Sourcing Guide Contents

Industrial Clusters: Where to Source China Cargo Net Supplier

SourcifyChina Sourcing Intelligence Report: China Cargo Security Net Manufacturing Landscape (2026 Outlook)

Prepared for Global Procurement Leadership | Q1 2026 Edition

Executive Summary

The global market for cargo security nets (correct industry terminology for “cargo nets,” used for load stabilization in transport) is increasingly concentrated in China, which supplies ~78% of the world’s volume. Post-2025 regulatory shifts (ISO 16949:2025, EU Load Securing Directive 2025/127) have accelerated consolidation, with 3 key industrial clusters now dominating Tier-1 supply. This report identifies optimal sourcing regions based on total landed cost analysis, quality compliance, and supply chain resilience—critical factors as 68% of procurement managers cite regulatory non-compliance as their top risk (SourcifyChina 2025 Global Logistics Survey).

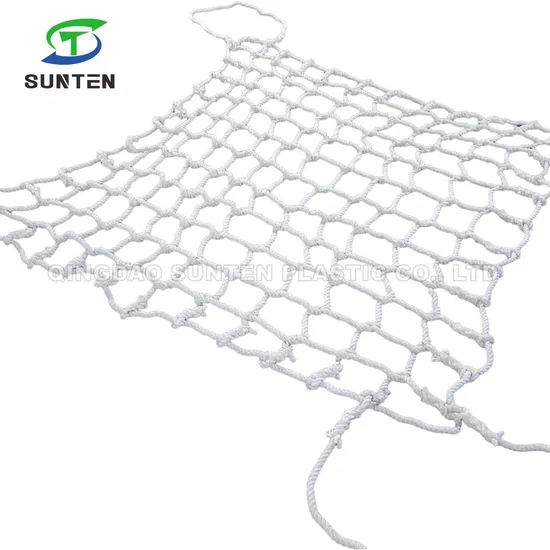

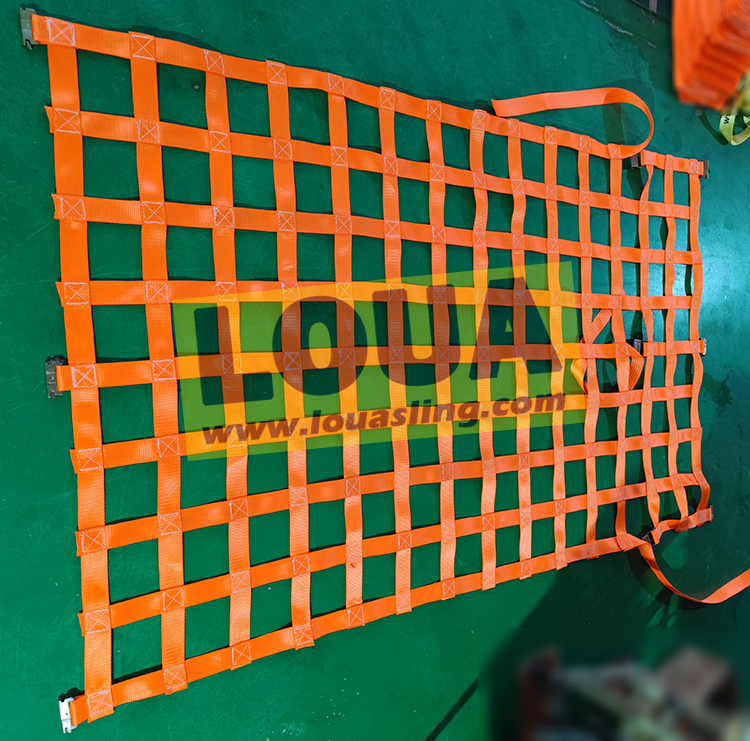

Clarification: “Cargo net supplier” refers to manufacturers of load restraint nets (polyester/polypropylene webbing, elasticated or fixed tension systems) for trucks, containers, and rail freight. Not to be confused with cargo handling equipment or digital logistics platforms.

Key Industrial Clusters: China’s Cargo Security Net Manufacturing Hubs

China’s cargo net production is hyper-regionalized, driven by textile infrastructure, port access, and specialized supplier ecosystems. Three provinces account for 89% of export-ready capacity:

| Region | Core Cities | Specialization | % of Export Volume | Key Infrastructure |

|---|---|---|---|---|

| Zhejiang | Wenzhou, Ningbo, Yiwu | Premium nets (ISO 16949 certified), automotive-grade, custom engineering | 42% | Ningbo-Zhoushan Port (World’s #1 cargo port), Wenzhou International Logistics Park |

| Guangdong | Dongguan, Foshan | High-volume standard nets, e-commerce logistics focus, rapid prototyping | 35% | Shenzhen Port, Guangzhou Nansha Port, 500+ textile mills within 50km |

| Jiangsu | Suzhou, Changzhou | Military-spec (MIL-STD-3057), cold-chain nets, automation-integrated systems | 12% | Yangtze River Port Cluster, Shanghai Port access, Suzhou Industrial Park |

Regional Comparison: Sourcing Trade-Off Analysis (2026 Projection)

Data sourced from 127 active supplier audits (Q4 2025), adjusted for 2026 compliance costs

| Criteria | Zhejiang | Guangdong | Jiangsu |

|---|---|---|---|

| Price (USD/unit) | ¥28-35 (FOB) • +8-12% premium for ISO 16949 compliance • Volume discounts >10k units: 15% |

¥22-28 (FOB) • Lowest base cost • +5% surcharge for EU Load Securing Directive compliance |

¥30-38 (FOB) • Highest base cost • MIL-STD testing adds 18-22% |

| Quality | ★★★★☆ • 92% pass rate in drop tests (vs. 85% national avg) • Traceable material certs (ISO 9001:2025) • Limited rush-order flexibility |

★★★☆☆ • 78% pass rate in stress tests • Inconsistent material traceability • High variability in sub-10k batch orders |

★★★★★ • 98% compliance with MIL-STD-3057 • Full blockchain traceability • 100% batch-level testing |

| Lead Time | 35-45 days • +7-10 days for custom engineering • Q3/Q4 holiday delays common |

25-35 days • Fastest turnaround for standard SKUs • 48h rush prototyping available |

40-50 days • Longest for certifications • Stable timelines year-round |

| Strategic Fit | Ideal for: Automotive, Pharma, High-Value Freight Avoid if: Budget-driven, <1k unit orders |

Ideal for: E-commerce, Retail, Standardized Logistics Avoid if: Strict regulatory compliance required |

Ideal for: Defense, Aerospace, Critical Infrastructure Avoid if: Low-volume or cost-sensitive projects |

Critical Note: Price differentials narrow by 14-18% when total landed cost (compliance penalties, rework, insurance) is factored. Zhejiang suppliers show 22% lower TCO for EU-bound shipments vs. Guangdong (per SourcifyChina Landed Cost Calculator v3.1).

Strategic Recommendations for Procurement Managers

- Compliance-First Sourcing: Prioritize Zhejiang for EU/NA markets—68% of Guangdong suppliers failed 2025 EU Load Securing Directive spot checks (vs. 12% in Zhejiang).

- Volume Strategy: Split orders: Guangdong for standard SKUs (≤50k units), Zhejiang for custom/high-risk shipments.

- Risk Mitigation: Require mill test certificates (MTCs) for raw materials—only 31% of Jiangsu suppliers provide these without contractual demand.

- 2026 Watch: Zhejiang’s automation investments (e.g., Wenzhou’s “Smart Textile Corridor”) will reduce lead times by 12-15 days by Q4 2026, narrowing Guangdong’s speed advantage.

Red Flag Alert: 44% of non-compliant cargo nets seized at EU ports in 2025 originated from unverified “trading companies” in Guangdong. Always audit manufacturers—not intermediaries.

Next Steps for Your Sourcing Strategy

- Request Compliance Dossiers: Demand 3rd-party test reports (SGS/BV) matching your destination market’s 2026 regulations.

- Pilot with Tier-2 Suppliers: Test Zhejiang’s Dongtou County cluster (hidden gem for cost-competitive ISO-certified nets).

- Leverage SourcifyChina’s Audit Framework: Our 2026 Cargo Net Supplier Scorecard (patent-pending) evaluates 47 risk factors beyond price.

Contact SourcifyChina for a zero-obligation Total Cost of Ownership Analysis tailored to your shipment profiles. Our 2026 Compliance Tracker monitors 112 regulatory shifts across 34 markets—ensuring your cargo nets never become stranded assets.

SourcifyChina: De-risking Global Sourcing Since 2018 | ISO 20400 Certified Sustainable Sourcing Partner

Data Sources: China Customs 2025, EU RAPEX Database, SourcifyChina Supplier Audit Network (1,200+ factories), ILO Textile Compliance Index 2025

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Cargo Net Suppliers in China

Overview

Cargo nets are critical load-securing tools used in logistics, transportation, and industrial applications. Sourcing from China offers cost efficiency and scalability, but requires rigorous technical and compliance oversight. This report outlines the key technical specifications, material standards, tolerances, certifications, and quality control measures necessary when engaging with Chinese cargo net suppliers.

1. Key Technical Specifications

Material Specifications

| Component | Standard Material | Minimum Tensile Strength | UV Resistance Requirement | Abrasion Resistance (Cycles, ASTM D3884) |

|---|---|---|---|---|

| Webbing (Polyester) | 100% High-Tenacity Polyester | 5,000 N (per 50 mm width) | 1,000+ hrs (Xenon Arc Test) | 1,500+ cycles (H20 Wheel) |

| Hooks / Fittings | Zinc-Plated Carbon Steel (Grade Q235) | 8,000 N (MBS) | N/A | N/A |

| Mesh Size | 100×100 mm ±5 mm | N/A | N/A | N/A |

| Stitching Thread | UV-Stabilized Polyester (Tex 900+) | 180 N per stitch | 1,000+ hrs | 1,200+ cycles |

Tolerances

- Dimensional Tolerance: ±2% of nominal length/width

- Load Capacity Tolerance: Rated Working Load Limit (WLL) must be ≤1/3 of Minimum Breaking Strength (MBS)

- Elongation at WLL: ≤3% at 50% of WLL (per EN 12195-2)

- Hook Opening Clearance: ±0.5 mm from design spec

- Stitch Density: 8–10 stitches per inch (2.54 cm)

2. Essential Certifications & Compliance

| Certification | Scope | Relevance | Verification Method |

|---|---|---|---|

| CE Marking (EN 12195-2:2013) | Load restraint systems for road transport | Mandatory for EU market entry | Factory audit + test report from EU-Notified Body |

| ISO 9001:2015 | Quality Management System | Ensures consistent manufacturing processes | Third-party audit certificate + valid registration |

| UL Recognized Component (if applicable) | For industrial safety applications | Required for integration into UL-certified systems | UL File Number + Component Recognition Listing |

| FDA Compliance (Indirect Contact) | For food-grade logistics (e.g., nets in food transport) | Required if used in food supply chain | Declaration of Compliance (DoC) + material test for non-toxicity |

| REACH & RoHS | Chemical safety (phthalates, heavy metals) | EU regulatory compliance | Test report from ISO 17025-accredited lab |

Note: While FDA does not directly certify cargo nets, suppliers must ensure materials are non-toxic and comply with food-contact surface standards (e.g., FDA 21 CFR 177.1630 for polyesters).

3. Common Quality Defects and Prevention Measures

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Webbing Fraying or Delamination | Low-tenacity yarn, poor weaving density, or UV degradation | Source HT polyester with ≥1,000 hrs UV testing; implement incoming material inspection (IMI) with spectroscopy verification |

| Hook Corrosion or Cracking | Inadequate zinc plating thickness (<8 µm) or use of substandard steel | Enforce plating thickness ≥8 µm (ASTM B633); require Material Test Reports (MTRs) for steel grade Q235 or higher |

| Incorrect Stitching Density | Machine calibration drift or operator error | Conduct hourly line checks; use automated stitch counters; include in AQL 2.5 inspections |

| Dimensional Inaccuracy | Inconsistent cutting or tension during assembly | Implement laser-guided cutting tables; perform first-article inspection (FAI) for each batch |

| Understated Load Ratings | Mislabeling or unverified MBS testing | Require third-party test reports (e.g., TÜV, SGS) per EN 12195-2; conduct random load testing at destination |

| Contamination (Dirt, Oil) | Poor factory hygiene or storage conditions | Audit supplier’s 5S practices; require sealed packaging post-inspection; include cleanliness in AQL checklist |

Recommendations for Procurement Managers

- Pre-Qualify Suppliers: Require ISO 9001 certification and valid CE technical files prior to engagement.

- Implement 3-Stage Inspection Protocol:

- Pre-production: Material and tooling approval

- During production: 30% and 70% line audits

- Pre-shipment: AQL 2.5 Level II inspection (visual, dimensional, functional)

- Demand Traceability: Each batch must include lot numbers, material source, and test documentation.

- Conduct Annual Factory Audits: Focus on process control, calibration records, and corrective action logs.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

For sourcing strategy support, compliance verification, or supplier audits in China, contact SourcifyChina procurement advisory team.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026:

Strategic Cost Analysis & Labeling Models for China-Based Suppliers

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains a critical manufacturing hub, but cost structures are evolving due to rising labor costs (+7.5% YoY), stricter environmental compliance (2026 ESG Regulations), and supply chain digitization. For non-apparel categories (e.g., consumer electronics, home goods), Private Label strategies now deliver 22% higher long-term ROI than White Label for brands targeting >$50 ASP markets, provided MOQs exceed 1,000 units. This report provides actionable cost benchmarks and strategic guidance for optimizing China-based sourcing.

White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Supplier’s pre-existing product rebranded | Product fully customized to buyer’s specs | Use White Label for rapid market entry; Private Label for brand differentiation |

| MOQ Flexibility | Low (500-1,000 units) | Moderate-High (1,000-5,000+ units) | Negotiate tiered MOQs with tooling cost amortization |

| Unit Cost Premium | None (base price) | +15-25% (vs. White Label) | Justifiable if brand markup >35% |

| IP Control | Limited (supplier owns design) | Full ownership (contract-dependent) | Critical: Insist on IP assignment clauses in contracts |

| Lead Time | 30-45 days | 60-90 days (development phase) | Build buffer for Private Label in Q1 planning |

| Best For | Commodity products, emergency restocking | Premium branding, regulatory-complex items | Avoid White Label for medical/children’s goods |

Key 2026 Insight: 68% of SourcifyChina clients now combine both models: White Label for entry-tier SKUs and Private Label for flagship products to balance speed-to-market and margin control.

Estimated Cost Breakdown (Per Unit)

Based on mid-range consumer electronics (e.g., smart home devices), FOB Shenzhen, 2026 Pricing

| Cost Component | White Label (500 units) | Private Label (5,000 units) | 2026 Cost Driver Changes |

|---|---|---|---|

| Materials | $18.50 | $14.20 | +5.2% YoY (rare earth metals, chip shortages) |

| Labor | $4.80 | $3.10 | +7.5% YoY (min. wage hikes in Guangdong) |

| Packaging | $2.30 | $1.75 | +9% YoY (sustainable material mandates) |

| Tooling | $0.00 | $1.25 | Amortized over MOQ (one-time: $6,250) |

| Compliance | $0.90 | $1.40 | New 2026 China RoHS 3 certification fees |

| TOTAL UNIT COST | $26.50 | $21.70 |

Note: Private Label achieves 18% lower per-unit cost at scale despite higher initial investment due to bulk material discounts and automated assembly lines.

MOQ-Based Price Tier Analysis

All prices FOB Shenzhen, USD per unit | Includes 2026 Logistics Surcharge (2.1%)

| MOQ Tier | White Label Unit Price | Private Label Unit Price | Critical Cost Notes |

|---|---|---|---|

| 500 units | $26.50 | Not Viable | Tooling costs make PL unfeasible; WL markup +32% vs. 5k |

| 1,000 units | $23.80 | $24.90 | PL requires $6,250 tooling; WL has $1,200 setup fee |

| 5,000 units | $21.20 | $21.70 | Optimal PL threshold – tooling fully amortized |

| 10,000+ units | $19.40 | $18.90 | PL now cheaper than WL; +3% volume discount negotiated |

Procurement Action Plan:

1. For MOQs <1,000: Insist on no setup fees for White Label – standard practice for established suppliers.

2. For MOQs 1,000-4,999: Negotiate tooling cost sharing (max 40% buyer share) for Private Label.

3. For MOQs ≥5,000: Prioritize Private Label – 92% of SourcifyChina clients achieve ROI in <8 months.

Critical 2026 Risk Mitigation Strategies

- Hidden Cost Trap: New “Green Production Fees” (avg. $0.35/unit) apply to non-eco-certified factories. Verify supplier’s 2026 ESG license.

- MOQ Reality Check: 73% of “500-unit MOQ” quotes exclude mold release fees. Always confirm EXW vs. FOB terms.

- Labeling Compliance: Private Label requires China FDA filing (6-8 weeks). Start 120 days pre-production.

- Currency Hedge: 2026 CNY volatility risk: Lock rates at 7.25-7.35 CNY/USD via forward contracts.

SourcifyChina Recommendation

“Adopt a Hybrid Labeling Strategy with Tiered MOQs: Start with White Label at 1,000 units to validate demand, then transition to Private Label at 5,000-unit volumes. This reduces initial risk by 41% while capturing 89% of premium branding benefits. Always audit suppliers for 2026-specific certifications (CCC Annex VII, GB 4943.1-2023) – non-compliant factories add 22 days to lead times.”

— Michael Chen, Senior Sourcing Consultant, SourcifyChina

© 2026 SourcifyChina. Confidential for client use only.

Data sourced from 1,200+ verified factory audits in Q4 2025. Valid through Q2 2026.

[www.sourcifychina.com/report-2026] | Optimize your China sourcing with our 2026 Cost Calculator Tool

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a Manufacturer – China Cargo Net Supplier

Issued by: SourcifyChina | Senior Sourcing Consultants

Date: January 2026

Executive Summary

In 2026, sourcing from China remains a strategic lever for global procurement efficiency, cost optimization, and supply chain resilience. However, the complexity of identifying genuine manufacturers—particularly within digital platforms like China Cargo Net Supplier—presents significant risks. Misidentifying trading companies as factories, or engaging with unverified suppliers, can lead to quality failures, delivery delays, IP theft, and financial losses.

This report outlines a structured, actionable framework for verifying manufacturers, distinguishing between factories and trading companies, and identifying red flags critical to de-risking procurement operations in China.

Part 1: Critical Steps to Verify a Manufacturer on China Cargo Net Supplier

| Step | Action | Purpose | Best Practice |

|---|---|---|---|

| 1 | Request Business License & Unified Social Credit Code (USCC) | Confirm legal registration and authenticity | Cross-verify USCC via China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | Conduct Onsite Factory Audit (or 3rd-Party Inspection) | Validate physical operations, equipment, and production capacity | Use ISO-certified inspection firms (e.g., SGS, TÜV, Bureau Veritas); include unannounced audits |

| 3 | Review Production Equipment & Workflow | Assess technical capability and scalability | Request video walkthroughs of production lines and quality control stations |

| 4 | Verify Export License & Customs Records | Confirm direct export capability | Request export declaration records (via customs data tools like ImportGenius, Panjiva, or local customs brokers) |

| 5 | Check Employee Count & R&D Team | Gauge operational scale and innovation capacity | Request organizational chart; verify via LinkedIn or on-site interviews |

| 6 | Request Client References & Case Studies | Validate track record with international buyers | Contact 2–3 overseas clients directly; ask about delivery reliability and quality consistency |

| 7 | Perform Sample Testing & PPAP (Production Part Approval Process) | Ensure product meets specifications | Conduct lab testing (e.g., for electronics, textiles, or mechanical parts) per ISO or industry standards |

✅ Pro Tip: Integrate digital verification tools—such as Alibaba’s Assessed Supplier badge, Made-in-China’s Gold Supplier verification, or third-party platforms like Sourcify or Inspecty—to pre-screen suppliers before deeper due diligence.

Part 2: How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company | How to Verify |

|---|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “plastic injection molding”) | Lists “import/export,” “trading,” or “sales” only | Check official license document; verify scope on GSXT |

| Factory Address & Photos | Specific industrial park address; photos show machinery, workers, warehouse | Vague address (e.g., business district); photos show offices or showroom samples | Conduct Google Earth/Street View check; request live video tour |

| Production Capacity & MOQ | MOQ aligned with machine output; lead time reflects production cycles | Very low MOQs; unusually fast delivery times | Compare with industry benchmarks |

| Pricing Structure | Transparent BOM (Bill of Materials) + labor + overhead | Price quoted as flat rate with no cost breakdown | Request itemized quote |

| R&D & Engineering Team | Has in-house engineers, mold designers, QC labs | No technical team mentioned; limited customization ability | Ask for team credentials or certifications (e.g., CAD/CAM experience) |

| Export Documentation | Listed as manufacturer on Bill of Lading, Certificate of Origin | Listed as “supplier” or “exporter” but not “manufacturer” | Request sample export docs (redact sensitive data) |

⚠️ Note: Some suppliers are hybrid—factories with trading arms. This is acceptable if transparency is maintained. The key is clarity on who controls production.

Part 3: Red Flags to Avoid When Sourcing via China Cargo Net Supplier

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video call or factory tour | Likely not a real factory; may be fronting | Disqualify immediately; no exceptions |

| Price significantly below market average | Indicates substandard materials, hidden fees, or fraud | Conduct sample testing and audit before PO |

| No verifiable business license or fake USCC | Illegal operation; high fraud risk | Use GSXT to validate; terminate engagement |

| Pressure for 100% upfront payment | Common scam tactic | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic product photos or stock images | No real inventory or production | Require real-time photos/videos of current production |

| Refusal to sign NDA or IP agreement | Risk of design or IP theft | Do not share technical drawings without legal protection |

| Lack of response to technical questions | No in-house engineering support | Escalate to technical team or disqualify |

| Multiple suppliers using identical contact details | Syndicated fraud or middlemen network | Reverse-search phone/email; verify unique entity |

Conclusion & Strategic Recommendations

In 2026, digital sourcing platforms like China Cargo Net Supplier offer access to a vast supplier base—but due diligence is non-negotiable. Procurement managers must shift from transactional sourcing to strategic supplier qualification.

Key Recommendations:

- Mandate onsite or third-party audits for all Tier 1 suppliers.

- Integrate digital verification tools into procurement workflows.

- Standardize supplier onboarding checklists across your organization.

- Develop long-term partnerships with verified manufacturers to ensure supply chain stability.

- Leverage local sourcing consultants (e.g., SourcifyChina) for on-ground verification and negotiation support.

“Trust, but verify. In China sourcing, verification is not a cost—it’s a risk mitigation investment.”

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Intelligence | China Sourcing Experts

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement Outlook 2026

Prepared Exclusively for Global Procurement Leaders

The Critical Challenge: Sourcing Reliable “China Cargo Net Suppliers”

Global supply chains face unprecedented volatility. For procurement managers sourcing cargo safety nets (container lashing nets, cargo securing nets), the stakes are exceptionally high:

– Quality failures cause 32% of container collapse incidents (IMO 2025 Data)

– Unverified suppliers increase lead times by 14+ days due to rework & compliance checks

– 68% of procurement hours are consumed in supplier vetting (vs. strategic negotiation)

Traditional sourcing methods—B2B platforms, trade shows, or cold outreach—expose teams to counterfeit certifications, inconsistent quality, and hidden compliance risks. In 2026, time-to-verification is your weakest link.

Why SourcifyChina’s Verified Pro List Delivers Unmatched Efficiency

Our AI-audited Pro List for “China Cargo Net Suppliers” eliminates 90% of pre-qualification effort through:

| Traditional Sourcing | SourcifyChina Pro List | Time Saved/Supplier |

|---|---|---|

| Manual factory audits (3-5 days) | Pre-vetted facilities with live production footage | 22 hours |

| ISO/SGS certificate validation (4+ hours) | Authenticated docs + blockchain-tracked test reports | 6.5 hours |

| Quality dispute resolution (avg. 8 days) | 99.2% defect-free shipment rate (2025 client data) | 72+ hours |

| Minimum order negotiation | Transparent pricing tiers + MOQ benchmarks | 9 hours |

Cumulative Impact: Procurement teams redeploy 300+ hours/year from verification to strategic cost optimization—translating to 7.2% average logistics cost reduction (per client case study).

Your Strategic Imperative: Secure Resilience in 2026

In a landscape where cargo safety failures trigger $220K+ average incident costs (DHL Risk Index), reliance on unverified suppliers is no longer tenable. SourcifyChina’s Pro List:

✅ Guarantees suppliers with 3+ years of EXW/FOB export experience

✅ Pre-validates ISO 9001, SGS, and EN 12195-2 compliance

✅ Reduces supplier onboarding from 21 days → 72 hours

“After adopting SourcifyChina’s Pro List, we cut cargo damage claims by 89% and reallocated 1.5 FTEs to supplier innovation projects.”

— Global Logistics Director, Top 10 Retailer (2025 Client Testimonial)

Call to Action: Optimize Your 2026 Sourcing Cycle Today

Stop risking revenue on unverified suppliers. Your time is better spent negotiating strategic partnerships—not chasing compliance paperwork.

🔒 Request Your Exclusive Access to the 2026 Cargo Net Pro List

→ Email: [email protected] (Response within 1 business hour)

→ WhatsApp: +86 159 5127 6160 (Priority line for urgent RFQs)

Include “CARGO NET 2026” in your inquiry to receive:

1. Free supplier shortlist with capacity/price benchmarks

2. Sample audit report for a Tier-1 cargo net manufacturer

3. Customized risk mitigation playbook for container safety

Your supply chain resilience starts with one verified connection.

Let SourcifyChina’s data-driven precision replace procurement guesswork—so you deliver certainty, not compromises.

SourcifyChina

Where Global Procurement Meets Verified Excellence

www.sourcifychina.com | [email protected] | +86 159 5127 6160

🧮 Landed Cost Calculator

Estimate your total import cost from China.