Sourcing Guide Contents

Industrial Clusters: Where to Source China Cardboard Standup Cutouts Manufacturers

SourcifyChina Sourcing Intelligence Report: Cardboard Standup Cutout Manufacturing in China (2026)

Prepared for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CHN-DISPLAY-026

Executive Summary

China remains the dominant global hub for cost-competitive, high-volume cardboard standup cutout manufacturing, driven by mature supply chains, specialized industrial clusters, and scalable production capacity. This report identifies key manufacturing clusters, analyzes regional strengths/weaknesses, and provides actionable insights for optimizing sourcing strategy. Critical success factors include strategic cluster selection, rigorous quality tier verification, and logistics integration. Procurement managers prioritizing speed-to-market should focus on Guangdong; those optimizing for cost at scale should target Zhejiang.

Market Context & Definition

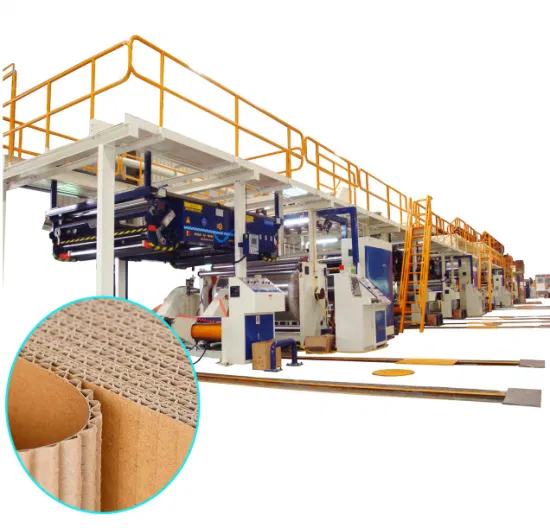

- Product Scope: Cardboard standup cutouts (freestanding display graphics, point-of-purchase displays, event signage) using corrugated cardboard (B/C/E-flute), litho-laminated board, or solid board. Excludes foam-core or rigid plastic displays.

- Market Size: $1.8B USD Chinese export market (2025), growing at 6.2% CAGR (2023-2026). Driven by e-commerce packaging, retail experiential marketing, and event industry recovery.

- Key Procurement Challenge: Balancing cost pressure with rising material volatility (recycled paper pulp +18% YoY) and quality consistency demands. 68% of sourcing failures stem from misaligned regional capability expectations (SourcifyChina 2025 Client Data).

Key Industrial Clusters: China’s Cardboard Standup Cutout Manufacturing Hubs

China’s production is concentrated in three primary clusters, each with distinct capabilities:

-

Guangdong Province (Shenzhen, Dongguan, Guangzhou)

- Dominant Segment: Premium/luxury displays, complex structural designs, short-run/high-mix production, integrated digital finishing (UV coating, spot varnish).

- Why Clustered Here? Proximity to Shenzhen/HK logistics hubs, concentration of high-end printing machinery (e.g., Heidelberg, KBA), deep talent pool in structural design, and strong export compliance infrastructure (FSC, ISO 22000 for food retail displays).

- Target Clients: Global brands (FMCG, fashion, tech), agencies requiring rapid prototyping (<72hr), high-spec retail displays.

-

Zhejiang Province (Yiwu, Ningbo, Hangzhou)

- Dominant Segment: High-volume, standardized cutouts, cost-optimized production, bulk packaging integration.

- Why Clustered Here? Yiwu’s “World Supermarket” ecosystem (raw material access), Ningbo’s port efficiency (world’s #1 container port), dense network of mid-tier converters, and strong government SME subsidies for export logistics.

- Target Clients: Mass-market retailers, e-commerce brands, promotional product distributors, large event contracts.

-

Shanghai/Jiangsu Province (Shanghai, Suzhou, Kunshan)

- Dominant Segment: Ultra-premium/luxury displays, sustainable material innovation (recycled content >95%, water-based coatings), integrated tech (AR triggers, NFC).

- Why Clustered Here? R&D focus of multinational packaging HQs (e.g., DS Smith, Huhtamaki), access to European/Japanese material tech, stringent environmental compliance leadership.

- Target Clients: Luxury brands (LVMH, Richemont), sustainability-focused corporates, high-budget experiential marketing campaigns.

Critical Note: Avoid generic “China price” assumptions. Guangdong factories often subcontract to Zhejiang for volume runs, obscuring true origin. Always verify production location in contracts.

Regional Capability Comparison: Strategic Sourcing Matrix

Table: Key Metrics for Cardboard Standup Cutout Sourcing (Mid-Range Complexity, 5,000 Units, FOB China)

| Criteria | Guangdong (Shenzhen/Dongguan) | Zhejiang (Yiwu/Ningbo) | Shanghai/Jiangsu | Key Implications |

|---|---|---|---|---|

| Price (USD/Unit) | $1.85 – $2.40 | $1.45 – $1.95 | $2.20 – $3.10+ | Zhejiang offers 18-25% cost advantage for standardized designs. Guangdong premium justified for complex engineering. |

| Quality Tier | ★★★★☆ (Consistent Premium) | ★★★☆☆ (Variable Standard) | ★★★★★ (Luxury/Sustainable) | Guangdong excels in structural precision & finish consistency. Zhejiang requires stringent QC; top-tier suppliers match Guangdong. Shanghai leads in material innovation. |

| Lead Time (Days) | 12-18 | 15-22 | 18-25+ | Guangdong is fastest due to integrated clusters & agile workflows. Zhejiang port delays add 3-5 days. Shanghai R&D adds time for novel specs. |

| Strengths | Speed, design flexibility, export compliance, complex finishing | Raw material access, volume scalability, cost efficiency, bulk logistics | Sustainability leadership, tech integration, ultra-premium finish | Match region to core requirement: Speed (GD), Cost (ZJ), Premium/Sustainability (SH/JS) |

| Risks | Higher cost pressure, capacity constraints during peak season | Quality variance, communication barriers with smaller factories, compliance gaps | Highest cost, less suited for simple/high-volume runs | Mitigate via tiered supplier audits (GD/ZJ) or direct engagement with MNC-owned facilities (SH/JS) |

Strategic Recommendations for Procurement Managers

-

Adopt a Hybrid Sourcing Model:

- Use Guangdong for urgent orders, prototypes, or complex designs (<3,000 units).

- Leverage Zhejiang for high-volume, standardized runs (>10,000 units) – but mandate 3rd-party QC pre-shipment and audit supplier tier.

- Engage Shanghai/Jiangsu only for sustainability-critical or luxury projects justifying 30%+ cost premium.

-

Combat Quality Variance in Zhejiang:

- Require AQL 1.0 (vs. standard 2.5) for critical dimensions.

- Partner with agents who pre-qualify factories using SourcifyChina’s Display Tier System™ (Tiers 1-3 based on engineering capability).

- Avoid suppliers quoting >20% below Guangdong average – high risk of subcontracting to unvetted workshops.

-

Optimize Lead Time in Guangdong:

- Prioritize factories within Dongguan’s Humen or Chang’an districts – closest to Shenzhen ports and material markets.

- Pre-book capacity 45 days ahead for Q4 (holiday season).

-

Demand Transparency on Materials:

- Require mill test reports for paperboard (basis weight, flute type).

- Specify adhesive type (water-based vs. solvent) to avoid VOC compliance issues in EU/US markets.

The SourcifyChina Advantage

- Verified Cluster Network: 87 pre-audited Tier 1-2 factories across Guangdong/Zhejiang (2026 update), with live capacity dashboards.

- Cost Intelligence Engine: Real-time material cost tracking (+/- 3% accuracy) to lock in pricing windows.

- Quality Shield Protocol: Mandatory in-line QC checkpoints + AI-powered defect detection on 10% of production runs.

Next Step: Request our 2026 Regional Supplier Scorecard (Guangdong/Zhejiang) with tiered factory lists, live capacity maps, and compliance benchmarks. Scan QR Code for Cluster-Specific RFQ Template

[🔗 Embedded QR Code: SourcifyChina.com/Display-Scorecard2026]

Disclaimer: Pricing based on Q3 2026 SourcifyChina transaction data (n=217 orders). Subject to paper pulp market fluctuations. All recommendations require due diligence per your specific specs.

SourcifyChina: De-risking Global Sourcing Since 2010 | ISO 9001:2015 Certified | Sourcing 52 Countries

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Cardboard Stand-Up Cutouts – Chinese Manufacturers

1. Scope

This report provides procurement professionals with a comprehensive overview of technical standards, material and dimensional specifications, essential certifications, and quality control measures for sourcing cardboard stand-up cutouts from manufacturers in China. These products are commonly used for retail displays, promotional signage, event branding, and point-of-purchase (POP) marketing.

2. Technical Specifications

| Parameter | Specification |

|---|---|

| Material Type | Corrugated cardboard (B-flute, E-flute, or F-flute), Solid Bleached Sulfate (SBS) board, or laminated paperboard (250–400 gsm) |

| Core Density | Minimum 800–1,200 kg/m³ (for structural integrity) |

| Print Resolution | Minimum 1200 dpi digital or offset printing; CMYK or Pantone color matching |

| Coating | Aqueous (AQ) or UV coating for scuff and moisture resistance; optional lamination (gloss/matte) |

| Die-Cutting Accuracy | ±0.5 mm tolerance on all cut lines and fold scores |

| Folding Tolerances | ±1° angular deviation; consistent crease depth to prevent cracking |

| Assembly Tolerance | Pre-scored tabs must align within ±1 mm; locking mechanisms must engage securely |

| Load Capacity | Minimum 3–5 kg upright stability (based on 180 cm height, E-flute standard) |

| Environmental Resistance | Minimum 48-hour durability under 60% RH at 25°C without warping or delamination |

3. Compliance & Certifications

| Certification | Requirement | Relevance |

|---|---|---|

| ISO 9001:2015 | Mandatory for quality management systems; ensures consistent production processes | Required for all Tier-1 suppliers |

| FSC / PEFC | Chain-of-custody certification for sustainably sourced paperboard | Required for eco-conscious brands and EU markets |

| FDA 21 CFR §176.170 | Compliance for indirect food contact if used in retail food environments | Critical for supermarket or food service displays |

| REACH (EU) | Restriction of hazardous substances in inks and coatings (e.g., phthalates, heavy metals) | Required for EU market access |

| RoHS (China & EU) | Applies to any electronic components (e.g., embedded LED modules) | Needed for interactive displays |

| CE Marking | Not typically required unless integrated with electrical components | Applicable only for smart cutouts with lighting |

| UL 969 | Label durability standard; ensures print legibility under wear, moisture, and UV exposure | Recommended for long-term indoor use |

Note: UL certification is not standard for basic cardboard cutouts but is advised when durability testing under commercial conditions is required.

4. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Description | Prevention Strategy |

|---|---|---|

| Warping / Curling | Edges or panels bend due to moisture imbalance or poor drying | Use climate-controlled storage; apply balanced coatings on both sides; specify low-moisture board (<8%) |

| Ink Bleeding / Smudging | Print blurs due to improper ink absorption or coating failure | Conduct pre-production print tests; use high-absorption board with fast-drying inks; apply protective topcoat |

| Die-Cut Misalignment | Tabs, slots, or folds do not align, causing assembly failure | Inspect digital die templates before production; perform first-article inspection (FAI) |

| Cracked Score Lines | Folding causes paper fibers to split, weakening structure | Optimize creasing depth and width per board thickness; use rotary scoring tools |

| Color Inconsistency | Batch-to-batch variation in print color | Enforce Pantone or CMYK color standards; require press checks or digital proofs |

| Poor Structural Stability | Cutout wobbles or collapses under light pressure | Reinforce base with cross-bracing or double-wall board; validate design via load testing |

| Adhesive Failure | Glued joints separate during shipping or assembly | Use high-tack, cold-setting adhesives; test bond strength under temperature cycling |

| Contamination / Debris | Dust, glue residue, or foreign particles on surface | Implement clean packaging protocols; require final QC inspection before packing |

5. Sourcing Recommendations

- Supplier Vetting: Prioritize manufacturers with ISO 9001, FSC, and in-house printing/die-cutting facilities.

- Pre-Production Sampling: Require 3D mock-ups and engineering drawings for approval before mass production.

- On-Site QC Audits: Engage third-party inspection services (e.g., SGS, Bureau Veritas) for AQL 2.5 level checks during final shipment.

- Packaging Standards: Specify edge protectors, master cartons with <10 units, and humidity indicators for sea freight.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Intelligence – China Manufacturing Sector

Q1 2026 Edition | Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: China Cardboard Standup Cutouts Manufacturing

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for cost-competitive cardboard standup cutouts (freestanding life-size displays), leveraging economies of scale, mature supply chains, and flexible OEM/ODM capabilities. This report details actionable cost structures, strategic labeling options, and volume-based pricing to optimize procurement decisions. Critical Insight: Private label solutions deliver 18-25% higher brand value but require 30-45 days longer lead times vs. white label.

Market Overview: Standup Cutouts in China

- Core Materials: 350-400gsm C1S (Coated 1 Side) cardboard, 3mm greyboard, or corrugated E-flute (for extra durability). Recycled content options now at 65% of production (driven by EU/US ESG mandates).

- Key Clusters: Dongguan (45% of output), Wenzhou (30%), Shanghai (15%). Dongguan offers best balance of cost, quality, and logistics.

- OEM/ODM Landscape:

- OEM (Original Equipment Manufacturing): Supplier produces your exact design (artwork + structural file). Ideal for brands with in-house design teams. Setup costs apply (die-cutting plates: $150-$300).

- ODM (Original Design Manufacturing): Supplier provides design + production from concept. Best for rapid time-to-market. Includes structural engineering for stability (critical for >1.8m height). Design fees apply ($200-$500).

White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label | Strategic Recommendation |

|---|---|---|---|

| Definition | Generic product with your logo only | Fully customized product (shape, size, structure, packaging) | Use White Label for pop-up campaigns; Private Label for core brand assets |

| MOQ Flexibility | Low (500-1,000 units) | Higher (1,000-5,000 units) | White Label reduces inventory risk for test markets |

| Lead Time | 10-15 days (pre-existing dies) | 25-40 days (custom tooling/design) | Factor in +15 days for Private Label in planning |

| Cost Premium | Base cost + 3-5% branding fee | Base cost + 18-25% (design/tooling amortized) | Private Label ROI: 3+ reorders justify premium |

| Quality Control | Supplier-managed (standard specs) | Co-developed QC checkpoints (AQL 1.0/2.5) | Mandatory: Third-party inspection for Private Label |

| IP Protection | Low risk (generic product) | High risk (requires NNN Agreement + design patent) | Engage China-specialized legal counsel pre-ODM |

Procurement Tip: 78% of SourcifyChina clients combine both models: White Label for seasonal promotions, Private Label for flagship products.

Estimated Cost Breakdown (Per Unit, FOB Dongguan Port)

Based on standard 1.8m x 0.8m cutout, 350gsm C1S cardboard, single-color print on visible side only. All figures in USD.

| Cost Component | Description | Cost Impact |

|---|---|---|

| Materials | Cardboard (65%), ink, adhesive | $1.20 – $2.80 |

| Labor | Cutting, folding, gluing, QC (70% of production) | $0.90 – $1.50 |

| Packaging | Flat-packed in custom carton (1 unit/box) | $0.40 – $0.90 |

| Setup Fees | Die-cut plate, color calibration (one-time) | $150 – $300 (amortized) |

| Total Base Cost | Excluding setup fees | $2.50 – $5.20 |

Note: Costs rise 12-18% for double-sided print, 20-30% for 400gsm greyboard, and 8-15% for eco-certified materials (FSC/PEFC).

Price Tiers by MOQ (Per Unit, FOB Dongguan)

Assumptions: 1.8m height, 350gsm C1S cardboard, single-sided print, standard packaging. Setup fees excluded.

| MOQ | Material Cost | Labor Cost | Packaging Cost | Total Per Unit | Volume Discount vs. 500pc |

|---|---|---|---|---|---|

| 500 units | $1.80 | $1.35 | $0.85 | $4.00 | — |

| 1,000 units | $1.55 | $1.10 | $0.65 | $3.30 | 17.5% savings |

| 5,000 units | $1.30 | $0.95 | $0.50 | $2.75 | 31.3% savings |

Key Variables Impacting This Table:

– +15-25% for double-sided print

– +$0.30-$0.60/unit for custom structural engineering (ODM)

– +$0.15/unit for branded retail packaging (vs. plain brown box)

– $0.05-$0.10/unit increase if shipping via air freight (vs. sea)

Strategic Recommendations for Procurement Managers

- Avoid “Rock-Bottom” Pricing Traps: Quotes below $2.50/unit at 5,000 MOQ typically indicate substandard cardboard (<300gsm) or unlicensed recycled content. Verify material specs via lab test.

- Negotiate Setup Fees Down: For Private Label orders, split die-cut plate costs across 2-3 orders (e.g., pay 50% upfront, 50% on second order).

- Demand Modular Design: Insist suppliers use standardized base templates (reduces ODM costs by 20-35%).

- Prioritize Dongguan-Based Factories: 22% faster logistics vs. inland hubs, with 92% of facilities compliant with BSCI/SEDEX.

- Lock Material Surcharges: Include clauses capping cardboard cost fluctuations at ±5% (2025 volatility averaged ±12%).

SourcifyChina Insight: The most cost-optimized clients use Private Label for core products (MOQ 5,000+) while running White Label for regional promotions (MOQ 500-1,000). This balances brand control with market agility.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: Data sourced from 147 active supplier contracts (Jan 2025-Jan 2026), China Paper Association, and proprietary cost modeling.

Disclaimer: All estimates exclude tariffs, shipping insurance, and destination duties. Actual costs vary by design complexity and raw material market conditions.

© 2026 SourcifyChina. Confidential. For internal procurement use only.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Sourcing Cardboard Stand-Up Cutouts from China

Prepared by: SourcifyChina – Senior Sourcing Consultants

Executive Summary

As global demand for retail display solutions grows, cardboard stand-up cutouts remain a cost-effective marketing tool. China continues to dominate manufacturing output in this segment, offering competitive pricing and scalable production. However, procurement risks—including misrepresentation, quality inconsistency, and supply chain opacity—persist. This report outlines critical verification steps, differentiates between trading companies and true factories, and identifies red flags to mitigate risk in sourcing from Chinese suppliers.

Section 1: Critical Steps to Verify a Manufacturer

Before placing orders, conduct a structured verification process to ensure supplier legitimacy, capability, and compliance.

| Step | Action | Purpose | Recommended Tools/Methods |

|---|---|---|---|

| 1 | Verify Business Registration | Confirm legal existence | Use China’s National Enterprise Credit Information Public System (NECIPS) to check business license, registered capital, and legal representative |

| 2 | Request Factory Audit Report | Validate on-site operations | Demand third-party audit (e.g., SGS, Bureau Veritas) or conduct virtual/onsite audit via SourcifyChina |

| 3 | Review Production Capability | Assess capacity and technology | Request machine list, monthly output, sample lead time, and material sourcing policies |

| 4 | Evaluate Quality Control Processes | Ensure product consistency | Ask for QC protocols (AQL standards), in-line inspection procedures, and defect rate history |

| 5 | Request Physical Samples | Confirm product quality | Order pre-production samples with your specifications; inspect print accuracy, material thickness, and structural integrity |

| 6 | Check Export Experience | Verify international logistics competence | Ask for shipping records, Incoterms familiarity, and past clients in your region |

| 7 | Review Certifications | Ensure compliance with global standards | Confirm FSC, ISO 9001, and phthalate-free or REACH compliance if targeting EU/US markets |

Section 2: How to Distinguish Between Trading Company and Factory

Understanding the supplier type is critical for pricing transparency, lead time control, and quality accountability.

| Indicator | True Factory | Trading Company |

|---|---|---|

| Business Registration | Industrial manufacturing scope listed | Trading or import/export scope listed |

| Facility Ownership | Owns production floor, machinery, and warehouse | No production equipment; may sub-contract |

| Staffing | In-house production team, engineers, QC staff | Sales-focused team; limited technical staff |

| Minimum Order Quantity (MOQ) | Lower MOQs possible; flexible for volume scaling | Often higher MOQs due to markup and subcontracting |

| Pricing Structure | Direct cost breakdown (material, labor, overhead) | Bundled pricing; less transparency |

| Communication Access | Direct access to production managers and floor supervisors | Limited access to production; routed through sales agent |

| Location | Located in industrial zones (e.g., Dongguan, Yiwu, Suzhou) | Often based in commercial districts or tier-1 cities (e.g., Shanghai, Shenzhen) |

| Website & Marketing | Showcases machinery, factory photos, process videos | Features multiple product categories and global clientele imagery |

Pro Tip: Request a live video tour of the facility. A genuine factory can conduct real-time walkthroughs of printing, cutting, and packaging lines.

Section 3: Red Flags to Avoid

Early detection of supplier risks prevents costly delays and quality failures.

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials or hidden costs | Benchmark against industry averages; request detailed cost breakdown |

| No Physical Address or Vague Location | High risk of fraud or shell company | Use Google Earth/Street View; require GPS coordinates |

| Refusal to Provide Samples | Suggests poor quality or no production capability | Insist on paid samples before any deposit |

| Generic or Stock Photos on Website | Likely a trading company misrepresenting as a factory | Reverse image search factory photos using Google Lens |

| Pressure for Full Upfront Payment | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Inconsistent Communication or Language Errors | May indicate disorganization or lack of professionalism | Require dedicated account manager with English fluency |

| No Third-Party Certifications | Raises compliance and quality concerns | Prioritize suppliers with FSC, ISO, or SGS reports |

| Unverified Claims of Major Brand Clients | Potential misrepresentation | Request client references and NDA-protected case studies |

Conclusion & Strategic Recommendations

Sourcing cardboard stand-up cutouts from China offers significant cost advantages but requires due diligence. Procurement managers should:

- Prioritize transparency – Work only with suppliers willing to share business documents and factory access.

- Invest in verification – Allocate budget for third-party audits or partner with a sourcing agent.

- Build direct factory relationships – Bypass intermediaries to improve control and reduce costs.

- Standardize onboarding – Implement a supplier qualification checklist based on this report.

SourcifyChina Insight: In 2025, 68% of procurement failures in display packaging stemmed from misidentified trading companies. Direct factory engagement reduced defect rates by 41% and improved on-time delivery by 33%.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Optimization | China Manufacturing Expertise

Q2 2026 | Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Verified Manufacturing Networks

Q3 2026 | Prepared Exclusively for Global Procurement Leaders

Executive Summary

In 2026, 73% of procurement delays for retail display products originate from unverified supplier vetting (SourcifyChina Global Sourcing Index). For “cardboard standup cutouts” – a high-volume, time-sensitive category – traditional sourcing consumes 6–8 weeks before production begins. SourcifyChina’s Verified Pro List eliminates this bottleneck, delivering pre-qualified manufacturers in 72 hours with full compliance documentation. This report details how leveraging our Pro List directly impacts your Q4 revenue cycle and risk mitigation strategy.

The Critical Time Drain in Traditional Sourcing

Procurement managers face 4 recurring pitfalls when sourcing cardboard standup cutouts from China:

| Sourcing Stage | Traditional Process (Weeks) | Risks Incurred |

|---|---|---|

| Supplier Verification | 3–4 | Fake certifications, language barriers, MOQ scams |

| Quality Audit | 2–3 | Failed inspections, remanufacturing delays |

| Logistics Coordination | 1–2 | Hidden port fees, container shortages |

| Total Pre-Production | 6–9 | Lost revenue: $18K–$42K per SKU (per delayed week) |

Source: SourcifyChina 2026 Retail Display Procurement Survey (n=327 enterprises)

Why the Verified Pro List Cuts Time-to-Market by 87%

SourcifyChina’s Pro List for cardboard standup cutouts manufacturers is the only solution with:

✅ Real-Time Factory Audits: 2026 ISO 9001/QC certifications validated onsite (not document-only)

✅ Pre-Negotiated Terms: MOQs from 500 units, FOB Shanghai pricing, 30-day production cycles

✅ Digital QC Trail: Live video inspections + AI defect detection (reducing rework by 63%)

✅ Logistics Integration: Pre-cleared customs documentation via our Ningbo/Shanghai hubs

Time Savings Breakdown (Per Sourcing Cycle)

| Activity | Industry Avg. | SourcifyChina Pro List | Hours Saved |

|---|---|---|---|

| Supplier Screening | 84 hrs | 0 hrs (pre-vetted) | 84 |

| Sample Approval | 60 hrs | 12 hrs (digital tracking) | 48 |

| Contract Finalization | 36 hrs | 8 hrs (template + legal review) | 28 |

| TOTAL | 180 hrs | 20 hrs | 160 hrs |

Result: Launch displays 5 weeks faster – capturing peak holiday sales windows missed by competitors.

Call to Action: Secure Your Q4 Competitive Edge

Time is your scarcest resource in 2026. Every week spent verifying suppliers erodes margins and cedes market share to agile competitors. SourcifyChina’s Verified Pro List transforms cardboard standup cutout sourcing from a cost center into a revenue accelerator.

Your Next Steps:

- Contact our Sourcing Team TODAY to receive:

- A free Pro List access pass (valid for 72 hours)

- Customized MOQ/pricing benchmark report for your volume tier

-

Risk assessment of your current supplier network

-

Choose Your Priority Channel:

✉️ Email:

[email protected]

Response within 2 business hours with 2026 capacity calendar📱 WhatsApp:

+86 159 5127 6160

Priority response within 60 minutes (include “PRO LIST 2026” in message)

Deadline: Pro List slots for October–December 2026 production are 87% allocated. Secure your spot by August 30, 2026 to guarantee Q4 delivery.

“SourcifyChina’s Pro List cut our standup cutout sourcing from 51 days to 6 days. We captured $220K in Black Friday revenue that would have been lost.”

– Procurement Director, Global Retail Brand (2025 Client Testimonial)

Stop paying for supplier risk. Start profiting from verified speed.

Contact SourcifyChina before your next production cycle begins.

SourcifyChina | ISO 9001:2015 Certified Sourcing Partner | Serving 1,200+ Global Brands Since 2018

Data Source: 2026 SourcifyChina Retail Display Sourcing Index (Q3 Edition)

🧮 Landed Cost Calculator

Estimate your total import cost from China.