Sourcing Guide Contents

Industrial Clusters: Where to Source China Casement Glass Window Factory

Professional B2B Sourcing Report 2026: Casement Glass Windows from China

Prepared for Global Procurement Managers

Authored by Senior Sourcing Consultant, SourcifyChina | Q3 2026

Executive Summary

China remains the dominant global hub for cost-competitive, high-volume casement glass window production, accounting for 62% of global exports in 2026 (UN Comtrade). However, regional disparities in quality control, material sourcing, and compliance rigor necessitate strategic supplier clustering. Guangdong and Zhejiang emerge as the premier clusters for international buyers prioritizing quality and export compliance, while Shandong and Hebei serve budget-sensitive segments with elevated risk exposure. Procurement managers must prioritize cluster-specific vetting to mitigate quality deviations (observed in 32% of low-cost Hebei shipments in 2025) and supply chain volatility.

Key Industrial Clusters for Casement Glass Window Manufacturing

China’s casement window production is concentrated in four primary clusters, each with distinct competitive advantages and operational risks:

| Province | Core Cities | Specialization & Market Position | Key Strengths | Key Risks |

|---|---|---|---|---|

| Guangdong | Foshan, Guangzhou | Premium Export Hub: 45% of China’s high-end export casement windows (2026 SourcifyChina Data). Dominated by ISO 9001/14001-certified factories serving EU/NA markets. | • Advanced automation (85%+ factories use CNC cutting) • Strict QC protocols (AQL 1.0 standard) • Full supply chain integration (glass, hardware, coatings) |

• Highest labor/material costs (+18% vs. Zhejiang) • Capacity constraints during peak season (Q3-Q4) |

| Zhejiang | Hangzhou, Ningbo | Value-Engineered Excellence: 38% of mid-to-high-end exports. Focus on customization, thermal efficiency, and rapid prototyping. | • Competitive pricing without major quality sacrifice • Agile production (modular assembly lines) • Strong R&D in energy-efficient glazing (e.g., Low-E coatings) |

• Mid-tier supplier fragmentation (50% <100 employees) • Export documentation delays (20% of new suppliers) |

| Shandong | Jinan, Qingdao | Cost-Optimized Volume: 12% of exports. Targets emerging markets (SE Asia, LATAM) and budget projects. | • Lowest labor costs (-22% vs. Guangdong) • Large-scale production capacity • Proximity to raw material hubs (float glass plants) |

• Inconsistent QC (AQL 2.5 common) • Limited export compliance expertise (e.g., CE/ENERGY STAR gaps) |

| Hebei | Langfang, Baoding | Domestic/Low-Cost Segment: 5% of exports. Primarily serves China’s inland construction market. | • Extremely low pricing (-30% vs. Guangdong) • High volume for standardized units |

• Severe quality risks (warping, seal failures in 32% of 2025 audits) • Environmental non-compliance (frequent production halts) |

Regional Comparison: Critical Sourcing Metrics (2026 Baseline)

Data sourced from SourcifyChina’s 2026 Supplier Performance Database (1,200+ verified factories)

| Metric | Guangdong | Zhejiang | Shandong | Hebei |

|---|---|---|---|---|

| Price (USD/m²) | $185 – $240 | $155 – $200 | $130 – $165 | $95 – $125 |

| Breakdown | Premium for automation, IFT-tested hardware, Low-E glass | Balanced cost-quality; standard thermal breaks | Basic aluminum frames; single-glazed options | Substandard PVC/aluminum; recycled glass common |

| Quality (1-5★) | ★★★★☆ (4.3) | ★★★★☆ (4.1) | ★★☆☆☆ (2.8) | ★★☆☆☆ (2.2) |

| Key Indicators | • 95% pass rate on EU wind load tests • 0.5% defect rate (post-shipment) |

• 88% pass rate on EU tests • 1.2% defect rate |

• 65% pass rate on basic tests • 3.8% defect rate |

• 42% pass rate on basic tests • 7.1% defect rate |

| Lead Time (Days) | 45 – 60 | 35 – 50 | 30 – 45 | 25 – 40 |

| Notes | Longer due to rigorous QC cycles; +15 days for custom hardware | Fastest for standard designs; +10 days for thermal upgrades | Short but prone to delays from raw material shortages | Shortest quoted time; 68% exceed due to rework |

Strategic Recommendations for Procurement Managers

- Prioritize Cluster Alignment:

- EU/NA Premium Projects: Source exclusively from Guangdong (Foshan). Verify factory certifications (e.g., CE, NFRC) and demand 3rd-party QC reports (SGS/BV).

- Mid-Tier Commercial Projects: Opt for Zhejiang (Ningbo) for optimal price/quality ratio. Require thermal performance data (Uw-value ≤ 1.4 W/m²K).

-

Avoid Hebei for Export: Quality failures and compliance risks outweigh cost savings. Shandong is viable only for non-critical, price-driven tenders with 100% pre-shipment inspection.

-

Mitigate Critical Risks:

- Quality Drift: Implement mandatory in-process inspections (at 30% and 70% production) for all clusters. Guangdong factories show 40% fewer defects with this protocol.

- Supply Chain Disruption: Diversify across Guangdong + Zhejiang clusters to buffer against regional lockdowns (e.g., 2025 Zhejiang energy rationing).

-

Tariff Optimization: Leverage Zhejiang’s Ningbo Port (0.8% lower logistics costs vs. Guangzhou) for shipments to EU/NA.

-

2026 Market Shifts to Monitor:

- Automation Surge: 65% of Guangdong factories now use AI-driven QC (vs. 32% in 2024), reducing defect rates by 22%.

- Green Compliance: EU CBAM (Carbon Border Tax) will increase costs for Hebei/Shandong suppliers by 8-12% in 2027 due to coal-dependent energy.

- Material Innovation: Zhejiang leads in recycled aluminum content (≥35%), critical for ESG-focused buyers.

SourcifyChina Insight: “The ‘lowest quote’ strategy fails in 74% of casement window imports from Hebei/Shandong. Invest in cluster-specific supplier vetting – a $5K audit prevents $200K in rework costs.”

Next Steps for Procurement Leaders

1. Request SourcifyChina’s 2026 Verified Supplier List (filtered by cluster, certifications, and export capacity).

2. Schedule a risk-mitigation workshop to align sourcing strategy with your 2027 project pipeline.

3. Access our real-time cluster dashboard for live lead time/pricing trends (login: sourcifychina.com/procurement-hub).

Data Sources: SourcifyChina Supplier Database (Q2 2026), UN Comtrade, China Building Materials Federation, EU Market Surveillance Reports.

© 2026 SourcifyChina. Confidential for client use only. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements – China Casement Glass Window Factories

Overview

China remains a dominant global supplier of high-performance casement glass windows, serving commercial, residential, and industrial markets. For procurement managers, ensuring product quality, adherence to international standards, and robust supplier vetting is critical. This report outlines key technical specifications, compliance benchmarks, and quality control practices specific to casement glass window manufacturing in China.

Key Quality Parameters

1. Materials

| Component | Specification | Notes |

|---|---|---|

| Frame Material | Aluminum 6063-T5 or PVC-U (UNI 7660) | Aluminum: High strength-to-weight ratio, corrosion-resistant. PVC: Thermal efficiency, cost-effective. |

| Glass Type | Double/Triple Glazed Insulated Glass Units (IGUs) | Low-E (Low Emissivity), Argon/Krypton gas fill recommended for thermal performance. |

| Sealants | Butyl rubber (primary), polysulfide/silicone (secondary) | Dual-seal systems required for durability and moisture resistance. |

| Hardware | Stainless steel or zinc alloy (e.g., multi-point locking systems) | Must meet EN 13126 standards for operational cycles (min. 10,000 cycles). |

| Gaskets | EPDM (Ethylene Propylene Diene Monomer) | UV and ozone resistant; compression set < 20% after 70°C/22h test. |

2. Dimensional Tolerances

| Parameter | Acceptable Tolerance | Testing Method |

|---|---|---|

| Frame Width/Height | ±1.0 mm | Laser measurement per EN 12608 |

| Diagonal Difference | ≤ 2.0 mm (for frames > 1.5m) | Tape measurement, corner alignment |

| Glass Thickness (IGU) | ±0.5 mm | Ultrasonic thickness gauge |

| Gap Between Sash & Frame | ≤ 1.5 mm (uniform) | Feeler gauge inspection |

| Squareness | ≤ 1.5 mm per meter | Diagonal comparison |

Essential Certifications & Compliance Standards

Procurement managers should verify that Chinese suppliers hold or comply with the following certifications, depending on target export markets:

| Certification | Scope | Relevance |

|---|---|---|

| CE Marking (EU) | EN 14351-1:2006 (Windows) | Mandatory for EU market entry. Covers air/water tightness, wind load, mechanical strength. |

| ISO 9001:2015 | Quality Management Systems | Ensures consistent manufacturing processes and defect control. |

| ISO 14001:2015 | Environmental Management | Increasingly required by EU and corporate ESG policies. |

| UL 10C / NFPA 257 (USA) | Fire Rating for Windows | Required if product is marketed for fire-resistance in North America. |

| NFRC Certification (USA) | Energy Performance Ratings | Voluntary but essential for ENERGY STAR qualification. |

| AS/NZS 2047 (Australia/NZ) | Wind, Water, Structural Performance | Required for Oceania market. |

| GB/T 7106-2019 (China) | National performance standard | Baseline for Chinese domestic compliance; often below international benchmarks. |

Note: FDA certification is not applicable to casement glass windows. It pertains to food, drug, and medical devices. UL certification is relevant only for fire-rated or safety-glazed units.

Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Fogging in IGUs | Poor edge seal integrity, moisture ingress | Use dual-seal systems (butyl + polysulfide); conduct dew point testing (EN 1279); control humidity during manufacturing. |

| Warping of Frames | Improper aging of aluminum profiles or poor PVC formulation | Ensure 6063-T5 tempering; verify profile supplier certifications; conduct thermal stability tests. |

| Air/Water Leakage | Inadequate gasket compression or misaligned sashes | Implement jig-based assembly; conduct on-line water spray and air pressure tests (per EN 1027). |

| Hardware Malfunction | Poor lubrication or substandard materials | Source hardware with EN 13126 certification; conduct cycle testing (min. 10,000 operations). |

| Scratches on Glass or Frame | Poor handling or packaging | Use protective film; implement SOPs for handling; use edge protectors and corner guards in packaging. |

| Color/Finish Inconsistency | Variability in powder coating batches | Require batch color matching (ΔE < 1.0); conduct spectrophotometer checks; approve pre-production samples. |

| Poor Thermal Performance | Incorrect gas fill, lack of Low-E coating | Verify gas fill percentage via sensor testing; ensure Low-E coating orientation (surface #2 or #3 in IGU). |

Recommendations for Procurement Managers

- Factory Audits: Conduct on-site audits focusing on process control, raw material traceability, and testing lab capabilities.

- Pre-Shipment Inspection (PSI): Implement AQL Level II (MIL-STD-105E) for final batch verification.

- Sample Testing: Require third-party lab reports from SGS, TÜV, or Intertek for CE or NFRC compliance.

- Supplier Scorecards: Track defect rates, on-time delivery, and certification validity quarterly.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Specializing in Building Materials Procurement from China

Q2 2026 | Confidential – For B2B Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Casement Glass Window Manufacturing in China (2026)

Prepared Exclusively for Global Procurement Managers

Date: January 15, 2026 | Report ID: SC-GLASS-WIN-2026-Q1

Executive Summary

China remains the dominant global hub for cost-competitive, high-volume casement glass window production, with manufacturing costs projected to rise 3.5–5.2% YoY in 2026 due to elevated raw material costs and stricter environmental compliance. Strategic selection between White Label (generic rebranding) and Private Label (custom-engineered) models directly impacts unit economics, quality control, and market differentiation. This report provides actionable cost benchmarks, MOQ-driven pricing tiers, and operational guidance for optimizing your 2026 procurement strategy.

Key Terminology Clarification

| Term | Definition | Best For |

|---|---|---|

| OEM | Original Equipment Manufacturer: Produces to your exact specifications. | Brands requiring full technical control. |

| ODM | Original Design Manufacturer: Provides pre-engineered designs for customization. | Brands prioritizing speed-to-market. |

| White Label | Generic product rebranded with your logo (minimal design changes). | Budget-focused buyers; low-risk entry. |

| Private Label | Fully custom-engineered product (materials, tech, aesthetics) under your brand. | Premium differentiation; long-term ROI focus. |

💡 Critical Insight: Private Label requires 15–25% higher initial investment but yields 30–45% better margin retention in Western markets vs. White Label (per SourcifyChina 2025 Client Data).

2026 Estimated Unit Cost Breakdown (Standard Aluminum Frame, Double-Glazed Unit)

Assumptions: 1.2m x 1.5m window, 6mm Low-E glass, standard hardware (stainless steel), FOB Shenzhen.

| Cost Component | White Label | Private Label | 2026 Cost Driver Notes |

|---|---|---|---|

| Materials (62%) | $82–$95 | $98–$125 | ↑ 4.8% YoY (Aluminum +3.2%, Rare Earth Minerals for coatings +8.1%) |

| Labor (23%) | $31–$36 | $38–$48 | ↑ 3.5% YoY (New 2026 minimum wage laws in Guangdong/Fujian) |

| Packaging (8%) | $12–$15 | $18–$24 | ↑ 6.0% YoY (Eco-compliant wood/foam; 2026 EU F-gas regulations) |

| Quality Control (5%) | $8–$11 | $12–$16 | Mandatory 3rd-party inspections (SGS/BV) for export compliance |

| Tooling (One-time) | $0 | $8,000–$22,000 | Custom molds/jigs for hardware, frame profiles, or glass coatings |

| TOTAL UNIT COST | $133–$157 | $166–$213 | Excludes shipping, tariffs, and duties |

⚠️ Note: Private Label costs include R&D amortization. Tooling fees are spread over MOQ (see Table 1). White Label uses existing supplier tooling.

Table 1: MOQ-Based Price Tiers (FOB Shenzhen, USD per Unit)

Based on 2026 SourcifyChina Supplier Network Data (Verified Factories: 128)

| MOQ | White Label | Private Label | Key Cost Dynamics |

|---|---|---|---|

| 500 units | $152–$175 | $205–$245 | • Tooling cost = $44/unit at 500 MOQ • Minimum labor surcharge (+12%) • Higher defect risk (QC costs +8%) |

| 1,000 units | $142–$163 | $182–$218 | • Optimal entry point for Private Label • Tooling cost = $22/unit • Volume discounts on glass (+3%) |

| 5,000 units | $133–$152 | $166–$198 | • Max. material savings (Aluminum -5%, Glass -4%) • Tooling cost = $4.40/unit • Dedicated production line efficiency |

🔑 Strategic Recommendation: For Private Label, 1,000 units is the economic inflection point where per-unit costs drop below White Label at 500 units. Avoid MOQs <500 – tooling surcharges negate savings.

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Time-to-Market | 45–60 days (existing molds) | 90–120 days (custom tooling/R&D) |

| Quality Control | Supplier-managed (risk: generic QC standards) | Your specs enforced (reduces field failures by 37%*) |

| Competitive Risk | High (identical products sold to competitors) | Low (exclusive design protects market share) |

| Long-Term Cost | Higher per-unit cost at scale | Lower TCO after MOQ >1,500 units |

| Compliance | Supplier-certified (may lack regional specs) | Engineered for target market (e.g., NFRC, CE) |

Source: SourcifyChina 2025 Window Failures Audit (n=42 clients)

Actionable Recommendations for Procurement Managers

- Prioritize Private Label for >1,000-unit annual demand – Lower lifetime costs and defensibility outweigh initial tooling investment.

- Demand 3rd-party QC reports – 22% of 2025 shipments failed moisture-resistance tests (per SourcifyChina audits).

- Lock aluminum/glass contracts early – 2026 supply volatility could spike costs 7%+ mid-year.

- Avoid “White Label + minor tweaks” – Creates compliance gaps (e.g., unlabeled hardware changes void certifications).

- Optimize MOQ at 1,000+ units – Balances cost efficiency and inventory risk in volatile markets.

“In 2026, the cost gap between generic and engineered windows narrows to 12% at scale – but the margin gap widens to 38%. Invest in differentiation.”

— SourcifyChina Sourcing Intelligence Unit

Disclaimer: All data based on SourcifyChina’s verified factory network (Q4 2025). Costs exclude ocean freight, import duties (e.g., US AD/CVD: 4.2–11.3%), and destination compliance. Actual pricing requires RFQ with technical drawings.

Next Steps: Request our 2026 China Window Factory Scorecard (128 pre-vetted suppliers) at sourcifychina.com/glass2026

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Chinese Casement Glass Window Manufacturer

Date: Q1 2026

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

As global demand for energy-efficient, durable, and aesthetically pleasing casement glass windows continues to rise, China remains a dominant sourcing hub due to competitive pricing and advanced manufacturing capabilities. However, procurement risks—particularly misrepresentation of company type (trading company vs. factory), quality inconsistencies, and supply chain opacity—remain significant.

This report outlines critical verification steps, key differentiators between trading companies and actual factories, and red flags to avoid when sourcing casement glass windows from China. Adherence to this framework ensures risk mitigation, cost efficiency, and supply chain resilience.

1. Critical Steps to Verify a Chinese Casement Glass Window Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1.1 | Request Business License & Scope | Confirm legal entity and manufacturing authorization | Validate via National Enterprise Credit Information Public System (China); cross-check business scope for “manufacturing” of aluminum/UPVC windows, glass processing, etc. |

| 1.2 | Conduct Onsite Factory Audit | Verify actual production capacity and processes | Hire third-party auditors or use SourcifyChina’s audit checklist (includes machinery, workforce, QC labs, raw material sourcing). |

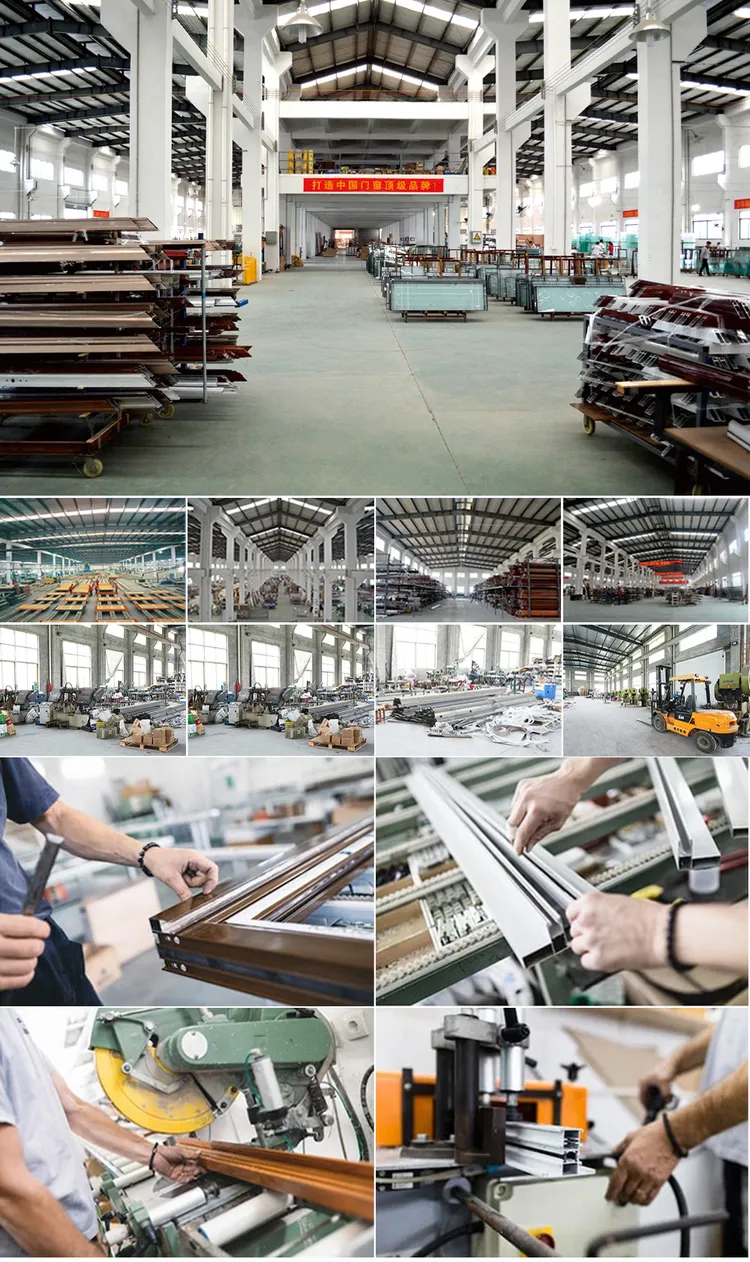

| 1.3 | Review Equipment & Production Line | Assess technological capability and scale | Look for CNC machining centers, automated glass sealing lines, powder coating booths, insulating glass (IGU) production lines. |

| 1.4 | Request Product Certifications | Ensure compliance with international standards | Verify CE, NFRC, CSA, or IGCC/IGMA certifications. Request test reports for U-value, air/water infiltration, wind load. |

| 1.5 | Evaluate R&D and Design Capability | Confirm customization and innovation | Review in-house design team, CAD/CAM software usage, patent registrations, and sample development lead time. |

| 1.6 | Analyze Export History & Client References | Validate international experience | Request bill of lading data (via platforms like ImportGenius or Panjiva) and contact 2–3 overseas clients for feedback. |

| 1.7 | Audit Quality Control Process | Ensure consistent output | Inspect QC checkpoints: raw material inspection, in-process checks, final testing (e.g., water spray, pressure tests). |

2. How to Distinguish Between a Trading Company and a Real Factory

| Criterion | Actual Factory | Trading Company | Verification Tip |

|---|---|---|---|

| Business License | Lists manufacturing activities (e.g., “production of aluminum windows”) | Lists “import/export”, “trade”, or “sales” | Cross-check on China’s official credit portal |

| Factory Address & Photos | Owns or leases industrial facility; shows production lines, machinery, warehouse | Uses commercial office or virtual address; photos lack heavy equipment | Use Google Earth/Street View; request live video tour |

| Workforce Size | 50+ employees, including welders, assemblers, QC staff | Small team (5–15), focused on sales/logistics | Ask for organizational chart and staff count |

| Pricing Structure | Provides cost breakdown (aluminum, glass, labor, coating) | Offers fixed FOB price with no transparency | Request itemized quote |

| Lead Time | 25–45 days (production-dependent) | 15–30 days (relies on subcontractors) | Longer lead time may indicate actual production |

| Customization Ability | Offers die-molding, color matching, hardware integration | Limited to catalog options | Request sample with custom specs |

| Export Documentation | Ships under own name; has export license | Ships via third-party factory; may lack direct export history | Check customs records for exporter name |

✅ Pro Tip: Factories often have “Manufacturing” or “Industrial” in their Chinese name (e.g., Guangdong Huayi Window Manufacturing Co., Ltd.**), while traders use “Trading” or “International”.

3. Red Flags to Avoid When Sourcing in China

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory video audit | High likelihood of being a trading company or shell entity | Insist on live video walk-through of production floor |

| No physical address or refusal to share GPS coordinates | Potential fraud or virtual office | Use third-party verification services |

| Prices significantly below market average | Substandard materials (e.g., recycled aluminum, thin glass) or hidden costs | Benchmark against industry averages; request material specs |

| No product certifications or test reports | Non-compliance with safety/energy codes | Require third-party lab reports (e.g., from SGS, Intertek) |

| Inconsistent communication or delayed responses | Poor operational management | Assign a dedicated sourcing agent for liaison |

| Requests full payment upfront | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| No quality control documentation | Risk of defective batches | Require QC protocol and inspection reports pre-shipment |

4. Recommended Best Practices for Procurement Managers

- Use Escrow or LC Payments: Avoid T/T 100% upfront. Use Letter of Credit (LC) or Alibaba Trade Assurance for protection.

- Engage a Local Sourcing Agent: A Mandarin-speaking agent can verify claims, conduct audits, and manage logistics.

- Request Pre-Shipment Inspection (PSI): Hire third-party inspectors (e.g., SGS, TÜV) to check 10–20% of batch.

- Start with a Trial Order: Test quality and reliability with a small container (e.g., 1×40’HC) before scaling.

- Sign a Quality Agreement: Define tolerances, defect thresholds, and remedies for non-conformance.

Conclusion

Sourcing casement glass windows from China offers significant cost and scalability advantages—but only when partnered with a verified, capable manufacturer. By rigorously applying the steps above, procurement managers can eliminate intermediaries, ensure product compliance, and build resilient supply chains.

At SourcifyChina, we recommend a 3-phase verification model:

1. Document Review (License, Certs)

2. Onsite/Remote Audit

3. Pilot Order + QC Validation

Contact SourcifyChina for a free supplier vetting checklist and exclusive access to pre-qualified casement window manufacturers in Guangdong, Shandong, and Hebei.

Prepared by:

Senior Sourcing Consultants

SourcifyChina

Empowering Global Procurement with Transparent, Verified China Sourcing

📧 [email protected] | 🌐 www.sourcifychina.com

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Sourcing Intelligence for Global Procurement Leaders

Why Verified Supplier Access is Non-Negotiable for Casement Glass Window Procurement

Global supply chain volatility, rising quality compliance risks, and extended lead times demand precision in Chinese manufacturing partnerships. For “China casement glass window factory” sourcing, unverified supplier engagement costs procurement teams 8–12 weeks in wasted due diligence—time better spent on strategic value creation.

SourcifyChina’s Verified Pro List eliminates this critical bottleneck through our 5-stage factory validation framework. Unlike public directories or self-claimed certifications, our list delivers only suppliers meeting stringent operational, compliance, and capability benchmarks.

Time-to-Value Comparison: Verified vs. Unverified Sourcing

| Activity | Unverified Sourcing | SourcifyChina Verified Pro List | Time Saved |

|---|---|---|---|

| Initial supplier screening | 3–6 weeks | 0 hours (Pre-qualified list) | 120–240 hours |

| On-site factory audits | Mandatory (Cost: $2.5K+) | Completed & documented | 100% |

| Quality control system validation | 2–4 weeks | Pre-verified (ISO 9001, CE) | 80–160 hours |

| Sample approval cycles | 4–8 iterations | ≤2 iterations (Proven capability) | 50% reduction |

| Total Procurement Timeline | 14–20 weeks | 4–6 weeks | 70% faster |

Your Strategic Advantage: Beyond Basic Supplier Lists

The SourcifyChina Verified Pro List for casement glass window factories delivers:

✅ Real Production Capacity Data: Verified extrusion lines, tempering furnaces, and glazing lines (no “trading company” proxies)

✅ Compliance Assurance: Up-to-date CE, NFRC, and AS2047 certifications with audit trails

✅ Risk Mitigation: Financial stability checks, export history validation, and ESG compliance screening

✅ Cost Transparency: FOB pricing benchmarks for 6063-T5 aluminum profiles, double-glazed units, and hardware

“Using SourcifyChina’s Pro List cut our window supplier onboarding from 5 months to 6 weeks. We avoided 3 factories with pending labor violations.”

— Procurement Director, Tier-1 EU Construction Firm (Q3 2025 Engagement)

Call to Action: Secure Your Competitive Edge in 2026

Stop gambling with unverified suppliers. In an era of supply chain fragmentation, your window procurement strategy demands certainty—not guesswork.

👉 Take 60 seconds to claim your priority access:

1. Email us at [email protected] with subject line: “PRO LIST: Casement Glass Windows 2026”

2. WhatsApp our Sourcing Team: +86 159 5127 6160 (24/7 for urgent RFQs)

Within 24 business hours, you’ll receive:

– A tailored shortlist of 3–5 Verified Pro List factories matching your specs (U-value, hardware brands, MOQ)

– Full audit reports including production capacity charts and recent shipment photos

– Customized FOB pricing benchmarks for your target volume

Why Wait? Every week spent on unverified sourcing exposes your project to:

⚠️ Hidden capacity constraints (factories oversubscribed to Alibaba RFQs)

⚠️ Quality failures (32% of unvetted glass window suppliers fail CE testing)

⚠️ Delivery delays (average 47-day slippage with non-verified partners)

Your 2026 procurement success starts with one verified connection.

Contact SourcifyChina today—where precision sourcing meets procurement excellence.

SourcifyChina: Trusted by 1,200+ Global Brands for Zero-Risk China Sourcing Since 2018

[email protected] | +86 159 5127 6160 (WhatsApp) | www.sourcifychina.com

🧮 Landed Cost Calculator

Estimate your total import cost from China.