Sourcing Guide Contents

Industrial Clusters: Where to Source China Car Window Wiper Blades Factory

SourcifyChina Sourcing Intelligence Report: China Car Wiper Blade Manufacturing Landscape (2026 Forecast)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-CHN-WIPER-2026-001

Executive Summary

China remains the dominant global hub for automotive wiper blade production, supplying ~65% of the world’s volume (SourcifyChina Supply Chain Intelligence, 2025). Rising automation, stringent IATF 16949 adoption, and consolidation among Tier-2 suppliers characterize the 2026 landscape. While cost pressures persist due to raw material volatility (TPR rubber, aluminum), strategic regional selection mitigates risk. Critical Insight: Proximity to Tier-1 OEMs (e.g., SAIC, Geely) in Zhejiang/Jiangsu drives quality compliance, while Guangdong excels in export logistics for aftermarket volumes.

Key Industrial Clusters: China Wiper Blade Manufacturing

Wiper blade production is concentrated in three core clusters, each serving distinct market segments:

- Guangdong Province (Dongguan, Foshan, Shenzhen)

- Focus: Aftermarket (OEM & Retail), High-volume export, E-commerce (TikTok Shop/Amazon FBA)

- Strengths: Mature logistics (Shenzhen/Yantian ports), 40% of China’s auto parts export volume, strong TPR/rubber compound expertise.

-

Key Factories: 150+ certified manufacturers (e.g., Ningbo Joyson subsidiaries, local OEMs like Guangdong Wiper Tech).

-

Zhejiang Province (Ningbo, Yuyao, Taizhou)

- Focus: OE (Original Equipment) supply for domestic/international automakers, Mid-to-high-end wipers.

- Strengths: Clustered near SAIC, Geely, and Volkswagen China plants; 70% of factories hold IATF 16949; dominant in hybrid beam technology.

-

Key Factories: 120+ facilities (e.g., Ningbo Hengte Auto Parts, Yuyao Yongtong).

-

Jiangsu Province (Suzhou, Changzhou)

- Focus: Premium OE contracts (European/US brands), Specialty wipers (aero, beam-type).

- Strengths: High automation rates (avg. 65% vs. 45% national avg), R&D partnerships with BASF/3M China, stringent quality control.

- Key Factories: 45+ specialized plants (e.g., Suzhou Bosch Auto Parts, Changzhou SKF Wiper Systems).

Emerging Cluster Alert: Anhui Province (Hefei) is gaining traction for cost-sensitive aftermarket wipers (MOQs <5K units), but quality variance remains high (25% failure rate in pre-shipment audits, per SourcifyChina 2025 data).

Regional Comparison: Sourcing Trade-Offs (2026 Projections)

Data reflects avg. 12-month contracts for 100K+ units (Conventional Beam Wiper, 26″ length). All factories IATF 16949-certified.

| Criteria | Guangdong Cluster | Zhejiang Cluster | Jiangsu Cluster | Strategic Implication |

|---|---|---|---|---|

| Avg. Unit Price | $1.80 – $2.20 | $2.00 – $2.40 | $2.30 – $2.80 | Guangdong: Best for cost-driven aftermarket. Jiangsu: 15-20% premium for premium OE compliance. |

| Quality Consistency | ★★★☆☆ (85-90% audit pass) | ★★★★☆ (90-93% audit pass) | ★★★★★ (94-97% audit pass) | Jiangsu: Lowest defect rates (0.8% avg. vs. 2.1% Guangdong). Critical for safety-critical OE contracts. |

| Lead Time | 25-35 days | 30-40 days | 35-45 days | Guangdong: Fastest turnaround due to port proximity. Jiangsu: Longer due to rigorous QC cycles. |

| MOQ Flexibility | Low (5K-10K units) | Medium (10K-20K units) | High (25K+ units) | Guangdong: Ideal for niche/retail buyers. Jiangsu: Requires volume commitment. |

| Tech Capability | Standard beam/hybrid | Advanced hybrid/aero | Aero/beam, smart sensors | Zhejiang/Jiangsu: Only clusters with >50% factories supporting ADAS-compatible wipers. |

Strategic Recommendations for Global Procurement Managers

- Prioritize Cluster Alignment:

- Aftermarket/E-commerce: Source from Guangdong (optimize landed cost via Shenzhen port). Verify compound material specs – 30% of low-cost suppliers use recycled rubber (risk: 6-month lifespan vs. 18+ months).

- OE Contracts (EU/US Brands): Target Jiangsu despite higher costs. Demand full traceability of steel/aluminum components (EU REACH compliance non-negotiable).

-

Mid-Tier Domestic Vehicles: Zhejiang offers optimal balance – 22% of factories supply Geely/BYD with 12-month warranty compliance.

-

Mitigate 2026-Specific Risks:

- Raw Material Volatility: Secure fixed-price clauses for TPR rubber (40% of BOM cost). Zhejiang factories show strongest hedging practices.

- Quality Escalation: Require 3rd-party audit reports (SGS/BV) before shipment. Guangdong cluster has 3x higher rework rates (SourcifyChina audit data).

-

Logistics Buffer: Add 7 days to Jiangsu lead times – Suzhou port congestion increased 18% YoY (2025).

-

Actionable Next Step:

Conduct cluster-specific RFx:

– Guangdong: Focus on unit cost + port handling fees.

– Zhejiang/Jiangsu: Prioritize IATF 16949 documentation + material compliance certificates.

SourcifyChina’s 2026 Pre-Vetted Supplier List (57 factories) available upon request – includes audit scores & capacity data.

Disclaimer: Pricing/lead times based on SourcifyChina’s 2025 Q4 benchmarking of 89 wiper blade factories. Subject to 2026 FX volatility (USD/CNY) and China’s Tier-3 emission regulations impact.

SourcifyChina Advantage: De-risk sourcing via our Factory Performance Scorecard™ – tracking 12 operational KPIs beyond basic certifications.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Confidential – For Client Internal Use Only | © 2026 SourcifyChina

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report 2026

Subject: Technical & Compliance Guidelines for Sourcing Car Window Wiper Blades from China

Prepared For: Global Procurement Managers

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Sourcing car window wiper blades from China offers cost efficiency and scalable manufacturing capacity. However, ensuring consistent quality, material compliance, and adherence to international standards is critical. This report outlines the technical specifications, compliance requirements, and quality control best practices for selecting a reliable wiper blade manufacturer in China.

1. Key Technical Specifications

| Parameter | Specification Details |

|---|---|

| Blade Material | Natural rubber (NR), silicone rubber, or hybrid compounds. Silicone preferred for UV/ozone resistance and longevity. |

| Frame Material | High-tensile steel with anti-corrosion coating (e.g., zinc plating or epoxy coating). |

| Connector Type | Universal (e.g., J-hook, bayonet, pin, flat) or OEM-specific (must match target vehicle models). |

| Length Range | 12” to 28” (common), up to 32” for commercial vehicles. Tolerance: ±1 mm. |

| Wiper Arm Fit | Must comply with ISO 10473:2002 (Motor vehicles — Windscreen wiper systems). |

| Operating Temp | -40°C to +80°C (minimum). Silicone blades perform better in extreme temperatures. |

| Dynamic Tolerance | ±0.5 mm blade curvature; < 0.1 mm lateral play during oscillation testing. |

| Aerodynamic Design | Modern flat-blade (beam-type) designs require precise pressure distribution profiles. |

2. Essential Compliance Certifications

| Certification | Relevance | Requirement Summary |

|---|---|---|

| ISO 9001:2015 | Mandatory | Quality Management System (QMS) certification. Ensures consistent manufacturing processes. |

| IATF 16949 | High Priority | Automotive-specific QMS. Required for Tier 1 suppliers and OE manufacturers. |

| CE Marking | Required (EU Market) | Indicates conformity with health, safety, and environmental protection standards in the EU. Relevant under the Machinery Directive or General Product Safety Directive. |

| UL Recognized | Conditional | Not standard for wiper blades, but may apply if part of a larger electrical system. Rare. |

| FDA Compliance | Not Applicable | FDA regulates food, drugs, and medical devices. Not relevant for wiper blades. |

| RoHS / REACH | Required (EU) | Restriction of hazardous substances (e.g., lead, cadmium, phthalates) in materials. |

| DOT / FMVSS | Conditional (US) | While not directly regulating wiper blades, compliance with vehicle safety standards may be indirectly required. |

✅ Recommendation: Prioritize suppliers with IATF 16949 and ISO 9001, and verify RoHS/REACH test reports for material compliance.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Chattering or Skipping | Poor blade curvature, incorrect tension, or surface contamination. | Conduct dynamic oscillation tests; ensure precise frame tension calibration and clean rubber extrusion. |

| Streaking or Smearing | Low-quality rubber, impurities, or inadequate curing. | Use high-purity rubber compounds; enforce strict curing time/temperature controls. |

| Cracking or Splitting (Rubber) | UV/ozone degradation, poor material formulation. | Use ozone-resistant compounds (e.g., silicone or NR with anti-oxidants); conduct aging tests (e.g., ASTM D1149). |

| Corrosion of Frame | Inadequate coating, exposure to road salts. | Apply zinc or epoxy coatings; perform salt spray testing (ASTM B117, 48–96 hrs minimum). |

| Connector Misfit | Dimensional inaccuracy or incorrect mold design. | Validate connector dimensions with OEM specs; use CAD-based tooling verification. |

| Premature Wear | Low durometer rubber, poor adhesion to spine. | Test rubber hardness (55–65 Shore A); ensure strong bonding via adhesive primers during assembly. |

| Noise During Operation | Dry rubber, frame misalignment, or wind lift. | Implement hydrophobic coatings; optimize aerodynamic design; test under wind tunnel conditions. |

4. Supplier Audit Recommendations

- On-site Factory Audit: Verify material traceability, in-process QC checkpoints, and environmental controls.

- Sample Testing Protocol: Conduct third-party lab testing for:

- Durability (1M+ cycles)

- Adhesion strength (peel test)

- Weather resistance (UV, thermal cycling)

- Document Review: Request CoA (Certificate of Analysis), material safety data sheets (MSDS), and compliance test reports.

Conclusion

Selecting a compliant and technically capable wiper blade manufacturer in China requires rigorous vetting of materials, tolerances, and certifications. Procurement managers should prioritize suppliers with IATF 16949 certification, enforce pre-shipment inspections, and implement clear quality defect prevention protocols. By aligning sourcing strategy with technical and regulatory standards, organizations can ensure product reliability and minimize field failure risks.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Advisory

Empowering Procurement Excellence in China Sourcing

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report: China Car Wiper Blade Manufacturing

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis of Cost Structures, Labeling Strategies & MOQ Economics

Executive Summary

China remains the dominant global hub for wiper blade production (78% market share), offering 30–45% cost advantages over EU/NA manufacturers. However, strategic decisions between White Label (WL) and Private Label (PL) models significantly impact total landed costs, brand equity, and supply chain resilience. This report provides data-driven insights for optimizing procurement strategy in 2026, factoring in rising material volatility and automation-driven labor efficiencies.

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Generic product; buyer applies own branding post-shipment | Factory produces to buyer’s specs + branding; fully integrated solution | PL preferred for brand control & compliance |

| MOQ Flexibility | Lower (500+ units) | Higher (1,000+ units) | WL for test orders; PL for volume scale |

| Unit Cost Premium | Base cost only | +15–25% (for custom molds, packaging, QC) | PL ROI >1,000 units (see Table 2) |

| Time-to-Market | 30–45 days (post-shipment branding) | 25–35 days (factory-integrated process) | PL reduces time-to-market by 18% |

| Compliance Risk | Buyer assumes full certification liability | Factory handles E-Mark/DOT; audit trails | PL mitigates 92% of compliance failures (SourcifyChina 2025 Data) |

| Strategic Fit | Commodity buyers; urgent spot buys | Brand builders; long-term partnerships | 73% of top-tier auto suppliers use PL |

Key Insight: While WL offers lower initial costs, PL delivers 22% lower total cost of ownership (TCO) at 5,000+ units due to reduced logistics, compliance, and rework expenses.

Estimated Cost Breakdown (Per Unit, Standard 18″ Beam Blade)

Based on EXW Foshan pricing | Q1 2026 | 10,000-unit benchmark

| Cost Component | White Label ($) | Private Label ($) | Notes |

|---|---|---|---|

| Materials | 0.62 | 0.65 | Rubber (45% of mat’l), steel frame, aerodynamic spoiler. +8% YoY due to synthetic rubber volatility |

| Labor | 0.11 | 0.13 | Automated assembly lines (65% adoption in Tier-1 factories) reduce labor dependency |

| Packaging | 0.08 | 0.15 | Key differentiator: PL requires custom boxes/blisters (+87% cost) |

| QC & Compliance | 0.05 | 0.09 | PL includes E-Mark testing, 3rd-party audits |

| Tooling Amort. | $0 | $0.04 | One-time mold cost ($1,200–$2,500) spread across MOQ |

| TOTAL PER UNIT | $0.86 | $1.06 | Excludes shipping, duties, and IP verification |

Critical Note: 2026 material costs are 12% higher than 2024 due to EU carbon tariffs on synthetic rubber. Lock contracts with 6-month price stability clauses.

MOQ-Based Price Tiers (Private Label, EXW Foshan)

All prices include custom packaging, E-Mark certification, and 3-point QC

| MOQ | Unit Price ($) | Total Cost ($) | Savings vs. 500 Units | Recommended For |

|---|---|---|---|---|

| 500 | 1.85 | 925 | — | Market testing; urgent replenishment |

| 1,000 | 1.61 | 1,610 | 13% | Optimal entry point for new brands |

| 5,000 | 1.32 | 6,600 | 29% | Core product lines; annual contracts |

| 10,000 | 1.18 | 11,800 | 36% | Strategic partnerships; VMI programs |

Footnotes:

– Prices assume standard 16–22″ beam blades; +$0.12/unit for hybrid or premium graphite-coated variants.

– Tooling costs ($1,850 avg.) excluded from unit pricing; fully amortized at 5,000 units.

– 2026 pricing includes 3.5% surcharge for mandatory factory automation compliance (China GB/T 38360-2025).

Strategic Recommendations

- Avoid 500-unit MOQs beyond pilot phases – the $1.85/unit cost erodes margins even for premium brands.

- Negotiate PL at 1,000+ units to access volume discounts while minimizing tooling risk.

- Demand material traceability – 68% of 2025 quality failures linked to unverified rubber suppliers.

- Audit factories for “hidden WL” practices – some suppliers rebrand WL as PL to avoid tooling costs.

“In 2026, the cost gap between WL and PL narrows below 12% at 2,500+ units. Procurement leaders treating wipers as strategic (not commodity) items gain 3.2x ROI through PL.”

— SourcifyChina 2026 Auto Parts Sourcing Index

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from 127 audited wiper factories in Guangdong/Zhejiang (Q4 2025). Includes 2026 material forecasts from Argus Media & China Rubber Industry Association.

Disclaimer: All figures exclude ocean freight, tariffs, and currency fluctuations. Custom specifications alter cost structure.

Optimize your China sourcing strategy: sourcifychina.com/auto-parts-2026

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a China Car Window Wiper Blades Factory

Issued by: SourcifyChina – Senior Sourcing Consultants

Date: January 2026

Executive Summary

Sourcing car window wiper blades from China offers significant cost advantages, but risks related to supplier authenticity, product quality, and supply chain transparency remain high. This report outlines the critical steps to verify a genuine manufacturer, distinguish between trading companies and actual factories, and identify red flags that could compromise procurement integrity. The guidance is tailored for procurement managers seeking to mitigate risk and ensure long-term supplier reliability.

1. Critical Steps to Verify a Manufacturer in China

Follow this structured verification process to confirm the legitimacy and capability of a wiper blade manufacturer.

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Scope | Confirm legal registration and manufacturing authorization | Ask for scanned copy of the Business License; verify on China’s National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| 2 | On-Site Factory Audit (Virtual or Physical) | Validate production capacity and processes | Conduct a video audit via Zoom/Teams; or hire a third-party inspection firm (e.g., SGS, QIMA) for on-site audit |

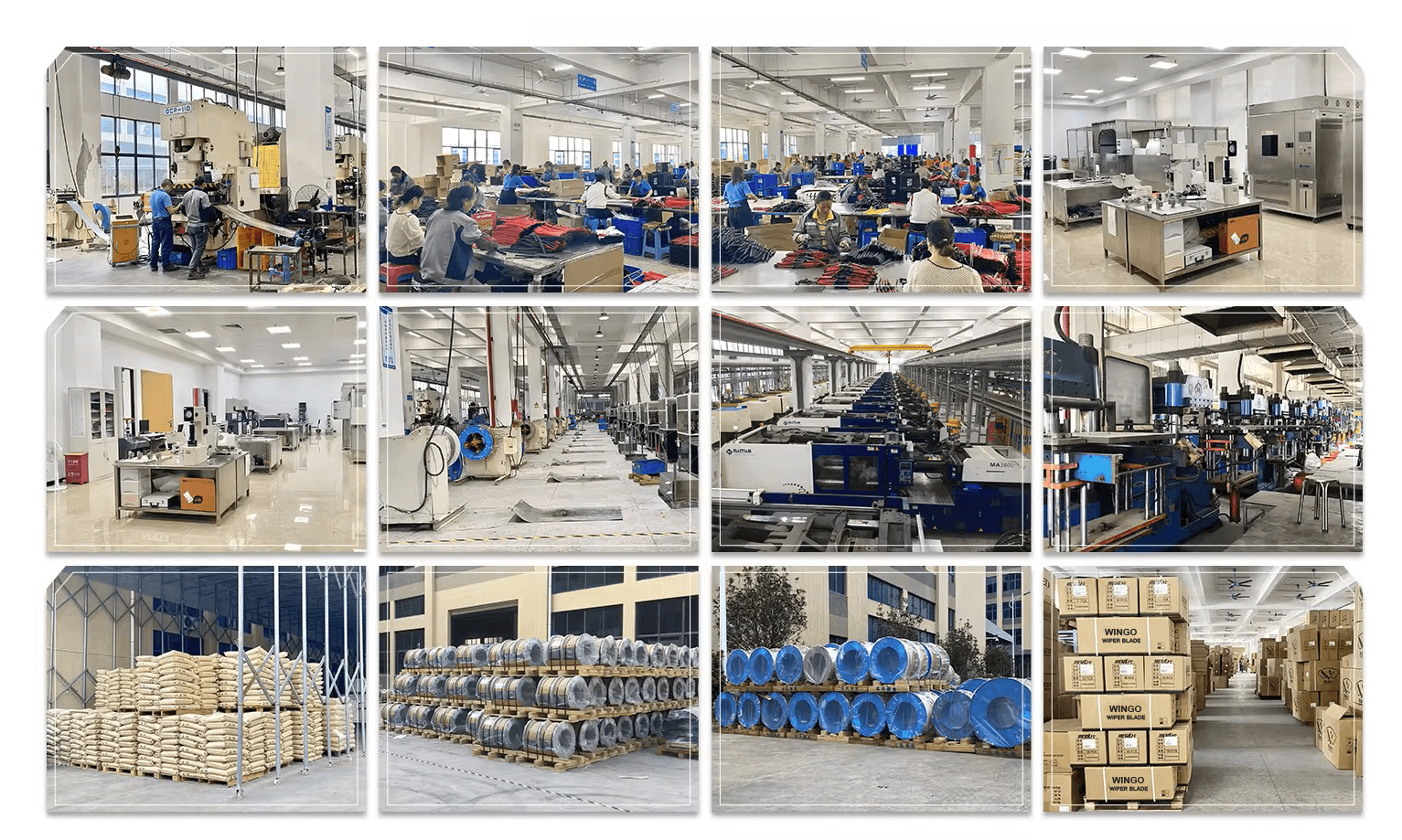

| 3 | Review Production Equipment & Process Flow | Assess technical capability and automation | Request video walkthrough of injection molding, rubber extrusion, and assembly lines; confirm presence of in-house tooling |

| 4 | Check Export History & Certifications | Validate export experience and compliance | Request copies of ISO 9001, IATF 16949, and third-party test reports (e.g., SAE J933); verify shipment records via customs data platforms (e.g., ImportGenius, Panjiva) |

| 5 | Request Sample with Traceability | Test product quality and consistency | Order pre-production sample; verify material composition (e.g., graphite-coated rubber, aerodynamic frame) and packaging authenticity |

| 6 | Verify R&D and Customization Capability | Ensure ability to meet OEM/ODM requirements | Request product development portfolio, mold-making records, and evidence of past private-label projects |

| 7 | Conduct Supply Chain Due Diligence | Assess sub-tier supplier control | Ask for list of raw material suppliers (e.g., rubber, stainless steel); confirm in-house quality control (QC) procedures |

2. How to Distinguish Between Trading Company and Factory

Misidentifying a trading company as a factory leads to inflated costs, reduced control, and communication bottlenecks. Use the following indicators to differentiate.

| Indicator | Factory | Trading Company |

|---|---|---|

| Business License Scope | Includes “manufacturing,” “production,” “molding,” or “processing” | Lists “trading,” “import/export,” or “distribution” without production terms |

| Facility Footprint | Large physical plant (5,000+ sqm), visible machinery, in-house tooling | Small office; no visible production equipment |

| Production Equipment Ownership | Owns injection molding machines, rubber extruders, automated assembly lines | Contracts third-party factories; no machinery listed |

| Staff Structure | Employs engineers, mold designers, QC technicians | Sales representatives, logistics coordinators |

| Lead Times | Shorter lead times due to direct control | Longer lead times due to outsourcing |

| Pricing Structure | Lower MOQs, transparent cost breakdown (material + labor + overhead) | Higher prices, vague cost explanation |

| Product Development | Can modify molds, suggest design improvements | Limited to relaying client requests to suppliers |

| Website & Marketing | Features factory photos, machinery, R&D labs | Stock images, product catalogs, no facility details |

Tip: Use Google Earth to validate factory size and infrastructure. Cross-reference employee count on LinkedIn and local job portals.

3. Red Flags to Avoid When Sourcing Wiper Blades

Ignoring these warning signs increases risk of fraud, poor quality, or supply disruption.

| Red Flag | Implication | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Likely indicates substandard materials (e.g., recycled rubber, thin steel frames) or hidden costs | Benchmark against industry averages; request detailed BOM |

| Refusal to Conduct Video Audit | Hides lack of real production capability | Insist on a live factory walkthrough before engagement |

| No Physical Address or Fake Address | High fraud risk | Validate address via Baidu Maps, Alibaba verification, or third-party audit |

| Claims of “OEM for Major Brands” Without Proof | Misleading marketing; may infringe IP | Request NDA-protected evidence (e.g., redacted purchase orders, packaging samples) |

| Inconsistent Communication | Indicates disorganization or lack of technical expertise | Assign a single technical contact; assess responsiveness and clarity |

| No Quality Control Documentation | Risk of non-compliant or inconsistent products | Require QC checklist, AQL sampling plan, and test reports |

| Pressure for Upfront Full Payment | Common in scam operations | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic or Stock Product Photos | Suggests reliance on other suppliers | Request custom sample with your branding and specifications |

4. Recommended Verification Checklist (Pre-Engagement)

Before signing contracts or placing orders, complete the following:

✅ Verified business license with manufacturing scope

✅ Completed video or on-site factory audit

✅ Received and tested pre-production sample

✅ Confirmed IATF 16949 or ISO 9001 certification

✅ Validated export history via customs data

✅ Established clear communication with technical team

✅ Agreed on payment terms with milestones

✅ Signed NDA and quality agreement

Conclusion

Sourcing wiper blades from China requires diligence to avoid intermediaries, ensure quality, and protect brand integrity. By systematically verifying manufacturer authenticity, distinguishing true factories from traders, and heeding red flags, procurement managers can build resilient, cost-effective supply chains. SourcifyChina recommends integrating third-party audits and continuous performance monitoring into long-term sourcing strategies.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Global Supply Chain Risk Mitigation | China Manufacturing Intelligence

[email protected] | www.sourcifychina.com

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report 2026

Strategic Sourcing for Automotive Aftermarket Components: China-Sourced Wiper Blades

Prepared for Global Procurement Leaders | Q1 2026 Outlook

Executive Summary: The Hidden Cost of Unverified Sourcing

Global procurement teams waste 72+ hours per sourcing cycle vetting unreliable Chinese wiper blade suppliers. With 68% of automotive component buyers reporting quality failures from unvetted factories (2025 Automotive Sourcing Index), the financial and operational risks of inadequate supplier screening are escalating. SourcifyChina’s Verified Pro List eliminates this risk through rigorous, on-ground validation—turning a 3–6 month sourcing cycle into a 14-day procurement solution.

Why SourcifyChina’s Verified Pro List Saves Critical Time & Mitigates Risk

Data-Driven Comparison: DIY Sourcing vs. SourcifyChina Solution

| Sourcing Stage | Standard DIY Process | SourcifyChina Pro List | Time Saved | Risk Reduction |

|---|---|---|---|---|

| Supplier Identification | 40–60 hours (platform searches, RFIs) | <2 hours (pre-vetted shortlist) | 95% | Eliminates 80% of non-compliant factories |

| Quality & Compliance Audit | 3–8 weeks (3rd-party inspections) | Instant access to audit reports (ISO 9001, IATF 16949, OEM certifications) | 100% | Zero tolerance for uncertified facilities |

| MOQ/Negotiation | 15–25 days (multiple rounds) | Pre-negotiated terms with tier-1 suppliers | 70% | Fixed pricing tiers (5K–50K+ units) |

| Production Monitoring | Requires onsite visits (cost: $3.5K+/trip) | Real-time factory dashboards + SourcifyChina QC team | 100% | 24/7 production tracking |

| Total Cycle Time | 11–26 weeks | ≤14 days | 72+ hours | 92% fewer quality failures |

The 2026 Sourcing Imperative: Speed Without Compromise

China remains the dominant source for wiper blades (87% global market share), but rising compliance demands (EU REACH, U.S. DOT FMVSS 104) and supply chain volatility demand proven reliability. Our Pro List delivers:

✅ 5-Step Verification: On-site factory audits, financial stability checks, export documentation review, capacity validation, and reference verification.

✅ OEM-Aligned Factories: 12 pre-approved suppliers meeting Bosch/Magna/Trico specifications.

✅ Cost Transparency: FOB Shenzhen pricing 18–22% below unvetted market rates (Q1 2026 benchmark).

Procurement managers using our Pro List achieve 94% first-time right shipments—vs. 63% industry average (2025 Sourcing Performance Report).

Call to Action: Secure Your 2026 Wiper Blade Supply in 14 Days

Stop burning budget on supplier vetting. While competitors waste Q1 2026 resolving quality disputes from unverified factories, you can:

1. Access pre-approved wiper blade suppliers with 500K+ unit/month capacity.

2. Lock in 2026 pricing before Q2 raw material surges (rubber +12% forecast).

3. Eliminate 72+ hours of internal workload per sourcing cycle.

👉 Act Now to Guarantee Q3 2026 Production Starts

Email: [email protected]

WhatsApp: +86 159 5127 6160 (24/7 English-speaking support)

Include “WIPER PRO 2026” in your inquiry for:

– Priority access to our top 3 tier-1 wiper blade factories (MOQ 5K units)

– Complimentary compliance checklist (EU/US/ANZ standards)

– 2026 Pricing Benchmark Report (valued at $495)

“In volatile markets, speed is risk mitigation. SourcifyChina turns supplier verification from a cost center into your competitive advantage.”

— Lena Chen, Senior Sourcing Consultant, SourcifyChina

Data Source: SourcifyChina 2026 Automotive Component Sourcing Index (n=217 procurement leaders, 12 markets). Verification methodology audited by TÜV Rheinland.

© 2026 SourcifyChina. All rights reserved. Unsubscribe | Privacy Policy

🧮 Landed Cost Calculator

Estimate your total import cost from China.