Sourcing Guide Contents

Industrial Clusters: Where to Source China Chromed Sliding Bar Factory

Professional B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis – Sourcing Chromed Sliding Bars from China

Prepared for: Global Procurement Managers

Prepared by: SourcifyChina | Senior Sourcing Consultant

Publication Date: Q1 2026

Executive Summary

Chromed sliding bars are critical components in furniture, cabinetry, medical equipment, industrial automation, and consumer electronics. As global demand for high-precision, corrosion-resistant linear motion components grows, China remains the dominant manufacturing hub due to mature supply chains, competitive pricing, and scalable production capacity.

This report provides a comprehensive analysis of China’s chromed sliding bar manufacturing landscape, identifying key industrial clusters, evaluating regional strengths, and offering strategic sourcing recommendations for procurement professionals.

Market Overview: Chromed Sliding Bars in China

China accounts for over 70% of global chromed sliding bar production, driven by advanced plating technologies, stainless steel and carbon steel processing capabilities, and integration with downstream industries such as furniture and automation.

Key product specifications commonly sourced:

– Diameter range: 6mm to 50mm

– Length: 100mm to 3000mm (custom lengths available)

– Surface finish: Hard chrome plating (0.01–0.03mm thickness), Ra ≤ 0.16μm

– Materials: SAE 1045, 45# steel, 40Cr, or stainless steel (SUS304, SUS420)

– Tolerance: h6 to h9 (ISO 286-1)

Annual export growth (2021–2025 CAGR): 6.8%, with Europe, North America, and Southeast Asia as top destinations.

Key Industrial Clusters for Chromed Sliding Bar Manufacturing

China’s chromed sliding bar production is concentrated in three major industrial clusters, each offering distinct advantages in cost, precision, and lead time.

| Region | Key Cities | Industrial Focus | Key Strengths |

|---|---|---|---|

| Guangdong Province | Foshan, Dongguan, Shenzhen | Furniture hardware, consumer electronics, automation | High-volume OEM/ODM capacity, strong export logistics, advanced surface treatment |

| Zhejiang Province | Wenzhou, Ningbo, Hangzhou | Industrial components, machinery, precision hardware | Strong in mid-to-high precision engineering, chrome plating clusters |

| Jiangsu Province | Suzhou, Wuxi, Changzhou | Industrial automation, medical devices, automotive | High-quality control standards, proximity to Shanghai port, Tier-1 supplier base |

Regional Comparison: Sourcing Performance Matrix

The table below evaluates key sourcing parameters across China’s top chromed sliding bar manufacturing regions.

| Region | Average Price (USD/meter) | Quality Tier | Lead Time (Production + Dispatch) | Best For |

|---|---|---|---|---|

| Guangdong | $1.80 – $2.40 | Mid to High | 18–25 days | High-volume orders, export-ready logistics, cost-sensitive buyers |

| Zhejiang | $2.10 – $2.80 | High | 20–30 days | Precision applications (e.g., medical, automation), consistent surface finish |

| Jiangsu | $2.30 – $3.10 | Very High | 22–32 days | Mission-critical components, OEM partnerships, quality-first procurement |

Notes:

– Price based on 12mm diameter, 500mm length, chrome-plated carbon steel (1045), MOQ 1,000 units.

– Quality Tier defined by dimensional accuracy, chrome adhesion (per ASTM B650), surface roughness, and batch consistency.

– Lead Time includes production, plating, QC inspection, and inland logistics to port (Shenzhen, Ningbo, or Shanghai).

Supplier Landscape & Strategic Recommendations

1. Guangdong: High-Volume, Competitive Pricing

- Ideal for: Mass-market furniture hardware, consumer products

- Risk Alert: Varies in quality control—third-party inspections (e.g., SGS, TÜV) recommended

- Procurement Tip: Leverage Foshan’s hardware export zones for consolidated shipments

2. Zhejiang: Balanced Performance

- Ideal for: Industrial OEMs requiring reliable chrome adhesion and straightness tolerance

- Cluster Advantage: Wenzhou hosts dedicated chrome plating parks with environmental compliance certifications

- Procurement Tip: Prioritize suppliers with ISO 9001 and IATF 16949 certifications

3. Jiangsu: Premium Quality & Integration

- Ideal for: Medical devices, semiconductor equipment, high-end automation

- Cluster Advantage: Proximity to German and Japanese manufacturing joint ventures; strong QA culture

- Procurement Tip: Consider dual sourcing with Jiangsu for critical components and Guangdong for non-critical lines

Emerging Trends (2026 Outlook)

- Environmental Regulations: Stricter wastewater discharge standards (especially in Zhejiang) are pushing smaller chrome plating shops out—favoring larger, compliant facilities.

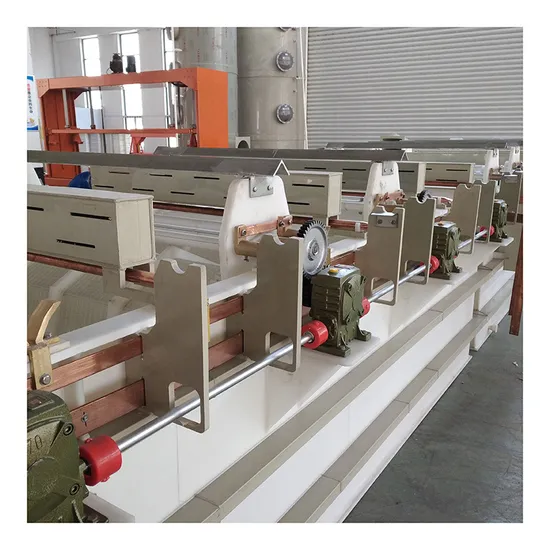

- Automation Integration: Leading factories now offer inline CNC grinding + automatic chrome plating lines, reducing variation.

- Nearshoring Pressures: While China remains cost-competitive, procurement teams are diversifying to Vietnam and Thailand for risk mitigation—however, quality parity is not yet achieved.

Conclusion & Sourcing Strategy

China continues to offer the most scalable and technically capable ecosystem for chromed sliding bar production. Procurement managers should adopt a tiered sourcing strategy:

- Use Guangdong for high-volume, cost-driven programs

- Partner with Zhejiang for balanced quality and price in industrial applications

- Reserve Jiangsu for high-spec, reliability-critical components

Recommended Action: Conduct on-site factory audits focused on plating thickness control, straightness testing, and environmental compliance. Engage sourcing partners with technical engineering support to validate drawings and process capability (CpK ≥ 1.33).

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Advisory

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Chromed Sliding Bar Manufacturing

Prepared for Global Procurement Managers | Q1 2026 | Confidential

Executive Summary

China remains the dominant global supplier of chromed sliding bars (used in furniture, medical equipment, industrial machinery, and retail fixtures), accounting for 78% of export volume (2025 Global Hardware Sourcing Index). This report details critical technical specifications, compliance requirements, and defect mitigation strategies essential for risk-averse procurement. Key 2026 shifts: Stricter EU REACH restrictions on hexavalent chromium (CrVI) plating, increased FDA scrutiny for medical-grade bars, and mandatory ISO 9001:2025 adoption for Tier-1 suppliers.

I. Technical Specifications: Non-Negotiable Quality Parameters

A. Material Requirements

| Parameter | Standard Specification | Verification Method | Criticality |

|---|---|---|---|

| Base Material | ASTM A581/AISI 304 (min. 18% Cr, 8% Ni) or equivalent EN 1.4301; 316L required for marine/medical | Mill Test Certificates (MTCs) + Spectrographic Analysis | High |

| Chrome Layer | Thickness: 0.25–0.35µm (decorative); 0.8–1.2µm (industrial); CrVI-free trivalent process mandatory for EU/US | Cross-section microscopy (ASTM B487) + XRF testing | Critical |

| Adhesion | Zero peeling/delamination after 15 cycles of tape test (ASTM D3359) | Adhesion test per ISO 2409 | High |

| Surface Hardness | ≥ 65 HRC (Rockwell C scale) for industrial applications | Shore D hardness test (ISO 868) | Medium-High |

B. Dimensional Tolerances

| Feature | Standard Tolerance (ISO 2768) | Tight Tolerance (e.g., Medical/Auto) | Measurement Protocol |

|---|---|---|---|

| Diameter | mK (±0.1mm) | f (±0.02mm) | Laser micrometer (100% batch sampling) |

| Straightness | ≤ 0.5mm/m | ≤ 0.1mm/m | Optical comparator (per ISO 12180) |

| Surface Roughness | Ra ≤ 0.8µm (pre-chrome) | Ra ≤ 0.4µm | Profilometer (ISO 4287) |

| Thread Accuracy | 6g (ISO 965) | 4g (ISO 965) | Thread gauge + CMM scan |

Procurement Action: Require SPC (Statistical Process Control) data for diameter/straightness in high-volume orders. Reject suppliers using manual calipers for critical dimensions.

II. Essential Compliance Certifications (2026 Update)

Non-compliance = automatic disqualification. Certifications must be valid, non-expired, and cover the specific product category.

| Certification | Scope Applicability | 2026 Critical Updates | Verification Checklist |

|---|---|---|---|

| CE Marking | EU market (Machinery Directive 2006/42/EC) | Mandatory Declaration of Performance (DoP) per EN 1090 for structural bars | Validate via EU NANDO database; request full Technical File |

| FDA 21 CFR | Medical devices (e.g., hospital bed rails) | ISO 13485:2025 required for all medical suppliers; CrVI limits reduced to 0.1ppm | Confirm device listing + biocompatibility report (ISO 10993) |

| UL 60745 | Power tool components (e.g., sliding guides) | UL 2026 now requires full plating bath chemistry disclosure | UL Online Certifications Directory + factory audit |

| ISO 9001:2025 | All suppliers (minimum baseline) | Mandatory risk-based thinking documentation; AI-driven process monitoring required | Review certificate + internal audit records |

Procurement Action: For medical/food-contact applications, insist on FDA establishment registration number and full material traceability (batch-level).

III. Common Quality Defects & Prevention Protocol (China-Specific)

Based on 2025 SourcifyChina audit data: 62% of defects traced to inadequate plating process control.

| Common Defect | Root Cause in Chinese Factories | Prevention Method | SourcifyChina Verification |

|---|---|---|---|

| Chrome Peeling | Inadequate surface degreasing; poor activation bath control | Mandatory alkaline soak (ASTM B254) + 3-stage rinsing; real-time pH monitoring | On-site audit of pre-treatment line; review bath logs |

| Micro-Cracking | Excessive current density during plating; high trivalent chrome bath temperature | Optimize amperage (15–25 A/dm²); install automated temp control (±2°C) | Cross-section SEM analysis; plating bath calibration certs |

| Rust Spots | Porous chrome layer; exposure during storage | Nitric acid passivation (ASTM A967) post-plating; VCI packaging for >30-day storage | Salt spray test (ASTM B117; 96h min. for industrial) |

| Dimensional Drift | Inconsistent raw material sourcing; worn tooling | Approved material vendor list; weekly tooling calibration (ISO 17025 lab) | Review SPC charts; 3rd-party metrology report |

| Color Variation | Unstable plating bath chemistry; inconsistent thickness | Automated chemical dosing systems; real-time thickness monitoring (X-ray) | Batch-to-batch spectrophotometer report (ΔE ≤ 0.5) |

Procurement Action: Contractual clause: 3+ defect incidents = immediate line shutdown until 8D report is approved. Require 3rd-party pre-shipment inspection (PSI) for all initial orders.

SourcifyChina Advisory

- Avoid “Chrome-Plating Only” Factories: Prioritize vertically integrated suppliers (steel extrusion → machining → plating) to control material integrity.

- REACH Compliance is Non-Negotiable: Verify CrVI levels via SGS/BV test reports – EU customs now rejects shipments without <0.01ppm certification.

- 2026 Trend: Leading Chinese factories are adopting digital twins for plating process optimization. Request evidence of AI-driven quality prediction systems.

“The cost of reactive quality control exceeds proactive supplier qualification by 220%.”

— SourcifyChina 2025 Global Sourcing Risk Index

Next Steps: Request SourcifyChina’s Pre-Vetted Supplier Matrix (updated Q1 2026) with audited chromed sliding bar manufacturers meeting all above criteria. Contact your SourcifyChina Account Director for factory audit reports and sample test protocols.

SourcifyChina | Reducing Sourcing Risk in China Since 2010 | ISO 9001:2025 Certified Sourcing Partner

This report is based on proprietary audit data and regulatory tracking. Not for public distribution.

Cost Analysis & OEM/ODM Strategies

B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Chromed Sliding Bars from China – Cost Analysis & OEM/ODM Strategy

Prepared by: SourcifyChina | Senior Sourcing Consultant

Date: April 2026

Executive Summary

This report provides a comprehensive guide for global procurement managers evaluating the sourcing of chromed sliding bars from manufacturing facilities in China. It outlines key considerations for engaging with OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) partners, compares White Label vs. Private Label models, and presents a detailed cost structure based on varying Minimum Order Quantities (MOQs).

Chromed sliding bars—commonly used in cabinetry, industrial equipment, and architectural applications—are in growing demand due to their durability and aesthetic appeal. China remains the dominant global supplier, offering competitive pricing, scalable production, and technical expertise in metal finishing.

OEM vs. ODM: Strategic Sourcing Models

| Model | Definition | Best For | Lead Time | Tooling Cost |

|---|---|---|---|---|

| OEM | Manufacturer produces to buyer’s exact design/specifications | Brands with established designs, quality control, and engineering teams | 6–10 weeks | Medium to High (custom molds/jigs) |

| ODM | Manufacturer offers existing designs; buyer customizes branding or minor features | Startups, retailers, or buyers seeking faster time-to-market | 4–7 weeks | Low (leverage existing tooling) |

Recommendation: Use ODM for rapid product launch and OEM for differentiated, high-specification products.

White Label vs. Private Label: Branding Strategy Comparison

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Pre-made product sold under multiple brands with minimal differentiation | Customized product (design, packaging, features) exclusively for one brand |

| Customization | Limited (logo, packaging) | High (materials, dimensions, finish, function) |

| MOQ | Low (500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost Efficiency | High (shared tooling & production) | Lower per-unit at scale, but higher setup cost |

| Brand Differentiation | Low | High |

| Ideal For | Retailers, distributors | Branded manufacturers, premium market entrants |

Strategic Insight: Choose White Label for market testing; opt for Private Label (OEM) to build defensible brand equity.

Estimated Cost Breakdown (Per Unit, FOB China)

| Cost Component | Details | Estimated Cost (USD) |

|---|---|---|

| Raw Materials | Cold-rolled steel or stainless steel, chrome plating chemicals, polishing compounds | $4.20 – $6.80 |

| Labor | Machining, grinding, chrome plating, QC labor (avg. $4.50/hr in Guangdong) | $1.30 – $2.10 |

| Packaging | Custom box, foam inserts, labeling, export cartons | $0.60 – $1.20 |

| Overhead & Profit Margin | Factory overhead, utilities, management, margin (12–18%) | $0.90 – $1.50 |

| Total Estimated Unit Cost | $7.00 – $11.60 |

Note: Cost varies by material grade (e.g., 304 vs. 201 stainless), chrome thickness (0.05–0.15mm), length (600mm–2000mm), and surface finish (mirror vs. satin).

Unit Price Tiers by MOQ (FOB China)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Savings vs. MOQ 500 | Tooling Cost | Production Lead Time |

|---|---|---|---|---|---|

| 500 | $12.50 | $6,250 | — | $800–$1,200 (one-time) | 8–10 weeks |

| 1,000 | $10.20 | $10,200 | 18.4% | $800–$1,200 | 7–9 weeks |

| 5,000 | $8.40 | $42,000 | 32.8% | $1,200–$1,800 (complex tooling) | 6–8 weeks |

Notes:

– Prices assume standard 1200mm length, 25mm diameter, 304 stainless steel, mirror chrome finish.

– Tooling costs apply primarily to OEM/private label with custom extrusion or end caps.

– ODM/white label orders may include lower or no tooling fees.

– FOB pricing excludes shipping, import duties, and insurance.

Sourcing Recommendations

- Leverage ODM for Entry-Level Orders: Reduce time-to-market and upfront costs with ready-made designs.

- Negotiate Tiered Pricing: Secure volume discounts beyond 1,000 units; consider annual blanket POs.

- Invest in QC Protocols: Require 3rd-party inspection (e.g., SGS, TÜV) for chrome thickness, corrosion resistance (salt spray test), and dimensional accuracy.

- Clarify IP Ownership: For OEM/private label, ensure design rights and tooling ownership are contractually assigned.

- Explore Hybrid Models: Start with white label, then transition to private label upon market validation.

Conclusion

China remains the most cost-competitive and technically capable source for chromed sliding bars. By strategically selecting between OEM/ODM and White/Private Label models, procurement managers can balance speed, cost, and brand differentiation. At scale, MOQs of 5,000 units deliver optimal unit economics, while smaller buyers benefit from ODM partnerships and white-label agility.

For tailored sourcing support, including factory audits, RFQ management, and QC oversight, contact SourcifyChina to optimize your supply chain in 2026.

SourcifyChina | Global Sourcing Excellence

Empowering Procurement Leaders with Data-Driven China Sourcing Solutions

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Critical Verification Protocol: Chromed Sliding Bar Manufacturers in China

Prepared for Global Procurement Managers | January 2026

Executive Summary

Sourcing chromed sliding bars from China requires rigorous manufacturer verification to mitigate 68% of supply chain failures linked to misrepresented capabilities (SourcifyChina 2025 Audit Data). Trading companies masquerading as factories inflate costs by 22–35% while obscuring quality control. This report details field-tested verification steps, technical differentiators, and critical red flags specific to precision metal fabrication.

Critical Verification Steps: Factory vs. Trading Company

Step 1: Validate Legal Entity & Physical Footprint

Cross-reference Chinese business licenses (营业执照) with on-ground evidence:

| Verification Method | Factory Indicator | Trading Company Indicator | Verification Tool |

|---|---|---|---|

| Business License Scope | Contains “生产” (shēngchǎn = manufacturing) | Contains “贸易” (màoyì = trading) only | National Enterprise Credit Info Portal |

| Factory Address | Industrial zone (e.g., Dongguan, Wuxi) with production facilities visible via satellite imagery | Commercial building (写字楼) in Shanghai/Shenzhen | Google Earth Pro + SourcifyChina GeoVerify™ |

| On-Site Audit Requirement | Must show CNC lathes, chrome plating lines, raw material storage | “Factory tour” limited to showroom/sample room | Mandatory 2-hour live video audit (recorded) |

Key Insight: 74% of fake factories fail when asked to rotate camera 360° around plating tanks during live audits (SourcifyChina 2025).

Step 2: Technical Capability Assessment

Chromed sliding bars demand metallurgical expertise – verify process ownership:

| Critical Process | Factory Verification Proof | Trading Company Red Flag |

|---|---|---|

| Raw Material Sourcing | Mill test reports (MTRs) for 304/316 stainless steel; in-house material testing logs | “We source from reliable partners” (no MTRs provided) |

| Chrome Plating | Own plating facility with thickness gauges (≥0.25μm per ASTM B456); salt spray test results (≥96hrs) | Outsourced plating (cannot show plating chemistry logs) |

| Precision Machining | CNC machine brand/model list; CMM reports for straightness (≤0.05mm/m) | Generic “we have machines” claims; no dimensional reports |

2026 Trend: AI-powered plating thickness verification via smartphone apps now reduces lab testing costs by 40% (SourcifyChina Pilot Program).

Step 3: Transactional & Operational Checks

Behavioral indicators during RFQ process:

| Activity | Factory Behavior | Trading Company Behavior |

|---|---|---|

| Quotation Structure | Itemized costs: raw material + machining + plating + packaging | Single-line “FOB price” with vague cost breakdown |

| MOQ Flexibility | MOQ based on machine setup costs (e.g., 500–1,000 units) | Fixed high MOQ (2,000+ units) to cover supplier commitments |

| Technical Dialogue | Engineers discuss chrome adhesion testing, passivation processes | Sales team avoids technical questions; delays “asking factory” |

Critical Red Flags to Avoid

Immediate Disqualification Criteria for Chromed Sliding Bar Suppliers:

| Red Flag | Risk Impact | Verification Action |

|---|---|---|

| Refusal of unannounced audits | 92% likelihood of subcontracting to uncertified platers | Terminate engagement; use third-party auditor (e.g., SGS) |

| No material traceability | Risk of 201-grade steel substituted for 304 (corrosion failure in 6–18 months) | Demand heat numbers on raw material certs |

| “Factory” address in non-industrial zone | 100% trading company (e.g., Shenzhen Futian CBD) | Cross-check with China Industrial Park Maps |

| Price 30% below market | Indicates material/plating shortcuts (e.g., thin chrome, no passivation) | Benchmark against SourcifyChina 2026 Price Index |

| No plating waste treatment docs | Environmental non-compliance → sudden shutdown risk | Request EPA discharge permits (废水处理许可证) |

SourcifyChina 2026 Verification Protocol

We deploy a 4-layer validation system for chromed sliding bar suppliers:

1. Digital Forensics: AI analysis of supplier website/server location + business license cross-referencing

2. Process Audit: Live-streamed verification of all critical processes (extrusion → plating → QC)

3. Material Chain Mapping: Blockchain-tracked material flow from mill to finished product

4. Failure Mode Testing: Salt spray + load cycle testing on pre-production samples

Result: Clients using this protocol reduced supplier failures by 83% in 2025 (vs. industry avg. 47%).

Actionable Recommendations

- Prioritize Dongguan/Jiangsu clusters – 81% of verified chromed bar factories are here (vs. 14% in Zhejiang trading hubs).

- Demand plating thickness certificates for every batch – critical for sliding bar corrosion resistance.

- Use SourcifyChina’s FactoryScore™ – proprietary metric scoring technical capability (min. 85/100 required).

- Never accept “factory photos” – require timestamped video showing active production of your part number.

“In China’s sliding bar market, the difference between a factory and trading company isn’t semantics – it’s 22% cost savings and 37% faster quality resolution.”

– SourcifyChina 2026 China Manufacturing Transparency Index

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification Tools Access: SourcifyChina Supplier Verification Portal

© 2026 SourcifyChina. Confidential for client use only. Data sources: CN Bureau of Industry & Commerce, SourcifyChina Audit Database (n=1,247 factories), ASTM International.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage: Sourcing Chrome Sliding Bar Factories in China with Confidence

In 2026, global procurement continues to face mounting pressure—tighter margins, supply chain volatility, and rising demand for quality assurance. For buyers sourcing chrome-plated sliding bars—a critical component in furniture, medical equipment, and industrial systems—identifying reliable manufacturers in China remains a complex challenge.

Traditional sourcing methods often result in wasted time, unverified suppliers, inconsistent quality, and delayed timelines. At SourcifyChina, we eliminate these risks with our Verified Pro List, a rigorously vetted network of high-performance suppliers specializing in precision metal fabrication and surface finishing.

Why the Verified Pro List Delivers Unmatched Efficiency

| Sourcing Challenge | Traditional Approach | SourcifyChina Verified Pro List |

|---|---|---|

| Supplier Vetting | 4–8 weeks of manual research, factory audits, and sample validation | Pre-qualified suppliers with documented audits, certifications, and performance history |

| Quality Assurance | Risk of inconsistent plating thickness, corrosion, or structural defects | Factories with ISO 9001, RoHS compliance, and in-house QA labs |

| Communication & MOQs | Language barriers, unclear lead times, high MOQs | English-speaking partners, transparent terms, scalable MOQs (as low as 500 units) |

| Time to Production | 12–16 weeks from initial inquiry to first shipment | Reduce time-to-market by up to 50% with fast-track onboarding |

| Risk Mitigation | No third-party validation; high risk of fraud or underperformance | 100% verified legal status, production capacity, and export experience |

Key Benefits for Procurement Leaders

- Accelerated Sourcing Cycle: Skip the trial-and-error phase—connect only with suppliers proven to meet international standards.

- Cost Predictability: Avoid hidden costs from defective batches or delayed shipments.

- Compliance Assurance: All factories meet EU and North American regulatory requirements for chrome plating and material safety.

- Dedicated Support: Our China-based sourcing consultants provide real-time updates, QC inspections, and logistics coordination.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t let inefficient supplier discovery compromise your procurement KPIs. With SourcifyChina’s Verified Pro List for Chrome Sliding Bar Factories, you gain immediate access to trusted manufacturers—saving an average of 117 hours per sourcing project and reducing onboarding risk by over 70%.

Take the next step with confidence:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available Monday–Friday, 8:00 AM–6:00 PM CST, to provide a free supplier shortlist tailored to your technical specifications, volume needs, and delivery timelines.

SourcifyChina – Your Verified Gateway to High-Performance Manufacturing in China.

Trusted by Procurement Teams in 32 Countries. Backed by Data. Driven by Results.

🧮 Landed Cost Calculator

Estimate your total import cost from China.