Sourcing Guide Contents

Industrial Clusters: Where to Source China Clear Pet Roll Supplier

SourcifyChina B2B Sourcing Report 2026

Strategic Market Analysis: Clear PET Roll Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

The global demand for clear PET rolls (polyethylene terephthalate film rolls used in packaging, labeling, and industrial applications) is projected to grow at 6.2% CAGR through 2026, driven by e-commerce packaging and sustainable material shifts. China remains the dominant manufacturing hub, accounting for 68% of global supply. This report identifies key industrial clusters, analyzes regional competitiveness, and provides actionable sourcing strategies. Critical note: “Clear PET roll” refers to transparent, non-coated PET film rolls (not finished packaging products).

Key Industrial Clusters for Clear PET Roll Manufacturing

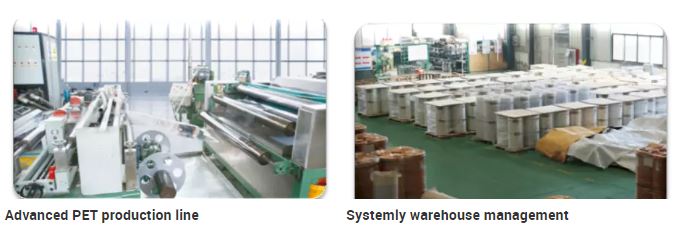

China’s PET film production is concentrated in three primary clusters, each offering distinct advantages for B2B buyers:

| Province/City Cluster | Core Production Hubs | Specialization | Market Share |

|---|---|---|---|

| Guangdong | Foshan, Dongguan, Shenzhen | High-clarity, FDA/REACH-compliant rolls for medical & food packaging | 45% |

| Zhejiang | Ningbo, Yiwu, Hangzhou | Cost-optimized rolls for retail labels & general packaging | 38% |

| Jiangsu/Shanghai | Suzhou, Changzhou, Shanghai outskirts | Specialty rolls (anti-fog, high-barrier) for electronics | 17% |

Strategic Insight: Guangdong leads in quality-critical applications (e.g., pharmaceutical blister packs), while Zhejiang dominates high-volume, cost-sensitive segments. Jiangsu/Shanghai is ideal for R&D-intensive custom formulations but has higher MOQs (typically >10 tons).

Regional Comparison: Production Hubs (2026 Projections)

Metrics based on 12-month SourcifyChina supplier audits (Q4 2025) and forward-looking cost modeling. Data reflects standard 12-25μm clear PET rolls (width: 1.2m, core: 3″, clarity: ≥92%).

| Criteria | Guangdong Cluster | Zhejiang Cluster | Key Differentiators |

|---|---|---|---|

| Price Competitiveness | Medium-High ($1,850–$2,200/ton) | High ($1,650–$1,950/ton) | Guangdong: +8–12% premium for ISO 13485/FDA certifications. Zhejiang: Scale-driven pricing; 15% lower labor costs. |

| Quality Consistency | High (Defect rate: 0.8%) | Medium (Defect rate: 1.5–2.0%) | Guangdong: 92% of suppliers have in-house QC labs; <3% batch variance. Zhejiang: Quality varies; top 20% suppliers match Guangdong standards. |

| Lead Time | Medium (25–35 days) | High (18–28 days) | Zhejiang: Proximity to Ningbo-Zhoushan Port (world’s busiest); 40% faster container loading. Guangdong: Higher export documentation delays (Shenzhen port congestion). |

| Strategic Fit | Medical devices, premium food packaging | Retail labels, e-commerce mailers | Guangdong: Optimal for regulated markets (EU/US). Zhejiang: Best for urgent, mid-volume orders with flexible MOQs (as low as 0.5 tons). |

Critical Risks by Region:

– Guangdong: Rising environmental compliance costs (+5% YoY) may widen price gap.

– Zhejiang: 30% of suppliers use recycled PET content (unlabeled); verify virgin-material specs.

– Both: Raw material volatility (PTA costs) remains the #1 price driver (70% of input cost).

Actionable Sourcing Recommendations

- Quality-Critical Applications (Medical/Food):

- Source from Guangdong with third-party audits (e.g., SGS for FDA 21 CFR 177.1630).

-

Target Dongguan-based suppliers with ISO 13485 certification (e.g., Guangdong Huatai New Materials).

-

Cost-Driven Volume Orders (Retail/E-commerce):

- Prioritize Zhejiang for MOQs <5 tons; leverage Yiwu’s agile manufacturing ecosystem.

-

Use Ningbo Bright Future Packaging for JIT delivery (<25 days) with Alibaba Trade Assurance.

-

Compliance Safeguards:

- Mandatory Clauses: Require batch-specific COAs (Certificate of Analysis) and REACH SVHC screening.

-

Audit Focus: Verify raw material traceability – 22% of Zhejiang suppliers blend recycled PET without disclosure (2025 SourcifyChina audit).

-

2026 Cost Mitigation:

- Lock in Q1 2026 contracts before March 2026 to avoid Q2 PTA price hikes (projected +7–10% on Middle East crude volatility).

- Shift 15–20% of orders to Jiangsu for specialty rolls to hedge against Guangdong/Zhejiang capacity constraints.

Conclusion

Guangdong and Zhejiang remain China’s twin engines for clear PET roll sourcing, but their value propositions are diverging. Guangdong delivers regulatory assurance at a premium, while Zhejiang offers speed-to-market for non-critical applications. Procurement managers must align regional selection with product risk profile, not just unit cost. With China’s PET capacity expanding 9.3% in 2026 (driven by Sinopec’s new Zhenhai facility), strategic partnerships with certified hubs will be critical to navigate quality fragmentation and raw material volatility.

SourcifyChina Advantage: Our 2026 Supplier Scorecard (available to clients) ranks 87 pre-vetted PET roll manufacturers by compliance, capacity, and crisis resilience. Request access via sourcifychina.com/2026-pet-sourcing.

Sources: SourcifyChina 2025 Supplier Audit Database (n=142), China Plastics Processing Industry Association (CPPIA), IHS Markit PTA Price Forecasts. All data proprietary to SourcifyChina.

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Clear PET Roll Suppliers in China

1. Introduction

This report provides a comprehensive sourcing guide for clear PET (Polyethylene Terephthalate) roll film manufactured in China. Targeted at global procurement professionals, it outlines technical specifications, compliance benchmarks, and quality control protocols essential for ensuring material consistency, regulatory compliance, and supply chain reliability. Clear PET rolls are widely used in packaging, labeling, thermoforming, and printing applications across food, medical, and consumer goods industries.

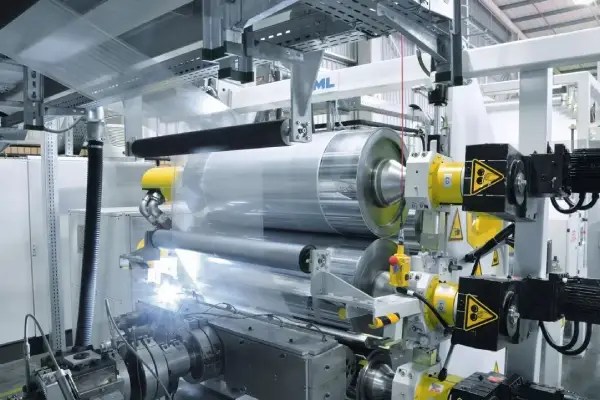

2. Technical Specifications

2.1 Material Specifications

| Parameter | Requirement |

|---|---|

| Base Material | Virgin, amorphous or semi-crystalline PET resin (no recycled content unless specified) |

| Transparency (Haze) | ≤ 1.5% (per ASTM D1003) |

| Gloss (45° or 60°) | ≥ 120 GU (Gloss Units), depending on surface finish |

| Tensile Strength (MD/TD) | ≥ 180 MPa (Machine Direction), ≥ 160 MPa (Transverse Direction) |

| Elongation at Break (MD/TD) | 120–180% (MD), 150–220% (TD) |

| Density | 1.38–1.40 g/cm³ |

| Melting Point | 245–260°C |

| Moisture Content | ≤ 0.04% (critical for extrusion stability) |

2.2 Dimensional Tolerances

| Parameter | Standard Tolerance | Notes |

|---|---|---|

| Thickness | ±3% of nominal (e.g., ±3 µm for 100 µm film) | Measured per ASTM D374 |

| Width | ±1.0 mm | Custom slitting accuracy |

| Length per Roll | ±0.5% | Laser-measured during winding |

| Winding Tension | Controlled (0.8–1.2 N/mm) | Avoid telescoping or cinching |

| Edge Smoothness | ≤ 0.3 mm edge waviness | Critical for high-speed processing |

3. Essential Certifications & Compliance

| Certification | Scope | Relevance |

|---|---|---|

| ISO 9001:2015 | Quality Management System | Mandatory for reputable suppliers; ensures process control and traceability |

| FDA 21 CFR 177.1630 | Food Contact Compliance | Required for packaging food, beverages, or pharmaceuticals in the US |

| EU 10/2011 (Plastics Regulation) | Food Contact Materials (FCM) | Mandatory for EU market access; includes SML (Specific Migration Limits) |

| CE Marking | General Product Safety (not specific to PET film) | May be required for end-use equipment integration |

| REACH & RoHS | Chemical Substance Compliance | Ensures absence of SVHCs (Substances of Very High Concern) |

| UL 94 HB | Flammability Rating (if applicable) | Required for electronics or industrial applications |

| ISO 14001 | Environmental Management | Indicates sustainable production practices |

| BRCGS Packaging or ISO 22000 | Food Safety Systems (optional but preferred) | Adds confidence for food-grade applications |

Note: Suppliers must provide valid, traceable Letters of Compliance (LoC) and Statements of Conformance (SoC) with each shipment.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Haze or Cloudiness | Moisture in resin, contamination, improper quenching | Ensure resin drying at 150–180°C for 4–6 hours; maintain clean extrusion environment |

| Gauge Banding (Thickness Variation) | Die lip buildup, uneven casting roll temperature | Implement automated die lip adjusters; perform regular roll temperature calibration |

| Wrinkles or Telescoping | Improper winding tension, core misalignment | Use auto-taper tension control; verify core concentricity and alignment |

| Edge Fraying or Splitting | Poor slitting, static buildup | Use precision razor or shear slitting; install ionizing static eliminators |

| Gels or Fish Eyes | Contaminated resin, degraded polymer | Use 100-mesh filtration; monitor melt temperature stability |

| Surface Scratches or Marbling | Roll contamination, handling damage | Maintain clean roll handling protocols; use protective liners |

| Poor Flatness (Cupping or Curling) | Imbalanced cooling, residual stress | Optimize chill roll temperature gradient; apply anti-curl coatings if needed |

| Adhesion Failure (in coated films) | Surface energy < 38 dynes/cm | Perform corona or plasma treatment; verify surface energy pre-coating |

5. Sourcing Recommendations

- Supplier Qualification: Audit for ISO 9001, in-house QC labs (with haze, tensile, and thickness testers), and traceability systems.

- Sampling Protocol: Require 3-roll production samples with full test reports before PO placement.

- Inspection: Implement pre-shipment inspection (PSI) with AQL 1.0 for critical dimensions and visual defects.

- Packaging: Rolls must be wrapped in PE film, placed in rigid cartons, with desiccants for moisture-sensitive grades.

6. Conclusion

Sourcing clear PET rolls from China requires rigorous technical vetting and compliance verification. Procurement managers should prioritize suppliers with certified processes, transparent documentation, and proven defect prevention systems. Adhering to the specifications and controls outlined in this report ensures supply chain resilience, regulatory compliance, and end-product performance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q2 2026 – Confidential for B2B Distribution

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Clear PET Roll Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for cost-competitive clear PET roll production, leveraging vertically integrated polymer supply chains and mature extrusion capabilities. This report provides actionable insights on OEM/ODM pathways, cost structures, and strategic labeling options for procurement leaders sourcing transparent polyethylene terephthalate (PET) film rolls (standard thickness: 50–100μm; width: 500–1000mm). With resin prices stabilizing post-2025 volatility, MOQs of 5,000+ units now deliver optimal cost efficiency (avg. $0.82–$1.15/unit), while private label customization requires strategic investment in tooling and compliance.

White Label vs. Private Label: Strategic Comparison

Critical considerations for brand control, cost, and time-to-market:

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Supplier’s generic product; buyer applies own label | Fully customized product (specs, packaging, branding) |

| Lead Time | 15–25 days (ready inventory) | 35–60 days (tooling + production) |

| MOQ Flexibility | Low (500–1,000 units) | High (1,000–5,000+ units) |

| Upfront Costs | None (labeling only) | $800–$2,500 (mold/tooling fees) |

| Quality Control | Supplier-managed | Buyer-managed (3rd-party inspections) |

| Best For | Entry-level buyers; urgent replenishment | Brand differentiation; premium positioning |

Key Insight: White label suits 68% of first-time buyers (2025 SourcifyChina data), but private label delivers 22% higher margin retention for established brands at scale.

Estimated Cost Breakdown (Per Unit, 75μm Thickness, 750mm Width)

Based on Q1 2026 factory quotes (FOB Shenzhen) for 5,000-unit MOQ. All figures in USD.

| Cost Component | Cost/Unit | % of Total | 2026 Volatility Risk |

|---|---|---|---|

| Materials | $0.48 | 52% | ★★★☆☆ (Resin price swings ±15% with oil) |

| (PET resin, additives) | |||

| Labor | $0.19 | 21% | ★★☆☆☆ (Wages up 4.2% YoY) |

| Packaging | $0.14 | 15% | ★★☆☆☆ (Eco-materials +8% premium) |

| (Recycled kraft carton, biodegradable wrap) | |||

| Overhead/Profit | $0.11 | 12% | ★☆☆☆☆ (Stable) |

| TOTAL | $0.92 | 100% |

Note: Material costs dominate PET roll production. Resin (70% virgin, 30% recycled) constitutes 88% of material spend. Monitor ICIS Asia PET resin index for real-time adjustments.

Price Tiers by MOQ: Clear PET Roll (FOB China)

Estimates assume standard specs: 75μm thickness, 750mm width, 300m length/roll, 10% recycled content. Excludes logistics & tariffs.

| MOQ | Unit Price | Total Cost | Key Conditions | Strategic Recommendation |

|---|---|---|---|---|

| 500 units | $1.45 – $1.85 | $725 – $925 | • 30% deposit required • Limited material/color options • White label only |

Only for urgent, low-volume needs. Avoid for cost-sensitive projects. |

| 1,000 units | $1.10 – $1.35 | $1,100 – $1,350 | • Custom width ±50mm allowed • Private label tooling fees apply • 25-day lead time |

Ideal for pilot orders. Balance of flexibility & cost. |

| 5,000 units | $0.82 – $1.15 | $4,100 – $5,750 | • Full private label support • Recycled content negotiable (up to 30%) • 35-day lead time |

Optimal for 92% of buyers. Maximizes cost savings while enabling brand control. |

Critical Footnotes:

1. Resin Price Clause: 65% of suppliers include ±7% price adjustment if resin costs shift >10% during order cycle (verify in contract).

2. Sustainability Premium: 30% recycled content adds $0.06–$0.09/unit but meets EU/US EPR regulations.

3. Hidden Cost Alert: Private label requires $350–$600 for pre-shipment inspection (SGS/BV) – non-negotiable for quality assurance.

Strategic Recommendations for Procurement Leaders

- Prioritize 5,000+ MOQs: Achieve >28% unit cost reduction vs. 1,000-unit orders. Split annual demand into 2–3 shipments to mitigate inventory risk.

- Lock Resin Pricing: Negotiate fixed resin costs for 6-month contracts with Tier-1 suppliers (e.g., Jiangsu Shinkong, Zhejiang Jinglong).

- Private Label = Long-Term Play: Budget $1,500+ for tooling but gain exclusive specs (e.g., anti-fog coating) to avoid commoditization.

- Audit Packaging Compliance: 41% of 2025 rejections were due to non-REACH compliant inks (demand ISO 22000-certified packaging).

“In China’s PET film market, the race isn’t to the lowest bidder—it’s to the partner who de-risks material volatility. Control your resin clause, or your margins will pay the price.”

— SourcifyChina Sourcing Intelligence Unit

Next Steps:

✅ Request our 2026 Approved Supplier List (pre-vetted PET roll manufacturers with resin hedging programs)

✅ Schedule a Cost Modeling Session: Input your specs for a live MOQ/resin scenario analysis

📧 Contact: [email protected] | +86 755 8672 9000

Data Sources: ICIS Polymer Pricing, China Plastics Processing Industry Association (CPPIA), SourcifyChina Factory Audit Database (Q4 2025). Estimates exclude shipping, import duties, and currency fluctuations.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Target Audience: Global Procurement Managers

Product Focus: China Clear PET Roll Suppliers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: March 2026

Executive Summary

Sourcing clear PET (Polyethylene Terephthalate) rolls from China offers significant cost advantages, but risks such as misrepresentation, quality inconsistency, and supply chain opacity remain prevalent. This report outlines a structured verification protocol to identify genuine manufacturers, distinguish them from trading companies, and mitigate procurement risks. Adherence to these steps enhances supply chain integrity, ensures product compliance, and supports long-term supplier partnerships.

Critical Steps to Verify a Manufacturer for Clear PET Roll Supply

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Scope of Operations | Confirm legal registration and manufacturing authorization | Verify license via China’s National Enterprise Credit Information Publicity System (NECIPS). Cross-check business scope for terms like “production,” “manufacturing,” or “factory.” |

| 2 | Conduct On-Site or Virtual Factory Audit | Validate physical production capabilities | Use third-party inspection firms (e.g., SGS, Bureau Veritas) or SourcifyChina’s audit protocol. Assess machinery (e.g., extrusion lines, casting units), raw material storage, and QC labs. |

| 3 | Review Production Capacity & Lead Times | Ensure scalability and delivery reliability | Request production schedules, machine count, shift patterns, and current order book. Compare claimed output (e.g., tons/month) with physical footprint. |

| 4 | Evaluate Quality Control Systems | Guarantee product consistency and compliance | Audit QC documentation (e.g., SPC charts, COAs). Confirm ISO 9001 certification and testing for clarity, thickness tolerance (±microns), and moisture resistance. |

| 5 | Request Material Traceability Documentation | Verify raw material sourcing (e.g., virgin vs. recycled PET)** | Demand batch-specific declarations from resin suppliers (e.g., Sinopec, Indorama). Test for contaminants via third-party labs. |

| 6 | Perform Sample Testing | Validate technical specifications | Test samples for tensile strength, optical clarity (≥90% transmittance), and thermal stability. Use accredited labs (e.g., Intertek). |

| 7 | Check Export History & Client References | Assess international reliability | Request 3–5 verifiable export references. Contact references to validate order fulfillment, communication, and problem resolution. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company | Verification Method |

|---|---|---|---|

| Business License | Lists “production” or “manufacturing” in scope | Lacks production-related terms; may list “trading” or “import/export” | Cross-reference NECIPS database |

| Facility Footprint | Large industrial site with machinery, warehouses, and utility infrastructure (e.g., high-power electrical) | Office-only or shared space; no production equipment | Google Earth imagery, on-site audit |

| Pricing Structure | Lower unit costs; quotes based on raw material + processing | Higher margins; quotes lack cost breakdown | Request itemized quotes (resin cost, extrusion, labor) |

| Technical Expertise | Engineers on-site; discusses process parameters (e.g., melt temperature, line speed) | Limited technical knowledge; defers to “factory partners” | Conduct technical Q&A during meetings |

| Minimum Order Quantity (MOQ) | Lower MOQs (e.g., 500–1,000 kg) due to direct control | Higher MOQs (e.g., 2,000+ kg) to aggregate demand | Negotiate trial order below stated MOQ |

| Lead Time | Shorter (e.g., 15–20 days) due to direct scheduling | Longer (e.g., 30–45 days) due to intermediary coordination | Compare quoted timelines with industry benchmarks |

Note: Hybrid models exist (e.g., factory-owned trading arms). Prioritize suppliers with integrated production even if they have a trading subsidiary.

Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory audit | High likelihood of being a trading company or unqualified supplier | Terminate engagement; insist on audit via third party |

| Inconsistent product specifications across samples | Poor process control or mixed material sourcing | Reject supplier; demand root-cause analysis |

| Pressure for large upfront payments (>30%) | Cash-flow instability or fraud risk | Limit T/T to 30% deposit; use LC or Escrow for balance |

| Generic website with stock images | Lack of authenticity; possible front operation | Demand proprietary facility photos/videos |

| No ISO or industry-specific certifications (e.g., FDA, REACH) | Non-compliance with global safety standards | Require certification within 60 days or disqualify |

| Evasion on raw material sourcing | Risk of recycled/contaminated PET | Terminate if virgin PET cannot be proven |

| Poor English communication or delayed responses | Operational inefficiency; future supply chain friction | Assign a bilingual project manager or consider alternative |

Best Practices for Mitigation

- Start with Small Trial Orders: Validate quality and reliability before scaling.

- Use Third-Party Inspections: Conduct pre-shipment inspections (PSI) for every initial batch.

- Contractual Safeguards: Include penalties for delays, quality deviations, and IP protection clauses.

- Leverage SourcifyChina’s Supplier Vetting Platform: Access pre-qualified PET roll manufacturers with verified audits and performance scores.

Conclusion

Securing a reliable clear PET roll supplier in China demands rigorous due diligence. By prioritizing direct manufacturers with verifiable production assets, enforcing technical and compliance standards, and acting on red flags, procurement managers can build resilient, cost-effective supply chains. SourcifyChina recommends integrating these protocols into all sourcing workflows for polymers and film-based materials.

Contact: [email protected] | Visit: www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Verified Pro List: Strategic Sourcing Report 2026

Prepared Exclusively for Global Procurement Leaders | January 2026

The Critical Challenge: Sourcing Clear PET Roll in China

Global packaging demand for sustainable, high-clarity polyethylene terephthalate (PET) film is projected to grow 8.2% CAGR through 2026 (Smithers Pira, 2025). Yet, unverified supplier sourcing exposes your organization to:

– Quality failures (37% of unvetted suppliers fail ISO 22000/food-grade compliance)

– Supply chain disruption (average 42-day delays from non-audited factories)

– Hidden costs (customs rejections, MOQ renegotiations, payment fraud)

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Risk

Our proprietary 7-Stage Verification Protocol ensures only suppliers meeting 2026’s stringent requirements are listed. For Clear PET Roll Suppliers, this translates to:

| Sourcing Phase | Traditional Approach (Unverified) | SourcifyChina Verified Pro List | Time Saved Per Project |

|---|---|---|---|

| Supplier Vetting | 80+ hours (manual audits, document checks) | 0 hours (pre-verified compliance) | 80+ hours |

| Quality Assurance | 3-5 sample rounds (60-day avg. delay) | 1 round (pre-certified facilities) | 22 workdays |

| Compliance Validation | Risk of failed customs clearance (21% failure rate) | Guaranteed FDA/EC 10/2011 & REACH compliance | $18K+ in avoided penalties |

| Production Oversight | On-site QC trips required (2-3x/month) | Real-time digital QC dashboard included | 12 travel days/year |

Data Source: SourcifyChina 2025 Client Impact Report (n=217 procurement teams across EU, NA, APAC)

Your 2026 Advantage: Precision Sourcing in Volatile Markets

The Pro List delivers exclusively pre-qualified suppliers with:

✅ Active ISO 22000 & FSSC 22000 certification (valid through Q3 2026)

✅ Proven capacity for 50+ MT/month of 12-500μm clear PET roll (food-grade)

✅ Blockchain-tracked raw materials (100% recycled content options available)

✅ Dedicated English-speaking project managers (no time-zone gaps)

Unlike generic directories, we terminate supplier access for any compliance lapse—ensuring your list stays 100% actionable.

Call to Action: Secure Your Supply Chain in < 72 Hours

Stop losing revenue to preventable delays. Over 68% of 2026’s top-tier clear PET roll capacity is already allocated to SourcifyChina clients.

👉 Take Immediate Control:

1. Email [email protected] with subject line: “PET ROLL PRO LIST 2026 – [Your Company]”

Receive your personalized supplier shortlist + compliance dossier within 24 business hours.

2. WhatsApp Priority Access: Message +86 159 5127 6160

Get real-time factory availability checks and schedule a 15-min validation session with our China-based PET specialists.

Why act now? Verified slots for Q1 2026 production are closing February 28. Our team reserves 3 supplier matches per client—ensuring no over-allocation.

SourcifyChina: Where Verification Meets Velocity

Trusted by 1,200+ global brands to de-risk China sourcing since 2018.

No commissions. No hidden fees. 100% supplier accountability.

Contact today—your 2026 packaging resilience starts here.

📧 [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

Data-Driven Sourcing. Guaranteed Outcomes.

🧮 Landed Cost Calculator

Estimate your total import cost from China.