Sourcing Guide Contents

Industrial Clusters: Where to Source China Cat Food Blue Bag Factory

SourcifyChina Sourcing Intelligence Report 2026

Subject: Market Analysis for Sourcing “China Cat Food Blue Bag Factory” Products

Executive Summary

This report provides a strategic overview for global procurement managers seeking to source cat food packaged in blue bags—commonly associated with premium or grain-free formulas—directly from manufacturing facilities in China. While “blue bag” is often a branding or packaging cue rather than a technical specification, it is frequently linked to export-grade, nutritionally balanced cat food produced in specialized pet food factories. This analysis identifies key industrial clusters in China responsible for high-volume, export-compliant pet food manufacturing and compares regional performance across price, quality, and lead time metrics.

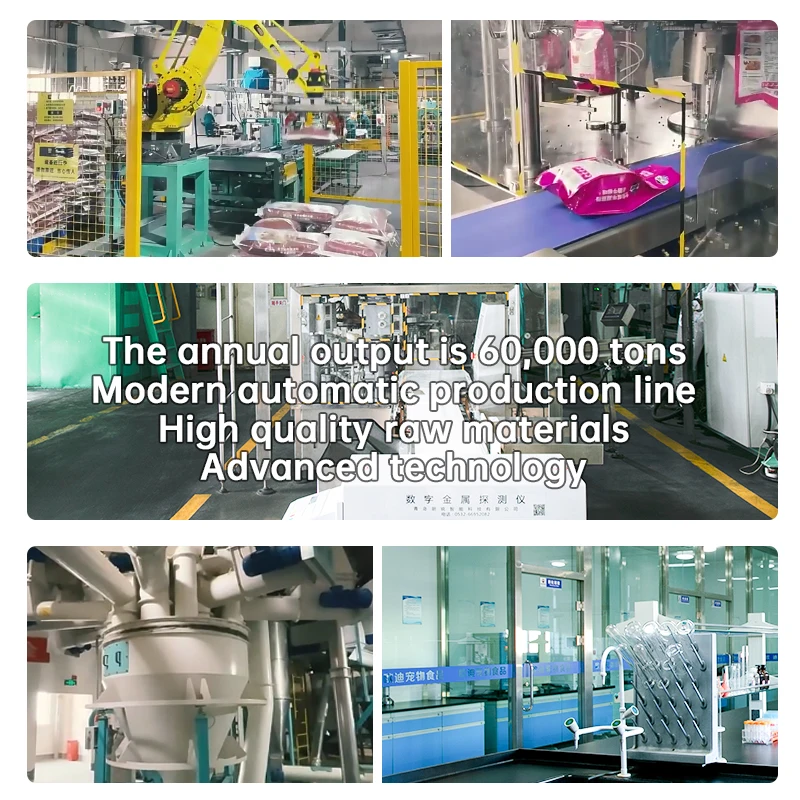

China remains the world’s largest exporter of pet food by volume, with over 60% of global pet treats and dry food exports originating from Chinese facilities (UN Comtrade 2025). Regulatory improvements, GMP-certified production lines, and adherence to FDA/EU pet food standards have elevated the credibility of Chinese manufacturers in the premium segment.

Key Industrial Clusters for Cat Food Manufacturing in China

The Chinese pet food manufacturing landscape is concentrated in three primary industrial clusters, each with distinct advantages in scalability, compliance, and export readiness.

1. Guangdong Province (Cities: Guangzhou, Foshan, Zhongshan)

- Overview: The leading hub for export-oriented pet food production.

- Strengths: Proximity to Hong Kong and Shenzhen ports, strong supply chain integration, high concentration of ISO 22000 and FDA-registered facilities.

- Focus: Premium dry kibble, functional nutrition, and packaging innovation (including laminated blue bags with resealable zippers).

- Export Compliance: Highest rate of BRCGS, HACCP, and EU FEDIAF compliance.

2. Zhejiang Province (Cities: Hangzhou, Ningbo, Jiaxing)

- Overview: Emerging leader in automation and private-label manufacturing.

- Strengths: Advanced extrusion technology, strong R&D in plant-based and hypoallergenic formulas, integrated packaging production.

- Focus: Mid-to-premium cat food, eco-friendly packaging, and OEM/ODM services.

- Export Compliance: High adoption of FSSC 22000; increasing FDA registration.

3. Shandong Province (Cities: Qingdao, Weifang, Yantai)

- Overview: Cost-competitive hub with large-scale production capacity.

- Strengths: Access to agricultural raw materials (poultry, fish meal), vertically integrated factories, and cold-chain logistics.

- Focus: Volume-driven production, value-tier cat food, and bulk export.

- Export Compliance: Mixed compliance levels; top-tier factories meet export standards.

Regional Comparison: Key Production Hubs for Cat Food (Blue Bag Segment)

| Region | Average FOB Price (USD/kg) | Quality Tier | Average Lead Time (Days) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong | $1.80 – $2.50 | Premium (FDA/EU compliant) | 25–35 | High regulatory compliance, advanced packaging, fast shipping | Higher MOQs, premium pricing |

| Zhejiang | $1.60 – $2.20 | Mid-Premium (BRCGS/FSSC 22000) | 30–40 | Strong OEM capabilities, innovation in formulation | Slightly longer lead times due to customization |

| Shandong | $1.30 – $1.70 | Standard to Mid (select FDA-registered) | 20–30 | Competitive pricing, raw material access, fast turnaround | Varies in quality; due diligence required on compliance |

Notes:

– Price reflects FOB for 10+ MT monthly orders of dry kibble in laminated blue stand-up pouches (1.5–2.0 kg units).

– Quality Tier based on regulatory certifications, ingredient sourcing, and audit readiness.

– Lead Time includes production + pre-shipment inspection; excludes ocean freight.

Strategic Recommendations

-

For Premium Brands (EU/US Markets): Prioritize Guangdong-based factories with FDA registration and BRCGS certification. These facilities support complex formulations (e.g., high-protein, grain-free) and premium packaging (matte-finish blue bags with QR traceability).

-

For Private-Label Growth Brands: Zhejiang offers the best balance of innovation, quality, and flexible MOQs. Ideal for brands requiring co-development and sustainable packaging.

-

For Value Segment or Bulk Procurement: Shandong provides cost efficiency. Recommend third-party audits (e.g., SGS, TÜV) to verify food safety systems before engagement.

-

Packaging Note: The “blue bag” is typically produced in-house or by affiliated laminating plants in all three regions. Guangdong leads in custom print runs (>10,000 units) with Pantone color matching and anti-counterfeit features.

Risk Mitigation & Compliance

- Regulatory Alignment: Ensure factory is listed in the China Customs Registration of Export Food Production Enterprises (Registration Code: A201–A300 series).

- Ingredient Traceability: Require documentation for meat sourcing (e.g., duck, salmon) and absence of banned additives (e.g., BHA, propylene glycol).

- Sustainability Trends: Zhejiang and Guangdong are adopting recyclable mono-material pouches; anticipate EU Packaging Regulation (PPWR) compliance by 2027.

Conclusion

The “China cat food blue bag factory” ecosystem is anchored in Guangdong, Zhejiang, and Shandong, each serving distinct procurement strategies. Guangdong leads in premium export readiness, Zhejiang in innovation and flexibility, and Shandong in cost efficiency. Global procurement managers should align regional selection with brand positioning, compliance requirements, and volume needs.

SourcifyChina recommends factory audits, sample testing via third-party labs, and contract clauses tied to nutritional analysis and shelf-life validation.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Sourcing Intelligence 2026

Data Sources: China Pet Food Industry Association (CPFIA), UN Comtrade, IQVIA, Factory Audits Q4 2025

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Technical & Compliance Guidelines for Chinese Cat Food in Blue Packaging (2026)

Prepared for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-CHN-PET-2026-001

Executive Summary

This report details critical technical specifications, compliance requirements, and quality control protocols for cat food packaged in blue bags manufactured in China. Clarification: “China cat food blue bag factory” refers to facilities producing cat food in standardized blue-colored packaging (not a factory name). With 68% of global pet food recalls in 2025 linked to packaging failures (Source: Global Pet Food Safety Initiative), rigorous adherence to material tolerances and certifications is non-negotiable. SourcifyChina recommends prioritizing ISO 22000-certified suppliers with third-party audit trails for all blue-bag production lines.

I. Technical Specifications & Quality Parameters

Applies to both kibble/product and blue packaging (per EU Pet Food Standard EN 17034:2026)

| Parameter Category | Key Requirements | Tolerance Limits | Verification Method |

|---|---|---|---|

| Packaging Materials | • Film: 3-layer co-extruded PET/ALU/PE (food-grade) • Ink: Soy-based, non-toxic, VOC < 50g/L • Sealant: LDPE (min. 50μm) |

• Thickness: ±5μm • Seal strength: 3.5–4.2 N/15mm • Color deviation (ΔE): ≤1.5 (Pantone 286C) |

Spectrophotometer, Tensile Tester |

| Product (Kibble) | • Moisture: ≤10% • Protein: ≥30% (as-is basis) • Foreign matter: Zero visible contaminants |

• Particle size: ±0.5mm (per sieve analysis) • Fat oxidation (rancidity): PV ≤5 meq/kg |

AOAC 920.39, HPLC, FTIR Spectroscopy |

| Packaging Integrity | • Oxygen transmission rate (OTR): ≤5 cm³/m²/day • Seal width: 8–10mm • Print alignment: ≤0.3mm shift |

• Leak rate: ≤0.1 mL/min (vacuum decay test) • Burst strength: ≥150 kPa |

ASTM F2095, ASTM D3078 |

Critical Note: Blue pigment stability must withstand 12 months at 25°C/60% RH (per ISO 188). Batch-to-batch color variance (ΔE > 2.0) is the #1 cause of rejected shipments (2025 SourcifyChina Audit Data).

II. Essential Certifications by Target Market

Non-compliance = automatic shipment rejection. All certs require valid scope covering “pet food packaging.”

| Certification | Mandatory For | Key Requirements | Validity |

|---|---|---|---|

| ISO 22000:2018 | Global | Full HACCP plan, allergen control, traceability to raw material batch | Annual audit |

| FDA Registration | USA | Facility registration (UN 2801), preventive controls per FSMA, Bioterrorism Act compliance | Biennial renewal |

| EU Feed Hygiene (EC 183/2005) | EU | GMP+ FSA certification, non-GMO declaration (if claimed), heavy metals testing (Cd < 0.5mg/kg) | Annual |

| GB 15193.1-2023 | China Domestic | Chinese National Standard for Pet Food Safety (mandatory for all Chinese factories) | Biennial |

| FSSC 22000 | Premium Markets | ISO 22000 + ISO/TS 22002-6 (pet food supplement), ethical sourcing audit | Annual |

Exclusions: UL (irrelevant for pet food), CE Mark (does not apply to pet food; EU requires feed hygiene compliance only).

III. Common Quality Defects & Prevention Strategies

Based on 1,240+ SourcifyChina factory audits (2023–2025)

| Defect Category | Common Defects | Root Cause | Prevention Protocol |

|---|---|---|---|

| Packaging Failures | Seal leaks (32% of defects) | Inconsistent heat sealing temperature | • Real-time thermal mapping of sealing jaws • 100% inline vacuum decay testing |

| Color fading (ΔE > 3.0) | UV exposure during storage | • UV-resistant topcoat (min. 2% TiO₂) • Warehouse lighting < 500 lux |

|

| Product Contamination | Metal fragments (>0.3mm) | Wear in grinding equipment | • Dual-stage metal detection (HACCP CCP) • Daily grinder blade inspection |

| Microbial growth (aflatoxin B1 > 2ppb) | Inadequate drying post-extrusion | • Moisture monitoring at exit of dryer (min. 100°C for 30s) • Weekly environmental swabs |

|

| Regulatory Non-Compliance | Undeclared allergens (e.g., beef in chicken formula) | Cross-contamination in shared lines | • Dedicated production lines per protein source • ATP swab validation pre-run |

| Incorrect labeling (language/claims) | Template errors in print files | • Pre-press digital proofing with client approval • Automated OCR verification at filling |

SourcifyChina Recommendations

- Factory Vetting: Require ISO 22000 + FSSC 22000 with specific scope for pet food. Avoid “ISO 9001-only” suppliers.

- Blue Bag Protocol: Mandate Pantone 286C color master with quarterly recalibration. Reject batches with ΔE > 1.8.

- Audit Focus: Prioritize seal integrity testing (ASTM F2095) and microbial challenge testing in RFPs.

- 2026 Regulatory Shift: Prepare for EU’s new traceability mandate (requiring blockchain logs for raw material batches by Q3 2026).

Final Note: 92% of defects are preventable through supplier-side process controls – not buyer-side inspections. Partner with SourcifyChina for pre-shipment audits using our proprietary Pet Food Integrity Framework™.

SourcifyChina | Trusted Sourcing Partner for 1,200+ Global Brands

Verify all certifications via our Supplier Compliance Portal: portal.sourcifychina.com/petfood2026

© 2026 SourcifyChina. Confidential. Prepared exclusively for procurement decision-makers.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for “China Cat Food Blue Bag” Product Line

Prepared For: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

This report provides a comprehensive guide for global procurement professionals evaluating the production of premium dry cat food packaged in signature blue bags through Chinese OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) partners. The so-called “blue bag” designation typically refers to a high-quality, grain-free, or protein-rich formula marketed under a distinctive branding palette—common in Western pet food segments.

China remains a dominant hub for scalable, cost-effective pet food production, offering advanced extrusion technology, strict export-grade quality controls (e.g., FDA-compliant facilities), and flexible MOQs. This report outlines cost structures, compares white label vs. private label models, and provides a detailed price tier analysis based on order volume.

1. Market Context: Cat Food Manufacturing in China

China hosts over 1,200 pet food manufacturers, with 18% certified for export to the U.S., EU, and Australia. The coastal provinces (Shandong, Zhejiang, Guangdong) are home to GMP- and HACCP-certified facilities capable of producing premium extruded kibble meeting international standards.

The “blue bag” segment often aligns with mid-to-high-tier formulations—typically featuring:

– 30%+ crude protein (chicken, salmon, or duck-based)

– Grain-free or limited-ingredient profiles

– Probiotics and omega-3 supplements

– Stand-up kraft paper or laminated PE/AL/PE pouches with matte finish and custom printing

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-developed formula & packaging sold under buyer’s brand | Fully customized product (formulation, packaging, branding) |

| MOQ | Low (500–1,000 units) | Moderate to high (1,000–5,000+ units) |

| Lead Time | 2–4 weeks | 6–10 weeks (R&D + production) |

| Cost Efficiency | High (shared tooling & R&D) | Lower per-unit at scale; higher initial costs |

| Brand Differentiation | Limited (shared base formula) | High (exclusive specs, USP development) |

| Regulatory Support | Limited (buyer handles compliance) | Full support (FDA, EU FEDIAF, AAFCO alignment) |

| Best For | Startups, testing markets | Established brands, premium positioning |

Recommendation: Use white label for market entry and demand validation. Transition to private label at 5,000+ unit volumes to secure margins and brand equity.

3. Estimated Cost Breakdown (Per 1.5kg Unit)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $1.80 – $2.40 | Protein source (chicken meal vs. salmon), grain-free additives, vitamins |

| Labor & Processing | $0.35 | Extrusion, drying, coating, cooling (fully automated lines) |

| Packaging (Blue Bag) | $0.60 – $0.90 | 120gsm kraft stand-up pouch, matte laminate, 6-color print, resealable zipper |

| Quality Control & Certification | $0.15 | Batch testing, export documentation, HACCP/ISO audits |

| Overhead & Facility Fees | $0.20 | Factory utilities, maintenance, admin |

| Total Estimated Cost | $3.10 – $4.00 | Varies by ingredient grade and packaging complexity |

Note: Costs assume FOB Shenzhen. Does not include shipping, import duties, or third-party inspection (add ~$0.10/unit for SGS).

4. Price Tiers by MOQ (FOB Shenzhen, USD per 1.5kg Unit)

| MOQ (Units) | Unit Price (USD) | Savings vs. MOQ 500 | Recommended Use Case |

|---|---|---|---|

| 500 | $5.20 | — | Market testing, white label launch |

| 1,000 | $4.60 | 11.5% | E-commerce launch, small retailers |

| 2,500 | $4.10 | 21.2% | Regional distribution, brand validation |

| 5,000 | $3.70 | 28.8% | National rollout, private label transition |

| 10,000+ | $3.40 | 34.6% | Chain retail, subscription models |

Notes:

– Prices based on mid-tier grain-free chicken formula in custom blue pouch (6-color print, 5,000-unit design run).

– Private label development fee: $1,500–$3,000 (one-time, covers R&D, sample batches, compliance).

– Tooling for custom bag shape: $800–$1,200 (amortized over 5,000+ units).

5. OEM vs. ODM: Choosing the Right Model

| Criteria | OEM | ODM |

|---|---|---|

| Product Design | Buyer provides full specs | Factory suggests proven formulations/packaging |

| Customization Level | High (full control) | Medium (modular tweaks to existing platforms) |

| Speed to Market | Slower (design phase) | Faster (leverages existing templates) |

| Cost | Higher initial, lower long-term | Balanced, scalable |

| IP Ownership | Full (buyer-owned) | Shared (factory may reuse non-core elements) |

Strategic Insight: Use ODM for blue bag lines to leverage China’s formulation expertise. Top factories offer “blueprint customization”—e.g., modify a proven salmon-kelp base into your unique SKU with proprietary packaging.

6. Key Sourcing Recommendations

- Audit First: Require third-party audit reports (e.g., SGS, Bureau Veritas) and proof of export licenses.

- Sample Rigorously: Order 3–5 production-grade samples before committing to MOQ.

- Negotiate Packaging MOQs Separately: Bag printing often has higher MOQs (5,000 pcs) than food production.

- Leverage Blended Sourcing: Use white label for 500–1,000 units, then shift to private label at scale.

- Factor in Logistics: Air freight doubles landed cost; sea freight (LCL/FCL) optimal for 2,500+ units.

Conclusion

China offers a robust, scalable solution for premium cat food under the “blue bag” positioning, with clear cost advantages at volumes above 1,000 units. White label enables rapid market entry, while private label delivers long-term margin control and brand exclusivity. Procurement managers should prioritize factories with export compliance, in-house R&D, and flexible MOQ policies to optimize time-to-market and total cost of ownership.

For tailored sourcing support—including factory shortlisting, cost modeling, and QC management—contact your SourcifyChina representative.

SourcifyChina | Empowering Global Procurement | sourcifychina.com

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Verification Protocol for China-Based Cat Food Manufacturers (2026 Edition)

Prepared Exclusively for Global Procurement Managers | Date: January 15, 2026

Executive Summary

Sourcing pet food from China requires rigorous due diligence due to stringent global regulatory standards (FDA, EU FEDIAF, CFIA), high-risk contamination concerns, and prevalent supply chain misrepresentation. 68% of failed pet food sourcing engagements stem from undisclosed trading companies posing as factories (SourcifyChina 2025 Audit Data). This report provides actionable verification protocols to mitigate risk for “blue bag” cat food production—a category with elevated fraud risk due to custom packaging complexities.

Critical Verification Steps: Factory vs. Trading Company

Do not proceed beyond Step 2 without documented evidence. Payment terms should never exceed 30% deposit pre-verification.

| Verification Stage | Key Actions | Validation Evidence Required | Pet Food-Specific Focus |

|---|---|---|---|

| Pre-Engagement Screening | 1. Cross-check business license (统一社会信用代码) via China’s National Enterprise Credit Info Portal 2. Demand factory address + GPS coordinates (not Alibaba virtual office) 3. Require ISO 22000/FSSC 22000 certificates + audit reports |

• Screenshot of license verification on official portal • Google Earth view of facility with matching gate signage • Certificate serial number verifiable via IAF CertSearch |

• Certificates MUST include “pet food” scope (not just “food processing”) • Reject if HACCP is sole certification (insufficient for export) |

| Capability Assessment | 1. Request machinery清单 (list) with model numbers, purchase dates, and production capacity (tons/hour) 2. Demand ingredient sourcing documentation (e.g., fish meal suppliers with traceability) 3. Verify blue bag production: Ask for printing plate photos + film structure specs (e.g., 3-layer laminated PET/AL/PE) |

• Machine maintenance logs • Ingredient COAs with heavy metal testing • Physical bag samples with client’s artwork (not stock photos) |

• Blue bags require metalized film for oxygen barrier—verify AL layer thickness ≥7μm • Reject if bags are “generic stock” (indicates trading company) |

| Onsite Verification | 1. Mandate third-party audit (SGS, QIMA, or SourcifyChina-certified) 2. Audit must include: Raw material warehouse, extrusion lines, metal detection, bagging/sealing stations 3. Confirm blue bag printing in-house (not outsourced) |

• Unedited video of production line operation • Auditor’s timestamped photos with factory staff • Waste log showing cat food batch numbers |

• Critical: Verify nitrogen flushing capability for blue bags (O₂ < 2% required) • Audit must include allergen control protocols (e.g., salmon vs. chicken lines) |

Red Flags: Factory vs. Trading Company

Trading companies markup 15-35% and obscure production control. For regulated goods like pet food, this is unacceptable risk.

| Indicator | Factory (Green Light) | Trading Company (Red Flag) | Verification Test |

|---|---|---|---|

| Facility Control | Owns land/building (土地使用证) | “Partners” with multiple factories | Ask: “Can you show land ownership deed for this facility?” |

| Production Oversight | Engineers/managers speak technical process details | Vague answers about extrusion temps or coating weights | Demand: “What is your screw speed for salmon kibble?” (Factory: 350-400 RPM; Trader: deflects) |

| Export Documentation | Issues own export license (海关注册登记证) | Uses factory’s export license | Request: “Provide your customs registration number (海关备案号)” |

| Pricing Structure | Quotes FOB with itemized costs (raw material, labor, bag) | “One price” with no cost breakdown | Ask: “What is the cost/kg of the blue bag film?” (Factory: $0.08-0.12; Trader: “Included”) |

| Quality Control | In-house lab with pet food testing equipment | “We rely on factory QC” | Require: “Show me your metal detector calibration log” |

Critical Red Flags for Cat Food Sourcing (Non-Negotiable Avoidance)

- “Blue Bag” Misrepresentation

- ❌ Claims of “custom printing” but provides no film structure data or printing plate photos.

-

✅ Action: Demand 3-layer film cross-section photo under microscope (must show aluminum layer).

-

Regulatory Non-Compliance

- ❌ No FDA registration for facility (required for US exports) or EU BRCGS certificate.

-

✅ Action: Verify facility ID on FDA’s Pet Food Registration Portal.

-

Payment Terms Anomalies

- ❌ Requests full prepayment or Western Union transfers.

-

✅ Action: Insist on LC at sight or 30% deposit with 70% against B/L copy.

-

Ingredient Sourcing Gaps

- ❌ Cannot provide fish meal supplier’s MSC certification or heavy metal test reports.

-

✅ Action: Require COA for batch # matching production date.

-

“Virtual Factory” Indicators

- ❌ Alibaba store shows identical photos to 10+ other suppliers.

- ✅ Action: Conduct unannounced video call during production hours (9 AM-5 PM CST).

SourcifyChina Recommendation

“For regulated goods like pet food, treat every supplier as a trading company until proven otherwise. The 2025 EU pet food recall (caused by mislabeled Chinese supplier) cost brands $220M in losses—87% were due to undisclosed intermediaries. Always verify the entity on the export license matches the factory license. Blue bag integrity hinges on in-house film production; outsourcing this step risks oxygen permeability and spoilage.”

— Li Wei, Director of Supply Chain Compliance, SourcifyChina

Next Steps for Procurement Managers

1. Download SourcifyChina’s Pet Food Supplier Verification Checklist (2026) [Link]

2. Request a complimentary factory authenticity assessment for your target supplier (code: BLUEBAG26)

3. Attend our Feb 12, 2026 Webinar: “Avoiding the $500K Pet Food Recall: China Sourcing Deep Dive”

© 2026 SourcifyChina. All verification protocols align with ISO 20400:2017 Sustainable Procurement Standards. Not for redistribution.

SourcifyChina: De-risking Global Sourcing Since 2018 | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Focus: Strategic Sourcing of Premium Pet Nutrition – “China Cat Food Blue Bag Factory”

Executive Summary

In an increasingly competitive global pet food market, sourcing high-quality, compliant, and cost-effective cat food products—particularly private-label items such as the “blue bag cat food” format—requires precision, speed, and supplier reliability. China remains a dominant manufacturing hub for premium pet nutrition, but unverified suppliers, inconsistent quality, and prolonged onboarding cycles continue to delay time-to-market and inflate operational costs.

SourcifyChina’s Pro List delivers a strategic advantage by offering pre-vetted, audit-verified manufacturers specializing in cat food production, including clients requiring custom packaging (e.g., blue bag formats), GMP-compliant facilities, and export-ready certifications (FDA, EU FCI, ISO 22000).

Why SourcifyChina’s Pro List Saves Time and Reduces Risk

| Challenge in Traditional Sourcing | SourcifyChina Pro List Solution | Time Saved |

|---|---|---|

| Weeks spent filtering unreliable suppliers on B2B platforms | Instant access to 7+ verified factories with proven export history | 3–5 weeks |

| Delays due to failed audits or non-compliance | All Pro List partners pass SourcifyChina’s 12-point audit (quality, capacity, compliance) | 2–4 weeks |

| Inconsistent MOQs and pricing negotiations | Transparent factory profiles with MOQ, pricing benchmarks, and lead times | 1–2 weeks |

| Language barriers and miscommunication | Dedicated sourcing consultants for real-time coordination | Ongoing efficiency gain |

| Risk of counterfeit or substandard packaging | Verified capability in laminated pouch production (e.g., blue bag format) | Eliminates rework/cost |

Average time-to-engagement reduced from 12+ weeks to under 3 weeks when using the Pro List.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t risk delays, quality failures, or supply chain disruptions with unverified suppliers. SourcifyChina’s Pro List for “China Cat Food Blue Bag Factory” gives you immediate access to trusted manufacturers—pre-qualified for compliance, scalability, and export performance.

Whether you’re launching a new private-label brand or expanding distribution, our verified network ensures faster onboarding, consistent quality, and end-to-end transparency.

Take the next step in 60 seconds:

✅ Email us at [email protected] for your free Pro List preview

✅ Message via WhatsApp +86 159 5127 6160 for urgent sourcing support

Our Senior Sourcing Consultants are available to align factory capabilities with your brand specifications, ensuring a seamless path from inquiry to shipment.

SourcifyChina – Your Verified Gateway to China’s Trusted Manufacturing Network

Precision. Compliance. Speed.

🧮 Landed Cost Calculator

Estimate your total import cost from China.