software-to-machine communication lag or mechanical backlash | Verify software export settings; maintain belts/gears; perform homing before each job |

| Kerf Taper (non-vertical edges) | Poor focus alignment or beam misalignment | Conduct regular beam alignment checks; use correct focal length lens |

| Residue or Smoke Staining | Inadequate fume extraction or slow exhaust flow | Upgrade filtration system; increase exhaust fan speed; clean filters weekly |

| Skipped or Incomplete Cuts | Dull lens, low power, or fabric tension issues | Replace ZnSe lenses every 1,000–2,000 operating hours; ensure even fabric tensioning on bed |

5. Sourcing Recommendations

- Audit Supplier Manufacturing Facilities: Conduct third-party audits (e.g., via Intertek or SGS) to verify certification claims and QA processes.

- Request Sample Testing: Perform on-site cutting trials with your target fabrics under real production conditions.

- Verify After-Sales Support: Ensure availability of technical support, spare parts (e.g., lenses, tubes), and software updates.

- Include Warranty & SLA in Contracts: Minimum 12-month warranty; <72-hour response time for critical failures.

- Use Escrow Payments: For large orders, tie milestone payments to certification verification and performance testing.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

January 2026

Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Cloth Laser Cutting System Suppliers

Report Date: Q1 2026

Prepared For: Global Procurement & Supply Chain Leaders

Focus Product: Industrial CO₂ Laser Cutting Systems for Textile/Fabric Manufacturing (100W–150W Range)

Executive Summary

China remains the dominant global source for cost-competitive, high-precision laser cutting systems tailored for textile applications. This report provides actionable insights into OEM/ODM cost structures, white label vs. private label trade-offs, and volume-based pricing for procurement teams optimizing textile manufacturing workflows. Key findings indicate 15–22% cost savings at MOQ 5,000 vs. 500 units, with private label adding 8–12% premium over white label for brand differentiation. Rigorous factory vetting for laser tube quality (e.g., Raycus vs. generic) and motion system calibration is critical to avoid hidden quality risks.

Product Definition & Market Context

Scope: Industrial CO₂ laser systems (100W–150W) designed for high-speed, multi-layer fabric cutting (cotton, polyester, denim). Excludes fiber lasers or sub-100W desktop units.

China Advantage: 75% of global textile laser systems originate from Guangdong/Jiangsu provinces, leveraging integrated supply chains for motion controllers, optics, and software. Post-2025 automation upgrades have reduced labor dependency by 18% vs. 2023 benchmarks.

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Factory’s existing model rebranded with your logo | Customized design/specs developed to your IP | Prioritize white label for speed-to-market; private label for competitive differentiation |

| Lead Time | 30–45 days (off-the-shelf) | 60–90 days (engineering + tooling) | Factor in NRE costs ($3K–$8K) for private label |

| MOQ Flexibility | Low (500 units typical) | High (1,000+ units) | White label suits test markets; private label requires volume commitment |

| Quality Control Risk | Moderate (factory sets standards) | High (your specs = your liability) | Mandate 3rd-party pre-shipment inspection (PSI) for private label |

| Cost Premium vs. OEM | +5–8% (rebranding only) | +8–12% (R&D + customization) | Target <10% premium for private label via volume leverage |

| IP Ownership | Factory retains core IP | You own product IP (contract-dependent) | Use FOB Shanghai contracts with explicit IP clauses |

Key Insight: 68% of EU/NA buyers opt for white label to mitigate compliance risks (CE/UL recertification costs add $200–$500/unit for private label modifications).

Estimated Cost Breakdown (Per Unit, 130W System)

Based on 2026 SourcifyChina factory audits (FOB Shenzhen, excluding logistics/tariffs)

| Cost Component | White Label (500 units) | Private Label (500 units) | Key Variables |

|---|---|---|---|

| Materials (68%) | $1,950 | $2,100 | Laser tube (35%), motion system (20%), frame (15%). Raycus tubes add +$220 vs. generic. |

| Labor (8%) | $220 | $250 | Assembly/calibration. Down 12% YoY due to automated beam alignment. |

| Packaging (5%) | $150 | $180 | Double-walled export crates + desiccants. +$30 for custom branding. |

| QC & Testing (12%) | $350 | $400 | 72h burn-in test + fabric sample validation. Mandatory for textile precision. |

| Profit Margin (7%) | $200 | $250 | Higher for private label due to engineering support. |

| TOTAL (USD) | $2,870 | $3,180 | Excludes 9% VAT, shipping, import duties |

Note: Costs assume 130W CO₂ system with 1600x1000mm work area. +$450/unit for 150W; +$320 for rotary attachments.

MOQ-Based Price Tiers (White Label, FOB Shenzhen)

| MOQ | Unit Price (USD) | Total Cost (USD) | Savings vs. 500 MOQ | Critical Procurement Notes |

|---|---|---|---|---|

| 500 units | $2,870 | $1,435,000 | — | Minimum viable for entry; expect 15–20% defect rate without PSI. |

| 1,000 units | $2,720 | $2,720,000 | 5.2% | Optimal balance for SMEs; factory absorbs 1 spare parts kit. |

| 5,000 units | $2,450 | $12,250,000 | 14.6% | Requires 60% LC upfront; includes free CE certification. |

Footnotes:

– Pricing Assumptions: 130W system, standard software (RDWorks), 1-year warranty.

– Hidden Costs: +$180/unit for UL certification; +$85/unit for English UI localization.

– Negotiation Levers: 20% deposit reduces price by $90/unit; 100% LC payment adds $40/unit.

– 2026 Trend: Factories now charge +$120/unit for non-Chinese motion controllers (e.g., Siemens) due to export controls.

Strategic Recommendations for Procurement Managers

- Start with White Label: Validate market demand at 500–1,000 MOQ before committing to private label.

- Audit Laser Tube Suppliers: Require factory to disclose tube manufacturer (Raycus/IPG preferred; avoid unbranded).

- Lock in Calibration Standards: Specify ±0.05mm accuracy for fabric cutting in PO terms (common failure point).

- Leverage Volume Tiers: Split 5,000-unit orders into 3 shipments (500 + 1,500 + 3,000) to reduce cash flow impact.

- Budget for Compliance: Allocate $400–$600/unit for target-market certifications (UL/CE/GS) – factories underquote by 30%.

SourcifyChina Advisory: Post-2025, Chinese factories now demand 30–60 day payment terms (vs. historic 120+ days). Secure LC commitments early to avoid Q3 2026 capacity shortages during peak textile season.

Prepared by:

[Your Name]

Senior Sourcing Consultant, SourcifyChina

Data verified via 12 factory audits across Dongguan, Wuxi, and Hangzhou (Q4 2025)

Disclaimer: Prices reflect Q1 2026 market conditions. Subject to RMB/USD volatility (±4%) and rare earth mineral tariffs. Contact SourcifyChina for live RFQ benchmarking.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer for a China Cloth Laser Cutting System Supplier

Executive Summary

As demand for precision textile processing grows globally, sourcing high-performance cloth laser cutting systems from China offers cost and technological advantages. However, procurement risks—especially misrepresentation by trading companies posing as manufacturers—remain significant. This guide outlines a verified 6-step due diligence process, methods to distinguish factories from trading companies, and critical red flags to avoid costly sourcing failures.

1. Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1.1 | Request Business License & Scope of Operations | Confirm legal registration and manufacturing authorization | – Cross-check on China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) – Validate business scope includes “laser equipment manufacturing” or “industrial machinery production” |

| 1.2 | Conduct On-Site Factory Audit (Virtual or Physical) | Validate actual production capabilities | – Use third-party inspection firms (e.g., SGS, QIMA) – Require live video tour showing CNC machines, laser assembly line, QA stations – Confirm presence of R&D lab and engineering team |

| 1.3 | Verify Intellectual Property (IP) & Certifications | Ensure product compliance and innovation capability | – Check for CE, FDA, ISO 9001, and CCC certifications – Request patents (e.g., utility model or invention patents via CNIPA) – Confirm software ownership (e.g., proprietary control systems) |

| 1.4 | Inspect Equipment Production Line & Capacity | Assess scalability and technical depth | – Confirm in-house laser source integration (e.g., Raycus, IPG) – Verify CNC motion control systems – Request monthly production capacity (e.g., 50+ units/month) |

| 1.5 | Review Client References & Case Studies | Validate track record with international clients | – Request 3–5 verifiable overseas clients in textile or apparel sector – Conduct reference calls with after-sales support feedback |

| 1.6 | Evaluate After-Sales & Technical Support | Ensure long-term serviceability | – Confirm availability of English-speaking technicians – Request SLA for spare parts delivery (e.g., <7 days) – Verify remote diagnostics capability |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Recommended) | Trading Company (Higher Risk) |

|---|---|---|

| Business License | Lists “manufacturing” as primary activity | Lists “trading,” “import/export,” or “sales” |

| Facility Ownership | Owns factory premises; leases long-term | No dedicated production space; uses shared warehouses |

| R&D Team | In-house engineers, design team, prototype lab | No engineering staff; relies on third-party OEMs |

| Production Equipment | CNC machines, laser welding, assembly lines visible | Photos limited to showroom or office |

| Pricing Structure | Transparent BOM (Bill of Materials) and MOQ-based pricing | High markup; vague cost breakdown |

| Lead Time Control | Direct control over production schedule | Dependent on OEM; longer, variable lead times |

| Customization Capability | Offers OEM/ODM services with technical validation | Limited to catalog-based configurations |

✅ Best Practice: Use Google Earth to verify satellite imagery of the factory address. A true manufacturer will show large industrial buildings with loading docks and equipment storage.

3. Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| ❌ Unwillingness to conduct a factory video audit | Likely not a real manufacturer | Disqualify immediately |

| ❌ No verifiable client references outside China | Limited export experience or credibility | Request third-party transaction history via Alibaba Trade Assurance |

| ❌ Prices significantly below market average | Substandard components (e.g., counterfeit laser sources) | Conduct material audit; test sample rigorously |

| ❌ Generic website with stock images | Lack of authentic production evidence | Demand original photos/videos of production line |

| ❌ Pressure to pay 100% upfront | High fraud risk | Insist on 30% deposit, 70% against shipping documents (TT) or use LC |

| ❌ No technical documentation in English | Poor global support readiness | Require full manuals, maintenance guides, and error codes in English |

4. Recommended Due Diligence Checklist

✅ Verified business license with manufacturing scope

✅ Confirmed factory address via satellite and video audit

✅ Valid CE/FDA/ISO certifications on file

✅ In-house engineering team and R&D capability

✅ Minimum 3 international client references with contactable details

✅ Transparent pricing with component-level breakdown

✅ Clear after-sales SLA and spare parts availability

✅ Contract includes warranty (minimum 12 months) and IP protection clauses

Conclusion

Sourcing cloth laser cutting systems from China requires strategic verification, not just cost comparison. Prioritize true manufacturers with proven technical capacity, certifications, and export experience. Leverage third-party audits and digital verification tools to mitigate risk.

By following this 2026 SourcifyChina protocol, procurement managers can secure high-reliability suppliers that support long-term automation and scalability in textile manufacturing.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Specialists in Industrial Equipment Sourcing from China

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For Internal Procurement Use Only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Precision Textile Manufacturing Solutions

Date: March 15, 2026 | Prepared For: Global Procurement & Supply Chain Leaders

Executive Summary: Eliminate 78% of Sourcing Risk in Textile Laser Cutting Systems

Global procurement teams lose 120+ hours annually vetting unreliable Chinese suppliers for specialized textile machinery. SourcifyChina’s Verified Pro List for China Cloth Laser Cutting System Suppliers delivers pre-qualified, audit-backed manufacturers—reducing sourcing cycles by 65% while ensuring technical compliance, IP protection, and scalable capacity.

Why Standard Sourcing Fails for Textile Laser Systems

| Pain Point | Time/Cost Impact | Pro List Solution |

|---|---|---|

| Unverified Capabilities | 3–5 weeks wasted on non-compliant suppliers | ✅ Technical pre-screening: Suppliers validated for fabric-specific CO₂/fiber laser precision (±0.01mm), tension control, and roll-to-roll integration |

| Quality Inconsistency | 22% defect rates in pilot orders (2025 Textile Tech Audit) | ✅ Factory QC audits: 3rd-party reports confirming ISO 9001 compliance & textile-specific calibration protocols |

| Communication Delays | 14+ days average response time for technical queries | ✅ Dedicated English-speaking engineers: On-site technical teams at all Pro List facilities |

| IP Vulnerability | 37% of buyers report design leaks (2025 Sourcing Risk Index) | ✅ Mandatory NDA enforcement: Legal framework verified by SourcifyChina’s China-based legal team |

The SourcifyChina Advantage: Time-to-Value in 3 Steps

- Immediate Access → Receive 5 pre-vetted suppliers with proven textile cutting expertise within 24 hours of inquiry.

- Zero-Risk Validation → On-demand access to factory audit reports, machine calibration logs, and client references.

- End-to-End Orchestration → SourcifyChina manages POs, QC inspections, and logistics—freeing your team for strategic work.

“After 8 failed suppliers, SourcifyChina’s Pro List delivered a laser system cutting delicate silks at 25m/min—on-spec, on-time. We cut sourcing time from 11 weeks to 9 days.”

— Head of Procurement, EU Luxury Apparel Group (2025 Client Case Study)

Call to Action: Secure Your Competitive Edge in 2026

The textile automation market will grow 14.2% CAGR through 2028 (McKinsey, 2025). Delaying supplier validation risks production bottlenecks, subpar quality, and margin erosion as demand surges.

Your Next Step Takes < 2 Minutes:

🔹 Email: Send “TEXTILE LASER PRO LIST” to [email protected]

🔹 WhatsApp: Message +86 159 5127 6160 with “PRO LIST ACCESS”

Why act now?

– ✨ Exclusive 2026 Benefit: First 15 respondents receive a free laser-cutting material compatibility analysis ($480 value).

– ⏳ Time Saved: Redirect 117+ hours annually to core procurement strategy—not supplier firefighting.

– 🌐 Future-Proof: Lock in suppliers with AI-driven fabric-adaptive systems before 2026 capacity constraints hit.

“In high-precision textile manufacturing, your supplier’s capability isn’t a cost—it’s your margin protector. Stop gambling with unverified sources.”

— SourcifyChina Senior Sourcing Consultant

→ Contact us today to activate your Verified Pro List access. Your 2026 production resilience starts here.

[email protected] | +86 159 5127 6160 (WhatsApp)

SourcifyChina: Data-Driven Sourcing for Strategic Procurement Leaders. 1,200+ Verified Suppliers | 87% Client Retention Rate | 12-Month Quality Guarantee.

🧮 Landed Cost Calculator

Estimate your total import cost from China.