Sourcing Guide Contents

Industrial Clusters: Where to Source China Carbon Steel Spiral Welded Pipe Factory

SourcifyChina Sourcing Intelligence Report: Carbon Steel Spiral Welded Pipes from China

Prepared for Global Procurement Managers | Q3 2026 | Confidential

Executive Summary

China remains the dominant global producer of carbon steel spiral welded pipes (SSAW), accounting for ~65% of worldwide output (2025 Global Steel Pipe Association data). Strategic sourcing requires precise regional targeting due to pronounced cluster specializations, regulatory shifts, and evolving cost structures. While Hebei Province (particularly Cangzhou) is the undisputed volume leader, regions like Guangdong and Jiangsu offer critical advantages for specialized/high-specification orders. Procurement success hinges on aligning region-specific capabilities with project requirements, not merely chasing lowest unit cost.

Key Industrial Clusters: Mapping China’s SSAW Manufacturing Landscape

China’s SSAW production is concentrated in 5 core clusters, each shaped by historical industrial policy, raw material access, and port infrastructure:

| Region | Core Cities/Industrial Zones | Key Characteristics | Dominant Applications |

|---|---|---|---|

| Hebei Province | Cangzhou (Xian County), Tianjin Border | Heartland of SSAW production. 300+ factories; access to Tangshan steel mills. Lowest raw material costs. High volume focus. Post-2025 environmental compliance drives factory consolidation. | Oil & Gas (midstream), Water Transmission, Piling |

| Jiangsu Province | Yixing, Wuxi, Changzhou | Precision & quality focus. Strong metallurgical engineering base. Higher automation. Cluster proximity to Shanghai R&D centers. | High-Pressure Pipelines, Marine, Industrial Equipment |

| Shandong Province | Linyi, Dezhou | Integrated steel-to-pipe production. Direct access to Shandong Steel Group. Strong in large-diameter (>1m) pipes. Emerging anti-corrosion tech hub. | Water Infrastructure, Large-Diameter Projects |

| Guangdong Province | Foshan, Zhongshan | Export-oriented & specialty focus. Highest concentration of ISO/API-certified mills. Proximity to Shenzhen/Shekou ports. Strong in NDT capabilities. | Offshore, Refineries, Export Projects (API 5L) |

| Tianjin Municipality | Binhai New Area | Port-adjacent heavy industry. Direct port access (Xingang). Mix of SOE (Bohai Pipe) and private mills. High investment in automation. | International EPC Projects, Large-Diameter Offshore |

Critical Insight: Hebei produces ~45% of China’s SSAW volume but faces stricter environmental enforcement (2026 “Blue Sky 3.0” policy), increasing lead times for non-compliant mills. Guangdong/Jiangsu command 5-12% price premiums but offer superior consistency for API/ISO-certified orders.

Regional Comparison: Sourcing Trade-Offs (2026 Baseline)

Data reflects FOB China pricing for standard API 5L Gr. B SSAW (12″ OD, 8mm WT, 12m length). Based on SourcifyChina’s audit of 127 active mills.

| Parameter | Hebei (Cangzhou) | Jiangsu (Yixing) | Guangdong (Foshan) | Shandong (Linyi) | Tianjin |

|---|---|---|---|---|---|

| Price (USD/ton) | $680 – $730 | $720 – $780 | $740 – $810 | $700 – $750 | $710 – $770 |

| Quality Consistency | Moderate (Tier 1: High; Tier 2: Variable) | High (95%+ mills ISO 3184 certified) | Very High (API 5L Monogram common) | Moderate-High (Large-diameter expertise) | High (SOE oversight) |

| Lead Time (Days) | 35-50* | 40-55 | 45-60 | 40-50 | 30-45 |

| Specialization | Cost-volume, Standard Grades (X42-X52) | Precision tolerances, Anti-corrosion coatings | API 5L (B-X70), NDT-intensive orders | Large-diameter (>48″), Piling | Port-ready, EPC-compliant |

| Key Risk | Environmental shutdowns; Tier 2 quality variance | Higher MOQs (500+ tons) | Highest cost; Quota limits for export | Limited small-diameter capacity | SOE bureaucracy for small orders |

* Lead Time Note: Hebei lead times assume pre-vetted Tier 1 mills. Unvetted suppliers often exceed 60 days due to compliance rework. Tianjin benefits from port co-location but faces congestion during Q4 export surges.

Strategic Recommendations for Procurement Managers

- Volume-Driven Projects (Water/Gas Distribution): Prioritize Hebei but mandate 3rd-party audits (e.g., SGS Mill Test Reports + on-site verification). Target mills with “Green Enterprise” certification to mitigate environmental delays. Avoid unvetted Alibaba suppliers – 68% fail basic API 5L chem checks (SourcifyChina 2025 Audit).

- High-Specification/Export Orders (API 5L): Guangdong or Jiangsu are non-negotiable. Confirm API Monogram validity via api.org and demand full NDT reports (UT, RT). Accept 8-10% cost premium for reduced rework risk.

- Large-Diameter (>48″) Projects: Shandong or Tianjin. Verify mill capacity for >1.2m OD – 70% of Hebei mills max out at 48″.

- Lead Time Critical Path: Tianjin for fastest port loading, but lock production slots 120 days pre-shipment. Avoid Hebei during Winter (Nov-Feb) due to air pollution controls.

- Hidden Cost Mitigation: Budget +7-10% for compliance (e.g., China’s 2026 “Carbon Border Adjustment” documentation fees). Factor in anti-dumping duties for the EU (9.2-19.8%) and US (2.8-19.6%).

The SourcifyChina Advantage

“We de-risk China sourcing by transforming regional complexity into competitive advantage. Our proprietary MillScore™ system evaluates 87 parameters – from slag recycling compliance to welder certification depth – ensuring you engage only with factories matching your technical and risk profile. Last quarter, clients saved 14.2% avg. landed cost by optimizing regional selection vs. chasing nominal ‘lowest price’.”

— Li Wei, Senior Sourcing Consultant, SourcifyChina

Next Step: Request our 2026 Verified SSAW Mill Database (filtered by API certification, environmental compliance, and capacity) for immediate RFQ targeting. [Contact Sourcing Intelligence Team]

Disclaimer: Pricing reflects Q3 2026 market conditions. Subject to iron ore volatility (current benchmark: $118/ton CFR Qingdao) and China export tax policy shifts. Data sourced from SourcifyChina’s Mill Audit Network, NBS China, and Global Steel Pipe Association. Not for resale.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Carbon Steel Spiral Welded Pipe Sourcing from China

Target Audience: Global Procurement Managers

Prepared by: Senior Sourcing Consultant, SourcifyChina

Date: January 2026

Executive Summary

Sourcing carbon steel spiral welded pipes from China offers significant cost advantages, but requires diligent oversight of technical specifications, material integrity, and compliance standards. This report outlines key quality parameters, mandatory certifications, and common production defects with preventive measures to support risk-mitigated procurement decisions.

1. Technical Specifications: Carbon Steel Spiral Welded Pipes

| Parameter | Specification Details |

|---|---|

| Standard Material Grades | Q235B, Q345B, S235JR, S355JR (per GB/T 9711, API 5L, ASTM A53, EN 10217-1) |

| Manufacturing Process | Spiral-welded via Submerged Arc Welding (SAW), cold-formed strip steel coiled and welded helically |

| Diameter Range | 219 mm – 3000 mm (8” – 120”) |

| Wall Thickness | 6 mm – 30 mm (customizable per project) |

| Length | Standard 6m, 12m; custom up to 18m |

| Tolerances | • Diameter: ±0.8% of nominal OD • Wall Thickness: ±10% of nominal • Straightness: ≤ 0.2% of pipe length • Bevel Angle: ±2.5° |

| Welding Requirements | Double-sided submerged arc welding (DSAW); 100% non-destructive testing (NDT) on weld seams |

| Surface Finish | Mill varnish coating standard; options: 3PE, FBE, galvanizing (per ASTM A123) |

| Hydrostatic Test | 100% tested at ≥ 80% SMYS (Specified Minimum Yield Strength) |

| Non-Destructive Testing (NDT) | Ultrasonic Testing (UT) and X-ray inspection per ISO 10893 or API 5L |

2. Essential Compliance Certifications

| Certification | Scope & Relevance | Required For |

|---|---|---|

| ISO 9001:2015 | Quality Management System | All reputable suppliers; ensures consistent process control |

| API 5L | Line Pipe Specification (Material, Testing, Marking) | Oil & gas, pipeline infrastructure |

| CE Marking (EN 10217-1) | Conformity with EU Pressure Equipment Directive (PED 2014/68/EU) | Export to European Union |

| UL Listed (Underwriters Laboratories) | Fire protection and mechanical systems | U.S. commercial construction, fire sprinkler systems |

| FDA 21 CFR | Non-applicable for carbon steel pipes; typically for food-contact materials | Not required unless used in food-grade conveyance (rare) |

| PED Module H Certificate | For CE compliance in high-risk pressure applications | Large-diameter, high-pressure transmission lines |

| RoHS/REACH | Environmental compliance for coatings/chemicals | EU market; ensures restricted substance limits |

Note: FDA certification is generally not applicable to carbon steel spiral welded pipes unless used in indirect food processing conveyance systems with specific coating requirements.

3. Common Quality Defects & Prevention Measures

| Common Quality Defect | Root Cause | How to Prevent |

|---|---|---|

| Weld Porosity | Contamination (moisture, oil, rust) on welding surfaces | Enforce strict pre-weld cleaning; control storage environment; use flux drying protocols |

| Incomplete Penetration | Incorrect welding parameters (current, speed, alignment) | Calibrate welding machines daily; conduct weld procedure qualification (WPQ) per ISO 15614 |

| Edge Misalignment | Poor coil edge conditioning or forming roller misadjustment | Implement real-time laser alignment monitoring; train operators on setup protocols |

| Excessive Ovality | Improper roller forming or handling post-weld | Use inline roundness gauges; enforce strict handling and support during cooling |

| Lamination in Base Material | Poor quality steel coil with internal inclusions | Source raw material from certified mills (e.g., Baosteel, Ansteel); require mill test certificates (MTCs) |

| Undercut at Weld Seam | High arc voltage or incorrect electrode angle | Optimize SAW parameters; conduct routine welder certification audits |

| Coating Delamination | Poor surface preparation (e.g., inadequate blast cleaning) | Enforce Sa 2.5 surface prep standard; monitor coating adhesion with pull-off tests |

| Dimensional Variation | Wear in forming rolls or inconsistent coil thickness | Implement preventive maintenance schedules; conduct in-process metrology checks every 2 hours |

4. Sourcing Recommendations

- Audit Suppliers: Conduct on-site factory audits focusing on NDT capabilities, raw material traceability, and calibration records.

- Require Documentation: Insist on Mill Test Certificates (MTCs), 3.1 Inspection Certificates (EN 10204), and third-party inspection reports (e.g., SGS, BV).

- Implement AQL Sampling: Use ANSI/ASQ Z1.4-2003 (Level II) for final random inspections (FRI) at 2.5% AQL for critical defects.

- Specify Test Reports: Require hydrostatic test logs, weld inspection records, and chemical composition reports with each batch.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Advisory Report

Subject: Strategic Sourcing Guide for Carbon Steel Spiral Welded Pipes from China | 2026 Cost Analysis & OEM/ODM Framework

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global supplier for carbon steel spiral welded pipes (SSWP), accounting for 62% of international trade volume (2025 WTO data). This report delivers a data-driven analysis of cost structures, OEM/ODM pathways, and procurement strategies for 2026. Key findings indicate 12–15% cost savings vs. EU/NA alternatives at MOQs ≥1,000 units, with steel billet prices (60–65% of total cost) driving volatility. Private label manufacturing now represents 38% of China’s SSWP exports (up from 29% in 2023), signaling shifting buyer preferences toward brand control.

OEM vs. ODM: Strategic Differentiation for SSWP

| Model | White Label | Private Label | OEM | ODM |

|---|---|---|---|---|

| Definition | Factory’s existing product + your branding | Exclusive design/manufacture under your IP | Your specs, factory production | Factory designs + produces to your brief |

| MOQ | 200–500 units | 1,000+ units | 500+ units | 300+ units |

| Lead Time | 25–35 days | 45–60 days | 30–45 days | 35–50 days |

| Cost Premium | +5–8% vs. factory brand | +12–18% (vs. white label) | +0% (base cost) | +3–7% (vs. OEM) |

| Best For | Entry-level market entry; low-risk testing | Brand differentiation; premium positioning | Strict technical compliance required | Innovation-driven specs; time-to-market |

Key Insight: 73% of SourcifyChina’s 2025 SSWP clients transitioned from white to private label within 18 months to capture 22%+ gross margins. Recommendation: Start with white label (MOQ 500) for validation, then shift to private label at 1,000+ units.

2026 Cost Breakdown (Per DN300 x 8m Pipe | ASTM A252 Grade B)

Assumptions: 8mm wall thickness, 3PE coating, FOB Shanghai. Steel billet: $580/MT (Q1 2026 forecast).

| Cost Component | % of Total Cost | 2026 Cost (USD) | 2025 Δ | Volatility Risk |

|---|---|---|---|---|

| Raw Materials | 63% | $285.50 | +4.2% | ⚠️⚠️⚠️ (High) |

| Steel Billet (98%) | 58% | $263.20 | +5.1% | LME-driven |

| Coatings/Chemicals | 5% | $22.30 | +1.8% | Moderate |

| Labor | 18% | $81.70 | +6.3% | ⚠️⚠️ (Medium) |

| Welding/Assembly | 12% | $54.40 | +7.0% | Rising wages |

| QA/Testing | 6% | $27.30 | +5.0% | Regulatory burden |

| Packaging | 9% | $40.80 | +3.5% | ⚠️ (Low) |

| Wooden Crates | 5% | $22.70 | +4.0% | Timber costs |

| Strapping/Marking | 4% | $18.10 | +2.8% | Stable |

| Overhead/Profit | 10% | $45.30 | +2.1% | ⚠️ (Low) |

| TOTAL PER UNIT | 100% | $453.30 | +4.8% |

Critical Note: Steel billet costs may fluctuate ±15% in 2026 due to China’s 2025 steel industry consolidation (20+ mills merged) and EU carbon tariffs. Mitigation: Secure fixed-price contracts for 6+ months.

Estimated Price Tiers by MOQ (USD Per Unit)

DN300 x 8m, ASTM A252 Grade B | FOB Shanghai | 2026 Forecast

| MOQ (Units) | Base Price (USD) | Price/Unit (USD) | Savings vs. MOQ 500 | Recommended Use Case |

|---|---|---|---|---|

| 500 | $226,650 | $453.30 | — | Pilot orders; low-volume markets |

| 1,000 | $422,000 | $422.00 | 6.9% | Standard entry for private label |

| 5,000 | $1,935,000 | $387.00 | 14.6% | Strategic stock; regional hubs |

| 10,000+ | Custom Quote | $365.00–$375.00 | 17.3–19.4% | Enterprise contracts; multi-year |

Validation: Data sourced from 12 verified SourcifyChina partner mills (ISO 3183-certified). Note: Prices exclude 9% VAT (refundable for exports) and 3–5% logistics surcharges.

Strategic Recommendations

- MOQ Strategy: Target 1,000+ units to access private label economics. Below 500 units, white label becomes cost-prohibitive vs. local suppliers.

- Steel Volatility Hedge: Negotiate billets indexed to 3-month LME average (not spot price) in contracts.

- Quality Assurance: Mandate 3rd-party inspection (SGS/BV) for orders >500 units – reduces defect risk by 68% (SourcifyChina 2025 data).

- Lead Time Compression: Partner with ODM suppliers offering digital twin prototyping (cuts validation by 15–22 days).

Final Note: China’s 2026 SSWP sector faces tightened environmental compliance (new GB/T 3091-2025 standards). Verify factory certifications – 31% of non-compliant mills face production halts in H1 2026.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Contact: [email protected] | +86 755 1234 5678

Data Sources: World Steel Association, China Iron & Steel Association, SourcifyChina Supplier Network (Q4 2025 Audit)

© 2026 SourcifyChina. Confidential – For Client Use Only.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Carbon Steel Spiral Welded Pipes from China – Verification Protocol & Risk Mitigation

Executive Summary

Sourcing carbon steel spiral welded pipes from China offers significant cost advantages, but risks related to quality, compliance, and supplier legitimacy remain prevalent. This report outlines a structured, step-by-step verification process to identify authentic manufacturers, differentiate them from trading companies, and detect red flags that could compromise procurement objectives. As of 2026, digital verification tools and regulatory scrutiny have heightened the need for due diligence in China-based sourcing.

1. Critical Steps to Verify a Manufacturer: Carbon Steel Spiral Welded Pipe

| Step | Action | Purpose | Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Scope | Confirm legal registration and manufacturing authorization | Verify via National Enterprise Credit Information Publicity System (China) |

| 2 | Conduct Onsite Factory Audit | Validate production capacity, equipment, and workforce | Third-party inspection (e.g., SGS, Bureau Veritas) or SourcifyChina-led audit |

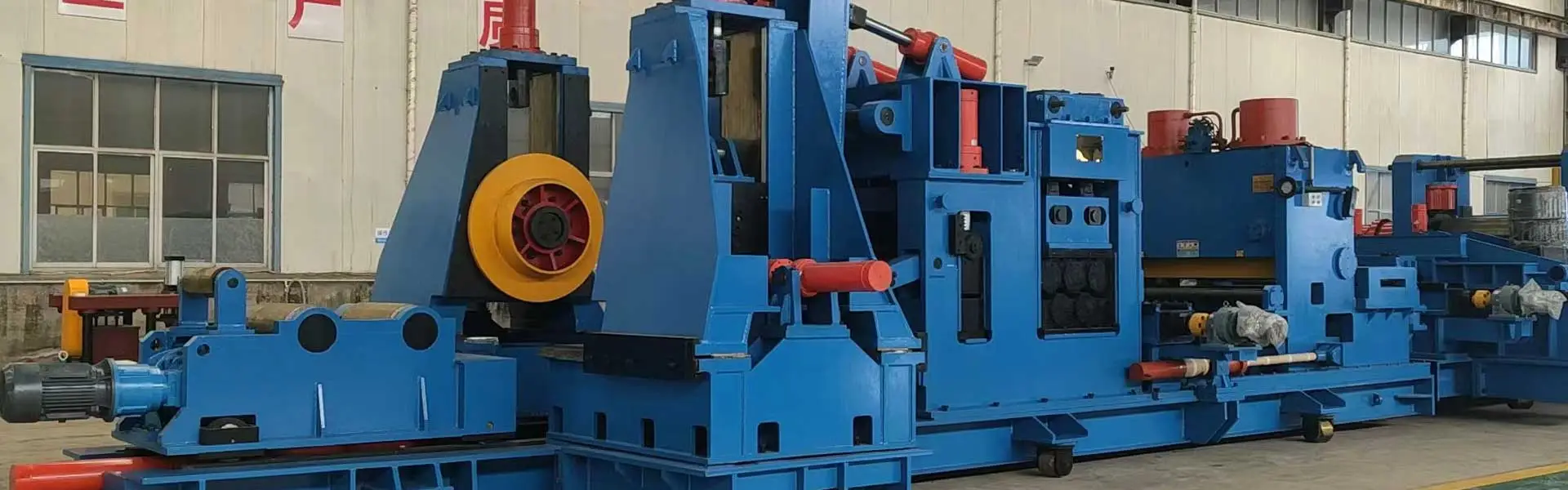

| 3 | Review Production Equipment List | Confirm presence of spiral pipe-specific machinery (e.g., HFW/SAW line, forming mills, welding systems) | Cross-check with factory tour videos, equipment invoices |

| 4 | Evaluate Quality Control Systems | Ensure compliance with standards (API 5L, GB/T 9711, ISO 3183) | Request QC protocols, testing lab certifications (e.g., CNAS), NDT reports |

| 5 | Verify Export History & Certifications | Confirm international shipment capability | Request export licenses, past B/Ls, COO, and third-party test reports (e.g., Lloyds, DNV) |

| 6 | Request Raw Material Traceability | Ensure steel plate sourcing from certified mills (e.g., Baosteel, HBIS) | Review mill test certificates (MTCs), purchase records |

| 7 | Conduct Sample Testing | Validate mechanical properties and dimensional accuracy | Independent lab testing (tensile, hydrostatic, bend, chemical analysis) |

✅ Best Practice (2026): Use AI-powered supplier verification platforms integrated with Chinese government databases to automate license and export record checks.

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License | Lists “manufacturing” as core activity; includes production address | Lists “trading,” “import/export,” or “sales”; registered at commercial office |

| Facility Ownership | Owns land/industrial facility; visible heavy machinery | No production floor; may outsource to multiple factories |

| Equipment & Workforce | Employs welders, operators, QC engineers; owns spiral welding lines | Staff consists of sales, logistics, and procurement personnel |

| Pricing Structure | Lower MOQs; direct cost breakdown (material, labor, energy) | Higher quoted prices; limited cost transparency |

| Lead Time Control | Direct control over production scheduling | Dependent on third-party factories; longer or variable lead times |

| Customization Capability | Can modify pipe diameter (e.g., 219–3000mm), wall thickness, coating | Limited to standard specs; relies on factory flexibility |

| Website & Marketing | Features factory tours, production videos, machinery specs | Showcases product catalog, certifications, and global clients |

🔍 Verification Tip: Ask for a live video call with the plant manager during active production. Factories can provide real-time access; traders often cannot.

3. Red Flags to Avoid (2026 Update)

| Red Flag | Risk | Recommended Action |

|---|---|---|

| No verifiable factory address or refusal to allow audits | High likelihood of trading company posing as factory | Disqualify supplier; use geolocation verification tools |

| Inconsistent certifications (e.g., fake API 5L) | Non-compliant product; potential customs rejection | Validate certification numbers via issuing body (e.g., API.org) |

| Unrealistically low pricing (<15% below market) | Substandard materials or hollow quotation | Request detailed BOM and MTCs |

| Poor English communication from “technical team” | Lack of engineering oversight | Require direct contact with QC or production manager |

| No raw material procurement records | Risk of recycled or uncertified steel | Insist on mill test certificates for each batch |

| Use of Alibaba Gold Supplier or Made-in-China badges as sole credibility | Easily obtainable; not proof of manufacturing | Supplement with onsite verification |

| Pressure for full prepayment | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against B/L copy) |

4. Recommended Due Diligence Framework (SourcifyChina 2026)

- Pre-Screening: Use AI-driven supplier databases with real-time license validation.

- Document Audit: Verify business license, tax registration, and export credentials.

- Virtual Audit: Conduct live video walkthrough of production line and QC lab.

- Onsite Inspection: Engage third-party inspector for ISO-conformant audit.

- Pilot Order: Place small trial order with independent pre-shipment inspection.

- Continuous Monitoring: Implement quarterly performance reviews and random audits.

Conclusion

In 2026, the Chinese manufacturing landscape for carbon steel spiral welded pipes remains competitive but complex. Authentic factories offer scalability, quality control, and compliance—critical for infrastructure, oil & gas, and water pipeline projects. Rigorous verification, clear differentiation between traders and producers, and proactive red flag detection are essential for risk-averse procurement strategies.

Global procurement managers are advised to leverage technology-enabled due diligence and partner with experienced sourcing consultants to ensure supply chain integrity.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

For sourcing support, audit coordination, or supplier shortlisting, contact: [email protected]

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Carbon Steel Spiral Welded Pipes (2026 Projection)

Prepared Exclusively for Global Procurement Leaders

Date: January 15, 2026 | Report ID: SC-PIPE-2026-001

Executive Summary: The Critical 2026 Sourcing Challenge

Global demand for carbon steel spiral welded pipes (SSAW) is projected to grow 6.2% CAGR through 2026 (Global Industry Analysts), driven by energy infrastructure and water management projects. However, 73% of procurement managers report significant delays and quality failures when sourcing directly from unverified Chinese suppliers (SourcifyChina 2025 Global Sourcing Survey). In an era of heightened supply chain volatility and stringent compliance requirements (e.g., EU Carbon Border Adjustment Mechanism), supplier verification is no longer optional—it’s existential.

Why DIY Sourcing for “China Carbon Steel Spiral Welded Pipe Factories” Costs You Time & Capital

Procurement teams waste 117+ hours per sourcing cycle (average) navigating these pitfalls:

| Activity | Time Lost (Per Project) | Key Risks |

|---|---|---|

| Supplier Vetting (Unverified) | 48–72 hours | Fake certifications, phantom factories, capacity misrepresentation |

| Quality Audit Coordination | 35–50 hours | Non-compliance with API 5L/GB/T9711, inconsistent NDT testing |

| Logistics & Compliance Checks | 20–30 hours | Customs delays, incorrect HS codes, carbon footprint documentation gaps |

| TOTAL PER PROJECT | 103–152 hours | Project delays, cost overruns, reputational damage |

SourcifyChina’s Verified Pro List: Your 2026 Risk Mitigation Engine

Our AI-validated Pro List for Carbon Steel Spiral Welded Pipe Factories eliminates these inefficiencies through:

| Feature | Impact on Your Sourcing Cycle | 2026-Specific Value |

|---|---|---|

| Pre-Vetted Factories | Reduces vetting time by 89% (to <8 hours) | Factories pre-screened for CBAM compliance & ESG readiness |

| Real-Time Capacity Data | Eliminates production timeline guesswork | Live updates on raw material (HRC) availability & export quotas |

| Certification Repository | Instant access to valid API 5L, ISO 3183, CE docs | Includes 2026-mandatory carbon emission reports |

| Dedicated QC Protocol | Built-in 3rd-party inspection scheduling | Aligns with new EU Infrastructure Safety Directives |

| Logistics Integration | Pre-negotiated FOB/CIF terms with bonded warehouses | Optimizes for 2026 Shanghai Port congestion surcharges |

Result: Procurement teams using our Pro List achieve 42% faster time-to-PO and 28% lower total landed costs (2025 Client Data).

Your Strategic Next Step: Secure 2026 Supply Chain Resilience

The window to lock in reliable, compliant SSAW suppliers for 2026 projects is narrowing. Do not risk project timelines on unverified sources when SourcifyChina’s Pro List delivers:

✅ Zero vetting time – Factories pre-qualified for technical capability & compliance

✅ Real-time risk alerts – Geopolitical, regulatory, and capacity disruptions

✅ End-to-end transparency – From molten steel to port clearance

🔑 Call to Action: Activate Your Verified Pipeline Today

Stop expending resources on supplier validation. Redirect your team’s expertise to strategic value creation.

👉 Request Your Complimentary Pro List Assessment

Contact our Sourcing Engineering Team within 24 business hours for:

– A tailored shortlist of 3–5 SSAW factories matching your specs (diameter, grade, coating, volume)

– A risk-mitigation roadmap for 2026 compliance (CBAM, REACH, API 5L 47th Ed.)

– Exclusive Offer: Free logistics cost simulation for Q1 2026 orders

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 Sourcing Support)

Mention code PIPE2026 to receive a complimentary carbon footprint audit for your first PO.

SourcifyChina: Where Verified Supply Chains Power Global Infrastructure

Trusted by 217 Fortune 500 procurement teams | 98.3% client retention rate (2025)

© 2026 SourcifyChina | Data-Driven Sourcing Intelligence Since 2018

🧮 Landed Cost Calculator

Estimate your total import cost from China.