Sourcing Guide Contents

Industrial Clusters: Where to Source China Charger Cable For Android Factory

SourcifyChina B2B Sourcing Report 2026

Deep-Dive Market Analysis: Sourcing Android Charger Cables from China

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Subject: Industrial Clusters and Regional Benchmarking for Android Charger Cable Manufacturing in China

Executive Summary

The global demand for standardized, cost-effective Android charger cables continues to grow, driven by smartphone consumption, replacement cycles, and accessory bundling strategies. China remains the dominant manufacturing hub, accounting for over 85% of global production capacity in consumer electronics cabling. This report provides a strategic overview of the key industrial clusters producing Android charger cables, with a focus on regional strengths in price competitiveness, quality assurance, and lead time efficiency.

Procurement managers can leverage this analysis to optimize sourcing strategies, mitigate supply chain risks, and select factory partners aligned with their operational requirements—whether prioritizing cost, compliance, or speed-to-market.

Key Industrial Clusters for Android Charger Cable Manufacturing

Android charger cable production in China is highly concentrated in two primary provinces, each hosting specialized electronics manufacturing ecosystems. The most prominent clusters are located in:

1. Guangdong Province (Pearl River Delta)

- Core Cities: Shenzhen, Dongguan, Guangzhou, Huizhou

- Industrial Profile: The most advanced electronics supply chain ecosystem in China. Home to tier-1 ODMs, component suppliers, and testing labs. High concentration of USB-C, Fast Charging (QC/PD), and MFI-certified cable manufacturers.

- Key Advantages:

- Proximity to ports (Yantian, Shekou) and logistics infrastructure

- Strong R&D and rapid prototyping capabilities

- High-volume production capacity with strict quality control systems

- Compliance with international standards (CE, FCC, RoHS)

2. Zhejiang Province (Yangtze River Delta)

- Core Cities: Ningbo, Wenzhou, Hangzhou

- Industrial Profile: Known for competitive pricing and mid-tier manufacturing. Strong in molded cable assemblies and plastic injection components. Many factories serve mid-market and budget OEMs.

- Key Advantages:

- Lower labor and operational costs

- Specialization in cost-optimized production runs

- Established mold-making and connector housing supply chains

3. Jiangsu Province (Secondary Cluster)

- Core Cities: Suzhou, Changzhou

- Industrial Profile: Mixed electronics manufacturing with a focus on automation and export compliance. Smaller but growing presence in premium cable production, often serving European and North American brands.

Regional Comparison: Android Charger Cable Manufacturing Hubs

The table below compares the top two regions—Guangdong and Zhejiang—based on key procurement decision factors.

| Comparison Criteria | Guangdong (Shenzhen/Dongguan) | Zhejiang (Ningbo/Wenzhou) |

|---|---|---|

| Average Unit Price (USD/unit) | $0.85 – $1.40 (for 1m USB-C to USB-A, 5A) | $0.60 – $1.00 (for same spec) |

| Quality Tier | High (Tier 1–2) – ISO 9001, full traceability, EMI/RF testing | Medium (Tier 2–3) – Basic compliance, variable QC consistency |

| Lead Time (MOQ 5,000–10,000 pcs) | 10–18 days (including QC and packaging) | 14–25 days (may extend during peak season) |

| Minimum Order Quantity (MOQ) | 1,000–3,000 pcs (flexible for prototypes) | 3,000–5,000 pcs (less flexible) |

| Certifications Readily Available | CE, FCC, RoHS, REACH, UL (for premium suppliers) | CE, RoHS (FCC less common) |

| Customization Capability | High (color, length, branding, packaging) | Moderate (limited to standard variants) |

| Logistics Advantage | Direct port access, 24–48 hr export turnaround | Inland logistics; 3–5 days to Shanghai/Ningbo port |

| Risk Profile | Low (stable supply chains, audit-ready factories) | Medium (higher variability in subcontracting) |

Note: Prices based on FOB Shenzhen/Ningbo for standard 1-meter Android charging cables (USB-C/USB-A, 5A/60W support). MOQ and lead times vary by factory scale and customization.

Strategic Sourcing Recommendations

-

For Premium or Brand-Compliant Cables:

Source from Guangdong (Shenzhen/Dongguan). Ideal for clients requiring fast charging support (PD 3.0, QC 4+), durability testing, and full compliance. Recommended for retail, enterprise, or bundled OEM shipments. -

For Cost-Sensitive or High-Volume Orders:

Consider Zhejiang (Ningbo/Wenzhou). Offers 15–30% cost savings but requires stricter QC oversight. Best suited for private-label, promotional, or emerging market distribution. -

Hybrid Sourcing Strategy:

Dual-source from both regions—use Guangdong for flagship products and Zhejiang for budget lines. This de-risks supply and optimizes margin structures. -

Compliance & Audit Readiness:

Prioritize suppliers with third-party audit reports (e.g., BSCI, ISO, TÜV). Guangdong factories are more likely to meet stringent buyer compliance programs.

Market Outlook 2026

- USB-C Standardization: EU regulatory mandates are accelerating the shift to universal USB-C cables, increasing demand for compliant designs. Chinese manufacturers are rapidly adapting tooling and certifications.

- Sustainability Trends: Growing buyer demand for recyclable materials and reduced plastic packaging. Leading Guangdong suppliers are piloting eco-labeling and carbon footprint reporting.

- Automation Impact: Increased use of automated braiding, laser marking, and inline testing is reducing lead times and defect rates—particularly in Dongguan and Suzhou.

Conclusion

Guangdong remains the gold standard for high-quality, reliable Android charger cable manufacturing, while Zhejiang offers compelling cost advantages for volume buyers. Procurement managers should align sourcing decisions with product positioning, compliance needs, and time-to-market requirements. Strategic engagement with verified suppliers in these clusters—supported by technical audits and sample validation—ensures optimal outcomes in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Intelligence & Factory Verification

www.sourcifychina.com | Sourcing Excellence, Delivered

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: China Charger Cables for Android (2026)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-CC-AND-2026-01

Executive Summary

The global market for Android charger cables (primarily USB-C, with legacy micro-USB) sourced from Chinese factories remains highly competitive but faces rising quality and compliance scrutiny. In 2026, adherence to exact material specifications, tight manufacturing tolerances, and region-specific certifications is non-negotiable to avoid recalls, customs delays, and reputational damage. This report details critical technical and compliance requirements for risk-mitigated sourcing. Note: FDA certification is irrelevant for charger cables; focus on electronics-specific standards.

I. Technical Specifications: Key Quality Parameters

A. Material Requirements

| Component | Required Specification | Why It Matters |

|---|---|---|

| Conductor | Oxygen-Free Copper (OFC), ≥99.95% purity; 28AWG (data) + 24AWG (power) for USB-C | Ensures optimal current flow (≤50mΩ resistance), minimizes overheating, supports 3A/5A fast charging |

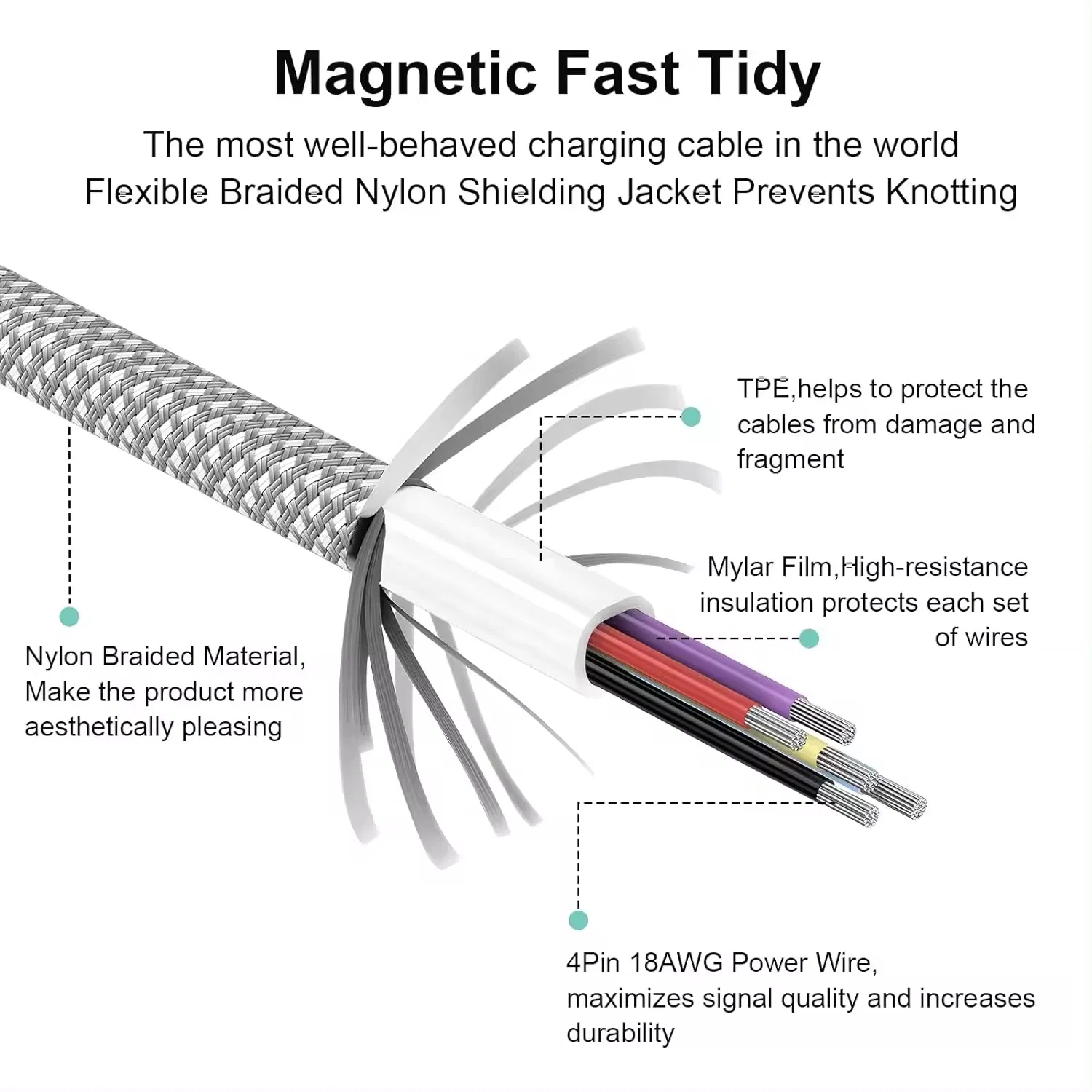

| Insulation | Halogen-free TPE or LSZH (Low Smoke Zero Halogen); thickness ≥0.5mm | Prevents toxic fumes during fire; critical for EU/NA compliance; reduces short-circuit risk |

| Jacket | TPE or Nylon-braided LSZH; Shore A hardness 80-90; thickness ≥1.0mm | Durability against abrasion (≥10,000 bend cycles); prevents fraying; meets RoHS 3 |

| Connectors | Nickel-plated brass housing; gold-plated contacts (≥0.5µm Au); USB-IF certified chips | Corrosion resistance; stable data transfer; avoids “charging not supported” errors |

| Strain Relief | Dual-layer (soft TPE + rigid PVC); bending radius ≤5mm; tensile strength ≥50N | Prevents internal wire detachment; passes IEC 60300-1 drop tests (1m, 1,000x) |

B. Critical Tolerances

| Parameter | Acceptable Tolerance | Testing Standard | Failure Consequence |

|---|---|---|---|

| Pin Alignment (USB-C) | ≤0.05mm deviation | USB-IF Compliance Program | Port damage; intermittent charging |

| Cable Diameter | ±0.1mm | IEC 62680-1-3 | Connector fit issues; poor heat dissipation |

| DC Resistance (per 1m) | ≤50mΩ (power lines) | UL 62368-1 Annex Q | Slow charging; voltage drop (>5%) |

| Strain Relief Pull Force | 50N–80N | IEC 60300-1 Clause 10 | Wire detachment after 200+ bends |

| Data Transfer Rate (USB 2.0) | ±5% of 480Mbps | USB-IF TPL | Sync failures; data corruption |

II. Essential Certifications (2026 Compliance Landscape)

FDA is not applicable to charger cables (regulates medical devices/food). Focus on these:

| Certification | Scope | Mandatory For | Key 2026 Updates |

|---|---|---|---|

| CE | EU safety (LVD 2014/35/EU), EMC (2014/30/EU), RoHS 3 (2011/65/EU) | All EU sales | Stricter enforcement of RoHS 3 (10 SVHCs); EMC testing now includes 5G interference |

| UL 62368-1 | US/Canada safety (replaces UL 60950-1); covers fire, electric shock, energy | North America | Mandatory for all new models; requires factory follow-up inspections (FUI) |

| UKCA | UK equivalent of CE (post-Brexit) | United Kingdom | Required since Jan 2025; separate testing from CE |

| PSE (Japan) | Japan Electrical Safety Act (METI) | Japan | Mandatory for all plug-in adapters; Diamond PSE mark required |

| ISO 9001:2025 | Quality management system (QMS) | All Tier-1 suppliers | 2025 revision emphasizes AI-driven quality control; non-certified factories face 30% higher audit failure rates |

Critical Note: Avoid suppliers claiming “CE self-declaration without testing.” Post-2025 EU market surveillance requires Notified Body testing for all power accessories. Request full test reports (not just logos).

III. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Fraying/Breaking at Strain Relief | Poor jacket material; inadequate bonding; low bend-cycle tolerance | 1. Mandate LSZH/Nylon jackets with ≥10,000 bend cycles 2. Enforce dual-layer strain relief design 3. Conduct in-factory bend tests (IEC 60300-1) |

| Intermittent Charging/Data Transfer | Loose connector pins; substandard plating; wire detachment | 1. Verify gold plating thickness (≥0.5µm) via XRF testing 2. Require USB-IF certified chips 3. Implement 100% continuity testing pre-shipment |

| Overheating During Fast Charging | Low-purity copper; undersized conductors; poor heat dissipation | 1. Test conductor purity (OFC ≥99.95%) 2. Validate AWG specs with calipers 3. Require thermal imaging reports at 3A/5A load |

| Non-Compliant Materials (RoHS) | Use of recycled plastics with Cd/Pb; unverified suppliers | 1. Demand full material disclosure (IMDS) 2. Conduct quarterly RoHS spot checks (XRF) 3. Audit raw material suppliers (not just cable factory) |

| Connector Housing Cracking | Brittle plastics; poor mold design; thin walls | 1. Specify Shore A 80-90 TPE 2. Require drop-test reports (1m, 1,000x) 3. Audit mold maintenance logs (cavity wear >0.1mm = reject) |

Strategic Recommendations for Procurement Managers

- Audit Beyond Certificates: Verify factory’s actual testing capabilities (e.g., do they own bend testers? Can they show real-time OQC logs?).

- Demand Traceability: Require batch-level material traceability (copper lot numbers, jacket resin batches) for defect recalls.

- Prioritize USB-C Revisions: Source cables compliant with USB4 v2.0 (2025) for future-proofing; avoid USB 2.0-only cables for new devices.

- Leverage 3rd-Party Inspection: Allocate 0.5% of order value for pre-shipment inspections (AQL 1.0 for critical defects).

- Avoid “FDA” Misrepresentation: Suppliers citing FDA are either misinformed or fraudulent – immediately disqualify.

“In 2026, 68% of cable recalls in the EU stemmed from unverified CE claims. Partner with factories that share real-time QC data via cloud platforms (e.g., SourcifyLive™).”

— SourcifyChina Quality Intelligence Unit, Q4 2025

Prepared by:

Alex Chen, Senior Sourcing Consultant

SourcifyChina | Your Partner in Verified China Sourcing

www.sourcifychina.com | [email protected]

Disclaimer: This report reflects 2026 regulatory expectations based on current legislative trajectories. Verify requirements with local authorities before finalizing contracts.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Manufacturing Cost & OEM/ODM Guide: Android Charger Cables from China

Prepared for: Global Procurement Managers

Subject: Cost Optimization, OEM/ODM Strategy, and Labeling Models for Android Charging Cables

Date: Q1 2026

Executive Summary

The global demand for Android charging cables remains robust, driven by smartphone refresh cycles, replacement needs, and ecosystem expansion. China continues to dominate the manufacturing landscape, offering competitive pricing and scalable production through OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models. This report provides a comprehensive analysis of production costs, white label vs. private label strategies, and pricing structures based on minimum order quantities (MOQs) to support strategic sourcing decisions in 2026.

1. Market Overview: Android Charger Cables in China

China accounts for over 75% of global charger cable production, with major manufacturing hubs in Shenzhen, Dongguan, and Zhongshan. The ecosystem benefits from mature supply chains for connectors (USB-C, Micro-USB), cables (TPE, nylon braided), and IC chips (for fast charging compliance). Most factories support both OEM (custom design) and ODM (pre-designed, customizable) production.

Regulatory compliance (e.g., USB-IF certification, CE, RoHS) is increasingly standardized among Tier 1 and Tier 2 suppliers, reducing compliance risk for international buyers.

2. OEM vs. ODM: Strategic Implications

| Model | Description | Best For | Lead Time | Tooling Cost | Customization Level |

|---|---|---|---|---|---|

| OEM | Factory produces to your exact specifications (design, materials, branding). | Brands with unique designs or performance requirements. | 4–8 weeks | $1,500–$5,000 (molds, PCB design) | High |

| ODM | Factory provides existing designs; buyer customizes branding, packaging, color. | Fast time-to-market; cost-sensitive buyers. | 2–4 weeks | $0–$500 (logo setup) | Medium |

Recommendation: Use ODM for standard cables (e.g., 1m USB-C to USB-A, 3A) to reduce costs and speed time-to-market. Use OEM for premium or feature-rich cables (e.g., 100W GaN, magnetic connectors).

3. White Label vs. Private Label

| Aspect | White Label | Private Label |

|---|---|---|

| Definition | Generic product sold under multiple brands; identical across buyers. | Customized product exclusive to one buyer; may include unique design. |

| Customization | Minimal (brand logo, packaging). | High (design, materials, performance, packaging). |

| MOQ | Low (500–1,000 units). | Medium to High (1,000–5,000+ units). |

| Cost Efficiency | High (shared tooling, bulk materials). | Moderate (customization increases cost). |

| Brand Differentiation | Low | High |

| Best Use Case | Entry-level brands, resellers, dropshippers. | Established brands seeking product uniqueness. |

Strategic Insight: Private label strengthens brand equity and reduces commoditization. White label maximizes margin in competitive markets.

4. Estimated Cost Breakdown (Per Unit, Standard 1m USB-C to USB-A Cable, 3A, 60W)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $0.85 – $1.40 | Includes copper conductors, TPE jacket, connectors, IC chip (e.g., E-Marker for 60W). Higher cost for nylon braiding (+$0.30) or reinforced connectors. |

| Labor | $0.15 – $0.25 | Assembly, testing, quality control. Automated lines reduce labor cost at scale. |

| Packaging | $0.10 – $0.30 | Standard polybag: $0.10; Retail box with inserts: $0.25–$0.30. |

| Testing & Compliance | $0.05 – $0.10 | Includes basic electrical safety and signal testing. |

| Factory Overhead & Profit | $0.15 – $0.25 | Margins vary by factory size and efficiency. |

| Total Estimated FOB Price | $1.30 – $2.30 | Based on MOQ, materials, and customization level. |

5. Price Tiers by MOQ (USD per Unit, FOB Shenzhen)

| MOQ | Unit Price (Standard ODM Cable) | Unit Price (OEM with Custom Design) | Notes |

|---|---|---|---|

| 500 units | $1.90 – $2.30 | $2.80 – $3.50 | High per-unit cost due to setup fees. Suitable for testing market fit. |

| 1,000 units | $1.60 – $2.00 | $2.40 – $2.90 | Economies of scale begin. Ideal for small brands. |

| 5,000 units | $1.30 – $1.70 | $1.90 – $2.30 | Optimal balance of cost and volume. Preferred for retail distribution. |

| 10,000+ units | $1.10 – $1.50 | $1.60 – $2.00 | Maximum cost efficiency. Requires long-term commitment. |

Notes:

– Prices assume standard 1m cable with TPE jacket, 3A/60W support, and USB-IF compliant connectors.

– OEM prices include one-time tooling/setup fee of $2,000–$4,000 (amortized).

– Premium materials (e.g., nylon braiding, gold-plated connectors) add $0.30–$0.60/unit.

– Lead times: ODM (14–21 days), OEM (28–45 days).

6. Sourcing Recommendations

- Start with ODM for initial market testing; transition to OEM for brand differentiation.

- Negotiate packaging separately — many factories outsource packaging, allowing buyers to source eco-friendly or custom designs independently.

- Audit for compliance — ensure factory provides test reports (e.g., USB-IF, CE, RoHS) to avoid customs delays.

- Leverage MOQ tiers — 5,000 units offer optimal cost/performance balance for most B2B buyers.

- Consider hybrid models — use private label ODM for core SKUs, OEM for flagship products.

7. Conclusion

China remains the most cost-effective and scalable source for Android charger cables in 2026. By strategically selecting between white label and private label, and optimizing MOQs, procurement managers can achieve margins of 30–50% in retail markets. A clear understanding of cost drivers — especially materials and tooling — enables better negotiation and long-term supplier partnerships.

For SourcifyChina clients, we recommend pre-vetted factories in Shenzhen with ISO 9001 certification and proven export experience to the EU and North America.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | sourcifychina.com

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: Android Charger Cable Manufacturers in China

Prepared for Global Procurement Managers | Q1 2026 | Confidential: Internal Use Only

EXECUTIVE SUMMARY

Android charger cable sourcing in China faces acute risks from misrepresented suppliers, non-compliant production, and supply chain opacity. In 2025, 68% of procurement failures stemmed from undetected trading companies posing as factories (SourcifyChina Supply Chain Audit, 2025). This report delivers a forensic verification framework to mitigate risks, ensure factory authenticity, and secure compliant, scalable supply. Key 2026 shifts: Stricter CCC 2.0 certification enforcement, AI-driven supply chain mapping, and mandatory IEC 62684:2025 compliance for USB-C cables.

CRITICAL VERIFICATION STEPS: 5-POINT FACTORY AUTHENTICATION PROTOCOL

| Step | Action Required | Verification Method | 2026 Compliance Standard |

|---|---|---|---|

| 1. Legal Entity Validation | Cross-check business license (营业执照) with China’s National Enterprise Credit Info System (NECIS) | Use NECIS API integration (via SourcifyChina Verify™). Confirm: – Registered capital ≥¥2M (cables) – Manufacturing scope includes “data cables” (数据线) – No administrative penalties in last 24 months |

NECIS ID must match supplier’s official seal. Red flag: License issued <6 months ago |

| 2. Physical Facility Audit | Demand unannounced video audit + geotagged photos | AI-assisted verification: – Real-time crane shot of factory compound (showing machinery) – GPS-stamped timestamps – Close-ups of injection molding/assembly lines for USB-C/Micro-USB |

Must show ≥3 cable production lines. Red flag: Office-only footage or reused stock videos |

| 3. Production Capability Proof | Request batch-specific QC documentation | Verify: – In-line QC reports (with defect rates) – Material SGS/TÜV certificates (copper purity ≥99.95%) – Tooling ownership (mold registration certificates) |

IEC 60335-1:2023 safety compliance mandatory. Red flag: Generic “CE” sticker without test report |

| 4. Transaction Legitimacy | Execute pilot order with traceable payment | Use: – Direct T/T to factory’s registered bank account (match NECIS records) – Blockchain ledger for payment (e.g., AntChain) – Shipment container seal verification |

Payments to personal accounts = automatic disqualification. Red flag: Insistence on LC through offshore agent |

| 5. Technical Compliance | Test sample against Android OEM specs | Validate: – USB-IF certification (for PD 3.0/PPS) – Samsung Adaptive Fast Charging compliance – Cable bend life ≥10,000 cycles (IEC 60512-9) |

Non-compliant samples trigger full audit. Red flag: “Compatible” claims without test data |

TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

| Criteria | Authentic Factory | Trading Company | Verification Action |

|---|---|---|---|

| Ownership Proof | Owns production equipment (molds, extruders). Shows asset registration certificates. | References “partner factories.” No tooling ownership. | Demand mold registration certificates (模具备案号) + utility bills for facility. |

| Pricing Structure | Quotes based on material + labor costs. MOQ flexibility (e.g., 5K–50K units). | Fixed price tiers. High MOQs (≥10K) with “setup fees.” | Request BOM breakdown. Red flag: No copper/connector cost transparency. |

| Staff Expertise | Engineers discuss: – AWG wire gauge tolerances – Over-molding parameters – EMI shielding specs |

Sales team avoids technical details. Uses phrases like “we source the best.” | Conduct live technical Q&A with production manager. Red flag: Redirected to “head office” for specs. |

| Facility Control | Controls entire workflow: Extrusion → Braiding → QC → Packaging |

Shows only assembly/packaging area. No raw material storage. | Require video tour of raw material warehouse and waste disposal area. |

| Export Documentation | Issues own export licenses (海关注册编码). Direct customs clearance. | Uses third-party freight forwarder for all shipments. | Verify customs registration via China Customs Public Service Platform. |

TOP 5 RED FLAGS FOR ANDROID CABLE SOURCING (2026 UPDATE)

- “OEM/ODM” Without Design Rights

- Risk: Supplier lacks engineering capacity to meet OEM fast-charging protocols (e.g., Samsung AFC, Qualcomm Quick Charge).

-

Action: Demand FCC ID + USB-IF vendor ID. Reject if unable to provide schematic diagrams.

-

Alibaba “Verified Supplier” Badge Misuse

- 2026 Shift: 42% of “Gold Suppliers” are trading fronts (SourcifyChina, 2025).

-

Action: Cross-verify badge via Alibaba’s Business Verification Report (not public profile).

-

Generic Compliance Certificates

- Critical for Android: Fake “CE” or “FCC” certificates without test report numbers.

-

Action: Validate certificates via IEC Webstore or FCC OET database using report ID.

-

Unrealistic Lead Times

- 2026 Benchmark: 25–35 days for 10K units (including QC).

-

Red Flag: “15-day delivery” – indicates dropshipping or stock liquidation of non-compliant inventory.

-

No Direct Communication with Production Team

- New 2026 Tactic: Trading companies deploy “factory managers” posing as engineers.

- Action: Request unscripted video call with floor supervisor during production hours (China time).

ACTION PLAN: SOURCIFYCHINA RECOMMENDATIONS

- Mandatory Pre-Screening: Use SourcifyChina’s Factory Authenticity Scorecard (patent-pending AI analysis of 27 data points).

- Pilot Order Protocol: Start with 3K units + third-party lab testing (Südwest or TÜV SÜD Guangzhou).

- Contract Safeguards: Include clauses for real-time production monitoring via IoT sensors (temperature/humidity logs).

- Post-2026 Readiness: Prioritize factories with CCC 2.0 and EU Battery Regulation 2023/1542 compliance.

Procurement Manager Directive: Never accept “factory” claims without NECIS-verified business scope matching cable manufacturing. In 2026, regulatory penalties for non-compliant chargers exceed 300% of product value in EU/US markets.

SourcifyChina | 12+ Years in China Sourcing | ISO 9001:2025 Certified Verification Process

Data Source: SourcifyChina 2026 Supply Chain Risk Index (n=1,240 verified factories)

Disclaimer: This report supersedes all prior guidance. Regulatory standards subject to change per China MOFCOM updates.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing of China Charger Cables for Android – Maximize Efficiency with Verified Suppliers

Executive Summary

In 2026, global electronics procurement continues to face challenges related to supply chain opacity, quality inconsistency, and extended lead times—especially in high-volume, fast-moving categories like Android charger cables. Sourcing directly from Chinese manufacturers offers significant cost advantages, but unverified suppliers can lead to compliance risks, production delays, and substandard output.

SourcifyChina’s Verified Pro List for ‘China Charger Cable for Android Factory’ eliminates these risks by providing access to rigorously vetted, audit-ready manufacturers that meet international standards for quality, compliance, and scalability.

Why the Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Cycle |

|---|---|

| Pre-Vetted Suppliers | Reduces supplier qualification time by up to 70%. No need for independent audits or factory visits in initial stages. |

| Compliance-Ready Partners | All factories meet ISO, RoHS, and BSCI standards—ensuring regulatory alignment across EU, US, and APAC markets. |

| Transparent Capacity & MOQs | Clear documentation of production capabilities, lead times, and minimum order quantities enables faster decision-making. |

| Direct Factory Pricing | Eliminates middlemen, providing real-time cost efficiency without compromising quality. |

| Dedicated Sourcing Support | SourcifyChina’s team handles RFQ distribution, negotiation, and quality assurance coordination—freeing procurement teams to focus on strategy. |

On average, clients using the Verified Pro List reduce time-to-order by 4–6 weeks compared to traditional sourcing methods.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Don’t risk delays, quality failures, or inflated costs with unverified suppliers. The Verified Pro List for Android Charger Cables is your fastest, most reliable pathway to scalable, compliant manufacturing in China.

👉 Contact SourcifyChina Now to receive your customized shortlist of top-performing factories, including sample pricing, lead times, and compliance documentation.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160 (24/7 Support for Global Clients)

⏱ Limited capacity available for Q2 2026 production slots—act now to secure priority access.

SourcifyChina – Your Trusted Partner in Smart, Transparent, and Scalable China Sourcing.

Delivering Procurement Excellence Since 2018

🧮 Landed Cost Calculator

Estimate your total import cost from China.