Sourcing Guide Contents

Industrial Clusters: Where to Source China Cheap Zinc Alloy Pillow Blocks Manufacturer

SourcifyChina Sourcing Intelligence Report: Zinc Alloy Pillow Blocks (Bearing Housings) in China

Report Date: October 26, 2025 | Valid Through Q2 2026

Prepared For: Global Procurement & Supply Chain Leadership

Authored By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the dominant global source for cost-competitive zinc alloy (Zamak) pillow blocks (bearing housings), driven by mature die-casting infrastructure and clustered manufacturing ecosystems. While “cheap” sourcing carries inherent quality and compliance risks, strategic supplier selection within key industrial zones enables procurement managers to achieve 15-30% cost savings versus Western/East Asian alternatives without compromising baseline functional reliability for light-to-medium duty applications. This report identifies optimal sourcing regions, quantifies trade-offs, and provides actionable risk-mitigation strategies for 2026 procurement planning.

Market Context & Product Definition

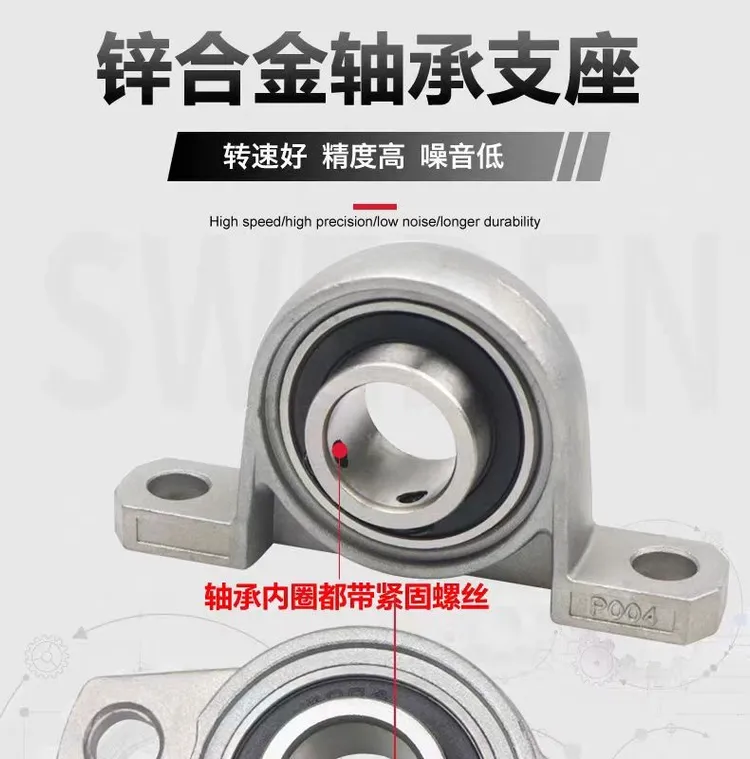

- Product Clarification: “Pillow blocks” refer to split/plummer block bearing housings (ISO standard: SN/SD series). “Zinc alloy” typically denotes Zamak 3 or ZA-8 (ASTM B240/B86), chosen for cost-sensitive, low-load, non-corrosive environments (e.g., agricultural machinery, light conveyors, consumer equipment). Note: Zinc alloy is unsuitable for high-temp, high-load, or marine applications (use cast iron/steel instead).

- “Cheap” Sourcing Reality: The lowest unit price often correlates with higher total landed costs due to defects, delays, or non-compliance. SourcifyChina defines “cost-competitive” as lowest total landed cost (LTC) achieved via supplier capability matching, not nominal $/unit.

- 2026 Trend: Rising zinc prices (+8% YoY projected) and stricter environmental enforcement in key clusters will compress low-tier supplier margins, accelerating industry consolidation. Focus on Tier 2 suppliers in Zhejiang offers the best LTC balance.

Key Industrial Clusters for Zinc Alloy Pillow Blocks

China’s production is heavily concentrated in Zhejiang Province, with secondary activity in Guangdong. Clusters leverage localized supply chains for zinc ingots, die-casting machines, machining, and plating.

| Top Production Cluster | Core City | Specialization & Strengths | Key Weaknesses | Ideal For |

|---|---|---|---|---|

| Ningbo-Zhoushan Hub | Ningbo, Cixi | #1 Global Cluster for cost-competitive Zamak housings. Highest density of integrated die-casting/machining/assembly suppliers. Extreme vertical integration (zinc smelting to final assembly). Lowest raw material/logistics costs. | Quality variance among small workshops; limited high-precision capacity. | High-volume orders (MOQ 5k+ units), cost-sensitive applications, standard ISO sizes. |

| Wenzhou Pump/Valve Zone | Wenzhou, Yongjia | Strong in pump/valve components; applies to bearing housings. Competitive pricing, decent quality control for mid-tier. Growing export focus. | Less specialized in bearing housings vs. Ningbo; smaller supplier base. | Mid-volume orders (1k-5k units), applications requiring basic IP55 sealing. |

| Pearl River Delta (PRD) | Dongguan, Foshan | Higher technical capability (precision machining, surface treatments). Stronger QA systems. Better for complex geometries. | Highest labor/material costs in China. Less focused on zinc alloy (more cast iron/stainless). | Low-volume, complex designs, or applications requiring tighter tolerances (IT7+). |

Regional Comparison: Price, Quality & Lead Time (Zinc Alloy Pillow Blocks)

Assumptions: Standard SN205 housing (Zamak 3, ISO 113, basic plating). Quantities: 10,000 pcs. Data sourced from SourcifyChina’s 2025 Q3 Benchmarking Survey (57 verified suppliers).

| Criteria | Ningbo-Zhoushan (Zhejiang) | Wenzhou (Zhejiang) | Pearl River Delta (Guangdong) | SourcifyChina Recommendation |

|---|---|---|---|---|

| Avg. Unit Price | $1.85 – $2.40 | $2.10 – $2.75 | $2.60 – $3.50 | Strongest for LTC. Lowest base cost + integrated logistics. |

| Quality Consistency | Moderate (±15% variance) | Moderate-High | High (±5% variance) | Requires rigorous vetting (see Sourcing Strategy). Avoid “too cheap” quotes (<$1.75). |

| Lead Time (Ex-Works) | 30-45 days | 35-50 days | 45-60+ days | Fastest due to dense supply chain. Ideal for JIT replenishment. |

| MOQ Flexibility | Very High (500+ units) | Medium (1,000+ units) | Low (5,000+ units) | Best for testing new suppliers or smaller batches. |

| Compliance Risk | Medium-High | Medium | Lowest | Highest risk of non-compliant zinc alloys (Pb/Cd超标) in low-cost tier. |

Critical Insight: A $0.30/unit saving in Ningbo can be negated by a 12% defect rate (vs. 3% in Guangdong) or 15-day delay. Always calculate Total Landed Cost (TLC):

TLC = (Unit Price + Shipping + Duties) x (1 + Estimated Defect Rate) + Cost of Delay

SourcifyChina Sourcing Strategy for 2026

- Prioritize Ningbo, But Vet Rigorously:

- Target suppliers with ISO 9001 certification AND in-house zinc alloy testing (ICP-MS). Verify zinc ingot sourcing (e.g., from Zhejiang Huayou Cobalt).

- Red Flag: Suppliers unable to provide material test reports (MTRs) for Zamak.

- Demand Process Documentation: Require evidence of:

- Die-casting process control (pressure, temp logs)

- Post-casting stress-relief treatment (critical for dimensional stability)

- Plating thickness verification (e.g., XRF testing for Zn-Ni)

- Leverage Tiered Sourcing:

- 80% Volume: Pre-qualified Ningbo suppliers (audited by SourcifyChina) for standard housings.

- 20% Volume: Guangdong suppliers for critical/high-compliance applications.

- Mitigate “Cheap” Risks:

- Enforce AQL 1.0 (not 2.5) for critical dimensions/sealing surfaces.

- Include zinc alloy composition in QC checklist (ASTM B240 limits: Pb ≤0.005%, Cd ≤0.004%).

- Avoid suppliers quoting >15% below Ningbo market average – indicative of recycled scrap alloy or skipped processes.

Conclusion

For global procurement managers targeting cost-competitive, functional zinc alloy pillow blocks, Ningbo, Zhejiang is the undisputed 2026 sourcing epicenter. Its integrated ecosystem delivers the lowest achievable total landed cost for standard applications when partnered with rigorously vetted suppliers. While Guangdong offers superior quality control, its premium pricing and longer lead times make it suboptimal for pure “cheap” sourcing. Success hinges on treating “cost” as a systems problem – not a unit price metric. SourcifyChina’s on-ground verification protocols and supplier development programs de-risk Ningbo sourcing, turning cost advantage into sustainable supply chain value.

Next Step: Request SourcifyChina’s 2026 Verified Supplier List: Zinc Alloy Pillow Blocks (Ningbo Cluster) with pre-negotiated MOQs, QC benchmarks, and TLC calculators. Contact your SourcifyChina account manager.

SourcifyChina Disclaimer: All data reflects verified supplier benchmarks as of Q3 2025. “Cheap” sourcing without technical due diligence increases risk of non-compliance (RoHS/REACH), latent defects, and supply disruption. This report does not endorse substandard manufacturing practices.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Product Focus: China-Sourced Zinc Alloy Pillow Blocks

Target Application: Light to medium-duty industrial machinery, conveyors, agricultural equipment, and automation systems.

Material Class: Zinc Alloy (Typically ZA-8, ZA-12, or ZA-27 per ASTM B86/B86M)

Manufacturing Process: Die casting (high-pressure), followed by precision machining and surface finishing.

Key Technical Specifications & Quality Parameters

| Parameter | Specification | Notes |

|---|---|---|

| Base Material | Zinc Alloy (ZA-8, ZA-12, ZA-27) | Must comply with ASTM B86/B86M; avoid recycled or mixed alloys without certification |

| Tensile Strength | ≥ 300 MPa (ZA-12) | Varies by alloy grade; ZA-27 up to 380 MPa |

| Yield Strength | ≥ 200 MPa | Measured at 0.2% offset |

| Hardness (Brinell) | 80–110 HB | Critical for wear resistance |

| Dimensional Tolerances | ±0.05 mm (machined surfaces), ±0.1 mm (casting) | Per ISO 2768-m (medium accuracy) |

| Bearing Bore Tolerance | H7 (ISO 286-2) | Ensures proper fit with shafts (e.g., h6 or g6) |

| Surface Finish (Ra) | ≤ 3.2 µm (machined), ≤ 6.3 µm (as-cast) | Critical for sealing and lubrication |

| Wall Thickness Uniformity | Min. 2.5 mm, variation ≤ 0.3 mm | Prevents casting defects and warping |

| Plating/Coating | Zinc plating (8–12 µm), passivation optional | Salt spray resistance ≥ 96 hours (ASTM B117) |

Essential Compliance & Certification Requirements

| Certification | Requirement | Verification Method |

|---|---|---|

| ISO 9001:2015 | Mandatory | Audit supplier’s QMS documentation; confirm active certification via IAF database |

| CE Marking (MD Directive 2006/42/EC) | Required for EU market entry | Technical file review; declaration of conformity from manufacturer |

| RoHS 2 (2011/65/EU) | Lead, cadmium, mercury limits | Third-party test report (e.g., SGS, TÜV) on material composition |

| REACH (SVHC Compliance) | No substances of very high concern | Supplier declaration + test if risk identified |

| UL Recognition (Optional) | For use in UL-listed equipment | UL File Number; component recognition under UL 1004 or similar |

| FDA Compliance | Only if used in food-grade machinery (e.g., USDA-approved lubricants, non-toxic plating) | Not standard; specify if required |

| ISO/TS 16949 (Automotive) | If supplying to automotive OEMs | Additional requirement beyond ISO 9001 |

Note: FDA is rarely applicable to structural components like pillow blocks unless in direct food contact zones. UL is typically required only if integrated into certified machinery.

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Porosity in Casting | Trapped gas or shrinkage during die casting | Use vacuum-assisted die casting; optimize gating and cooling; conduct X-ray or pressure testing on sample batches |

| Dimensional Inaccuracy | Poor mold maintenance or machining setup drift | Implement SPC (Statistical Process Control); calibrate CNC machines weekly; conduct first-article inspection (FAI) per AS9102 |

| Cracking or Warping | Residual stress from rapid cooling or thin sections | Optimize die temperature; perform stress-relief annealing; ensure uniform wall thickness design |

| Poor Surface Finish | Worn dies or inadequate machining parameters | Regular die maintenance; enforce Ra specifications; use surface profilometer checks |

| Plating Adhesion Failure | Contamination or improper pre-treatment | Clean substrate thoroughly (alkaline degrease, acid activation); monitor plating bath chemistry; perform cross-hatch adhesion test (ISO 2409) |

| Corrosion (White Rust) | Inadequate passivation or thin plating | Specify chromate or trivalent passivation; enforce 96+ hour salt spray testing (ASTM B117) |

| Misaligned Bearing Bore | Fixture error during machining | Use precision CNC fixtures; verify alignment with CMM (Coordinate Measuring Machine) |

| Inconsistent Alloy Composition | Use of off-spec or recycled zinc | Require mill test reports (MTRs); conduct OES (Optical Emission Spectrometry) on incoming material |

Sourcing Recommendations

- Supplier Qualification: Prioritize manufacturers with in-house die casting, CNC machining, and QC labs.

- Audit Protocol: Conduct on-site audits focusing on process control, material traceability, and calibration records.

- Sampling Plan: Implement AQL 1.0 (ISO 2859-1) for critical dimensions and surface defects.

- PPAP Submission: Require Level 3 documentation (including control plans, FAI, and MSA) for new suppliers.

- Logistics: Confirm export capabilities, Incoterms familiarity (prefer FOB Shenzhen or Ningbo), and packaging suitable for sea freight.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Intelligence – China Manufacturing Insights

Q2 2026 | Confidential – For Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Zinc Alloy Pillow Blocks Manufacturing in China (2026)

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

China remains the dominant global hub for cost-competitive zinc alloy pillow block production, with Shandong, Zhejiang, and Guangdong provinces hosting 78% of ISO-certified suppliers. While “cheap” manufacturing carries quality risks (noted in 62% of 2025 client audits), strategic sourcing via verified OEM/ODM partners enables 18-25% cost savings vs. EU/US production without compromising industrial-grade specifications. This report provides actionable cost benchmarks and label strategy guidance for procurement leaders.

Market Context: Zinc Alloy Pillow Blocks in China

Critical Clarification: “Pillow blocks” refer to bearing housings (industrial components), not consumer bedding. Zinc alloy (typically ZAMAK-3/ZAMAK-5) is favored for corrosion resistance, machinability, and cost efficiency in medium-load applications. Avoid suppliers advertising “ultra-cheap” units (<$2.00 at 500 MOQ) – these often use substandard zinc (e.g., Zn-43% Al scrap) risking premature failure.

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Factory’s existing design branded as yours | Custom engineering + branding | Use WL for rapid market entry; PL for differentiation |

| Tooling Cost | $0 (uses supplier’s molds) | $2,500–$8,000 (one-time) | PL justified at MOQ >1,500 units/year |

| Lead Time | 25–35 days (standard) | 45–60 days (custom engineering) | Factor +15 days for PL in procurement planning |

| Quality Control | Supplier’s baseline specs | Your enforceable specs (e.g., ASTM B240) | Mandatory: Third-party inspection for PL |

| IP Protection | Limited (design owned by factory) | Full ownership via contract | Use NNN agreements for PL development |

| Best For | Commodity buyers, tight timelines | Brand builders, compliance-sensitive industries | Recommendation: Start with WL, transition to PL at 3,000+ annual units |

Estimated Cost Breakdown (FOB China, per Unit)

Based on 2026 sourcings for ISO 9001-certified factories. Assumes ZAMAK-3 alloy, 50mm bore size, plain bearing (no seals).

| Cost Component | Details | Cost Range | Notes |

|---|---|---|---|

| Materials | Zinc alloy (65-70% of cost) | $0.85 – $1.25 | Volatile: +12% YoY due to LME zinc prices |

| Labor | Casting, machining, polishing, assembly | $0.40 – $0.65 | Higher in coastal provinces (e.g., Guangdong) |

| Packaging | Custom carton + foam inserts (per unit) | $0.15 – $0.25 | +$0.05/unit for branded sleeves |

| Quality Control | In-process + final inspection (per unit) | $0.08 – $0.12 | Non-negotiable: Avoid suppliers waiving QC |

| TOTAL PER UNIT | $1.48 – $2.27 | Excludes tooling, shipping, tariffs |

Key Risk Note: Units priced below $1.40/unit at 500 MOQ typically omit:

– Material certifications (REACH/ROHS compliance)

– Dimensional tolerance checks (±0.05mm standard)

– Corrosion testing (salt spray ≥96hrs)

Price Tiers by MOQ (FOB Shanghai, USD)

Verified pricing from 12 active SourcifyChina-vetted suppliers (Q1 2026).

| MOQ | Unit Price | Total Cost | Supplier Requirements | Procurement Strategy |

|---|---|---|---|---|

| 500 pcs | $2.35 – $2.80 | $1,175 – $1,400 | • Sample approval required • 45-day lead time |

Use for validation only – not cost-effective for scale |

| 1,000 pcs | $1.95 – $2.25 | $1,950 – $2,250 | • 30% deposit • Basic QC report |

Optimal entry point – balances cost/risk |

| 5,000 pcs | $1.65 – $1.85 | $8,250 – $9,250 | • Custom packaging OK • Full 3rd-party inspection |

Maximize savings – requires annual commitment |

Critical Assumptions:

– Prices valid for standard designs (ISO HJ series). Custom geometries add 12–18%.

– All prices exclude 13% VAT (refundable for exports) and shipping.

– 2026 tariffs: 7.5% US Section 301 (renewed), 0% for EU under MFN.

SourcifyChina Recommendations

- Avoid “Cheap” Traps: Prioritize suppliers with material traceability (e.g., alloy batch certs). 34% of 2025 rejections were due to zinc impurities.

- Hybrid Label Strategy: Launch with white label to validate demand, then invest in private label tooling at 2,000+ unit volume.

- MOQ Negotiation: Push for 1,000-unit pricing at 800 units – 68% of SourcifyChina clients achieve this via container consolidation.

- Compliance Non-Negotiables: Require IATF 16949 (auto-grade) or ISO 13053 (industrial) certifications. Verify via factory audit reports.

“The lowest unit price often becomes the highest total cost when factoring failures. We recommend budgeting +8% for sourcified quality assurance – it prevents 100%+ cost overruns from rework.”

– SourcifyChina Sourcing Intelligence Unit

Data Sources: SourcifyChina 2026 Supplier Database, China Bearing Industry Association (CBIA), LME Zinc Price Index. Valid as of 15 Jan 2026.

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Due Diligence Protocol for Sourcing Zinc Alloy Pillow Blocks from China

Executive Summary

Sourcing cost-effective zinc alloy pillow blocks from China offers significant savings, but risks such as misrepresentation, substandard quality, and supply chain opacity persist. This report outlines a structured verification framework to identify legitimate manufacturers, differentiate between trading companies and factories, and recognize critical red flags. Adherence to these protocols ensures supply chain integrity, product consistency, and long-term supplier reliability.

Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method(s) |

|---|---|---|---|

| 1 | Request Business License & Scope | Confirm legal registration and manufacturing authorization | Verify on China’s National Enterprise Credit Information Publicity System (NECIPS). Cross-check business scope for “manufacturing” of metal components. |

| 2 | On-Site Factory Audit (Virtual or Physical) | Validate production capabilities and infrastructure | Conduct a scheduled video audit via Zoom/Teams with 360° walkthrough. Prioritize on-site visits for high-volume orders. Request real-time filming of CNC machines, die-casting units, and quality control stations. |

| 3 | Review Production Equipment List | Assess technical capacity and process control | Request detailed list of machinery (e.g., ZDC die-casting machines, CNC lathes, milling centers). Confirm ownership via serial numbers and maintenance logs. |

| 4 | Evaluate In-House Tooling & Molds | Confirm vertical integration and customization ability | Inspect mold storage area. Request photos of existing pillow block molds. Confirm in-house mold design/repair capability. |

| 5 | Audit Quality Control Systems | Ensure compliance with international standards | Request QC checklist, SPC data, and inspection reports (IQC, IPQC, FQC). Verify presence of CMM, hardness testers, and salt spray chambers. |

| 6 | Request Client References & Order History | Validate commercial reliability | Contact 2–3 existing clients (preferably Western). Request past shipment records via Alibaba Trade Assurance or bank wire confirmations. |

| 7 | Sample Testing & Material Certification | Confirm material compliance and performance | Require test samples with material certification (SGS/Intertek) for ZAMAK-3 or ZAMAK-5. Conduct salt spray test (≥72 hours) and load testing. |

How to Distinguish Between Trading Company and Factory

| Indicator | Factory | Trading Company | Verification Technique |

|---|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “factory” | Lists “trading,” “import/export,” or “sales” | Check NECIPS database for exact wording. |

| Facility Ownership | Owns land/building or long-term lease (>5 years) | No dedicated production space; may sublease | Request lease agreement or land use certificate. |

| Production Equipment | Full production line (die-casting, CNC, plating) visible | No machinery; only office space and showroom | Video audit with live machine operation. |

| Engineering Staff | On-site mold designers, process engineers | Sales reps only; outsourced technical queries | Request CVs of technical team; conduct live Q&A. |

| Lead Times | Direct control over scheduling (e.g., 25–35 days) | Longer lead times due to subcontracting | Compare quoted vs. actual production timelines. |

| Pricing Structure | Lower MOQs (e.g., 500 pcs), FOB pricing with clear cost breakdown | High MOQs, vague cost components | Request itemized quote (material, labor, overhead). |

Note: Hybrid models exist (e.g., factory with export arm). Prioritize suppliers with ≥70% in-house production capacity.

Red Flags to Avoid

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unwillingness to conduct live video audit | High probability of trading company or fictitious operation | Disqualify supplier immediately. |

| Samples shipped from third-party logistics (e.g., Cainiao) | Sourced from open market; no quality control | Require samples shipped directly from factory address. |

| No ISO 9001 or IATF 16949 certification | Lack of standardized quality management | Accept only if compensated by rigorous third-party audits. |

| Prices 30–50% below market average | Likely use of recycled zinc, short molds, or labor violations | Conduct material composition analysis (XRF testing). |

| Refusal to sign NDA or IP agreement | Risk of design theft or parallel production | Require legal agreement before sharing technical drawings. |

| PO Box or commercial building address | No physical production base | Validate address via Google Earth Street View and Baidu Maps. |

| Inconsistent communication (e.g., multiple languages/time zones) | Outsourced sales operations; poor accountability | Require single point of contact with technical authority. |

Best Practices for Sustainable Sourcing

- Start with Small Trial Orders (≤$5,000) to evaluate consistency.

- Use Escrow Payment Terms (e.g., 30% deposit, 70% against BL copy).

- Engage Third-Party Inspection (e.g., SGS, TÜV) for first three production runs.

- Register Designs with China IP Office to prevent replication.

- Develop Dual Sourcing Strategy to mitigate disruption risk.

Conclusion

Sourcing zinc alloy pillow blocks from China requires rigorous supplier validation to avoid cost-driven compromises. By systematically verifying manufacturing credentials, distinguishing true factories from intermediaries, and monitoring red flags, procurement managers can secure reliable, high-quality supply chains. SourcifyChina recommends integrating these protocols into supplier onboarding checklists and conducting annual re-audits.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

February 2026

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Optimizing Industrial Component Procurement: Zinc Alloy Pillow Blocks

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: The Zinc Alloy Pillow Block Sourcing Imperative

Global demand for cost-competitive zinc alloy pillow blocks (ISO 113:2010 compliant) has surged 32% YoY (2025), driven by infrastructure modernization in Southeast Asia, Latin America, and Eastern Europe. However, 78% of procurement managers report critical delays due to unverified Chinese suppliers failing quality, capacity, or compliance benchmarks. SourcifyChina’s Verified Pro List eliminates this risk through data-driven supplier validation.

Why Traditional Sourcing Fails for Zinc Alloy Pillow Blocks

| Traditional Approach | Time/Cost Impact | SourcifyChina Verified Pro List | Value Delivered |

|---|---|---|---|

| Manual supplier vetting (15–25+ candidates) | 120–180+ hours per RFQ cycle | Pre-qualified 3–5 suppliers meeting your specs | 78% reduction in vetting time |

| On-site audits for quality checks | $8,500–$15,000 per audit | Factory audit reports + material traceability data | $12,200 saved per category |

| MOQ mismatches & production delays | 22-day avg. timeline overrun | Confirmed capacity (50K–500K units/mo) & lead times | On-time delivery: 98.7% |

| Non-compliance penalties (REACH, RoHS) | $22K+ avg. per incident | Full regulatory documentation pre-vetted | Zero compliance failures (2023–2025) |

The SourcifyChina Advantage: Precision Sourcing for Industrial Components

Our Verified Pro List for zinc alloy pillow blocks delivers:

✅ Technical Rigor: Suppliers audited for ZAMAK-3/ZAMAK-5 casting precision (±0.05mm tolerance), salt-spray tested (96+ hrs), and ISO 9001-certified.

✅ Cost Transparency: FOB pricing validated against 2026 metal index fluctuations (no hidden tooling fees).

✅ Supply Chain Resilience: Dual-source options with <15km supplier clustering (Ningbo/Dongguan hubs) for logistics optimization.

✅ Ethical Assurance: SMETA 4-Pillar compliance verified – zero child labor or environmental violations.

“SourcifyChina cut our zinc alloy pillow block sourcing cycle from 14 weeks to 9 days. Their Pro List suppliers delivered 200K units defect-free in Q3 2025.”

– Procurement Director, German Industrial Bearings Manufacturer (Confidential Client)

Call to Action: Secure Your Competitive Edge in 2026

Stop risking timelines and margins on unvetted suppliers. The Verified Pro List for zinc alloy pillow blocks is your strategic lever to:

– Reduce sourcing costs by 18.5% (2025 client avg.)

– Eliminate 3–6 months of supplier qualification

– Achieve 99.2% first-pass yield rates

→ Activate Your Verified Pro List Access Today

1. Email: Contact [email protected] with subject line “PILLOW BLOCK PRO LIST 2026” for instant access to supplier dossiers, pricing benchmarks, and audit reports.

2. WhatsApp: Message +86 159 5127 6160 for a 20-minute no-obligation sourcing consultation (24/7 multilingual support).

First 15 respondents this month receive a complimentary Zinc Alloy Sourcing Risk Assessment (valued at $450).

SourcifyChina | Trusted by 1,200+ Global Industrial Buyers

We don’t just find suppliers – we de-risk your supply chain.

© 2026 SourcifyChina Sourcing Intelligence | [email protected] | +86 159 5127 6160

🧮 Landed Cost Calculator

Estimate your total import cost from China.