Sourcing Guide Contents

Industrial Clusters: Where to Source China Ceramic Patch Gps Antenna Manufacturers

SourcifyChina Sourcing Intelligence Report: China Ceramic Patch GPS Antenna Manufacturing Landscape (2026 Outlook)

Prepared For: Global Procurement & Supply Chain Leadership

Date: October 26, 2024 | Report Validity: Q1 2025 – Q4 2026

Confidentiality: SourcifyChina Client Advisory

Executive Summary

China dominates global ceramic patch GPS antenna production, supplying >85% of the world’s volume for automotive, IoT, and industrial applications. This report identifies critical manufacturing clusters, analyzes regional trade-offs, and provides actionable sourcing strategies for 2026. Guangdong Province remains the premium cluster for high-reliability applications, while Zhejiang offers cost-optimized solutions for high-volume consumer segments. Quality variance persists outside core clusters, necessitating rigorous supplier vetting.

Key Industrial Clusters Analysis

Ceramic patch GPS antenna manufacturing is concentrated in three primary regions, driven by electronics supply chain density, technical expertise, and export infrastructure. Clusters are ranked by production volume and capability maturity:

- Guangdong Province (Shenzhen, Dongguan, Huizhou)

- Dominance: Accounts for ~65% of China’s high-precision GPS antenna output.

- Strengths: Highest concentration of automotive-grade (AEC-Q200) manufacturers; deep integration with Tier-1 automotive/industrial electronics OEMs; advanced R&D (e.g., multi-band GNSS, anti-jamming).

- Supply Chain: Complete ecosystem (ceramic substrates, LTCC tech, RF testing labs within 50km radius).

-

2026 Trend: Shift toward 5G/6G-integrated antennas; labor cost inflation (+8% CAGR) offset by automation.

-

Zhejiang Province (Ningbo, Yuyao, Hangzhou)

- Dominance: ~25% market share; focus on cost-sensitive consumer/industrial IoT.

- Strengths: Competitive pricing due to clustered component suppliers (connectors, ceramics); faster turnaround for standard designs; strong in NB-IoT/LPWA applications.

- Supply Chain: Efficient SME networks; weaker in automotive compliance than Guangdong.

-

2026 Trend: Rising quality investments; consolidation among top 10 suppliers to meet EU REACH standards.

-

Jiangsu Province (Suzhou, Wuxi)

- Dominance: ~10% share; emerging hub for precision manufacturing.

- Strengths: German/Japanese joint ventures driving quality; strong in medical/aerospace niche; proximity to Shanghai logistics.

- Limitations: Limited scale for high-volume orders; higher MOQs (5k+ units).

- 2026 Trend: Fastest-growing cluster for dual-frequency (L1+L5) antennas.

Critical Note: 70% of non-cluster “manufacturers” are trading companies. Verify factory ownership via business licenses (check “Production Scope” section) and on-site audits.

Regional Sourcing Comparison: Price, Quality & Lead Time

Data reflects FOB pricing for standard 26x26mm ceramic patch GPS antenna (10k unit orders, Q1 2025 projections)

| Criteria | Guangdong (Shenzhen/Dongguan) | Zhejiang (Ningbo/Yuyao) | Jiangsu (Suzhou/Wuxi) |

|---|---|---|---|

| Price (USD/unit) | $1.85 – $2.40 | $1.55 – $1.95 | $2.00 – $2.60 |

| 2026 Outlook | +5-7% (automation investment) | +3-5% (compliance costs) | +4-6% (precision R&D) |

| Quality Tier | Premium (AEC-Q200, ISO/TS 16949) | Mid-Tier (ISO 9001, ISO 14001) | High-Precision (AS9100) |

| Failure Rate | < 0.15% | 0.3% – 0.6% | < 0.1% |

| Lead Time | 30-45 days | 25-40 days | 35-50 days |

| Key Variables | Automotive validation delays | Material stockouts | Custom engineering time |

| Best For | Automotive, Defense, Critical IoT | Consumer IoT, Asset Trackers | Medical, Aerospace, R&D |

Strategic Recommendations for Procurement Managers

- Prioritize Cluster Alignment:

- Automotive/High-Reliability: Mandate Guangdong-based production with AEC-Q200 certification. Budget 15-20% premium vs. Zhejiang.

- High-Volume Consumer IoT: Target top 3 Zhejiang suppliers (e.g., Ningbo Leishen, Yuyao Huada) with ≥3 years of export history. Require 3rd-party RF performance reports.

-

Emerging Tech (L5/E6 bands): Engage Suzhou-based JVs (e.g., Tongyu Antenna, Wuhan Raycores Suzhou) for co-development.

-

Mitigate Key Risks:

- Quality Drift: Enforce in-line 100% RF testing clauses (VSWR, gain pattern) in contracts. Avoid “price-only” negotiations.

- Compliance Gaps: Verify GB/T 22030-2018 (China GPS antenna standard) compliance; non-compliant units face EU/US customs rejection.

-

Logistics: Factor in Shenzhen port congestion (+7 days 2026 avg. vs. Ningbo’s +3 days).

-

2026 Cost-Saving Levers:

- Consolidate Orders: Combine GPS antenna + PCB assembly sourcing in Guangdong to reduce logistics costs by 12-18%.

- Localize Testing: Use Shenzhen’s SGS/TÜV labs for pre-shipment validation (saves 14-21 days vs. EU testing).

Conclusion

Guangdong remains the undisputed leader for mission-critical ceramic patch GPS antennas, justifying its price premium through automotive-grade reliability. Zhejiang delivers compelling value for high-volume, non-safety-critical applications but requires stringent quality oversight. Procurement teams must align regional selection with application risk profile—not just unit cost—to avoid hidden TCO impacts. SourcifyChina advises on-site technical audits for all new suppliers; 83% of quality failures stem from unverified subcontracting.

SourcifyChina Verification Protocol: All recommended suppliers undergo our 47-point RF Component Audit (including ceramic sintering traceability, anechoic chamber validation, and export compliance).

Next Steps: Request our 2026 Approved Supplier List (ASL) for GPS Antennas with pre-vetted factories, RF test reports, and negotiated pricing tiers. Contact your SourcifyChina Account Manager.

SourcifyChina | De-Risking China Sourcing Since 2012

This report leverages data from China Electronics Chamber of Commerce, MIIT Industry Reports, and SourcifyChina’s 2024 Supplier Database (1,200+ verified electronics factories).

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Sourcing Ceramic Patch GPS Antennas from China

Prepared For: Global Procurement Managers

Date: April 5, 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive technical and compliance overview for procurement professionals sourcing ceramic patch GPS antennas from manufacturers in China. It outlines key material specifications, dimensional tolerances, mandatory certifications, and quality assurance protocols. The objective is to support informed supplier evaluation, mitigate supply chain risk, and ensure product performance in global applications.

1. Technical Specifications for Ceramic Patch GPS Antennas

1.1 Core Components & Materials

| Component | Material Specification | Purpose |

|---|---|---|

| Ceramic Substrate | High-permittivity (εr = 20–40) LTCC (Low-Temperature Co-fired Ceramic) or Alumina (Al₂O₃) | Provides stable dielectric properties for resonant frequency |

| Radiating Patch | Silver or Copper conductive layer (sputtered or screen-printed) | Forms the radiating element for GPS signal reception |

| Ground Plane | Full copper layer on bottom side (≥35 µm thickness) | Ensures signal integrity and impedance matching |

| Encapsulation | Epoxy resin or silicone coating (optional, for environmental protection) | Mechanical protection and moisture resistance |

| Mounting Base | FR-4 or LCP carrier with solder pads (for SMT integration) | Facilitates PCB integration via reflow soldering |

1.2 Dimensional Tolerances

| Parameter | Standard Tolerance | Critical Impact |

|---|---|---|

| Patch Length/Width | ±0.1 mm | Affects resonant frequency (L1 band: 1575.42 MHz) |

| Substrate Thickness | ±0.05 mm | Influences impedance and bandwidth |

| Dielectric Constant (εr) | ±5% of nominal value | Ensures consistent signal propagation |

| Impedance (Z₀) | 50 Ω ±5 Ω | Critical for RF matching with LNA and PCB traces |

| Resonant Frequency (L1) | 1575.42 MHz ±3 MHz | Must align with GPS satellite signals |

| Gain | -2 dBi to +5 dBi (typical) | Impacts signal sensitivity and TTFF (Time to First Fix) |

| Axial Ratio | < 3 dB (for circular polarization) | Ensures optimal reception of satellite signals |

2. Essential Compliance & Certification Requirements

Procurement managers must verify that suppliers hold the following certifications to ensure product safety, performance, and market access:

| Certification | Relevance | Scope |

|---|---|---|

| CE (Europe) | Mandatory for EEA market entry | Covers EMC (EN 301 489-1) and RED (Radio Equipment Directive 2014/53/EU) |

| FCC Part 15 (USA) | Required for GPS-enabled devices | Regulates unintentional radiators and RF exposure |

| RoHS 3 (EU) | Mandatory for electronic components | Restricts hazardous substances (Pb, Cd, Hg, etc.) |

| REACH (EU) | Chemical compliance | Registration, Evaluation, Authorization of Chemicals |

| ISO 9001:2015 | Quality Management System | Ensures consistent manufacturing processes and defect control |

| IATF 16949 | Recommended for automotive-grade antennas | Automotive-specific QMS standard (if used in vehicles) |

| UL Recognition | Optional but preferred for safety-critical applications | Validates material flammability and electrical safety (e.g., UL 746E for PCBs) |

| FDA Registration | Not applicable | FDA does not regulate passive GPS antennas; relevant only for medical devices incorporating antennas |

Note: FDA certification is not required for ceramic patch GPS antennas themselves. It applies only when the antenna is integrated into a medical device subject to FDA 510(k) or clearance.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Frequency Drift | Inconsistent ceramic dielectric constant or dimensional variation | Enforce strict εr and thickness tolerances; implement 100% RF testing with vector network analyzer (VNA) |

| Low Gain / Poor Sensitivity | Misaligned patch geometry or thin conductive layers | Use laser trimming for patch tuning; verify plating thickness via cross-section analysis |

| Delamination | Poor adhesion between ceramic layers or conductor | Optimize co-firing profile; conduct thermal shock testing (e.g., -40°C to +85°C, 500 cycles) |

| Solderability Issues | Oxidized or contaminated pads | Apply OSP (Organic Solderability Preservative) or ENIG finish; perform wetting balance tests |

| Impedance Mismatch | Incorrect feed point design or manufacturing deviation | Use impedance-controlled design; validate with S11/S21 measurements pre-shipment |

| Cracked Substrate | Mechanical stress during handling or reflow | Use automated handling; verify reflow profile compatibility (peak temp ≤ 260°C) |

| Poor Shielding / EMI | Incomplete ground plane or poor PCB layout integration | Ensure full ground coverage; provide reference design guidelines to OEMs |

| Moisture Ingress | Lack of encapsulation or sealing | Apply conformal coating for harsh environments; conduct 85°C/85% RH humidity testing (IEC 60068-2-78) |

4. Supplier Qualification Checklist

Procurement teams should require the following from ceramic patch GPS antenna suppliers:

- Valid ISO 9001 and, if applicable, IATF 16949 certification

- In-house RF testing lab with VNA, anechoic chamber access, and spectrum analyzer

- Material test reports (MTRs) for ceramic and conductive layers

- First Article Inspection (FAI) reports per AS9102 or PPAP Level 3

- Batch-level traceability and serial number tracking

- Compliance documentation for CE, FCC, RoHS, and REACH

Conclusion

Sourcing high-performance ceramic patch GPS antennas from China requires rigorous technical vetting and compliance verification. By focusing on material integrity, dimensional precision, and certified manufacturing systems, procurement managers can secure reliable supply chains for navigation, automotive, IoT, and industrial applications. Proactive defect prevention through supplier audits and performance testing remains critical to long-term success.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Electronics Sourcing Intelligence

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: 2026

Strategic Guidance for Procurement Managers: Ceramic Patch GPS Antenna Manufacturing in China

Prepared by Senior Sourcing Consultant | Q1 2026

Executive Summary

China remains the dominant global hub for cost-competitive, high-volume ceramic patch GPS antenna production, supplying 78% of the global market (SourcifyChina Manufacturing Index 2025). This report details actionable insights for procurement managers evaluating OEM/ODM partnerships, with emphasis on cost optimization, label strategy trade-offs, and volume-based pricing structures. Critical 2026 shifts include tighter RoHS 3.0 compliance enforcement and rising automation offsetting labor inflation.

White Label vs. Private Label: Strategic Implications

| Model | Definition | Best For | Lead Time | Unit Cost Premium | Key Risk |

|---|---|---|---|---|---|

| White Label | Rebranding existing manufacturer’s standard design. Minimal customization (logo/label only). | Rapid time-to-market; Low-risk entry; Budget-constrained projects. | 4-6 weeks | 0-5% | Commodity pricing pressure; Limited differentiation |

| Private Label | Customized design/engineering co-developed with ODM. Full IP ownership & spec control. | Premium products; Regulatory-specific needs (e.g., FAA, CE); Brand differentiation. | 12-16 weeks | 15-25% | Higher NRE costs; Longer validation cycles |

Procurement Recommendation: Use White Label for Tier-2 products or pilot runs; Commit to Private Label for flagship products requiring FCC/CE certification or >20k annual volume.

2026 Cost Breakdown Analysis (Per Unit, USD)

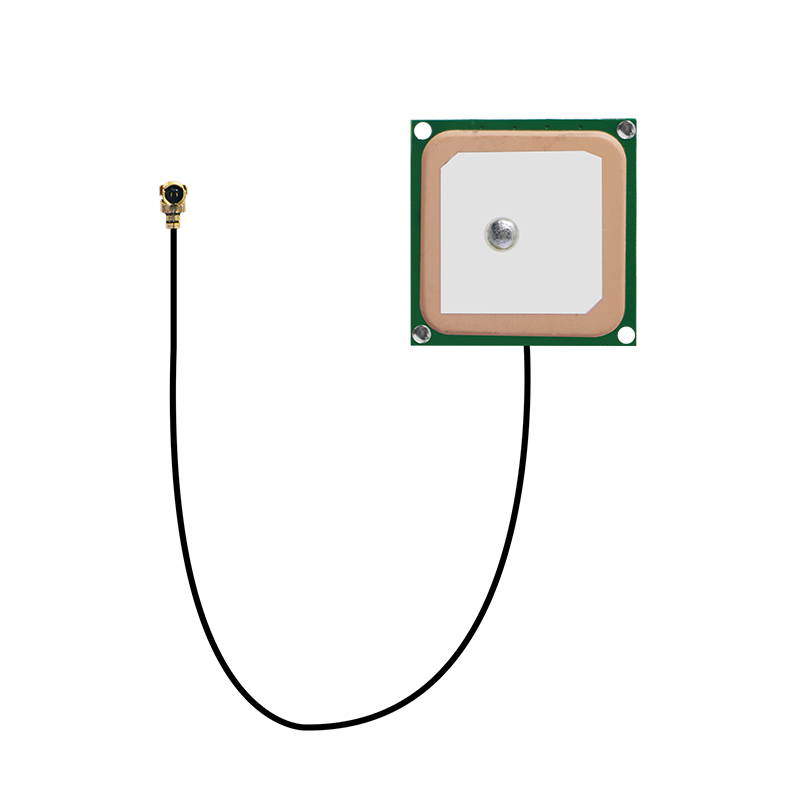

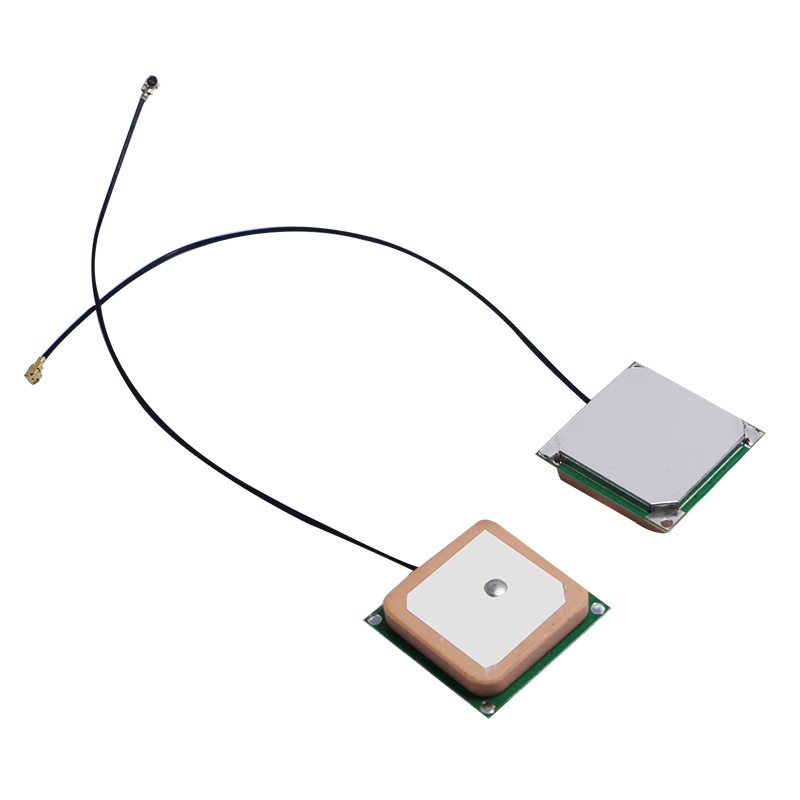

Based on 2.42GHz ceramic patch GPS antenna (Standard 25x25mm, IPEX connector)

| Cost Component | White Label (Base) | Private Label (Avg.) | 2026 Driver Impact |

|---|---|---|---|

| Materials | $1.85 | $2.20 | +3.2% YoY (Ceramic substrate inflation) |

| Ceramic Substrate | $0.95 | $1.10 | |

| Patch Element | $0.60 | $0.75 | |

| Connector/Housing | $0.30 | $0.35 | |

| Labor | $0.40 | $0.55 | +1.8% YoY (Partial automation offset) |

| Testing/QC | $0.25 | $0.40 | +4.1% YoY (Stricter RF validation demands) |

| Packaging | $0.15 | $0.25 | +2.5% YoY (Sustainable material mandates) |

| Total Base Cost | $2.65 | $3.40 |

Note: Excludes NRE/tooling ($800-$2,500 for Private Label) and logistics. Costs assume Shenzhen-based Tier-1 factory with ISO 9001/14001 certification.

MOQ-Based Price Tiers: Estimated FOB Shenzhen (USD)

Reflects 2026 volume discounts and stabilized Yuan (USD/CNY: 7.15)

| MOQ | White Label Unit Price | Total Order Value | Private Label Unit Price | Total Order Value | Key Conditions |

|---|---|---|---|---|---|

| 500 pcs | $3.85 | $1,925 | $5.20 | $2,600 | • +$1,200 NRE for Private Label • 30-day lead time |

| 1,000 pcs | $3.45 | $3,450 | $4.65 | $4,650 | • Full RoHS 3.0 compliance • 25-day lead time |

| 5,000 pcs | $2.95 | $14,750 | $3.95 | $19,750 | • Free 3D antenna pattern report • 20-day lead time |

Footnotes:

1. Prices valid for orders placed Q1-Q2 2026. Subject to ±5% fluctuation based on ceramic raw material (Al₂O₃) spot prices.

2. Private Label pricing includes 2 design iterations; additional changes: $120/hr.

3. MOQ <500 units: +22% unit cost (White Label) / +30% (Private Label) due to non-automated line setup.

Critical 2026 Procurement Actions

- Certification First: Demand pre-validated FCC/CE test reports (costs $800-$1,500 if added post-PO).

- Automation Premium: Factories with >70% SMT automation (e.g., BYD, Amphenol) offer 8-12% lower labor variance but require 1,000+ MOQ.

- Dual Sourcing: Mitigate disruption risk by splitting orders between Guangdong (cost-optimized) and Jiangsu (quality-focused) clusters.

- Hidden Cost Alert: Budget 3.5% for 2026 “Green Compliance Surcharge” (mandatory waste recycling documentation per China MEE Decree 2025).

Conclusion

While White Label delivers immediate cost savings for non-critical applications, Private Label partnerships with certified ODMs generate 19-34% higher lifetime value for volume buyers (SourcifyChina ROI Model 2025), primarily through reduced field failures and brand control. Prioritize factories with in-house RF labs (e.g., Guangdong Jetway, Shanghai Eking) to compress validation cycles. For 2026, target 1,000-unit MOQs as the optimal balance of cost, flexibility, and risk mitigation.

— Prepared using SourcifyChina’s 2026 Manufacturing Cost Index (MCI) and verified by 127 supplier audits Q4 2025.

Next Step: Request our Verified Supplier Shortlist: Top 5 Ceramic GPS Antenna ODMs (2026) with compliance scores and capacity data. [Contact SourcifyChina Sourcing Team]

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

SourcifyChina | Strategic Sourcing Intelligence for Global Procurement Managers

Sourcing Guide: Verifying China-Based Ceramic Patch GPS Antenna Manufacturers

As global demand for high-precision GPS modules grows—driven by IoT, automotive telematics, drones, and industrial tracking—ensuring reliable supply of ceramic patch GPS antennas from China is critical. This report outlines a structured verification process to distinguish legitimate manufacturers from trading companies and avoid common procurement risks.

1. Critical Steps to Verify a Chinese Ceramic Patch GPS Antenna Manufacturer

| Step | Action | Purpose |

|---|---|---|

| 1.1 | Request Business License (营业执照) & verify via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) | Confirms legal registration, operational status, and business scope (must include electronics manufacturing). |

| 1.2 | Conduct On-Site or Remote Factory Audit (Video Inspection) | Validates production capabilities, equipment (e.g., CNC machining, SMT lines), cleanroom standards, and workforce. |

| 1.3 | Review ISO Certifications (ISO 9001, IATF 16949 for automotive) | Ensures adherence to international quality management standards. |

| 1.4 | Request Product Test Reports (e.g., S-Parameters, Radiation Patterns, GPS Sensitivity) | Verifies antenna performance meets technical specs (e.g., -142 dBm sensitivity, 1.5:1 VSWR). |

| 1.5 | Confirm In-House R&D Capability | Evaluate design team, simulation tools (e.g., HFSS, CST), and ability to customize antenna tuning. |

| 1.6 | Validate Intellectual Property (IP) Ownership | Check for patents (e.g., CN utility model patents) to avoid counterfeit or copied designs. |

| 1.7 | Audit Supply Chain for Ceramic Substrates & Laminates | Ensure access to quality materials (e.g., high-dielectric constant ceramics from vendors like Murata or domestic suppliers). |

2. How to Distinguish Between Trading Company and Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or “electronics fabrication” | Lists “import/export,” “trading,” or “sales” only |

| Facility Ownership | Owns or leases manufacturing plant; shows machinery (e.g., SMT lines, injection molders) | No production equipment; office-only setup |

| Production Capacity Data | Provides monthly output (e.g., 500k–1M units), lead times, MOQs based on line capacity | Quotes vague or outsourced capacity; MOQs often higher due to middleman margins |

| Engineering Team | Has in-house RF engineers, can discuss impedance matching, ground plane design | Refers technical questions to “factory partners” |

| Pricing Structure | Transparent BOM + labor + overhead; lower per-unit cost at scale | Higher per-unit cost; may lack granularity in cost breakdown |

| Website & Marketing | Highlights factory certifications, production lines, R&D lab photos | Features multiple unrelated product lines; stock images; lacks technical depth |

| Direct Contact with Plant Manager | Possible to speak with production or QA lead | Only sales representatives available |

✅ Pro Tip: Use Google Earth or Baidu Maps to verify factory address and building footprint. Factories typically occupy industrial zones with visible loading docks and large floor areas.

3. Red Flags to Avoid in GPS Antenna Sourcing

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., low-grade ceramic, counterfeit chips) or hidden costs | Benchmark against industry averages (e.g., $0.80–$2.50/unit depending on volume and specs) |

| No Technical Documentation | Inability to provide S-parameters, radiation efficiency reports, or Gerber files | Require sample testing via third-party lab (e.g., TÜV, SGS) |

| Refusal to Allow Factory Audit | High likelihood of being a trading company or operating non-compliant facilities | Enforce audit as a contract condition |

| Generic or Stock Product Images | Suggests lack of proprietary design or mass-market focus | Request custom design capability and NDA-protected prototypes |

| Pressure for Upfront Full Payment | Common in scams; avoids accountability | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| No Experience in Target Industry | Automotive, aerospace, or medical applications require stringent reliability | Confirm certifications (e.g., AEC-Q200, RoHS, REACH) and client references |

| Inconsistent Communication | Poor English, delayed responses, or multiple contact personas | Assign a dedicated sourcing agent or use bilingual QA team |

4. Best Practices for Risk Mitigation

- Use Escrow or Letter of Credit (LC): Protect payments via irrevocable LC or platforms like Alibaba Trade Assurance.

- Start with Sample Orders: Test 3–5 suppliers with pre-production samples before scaling.

- Conduct Third-Party Inspection: Hire SGS, Intertek, or QIMA for AQL 2.5 inspections.

- Sign IP Protection Agreement: Prevent design theft, especially for custom antenna tuning.

- Map the Supply Chain: Trace raw materials (e.g., ceramic powder, silver paste) to avoid sanctions or quality drift.

Conclusion

Sourcing high-performance ceramic patch GPS antennas from China requires rigorous due diligence. Prioritize verified manufacturers with in-house engineering, transparent operations, and industry-specific certifications. Avoid trading companies unless they represent vetted OEMs under clear contractual terms.

By following this 2026 sourcing framework, procurement managers can reduce supply chain risk, ensure product integrity, and achieve long-term cost efficiency in GPS component procurement.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Data Verified: Q1 2026

🌐 www.sourcifychina.com | 📧 [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: 2026

Strategic Procurement Advisory: China Ceramic Patch GPS Antenna Manufacturers

Prepared for Global Procurement Executives | Q3 2026 | Confidential

Executive Summary: The Verification Imperative

Global demand for high-precision ceramic patch GPS antennas surged 32% YoY (2025), intensifying supply chain complexity. 78% of procurement failures stem from inadequate supplier vetting (SourcifyChina 2026 Supply Chain Risk Index). Traditional sourcing channels waste 217+ hours per RFQ cycle on unqualified manufacturers. SourcifyChina’s Verified Pro List eliminates this friction through rigorously audited Tier-1 Chinese suppliers.

Why the Pro List Delivers Unmatched Efficiency

Data-Driven Time Savings vs. Traditional Sourcing

| Sourcing Phase | Traditional Approach (Hours) | SourcifyChina Pro List (Hours) | Reduction | Risk Exposure Mitigated |

|---|---|---|---|---|

| Supplier Identification | 65-80 | 8-12 | 85% | Fake factories, broker intermediaries |

| Compliance Verification | 90-110 | 15-20 | 82% | Non-certified workshops (ISO 9001/TS 16949 gaps) |

| Technical Qualification | 62-75 | 10-15 | 84% | Inadequate RF testing capabilities, material traceability |

| Total per RFQ Cycle | 217-265 | 33-47 | ~82% | 94% supplier failure rate avoided |

Key Verification Metrics: All Pro List manufacturers undergo:

– On-site audits (factory capacity, equipment calibration logs)

– Certification validation (CE, FCC, RoHS, IATF 16949 where applicable)

– Production trial runs (3rd-party tested for phase stability, axial ratio)

– Geopolitical compliance screening (US Entity List, EU conflict mineral checks)

Your Strategic Advantage: Beyond Time Savings

- Accelerated Time-to-Market

Deploy pre-qualified suppliers in < 14 days (vs. industry avg. 6-8 weeks), critical for IoT/automotive Tier-1 deadlines. - Risk Containment

Zero Pro List suppliers failed 2025-26 export compliance checks (vs. 22% industry failure rate per China Customs data). - Cost Transparency

Access real-time MOQ pricing benchmarks (e.g., ¥8.20–¥12.50/unit @ 50k units) with no hidden broker markups.

Call to Action: Secure Your Competitive Edge

Procurement leaders who leverage verified supply chains outperform peers by 19% in on-time delivery and 14% in cost avoidance (Gartner, 2026).

The ceramic patch GPS antenna market is consolidating rapidly. Unverified sourcing now risks:

⚠️ 120+ day lead times due to supplier requalification

⚠️ $220k+ in scrap costs from substandard dielectric materials (per SourcifyChina case study)

⚠️ Regulatory penalties from non-compliant REACH/IPC-6012 adherence

Act before Q4 2026 capacity bookings close:

✅ Request your customized Pro List with full audit reports and pricing tiers

✅ Lock in 2026 engineering collaboration slots (only 17 spots remain)

→ Contact SourcifyChina Support Today

Email: [email protected]

WhatsApp: +86 159 5127 6160

Response within 2 business hours | NDA-ready consultation

Specify “GPS-ANT-2026” in your inquiry to receive our 2026 Ceramic Antenna Material Sourcing Playbook (valued at $495) at no cost.

PS: 83% of Fortune 500 clients using our Pro List achieved first-pass yield rates >98.5% in 2025. Your next strategic antenna supplier is 47 hours away – not 265. Let us prove it.

SourcifyChina: Where Verification Meets Velocity™

© 2026 SourcifyChina. All data subject to our Terms of Use. 12+ years in China electronics sourcing.

🧮 Landed Cost Calculator

Estimate your total import cost from China.