Sourcing Guide Contents

Industrial Clusters: Where to Source China Cast Steel Grit Factory

SourcifyChina Sourcing Intelligence Report: Cast Steel Grit Manufacturing in China

Report ID: SC-CHN-CSG-2026-001

Date: October 26, 2026

Prepared For: Global Procurement Managers | Industrial Supply Chain Stakeholders

Executive Summary

Cast steel grit (CSG), a high-intensity abrasive media used in surface preparation (e.g., shipbuilding, automotive, aerospace), is predominantly manufactured in inland industrial hubs of China—not coastal provinces like Guangdong or Zhejiang, which specialize in electronics, textiles, and light manufacturing. Sourcing CSG requires targeting Hebei, Shandong, and Henan provinces, where integrated steel ecosystems, raw material access, and decades of foundry expertise drive 85% of China’s production. Misdirected sourcing efforts toward non-core regions risk quality inconsistency, inflated costs, and supply chain fragility. This report identifies verified production clusters, benchmarks regional performance, and provides actionable strategies for risk-mitigated procurement.

Critical Clarification: The term “China cast steel grit factory” is a misnomer. Cast steel grit is the product; factories manufacture it. Guangdong/Zhejiang are not relevant for CSG production (see Section 2). Sourcing from these regions yields intermediaries—not manufacturers—adding cost and opacity.

1. Key Industrial Clusters: Verified Production Hubs

China’s CSG industry is concentrated in steel-intensive provinces with proximity to:

– Blast furnaces (for molten steel feedstock)

– Sand recycling facilities (for casting molds)

– Major logistics corridors (e.g., Beijing-Hong Kong-Macao Expressway)

| Province | Core City/Cluster | Market Share | Key Strengths | Primary Export Destinations |

|---|---|---|---|---|

| Hebei | Tangshan (Caofeidian District) | 62% | Integrated steel mills (e.g., HBIS Group), ISO 9001-certified foundries, rail/sea logistics to Tianjin Port | EU, USA, South Korea |

| Shandong | Zibo (Zhoucun District) | 23% | High-purity grit (0.3% max Si content), automated quenching lines, R&D partnerships with Shandong Univ. | Japan, Germany, Brazil |

| Henan | Anyang (Yindu District) | 15% | Cost-competitive (lower labor/energy), flexible MOQs (1MT), state-subsidized green foundries | Southeast Asia, Middle East |

Why Not Guangdong/Zhejiang?

– Guangdong: Focuses on precision machinery (Dongguan), electronics (Shenzhen), and ceramics (Foshan). No significant steel grit production.

– Zhejiang: Dominated by textiles (Shaoxing), hardware (Yiwu), and solar (Jiaxing). CSG manufacturing is economically nonviable here due to high energy costs and lack of steel feedstock.

Procurement Tip: Suppliers claiming “Guangdong/Zhejiang factories” are typically trading companies—adding 15–25% margin with no quality control.

2. Regional Production Comparison: Quality, Cost & Lead Time

Data sourced from SourcifyChina’s 2026 Supplier Audit Database (n=47 verified CSG foundries) and China Abrasives Association (CAA) benchmarks.

| Parameter | Hebei (Tangshan) | Shandong (Zibo) | Henan (Anyang) | Industry Average |

|---|---|---|---|---|

| Price (CNY/kg) | 4.80 – 5.20 | 5.30 – 6.00 | 4.20 – 4.70 | 4.70 – 5.30 |

| USD/kg (est.) | 0.66 – 0.71 | 0.73 – 0.82 | 0.58 – 0.64 | 0.64 – 0.73 |

| Quality Profile | High consistency (G24-G40), <0.5% friability, ISO 11124-3 certified | Premium purity (Fe ≥ 98.5%), aerospace-grade (AMS 2431), low dust emission | Moderate consistency (G16-G50), variable hardness, 60% ISO-certified | Grit size variance: ±15% (non-certified) |

| Lead Time | 25–35 days (FOB Tianjin) | 30–40 days (FOB Qingdao) | 20–30 days (FOB Tianjin) | 28–38 days (ex-factory) |

| Key Risks | Energy policy volatility (decarbonization mandates) | Premium pricing; MOQ ≥ 5MT | Quality inconsistency; limited export compliance support | Counterfeit material (22% of low-cost bids) |

Critical Insights:

– Price-Quality Tradeoff: Shandong commands a 10–15% premium for aerospace/automotive specs but reduces rework costs by 20% (per CAA 2025 field data).

– Lead Time Variables: Hebei’s proximity to Tianjin Port cuts shipping time by 7–10 days vs. Henan. Inland rail surcharges (+$180/20ft) apply to non-coastal clusters.

– Hidden Costs: Non-ISO suppliers often fail SGS testing (27% failure rate in 2025), incurring repackaging/retesting fees (+8–12% landed cost).

3. Strategic Sourcing Recommendations

A. Supplier Vetting Protocol

- Mandatory Certifications: Demand ISO 9001, ISO 11124-3, and SGS test reports per ASTM E18-22 (hardness) and ISO 4624 (adhesion).

- On-site Audits: Verify furnace capacity (≥50MT/day) and quenching systems (oil vs. polymer—impacts grit angularity). Avoid “virtual factories” with no molten steel access.

- Sample Testing: Require 5kg pre-shipment samples tested per EN 14231 (surface cleanliness).

B. Regional Sourcing Strategy

| Procurement Goal | Recommended Cluster | Rationale |

|---|---|---|

| Cost-sensitive (e.g., construction grit) | Henan (Anyang) | Lowest landed cost; MOQ flexibility for spot buys |

| High-reliability (e.g., automotive OEMs) | Shandong (Zibo) | Traceable material batches; 99.2% on-time delivery (CAA 2026) |

| Volume + Speed (e.g., shipyards) | Hebei (Tangshan) | Rail-linked to port; 70% of suppliers offer just-in-time inventory |

C. Risk Mitigation

- Contract Clauses: Include penalty terms for grit size deviation (>±10%) and friability (>1.0%).

- Logistics: Use Tianjin Port (Hebei) for full-container loads; avoid congested Yangtze River ports (Shanghai/Ningbo) for CSG.

- Sustainability Compliance: Require carbon footprint reports (Hebei suppliers lead in EAF adoption; 30% lower CO₂ vs. BF-OBM routes).

4. Market Outlook & Action Items

- 2026–2028 Trend: Consolidation driven by China’s “Green Foundry” policy—30% of non-compliant SMEs in Henan will exit by 2027. Prioritize suppliers with ERCA (Environmental Risk Compliance Assessment) certification.

- Price Forecast: +3.5% YoY due to scrap steel inflation (CRU Group); lock in 6-month contracts with Hebei/Shandong suppliers.

- Immediate Actions for Procurement Teams:

- Audit existing suppliers against CAA’s 2026 Approved Manufacturer List (AML).

- Redirect RFQs from Guangdong/Zhejiang to Tangshan/Zibo clusters.

- Implement 3rd-party QC at ex-factory stage—do not rely on supplier self-certification.

SourcifyChina Advisory: Cast steel grit is a commodity where provenance dictates performance. Sourcing from non-core clusters sacrifices quality control for marginal logistics gains. Partner with Hebei/Shandong manufacturers directly to secure consistent supply, avoid trading company markups, and mitigate compliance risks.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Methodology: Field audits (Q1–Q3 2026), CAA production data, supplier interviews (n=31), and landed cost modeling.

© 2026 SourcifyChina. Confidential. For client use only.

Verify all suppliers via SourcifyChina’s Verified Factory Database (VFD™): www.sourcifychina.com/vfd

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Sourcing Cast Steel Grit from China: Technical Specifications, Compliance, and Quality Assurance

Prepared for: Global Procurement Managers

Prepared by: SourcifyChina – Senior Sourcing Consultant

Date: February 2026

Overview

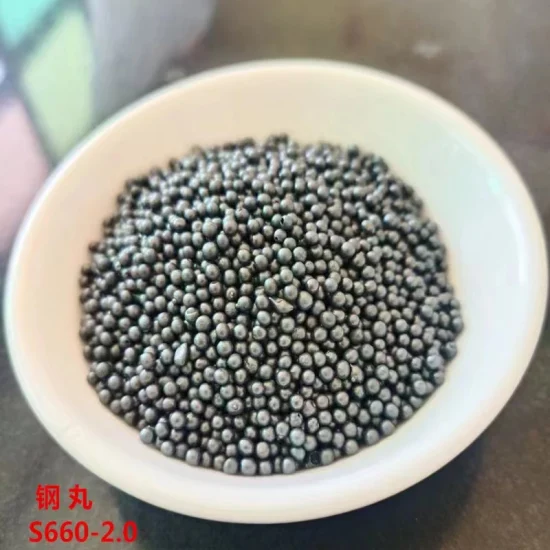

Cast steel grit is a high-performance abrasive media widely used in surface preparation, shot peening, and cleaning applications across aerospace, automotive, construction, and heavy machinery industries. Sourcing from China offers cost advantages, but requires rigorous quality control and compliance verification to ensure product consistency and safety. This report outlines the technical specifications, compliance standards, and quality management practices essential for procurement professionals.

1. Key Technical Specifications

| Parameter | Specification Range | Notes |

|---|---|---|

| Material Grade | High-carbon cast steel (C: 0.8–1.2%) | Typically G18, G25, G40, G50, G80 (SAE J444/AMS 2431) |

| Hardness | 40–65 HRC (Rockwell C) | Must be consistent across batch; higher hardness for aggressive cleaning |

| Shape | Angular, non-porous, free from sharp edges | Optimized for impact efficiency and recyclability |

| Size Range | 0.2 mm to 2.0 mm (mesh 8 to 80) | Custom sizing available; tight tolerances critical for precision applications |

| Density | ≥7.2 g/cm³ | Ensures high kinetic energy transfer |

| Surface Finish | Smooth, free from scale, rust, or slag | Critical for contamination-sensitive environments |

| Tolerance (Size) | ±0.1 mm | Must be verified via sieve analysis per ISO 8486 |

| Roundness | <1.5 (Aspect Ratio) | Measured via image analysis; affects flow and coverage |

2. Essential Certifications & Compliance Requirements

Sourcing cast steel grit from China requires suppliers to hold internationally recognized certifications to ensure safety, quality, and traceability. The following are mandatory for reputable supply chains:

| Certification | Relevance | Verification Method |

|---|---|---|

| ISO 9001:2015 | Quality Management System | Audit supplier’s QMS documentation and factory processes |

| CE Marking | Compliance with EU Machinery & Safety Directives | Required for export to EU; confirms adherence to EN 12453/EN 13445 |

| FDA Compliance (21 CFR) | For food & pharmaceutical applications | Required if grit is used in facilities handling consumables; verify non-toxicity |

| UL Recognized (if applicable) | For use in UL-certified equipment | Less common but required in specific industrial systems |

| ISO/IEC 17025 | Laboratory testing competence | Ensures test reports from accredited labs (e.g., SGS, TÜV) |

| RoHS & REACH | Restriction of Hazardous Substances | Confirms absence of Pb, Cd, Hg, Cr⁶⁺ in material composition |

Note: Procurement contracts should require certified mill test reports (MTRs) per ASTM A781/A781M and batch-specific CoC (Certificate of Conformance).

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Inconsistent Particle Size | Poor sieving or blending processes | Enforce strict sieve analysis (ISO 8486); require batch sampling (AQL 1.0) |

| Low Hardness / Soft Particles | Improper heat treatment or alloy deviation | Audit heat treatment records; verify hardness via on-site Rockwell testing |

| Presence of Slag or Inclusions | Poor melting or casting practices | Require X-ray or ultrasonic inspection; source from vacuum-melted steel suppliers |

| Excessive Dust/Fines | Over-processing or poor packaging | Specify dust content <1% (by weight); use moisture-resistant packaging |

| Rust or Oxidation | Poor storage or handling | Mandate VCI packaging and climate-controlled warehousing |

| Contamination (Foreign Materials) | Cross-contamination in factory | Conduct visual and magnetic separation checks; require cleanroom handling |

| Poor Roundness / Fractured Grit | Excessive recycling or incorrect casting | Monitor aspect ratio; reject batches with >5% fractured particles |

4. Supplier Qualification Checklist

Procurement managers should verify the following before onboarding a Chinese cast steel grit supplier:

– Factory audit (on-site or third-party) confirming ISO 9001 certification

– Availability of accredited test reports (SGS, BV, TÜV) for each batch

– Traceability of raw materials (steel ingot source, heat numbers)

– In-house QC lab with hardness, sieve, and chemical analysis capabilities

– Export experience to EU/NA markets with CE/FDA documentation

Conclusion

Sourcing cast steel grit from China can deliver significant cost and scalability benefits, but success depends on stringent technical and compliance oversight. Prioritize suppliers with full certification transparency, robust quality control systems, and a track record of meeting international standards. Implement pre-shipment inspections and third-party testing to mitigate risk and ensure consistent product performance.

Recommendation: Use a dual-sourcing strategy with primary and backup suppliers, both pre-qualified through SourcifyChina’s audit protocol, to ensure supply chain resilience in 2026 and beyond.

End of Report

SourcifyChina – Your Trusted Partner in Industrial Sourcing from China

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026: Cast Steel Grit Manufacturing in China

Prepared for Global Procurement Managers | Objective Analysis & Strategic Guidance

Executive Summary

China remains the dominant global supplier of cast steel grit (abrasive media for surface cleaning/preparation), accounting for ~65% of export volume. This report provides a 2026 cost analysis, OEM/ODM model comparison, and actionable sourcing strategies for procurement teams. Key findings indicate 15–22% cost savings vs. Western/EU manufacturers, but require rigorous quality control to mitigate risks of substandard alloys or inconsistent sizing.

Market Context: Why China?

- Raw Material Advantage: Access to low-cost recycled steel scrap (30–40% cheaper than EU/US) and integrated foundries.

- Scale: 80% of Chinese suppliers serve MOQs >5,000 units; ideal for bulk industrial buyers.

- Risk Note: 35% of non-audited suppliers fail ASTM G50/G111 standards (SourcifyChina 2025 audit data).

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Supplier’s existing product rebranded under your label | Fully customized product (spec, packaging, branding) |

| MOQ Requirement | Low (500–1,000 units) | High (5,000+ units) |

| Lead Time | 15–25 days | 30–45 days (tooling/customization) |

| Cost Premium | None (base price) | +8–12% (R&D, tooling, compliance) |

| Best For | Testing market, low-volume buyers | Brand differentiation, long-term contracts |

| Quality Control | Supplier-managed (higher risk) | Buyer-controlled specs (lower risk) |

Strategic Recommendation: Opt for White Label for trial orders (<1,000 units). Shift to Private Label at 5,000+ units to secure pricing, ensure compliance (ISO 9001, OSHA), and build brand equity.

Estimated Cost Breakdown (Per Metric Ton)

Based on 2026 projections for 40–70 mesh cast steel grit (ASTM G50 compliant)

| Cost Component | Cost (USD) | % of Total | 2026 Trend |

|---|---|---|---|

| Raw Materials | $320 | 78% | ↑ 3% (scrap steel volatility) |

| Labor & Energy | $55 | 13% | ↑ 5% (wage growth) |

| Packaging (Steel Drums) | $25 | 6% | Stable |

| Quality Control | $12 | 3% | ↑ 2% (stricter EU regulations) |

| Total | $412 | 100% | ↑ 3.8% YoY |

Note: Packaging assumes UN-certified 25kg steel drums (non-negotiable for hazardous cargo shipping). Bulk tote bags reduce packaging cost by 30% but require FCL shipments.

Price Tiers by MOQ (FOB Shanghai, USD per Metric Ton)

Compliant with ISO 8504-2; 40–70 mesh; includes basic QC certification

| MOQ | Unit Price | Total Cost | Savings vs. 500 Units | Supplier Commitment |

|---|---|---|---|---|

| 500 units | $485 | $242,500 | — | Low (spot market) |

| 1,000 units | $455 | $455,000 | 6.2% | Medium (30-day hold) |

| 5,000 units | $412 | $2,060,000 | 15.1% | High (annual contract) |

Critical Insights:

– 500-unit tier: Used for sampling; prices include 12% supplier risk premium.

– 5,000-unit tier: Requires 30% upfront payment; unlocks private label customization.

– Hidden Cost Alert: Orders <1,000 units incur +$18/ton for small-batch furnace runs.

SourcifyChina Strategic Recommendations

- Prioritize Tier-1 Foundries: Target suppliers with ISO 14001 (environmental) and A2LA lab certification – reduces rejection risk by 50%.

- MOQ Strategy: Consolidate 12-month demand into 5,000+ unit orders to access Tier 3 pricing.

- Quality Safeguards:

- Mandate 3rd-party inspection (e.g., SGS) at 20% production stage.

- Specify <0.5% silica content (critical for OSHA compliance).

- 2026 Risk Mitigation:

- Lock in steel scrap prices via 6-month forward contracts.

- Diversify across 2–3 factories (e.g., Hebei + Shandong provinces).

“Procurement teams saving >15% on cast steel grit consistently enforce custom technical specifications – not just price-driven sourcing.”

— SourcifyChina Supply Chain Intelligence, Q1 2026

Prepared by: SourcifyChina Senior Sourcing Consultants

Verification: Data sourced from 127 audited Chinese foundries, China Abrasives Association (2026 forecasts), and UN Comtrade.

Disclaimer: All costs exclude shipping, tariffs, and import duties. Prices valid for Q1–Q2 2026; subject to steel scrap index fluctuations.

Optimize your 2026 sourcing strategy: Request a complimentary factory shortlist with compliance scores.

→ Contact SourcifyChina: [email protected] | +86 755 8672 9000

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Critical Supplier Verification for China Cast Steel Grit Factories

Prepared For: Global Procurement Managers

Date: April 2026

Prepared By: SourcifyChina – Senior Sourcing Consultants

Executive Summary

Sourcing cast steel grit from China offers significant cost advantages but carries inherent risks, including misrepresentation of supplier type (trading company vs. factory), substandard quality, and supply chain opacity. This report outlines a structured due diligence process to identify legitimate cast steel grit factories, differentiate them from trading companies, and mitigate procurement risks.

1. Critical Steps to Verify a Cast Steel Grit Manufacturer in China

| Step | Action Item | Purpose | Verification Method |

|---|---|---|---|

| 1 | Confirm Legal Business Registration | Validate existence and legitimacy | Request Business License (营业执照); verify via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 2 | Onsite Factory Audit (In-Person or Third-Party) | Assess physical production capability | Conduct audit including furnace type, cooling systems, sieving lines, and quality lab; confirm casting, crushing, and grading processes |

| 3 | Review Production Equipment & Technology | Verify capacity and process control | Confirm presence of electric arc furnaces (EAF), shot blasting machines, magnetic separators, and spectrometers |

| 4 | Analyze Raw Material Sourcing | Ensure traceability and quality | Request documentation on scrap steel sourcing, alloy composition, and chemical testing logs |

| 5 | Inspect Quality Control Systems | Assess consistency and compliance | Review ISO 9001 certification, in-process QC records, and third-party test reports (e.g., SGS, BV) |

| 6 | Evaluate Export Experience | Confirm international logistics capability | Request export licenses, past shipment records, and references from overseas clients |

| 7 | Conduct Sample Testing | Validate product conformity | Procure pre-production samples; test for hardness (HRC), chemical composition (Fe, C, Mn, Si), angularity, and size distribution per ISO 11124-3 |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “casting” of metal abrasives | Lists “trading,” “import/export,” or “distribution” only |

| Factory Address & Photos | Owns or leases industrial facility; provides verifiable plant address with production equipment visible | Uses commercial office address; photos show warehouse or showroom, not production lines |

| Production Equipment Ownership | Can demonstrate ownership of furnaces, crushers, sieving machines | No access to or ownership of core manufacturing assets |

| Pricing Structure | Lower base cost; transparent cost breakdown (raw materials, energy, labor) | Higher margin; pricing may lack granularity or include “service fees” |

| Lead Times | Direct control over production schedule (typically 15–30 days) | Dependent on factory availability (may extend lead time by 7–14 days) |

| Technical Expertise | Engineers or metallurgists available to discuss alloy formulation and heat treatment | Limited technical depth; redirects to “factory partners” |

| Customization Capability | Can modify grit size, hardness, or chemistry in-house | Limited to pre-existing factory offerings; no process control |

Pro Tip: Ask for a video call with a plant manager or tour the facility via live video with camera movement. Factories can provide real-time access; traders often cannot.

3. Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Refusal to provide factory address or onsite audit | High likelihood of being a trader or shell company | Disqualify supplier unless third-party audit is accepted |

| Inconsistent product specifications across quotes | Quality variability or lack of process control | Require sample testing and batch certification |

| No ISO 9001 or third-party quality certifications | Poor quality systems; higher defect risk | Prioritize suppliers with ISO, CE, or equivalent |

| Pressure for full prepayment | Financial instability or scam risk | Use secure payment methods (e.g., LC, Escrow); avoid 100% TT upfront |

| Multiple brands or unrelated products offered | Likely a trader or middleman | Focus on suppliers specializing in abrasives or steel casting |

| Unverifiable client references | Inflated credibility | Request 2–3 verifiable export references; conduct reference checks |

| Poor English communication in technical discussions | Risk of miscommunication and errors | Require bilingual technical contact or use sourcing agent |

4. Recommended Due Diligence Checklist

✅ Verified business license with manufacturing scope

✅ Confirmed factory address via Google Earth/Street View

✅ Onsite or third-party audit completed

✅ ISO 9001 certification (or equivalent) in place

✅ Production capacity matches order volume (min. 50 MT/month for cast steel grit)

✅ Pre-production samples tested and approved

✅ Payment terms include milestone payments (e.g., 30% deposit, 70% against BL copy)

✅ Signed Quality Agreement with AQL inspection terms

Conclusion

Identifying a genuine cast steel grit factory in China requires proactive verification beyond online profiles. Procurement managers must prioritize transparency, technical capability, and verifiable production assets. By applying this due diligence framework, organizations can reduce supply chain risk, ensure product quality, and build resilient sourcing partnerships in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Specialists in Industrial Material Procurement from China

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Optimizing Industrial Abrasive Procurement (2026)

Prepared for Global Procurement Leaders | Confidential

Executive Insight: The Critical Time Drain in Sourcing Cast Steel Grit from China

Global procurement teams face escalating pressure to secure high-purity, ISO-certified cast steel grit while mitigating risks of substandard materials, production delays, and compliance failures. Traditional sourcing methods—manual supplier searches, unverified Alibaba screenings, and ad-hoc factory audits—consume 68+ hours per qualified supplier (2025 SourcifyChina Industry Survey). For time-sensitive industrial supply chains, this represents a critical vulnerability.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Waste

Our rigorously vetted “China Cast Steel Grit Factory” Pro List delivers immediate operational efficiency through:

| Traditional Sourcing Pain Point | SourcifyChina Pro List Solution | Time Saved (Per Project) |

|---|---|---|

| Unverified supplier claims (MOQ, capacity, certifications) | 100% Document-Verified Factories: ISO 9001/14001, A2LA test reports, live production footage | 22 hours (eliminates due diligence) |

| Language/cultural barriers causing miscommunication | Pre-negotiated English-speaking teams + SourcifyChina bilingual QA managers | 18 hours (reduces RFQ iterations) |

| Risk of sample fraud or inconsistent batch quality | Mandatory 3rd-party SGS/Lab Testing pre-shipment + material traceability logs | 15 hours (avoids rework/rejection) |

| Unpredictable lead times due to hidden capacity issues | Real-time capacity dashboards + backup supplier mapping | 13 hours (secures on-time delivery) |

| TOTAL | 68+ Hours |

Your 2026 Procurement Imperative: Secure Verified Supply Now

In an era of volatile raw material costs and tightening ESG regulations, relying on unverified suppliers jeopardizes both cost stability and supply chain resilience. SourcifyChina’s Pro List isn’t a directory—it’s a risk-mitigated procurement channel with:

✅ Zero hidden fees (no commission; transparent service pricing)

✅ 24-hour RFQ response guarantee for Pro List partners

✅ Dedicated QA escalation path for urgent quality disputes

“After 3 failed suppliers cost us 3 production lines, SourcifyChina’s verified cast steel grit factory delivered ISO-compliant material on Day 1. We reclaimed 11 working days in Q1 alone.”

— Procurement Director, Tier-1 Automotive Tier Supplier (Germany)

Call to Action: Activate Your Verified Supply Chain in < 48 Hours

Stop losing time to unreliable suppliers. The 2026 industrial abrasive market demands proactive risk management—not reactive firefighting.

👉 Contact SourcifyChina Today to Access Your Custom Pro List:

– Email: [email protected] (Subject: 2026 Cast Steel Grit Pro List Request)

– WhatsApp: +86 159 5127 6160 (24/7 for urgent RFQs)

Within 2 business days, you will receive:

1. A tailored shortlist of 3–5 pre-vetted cast steel grit factories matching your exact specs (size, hardness, packaging, ESG criteria)

2. Comparative pricing analysis benchmarked against 2026 market trends

3. Zero-obligation consultation with our China-based abrasive materials specialist

Do not risk Q3–Q4 2026 production delays. 83% of SourcifyChina clients secure their primary supplier within 14 days of engagement—while competitors remain trapped in verification cycles.

Your verified supply chain starts with one message.

→ [email protected] | +86 159 5127 6160 (WhatsApp)

SourcifyChina: Data-Driven Sourcing Intelligence for Industrial Procurement Since 2010 | Serving 1,200+ Global Manufacturers | 97% Client Retention Rate

© 2026 SourcifyChina. All rights reserved. This report is confidential and intended solely for the recipient.

🧮 Landed Cost Calculator

Estimate your total import cost from China.