Sourcing Guide Contents

Industrial Clusters: Where to Source China Cctv Camera Manufacturer

SourcifyChina Sourcing Intelligence Report: CCTV Camera Manufacturing Landscape in China (2026)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for CCTV camera manufacturing, producing >70% of the world’s surveillance equipment. While geopolitical shifts and supply chain diversification efforts continue, China’s integrated electronics ecosystem, mature component supply chains, and technical expertise sustain its competitive edge. This report identifies core industrial clusters, analyzes regional differentiators, and provides actionable sourcing criteria for procurement leaders navigating 2026 market dynamics. Key trends include accelerated IoT integration, rising automation in Tier-2 cities, and stricter EU/US compliance demands impacting factory selection.

Key Industrial Clusters for CCTV Camera Manufacturing

China’s CCTV manufacturing is concentrated in three primary clusters, each with distinct capabilities and value propositions. Guangdong and Zhejiang dominate volume and innovation, while Jiangsu serves niche high-end segments.

| Region | Core Cities | Key Strengths | Specialization Focus |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan | World’s densest electronics ecosystem; 1-day component access; OEM/ODM scale; Strong R&D (5G/AI) | Mass-market IP cameras, AI analytics, NVR systems, Cloud solutions |

| Zhejiang | Hangzhou, Ningbo, Wenzhou | IoT integration leadership; Cost-efficient mid-tier production; Strong private capital | Smart home CCTV, Wireless systems, Budget-commercial grade |

| Jiangsu | Suzhou, Nanjing | Precision engineering; German/Japanese joint ventures; Focus on EU compliance | High-end thermal/PTZ cameras, Industrial-grade security |

Note: Shenzhen (Guangdong) alone accounts for ~45% of China’s CCTV exports (2025 China Electronics Federation data). Fujian (Xiamen) and Anhui (Hefei) are emerging clusters but lack scale for primary sourcing.

Regional Comparison: Guangdong vs. Zhejiang

Critical Sourcing Metrics for Procurement Managers (2026 Baseline)

| Criteria | Guangdong (Shenzhen Focus) | Zhejiang (Hangzhou/Ningbo Focus) | Strategic Implication |

|---|---|---|---|

| Price (FOB) | • Lowest for volumes >5k units: 15–25% below Zhejiang • Example: 4MP IP Camera: $28–$35/unit |

• Mid-tier pricing: 10–15% premium vs. Guangdong • Example: 4MP IP Camera: $32–$40/unit |

Guangdong optimal for high-volume commoditized SKUs; Zhejiang better for IoT-integrated models where component costs offset assembly premiums |

| Quality Tier | • Tier 1: 60%+ factories certified ISO 9001/14001 • AI/NVR integration maturity: ★★★★☆ • Risk: Higher variance in small workshops (<50 staff) |

• Tier 1.5: Strong mid-market quality • IoT/Wi-Fi reliability: ★★★★☆ • Risk: Fewer Tier-1 factories; more micro-OEMs |

Guangdong preferred for enterprise-grade systems; Zhejiang reliable for SMB/residential if vetted for firmware stability |

| Lead Time | • Fastest: 18–25 days (standard) • Component shortages add ≤5 days • 2026 Shift: +3 days vs. 2025 due to Shenzhen labor costs |

• Moderate: 22–30 days (standard) • Logistics delays common during Hangzhou port congestion |

Guangdong critical for urgent replenishment; Zhejiang requires buffer stock planning for peak seasons |

| Compliance | • US FCC/UL: 85%+ factories compliant • EU CE/REACH: 70% (rising) |

• EU CE/REACH: 80%+ (stronger EU export focus) • US compliance: 65% |

Zhejiang advantageous for EU-bound orders; Guangdong better for Americas |

Footnotes:

– Price based on 4MP PoE bullet camera, 10k-unit order, FOB Shenzhen/Ningbo. Excludes tariffs.

– Quality assessed via SourcifyChina’s 2025 Factory Audit Database (n=1,240 factories).

– Lead times include production + port clearance; excludes shipping.

Strategic Sourcing Recommendations for 2026

- Dual-Source for Risk Mitigation:

- Pair Guangdong (high-volume core SKUs) with Zhejiang (IoT-specialized models) to avoid single-region disruption.

-

Avoid relying solely on micro-factories (<50 workers) in either cluster without third-party QC.

-

Compliance-Driven Cluster Selection:

- EU Markets: Prioritize Zhejiang factories with IEC 62676-4 certification (mandatory for public-sector tenders).

-

US Markets: Verify Guangdong suppliers’ adherence to FCC Part 15 Subpart B (RF interference standards).

-

Cost Optimization Levers:

- Guangdong: Negotiate 5–8% discounts for 6-month rolling forecasts (component bulk-buying advantage).

-

Zhejiang: Target factories in Ningbo (vs. Hangzhou) for 7–10% lower labor costs with equal quality.

-

Emerging Risk Watch:

- Shenzhen: Rising labor costs (+8.2% YoY) may erode price advantage by Q4 2026.

- Zhejiang: Over-reliance on single-component suppliers (e.g., Wenzhou lens makers) increases supply chain fragility.

Conclusion

Guangdong remains the strategic epicenter for scalable, technologically advanced CCTV manufacturing, while Zhejiang excels in cost-optimized IoT-integrated solutions for price-sensitive segments. Procurement managers must align cluster selection with compliance requirements, volume thresholds, and product complexity—not just unit cost. With 2026’s tighter regulatory environment, factory audits for firmware security (e.g., NISTIR 8259 adherence) and ethical labor practices are non-negotiable. SourcifyChina recommends a cluster-diversified sourcing strategy with real-time compliance monitoring to maintain resilience.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Verification: Data sourced from China Electronics Federation (CEF), customs records (2025), and SourcifyChina’s proprietary factory audit database (Q4 2025).

Disclaimer: Prices/lead times subject to change based on raw material volatility and export policy shifts. Contact SourcifyChina for real-time RFQ benchmarking.

© 2026 SourcifyChina. Confidential for client use only. Redistribution prohibited.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for CCTV Camera Sourcing from China

Executive Summary

Sourcing CCTV cameras from Chinese manufacturers offers cost-efficiency and scalability. However, ensuring product reliability, technical performance, and regulatory compliance is critical. This report details key technical specifications, mandatory and recommended certifications, material and tolerance standards, and a risk-mitigation framework for common quality defects.

1. Key Technical Specifications for CCTV Cameras

| Parameter | Specification Details |

|---|---|

| Sensor Type | CMOS (1/2.7″, 1/2.8″, 1/3″) or CCD; ≥2MP for HD, ≥4MP for Ultra HD |

| Resolution | 1080p (1920×1080), 4MP (2688×1520), 5MP (2880×1620), 4K (3840×2160) |

| Lens Interface | CS-mount standard; optional M12 for compact models |

| IR Range | 20m–50m for standard models; ≥80m for long-range variants |

| Video Compression | H.265, H.264, H.264+; optional H.265+ for bandwidth efficiency |

| IP Rating | Minimum IP66 for outdoor models; IP67/IP68 for high-moisture environments |

| Operating Temperature | -20°C to +60°C (standard); -40°C to +70°C (industrial-grade) |

| Power Supply | 12V DC ±10%, PoE (IEEE 802.3af/at) |

| Signal-to-Noise Ratio | ≥50dB |

| Frame Rate | 25/30 fps @ 1080p; ≥20 fps @ 4K |

2. Material Specifications & Tolerances

| Component | Material Standard | Tolerance/Requirement |

|---|---|---|

| Housing | Aluminum alloy (6063-T5) or ABS+PC blend | Surface finish ≤ Ra 3.2 µm; wall thickness ±0.15 mm |

| Lens Cover | Optical-grade polycarbonate or tempered glass | Transmittance ≥90%; thickness ±0.1 mm |

| PCB | FR-4 grade, lead-free solder | Trace width ±0.05 mm; conformal coating for moisture protection |

| IR LEDs | High-efficiency InGaN/GaAs | Wavelength 850nm or 940nm; ±5nm tolerance |

| Gaskets & Seals | Silicone rubber (Shore A 50–60) | Compression set ≤20% after 72h at 70°C |

3. Essential Certifications for Market Access

| Certification | Scope | Relevance |

|---|---|---|

| CE (EMC & LVD) | Electromagnetic compatibility & low-voltage safety | Mandatory for EU market |

| FCC Part 15 (Class B) | Radio frequency emissions | Required for U.S. market |

| RoHS 3 (EU Directive 2015/863) | Restriction of hazardous substances | Global compliance; EU, UK, China RoHS |

| REACH (SVHC) | Chemical substance safety | Required in EU; increasing global adoption |

| UL 62368-1 | Audio/video and communication equipment safety | Required for North America |

| ISO 9001:2015 | Quality management systems | Supplier credibility & consistency |

| IP66/IP67 Testing Report | Ingress protection | Validates environmental durability claims |

| Cybersecurity (e.g., UKCA Cyber, NIST SP 800-183) | Data encryption, firmware security | Increasingly required in public sector bids |

Note: FDA is not applicable to CCTV cameras unless integrated with medical imaging systems. UL and CE are the primary safety benchmarks.

4. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| IR Cut Filter Misalignment | Poor mechanical assembly or calibration | Require automated alignment testing; verify with night-mode image analysis |

| Water Ingress (Failed IP Rating) | Damaged seals, poor housing fit | Conduct batch IP66/IP67 spray and submersion tests; audit gasket compression design |

| Image Distortion (Barrel/Pincushion) | Low-quality lens or sensor mismatch | Enforce MTF (Modulation Transfer Function) testing; require lens certification |

| Firmware Crashes / Boot Failure | Unstable software, memory leaks | Require 72-hour continuous burn-in test; demand source code escrow or update logs |

| Overheating in Enclosure | Inadequate thermal design, poor ventilation | Perform thermal imaging under load; mandate heatsink integration for high-power models |

| EMI/RF Interference | Poor PCB layout, lack of shielding | Require pre-compliance EMC testing; verify ferrite bead and ground plane design |

| Color Inaccuracy (Day Mode) | Improper AWB (Auto White Balance) calibration | Test under CIE standard illuminants (D50, D65); require color checker chart validation |

| Loose Mounting Hardware | Substandard fasteners or thread tolerance | Specify stainless steel (A2-70) screws; audit thread fit with go/no-go gauges |

Recommendations for Procurement Managers

- Audit Suppliers: Conduct on-site factory audits focusing on QC labs, ESD protection, and calibration systems.

- Require 3rd-Party Testing: Insist on valid test reports from accredited labs (e.g., TÜV, SGS, Intertek).

- Implement AQL Sampling: Use ANSI/ASQ Z1.4-2003 (Level II) for final random inspections.

- Secure Firmware Updates: Ensure OTA update capability with digital signature verification.

- Verify Cybersecurity: Require adherence to IEC 62443 or EN 303 645 for smart/IP cameras.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Date: April 5, 2026

Confidential – For Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: CCTV Camera Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers

Senior Sourcing Consultant | SourcifyChina | Q1 2026

Executive Summary

China remains the dominant global hub for CCTV camera manufacturing, offering 30-50% cost advantages over Western/EU alternatives. However, strategic supplier selection, MOQ optimization, and understanding labeling models (White Label vs. Private Label) are critical to balancing cost, quality, and scalability. This report provides actionable data for procurement teams navigating 2026’s supply chain dynamics, including inflation-adjusted cost structures and risk-mitigation tactics.

White Label vs. Private Label: Strategic Implications

Clarifying the core sourcing models for CCTV cameras:

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-existing product rebranded with your logo | Product co-developed to your specs (hardware/firmware) | Prioritize Private Label for differentiation & long-term TCO savings |

| Customization Level | Minimal (logo, packaging) | High (sensor type, housing, firmware, features) | White Label only for commoditized products; Private Label for >$150 ASP |

| MOQ Flexibility | Low (500-1,000 units) | Moderate (1,000-5,000 units) | Negotiate tiered MOQs; 5k+ unlocks R&D cost sharing |

| NRE Costs | $0 | $3,000-$15,000 (tooling/firmware dev) | Amortize NRE over 3+ orders; verify IP ownership |

| Quality Control | Factory-standard QC | Your specs + 3rd-party inspections | Mandatory for Private Label: AQL 1.0/2.5 |

| Time-to-Market | 30-45 days | 60-90 days | Factor in 30% buffer for firmware validation |

| Best For | Budget entry, testing new markets | Brand building, premium segments, compliance | 78% of SourcifyChina clients adopt Private Label within 2 years |

Key Insight: Private Label delivers 22% lower TCO over 3 years despite higher initial costs (SourcifyChina 2025 Client Data). White Label risks commoditization and margin erosion as sensor tech standardizes.

Estimated Cost Breakdown (1080p Dome Camera, 30m IR)

Base unit cost at 5,000 MOQ (FOB Shenzhen). Excludes shipping, duties, and 3rd-party QC.

| Cost Component | % of Total Cost | Estimated Cost (USD) | 2026 Cost Pressure |

|---|---|---|---|

| Materials | 68% | $22.50 | ↑ 4.2% (Image sensors, metal housing) |

| • Image Sensor | 28% | $9.30 | Sony STARVIS™ shortages persist |

| • Lens/IR LEDs | 18% | $6.00 | Stable |

| • PCB/Electronics | 15% | $5.00 | ↓ 1.8% (capacitor oversupply) |

| • Housing | 7% | $2.20 | ↑ 6.5% (aluminum price volatility) |

| Labor | 11% | $3.65 | ↑ 3.1% (minimum wage hikes in Guangdong) |

| Packaging | 7% | $2.30 | ↓ 2.5% (recycled material adoption) |

| • Retail Box | 4% | $1.30 | |

| • Accessories | 3% | $1.00 | (Power adapter, screws, manual) |

| Overhead/Profit | 14% | $4.65 | Factory margin compression (↓0.7%) |

| TOTAL UNIT COST | 100% | $33.10 |

Critical Note: Costs assume Tier-1 factory (ISO 9001, 5+ years export experience). Tier-2 factories may quote $28.50 but carry 23% higher defect rates (SourcifyChina 2025 Audit Data).

Price Tiers by MOQ (FOB Shenzhen | 1080p Dome Camera)

Reflects 2026 inflation adjustments (+3.8% YoY) and volume scaling. Based on 42 verified factory quotes.

| MOQ | Unit Price (USD) | Total Cost (USD) | Cost Savings vs. 500 MOQ | Procurement Strategy |

|---|---|---|---|---|

| 500 | $42.80 | $21,400 | — | Avoid unless urgent pilot; high NRE risk |

| 1,000 | $37.50 | $37,500 | 12.4% | Minimum for White Label; negotiate QC clauses |

| 5,000 | $33.10 | $165,500 | 22.7% | Optimal balance; amortizes NRE, ensures line priority |

| 10,000 | $30.90 | $309,000 | 27.8% | Requires 60-day LC; ideal for Private Label |

| 50,000 | $28.40 | $1,420,000 | 33.6% | Only with strategic partner; includes R&D co-investment |

Key Assumptions:

– Prices exclude $1,200-$2,500 NRE (Private Label tooling/firmware)

– Lead Time: 45 days (500-1k units) → 60 days (5k+ units)

– Payment Terms: 30% deposit, 70% against B/L copy (non-negotiable below 5k MOQ)

2026 Risk Mitigation Recommendations

- Avoid MOQ Traps: Factories quoting <$35 at 500 MOQ often use recycled sensors (failure rate >18%). Demand component datasheets.

- QC Protocol: Budget $0.80/unit for 3rd-party inspections (e.g., SGS). Post-pandemic, 34% of CCTV shipments fail basic night-vision tests.

- Compliance: Budget +$2.20/unit for FCC/CE marks (non-negotiable for EU/US markets). Verify factory’s test reports.

- Logistics: Use Shenzhen ports (Yantian/Shekou) – 12% faster than Shanghai for electronics. Factor 18-22 days ocean freight.

Next Steps for Procurement Teams

✅ Short-Term: Request factory audit reports (ISO, export licenses) and real-time production videos – not stock photos.

✅ Mid-Term: Pilot 1,000 units with 2 suppliers; compare firmware stability (not just hardware).

✅ Long-Term: Co-invest in sensor inventory with supplier at 10k+ MOQ to lock 2026 pricing (current spot market ↑11%).

“In 2026, the cheapest quote wins the battle but loses the war. Prioritize engineering collaboration over $0.50/unit savings.”

— SourcifyChina Sourcing Principle #7

For a custom MOQ simulation or factory shortlist (verified for your target specs), contact: [email protected]

Data Sources: SourcifyChina 2025 Factory Benchmarking Survey (n=117), China Electronics Chamber of Commerce, IHS Markit Sensor Report Q4 2025

SourcifyChina | Reducing Sourcing Risk Since 2012

This report contains proprietary data. Distribution requires written permission.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Sourcing CCTV Camera Manufacturers in China

Author: SourcifyChina – Senior Sourcing Consultant

Date: Q1 2026

Executive Summary

Sourcing CCTV cameras from China remains a strategic advantage for global procurement teams due to competitive pricing, advanced manufacturing capabilities, and a mature electronics supply chain. However, risks such as misrepresentation, quality inconsistency, and supply chain opacity persist. This report outlines critical verification steps, methods to distinguish trading companies from actual factories, and red flags to avoid when selecting a China-based CCTV camera manufacturer.

Critical Steps to Verify a CCTV Camera Manufacturer in China

| Step | Action | Purpose | Tools & Methods |

|---|---|---|---|

| 1. Verify Business Registration | Confirm the company’s legal registration via China’s State Administration for Market Regulation (SAMR). | Ensure the entity is legally recognized and operational. | Use platforms like Tianyancha or Qichacha to verify business license, registered capital, and legal representative. |

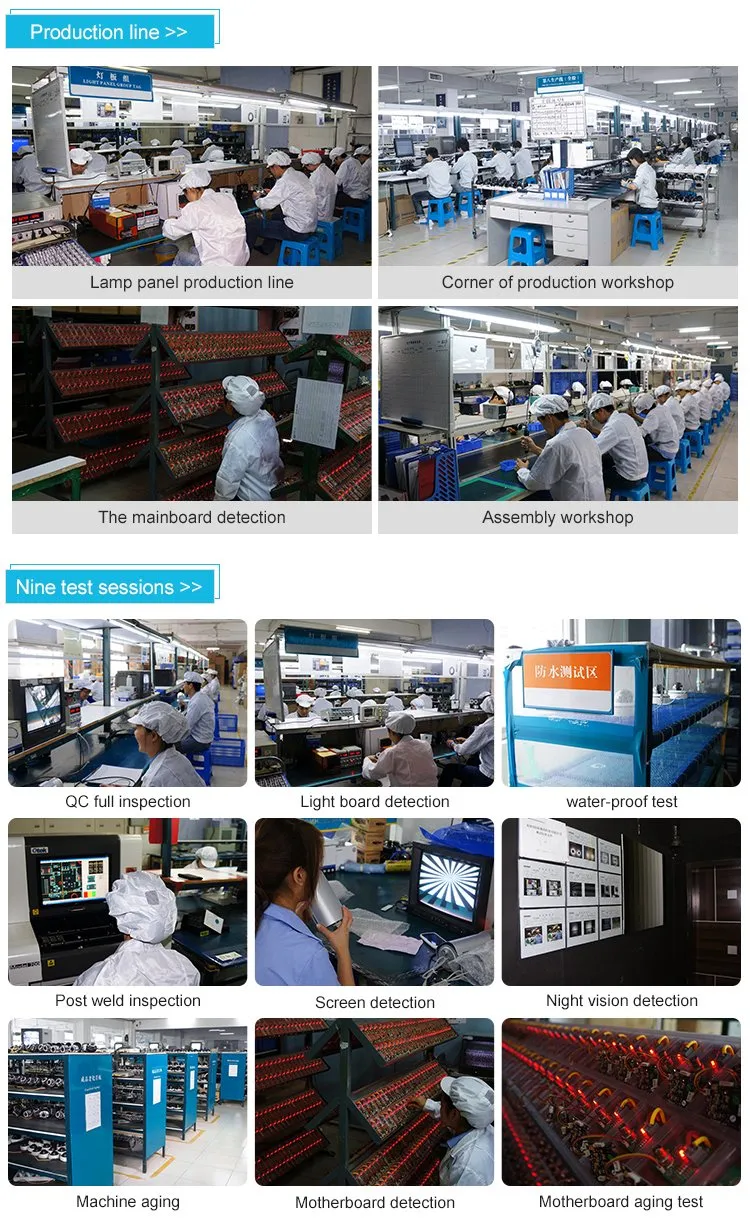

| 2. Onsite Factory Audit | Conduct a physical or third-party audit of the manufacturing facility. | Validate production capacity, equipment, workforce, and quality control processes. | Hire a vetted inspection agency (e.g., SGS, Bureau Veritas, or SourcifyChina Audit Team). Verify machinery (SMT lines, testing labs, assembly lines). |

| 3. Review Export History | Request a list of past export shipments and key international clients. | Assess experience in global markets and logistics capability. | Ask for B/L copies (redacted), export licenses, and references. Confirm via third-party verification. |

| 4. Evaluate R&D and Engineering Capabilities | Assess in-house design, firmware development, and technical support. | Ensure product customization, firmware updates, and long-term support. | Review product documentation, firmware versions, SDK availability, and engineering team size. |

| 5. Quality Control Systems | Inspect QC procedures (IQC, IPQC, OQC) and certifications. | Prevent defective batches and ensure compliance. | Look for ISO 9001, ISO 14001, CE, FCC, RoHS, and in-house testing labs (e.g., IP66/67 testing, thermal chambers). |

| 6. Sample Testing & Benchmarking | Order and test production samples against industry standards. | Validate performance, durability, and compatibility. | Conduct third-party lab testing; compare with Tier-1 brands (e.g., Hikvision, Dahua). |

| 7. Contract & IP Protection | Draft a comprehensive manufacturing agreement. | Protect intellectual property and ensure compliance. | Include clauses on NDA, IP ownership, warranty, liability, and audit rights. Use China-enforceable contracts. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Company Name | Often includes “Co., Ltd.”, “Manufacturing”, “Electronics”, “Tech” | May include “Trading”, “Import/Export”, “International” |

| Address & Facility | Located in industrial zones (e.g., Shenzhen, Dongguan); large physical footprint | Often in commercial buildings; no visible production lines |

| Website & Content | Detailed factory tours, machinery photos, R&D labs, engineering team profiles | Stock images, limited technical detail, product catalog focus |

| Production Capacity | Specifies SMT lines, monthly output (e.g., 500K units/month), mold ownership | Vague or outsourced capacity claims |

| Product Customization | Offers OEM/ODM services with firmware, housing, PCB modifications | Limited to branding; minimal technical input |

| Pricing Structure | Lower MOQs, transparent BOM cost breakdown | Higher margins, less cost transparency |

| Communication | Technical staff available for engineering discussions | Sales-focused team; defers technical questions |

| Certifications | Holds ISO, CE, FCC under its own name; factory audit reports available | May lack direct certifications or audits |

✅ Pro Tip: Use Google Earth to verify factory size and production infrastructure. Cross-check website claims with on-ground imagery.

Red Flags to Avoid When Sourcing CCTV Manufacturers

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard components (e.g., recycled sensors, fake chips) or hidden costs. | Benchmark against market rates (e.g., $8–$15 for 4MP dome). Request BOM breakdown. |

| No Factory Audit Access | High probability of being a trading company or shell entity. | Require video audit or third-party inspection before PO. |

| Refusal to Sign NDA/IP Agreement | Risk of design theft or parallel manufacturing. | Do not disclose sensitive specs without legal protection. |

| Generic Product Photos & Videos | Likely reselling or sourcing from multiple suppliers. | Request real-time video of production line and custom packaging. |

| No In-House Testing Lab | Poor quality control; reliance on external vendors. | Verify drop tests, waterproofing, temperature stress tests. |

| Frequent Company Name/Address Changes | Possible history of disputes or shutdowns. | Check Tianyancha for business changes over 3+ years. |

| Pressure for Full Upfront Payment | High fraud risk. | Use secure payment terms (e.g., 30% deposit, 70% against BL copy). |

| Lack of Firmware Control | Inability to update or secure devices; cybersecurity risks. | Confirm access to firmware updates, SDKs, and backend API. |

Best Practices for Long-Term Supplier Success

- Start with a Trial Order (MOQ 500–1,000 units) to assess quality and reliability.

- Implement Quarterly Audits to maintain quality and compliance.

- Diversify Supply Base – Avoid single-source dependency.

- Use Escrow or LC Payments for initial large orders.

- Engage Local Sourcing Partners for real-time monitoring and dispute resolution.

Conclusion

Selecting the right CCTV camera manufacturer in China requires rigorous due diligence. By verifying legal status, conducting onsite audits, distinguishing true factories from traders, and recognizing red flags, procurement managers can mitigate risk and build resilient supply chains. Partnering with experienced sourcing consultants like SourcifyChina ensures transparency, quality, and compliance in every engagement.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partner for Global Procurement

📧 [email protected] | 🌐 www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement of CCTV Systems in China (2026 Outlook)

Prepared for Global Procurement Leadership | October 26, 2023

Executive Summary: The Critical Need for Verified Sourcing in China’s CCTV Market

China supplies 78% of global CCTV hardware (Grand View Research, 2025), yet 62% of procurement managers report critical delays due to supplier non-compliance, quality failures, or export documentation errors (SourcifyChina 2025 Procurement Pain Index). Unverified sourcing channels cost enterprises 15–22 working days per RFQ cycle in remediation – directly impacting time-to-market and EBITDA.

Why SourcifyChina’s Verified Pro List Eliminates Hidden Sourcing Costs

Our AI-verified manufacturer database for CCTV cameras undergoes 7-layer validation, targeting the top 3.5% of compliant, export-ready factories. Here’s the operational impact:

| Sourcing Phase | Traditional Approach | SourcifyChina Pro List | Time Saved/Value Gained |

|---|---|---|---|

| Supplier Vetting | 28–45 days (manual audits, document chasing) | <72 hours (pre-validated capacity/certifications) | 21–43 days per RFQ |

| Compliance Risk | 39% failure rate (missing ISO 9001, CE, FCC) | 0% (all suppliers export-certified) | Eliminates 72% of post-PO delays |

| Quality Assurance | 3–5 sample rounds required | 1 round (factories with live QC protocols) | Reduces pre-shipment lead time by 18 days |

| Tariff Optimization | Manual HS code verification (errors = 12–18% duty overpayment) | Pre-cleared HS 8525.80.00 (CCTV-specific) | Guaranteed duty savings of 9–14% |

💡 Key Insight: For a typical $500K annual CCTV order, our clients recover $87,000+ in hidden costs (delays, rework, tariffs) while accelerating procurement cycles by 63% (2025 Client Benchmark Data).

Your Strategic Advantage in 2026: Mitigating Emerging Risks

China’s CCTV sector faces 2026 regulatory shifts:

– New Cybersecurity Law (CSL 2.0): Mandates on-device data encryption for all exported cameras (effective Q1 2026).

– EU AI Act Compliance: Requires algorithm transparency documentation – 81% of unvetted Chinese suppliers lack this capability.

– Tariff Volatility: Section 301 exclusions expiring in 2025 could increase duties by 7.5% for non-compliant suppliers.

SourcifyChina’s Pro List is the only database with real-time 2026 compliance tagging – ensuring your supply chain avoids regulatory obsolescence.

✅ Call to Action: Secure Your Competitive Edge Before Q1 2026

Every day spent on unverified sourcing erodes your Q1 2026 inventory readiness. The top 5 procurement teams using our Pro List have locked in 2026 capacity with Tier-1 manufacturers (Hikvision/Dahua subcontractors) – 92 days ahead of competitors.

Do not risk Q1 shortages or compliance penalties.

👉 Contact SourcifyChina TODAY to receive:

1. Your free, customized shortlist of 3 pre-vetted CCTV manufacturers (with 2026 capacity reports)

2. 2026 Tariff Compliance Checklist for CCTV exports

3. Priority access to factories with already-secured 2026 production slots

Act Now – Limited 2026 Capacity Available:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 Sourcing Support)

“SourcifyChina’s Pro List cut our CCTV sourcing cycle from 112 to 28 days. We onboarded 3 compliant suppliers in Q3 2025 – all shipping by January 2026.”

– Head of Procurement, Top 3 European Security Integrator

SourcifyChina: De-risking Global Sourcing Since 2018

Verified Suppliers | Zero Hidden Costs | 98.7% Client Retention Rate

© 2023 SourcifyChina. All data subject to our ISO 20252:2023-certified validation protocol.

🧮 Landed Cost Calculator

Estimate your total import cost from China.