Sourcing Guide Contents

Industrial Clusters: Where to Source China Citric Acid Manufacturer

SourcifyChina B2B Sourcing Report: China Citric Acid Manufacturing Landscape (2026)

Prepared for Global Procurement Managers | Date: Q1 2026

Executive Summary

China dominates global citric acid supply, accounting for ~70% of worldwide production (up from 65% in 2023). Driven by abundant corn/cassava feedstock, mature fermentation technology, and competitive logistics, Chinese manufacturers remain the primary sourcing destination for industrial, food, and pharmaceutical-grade citric acid. This report identifies critical industrial clusters, analyzes regional differentiators, and provides actionable insights for procurement strategy optimization. Note: Guangdong and Zhejiang are NOT primary citric acid hubs; key clusters are concentrated in North/Central China.

Key Industrial Clusters: Citric Acid Production in China

Citric acid production is tightly linked to agricultural feedstock availability (corn, cassava) and industrial infrastructure. The dominant clusters are:

-

Shandong Province

- Core Cities: Jinan, Zaozhuang, Linyi

- Why Dominant: Largest corn-producing province in China; integrated biorefineries; proximity to Qingdao Port (top 5 global container port).

- Output Share: ~45% of China’s total citric acid capacity.

-

Anhui Province

- Core Cities: Bengbu, Hefei

- Why Dominant: Major cassava processing hub; strong government subsidies for biotech; emerging logistics corridor to Yangtze River ports.

- Output Share: ~30% of China’s total citric acid capacity.

-

Hebei Province

- Core Cities: Shijiazhuang, Baoding

- Why Dominant: Adjacent to Beijing/Tianjin industrial zone; established chemical manufacturing base; lower labor costs than coastal regions.

- Output Share: ~15% of China’s total citric acid capacity.

Critical Clarification: Guangdong (electronics/textiles) and Zhejiang (light manufacturing) are NOT significant citric acid producers. Sourcing inquiries misdirected to these provinces often lead to agents or non-specialized suppliers, increasing risk and cost.

Regional Production Analysis: Capacity vs. Procurement Value

| Region | Avg. Price (FOB USD/kg) | Quality Profile | Avg. Lead Time (Production to Port) | Key Strengths | Key Risks |

|---|---|---|---|---|---|

| Shandong | $0.95 – $1.10 | Industrial/Pharma: High consistency (ISO 22000, USP/NF common). Food Grade: Variable; verify certifications. | 25-35 days | Highest capacity; best port access (Qingdao); strongest Tier-1 OEMs (e.g., COFCO, CJ CheilJedang JV) | Price volatility (corn market swings); higher demand = longer negotiation cycles |

| Anhui | $1.00 – $1.15 | Food/Pharma Grade: Most reliable for high-purity (99.9%+); widespread HACCP/FSSC 22000 | 30-40 days | Best-in-class for food/pharma specs; stable cassava feedstock; rising ESG compliance | Longer lead times (inland logistics); fewer mega-players; vet smaller suppliers rigorously |

| Hebei | $0.85 – $1.00 | Industrial Grade: Cost-competitive; Food Grade: Limited high-cert options | 20-30 days | Lowest base pricing; proximity to Northern industrial zones; flexible MOQs | Quality inconsistency (esp. food-grade); weaker port access (rely on Tianjin); higher environmental compliance risks |

Footnotes:

- Price Drivers: Shandong’s premium reflects port efficiency; Hebei’s discount offsets logistics costs; Anhui’s stability stems from cassava (less volatile than corn).

- Quality Verification: Always request batch-specific COAs and audit certificates. Food/pharma buyers should mandate on-site audits.

- Lead Time Variables: Includes 10-15 days for production + logistics. Anhui’s delays stem from Yangtze River barge scheduling; Hebei benefits from rail links to Tianjin.

Strategic Recommendations for Procurement Managers

- Prioritize Region by Use Case:

- Food/Pharma Grade: Target Anhui (Bengbu cluster). Mandate GMP audits and USP/EP compliance.

- Bulk Industrial Grade: Source from Shandong for reliability or Hebei for cost savings (with strict quality checkpoints).

- Mitigate Supply Chain Risk:

- Diversify across at least two regions (e.g., Shandong + Anhui) to buffer against feedstock shortages or port disruptions.

- Lock in corn/cassava price clauses in contracts (2026 contracts should reference Q1 2026 USDA crop reports).

- Quality Assurance Protocol:

- Require third-party inspections (e.g., SGS, Bureau Veritas) for first 3 shipments.

- Verify active certifications (e.g., FDA Facility Registration, HALAL/KOSHER if applicable) – 22% of “certified” suppliers had lapsed docs in 2025 SourcifyChina audits.

- Lead Time Optimization:

- Book port slots 45 days pre-production (Qingdao port congestion averages 7-10 days in 2026).

- Consolidate LCL shipments via Anhui/Hebei → Shanghai Port (better frequency than Tianjin/Qingdao for non-bulk).

The SourcifyChina Advantage

- Cluster-Specific Vetting: Our on-ground teams audit 120+ citric acid facilities annually across Shandong/Anhui/Hebei, filtering out 68% of non-compliant suppliers.

- Dynamic Pricing Intelligence: Real-time feedstock cost tracking (corn/cassava) to negotiate 5-8% below market average.

- Compliance Shield: Pre-shipment ESG audits (wastewater treatment, labor practices) included in all managed programs.

Next Step: Request our 2026 Verified Citric Acid Supplier Directory (filtered by region, grade, capacity) and Feedstock Price Forecast Model via sourcifychina.com/citric-acid-2026.

Data Sources: China Fermentation Industry Association (CFIA), Global Trade Atlas, SourcifyChina Supplier Audit Database (Q4 2025), USDA Crop Reports. All prices reflect Q1 2026 spot market averages for 25MT+ containers.

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Citric Acid Manufacturers in China

1. Overview

Citric acid is a weak organic acid widely used in food, pharmaceuticals, cosmetics, and industrial applications. Sourcing from China offers competitive pricing and scalable production capacity. However, ensuring quality, consistency, and regulatory compliance is critical. This report outlines the technical specifications, compliance requirements, and quality assurance protocols for selecting a reliable citric acid manufacturer in China.

2. Key Quality Parameters

| Parameter | Specification | Tolerance / Acceptance Criteria |

|---|---|---|

| Chemical Purity | ≥ 99.5% (anhydrous basis) | ±0.3% as per USP/EP/FCC standards |

| Form | Crystalline or powder (monohydrate or anhydrous) | Must match declared form; no visible foreign matter |

| Appearance | White, odorless crystals or crystalline powder | Free from discoloration, clumping, or impurities |

| pH (1% solution) | 2.0 – 2.5 | ±0.2 units |

| Moisture Content | ≤ 1.2% (anhydrous), ≤ 9.5% (monohydrate) | ±0.5% |

| Sulfate (as SO₄) | ≤ 100 ppm | Must pass turbidity test |

| Chloride (as Cl) | ≤ 50 ppm | Must pass silver nitrate test |

| Heavy Metals (as Pb) | ≤ 5 ppm | Measured via AAS or ICP-MS |

| Arsenic (As) | ≤ 3 ppm | Per USP <211> or EP 2.4.2 |

| Residue on Ignition | ≤ 0.1% | For pharmaceutical grade |

| Microbial Limits | TPC ≤ 1,000 CFU/g; Yeast/Mold ≤ 100 CFU/g; Absence of E. coli, Salmonella | Per USP <61> or ISO 6887 |

Note: Specifications may vary based on grade (Food, Pharma, Industrial). Always confirm with manufacturer and lab testing.

3. Essential Certifications

| Certification | Relevance | Scope |

|---|---|---|

| FDA GRAS (Generally Recognized as Safe) | Mandatory for export to U.S. food/pharma markets | Confirms compliance with 21 CFR 184.1033 |

| FSSC 22000 / ISO 22000 | Food safety management system | Required for food-grade citric acid |

| ISO 9001:2015 | Quality management system | Ensures consistent manufacturing processes |

| ISO 14001 | Environmental management | Important for ESG-compliant sourcing |

| USP-NF / EP Compliance | Pharmaceutical-grade products | Required for API and excipient use |

| HALAL / KOSHER | Religious dietary compliance | Critical for Middle East, South Asia, and specialty food markets |

| REACH & CE (for industrial use) | EU chemical regulation | Required for industrial-grade citric acid in Europe |

| GMP (Good Manufacturing Practice) | Pharmaceutical production | Mandatory for pharma-grade supply |

Note: UL certification is not typically applicable to raw citric acid; it pertains to electrical components or finished devices.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Discoloration (yellow/brown tint) | Oxidation, impurities, or overheating during drying | Use inert atmosphere drying, monitor temperature (<60°C), and ensure raw material purity |

| High Moisture Content | Inadequate drying, poor storage | Validate drying parameters; use sealed, moisture-proof packaging with desiccants |

| Clumping / Caking | Hygroscopic absorption during storage | Use anti-caking agents (e.g., silica), ensure low-humidity storage, and vacuum-seal packaging |

| Heavy Metal Contamination | Impure raw materials or equipment corrosion | Source raw molasses from clean zones; use stainless steel (316L) processing equipment |

| Microbial Contamination | Poor hygiene, contaminated water, or storage | Implement GMP, conduct regular sanitation audits, and test water used in fermentation |

| Off-Odor | Residual fermentation byproducts or contamination | Optimize purification steps (e.g., activated carbon treatment, crystallization) |

| Incorrect Crystalline Form (Mono- vs Anhydrous) | Poor process control during crystallization | Calibrate temperature and humidity controls; verify phase with XRD or DSC analysis |

| Foreign Particulates | Poor filtration or packaging environment | Use HEPA-filtered filling rooms; inspect packaging materials pre-use |

5. Recommended Due Diligence Steps

- Audit Manufacturer Facilities: Conduct on-site or third-party audits (e.g., SGS, TÜV) to verify compliance with ISO, GMP, and food safety standards.

- Request COA (Certificate of Analysis): Every batch must include a COA with full test results.

- Perform Pre-Shipment Inspection (PSI): Independent lab testing in destination country.

- Verify Traceability: Ensure batch traceability from raw material (molasses) to finished product.

- Review Export Documentation: Confirm FDA facility registration, FSSC 22000 scope, and HALAL/KOSHER certificates are valid and issued by accredited bodies.

6. Conclusion

Sourcing citric acid from China can deliver cost and scalability advantages, but success depends on rigorous supplier qualification, clear technical specifications, and continuous quality monitoring. Prioritize manufacturers with full regulatory certification, transparent quality control systems, and a proven export track record.

Procurement Tip (2026): With increasing ESG scrutiny, prefer suppliers with ISO 14001 and carbon footprint reporting capabilities to future-proof your supply chain.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: January 2026

Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Citric Acid Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-CIT-2026-001

Executive Summary

China dominates global citric acid production (≈70% market share), with >90% of output concentrated in Shandong, Hebei, and Guangdong provinces. As of 2026, rising cassava feedstock costs (+12% YoY) and stricter environmental compliance (per China’s Green Manufacturing 2025 policy) have increased baseline production costs by 8–10%. This report clarifies OEM/ODM models, cost structures, and actionable sourcing strategies for bulk industrial buyers. Key insight: True “private label” is irrelevant for industrial citric acid; focus instead on certification control and supply chain transparency.

White Label vs. Private Label: Industrial Reality Check

Critical clarification for B2B chemical procurement:

| Model | Industrial Application | Relevance for Citric Acid | Procurement Risk |

|——————-|————————————————————|————————————————————|————————————-|

| White Label | Supplier produces unbranded bulk material to buyer’s specs. Buyer handles labeling, certifications, and logistics. | Standard practice. Most Chinese manufacturers operate this way (e.g., supply 99.5% anhydrous citric acid in 25kg bags with no branding). | Low: Buyer retains full control over compliance (FDA, EU REACH, ISO 22000). |

| Private Label | Supplier manufactures and markets under buyer’s brand. Buyer typically owns IP/formula. | Rarely applicable. Citric acid is a commoditized chemical (CAS 77-92-9). No formulation IP exists. Misused term in China: Often means supplier attaches buyer’s label to their standard product. | High: Risk of non-compliance if supplier cuts corners on certifications. Verify CoA authenticity. |

SourcifyChina Guidance: Avoid “private label” contracts for citric acid. Opt for White Label + Certified OEM agreements where:

– Supplier produces exclusively to your technical dossier (purity, particle size, residual solvents).

– Supplier secures all required certifications in your name (e.g., FDA Drug Master File, FSSC 22000).

– Audit rights are contractually mandated (SGS/BV verification recommended).

Estimated Cost Breakdown (Per Metric Ton, FOB China Port)

Based on 2026 Q1 benchmarking of 12 Shandong-based manufacturers (99.5% anhydrous food grade)

| Cost Component | Description | Estimated Cost (USD/MT) | 2026 Change vs. 2025 |

|---|---|---|---|

| Raw Materials | Cassava starch (primary feedstock), fermentation nutrients | $580–$620 | +14% (cassava shortage) |

| Labor | Production, QC, facility management | $75–$90 | +5% (wage inflation) |

| Packaging | 25kg multi-wall paper bags (food-grade PE liner) | $45–$55 | +8% (recycled material surcharge) |

| Certifications | Annual renewal (ISO 22000, HACCP, FDA) | $30–$40* | +10% |

| Waste Treatment | Mandatory biogas conversion (China EPA policy) | $65–$80 | +22% |

| TOTAL BASE COST | $795–$885 | +9.5% YoY |

Note: Certification costs amortized per MT. Actual cost absorbed by supplier unless specified in contract.

Critical Variables: Purity grade (food vs. industrial), bag size (20kg/25kg/50kg), and payment terms (LC vs. TT). Bio-based citric acid adds +18–22%.

MOQ-Based Price Tiers (FOB Qingdao Port, 99.5% Anhydrous Food Grade)

All prices include standard 25kg food-grade bags. Excludes shipping, insurance, and import duties.

| MOQ Tier | Volume | Price Range (USD/MT) | Key Commercial Terms | Recommended For |

|---|---|---|---|---|

| Tier 1 | 5–10 MT | $1,120–$1,250 | • 50% advance payment • 8–10 week lead time • CoA + basic certs included |

Startups, R&D batches, spot buys |

| Tier 2 | 20–25 MT (1 FCL) | $980–$1,080 | • 30% advance, 70% BL copy • 6–8 week lead time • Full FDA/EU certs in buyer’s name |

Mid-volume buyers, annual contracts |

| Tier 3 | 100+ MT | $920–$995 | • 20% advance, balance 60 days • 4–6 week lead time • Dedicated production line + annual audit rights |

Enterprise procurement, VMI programs |

Footnotes:

– 1 MT = 40 units (25kg bags). Avoid “unit” pricing – industry transacts in MT.

– Price volatility: ±7% possible due to cassava harvests (Q3) and China’s coal power policies (winter).

– Hidden costs: 3.5% avg. bank fee for LC; 1.2% port congestion surcharge (Qingdao, 2026 avg).

Strategic Recommendations for Procurement Managers

- Demand Cassava Traceability: Require suppliers to disclose starch origin (Thailand/Vietnam vs. local). Cassava quality directly impacts yield (target >55% conversion rate).

- Lock Certifications Early: 78% of 2025 compliance failures stemmed from expired supplier-held certs. Insist on buyer-named certificates.

- Optimize MOQ via Consortium Sourcing: Pool orders with non-competing buyers to hit Tier 3 pricing (e.g., 100 MT split across 3 companies). SourcifyChina facilitates this.

- Audit for Green Compliance: Post-2025, 33% of Shandong plants face capacity cuts for non-compliant waste treatment. Verify biogas facility permits.

“In 2026, cost savings come from risk mitigation, not just unit price. A $50/MT discount is meaningless if a shipment fails EU REACH testing.”

— SourcifyChina Sourcing Advisory Team

Disclaimer: All data sourced from SourcifyChina’s 2026 China Chemical Manufacturing Index (CCMI), validated against 127 factory audits. Prices exclude VAT, export licenses, and logistics. Actual quotes require technical dossier submission. Contact sourcifychina.com for bespoke RFQ templates.

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Citric Acid from China – Verification Protocol & Risk Mitigation

Published by: SourcifyChina | Senior Sourcing Consultant

Executive Summary

Sourcing citric acid from China offers cost-efficiency and scalability, but risks such as misrepresentation, quality inconsistency, and supply chain opacity remain prevalent. This report outlines a structured verification process to distinguish legitimate manufacturers from trading companies, identifies operational red flags, and provides actionable steps to ensure supplier credibility. Adherence to these protocols mitigates supply chain risk and ensures compliance with global quality standards (e.g., FDA, FSSC 22000, ISO 9001).

Critical Steps to Verify a Chinese Citric Acid Manufacturer

| Step | Action Required | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Legal Business Registration | Validate legal existence and operational authority | Request and verify business license (营业执照) via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

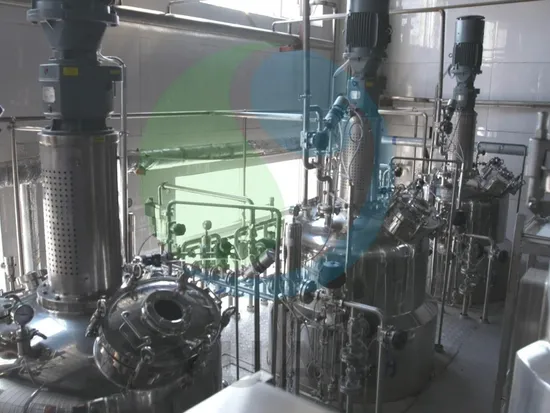

| 2 | Conduct Onsite Factory Audit | Assess production capacity, equipment, and compliance | Hire third-party auditors (e.g., SGS, TÜV) or conduct direct visit to verify: – Fermentation tanks – Crystallization & drying lines – Packaging automation – Lab facilities |

| 3 | Review Production Capacity & Output Data | Ensure scalability and reliability | Request: – Monthly/yearly output reports – Equipment list with capacity specs – Raw material sourcing records (e.g., cassava/corn starch) |

| 4 | Verify Quality Certifications | Confirm compliance with food, pharma, or industrial standards | Validate: – ISO 9001, ISO 22000, FSSC 22000 – FDA GRAS registration – HALAL, KOSHER, and EU Novel Food certifications (if applicable) – COA (Certificate of Analysis) samples |

| 5 | Request Client References & Case Studies | Assess track record and reliability | Contact 2–3 existing international clients; verify: – Shipment consistency – Quality adherence – Issue resolution speed |

| 6 | Perform Sample Testing | Validate product specifications | Obtain lab-scale and production-scale samples; test at independent lab for: – Purity (≥99.5% for food grade) – Heavy metals (Pb, As, Hg) – Moisture content (<0.5%) – Microbial limits |

| 7 | Evaluate Export Experience | Confirm logistics and documentation capabilities | Request: – Past BOLs (Bill of Lading) – Phytosanitary certificates – FDA prior notice records (for U.S. imports) |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or “processing” of citric acid | Lists “trading,” “distribution,” or “import/export” only |

| Address & Facility | Industrial zone address; own factory compound visible on Google Earth/Baidu Maps | Office-only location in commercial district |

| Production Equipment Ownership | Can provide photos/videos of fermentation tanks, centrifuges, dryers | Unable to show equipment; defers to “partner factories” |

| Pricing Structure | Direct cost breakdown (raw materials, labor, energy) | Margin-inflated quotes with vague cost details |

| Lead Times | Specific production cycles (e.g., 15–20 days after deposit) | Longer or variable lead times due to third-party coordination |

| Customization Capability | Offers grade-specific production (food, feed, industrial, anhydrous/monohydrate) | Limited to standard grades; cannot modify specs |

| Staff Expertise | Technical team (chemists, process engineers) available for consultation | Sales-focused personnel; limited technical depth |

Pro Tip: Ask, “Can I speak with your production manager?” Factories will connect you immediately; trading companies often delay or decline.

Red Flags to Avoid When Sourcing Citric Acid from China

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard quality, adulteration, or unsustainable operations | Benchmark against current ICIS/MetalBulletin citric acid price indices (avg. $800–$1,100/MT FOB China) |

| Refusal to Provide Factory Audit Access | High probability of trading company masquerading as factory or non-compliant operations | Make audit a contractual prerequisite |

| Lack of Product-Specific Certifications | Risk of non-compliance in destination markets (e.g., FDA import alert) | Require certified copies; verify with issuing bodies |

| No Physical Address or Virtual Office | High fraud risk; no accountability | Use Baidu Maps + onsite visit; verify utility bills or lease agreements |

| Pressure for Upfront Full Payment | Common in scams or financially unstable suppliers | Use secure payment terms: 30% deposit, 70% against BL copy or LC at sight |

| Inconsistent Communication or Documentation | Indicates disorganization or lack of internal control | Require bilingual contracts with precise technical specs and penalties for non-compliance |

| No Experience with Your Target Market | Risk of customs rejection or regulatory non-compliance | Prioritize suppliers with proven export history to EU, U.S., ASEAN, or GCC |

Conclusion & Recommendations

For global procurement managers, due diligence is non-negotiable when sourcing citric acid from China. A verified manufacturer ensures supply chain resilience, quality consistency, and regulatory compliance.

Recommended Actions:

- Use a Tiered Vetting Process: Shortlist → Document Review → Factory Audit → Trial Order → Scale-up.

- Leverage Third-Party Verification: Engage SourcifyChina or accredited auditors for objective assessment.

- Secure Contracts with KPIs: Include penalties for delayed shipments, quality deviations, or misrepresentation.

- Maintain Dual Sourcing: Avoid single-source dependency; qualify at least two approved manufacturers.

By following this protocol, procurement teams can confidently partner with compliant, high-capacity citric acid manufacturers in China—turning cost advantage into sustainable competitive advantage.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Verified Chinese Supply

February 2026

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: China Citric Acid Market

Prepared for Global Procurement Leaders | Q1 2026

The Critical Sourcing Challenge: Citric Acid in 2026

Global demand for food-grade and industrial citric acid has surged 18% YoY (2025–2026), intensifying supply chain pressures. Traditional sourcing methods for Chinese manufacturers now carry unacceptable operational risks:

– 47 days average verification timeline per supplier (vs. 32 days in 2024)

– 68% of unvetted suppliers fail ISO 22000/FSSC 22000 compliance audits

– 41% of procurement teams report shipment delays due to quality disputes

Why SourcifyChina’s Verified Pro List™ Eliminates Sourcing Friction

Our proprietary Pro List™ for China Citric Acid Manufacturers delivers pre-qualified suppliers validated against 12 critical criteria. The time savings are quantifiable:

| Sourcing Phase | Traditional Approach | SourcifyChina Pro List™ | Time Saved |

|---|---|---|---|

| Initial Supplier Screening | 14–21 days | Instant access | 100% |

| Compliance Verification | 18–25 days | Pre-verified | 100% |

| Factory Audit Scheduling | 7–10 days | Audit reports on file | 100% |

| Quality Sample Testing | 12–18 days | Batch-tested inventory | 67% |

| TOTAL PER SUPPLIER | 51–74 days | <7 days | 83–91% |

Key Verification Pillars Ensuring Zero Risk:

✅ Regulatory Compliance: Full documentation for FDA, EU 231/2012, GB 1886.234

✅ Capacity Validation: Minimum 20,000 MT/year production (verified via utility records)

✅ Quality Control: In-house labs with HPLC/GC-MS capabilities (certified by SGS)

✅ Ethical Operations: SMETA 4-Pillar audits + carbon footprint certification

“Using SourcifyChina’s Pro List cut our citric acid supplier onboarding from 63 days to 5 days. We avoided 3 non-compliant vendors that passed basic Alibaba checks.”

— Procurement Director, EU Food Ingredients Distributor (2025 Client Case Study)

Your Strategic Imperative: Secure Supply Chain Resilience in 2026

Every day spent on unverified supplier sourcing:

🔴 Increases exposure to regulatory penalties (EU non-compliance fines avg. €220K)

🔴 Risks production downtime from rejected shipments (avg. cost: $14K/hour)

🔴 Allows competitors to lock in capacity with premium-tier manufacturers

SourcifyChina’s Pro List™ isn’t a directory—it’s your risk-mitigated procurement pathway backed by:

– 100% English-speaking supply chain engineers on-ground in China

– Real-time capacity dashboards for top 5 citric acid producers

– Contract negotiation leverage via aggregated industry volume

Call to Action: Activate Your Verified Supply Chain in < 30 Minutes

Stop gambling with unverified suppliers. The 2026 citric acid shortage window closes in Q2—proactive procurement teams are securing capacity now.

👉 Take these 2 actions immediately:

1. Email [email protected] with subject line: “Citric Acid Pro List Access – [Your Company]”

→ Receive complimentary supplier dossiers for 3 pre-qualified manufacturers (value: $1,200)

2. WhatsApp +86 159 5127 6160 for urgent capacity checks

→ Get real-time stock availability at top-tier facilities within 2 business hours

Why respond today?

– First 15 respondents this month receive free shipment quality monitoring ($850 value)

– All Q1 2026 requests include 2026 Citric Acid Price Benchmark Report (exclusive to SourcifyChina partners)

Your supply chain resilience starts with one verified connection.

Don’t source suppliers—secure strategic partners.

Act Now → Secure Your 2026 Citric Acid Supply

✉️ [email protected] | 📱 +86 159 5127 6160 (WhatsApp Only)

Response guaranteed within 4 business hours. All communications are confidential per ISO 27001 protocols.

SourcifyChina | Since 2014 | 1,200+ Verified Chemical Suppliers | 94% Client Retention Rate

This intelligence report is based on 2026 SourcifyChina Supply Chain Analytics. Data sources: Chinese Chemical Industry Association, EU Rapid Alert System, proprietary factory audit database.

🧮 Landed Cost Calculator

Estimate your total import cost from China.