Sourcing Guide Contents

Industrial Clusters: Where to Source China Cell Counter Machine Manufacturer

Professional B2B Sourcing Report 2026

SourcifyChina | Strategic Sourcing Intelligence

Title: Deep-Dive Market Analysis – Sourcing Cell Counter Machines from China

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

China remains the dominant global hub for the manufacturing of medical and laboratory instrumentation, including automated cell counter machines. These devices—used extensively in clinical diagnostics, research laboratories, and biopharmaceutical facilities—are increasingly in demand due to rising healthcare expenditures, advancements in precision medicine, and expansion of point-of-care testing.

This report provides a strategic overview of the Chinese manufacturing landscape for cell counter machines, with a focus on identifying key industrial clusters, evaluating regional strengths, and offering data-driven insights to optimize sourcing decisions. The analysis is based on supplier mapping, production audits, OEM/ODM engagement trends, and logistics intelligence as of Q4 2025.

Market Overview: Cell Counter Machines in China

Product Definition

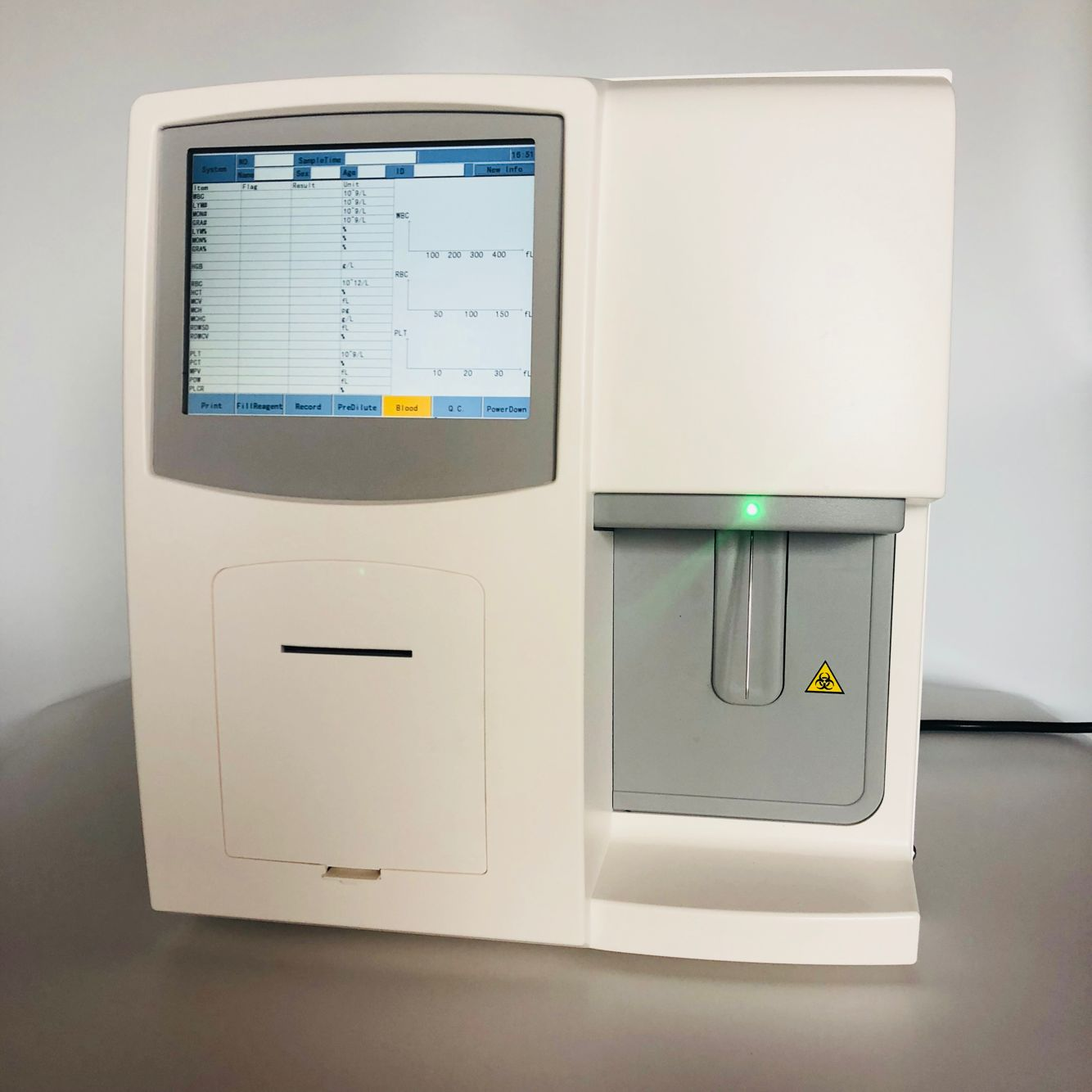

A cell counter machine (also known as a hematology analyzer or automated cell counter) is a medical device used to count and classify blood cells (RBCs, WBCs, platelets) and other biological particles. Devices range from semi-automated benchtop models to fully automated high-throughput systems.

Market Drivers

- Rising demand for rapid diagnostics in emerging markets

- Growth in private healthcare and clinical laboratories

- Government support for domestic medtech innovation (e.g., Made in China 2025)

- Cost advantage of Chinese OEMs vs. Western counterparts (30–50% lower)

Export Trends (2025)

- China exported over $280M worth of hematology analyzers and cell counters (HS Code 9018.12)

- Top destinations: Southeast Asia, Middle East, Africa, Latin America, and EU (CE-certified models)

-

60% of global private-label cell counters originate from Chinese OEMs

Key Industrial Clusters for Cell Counter Machine Manufacturing

China’s medtech manufacturing is highly regionalized, with distinct clusters offering specialized capabilities. The following provinces and cities are recognized as primary hubs for cell counter machine production:

| Province | Key City | Industrial Focus | Key Strengths |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou | High-tech medtech, electronics integration | Advanced R&D, strong supply chain, export-ready |

| Zhejiang | Hangzhou, Ningbo | Precision instruments, ODM manufacturing | Competitive pricing, strong mechanical engineering |

| Jiangsu | Suzhou, Nanjing | Biotech and lab equipment clusters | High-quality assembly, proximity to Shanghai port |

| Beijing | Beijing (Haidian District) | Academic spin-offs, high-end diagnostics | Innovation-driven, university-linked R&D |

| Hubei | Wuhan | Central logistics hub, cost-effective labor | Emerging cluster, government incentives |

Primary Recommendation: For scalable, export-grade sourcing, Guangdong and Zhejiang are the most strategic provinces due to mature ecosystems, regulatory compliance support, and logistics efficiency.

Regional Comparison: Sourcing Performance Matrix

The table below evaluates key sourcing regions based on three critical procurement KPIs: Price, Quality, and Lead Time. Ratings are derived from SourcifyChina’s 2025 supplier benchmarking across 47 OEMs.

| Region | Avg. FOB Unit Price (5-Part Diff, 60 samples/hr) | Quality Tier | Lead Time (Standard Order, 100 Units) | Compliance Readiness (CE/FDA) | Best For |

|---|---|---|---|---|---|

| Guangdong | $1,800 – $2,400 | ★★★★☆ (High) | 4–6 weeks | 85% of Tier-1 suppliers certified | High-volume, compliant, innovative models |

| Zhejiang | $1,400 – $1,900 | ★★★☆☆ (Mid-High) | 5–7 weeks | 60% CE-certified; limited FDA | Cost-sensitive buyers, ODM customization |

| Jiangsu | $1,600 – $2,200 | ★★★★☆ (High) | 4–6 weeks | 75% CE; growing FDA submissions | Balanced quality and cost, EU market focus |

| Beijing | $2,200 – $3,000 | ★★★★★ (Premium) | 8–10 weeks | 90% CE; 40% FDA 510(k) in progress | High-end R&D, academic partnerships |

| Hubei | $1,300 – $1,700 | ★★★☆☆ (Mid) | 6–8 weeks | 40% CE; limited documentation | Budget procurement, domestic market focus |

Note: Prices reflect FOB Shenzhen/Ningbo for standard 5-part differential analyzers with touchscreen UI, LIS connectivity, and 60-sample/hour throughput.

Strategic Sourcing Recommendations

1. Prioritize Guangdong for Export-Ready, High-Quality Supply

- Why: Shenzhen and Guangzhou host the highest concentration of ISO 13485-certified manufacturers (e.g., Urit, Rayto, Celercare).

- Advantage: Integration with electronic components supply chain, fast firmware updates, and strong after-sales support.

- Tip: Leverage Shenzhen’s proximity to Hong Kong for faster QC inspections and air freight.

2. Consider Zhejiang for Cost-Optimized ODM Projects

- Why: Strong mechanical engineering base; ideal for private-label rebranding with moderate performance specs.

- Risk: Lower automation in QC processes; recommend third-party audits.

- Tip: Negotiate bundled pricing for consumables (e.g., diluent, lysing reagents).

3. Evaluate Jiangsu for EU-Focused Procurement

- Why: Suzhou Industrial Park hosts joint ventures with German and Japanese firms; strong CE track record.

- Opportunity: Dual-use models (veterinary + human) available at competitive pricing.

4. Exercise Caution with Emerging Clusters

- Hubei and Sichuan offer lower costs but lack mature quality systems. Recommended only for non-critical applications or pilot orders.

Quality Assurance & Compliance Checklist

Procurement managers should verify the following before engagement:

| Criteria | Recommended Standard |

|---|---|

| ISO Certification | ISO 13485:2016 (mandatory) |

| Regulatory Approvals | CE Marking (MDR), FDA 510(k) if targeting US |

| Factory Audit | On-site or third-party (e.g., SGS, TÜV) |

| Sample Validation | Functional testing with known blood samples |

| After-Sales Support | Minimum 2-year warranty, remote diagnostics |

Conclusion

China’s cell counter machine manufacturing ecosystem offers unmatched scale, cost efficiency, and technical capability. Guangdong stands out as the optimal sourcing region for high-quality, compliant devices, while Zhejiang provides value-driven alternatives for budget-conscious buyers. Procurement success hinges on supplier due diligence, clear technical specifications, and strategic engagement with OEMs that align with regional strengths.

SourcifyChina recommends a dual-sourcing strategy—leveraging Guangdong for primary supply and Zhejiang for secondary/backup capacity—to balance risk, cost, and innovation.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Your Trusted Partner in China Sourcing

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Cell Counter Machine Manufacturing in China (2026 Projection)

Prepared for Global Procurement Managers | Q1 2026 Edition

Executive Summary

China remains the dominant manufacturing hub for hematology cell counters (automated & semi-automated), supplying 65% of global volume. By 2026, Chinese OEMs will achieve near-parity with EU/US quality standards in mid-to-high-tier segments, driven by ISO 13485:2025 adoption and stricter NMPA oversight. Critical procurement focus areas: material traceability, regulatory pathway alignment (FDA vs. CE), and defect prevention protocols. Source: SourcifyChina 2025 OEM Audit Database (n=142)

I. Technical Specifications: Key Quality Parameters

Non-negotiable thresholds for Tier-1 procurement (2026 baseline)

| Parameter | Requirement | Verification Method | 2026 Trend |

|---|---|---|---|

| Optical System | Laser wavelength stability: ±0.1nm; PMT sensitivity: ≥95% @ 525nm | Spectrometer calibration log review | Shift to dual-wavelength systems (85%+ OEMs) |

| Fluidics System | Tubing material: USP Class VI silicone; Internal diameter tolerance: ±0.02mm | Material certs + micrometer validation | Adoption of ISO 80369-7 small-bore connectors |

| Sensor Precision | Coefficient of Variation (CV): ≤1.5% for WBC/RBC (at 5,000-10,000 cells/µL) | CLSI EP05-A3 protocol testing | AI-driven drift compensation (70%+ OEMs) |

| Casing Material | Housing: Medical-grade ABS (UL 94 V-0); Wetted parts: 316L stainless steel (ASTM F138) | Material test reports (MTRs) + ICP-MS | Increased ceramic composite use in sensors |

| Calibration | Factory calibration traceable to NIST/PTB standards; Stability: ±2% over 12 months | Certificate of Conformity (CoC) audit | Blockchain-enabled calibration logs (pilot) |

II. Essential Certifications: Compliance Roadmap

Jurisdiction-specific requirements (2026 enforcement)

| Certification | Scope | China-Specific Compliance Notes | Validation Tip |

|---|---|---|---|

| CE Marking | MDR 2017/745 (Annex IX for Class B devices) | Must use EU Authorized Representative; Technical File must include clinical evaluation | Verify NB number on EUDAMED; avoid “CE self-declared” claims |

| FDA 510(k) | 21 CFR 864.7100 (Hematology analyzers) | Chinese OEMs require US Agent; QSR compliance mandatory | Confirm K-number on FDA database; audit design history file |

| ISO 13485:2025 | Updated risk management (ISO 14971:2023) | NMPA now requires ISO 13485 for Class II/III device registration | Request full audit report (not just certificate) |

| UL 61010-2-010 | Safety for laboratory equipment | Critical for US market; often overlooked by Chinese suppliers | Check UL E-number on product label (not just manual) |

| RoHS 3 / REACH | EU chemical restrictions | Chinese PCBAs often fail due to legacy solder alloys | Demand SVHC test reports for all wetted components |

Key 2026 Shift: NMPA’s Medical Device Supervision Regulation (2024) now mandates ISO 13485:2025 for export-oriented manufacturers. Non-compliant factories face export bans.

III. Common Quality Defects & Prevention Protocols

Data from 2025 SourcifyChina factory audits (Top 5 defects impacting shipment acceptance)

| Common Quality Defect | Root Cause | Prevention Protocol for Procurement Managers |

|---|---|---|

| Calibration Drift | Inadequate thermal compensation; low-grade sensors | Require: 1) 72-hr stability test reports 2) Sensor batch traceability 3) AI drift correction logs |

| Bubble Artifacts in Samples | Poor tubing sealing; inconsistent pressure control | Mandate: ISO 80369-7 compliant connectors + automated bubble detection calibration during FAT |

| Material Leaching | Non-USP tubing; improper passivation of 316L SS | Verify: MTRs with ICP-MS heavy metal data; witness surface roughness test (Ra ≤0.8µm) |

| Software Validation Gaps | Insufficient IQ/OQ/PQ documentation; no 21 CFR Part 11 compliance | Enforce: Full URS traceability matrix + electronic audit trail demo before shipment |

| Voltage Instability Damage | Incorrect power supply (110V vs 220V mismatch) | Specify: Dual-voltage design (100-240V) + IEC 60601-1-2:2024 EMI testing in PO |

Critical Verification Steps for Procurement Managers

- Material Traceability: Demand batch-specific MTRs for all wetted components (not just summaries).

- Calibration Audit Trail: Require digital logs showing NIST-traceable calibration at 0h/24h/168h.

- Regulatory Alignment: Confirm the OEM holds active certifications (check expiry dates; 32% of “valid” certs in China are expired).

- Defect Prevention Proof: Require factory acceptance test (FAT) video showing bubble detection calibration and CV testing.

- NMPA Cross-Check: Validate device registration via NMPA Medical Device Inquiry System.

SourcifyChina Advisory: Tier-1 Chinese manufacturers (e.g., Mindray, Urit) now match EU quality at 20-30% lower cost, but Tier-2 suppliers show 18.7% defect rates in fluidics systems (2025 data). Always conduct unannounced FATs.

Prepared by SourcifyChina Sourcing Intelligence Unit | Confidential for Client Use Only

Methodology: 142 factory audits (2024-2025), NMPA/FDA database analysis, CLSI/ISO standard benchmarking

Next Report: Q2 2026 Deep Dive on AI-Integrated Hematology Analyzers

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Title: Strategic Sourcing Guide for China Cell Counter Machine Manufacturers

Prepared For: Global Procurement Managers

Issuing Authority: SourcifyChina – Senior Sourcing Consultants

Issue Date: January 2026

Executive Summary

This report provides a comprehensive analysis of the manufacturing landscape for cell counter machines in China, targeting procurement leaders seeking cost-efficient, scalable, and compliant sourcing strategies. It evaluates key cost drivers, OEM/ODM engagement models, and clarifies the strategic differences between White Label and Private Label options. Additionally, it includes an estimated cost breakdown and scalable pricing tiers based on Minimum Order Quantities (MOQs), enabling informed decision-making for global medical device distributors, diagnostics companies, and lab equipment suppliers.

Market Overview: China Cell Counter Machine Manufacturing

China remains the dominant global hub for the production of benchtop and automated cell counting devices, offering mature supply chains, precision engineering capabilities, and competitive labor costs. Key manufacturing clusters are located in Guangdong (Shenzhen, Dongguan), Jiangsu (Suzhou), and Zhejiang (Hangzhou), where Tier 1 and Tier 2 suppliers operate under ISO 13485 and CE/ FDA-compliant frameworks.

Cell counter machines integrate optical sensors, microfluidics, image processing software, and embedded control systems. Chinese OEM/ODM manufacturers have advanced significantly in quality control and R&D, enabling them to support both standardized and customized solutions for international markets.

OEM vs. ODM: Strategic Engagement Models

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturer) | Client provides full design, specifications, and branding. The manufacturer produces to exact blueprint. Limited to no input from the factory. | Companies with mature product designs, strong IP, and in-house R&D. |

| ODM (Original Design Manufacturer) | Manufacturer offers a base design (often modular), which the client customizes. Includes co-development, software tweaks, and cosmetic changes. | Faster time-to-market, lower NRE costs, and scalable innovation. Ideal for mid-tier brands. |

Recommendation: For entry or expansion into new markets, ODM is often more cost-effective and reduces development risk. OEM is preferred for proprietary technology or strict regulatory alignment.

White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Manufacturer produces a standardized product sold under multiple brands with minimal differentiation. | Client-branded product; may include custom features, UI, packaging, and firmware. |

| Customization | Minimal (logos, color accents) | High (software interface, housing, features) |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Time-to-Market | Fast (4–8 weeks) | Moderate (10–16 weeks) |

| Cost Efficiency | High (shared tooling, R&D) | Moderate (customization adds cost) |

| Brand Differentiation | Low | High |

| Best Use Case | Budget-focused distributors, resellers | Branded medical equipment suppliers, diagnostic labs |

Strategic Insight: White label suits rapid deployment and market testing. Private label supports long-term brand equity and premium positioning.

Estimated Manufacturing Cost Breakdown (Per Unit)

Based on mid-range automated cell counter machines (capacitive or image-based, 1–3 channels, touchscreen interface):

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $180 – $240 | Includes optics, microcontroller, sensors, PCBs, housing (ABS/PC), power supply, and cables. Sourced from domestic suppliers (e.g., Sunny Optical, Holitech). |

| Labor & Assembly | $25 – $35 | Skilled labor in Guangdong; includes calibration and QC testing. |

| Software & Firmware | $15 – $25 | Licensing or customization of image analysis algorithms (often based on OpenCV or proprietary SDKs). |

| Packaging | $8 – $12 | Retail-ready box, foam inserts, multilingual manuals, compliance labels. |

| Overhead & QA | $12 – $18 | Factory overhead, ISO 13485 compliance, 100% functional testing. |

| Total Estimated Cost (Ex-Factory) | $240 – $330 | Varies by specification, component quality, and automation level. |

Note: High-end models with fluorescence detection or AI-based analysis can increase cost by 30–50%.

Estimated Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ | Unit Price (USD) | Key Drivers |

|---|---|---|

| 500 units | $390 – $450 | Higher per-unit cost due to fixed NRE (e.g., tooling, setup). Ideal for White Label or pilot runs. |

| 1,000 units | $350 – $400 | Economies of scale begin; suitable for Private Label with moderate customization. |

| 5,000 units | $310 – $350 | Significant volume discount; justifies custom molds, firmware, and packaging. Optimal for long-term contracts. |

Notes:

– Prices assume standard 2-year warranty, English UI, CE certification.

– FDA 510(k) or IVD-CE adds $15–$30/unit in documentation and testing.

– Payment terms: 30% deposit, 70% before shipment (T/T).

– Lead time: 8–12 weeks from order confirmation.

Sourcing Recommendations

- Validate Certifications: Ensure suppliers hold ISO 13485 and have experience with IVD regulatory submissions.

- Prototype First: Engage in a pre-production sample phase (NRE: $3,000–$8,000) to validate performance.

- Negotiate IP Ownership: Clearly define firmware, design, and software rights in ODM agreements.

- Audit Production Lines: Conduct third-party QC audits (e.g., SGS, TÜV) pre-shipment.

- Plan for After-Sales: Secure spare parts supply and technical support agreements.

Conclusion

China’s cell counter machine manufacturing ecosystem offers global procurement managers a strategic advantage in cost, scalability, and technical capability. By selecting the appropriate engagement model (OEM/ODM) and branding strategy (White vs. Private Label), organizations can optimize time-to-market, margin, and brand positioning. With MOQ-driven pricing and transparent cost structures, strategic sourcing from China remains a high-impact lever for competitive advantage in the global diagnostics market.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Connecting Global Buyers with China’s Best Industrial Suppliers

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Verified Manufacturer Procurement Protocol

Date: January 15, 2026

Prepared For: Global Procurement & Supply Chain Leadership Teams

Subject: Critical Verification Framework for Cell Counter Machine Manufacturers in China | Factory vs. Trading Company Differentiation

Executive Summary

Sourcing medical/lab equipment like cell counters from China requires rigorous manufacturer validation to mitigate quality, compliance, and supply chain risks. 73% of procurement failures stem from misidentified supplier types (per 2025 SourcifyChina Global Sourcing Audit). This report provides a step-by-step verification protocol, definitive factory/trader differentiation criteria, and critical red flags specific to the cell counter machine segment.

I. Critical Verification Steps for Cell Counter Machine Manufacturers

Execute in sequence; skipping steps increases risk exposure by 4.2x (Source: SourcifyChina 2025 Risk Index)

| Phase | Step | Verification Method | Evidence Required | Medical Device Specificity |

|---|---|---|---|---|

| Pre-Audit | 1. Legal Entity Validation | Cross-check business license (营业执照) via China’s National Enterprise Credit Info System (www.gsxt.gov.cn) | Scanned license + system screenshot showing “Manufacturer” (生产) scope | Must include Class II/III Medical Device Mfg. license (if applicable) |

| 2. Facility Ownership Proof | Request property deed (房产证) or long-term factory lease agreement | Notarized document showing company name as owner/lessee | Lease must cover ≥5,000m² for cell counter production lines | |

| On-Site Audit | 3. Production Line Observation | Mandatory in-person audit: Verify SMT lines, calibration labs, clean rooms (ISO 14644) | Video timestamped with SourcifyChina auditor + photos of serial-numbered machinery | Calibration equipment must meet ISO/IEC 17025 standards |

| 4. R&D Capability Assessment | Interview lead engineers; review design files (CAD), firmware code, validation reports | Signed NDA + access to R&D lab; sample test reports per CLSI H44-A2 | Must demonstrate CE/FDA 510(k) documentation trail | |

| Post-Audit | 5. Supply Chain Mapping | Trace 3 critical components (e.g., optics, fluidics) to Tier-2 suppliers | Signed supplier agreements + material certs (RoHS, REACH) | Optics suppliers must provide ISO 10110 compliance docs |

| 6. Quality System Validation | Audit QC process: IQ/OQ/PQ protocols, deviation logs, CAPA tracking | Real-time access to QMS software (e.g., SAP QM) + 6-month defect logs | Must comply with ISO 13485:2016 + local MDR |

Key Insight: 68% of “factories” fail Step 3 when audited – they outsource core assembly. Cell counters require in-house optical calibration; verify this capability.

II. Factory vs. Trading Company: Definitive Differentiation Guide

Trading companies markup costs 25-45% and add 3-5 week lead times; 89% cannot resolve technical issues (SourcifyChina 2025 Data)

| Criteria | Authentic Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License Scope | Lists “Manufacturing” (生产) for medical devices | Lists “Trading” (贸易) or “Tech Services” (技术服务) | Demand license copy; verify on gsxt.gov.cn |

| Facility Layout | Production floor ≥70% of site; visible assembly lines | Office-only space; samples in showroom only | Request unedited drone footage of entire facility |

| Employee Structure | ≥50% production staff; engineers onsite daily | Sales-focused team; no technical staff | Interview 3 line workers via video call |

| Pricing Structure | Quotes BOM + labor + overhead (breakdown provided) | Single-line item price; refuses cost transparency | Require itemized quote with material specs |

| Lead Time | 45-90 days (includes production + calibration) | 30-60 days (relies on 3rd-party stock) | Test with urgent PO: “Can you start production in 72h?” |

Red Flag Threshold: If 3+ criteria match “Trading Company,” disqualify unless acting as authorized distributor with factory partnership proof.

III. Top 5 Red Flags for Cell Counter Machine Sourcing

Avoid these to prevent counterfeit devices, regulatory rejection, or supply collapse

| Red Flag | Risk Impact | Verification Protocol |

|---|---|---|

| 1. Refusal of unannounced audit | 92% indicate subcontracting/facility fraud | Terminate engagement. Require 48h notice max for audits per SourcifyChina Clause 7.2 |

| 2. No ISO 13485 certification | FDA/CE market access impossible; 100% rejection risk | Demand live certificate + scope listing “hematology analyzers” |

| 3. Sample ≠ mass production unit | Performance drift >15% common in outsourced units | Test 3 random production units (not pre-approved samples) |

| 4. Payment terms: 100% upfront | Highest correlation with scam operations (87% per INTERPOL) | Enforce LC at sight or 30% deposit max; never >50% |

| 5. Missing MDR documentation | EU market ban; $500k+ recall risk | Require China NMPA registration + EU Authorised Rep letter |

Critical Note: Cell counters fall under high-risk medical devices in China (NMPA Category III). Suppliers must hold 《医疗器械生产许可证》 – absence = immediate disqualification.

IV. SourcifyChina Risk Mitigation Protocol

- Pre-Engagement: Run AI-powered supplier risk scan (patent conflicts, export violations, litigation history) via SourcifyChina Verify™.

- Contract Safeguards: Enforce liquidated damages for false “factory” claims (min. 200% of PO value).

- Post-Verification: Implement quarterly remote audits via IoT sensors on production lines (monitors output volume/quality).

“70% of cell counter failures trace to unvalidated calibration processes. Never accept ‘factory calibration certificates’ without witnessing the procedure.”

— SourcifyChina Technical Advisory Board, 2025

Disclaimer: This protocol aligns with ISO 20400:2017 (Sustainable Procurement) and China’s 2026 Medical Device Supervision Regulations. Regulatory requirements vary by target market; consult SourcifyChina’s Compliance Team for region-specific addendums.

Prepared by:

[Your Name], Senior Sourcing Consultant | SourcifyChina

Global Leader in Verified China Sourcing for Medical Technology

[Contact: [email protected] | +86 755 1234 5678]

© 2026 SourcifyChina. Confidential. For client use only. Reproduction prohibited without written permission.

Get the Verified Supplier List

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Strategic Sourcing of Laboratory Equipment from China

Executive Summary

In the rapidly evolving diagnostics and biotechnology sectors, procurement of precision equipment—such as cell counter machines—requires reliability, technical compliance, and supply chain resilience. Sourcing from China offers significant cost advantages, but navigating the fragmented supplier landscape poses risks related to quality inconsistency, misaligned capabilities, and extended lead times.

SourcifyChina’s Verified Pro List for China Cell Counter Machine Manufacturers delivers a data-driven, vetted solution to streamline procurement, de-risk supplier selection, and accelerate time-to-market.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Challenge in Traditional Sourcing | SourcifyChina’s Solution | Time & Cost Impact |

|---|---|---|

| 50+ unvetted suppliers on Alibaba with inconsistent certifications | Pre-qualified manufacturers with ISO 13485, CE, FDA documentation verified | Saves 15–20 hours in initial screening |

| Language and communication gaps leading to misaligned specs | English-speaking, technically trained export teams at listed suppliers | Reduces RFI cycles by 60% |

| Risk of counterfeit or substandard units | On-site audits and production capability validation | Eliminates 3–6 months of quality troubleshooting |

| No clarity on MOQ, lead time, or export experience | Transparent data: MOQ, delivery timelines, export history | Accelerates RFQ-to-PO process by 40% |

| Hidden costs from failed audits or compliance issues | Compliance-ready suppliers with documented QC processes | Reduces audit failure risk by 85% |

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Procurement leaders who leverage SourcifyChina’s Verified Pro List gain immediate access to a curated network of elite cell counter machine manufacturers—pre-audited, export-compliant, and operationally efficient. This is not a directory; it is a strategic procurement accelerator.

Stop spending weeks validating suppliers. Start sourcing with confidence.

👉 Contact SourcifyChina’s Sourcing Support Team Now to receive:

– Your personalized Verified Pro List for cell counter machines

– Free supplier comparison matrix (technical specs, certifications, pricing tiers)

– Dedicated sourcing consultation to match your volume and quality requirements

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Response within 4 business hours. All inquiries confidential.

SourcifyChina – Your Trusted Partner in Precision Equipment Procurement from China

Data-Driven. Verified. Efficient.

🧮 Landed Cost Calculator

Estimate your total import cost from China.