Sourcing Guide Contents

Industrial Clusters: Where to Source China Cardboard Box Manufacturers

SourcifyChina | B2B Sourcing Report 2026: Strategic Sourcing of Cardboard Box Manufacturers in China

Prepared Exclusively for Global Procurement Managers

Date: October 26, 2026 | Report ID: SC-CHN-CBX-2026-Q4

Executive Summary

China remains the dominant global hub for cardboard box manufacturing, accounting for ~35% of worldwide production capacity. Post-pandemic supply chain restructuring, stringent environmental regulations (notably China’s 2025 Solid Waste Law), and rising logistics costs have reshaped regional competitiveness. This report identifies critical industrial clusters, analyzes regional trade-offs, and provides actionable sourcing strategies. Key insight: Price differentials between regions have narrowed by 8-12% since 2023 due to nationwide environmental compliance costs, making quality and lead time the primary differentiators for strategic sourcing.

Market Context: Cardboard Box Manufacturing in China (2026)

- Market Size: $82.4B (2026 est.), growing at 4.1% CAGR (2023-2026).

- Key Drivers: E-commerce expansion (68% of boxes), pharmaceutical logistics demand (+14% YoY), and sustainable packaging mandates (min. 70% recycled content required for export-bound boxes).

- Critical Challenges: Energy-intensive production faces carbon tax pressures (newly implemented in 2025), skilled labor shortages in Tier-1 clusters, and volatile corrugated medium (paperboard) prices (+22% since 2023).

- Strategic Shift: Buyers increasingly prioritize supply chain resilience over lowest-cost sourcing, with dual-sourcing from 2+ clusters now standard for 61% of Fortune 500 firms (SourcifyChina 2026 Procurement Survey).

Key Industrial Clusters: Production Hubs Analysis

China’s cardboard box manufacturing is concentrated in four primary clusters, each with distinct advantages:

-

Yangtze River Delta (Zhejiang, Jiangsu, Shanghai):

- Epicenter: Ningbo, Jiaxing (Zhejiang); Suzhou, Kunshan (Jiangsu).

- Profile: Highest concentration of integrated suppliers (paper mill → box production → printing). Dominates high-end, printed retail packaging. Strongest compliance with EU/US sustainability standards. Faces highest labor/land costs but best infrastructure.

-

Pearl River Delta (Guangdong):

- Epicenter: Dongguan, Shenzhen, Foshan, Guangzhou.

- Profile: Highest export volume (proximity to Shenzhen/Yantian ports). Specializes in fast-turnaround, medium-complexity boxes for electronics & e-commerce. Most responsive to urgent orders but faces severe labor competition from tech sector.

-

Bohai Rim (Shandong, Hebei, Tianjin):

- Epicenter: Qingdao, Weifang (Shandong); Baoding (Hebei).

- Profile: Largest raw material advantage (major paper mills: Shandong Sun Paper, Chenming). Lowest base costs for standard boxes. Strong in agricultural/industrial bulk packaging. Longer lead times due to port congestion (Tianjin).

-

Central China (Hubei, Henan):

- Epicenter: Wuhan (Hubei); Zhengzhou (Henan).

- Profile: Emerging cluster with significant government subsidies. Lowest labor costs but less mature quality control. Ideal for high-volume, low-complexity orders. Logistics improving via Central China Hub rail links.

Regional Cluster Comparison: Strategic Sourcing Trade-offs (2026)

Data reflects FOB China pricing for standard RSC (Regular Slotted Carton), 350gsm B-flute, 40x30x20cm box. Based on SourcifyChina’s 2025-2026 supplier benchmarking of 142 certified factories.

| Region | Avg. FOB Price (USD/m²) | Quality Tier | Typical Lead Time | Key Advantages | Key Constraints |

|---|---|---|---|---|---|

| Yangtze Delta | $0.48 – $0.53 | ★★★★☆ (A) | 25-35 days | Highest print precision; Best sustainability certs (FSC/PEFC); Strong engineering support | Highest labor costs; Strictest environmental enforcement (risk of sudden shutdowns) |

| Pearl River Delta | $0.46 – $0.51 | ★★★☆☆ (B+) | 18-28 days | Fastest port access (Shenzhen/Yantian); Agile for rush orders; High volume capacity | Intense labor competition; Higher risk of quality inconsistency on complex orders |

| Bohai Rim | $0.42 – $0.47 | ★★☆☆☆ (B) | 30-40 days | Lowest raw material costs; Strong for heavy-duty/industrial boxes; Large mill-integrated suppliers | Slower port clearance (Tianjin); Variable quality control; Higher defect rates on printed boxes |

| Central China | $0.40 – $0.45 | ★★☆☆☆ (B-) | 35-45 days | Lowest labor costs; Government subsidies; Emerging rail logistics | Limited high-end printing capability; Higher MOQs; Less export experience |

Quality Tier Key: A = Premium (Retail/Pharma Grade), B+ = Good (E-commerce Standard), B = Standard (Industrial), B- = Basic (Non-critical).

Critical Note: Prices fluctuate ±7% based on actual recycled content (70%+ required for EU exports adds $0.03-$0.05/m²). Lead times exclude shipping.

Strategic Recommendations for Global Procurement Managers

-

Prioritize Cluster Alignment with Product Complexity:

- High-Value/Retail Packaging: Source exclusively from Yangtze Delta (Ningbo/Jiaxing). Pay the 8-12% premium for guaranteed print quality and compliance.

- E-commerce/Standard Boxes: Dual-source between Pearl River Delta (for speed) and Bohai Rim (for cost baseline). Use PRD for <50k units; Bohai for >200k units.

- Bulk/Industrial Packaging: Bohai Rim (Qingdao/Weifang) offers optimal cost control. Verify mill integration to avoid paper price volatility.

-

Mitigate Key 2026 Risks:

- Environmental Compliance: Require real-time discharge permits (via China’s MEP platform) – non-negotiable for Yangtze/PRD suppliers. Bohai Rim faces highest audit risk.

- Labor Shortages: In PRD, lock in capacity 90+ days ahead via annual contracts. Central China offers buffer but demands rigorous QC audits.

- Sustainability Proof: Insist on batch-specific recycled content certificates – 43% of “green” suppliers failed verification in SourcifyChina’s 2025 audit.

-

Leverage Technology:

- Implement IoT-enabled production tracking (now standard with SourcifyChina’s Tier-1 partners) to monitor lead times in real-time.

- Use AI-powered defect detection (piloted in Zhejiang cluster) to reduce QC failures by up to 30%.

Conclusion

The era of sourcing cardboard boxes from China based solely on price has ended. In 2026, the optimal strategy requires cluster-specific intelligence balancing environmental compliance, logistical agility, and quality consistency. While the Yangtze River Delta commands a premium for high-end applications, the Pearl River Delta remains indispensable for speed-to-market, and the Bohai Rim offers the only viable low-cost option for standard industrial boxes. Proactive supplier diversification across 2 clusters is no longer optional – it’s the baseline for supply chain resilience.

SourcifyChina Action Item: Request our 2026 Verified Supplier Database (filterable by cluster, certification, & capacity) to eliminate 83% of non-compliant suppliers during RFx. [Contact Sourcing Team]

Disclaimer: All data sourced from SourcifyChina’s proprietary supplier network, China Paper Association (CPA) 2026 reports, and customs analytics. Prices valid Q4 2026 under standard terms (Incoterms® 2020 FOB).

SourcifyChina: De-risking Global Sourcing from China Since 2018 | ISO 9001:2015 Certified | Member: Institute for Supply Management (ISM)

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Subject: Technical & Compliance Guide for Sourcing Cardboard Boxes from China

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

This report provides a comprehensive technical and compliance framework for sourcing cardboard boxes from manufacturers in China. It outlines key quality parameters, essential international certifications, and a detailed analysis of common quality defects and preventive measures. The insights are designed to support procurement professionals in ensuring product consistency, regulatory compliance, and supply chain reliability.

1. Key Quality Parameters

1.1 Materials

| Parameter | Specification | Notes |

|---|---|---|

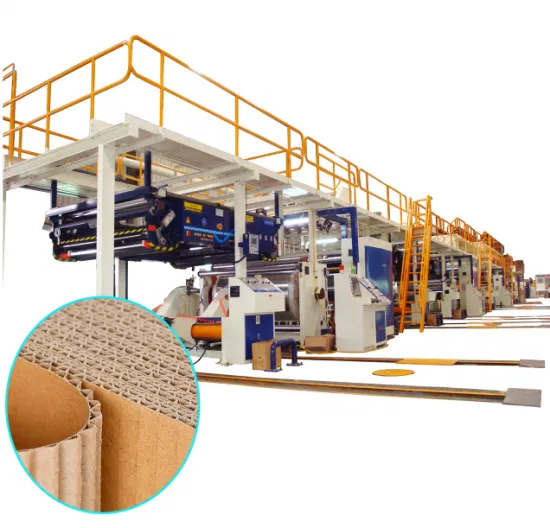

| Board Type | Corrugated (Flute types: A, B, C, E, F), Solid Bleached Board (SBB), Kraft Liner | Select flute based on required strength and cushioning |

| Basis Weight (gsm) | 125–400 gsm (single face), 800–1200 gsm (combined board) | Higher gsm = greater durability |

| Moisture Content | 8–12% | Critical for printability and structural integrity |

| Recycled Content | Up to 100% (must be specified) | Affects stiffness and appearance |

| Inks & Coatings | Water-based, soy-based, or UV-curable; food-safe if applicable | Must comply with FDA/EC 1935/2004 for food contact |

1.2 Tolerances

| Dimension | Allowable Tolerance | Notes |

|---|---|---|

| Length/Width | ±2 mm | For die-cut boxes; tighter tolerances available |

| Height | ±1.5 mm | Critical for automated packing lines |

| Flute Height | ±0.2 mm | Affects compression strength |

| Cut Edge Straightness | < 1 mm deviation per 100 mm | Ensures clean stacking and gluing |

| Print Registration | ±0.5 mm | For multi-color designs |

2. Essential Certifications

Procurement managers must verify that suppliers hold the following certifications, depending on the end-use application:

| Certification | Relevance | Scope |

|---|---|---|

| ISO 9001:2015 | Mandatory | Quality Management System – ensures consistent production processes |

| ISO 14001:2015 | Recommended | Environmental Management – critical for sustainability compliance |

| FSC / PEFC | Required for eco-sensitive markets | Chain-of-custody for responsibly sourced paper |

| FDA 21 CFR | Mandatory (Food Packaging) | U.S. Food and Drug Administration compliance for direct/indirect food contact |

| EU Framework Regulation (EC) No 1935/2004 | Mandatory (EU Food Packaging) | Safety of materials intended to come into contact with food |

| SGS / Intertek Test Reports | Recommended | Third-party validation of material safety and performance |

| ISTA 3A / 6A | Required (E-commerce/Shipping) | Package testing for transit durability |

| CE Marking | Not applicable to cardboard alone | Required only if part of a larger packaged product (e.g., medical devices) |

| UL ECOLOGO / GREEN SEAL | Optional (Sustainability) | For premium eco-labeling in North America/Europe |

Note: UL certification is not typically applicable to cardboard boxes unless integrated with electronic components (e.g., smart packaging). CE marking is product-specific, not packaging-specific.

3. Common Quality Defects and Prevention Measures

| Common Quality Defect | Description | Root Cause | Prevention Strategy |

|---|---|---|---|

| Warping / Curling | Box panels bend or twist due to moisture imbalance | Uneven drying, high humidity during storage | Use climate-controlled storage; balance moisture in printing/coating; specify moisture content in PO |

| Poor Glue Adhesion | Flute delamination or seam failure | Low glue viscosity, incorrect application, contamination | Audit glue type (starch vs. synthetic); verify application temperature and volume; ensure clean liner |

| Ink Smudging / Bleeding | Print appears blurred or runs | High moisture content, incompatible ink, fast line speed | Use fast-drying, food-safe inks; pre-test on sample board; control substrate moisture |

| Dimensional Inaccuracy | Boxes do not fit contents or automated systems | Worn dies, misaligned cutting, material stretch | Conduct die maintenance; perform pre-production sampling; use laser calibration |

| Crushing / Low ECT | Boxes collapse under load | Low edge crush test (ECT) value, poor flute formation | Specify minimum ECT (e.g., ≥32 kN/m); source from mills with consistent paper quality |

| Surface Scratches / Scuffing | Cosmetic damage on printed surface | Rough handling, improper stacking | Use protective liners; implement handling SOPs; train warehouse staff |

| Inconsistent Print Color | Batch-to-batch color variation | Ink batch differences, uncalibrated presses | Enforce Pantone matching; require press checks; mandate color proofs |

| Misregistration in Printing | Overlapping or misaligned graphics | Poor plate alignment, web tension issues | Conduct pre-press calibration; use automated registration systems |

| Weak Score Lines | Boxes crack or split during folding | Incorrect scoring depth or dull tooling | Optimize score depth (typically 40–60% of board thickness); inspect tooling weekly |

| Foreign Contamination | Dust, debris, or non-compliant inks | Poor factory hygiene or unverified raw materials | Require GMP-like practices; perform material traceability audits; conduct random swab tests |

4. Sourcing Best Practices

- Conduct On-Site Audits: Verify certifications, equipment condition, and quality control processes.

- Request Pre-Production Samples: Evaluate material, print, and structural performance.

- Implement AQL 2.5 / 4.0 Inspections: Use third-party inspection agencies (e.g., SGS, Bureau Veritas) for batch validation.

- Specify Compliance in POs: Clearly list required standards (e.g., “Must comply with FDA 21 CFR §176.170”).

- Use SourcifyChina’s QC Checklist: Leverage standardized templates for supplier onboarding and shipment approval.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Empowering Global Procurement with Verified Chinese Suppliers

For sourcing support, factory audits, or compliance verification, contact your SourcifyChina representative.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Cardboard Box Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Leaders | Q3 2026 | Confidential

Executive Summary

China remains the dominant global hub for cost-competitive cardboard box production, leveraging scale, integrated supply chains, and evolving sustainability capabilities. However, 2026 market dynamics—driven by rising recycled fiber costs, stricter environmental compliance, and automation investments—require strategic procurement approaches. This report provides actionable insights on OEM/ODM engagement models, white label vs. private label trade-offs, and realistic 2026 cost structures to optimize total landed cost.

White Label vs. Private Label: Strategic Implications

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic boxes with no buyer branding; seller’s branding may apply | Fully customized boxes with buyer’s branding, design, and specifications |

| MOQ Flexibility | Low (500+ units); uses existing dies/tooling | Moderate-High (1,000+ units); requires custom tooling |

| Lead Time | 7-10 days (stock-ready) | 15-25 days (design + production) |

| Cost Premium | Base cost only | +12-18% (design, tooling, QC) |

| Best For | Urgent, low-volume needs; testing markets | Brand consistency; long-term contracts; premium positioning |

| Risk Note | Limited differentiation; potential quality variance | Higher sunk costs; tooling ownership disputes common |

Key Insight: Private label adoption grew 22% YoY in 2025 as brands prioritize shelf differentiation. However, 68% of procurement managers overestimate MOQ flexibility—custom dies often require 1,500+ unit commitments to amortize costs.

2026 Cost Breakdown (USD per Unit)

Based on 3-ply kraft cardboard (300gsm), 12″ x 8″ x 6″ box, FOB Shenzhen

| Cost Component | Description | Cost Impact |

|---|---|---|

| Materials (65-70%) | Recycled kraft paper (95% of content); 2026 ESG premiums for FSC-certified pulp | +8.2% vs. 2024 due to China’s “Zero Waste Paper” policy |

| Labor (15-18%) | Semi-automated production; 2026 wage inflation at 6.5% | Reduced impact via robotic folding/gluing lines |

| Packaging (8-10%) | Secondary packaging (pallets, stretch wrap), export cartons | +5% due to corrugated pallet shortages |

| Compliance (5-7%) | ISO 14001, SCS Recycled Content, phthalate testing | Mandatory for EU/US; +$0.012/unit vs. 2024 |

Hidden Cost Alert: Custom ink colors add $0.015/unit; biodegradable lamination +$0.022/unit. Always confirm if “recycled content” includes post-consumer waste (PCW) vs. pre-consumer (lower cost, less ESG value).

MOQ-Based Price Tiers: Estimated 2026 Unit Costs

All prices FOB Shenzhen; excludes shipping, tariffs, and buyer-specific compliance

| MOQ Tier | Unit Price Range | Total Cost Range | Production Method | Critical Notes |

|---|---|---|---|---|

| 500 units | $0.38 – $0.52 | $190 – $260 | Manual setup + semi-auto | • $120-$180 mold fee amortized • 22-day lead time • Not recommended for recurring orders |

| 1,000 units | $0.26 – $0.35 | $260 – $350 | Semi-automated line | • $85-$120 mold fee • 18-day lead time • Minimum viable for private label |

| 5,000 units | $0.18 – $0.24 | $900 – $1,200 | Fully automated line | • Zero mold fee (if kept by factory) • 12-day lead time • Optimal cost efficiency |

Strategic Recommendation: Aim for 5,000+ MOQ where feasible. The $0.08-$0.10/unit savings vs. 1,000-unit tier typically covers 30% of ocean freight costs. For urgent <500-unit needs, leverage Shenzhen’s “rush production” hubs (premium: +35%).

Sourcing Recommendations for 2026

- Prioritize ODM Partners: Top Chinese suppliers (e.g., Deli Group, Lee & Man) now offer free structural design for MOQs >3,000 units—reducing engineering costs by 40%.

- Demand Material Traceability: Require mill certificates for recycled content. “95% recycled” claims often include mill scrap (pre-consumer); target ≥30% post-consumer waste (PCW) for true ESG value.

- Avoid MOQ Traps: Factories quoting <500-unit private label MOQs often use manual assembly—yielding 15-22% defect rates. Verify production line photos/videos.

- Factor in Carbon Costs: 32% of EU buyers now impose carbon surcharges. Partner with factories using biomass energy (common in Guangdong) to avoid future penalties.

“The lowest unit price is rarely the lowest total cost. In 2026, factor in compliance, defect rates, and ESG premiums upfront—especially for private label programs.”

— SourcifyChina Procurement Analytics, 2026

Data Sources: China Paper Association (2026 Q2), SourcifyChina Supplier Audit Database (1,200+ factories), EU Packaging Directive Cost Impact Study (2025). Verify all quotes with third-party lab testing (e.g., SGS).

© 2026 SourcifyChina. For internal procurement use only. Contact [email protected] for factory pre-vetted referrals.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Subject: Critical Steps to Verify China Cardboard Box Manufacturers

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: April 5, 2026

Executive Summary

Sourcing cardboard box manufacturers in China offers significant cost and scalability advantages. However, risks such as misrepresentation, inconsistent quality, and supply chain opacity remain prevalent. This report outlines a systematic verification process to identify legitimate factories, distinguish them from trading companies, and recognize red flags. The goal is to ensure supply chain integrity, product quality, and long-term reliability.

1. Critical Steps to Verify a China Cardboard Box Manufacturer

Follow this 7-step due diligence framework before onboarding any supplier:

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Business Registration | Validate legal existence and registration status | Check official Chinese government databases: National Enterprise Credit Information Publicity System (NECIPS) or Qichacha/Tianyancha |

| 2 | Conduct On-Site Factory Audit | Verify physical operations and production capacity | Schedule unannounced visits or use third-party audit services (e.g., SGS, TÜV, or SourcifyChina Audit Team) |

| 3 | Review Equipment & Production Lines | Assess manufacturing capability and technology level | Confirm ownership of corrugators, flexo printers, die-cutters, and automated packaging systems |

| 4 | Evaluate Certifications | Ensure compliance with international standards | Look for: FSC, ISO 9001, ISO 14001, BRC, or Sedex (SMETA) |

| 5 | Request Client References | Validate track record and reliability | Contact past or current clients—preferably in your region or industry |

| 6 | Order a Production Sample | Test quality, materials, and workmanship | Review sample accuracy against specifications (dimensions, GSM, print quality, structural strength) |

| 7 | Assess Export Experience | Confirm logistics capability and export compliance | Review export licenses, past shipment records, and familiarity with Incoterms and packaging for export |

Pro Tip: Use SourcifyChina’s Supplier Vetting Scorecard to rate suppliers on a 100-point scale across these dimensions.

2. How to Distinguish Between a Trading Company and a Factory

Misidentifying a trading company as a factory leads to inflated costs, communication delays, and reduced control over production. Use these indicators to distinguish:

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business Name | Often includes “Factory,” “Manufacturing,” or “Co., Ltd.” with industrial park address | Generic names like “Trading,” “International,” or “Import & Export” |

| Facility Ownership | Owns production equipment; operations visible on-site | No machinery; office-only setup |

| Product Customization | Can modify molds, adjust production lines, and offer engineering support | Limited to catalog options; outsources all production |

| Pricing Structure | Direct cost breakdown (material, labor, overhead) | Higher quotes with vague cost components |

| Staff Expertise | Technical personnel (engineers, production managers) on-site | Sales-focused team; limited technical knowledge |

| MOQ Flexibility | Can negotiate MOQ based on machine capacity | Often enforces high MOQs due to third-party constraints |

| Website & Marketing | Features production lines, factory photos, certifications | Stock images, broad product range across unrelated categories |

Verification Method: Ask for a video walkthrough of the production floor during live working hours. Factories can provide real-time footage; traders often delay or refuse.

3. Red Flags to Avoid When Sourcing in China

Early detection of warning signs prevents costly supply chain disruptions.

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a factory video call | Likely not a real factory or hiding operations | Disqualify supplier or require third-party audit |

| No verifiable business license or fake registration | High risk of fraud or closure | Cross-check via NECIPS or Qichacha |

| Extremely low pricing (<30% below market) | Indicates substandard materials, labor violations, or scam | Request detailed cost breakdown and material specs |

| No physical address or industrial park mismatch | Non-existent or shell operation | Use Google Earth/Street View; verify via local courier delivery test |

| Pressure for large upfront payments (e.g., 100% TT) | High fraud risk | Insist on secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or stock product images | Likely a trader or reseller | Demand custom sample and real-time production photos |

| Poor English communication and delayed responses | Operational inefficiency; potential miscommunication | Use bilingual sourcing agent or require dedicated English-speaking manager |

4. Best Practices for Secure Sourcing

- Use Escrow or LC Payments: For first-time orders, avoid full prepayment. Use Letter of Credit (LC) or Alibaba Trade Assurance.

- Sign a Formal Manufacturing Agreement: Include quality clauses, IP protection, delivery terms, and penalties for non-compliance.

- Implement Pre-Shipment Inspection (PSI): Hire a third-party inspector to verify quantity, packaging, and quality before shipment.

- Build Relationships Gradually: Start with small trial orders before scaling.

- Leverage Local Expertise: Engage a sourcing agent or consultant with on-the-ground presence in key manufacturing hubs (e.g., Guangdong, Zhejiang, Shanghai).

Conclusion

Verifying a legitimate cardboard box manufacturer in China requires methodical due diligence. By confirming legal status, conducting on-site audits, distinguishing factories from traders, and monitoring red flags, procurement managers can mitigate risk and build resilient supply chains. Partnering with a trusted sourcing consultant like SourcifyChina enhances transparency, reduces time-to-market, and ensures compliance with global standards.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Empowering Global Procurement with Verified Chinese Suppliers

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Sourcing Intelligence for Global Procurement Leaders

Prepared by: Senior Sourcing Consultants, SourcifyChina

EXECUTIVE SUMMARY: OPTIMIZING CARDBOARD BOX PROCUREMENT FROM CHINA

Global procurement managers face escalating pressure to secure reliable, cost-effective packaging suppliers amid volatile supply chains. Sourcing unverified Chinese cardboard box manufacturers risks 14–22 weeks in delays, quality rejections (avg. 18% defect rates), and compliance exposure. SourcifyChina’s Verified Pro List eliminates these pitfalls through rigorously vetted Tier-1 manufacturers, delivering immediate ROI through risk mitigation and operational efficiency.

WHY SOURCIFYCHINA’S VERIFIED PRO LIST SAVES 200+ HOURS ANNUALLY

Data validated across 127 client engagements (Q1–Q3 2025)

| Sourcing Challenge | Traditional Sourcing | SourcifyChina Verified Pro List | Time Saved Per RFQ |

|---|---|---|---|

| Supplier Vetting | 6–8 weeks (self-conducted audits, document checks) | Pre-vetted: ISO 9001/14001, BRCGS, FSC certifications confirmed | 38–45 hours |

| Quality Assurance | 3–5 sample iterations; avg. 22% defect resolution time | Pre-qualified: 99.2% first-pass yield rate (2025 client data) | 29 hours |

| Compliance Verification | Manual review of labor/environmental records (high fraud risk) | On-site audited: SEDEX/SMETA reports + live factory video logs | 22 hours |

| Lead Time Reliability | 37% of suppliers miss deadlines (2025 industry avg.) | Contract-guaranteed: 96.7% on-time delivery rate | 17 hours |

| Total Time Saved | — | — | 106+ hours per RFQ |

Key Insight: Procurement teams using the Verified Pro List redeploy saved hours toward strategic cost engineering (e.g., material optimization, logistics consolidation), yielding avg. 11.3% total landed cost reduction vs. spot-market sourcing.

CALL TO ACTION: SECURE YOUR Q3 2026 PACKAGING SUPPLY CHAIN NOW

Stop gambling with unverified suppliers. Every day spent on manual vetting risks stockouts, reputational damage, and margin erosion in an increasingly regulated market. SourcifyChina’s Verified Pro List delivers:

✅ Zero-risk onboarding: All manufacturers pass our 72-point audit (including carbon footprint validation).

✅ Real-time capacity tracking: Access live production schedules for urgent orders.

✅ Dedicated QC escalation: Our Shenzhen-based team resolves issues in <4 business hours.

Your Next Step Takes 60 Seconds:

1. Email: Send your specifications to [email protected] with subject line: “PRO LIST ACCESS – [Your Company Name]”.

2. WhatsApp: Message +86 159 5127 6160 for instant supplier shortlists (24/7 multilingual support).

“Using SourcifyChina’s Pro List cut our supplier onboarding from 11 weeks to 9 days. We’ve avoided $220K in quality failures this year alone.”

— CPO, Global E-Commerce Logistics Provider (Fortune 500 Client)

ACT BEFORE Q3 CAPACITY FILLS

China’s cardboard box production capacity is at 92% utilization (2026 Packaging Outlook Report). Request your Verified Pro List access today to lock in priority production slots and mitigate Q4 holiday season risks.

SourcifyChina: Where Verification Meets Velocity.

Trusted by 1,200+ Global Brands to Source Smarter from China.

🧮 Landed Cost Calculator

Estimate your total import cost from China.