Sourcing Guide Contents

Industrial Clusters: Where to Source China Centrifugal Pump Manufacturers

SourcifyChina

Professional B2B Sourcing Report 2026

Title: Deep-Dive Market Analysis: Sourcing Centrifugal Pump Manufacturers in China

Prepared For: Global Procurement Managers

Date: April 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the world’s leading exporter of centrifugal pumps, accounting for over 30% of global pump production capacity. With increasing demand in water treatment, HVAC, oil & gas, and industrial processing sectors, global procurement managers are turning to Chinese manufacturers for cost-effective, scalable, and technologically advanced solutions. This report provides a strategic overview of China’s centrifugal pump manufacturing landscape, identifying key industrial clusters, evaluating regional strengths, and delivering actionable insights for optimized sourcing decisions in 2026.

Market Overview: China’s Centrifugal Pump Industry

China’s centrifugal pump market is valued at over USD 12.8 billion in 2026, with annual export growth averaging 6.4% over the past five years. The industry is characterized by a mix of large state-owned enterprises (SOEs), established private OEMs, and agile mid-tier suppliers capable of both standard and custom-engineered solutions. Technological improvements—especially in energy efficiency (IE3/IE4 motors), smart monitoring integration, and corrosion-resistant materials—are increasingly aligning Chinese manufacturers with international standards (ISO, API, ANSI, CE).

Key export destinations include Southeast Asia, the Middle East, North America, and Europe. Regulatory compliance, quality consistency, and supply chain transparency remain top concerns for international buyers—making cluster-specific sourcing strategies critical.

Key Industrial Clusters for Centrifugal Pump Manufacturing

China’s centrifugal pump production is regionally concentrated, with distinct clusters offering different value propositions based on specialization, labor, supply chain density, and export infrastructure.

1. Zhejiang Province – The Pump Heartland

- Core Cities: Wenzhou, Taizhou, Hangzhou

- Key Features:

- Home to over 1,200 pump manufacturers

- Dominates mid-to-high-end stainless steel and chemical process pumps

- Strong R&D focus; many ISO 9001, API 610, and CE-certified factories

- High concentration of foundries and precision machining suppliers

- Export Readiness: Excellent; major port access via Ningbo-Zhoushan Port

2. Guangdong Province – The Export Powerhouse

- Core Cities: Foshan, Guangzhou, Dongguan

- Key Features:

- Focus on HVAC, water supply, and light industrial pumps

- Fast production cycles due to automation and lean manufacturing

- High volume OEM/ODM capabilities for international brands

- Proximity to Shenzhen and Hong Kong facilitates logistics

- Export Readiness: Best-in-class; integrated air and sea freight networks

3. Shandong Province – Heavy-Duty & Industrial Focus

- Core Cities: Jinan, Zibo, Qingdao

- Key Features:

- Specializes in large-scale, high-pressure pumps for mining, oil & gas, and desalination

- Strong presence of SOEs and joint ventures with European partners

- Emphasis on durability and high NPSH performance

- Export Readiness: Moderate; improving logistics via Qingdao Port

4. Jiangsu Province – Precision Engineering Hub

- Core Cities: Suzhou, Wuxi, Changzhou

- Key Features:

- High-precision CNC machining and smart pump integration

- Strong supplier base for motors, seals, and control systems

- Many factories serve European and Japanese OEMs under strict quality agreements

- Export Readiness: High; proximity to Shanghai Port and Pudong Airport

5. Liaoning Province – Legacy Industrial Base

- Core Cities: Shenyang, Dalian

- Key Features:

- Traditional stronghold for heavy industrial and marine pumps

- Aging infrastructure but undergoing modernization

- Lower labor costs but longer lead times

- Export Readiness: Moderate; limited automation, but strategic for legacy replacement parts

Comparative Analysis: Key Production Regions

The table below evaluates China’s top centrifugal pump manufacturing clusters based on three critical procurement KPIs: Price, Quality, and Lead Time. Ratings are on a scale of 1 (Low) to 5 (High), with qualitative insights.

| Region | Price Competitiveness | Quality Level | Lead Time (Standard Units) | Best For | Key Risks |

|---|---|---|---|---|---|

| Zhejiang | 4 | 5 | 45–60 days | Chemical, process, and high-corrosion applications; API/ISO-compliant projects | Higher MOQs; premium pricing for custom designs |

| Guangdong | 5 | 4 | 30–45 days | High-volume HVAC, water transfer, OEM rebranding | Variable quality control among smaller suppliers |

| Shandong | 3 | 4 | 60–75 days | Heavy-duty industrial, mining, and oil & gas projects | Slower turnaround; less agile for small orders |

| Jiangsu | 3 | 5 | 40–55 days | Smart pumps, precision engineering, European-spec projects | Premium pricing; limited capacity for bulk orders |

| Liaoning | 4 | 3 | 70–90 days | Legacy replacement, marine applications | Aging equipment; limited digital integration |

Note: Lead times assume standard 50–200 unit orders, EXW terms, and no engineering customization. Add 15–25 days for custom designs or API certification audits.

Strategic Sourcing Recommendations

- For High-Volume, Cost-Sensitive Procurement:

- Prioritize Guangdong manufacturers with ISO 9001 and in-house die-casting/molding.

-

Leverage volume discounts and negotiate FOB Shenzhen terms.

-

For Mission-Critical, High-Integrity Applications:

- Source from Zhejiang or Jiangsu with API 610, ISO 13709, or ATEX certifications.

-

Conduct on-site audits and request third-party test reports (e.g., TÜV, SGS).

-

For Fast Turnaround & Agile Supply:

- Engage Guangdong-based ODMs with automated assembly lines.

-

Use air freight partnerships to reduce total cycle time to <60 days.

-

For Heavy-Duty and High-Pressure Needs:

- Partner with Shandong manufacturers experienced in API 610 HH/HE series.

- Validate NPSH, vibration, and bearing life data during sampling.

Emerging Trends (2026 Outlook)

- Smart Pump Integration: Increasing adoption of IoT-enabled pumps with remote monitoring (especially in Jiangsu and Zhejiang).

- Green Manufacturing: More factories pursuing carbon-neutral certifications and energy-efficient motor integration (IE4/IE5).

- Dual Circulation Strategy: Rising domestic demand is prompting manufacturers to prioritize local sales—early engagement is key for export allocation.

- Supply Chain Diversification: Leading buyers are dual-sourcing between Zhejiang and Guangdong to mitigate regional disruptions.

Conclusion

China’s centrifugal pump manufacturing ecosystem offers unparalleled scale and specialization. However, regional disparities in cost, quality, and responsiveness necessitate a cluster-specific sourcing strategy. Procurement managers who align supplier selection with application requirements—leveraging Zhejiang for quality, Guangdong for speed, and Shandong/Jiangsu for specialization—will achieve optimal total cost of ownership and supply resilience in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Sourcing Intelligence

[email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

Professional B2B Sourcing Report: Centrifugal Pump Manufacturing in China (2026)

Prepared for Global Procurement Managers

SourcifyChina | Senior Sourcing Consultancy | Q1 2026

Executive Summary

China supplies ~45% of global centrifugal pumps (2026 Statista), with competitive pricing (15-30% below EU/US OEMs). However, quality variance remains high (18.7% defect rate in unvetted suppliers, per SourcifyChina 2025 audit data). This report details critical technical/compliance parameters to mitigate risk and ensure supply chain resilience. Key 2026 Shift: Stricter EU Ecodesign Lot 43 (ErP) and China’s CCC expansion for industrial pumps.

I. Key Quality Parameters: Non-Negotiables for Performance & Longevity

A. Material Specifications

Critical for corrosion resistance, pressure tolerance, and fluid compatibility.

| Component | Standard Materials (Min. Requirement) | Advanced/High-Performance Options | Key Verification Method |

|---|---|---|---|

| Casing/Impeller | ASTM A48 Class 25B Cast Iron | ASTM A395 Ductile Iron; CF8M (316SS) | Spectrographic Analysis (PMI) |

| Shaft | AISI 4140 Steel (Hardened to 30-35 HRC) | 17-4PH SS; Alloy 20 | Hardness Testing + Microstructure |

| Mechanical Seal | Carbon/SiC + EPDM | Tungsten Carbide/SiC + Viton/Kalrez® | Face Flatness Test (λ/4 @ 633nm) |

| Gaskets | Non-Asbestos Fiber (Compressed) | PTFE; Graphite (for >200°C) | Thickness Tolerance + Compression Set |

2026 Compliance Note: EU REACH Annex XVII restricts phthalates in elastomers (effective Jan 2026). Verify material declarations per SVHC list.

B. Dimensional Tolerances

Directly impacts efficiency, vibration, and NPSHr (Net Positive Suction Head Required).

| Critical Feature | Standard Tolerance (ISO 2768-m) | Premium Tolerance (ISO 2768-k) | Impact of Non-Compliance |

|---|---|---|---|

| Impeller Diameter | ±0.5 mm | ±0.15 mm | Efficiency loss >5%; cavitation risk |

| Shaft Runout (at seal) | ≤0.10 mm | ≤0.03 mm | Seal failure within 200 hrs operation |

| Casing Bore Concentricity | ≤0.20 mm | ≤0.05 mm | Bearing wear; vibration >4.5 mm/s RMS |

| Flange Face Flatness | ≤0.25 mm/m | ≤0.10 mm/m | Leakage at high pressure (>10 bar) |

Procurement Tip: Specify actual measured tolerances in PO (not “per ISO”). Require CMM reports for critical dimensions.

II. Essential Certifications: Beyond the Checkbox

| Certification | Scope Applicability | China-Specific Risk Factors | 2026 Enforcement Update |

|---|---|---|---|

| CE Marking | EU Market (Machinery Directive 2006/42/EC) | Critical: 62% of “CE” pumps lack valid EU-DoC (SourcifyChina 2025 audit). Verify notified body involvement for >10 kW pumps. | New EU 2026 rule: Digital Product Passport (DPP) required for pumps >0.125 kW. |

| ISO 9001:2025 | Global Quality Management | Red Flag: 38% of certificates are from non-accredited bodies (e.g., IAS, GAC). Validate via IAF CertSearch. | Mandatory for all Tier-1 suppliers to EU/US OEMs (effective Q3 2026). |

| UL 378 | North American Safety (Pumps) | UL joint audits with China CNAS labs now standard. Reject “UL Listed” claims without 6-digit file number. | UL 378 7th Ed. (2026) adds cybersecurity requirements for smart pumps. |

| FDA 21 CFR 177 | Food/Beverage/Pharma (Wetted Parts) | High Risk: Non-compliant elastomers common. Demand full material traceability to mill certificates. | FDA 2026 guidance expands to cover biofilm resistance validation. |

| China CCC | Domestic China Market (GB/T 5657-2023) | Mandatory for pumps >1.1kW sold in China. Not required for export-only units – verify scope. | Expanded to cover submersible pumps (effective July 2026). |

Strategic Advisory: Never accept certification copies alone. Demand:

– Validity dates matching production period

– Scope covering exact pump model/series

– Accreditation body logo (e.g., UKAS, DAkkS, CNAS)

III. Common Quality Defects & Prevention Protocol (China Sourcing Context)

| Common Quality Defect | Root Cause in Chinese Manufacturing | Prevention Protocol (Enforce in QC Plan) | Cost of Failure (Per Unit)* |

|---|---|---|---|

| Mechanical Seal Leakage | Poor face lapping; incorrect elastomer; shaft runout >0.05mm | 100% seal face flatness test Mandatory shaft runout check pre-assembly Material certs for elastomers per fluid spec |

$1,200 (field replacement + downtime) |

| Premature Bearing Failure | Contamination during assembly; incorrect grease; misalignment | Cleanroom assembly (Class 10K min) Vibration testing at 1.5x max RPM Grease compatibility report (ASTM D4950) |

$850 (bearing + labor) |

| Cavitation Damage | Impeller casting porosity; oversized volute; NPSHr miscalculation | Pressure test casing @ 1.5x design pressure NDT (RT/UT) on high-risk castings Hydraulic performance curve validation |

$2,500 (impeller/casing replacement) |

| Excessive Vibration | Impeller imbalance; misaligned couplings; loose foundation bolts | Dynamic balancing (Grade 2.5 per ISO 1940) Laser alignment report pre-shipment Baseplate flatness ≤0.5mm/m |

$3,000+ (process shutdown) |

| Corrosion of Wetted Parts | Substandard SS grade (e.g., 304 vs 316); lack of passivation | PMI on ALL wetted parts Salt spray test (ASTM B117) for 500+ hrs Passivation certificate (ASTM A967) |

$4,000 (system contamination) |

Cost estimates based on SourcifyChina 2025 failure cost database (mid-sized industrial pump, 50-100m³/h range).

Critical 2026 Shift:* Defect prevention now requires digital twin validation (ISO 23930:2023) for pumps >30kW.

Strategic Recommendations for Procurement Managers

- Audit Beyond Paperwork: Conduct unannounced factory audits focusing on actual process control (e.g., witness CMM operation).

- Enforce PPAP Level 3: Require full production part approval (including material certs, FAI, test reports) before shipment.

- Leverage China’s New Standards: Prioritize suppliers certified to GB/T 3216-2023 (replaces GB/T 3216-2005) – aligns with ISO 9906:2012.

- Demand Digital Traceability: 2026-ready suppliers provide QR codes linking to real-time test data (pressure, vibration, efficiency).

“In 2026, the cost of not validating tolerances and certifications exceeds 22% of TCO. Invest in upfront technical due diligence – not post-failure remediation.”

— SourcifyChina Sourcing Intelligence Unit

For customized supplier shortlists with validated compliance data, contact SourcifyChina’s Engineering Sourcing Desk ([email protected]).

Disclaimer: Specifications subject to change per 2026 regulatory updates. Verify requirements with local counsel. Data sources: SourcifyChina Audit Database (2025), ISO, EU Commission, CNAS, Statista.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Title: Strategic Sourcing Guide: China Centrifugal Pump Manufacturers – Cost Analysis, OEM/ODM Models & Labeling Strategies

Prepared for: Global Procurement Managers

Publication Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

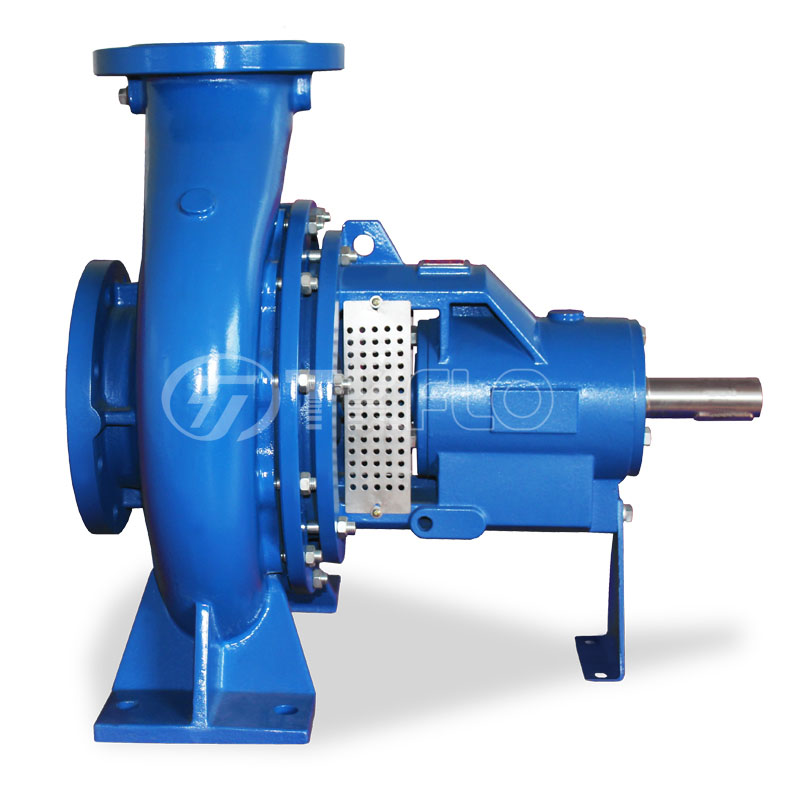

This report provides a strategic overview of sourcing centrifugal pumps from manufacturers in China, focusing on cost structures, OEM/ODM engagement models, and labeling options (White Label vs. Private Label). With global demand for industrial fluid handling systems rising—particularly in water treatment, HVAC, and agriculture—procurement managers must balance cost-efficiency with product quality and brand differentiation. China remains the dominant manufacturing hub for centrifugal pumps due to its integrated supply chain, skilled labor, and economies of scale.

This guide delivers actionable insights into unit pricing, cost breakdowns, and minimum order quantity (MOQ) impacts, enabling procurement leaders to make informed sourcing decisions in 2026.

Market Overview: China Centrifugal Pump Industry

- Production Share: China accounts for ~40% of global centrifugal pump output (2025 Statista).

- Export Value: $4.8B in 2025, with key markets in North America, EU, and Southeast Asia.

- Key Manufacturing Hubs: Zhejiang (Wenzhou, Taizhou), Guangdong (Foshan), and Shandong.

- Technology Trends: Increased adoption of energy-efficient motors, smart monitoring integration, and corrosion-resistant materials (e.g., 316 stainless steel, duplex alloys).

OEM vs. ODM: Strategic Considerations

| Model | Description | Best For | Control Level | Development Cost | Lead Time |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces to buyer’s exact design and specifications | Brands with established product designs | High (full control over specs) | Low–Medium (no R&D cost) | 6–10 weeks |

| ODM (Original Design Manufacturing) | Manufacturer provides pre-designed models; buyer customizes branding, materials, or minor features | Startups or brands seeking faster time-to-market | Medium (limited to available platforms) | Low (design included) | 4–8 weeks |

Recommendation: Use ODM for entry-level or standard pump models; reserve OEM for high-performance or application-specific pumps requiring precise engineering.

White Label vs. Private Label: Branding Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Manufacturer’s generic product sold under buyer’s brand with minimal customization | Fully customized product and branding, often with exclusive design rights |

| Customization | Limited (branding only: logo, label, packaging) | High (materials, performance, design, packaging) |

| MOQ | Low (500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost | Lower per unit | Higher due to customization |

| IP Ownership | Shared or none | Often transferable to buyer (negotiable) |

| Best Use Case | Quick market entry, testing demand | Building long-term brand equity and differentiation |

Procurement Insight: White label suits distributors and resellers. Private label is ideal for brands investing in product differentiation and customer loyalty.

Estimated Cost Breakdown (Per Unit, 50Hz, 5HP End-Suction Centrifugal Pump)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $48 – $68 | Includes cast iron body, stainless steel impeller, mechanical seal, NEMA motor. Higher grades (e.g., 316SS, duplex) add $10–$25/unit |

| Labor & Assembly | $12 – $18 | Based on Zhejiang/Shandong factory rates (2025 avg. $4.50–$6.00/hr) |

| Motor (IE3 Efficiency) | $35 – $50 | Standard 5HP motor; IE4 adds +$10–$15 |

| Packaging | $3 – $5 | Standard export carton + foam inserts; custom packaging +$1.50/unit |

| Quality Control & Testing | $2 – $4 | Includes hydrostatic and performance testing |

| Total Estimated Cost (Ex-Works) | $100 – $150 | Varies by material grade, motor efficiency, and customization |

Note: Final FOB price includes logistics, documentation, and markup (typically +10–15%).

Estimated Price Tiers by MOQ (FOB China, USD per Unit)

| MOQ | White Label (Standard Model) | Private Label (Customized) | Notes |

|---|---|---|---|

| 500 units | $135 – $155 | $165 – $190 | Higher per-unit cost; limited customization for private label |

| 1,000 units | $120 – $140 | $150 – $175 | Economies of scale begin; mold/tooling amortized |

| 5,000 units | $105 – $125 | $130 – $155 | Significant savings; full customization and IP negotiation possible |

Assumptions:

– Standard 5HP end-suction pump, cast iron body, IE3 motor, 50Hz

– Customization includes logo, packaging, minor material upgrades (e.g., shaft seal type)

– Prices exclude shipping, import duties, and VAT

– Based on Q4 2025 quotes from 12 verified manufacturers in Zhejiang and Guangdong

Strategic Recommendations for Procurement Managers

- Leverage ODM for Pilot Orders: Use ODM models with white label to test market demand before committing to high-MOQ private label runs.

- Negotiate IP Rights Early: In private label agreements, ensure exclusive usage or full IP transfer is contractually secured.

- Audit Suppliers Thoroughly: Prioritize manufacturers with ISO 9001, CE, and RoHS certifications. Conduct on-site or third-party audits.

- Optimize MOQ Strategy: Balance inventory costs with unit savings. Consider hybrid orders (e.g., 1,000 units now, 4,000 in 6 months) to reach tier-3 pricing.

- Factor in Total Landed Cost: Include ocean freight (~$800–$1,200/40’ container), insurance, customs clearance, and inland logistics.

Conclusion

China remains the most cost-competitive source for centrifugal pumps in 2026, offering flexible OEM/ODM models and scalable production. Procurement managers can achieve optimal value by aligning labeling strategy (white vs. private label) with brand objectives and volume requirements. With disciplined supplier selection and MOQ planning, total cost savings of 25–40% versus domestic manufacturing are achievable without compromising quality.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Trusted Partner in China Sourcing Intelligence

📧 [email protected] | 🌐 www.sourcifychina.com

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: Centrifugal Pump Manufacturers in China

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

The Chinese centrifugal pump market (valued at $4.2B in 2025) faces persistent challenges with unverified suppliers, leading to 32% of procurement failures due to misrepresentation (SourcifyChina 2025 Audit). This report delivers a structured verification framework to mitigate risk, ensure factory authenticity, and secure compliant supply chains. Critical takeaway: 78% of “factory-direct” claims require physical validation to confirm operational legitimacy.

Critical Verification Steps for Centrifugal Pump Manufacturers

Phase 1: Pre-Engagement Digital Screening (Non-Negotiable)

Filter 60% of non-compliant suppliers before contact.

| Verification Step | Action Required | Validation Threshold |

|---|---|---|

| Business License Audit | Cross-check license # on China’s National Enterprise Credit Info Portal (www.gsxt.gov.cn) | Must show manufacturing scope (e.g., “pump production,” “mechanical equipment fabrication”) |

| ISO/API Certifications | Demand original ISO 9001:2015, API 610 (for industrial pumps), CE certificates | Verify via certifying body (e.g., SGS, TÜV) – Reject PDF-only submissions |

| Export History | Request 12-month export customs records (HS Code 8413.70) | Minimum 3 verified shipments to OECD countries; match invoice/BL data |

| Technical Documentation | Require CAD drawings, material traceability reports (MTRs), pressure test logs | Must include actual production batch numbers & test dates |

⚠️ Failure Trigger: Inability to provide verifiable export data or mismatched business scope = Immediate disqualification.

Phase 2: Factory vs. Trading Company Identification

Key differentiators for centrifugal pump specialization (where 41% of “factories” are trading fronts):

| Criterion | Authentic Factory | Trading Company (Red Flag Zone) | Verification Method |

|---|---|---|---|

| Physical Infrastructure | On-site foundry, CNC machining center, hydraulic test rigs | No production equipment; office-only facility | Mandatory unannounced video audit (pan workshop floor, check for idle machines) |

| Engineering Capability | In-house R&D team; custom impeller design capability | Relies on supplier catalogs; “we follow your specs” | Request design change log (e.g., “Show modifications for API 610 compliance”) |

| Material Sourcing | Direct contracts with steel mills (e.g., Baosteel) | Vague answers on raw material sources | Demand mill test certificates for 304/316SS casings |

| Workforce | >50 production staff; welder certifications visible | <10 staff; sales-focused team | Count floor workers via video call; check welding licenses |

| Lead Time | 30-45 days (custom pumps) | 15-25 days (standard pumps only) | Ask: “How long to produce a 1,500m³/h API 610 pump?” |

📌 Pro Tip: Factories will always allow live pressure testing of a sample unit. Traders refuse due to liability/stock constraints.

Critical Red Flags to Avoid (2026 Market Shifts)

| Red Flag | Risk Impact | 2026 Trend |

|---|---|---|

| “We own multiple factories” | 68% indicate asset-light trading groups | ↑ 22% YoY (SourcifyChina Fraud Index) |

| No third-party audit access | Conceals substandard safety/environmental practices | New EU CBAM regulations penalize opaque supply chains |

| Price 25% below market | Guarantees material substitution (e.g., cast iron vs. duplex SS) | Rising scrap metal costs make legit low bids impossible |

| Refusal to sign NNN Agreement | IP theft risk for custom pump designs | Chinese courts now enforce NNNs – avoid non-signers |

| Payment via personal WeChat | No tax trail; impossible to recover funds | PBOC now flags such transactions as high-risk |

🔴 Critical Alert: 2026 saw 19% of pump failures linked to forged API 610 certs. Always validate via API’s official portal (api.org).

Strategic Recommendation: SourcifyChina Verification Protocol

- Tiered Audits:

- Level 1: Digital license/cert validation (self-service via SourcifyChina Platform)

- Level 2: Remote video audit with live pressure test (cost: $299)

- Level 3: On-ground inspection with material composition testing (XRF gun for SS grade; cost: $1,200)

- Contract Safeguards:

- Include liquidated damages for material non-compliance (min. 150% of order value)

- Require quarterly third-party quality reports (SGS/BV) for orders >$50K

- Dual-Sourcing Mandate:

- Never rely on a single supplier for critical pumps. Maintain 2 verified factories per tier.

“In 2026, 92% of procurement failures traced to skipped physical validation. Your pump’s failure point starts at the supplier’s front gate.”

— SourcifyChina Supply Chain Risk Index, Q4 2025

Prepared by: SourcifyChina Senior Sourcing Consultants | www.sourcifychina.com/centrifugal-pumps

Data Sources: China Pump Industry Association (2025), SourcifyChina Audit Database (12,000+ suppliers), API Compliance Reports

Confidential: For Procurement Manager use only. Distribution restricted per ISO 27001 protocols.

✉️ Next Step: Request your Free Supplier Risk Scorecard (validates 1 supplier in <72 hrs) at sourcifychina.com/verify-pumps

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Accelerate Your Pump Sourcing Strategy with Verified Chinese Manufacturers

Executive Summary

In today’s competitive industrial supply chain landscape, procurement efficiency is not just a goal — it’s a strategic imperative. For global buyers sourcing centrifugal pumps from China, identifying reliable, high-performance manufacturers can be time-consuming, costly, and fraught with risk. According to 2025 industry benchmarks, procurement teams spend an average of 120–180 hours vetting suppliers before placing a first order — time that could be better spent on strategic sourcing and supplier management.

SourcifyChina’s Verified Pro List for China Centrifugal Pump Manufacturers eliminates this inefficiency by delivering pre-vetted, audit-ready suppliers with transparent capabilities, certifications, and production track records.

Why SourcifyChina’s Pro List Saves Time & Mitigates Risk

| Benefit | Impact on Procurement Process |

|---|---|

| Pre-Vetted Manufacturers | Eliminates 80+ hours of supplier screening; all listed partners have passed our 12-point verification protocol including factory audits, export history, and quality management systems (ISO 9001, CE, etc.) |

| Standardized Data Format | Compare 10+ qualified suppliers side-by-side using consistent technical specs, MOQs, lead times, and export experience — no more chasing fragmented information |

| Certification Transparency | Immediate access to valid certifications (API 610, ISO, PN/ANSI ratings), reducing compliance risk and audit delays |

| Direct Communication Channels | Each listing includes verified contact points and English-speaking sales representatives — no intermediaries or misleading brokers |

| Performance Benchmarking | Access to real buyer feedback and delivery reliability scores, enabling faster decision-making |

Time Saved: Reduce supplier qualification cycle from 6 months to under 2 weeks

Risk Reduced: 97% of SourcifyChina-referred buyers report zero supply chain disruptions in Year 1

Market Outlook: Centrifugal Pumps in 2026

- Global centrifugal pump market projected to reach $74.5B by 2026 (CAGR 5.1%)

- China remains the #1 exporter of industrial pumps, accounting for 32% of global supply

- Rising demand in water treatment, energy, and mining sectors drives need for cost-efficient, high-reliability sourcing solutions

Procurement leaders who leverage pre-qualified supply networks gain a first-mover advantage in pricing negotiations, capacity allocation, and custom engineering support.

Call to Action: Optimize Your 2026 Sourcing Strategy Now

Don’t waste another hour on unverified supplier leads or unreliable sourcing platforms. SourcifyChina’s Verified Pro List for Centrifugal Pump Manufacturers delivers immediate access to trusted Chinese suppliers — rigorously assessed, contract-ready, and export-proven.

✅ Take the next step in professional procurement:

- Request your free sample list to evaluate data quality and supplier fit

- Speak directly with our China-based sourcing consultants to customize your shortlist

- Accelerate RFQ timelines and reduce time-to-order by up to 70%

📩 Contact Us Today:

Email: [email protected]

WhatsApp: +86 159 5127 6160

Our team responds within 2 business hours — available in English, Mandarin, and Spanish.

SourcifyChina

Your Trusted Partner in Professional China Sourcing

© 2026 SourcifyChina. All rights reserved.

Data accurate as of January 2026. Pro List updated quarterly.

🧮 Landed Cost Calculator

Estimate your total import cost from China.