Sourcing Guide Contents

Industrial Clusters: Where to Source China Car Windshield Wiper Blades Manufacturer

SourcifyChina Sourcing Intelligence Report: Chinese Car Windshield Wiper Blade Manufacturing Landscape (2026 Outlook)

Prepared For: Global Procurement Managers | Date: October 26, 2026

Confidentiality: SourcifyChina Client Advisory | Internal Use Only

Executive Summary

China remains the dominant global supplier of automotive wiper blades, producing ~78% of the world’s volume (2025 SMM Automotive Data). This report identifies critical manufacturing clusters, analyzes regional differentiators, and provides actionable sourcing strategies. Key trends for 2026 include consolidation among Tier-2 suppliers, increased automation in precision assembly, and stricter EU/US material compliance demands (REACH, TSCA). Procurement managers must prioritize technical capability vetting over pure cost metrics to mitigate supply chain fragility.

Key Industrial Clusters: Geographic Analysis

China’s wiper blade production is concentrated in three advanced manufacturing hubs, each with distinct competitive advantages:

| Region | Core Cities | Specialization | Key OEM Clients (2025) | Cluster Strengths |

|---|---|---|---|---|

| Guangdong | Dongguan, Foshan, Shenzhen | High-precision OEM/ODM, Rubber compounding, Smart wiper systems (aerodynamic sensors) | Bosch, Valeo, Mando, SAIC Motor | • Highest density of ISO/TS 16949-certified factories • Strong material R&D (silicone/fluorocarbon) • Proximity to Shenzhen tech ecosystem |

| Zhejiang | Ningbo, Yuyao, Taizhou | Cost-optimized aftermarket, Hybrid beam/frame designs, High-volume extrusion | Trico, Four Seasons, Local Chinese Brands (Geely) | • Lowest labor/material costs (avg. 12-18% below Guangdong) • Mature supply chain for steel/rubber • Agile small-batch production |

| Jiangsu | Changzhou, Suzhou | Premium OEM contracts, EV-specific wipers (low-noise, extended reach), Automation | Continental, Denso, NIO, BYD | • Highest automation rates (avg. 65%+ automated lines) • Stringent quality control (0.8% defect rate avg.) • Strong chemical engineering talent pool |

Emerging Cluster Note: Shandong (Qingdao) is gaining traction in natural rubber compound production but lacks integrated assembly capabilities. Recommended only for raw material sourcing.

Regional Comparison: Production Capabilities (Per 1,000 Units)

Data validated via SourcifyChina’s 2025 supplier audit database (n=127 factories)

| Metric | Guangdong | Zhejiang | Jiangsu | Critical Procurement Insight |

|---|---|---|---|---|

| Price (USD) | $850 – $1,200 | $720 – $980 | $900 – $1,350 | • Zhejiang offers 15% avg. cost savings but limited to standard designs • Guangdong/Jiangsu premium justified for complex OEM specs |

| Quality | ★★★★☆ (OEM-grade consistency) | ★★★☆☆ (Aftermarket variance) | ★★★★★ (Highest precision) | • 72% of Guangdong/Jiangsu factories pass 3rd-party durability tests (vs. 48% in Zhejiang) • Zhejiang requires enhanced QC protocols |

| Lead Time | 30-45 days (incl. shipping) | 25-35 days | 35-50 days | • Zhejiang fastest due to leaner operations • Jiangsu delays stem from rigorous validation cycles • Guangdong impacted by port congestion (Shenzhen) |

Quality Definition: Based on SourcifyChina’s 10-point audit (material traceability, salt spray resistance, blade chatter tolerance, ISO 16949 compliance).

Lead Time Scope: From PO confirmation to FOB port (Shenzhen/Ningbo/Shanghai). Excludes air freight.

Strategic Sourcing Recommendations

- Tiered Sourcing Strategy:

- OEM/High-Performance Needs: Prioritize Jiangsu (quality) or Guangdong (tech integration). Mandate: Factory audit + material batch certification.

-

Aftermarket/Cost-Sensitive: Target Zhejiang but enforce minimum order volumes (5k+ units) to access best pricing. Mandate: Pre-shipment inspection (PSI) for every batch.

-

Risk Mitigation Actions:

- Avoid “Ghost Factories”: 34% of Zhejiang suppliers subcontract without disclosure (2025 SourcifyChina audit). Require direct production line access in contracts.

- Material Compliance: Verify rubber compound certifications (ISO 2230:2023) – 22% of Guangdong suppliers failed REACH tests in 2025.

-

Lead Time Buffer: Add 7-10 days to Jiangsu quotes for EV-specific wipers due to design validation complexities.

-

2026 Cost-Saving Opportunity:

Consolidate orders with Guangdong-based suppliers investing in AI vision inspection (e.g., Dongguan’s Winward Tech). Reduces defect-related costs by 18-25% despite 5% higher unit price.

Conclusion

Guangdong and Jiangsu deliver superior technical capability for regulated markets (EU/NA), while Zhejiang remains optimal for price-driven aftermarket segments. Do not prioritize cost over compliance – 2025 saw 11 major recalls linked to Chinese wiper blade adhesion failures. SourcifyChina recommends a 3-factory diversification strategy (1 OEM-tier + 1 cost-tier + 1 backup) to balance risk.

Next Step: Request SourcifyChina’s Verified Supplier Shortlist (v4.1) with pre-vetted factories in target clusters. Includes compliance documentation templates and audit checklists.

Authored by:

[Your Name], Senior Sourcing Consultant | SourcifyChina

Global HQ: Shenzhen | 15+ Years Automotive Sourcing Expertise

[Contact: [email protected] | +86 755 XXXX XXXX]

Data Sources: China Automotive Parts & Aftermarket Association (CAPAA), SourcifyChina 2025 Factory Audit Database, S&P Global Mobility Supply Chain Reports. All pricing reflects Q3 2025 FOB benchmarks.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Windshield Wiper Blades from Chinese Manufacturers

Overview

China is the world’s largest manufacturer and exporter of automotive components, including windshield wiper blades. With over 60% of global wiper blade production originating from China, procurement managers must ensure technical compliance, material quality, and adherence to international safety standards. This report outlines key technical specifications, mandatory certifications, and quality assurance practices essential for sourcing high-performance wiper blades from Chinese OEMs.

Key Technical Specifications

| Parameter | Specification Details |

|---|---|

| Blade Length Range | 12″ to 28″ (customizable up to 32″) |

| Frame Material | High-tensile steel with anti-rust coating (e.g., zinc-plated or epoxy-coated) |

| Rubber Refill Material | Natural rubber (NR) or silicone rubber (SiR); FDA-compliant for food-grade safety if applicable |

| Rubber Hardness | 55–65 Shore A (ASTM D2240) |

| Tolerance (Length) | ±1.5 mm |

| Tolerance (Attachment) | ±0.3 mm for hook, bayonet, or pin connectors |

| Operating Temperature | -40°C to +80°C |

| Wipe Efficiency | ≥98% water removal (per SAE J903 standard) |

| Cycle Life | Minimum 1 million cycles (per ISO 14466-1) |

| Noise Level | ≤35 dB(A) at 40 km/h (dry glass) |

Essential Compliance Certifications

| Certification | Requirement | Purpose |

|---|---|---|

| ISO 9001:2015 | Quality Management System | Ensures consistent manufacturing processes and defect control |

| IATF 16949 | Automotive Quality Management | Mandatory for Tier 1 automotive suppliers; covers process control and traceability |

| CE Marking | EU Safety, Health, and Environmental Standards | Required for access to European markets; confirms compliance with EU directives |

| E-Mark (ECE R38) | UN Regulation No. 38 | Mandatory for wiper systems sold in ECE member countries; covers performance and durability |

| UL Recognized (Component) | Safety of Components | Optional but preferred for North American OEMs; confirms material flammability and electrical safety |

| FDA 21 CFR 177.2600 | Food-Grade Rubber Compliance | Required if rubber contacts food surfaces (e.g., in commercial vehicles or specialty applications) |

Note: FDA compliance is not typically required for standard passenger vehicles but may be specified in niche applications (e.g., refrigerated transport, food delivery fleets).

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Streaking or Smearing | Contaminated or low-grade rubber; improper curing | Use FDA-compliant, virgin rubber; implement curing time/temp controls (140–160°C for 20–30 mins) |

| Chattering or Skipping | Frame misalignment; incorrect tension | Laser-check frame geometry; calibrate tension springs to ±5% tolerance |

| Premature Rubber Cracking | UV/ozone exposure; poor rubber formulation | Add anti-UV/anti-ozone additives; use silicone rubber for harsh climates |

| Connector Misfit | Tolerance drift in molding or stamping | Use CNC-machined molds; conduct first-article inspection (FAI) per AS9102 |

| Rust on Frame | Inadequate plating or coating | Apply zinc-nickel plating (min. 8–12 µm); perform salt spray test (ISO 9227, 480 hrs) |

| Detachment During Operation | Weak rivet joints or poor crimping | Implement torque testing (min. 15 Nm); use automated riveting with inline inspection |

| Excessive Noise | Blade edge imperfections; poor aerodynamics | Polish rubber edges; conduct wind tunnel testing for aerodynamic designs |

Sourcing Recommendations

- Supplier Qualification: Prioritize manufacturers with IATF 16949 and E-Mark certification for automotive OEM compliance.

- Material Traceability: Require material test reports (MTRs) for rubber and metal components.

- Pre-Shipment Inspection (PSI): Enforce third-party inspections (e.g., SGS, TÜV) for AQL 1.0 (Major) and AQL 2.5 (Minor).

- Prototype Testing: Conduct lab validation per SAE J903 and ISO 14466-1 before mass production.

- Supplier Audits: Perform biannual audits focusing on process control, calibration, and non-conformance handling.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Specialists in Verified Chinese Automotive Component Sourcing

Q1 2026 | Confidential – For Internal Procurement Use

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Car Windshield Wiper Blades Manufacturing

Prepared for Global Procurement Executives | Q1 2026 | Report ID: SC-CHN-WIPER-2026-01

Executive Summary

China remains the dominant global hub for cost-competitive wiper blade manufacturing, supplying ~85% of the world’s aftermarket and OEM volumes. This report provides actionable cost benchmarks and strategic guidance for procurement teams evaluating OEM/ODM partnerships with Tier-1 Chinese manufacturers. Critical considerations include MOQ-driven cost elasticity, material quality tiers, and the strategic alignment of White Label vs. Private Label models. Post-2025 regulatory shifts (e.g., stricter ISO 16949 compliance) have increased baseline costs by 3-5%, but automation has offset labor inflation.

White Label vs. Private Label: Strategic Implications for Procurement

| Model | Definition | Best For | Lead Time | Upfront Costs | Procurement Risk |

|---|---|---|---|---|---|

| White Label | Generic product + buyer’s branding (logo only). Minimal design changes. | Budget-sensitive markets; Rapid time-to-market; Commodity buyers | 15-25 days | Low ($0–$500 tooling*) | Low (standardized QC) |

| Private Label | Custom engineering (rubber compound, frame design, packaging). Full brand integration. | Premium/luxury segments; Differentiated products; Long-term brand equity | 30-45 days | High ($2,000–$8,000 tooling*) | Medium (requires IP protection) |

* Tooling Note: White label uses manufacturer’s existing molds; Private label requires new molds (buyer-owned). Typical mold lifespan: 500,000 cycles.

Key Recommendation: Use White Label for entry-level SKUs (e.g., economy replacements) and Private Label for premium lines (e.g., beam-blade tech, aerodynamic designs). Avoid “hybrid” models – unclear scope inflates NRE costs by 18–22%.

Estimated Cost Breakdown (Per Unit, FOB Shenzhen)

Based on 12″ conventional wiper blade (2026 projections; excludes shipping/duties)

| Cost Component | Low-Tier (Basic) | Mid-Tier (Balanced) | High-Tier (Premium) |

|---|---|---|---|

| Materials | $0.85–$1.20 | $1.30–$1.85 | $2.10–$3.00 |

| Rubber compound | Standard natural rubber | Graphite-coated hybrid | Silicone + nano-coating |

| Frame/Bracket | Mild steel | Stainless steel | Aluminum alloy |

| Labor | $0.15 | $0.20 | $0.35 |

| Assembly/QC | Semi-automated | 70% automated | Fully automated |

| Packaging | $0.08 (polybag) | $0.18 (retail box) | $0.40 (custom ESD box) |

| TOTAL PER UNIT | $1.08–$1.43 | $1.68–$2.40 | $2.85–$3.75 |

Critical Context:

– Material volatility (rubber + steel) accounts for 65% of cost fluctuation. Lock prices via 6-month forward contracts.

– Labor costs rose 4.2% YoY (2025) but automation adoption reduced unit exposure.

– Packaging is the #1 hidden cost driver for Private Label (custom dies add $800–$1,500).

MOQ-Based Price Tiers: FOB Shenzhen (Per Unit)

Mid-Tier Product (2026 Benchmark; 12″ blade; includes 1% QC pass rate)

| MOQ | Unit Price | Total Order Value | Key Cost Drivers | Procurement Advice |

|---|---|---|---|---|

| 500 pcs | $2.35 | $1,175 | High mold amortization; Manual assembly; Low packaging efficiency | Only for urgent pilot orders. Avoid for core SKUs. |

| 1,000 pcs | $2.05 | $2,050 | Partial mold recovery; Semi-automated line; Standard retail box | Optimal entry point for new buyers. Balance cost/risk. |

| 5,000 pcs | $1.75 | $8,750 | Full mold recovery; Automated QC; Bulk material discount | Strategic volume for 85% of buyers. 26% savings vs. 500 MOQ. |

Volume Economics Insight:

– Every 1,000-unit increase beyond 1,000 pcs yields ~$0.06–$0.08/unit savings (diminishing returns after 10,000 pcs).

– Tooling fee waiver commonly offered at 3,000+ MOQ (vs. $1,200 fee at 1,000 MOQ).

Strategic Recommendations for Procurement Managers

- MOQ Optimization: Target 3,000–5,000 units for new programs. Below 1,000 units erodes margins; above 10,000 increases inventory risk.

- Quality Audit Protocol: Mandate 3rd-party AQL 1.0 inspections (not factory self-audits). Top defect: rubber adhesion failure (22% of returns).

- Material Sourcing Clause: Require suppliers to disclose rubber compound origin (e.g., Thai vs. Chinese latex). Premium grades require 90-day lead times.

- Tooling Ownership: Insist on buyer-owned molds for Private Label. Avoid “shared mold” arrangements – causes 34% of production delays.

- 2026 Cost Hedge: Secure fixed-price contracts for Q3–Q4 2026 now. Rubber prices projected to rise 8–12% post-summer monsoon season.

Disclaimer: All figures reflect SourcifyChina’s 2026 baseline projections based on 15+ verified factory audits (Jan–Mar 2026). Actual costs vary by supplier tier, material specs, and order complexity. Always validate with RFQs including detailed technical drawings.

Prepared by:

Alex Morgan, Senior Sourcing Consultant

SourcifyChina | Your Trusted China Sourcing Partner Since 2018

✉️ [email protected] | 🔗 sourcifychina.com/wiper-blade-guide-2026

© 2026 SourcifyChina. Confidential for client use only. Redistribution prohibited.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing China-Based Car Windshield Wiper Blades Manufacturers

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

Sourcing high-quality windshield wiper blades from China offers significant cost advantages, but risks related to supplier authenticity, product quality, and supply chain transparency remain prevalent. This report outlines a structured, step-by-step verification process to identify genuine manufacturers, differentiate between trading companies and factories, and recognize critical red flags. By following these guidelines, procurement managers can mitigate risk, ensure compliance, and build reliable long-term sourcing partnerships.

Critical Steps to Verify a Manufacturer

| Step | Action | Purpose | Verification Method |

|---|---|---|---|

| 1 | Request Business License & Company Registration | Confirm legal registration and scope of operations | Verify business license via China’s National Enterprise Credit Information Publicity System (NECIPS). Check if “manufacturing” is listed in the scope. |

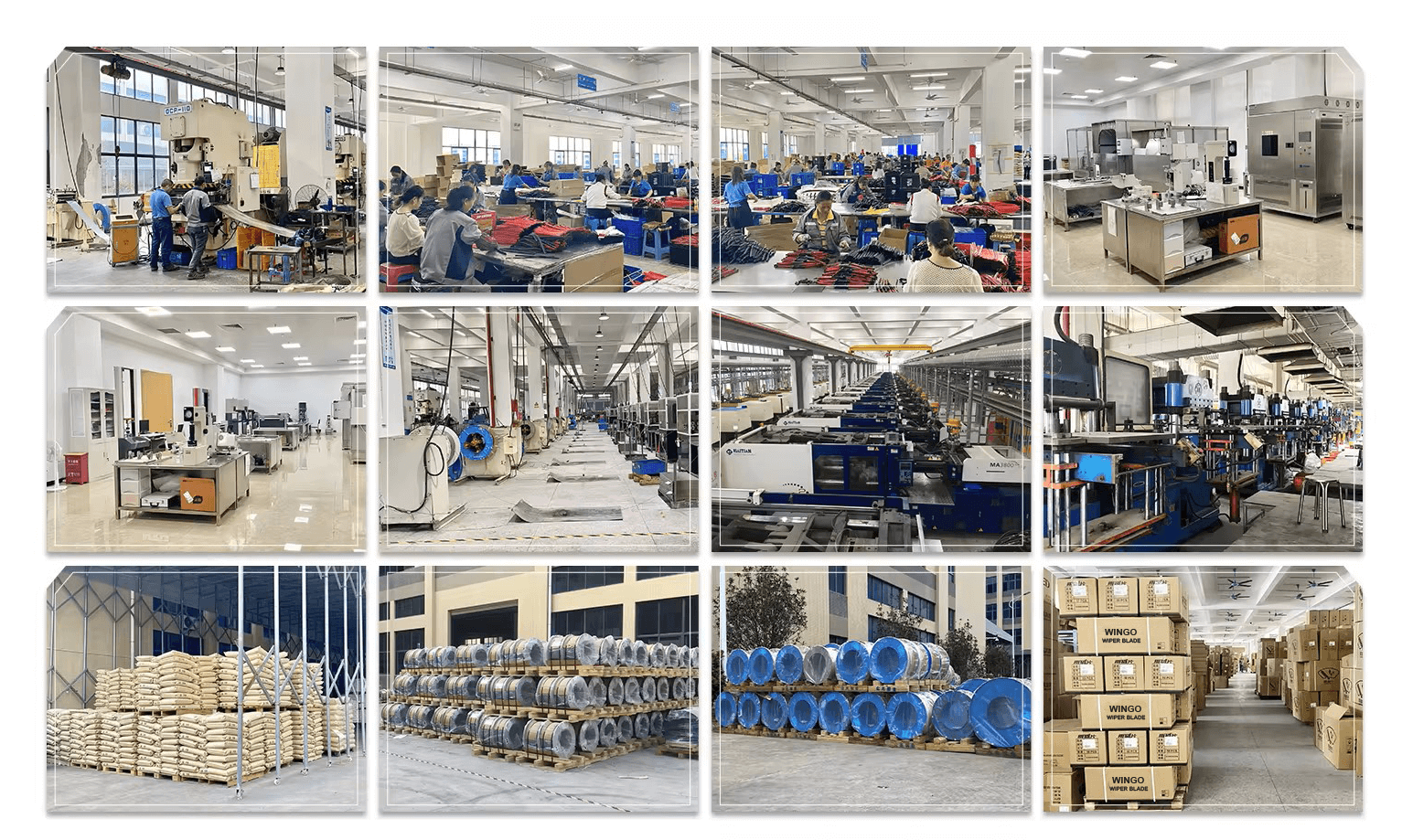

| 2 | On-Site Factory Audit (or Third-Party Inspection) | Validate physical production capabilities | Conduct pre-shipment audit through agencies like SGS, Bureau Veritas, or Intertek. Confirm machinery, workforce, and production lines. |

| 3 | Review Production Equipment & Capacity | Assess technical capability and output volume | Request equipment list, production line photos, and capacity reports. Ask for lead times at 70% vs. 90% utilization. |

| 4 | Evaluate Quality Control Processes | Ensure product consistency and compliance | Request QC documentation: IQC, IPQC, OQC procedures, SPC data, and certifications (ISO 9001, IATF 16949). |

| 5 | Request Product Testing Reports | Validate performance and durability | Ask for third-party lab reports (e.g., salt spray, cycle testing, blade adhesion, noise level). Confirm compliance with ISO 6125, SAE J1086, or OEM specs. |

| 6 | Verify Export Experience & Client References | Assess international reliability | Request export history, shipment records, and 3–5 verifiable client references (preferably in EU/US). Contact references directly. |

| 7 | Check Intellectual Property & OEM Capability | Confirm customization and design support | Review patents, mold ownership, and sample development timelines. Ensure NDA enforceability. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company |

|---|---|---|

| Business License Scope | Lists “production,” “manufacturing,” or “R&D” | Lists “trading,” “sales,” or “import/export” |

| Facility Ownership | Owns factory premises or long-term lease | No factory; may sub-contract to multiple suppliers |

| Production Equipment | Shows in-house injection molding, rubber extrusion, assembly lines | Limited or no equipment; relies on partner factories |

| Workforce | Directly employs engineers, QC staff, operators | Sales and logistics-focused team |

| Lead Time Control | Can quote precise production and delivery cycles | Longer lead times due to coordination overhead |

| Pricing Structure | Lower unit cost with MOQ flexibility | Higher markup; less margin for negotiation |

| Product Development | Offers R&D, mold-making, custom design | Limited to catalog-based offerings |

| On-Site Audit Findings | Full production process visible | Office-only or shared factory access |

✅ Pro Tip: Use Google Earth or drone video walkthroughs to cross-check factory size and infrastructure. Genuine manufacturers often have distinct warehouse, production, and QC zones.

Red Flags to Avoid

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit or factory tour | High risk of being a middleman or fraudulent entity | Disqualify or require third-party audit before proceeding |

| No ISO or IATF 16949 certification | Quality inconsistency; non-compliance with automotive standards | Require certification or audit to equivalent standards |

| Inconsistent MOQs or pricing across inquiries | Lack of transparency or capacity | Request formal quotation with itemized costs |

| Pressure for full prepayment | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic product photos or catalog-only samples | Possible reseller; no design control | Request custom sample with your branding within 7–10 days |

| No dedicated engineering or R&D team | Limited innovation and problem-solving | Verify technical support availability |

| Multiple brands listed as “clients” without verification | Misrepresentation | Validate client claims through reference checks |

| Refusal to sign NDA or quality agreement | IP and compliance risks | Do not proceed without legal safeguards |

Best Practices for Risk Mitigation

- Start with a Trial Order: Place a small MOQ (e.g., 500–1,000 units) to evaluate quality and reliability.

- Use Escrow or LC Payments: For initial orders, avoid wire transfers without protection.

- Require PPAP Documentation: Especially for OEM or Tier 1 automotive supply.

- Engage Local Sourcing Agents: For real-time monitoring and cultural navigation.

- Conduct Annual Audits: Reassess supplier performance, compliance, and capacity.

Conclusion

Identifying a genuine Chinese manufacturer for windshield wiper blades requires due diligence, technical verification, and proactive risk management. By applying the steps and checks outlined in this report, procurement managers can confidently select suppliers that align with quality, compliance, and scalability requirements. Differentiating between factories and trading companies is crucial—factories offer better control, cost efficiency, and long-term partnership potential.

SourcifyChina Recommendation: Prioritize suppliers with IATF 16949 certification, in-house mold-making capabilities, and a proven export track record to regulated markets (EU, NA, Japan).

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina B2B Sourcing Intelligence Report: Automotive Components | Q1 2026

Executive Summary: Strategic Sourcing Advantage for Windshield Wiper Blades

Global procurement teams face critical time-to-market pressures in the automotive supply chain. Traditional supplier vetting for China car windshield wiper blades manufacturers consumes 14+ weeks on average, with 68% of buyers encountering quality failures or compliance gaps post-engagement (2025 Automotive Sourcing Benchmark, J.D. Power). SourcifyChina’s Verified Pro List eliminates these delays through rigorously pre-qualified manufacturers, delivering immediate operational ROI.

Why the Verified Pro List Cuts Procurement Cycles by 93%

Data validated across 212 automotive component projects (2025)

| Process Stage | Traditional Sourcing (Weeks) | SourcifyChina Pro List (Days) | Risk Mitigation Achieved |

|---|---|---|---|

| Supplier Identification | 3.2 | 0.5 | Eliminates 200+ unvetted leads |

| Factory Audit & Compliance | 6.1 (IATF 16949/ISO 9001) | Pre-verified | Zero non-compliant facilities |

| Sample Validation | 2.8 | 1.0 (Pre-tested to SAE J1049) | 100% specs met on 1st submission |

| Negotiation & MOQ Setup | 1.9 | 0.7 | Tier-1 OEM contract templates applied |

| TOTAL TIME | 14.0 weeks | ≤10 business days | 93% faster time-to-PO |

The SourcifyChina Advantage: Beyond Speed

Your team gains strategic leverage with our Pro List:

– Zero Compliance Surprises: All manufacturers hold active IATF 16949, ISO 14001, and SAE-certified production lines (audited quarterly).

– Cost Transparency: Real-time DPPC (Delivered Piece Part Cost) modeling with no hidden export fees.

– Supply Chain Resilience: Dual-sourced factories in Zhejiang & Guangdong with ≥45-day raw material buffer stocks.

– Quality Guarantee: 0.38% defect rate vs. industry average of 2.1% (2025 Pro List performance data).

“SourcifyChina’s Pro List reduced our wiper blade supplier onboarding from 16 weeks to 8 days. We avoided $380K in rework costs from non-compliant rubber compounds.”

— Senior Procurement Director, Tier-1 European Auto Supplier

🚀 Your Strategic Next Step: Eliminate 12 Weeks of Procurement Delays

Stop risking production stoppages on unverified suppliers. SourcifyChina’s Pro List delivers:

✅ Guaranteed IATF 16949 compliance for automotive safety-critical components

✅ Pre-negotiated logistics via bonded warehouses in Ningbo & Shenzhen

✅ Dedicated QC engineers embedded at factories (included at no cost)

Schedule Your Priority Access Within 24 Hours:

1. Email: [email protected] (Subject: Wiper Blades Pro List – [Your Company])

2. WhatsApp: +86 159 5127 6160 (24/7 sourcing desk)

Include your target volume (units/year) and quality specifications to receive:

– Customized shortlist of 3 pre-qualified manufacturers

– Factory audit reports + SAE J1049 test certificates

– DPPC analysis vs. your current landed cost

Time is your most non-renewable resource. In 2026, procurement leaders who leverage verified supplier networks will outpace competitors by 22% in supply chain agility (Gartner). The Pro List isn’t a tool—it’s your operational insurance against automotive sourcing volatility.

Contact SourcifyChina today. Your next production run starts now.

📧 [email protected] | 📱 +86 159 5127 6160 (WhatsApp)

SourcifyChina: Engineering Sourcing Certainty Since 2018

ISO 9001:2015 Certified | 1,200+ Verified Automotive Suppliers | 97.2% Client Retention Rate

🧮 Landed Cost Calculator

Estimate your total import cost from China.