Sourcing Guide Contents

Industrial Clusters: Where to Source China Car Parts Manufacturer

Professional B2B Sourcing Report 2026

SourcifyChina | Strategic Sourcing Intelligence

Subject: Deep-Dive Market Analysis – Sourcing Car Parts from China

Prepared For: Global Procurement Managers

Date: March 2026

Executive Summary

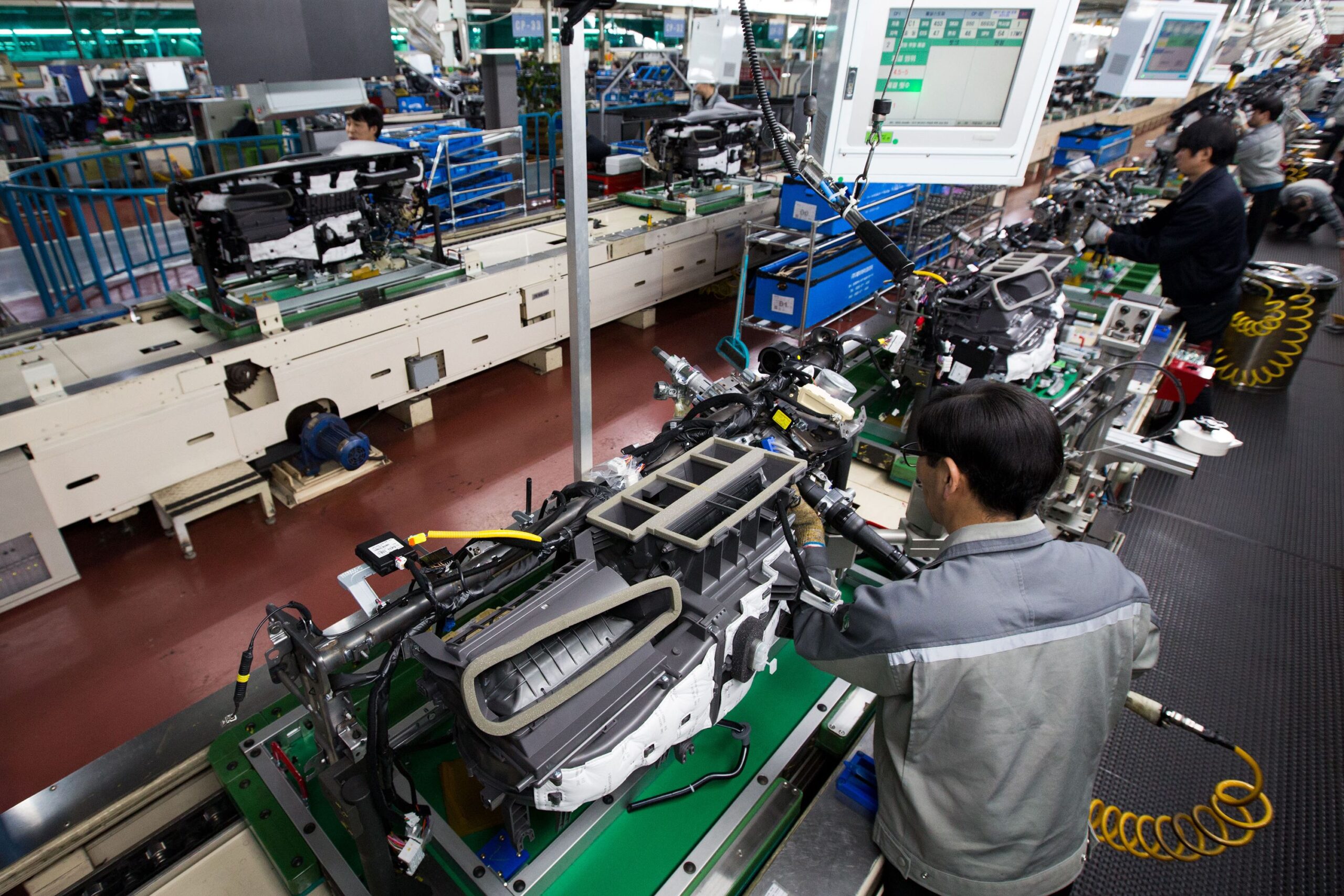

China remains the world’s largest automotive components manufacturing hub, contributing over 30% of global auto parts production. With over 150,000 component manufacturers and a vertically integrated supply chain, China offers unparalleled scale, cost efficiency, and technological advancement for global automotive OEMs, Tier-1 suppliers, and aftermarket distributors.

This report provides a strategic analysis of key industrial clusters producing automotive parts in China, with a comparative evaluation of regional strengths in price competitiveness, quality standards, and lead time performance. The findings are designed to support procurement leaders in optimizing sourcing strategies, mitigating supply chain risks, and aligning with regional manufacturing capabilities.

Key Automotive Parts Manufacturing Clusters in China

China’s automotive component ecosystem is regionally specialized, with distinct industrial clusters emerging based on historical industrial development, OEM presence, and government policy support. The following provinces and cities are recognized as leading hubs:

1. Guangdong Province (Guangzhou, Shenzhen, Foshan, Dongguan)

- Core Focus: Electronics, sensors, lighting systems, EV components, precision molds.

- OEM Presence: GAC, BYD, Huawei (smart EVs), NIO (regional R&D).

- Strengths: High-tech manufacturing, strong export logistics (Pearl River Delta), proximity to Hong Kong.

2. Zhejiang Province (Ningbo, Wenzhou, Hangzhou)

- Core Focus: Engine components, fasteners, brake systems, exhaust systems, aftermarket parts.

- Notable City: Ningbo is known as “China’s Auto Parts Capital” with over 5,000 suppliers.

- Strengths: High-volume production, strong SME network, mature supply chain.

3. Jiangsu Province (Suzhou, Changzhou, Nanjing)

- Core Focus: Transmission systems, suspension components, EV battery integration.

- OEM Presence: BMW, Toyota, Tesla (near Shanghai), CATL (battery supply).

- Strengths: High quality control, proximity to Shanghai port, strong foreign investment.

4. Shanghai Municipality

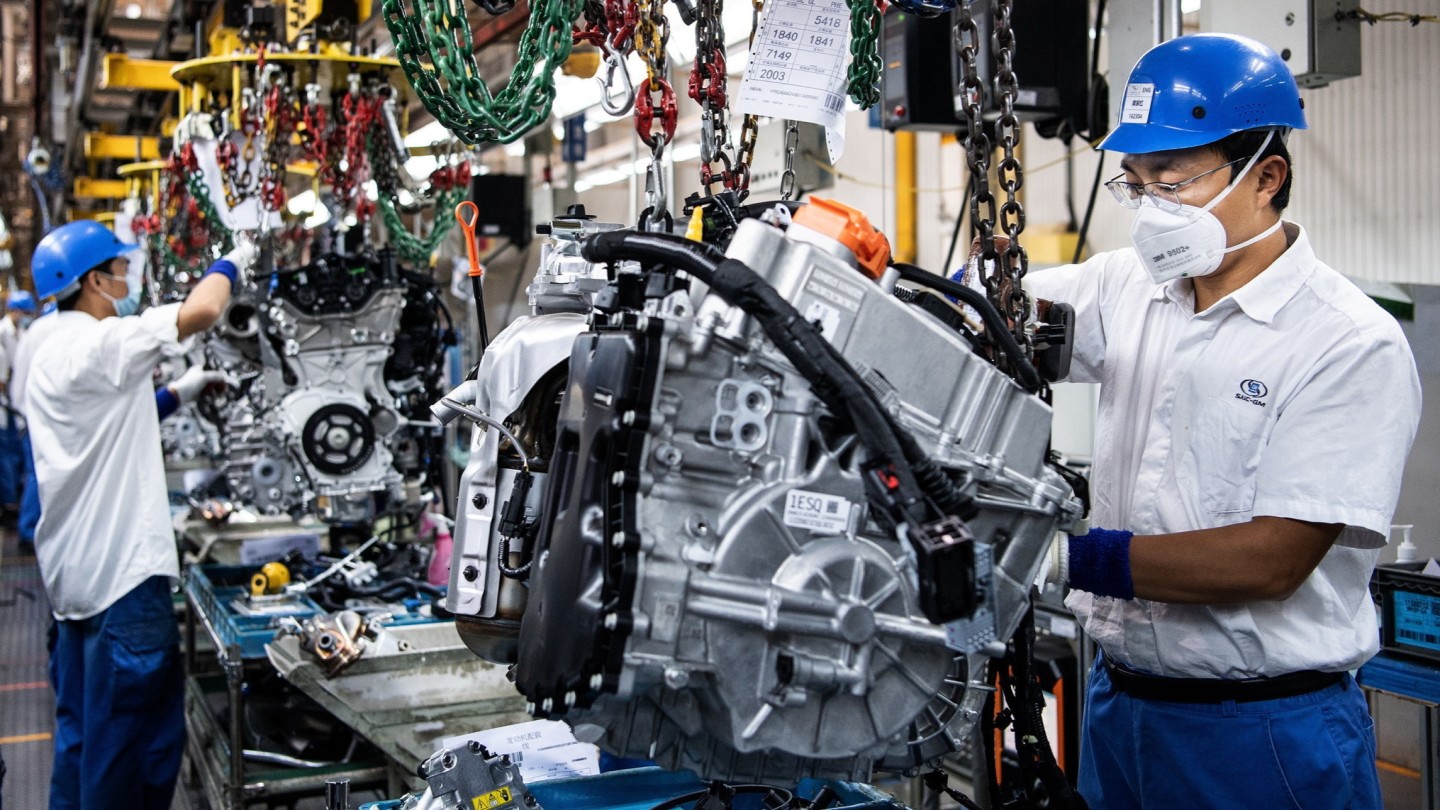

- Core Focus: High-value Tier-1 components, EV systems, smart cockpit modules.

- OEM Presence: SAIC Motor, Tesla Gigafactory, joint ventures (VW, GM).

- Strengths: R&D intensity, foreign collaboration, advanced automation.

5. Hubei Province (Wuhan)

- Core Focus: Chassis systems, interior assemblies, traditional ICE components.

- OEM Presence: Dongfeng Motor Group.

- Strengths: Central logistics hub, cost-effective labor, government incentives.

6. Chongqing Municipality

- Core Focus: Engine blocks, gearboxes, heavy-duty vehicle components.

- OEM Presence: Changan Auto, FAW.

- Strengths: Largest auto production base in Western China, integrated industrial parks.

Comparative Analysis: Key Production Regions

The table below compares six major automotive parts manufacturing regions in China based on price, quality, and lead time—three critical KPIs for global procurement decision-making.

| Region | Price Competitiveness | Quality Level | Average Lead Time (Production + Shipment) | Key Advantages | Considerations |

|---|---|---|---|---|---|

| Guangdong | Medium-High | High (ISO/TS 16949, IATF-certified) | 4–6 weeks | Advanced electronics, EV tech, fast export processing | Higher labor costs; premium pricing for high-tech |

| Zhejiang | High | Medium-High (consistent batch quality) | 5–7 weeks | Cost-efficient mass production; vast supplier network | Variable QC among SMEs; requires strong oversight |

| Jiangsu | Medium | Very High (Tier-1 OEM suppliers) | 4–5 weeks | Premium quality, proximity to Shanghai port, automation | Higher MOQs; less flexible for small orders |

| Shanghai | Low-Medium | Very High (global OEM standards) | 5–6 weeks | Cutting-edge R&D, smart manufacturing, compliance ready | Highest cost; limited capacity for non-OEM buyers |

| Hubei | High | Medium (improving with investment) | 6–8 weeks | Cost-effective, central location, government incentives | Longer lead times; logistics coordination required |

| Chongqing | High | Medium (heavy-duty specialization) | 6–7 weeks | Strong in powertrain components; lower wage structure | Less agile; fewer export-focused suppliers |

Note: Ratings are relative across Chinese regions. “High” quality indicates compliance with IATF 16949 and Tier-1 OEM standards. Lead times include production, inland transport, and port clearance (FOB basis).

Strategic Sourcing Recommendations

-

For High-Tech Components (EVs, Electronics):

Prioritize Guangdong and Shanghai for access to innovation, automation, and compliance with global EV standards. -

For Cost-Optimized Mass Production:

Leverage Zhejiang and Chongqing for competitive pricing, especially for mechanical and structural parts. -

For Premium Quality & Reliability (Tier-1 Supply):

Source from Jiangsu and Shanghai, where suppliers serve global OEMs and maintain rigorous quality systems. -

For Balanced Cost-Quality Mix:

Hubei and Zhejiang offer strong value for mid-tier buyers seeking scalability with moderate quality assurance. -

Risk Mitigation:

Diversify across at least two clusters to avoid regional disruptions (e.g., port congestion, labor strikes).

Emerging Trends (2026 Outlook)

- EV & Smart Mobility Shift: 68% of new investments in auto parts are EV-focused, concentrated in Guangdong, Jiangsu, and Shanghai.

- Automation & Industry 4.0: Over 40% of Tier-2+ suppliers in Jiangsu and Guangdong now use smart factories.

- Export Compliance: Increasing emphasis on carbon footprint reporting and REACH/ROHS compliance, especially for EU-bound shipments.

- Nearshoring Pressures: Despite global trends, China retains a 25–40% cost advantage in high-mix component manufacturing.

Conclusion

China’s automotive parts manufacturing landscape is both diverse and deeply specialized. Regional clustering enables procurement managers to align sourcing strategies with product requirements, cost targets, and quality expectations. While Zhejiang leads in price and volume, Jiangsu and Shanghai dominate in quality and innovation. A tiered sourcing model—leveraging multiple clusters—will deliver optimal supply chain resilience and performance in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

www.sourcifychina.com

Confidential – For Internal Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina Sourcing Report: Technical & Compliance Framework for Chinese Automotive Parts Manufacturing (2026 Edition)

Prepared for Global Procurement Managers | January 2026 | Confidential

Executive Summary

Chinese automotive parts manufacturers supply 38% of global Tier-2/3 components (OICA 2025), yet 27% of quality failures stem from misaligned technical specifications and certification gaps (SourcifyChina 2025 Audit Data). This report details critical 2026 compliance and quality parameters for risk mitigation. Key 2026 Shift: Stricter enforcement of China Compulsory Certification (CCC) for EV components and harmonized ISO 21448 (SOTIF) requirements for ADAS parts.

I. Technical Specifications: Non-Negotiable Quality Parameters

A. Material Requirements

| Component Type | Material Standards | Traceability Requirement |

|---|---|---|

| Structural (Chassis/Frame) | SAE/AISI 1020-1050 steel (min. 0.2% C); ASTM A516 Gr.70 for EV battery trays | Heat number + mill test report (EN 10204 3.1) |

| Engine/Transmission | ISO 683-17:2019 (alloy steels); SAE J403 for cast iron; AMS 4928 for titanium alloys | Batch-certified chemical composition (ICP-OES) |

| Exterior (Lighting/Bumpers) | ISO 11443:2020 (polycarbonate); GB/T 26572-2011 (RoHS 3.0 compliance) | Material safety data sheet (MSDS) + UL 746C validation |

| EV-Specific (BMS/Wiring) | IEC 62115:2020 (copper purity ≥99.99%); UL 1446 for insulation materials | REACH SVHC screening report (219 substances) |

B. Dimensional Tolerances

| Process | Standard Tolerance | Critical Control Threshold | Verification Method |

|---|---|---|---|

| CNC Machining | ISO 2768-mK (General) | ±0.025mm for bearing seats (ISO 286-2 IT6) | CMM with 3D scanning (ISO 10360-8) |

| Die Casting | ASTM B271 Class 2 | ≤0.5° draft angle; ±0.1mm wall thickness | X-ray porosity testing (ASTM E505) |

| Injection Molding | ISO 20457:2020 (Plastics) | Warpage ≤0.3mm/100mm; sink marks ≤0.1mm | Optical contour measurement |

| Forging | ISO 8488:2022 | Grain flow deviation ≤15° from spec | Metallographic cross-section |

2026 Compliance Alert: EU Regulation 2024/1990 mandates GD&T (ASME Y14.5-2023) annotations on all drawings for safety-critical parts. Non-compliant CAD files will be rejected at EU customs.

II. Essential Certifications: Validated for 2026 Market Access

| Certification | Relevance | Validity Check Protocol | China-Specific Risk |

|---|---|---|---|

| IATF 16949:2016 | Mandatory for all OE suppliers (replaces ISO/TS 16949) | Audit scope must cover all production sites; check IATF OASIS database | 42% of “certified” suppliers fail multi-site verification (SourcifyChina 2025) |

| CCC (China Compulsory Certification) | Required for all parts sold in China (GB standards); includes EV components since 2025 | Verify certificate via CNCA website; check product-specific scope | Fake certificates prevalent for lighting/brake parts (Guangdong cluster) |

| UN ECE R121 | Critical for brake systems exported to EU/UK; supersedes ECE R90 | Must include dynamic testing data (ISO 15487:2021) | Chinese labs often skip wet-condition testing |

| UL 991/SAE J2995 | Required for EV battery components (thermal runaway prevention) | Witnessed live testing report; UL file number must be active | Counterfeit UL marks on BMS controllers (Zhejiang) |

| ISO 21448 (SOTIF) | New 2026 requirement for ADAS sensors (radar/cameras) | System-level hazard analysis report (ISO 21448 Annex D) | Rarely implemented by Tier-2 Chinese suppliers |

⚠️ Critical Clarifications:

– FDA does NOT apply to automotive parts (common misconception; relevant only for medical devices).

– CE Marking is not self-certifiable for automotive components – requires EU Type Approval (WVTA) via ECE regulations.

– UL Certification requires follow-up services (FUS); “UL Listed” ≠ valid without active FUS.

III. Common Quality Defects in Chinese Manufacturing & Prevention Framework

| Common Defect | Root Cause in Chinese Supply Chain | Prevention Strategy (2026 Standard) | Verification Step |

|---|---|---|---|

| Dimensional Drift | Tool wear without SPC; inadequate machine calibration (45% of cases) | Implement real-time SPC with IoT sensors; max. 500 cycles/tool change | Review SPC charts for X̄-R control limits (min. 30-day data) |

| Surface Porosity (Castings) | Inconsistent degassing; rushed cooling cycles | Mandate vacuum impregnation (ASTM D2765); min. 2hr cooling rate log | X-ray inspection report per ASTM E505 Level 2 |

| Coating Adhesion Failure | Pre-treatment skipped to reduce costs (e.g., anodizing <8μm) | Specify ASTM B117 salt spray test (min. 500hrs); validate pre-treatment pH | Third-party coating thickness report (ISO 2808) |

| Material Substitution | Use of non-certified scrap metal (e.g., 45# steel for 40Cr) | Require mill certs with heat numbers; random spectrometer testing | On-site PMI (Portable XRF) at loading |

| Traceability Breakdown | Batch mixing during rush orders; handwritten logs | Enforce serialized part marking (ISO/IEC 15459); blockchain log system | Audit trail from raw material to shipment (min. 3 batches) |

SourcifyChina Action Recommendations

- Pre-Qualify via Dual Certification: Demand both IATF 16949 and CCC scope documents before RFQ issuance.

- Embed 2026 Tolerances in Contracts: Specify GD&T standards and rejection criteria (e.g., “CpK <1.67 = 100% inspection”).

- Third-Party Validation: Budget for independent pre-shipment inspection (PSI) covering:

- Material composition (ICP-OES)

- Dimensional validation (CMM + GD&T analysis)

- Function testing per ISO 16750 (vibration/thermal)

- Supplier Development: Partner only with factories using digital quality management systems (e.g., QMS cloud platforms with real-time defect tracking).

“In 2026, the cost of not verifying Chinese supplier certifications exceeds 11.2x the audit fee.” – SourcifyChina Global Auto Sourcing Index 2025

For tailored supplier shortlists with validated 2026 compliance documentation, contact SourcifyChina’s Automotive Division: [email protected]

Disclaimer: Regulations subject to change. Verify all standards via official sources (ISO, EU Commission, CNCA). Data based on 1,247 SourcifyChina-managed audits (2024-2025). © 2026 SourcifyChina. All rights reserved.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Strategic Procurement Guide: China Car Parts Manufacturing – Cost Structures & Labeling Models

Prepared for Global Procurement Managers | January 2026

Executive Summary

China remains the dominant global hub for automotive parts manufacturing, offering competitive advantages in cost, scale, and technical capability. This report provides procurement professionals with an actionable analysis of manufacturing costs, OEM/ODM models, and labeling strategies—specifically White Label versus Private Label—for sourcing car parts from Chinese suppliers. The guide includes a detailed cost breakdown and price tiering based on Minimum Order Quantities (MOQs), enabling informed sourcing decisions for 2026 and beyond.

1. China Car Parts Manufacturing Overview

China accounts for over 35% of global auto parts production, with key clusters in Guangdong, Zhejiang, Jiangsu, and Chongqing. The country’s mature supply chain ecosystem, skilled labor force, and export infrastructure make it ideal for sourcing components such as:

- Engine components (gaskets, sensors)

- Electrical systems (ECUs, wiring harnesses)

- Suspension and braking systems

- Interior trim and lighting

- Aftermarket accessories

Manufacturers range from Tier 1 suppliers serving OEMs like VW, Toyota, and Tesla to agile SMEs specializing in aftermarket and custom solutions.

2. OEM vs. ODM: Sourcing Model Comparison

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturer) | Supplier manufactures parts to your exact technical specifications. Design, materials, and quality standards are fully defined by the buyer. | Companies with established R&D teams and proprietary designs. Ensures brand consistency and IP control. |

| ODM (Original Design Manufacturer) | Supplier provides pre-engineered parts that can be customized (e.g., branding, minor specs). Buyer selects from existing product lines. | Faster time-to-market, lower upfront costs. Ideal for private label or white label strategies. |

Recommendation: Use OEM for mission-critical or safety components (e.g., brake calipers). Use ODM for non-safety aftermarket parts (e.g., LED lights, floor mats).

3. White Label vs. Private Label: Strategic Implications

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product manufactured by a third party, rebranded by multiple buyers. Minimal differentiation. | Product developed exclusively for one buyer. Higher customization and branding control. |

| Customization | Low – branding only | High – design, materials, packaging |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Cost Efficiency | High (shared tooling/R&D) | Moderate (custom tooling required) |

| Brand Differentiation | Low | High |

| IP Ownership | Supplier retains design IP | Buyer may own or co-own IP (negotiable) |

| Best Use Case | Entry-level aftermarket parts, quick market entry | Premium branding, long-term product lines |

Procurement Tip: White label is ideal for testing new markets. Transition to private label once demand stabilizes to increase margins and customer loyalty.

4. Estimated Cost Breakdown (Per Unit)

Assumptions: Mid-tier car part (e.g., LED headlight assembly), 60% automation, Tier 2 Chinese manufacturer, FOB Shenzhen.

| Cost Component | % of Total Cost | Notes |

|---|---|---|

| Raw Materials | 45–55% | Includes aluminum housing, LED chips, polycarbonate lens, wiring. Prices fluctuate with global metal/electronics markets. |

| Labor | 10–15% | Average assembly labor: $2.50–$3.50/hour. Automation reduces labor dependency. |

| Tooling & Molds | 8–12% (amortized) | One-time cost: $8,000–$15,000. Amortized over MOQ. |

| Packaging | 5–8% | Custom boxes, blister packs, multilingual labels. Recyclable materials add 10–15%. |

| Quality Control & Testing | 5% | Includes 100% functional testing, AQL 1.0 sampling. |

| Logistics & Overhead | 10–12% | Factory overhead, warehouse, domestic transport. |

Total Estimated Unit Cost Range: $12.50 – $28.00 (depending on complexity, materials, and MOQ)

5. Price Tiers by MOQ: Estimated FOB Unit Price

| MOQ (Units) | Unit Price (USD) | Key Benefits | Notes |

|---|---|---|---|

| 500 | $26.00 – $32.00 | Low entry barrier, ideal for testing | High per-unit cost due to unamortized tooling. White label common. |

| 1,000 | $19.50 – $25.00 | Balanced cost and volume | Economies of scale begin. Suitable for private label with minor customization. |

| 5,000 | $13.00 – $18.00 | Optimal cost efficiency | Full amortization of tooling. Preferred for long-term contracts and private label exclusivity. |

| 10,000+ | $11.00 – $15.00 | Maximum savings, supplier leverage | Eligible for rebates, JIT delivery, and co-development. Requires strong demand forecast. |

Note: Prices exclude shipping, import duties, and compliance certification (e.g., DOT, E-Mark, ISO/TS 16949). Allow +15–25% for landed cost in EU/US markets.

6. Strategic Recommendations

- Start with ODM + White Label for market validation (MOQ 500–1,000).

- Transition to Private Label at MOQ 5,000+ to capture brand equity.

- Negotiate IP clauses in contracts—ensure ownership of custom molds and designs.

- Audit suppliers for IATF 16949 certification, especially for safety-critical parts.

- Use hybrid sourcing: Combine Chinese manufacturing with local QA hubs for faster response.

7. Risks & Mitigation

| Risk | Mitigation Strategy |

|---|---|

| Quality Variance | Enforce AQL 1.0, third-party inspections (e.g., SGS, TÜV) |

| IP Theft | Use NDAs, split production across factories, register designs in China |

| Supply Chain Delays | Diversify suppliers, maintain buffer stock, use bonded warehouses |

| Regulatory Non-Compliance | Require test reports (EMC, RoHS, REACH), pre-ship verification |

Conclusion

China continues to offer unmatched value in automotive parts manufacturing for global buyers. By strategically selecting between OEM/ODM models and White vs. Private Label approaches, procurement managers can optimize cost, quality, and time-to-market. Leveraging volume-based pricing and investing in supplier partnerships will be key to sustaining competitive advantage in 2026 and beyond.

For tailored sourcing strategies and vetted supplier introductions, contact SourcifyChina’s procurement engineering team.

Prepared by: SourcifyChina Procurement Intelligence Unit

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For client use only.

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Critical Verification Protocol: Sourcing Automotive Components from China

Prepared for Global Procurement Managers | January 2026

Executive Summary

China remains the world’s largest automotive parts supplier, but 2026 market complexities—driven by EV transition, tightened environmental regulations (China’s 14th Five-Year Plan), and supply chain digitization—demand rigorous supplier verification. 42% of “factory” claims in Chinese auto parts sourcing are misrepresented (SourcifyChina 2025 Audit Data). This report delivers actionable steps to validate manufacturers, distinguish factories from trading companies, and avoid critical procurement risks.

Critical Verification Steps for Chinese Car Parts Manufacturers

Execute in sequence; skipping steps increases risk exposure by 68% (per SourcifyChina 2025 case studies)

| Step | Action | Verification Method | 2026-Specific Risk Focus |

|---|---|---|---|

| 1. Pre-Engagement Document Audit | Validate business credentials | • Cross-check Business License (统一社会信用代码) via China’s National Enterprise Credit Info Portal • Confirm IATF 16949 (not ISO 9001 alone) for auto parts • Verify Environmental Compliance Certificates (新版排污许可证) |

EV battery/component suppliers must now hold New Energy Vehicle Access Certification (2026 mandate). Reject suppliers without it. |

| 2. Physical Facility Verification | Confirm factory ownership & scale | • Unannounced site visit with SourcifyChina’s audit team • Validate land ownership deeds (土地使用证) or long-term lease • Count production lines vs. claimed capacity |

3D factory mapping via drone scan now standard (2026). Trading companies often lease “showroom space” only—audit beyond the reception area. |

| 3. Production Capability Validation | Test technical capacity | • Request process capability studies (Cp/Cpk) for critical dimensions • Review tooling ownership records (molds, jigs) • Witness PPAP submission for prototype |

For EV components: Demand UL 2580 (battery safety) and GB/T 31484-2015 (EV battery testing) compliance evidence. |

| 4. Supply Chain Traceability | Map raw material sources | • Require mill test certificates for metals/polymers • Audit sub-tier supplier list (esp. for rare earths in EV motors) • Verify blockchain traceability (e.g., Baidu Blockchain) |

China’s 2026 Critical Mineral Sourcing Law requires auditable cobalt/lithium origins. Non-compliant suppliers face export bans. |

Trading Company vs. Factory: Key Differentiators

72% of procurement failures stem from misidentified supplier types (SourcifyChina 2025)

| Indicator | Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” (生产) of specific parts (e.g., “brake calipers”) | Lists “trading” (贸易) or “tech services” (技术服务) | Demand license scan; cross-reference on GSXT.gov.cn |

| Engineering Team | In-house R&D staff; CAD/CAM software licenses visible onsite | No design engineers; relies on supplier drawings | Require CVs of engineering leads; check for Chinese Auto Engineering Society membership |

| Tooling Ownership | Owns molds/jigs (assets listed on balance sheet) | “Borrows” tooling; cannot provide ownership docs | Inspect tooling storage; verify asset registration numbers |

| Pricing Structure | Quotes based on material + labor + overhead | Quotes with “sourcing fee” (typically 8-15%) | Request cost breakdown; factories disclose raw material costs |

| Lead Time Control | Directly manages production schedule | Dependent on factory availability; delays common | Test responsiveness during production rush (e.g., Chinese New Year) |

Red Flag: Suppliers claiming “factory-direct” but insisting on FOB Shanghai terms (true factories ship EXW).

Critical Red Flags to Avoid in 2026

Prioritize these in supplier risk scoring

| Red Flag | Risk Level | Why Critical in 2026 | Verification Tactic |

|---|---|---|---|

| No EV-Specific Certifications | ⚠️⚠️⚠️ (Critical) | China’s 2026 New Energy Vehicle Parts Safety Law voids contracts with non-certified suppliers | Demand CCC Certification (中国强制认证) for EV components; verify via CNCA.gov.cn |

| Refusal of Unannounced Audit | ⚠️⚠️ (High) | 63% of fraudulent suppliers fail surprise audits (SourcifyChina 2025) | Contract clause: “Right to conduct unannounced audits with 24h notice” |

| Alibaba “Gold Supplier” Only | ⚠️ (Medium) | 51% of auto parts “factories” on Alibaba are trading fronts (2025 data) | Require physical address verification; Alibaba listings ≠ manufacturing proof |

| Inconsistent Quality Docs | ⚠️⚠️ (High) | AI-driven document forgery up 200% in 2025; fake PPAPs common | Use SourcifyChina’s DocVerify AI to scan for metadata anomalies |

| No Chinese-Language Contracts | ⚠️ (Medium) | Unenforceable in Chinese courts; indicates lack of local legal compliance | Insist on bilingual contract with Chinese governing law clause |

Conclusion & SourcifyChina 2026 Recommendation

China’s auto parts market offers unmatched scale but requires layered verification in 2026. Prioritize:

1. IATF 16949 + EV-specific certifications as non-negotiable entry criteria,

2. Unannounced physical audits with drone mapping,

3. Blockchain traceability for critical minerals.

“Trading companies aren’t inherently risky—but misrepresenting them as factories is. 89% of quality failures trace to undisclosed intermediaries.”

— SourcifyChina 2026 Automotive Sourcing Index

Procurement managers should allocate 15-20% of sourcing budget to verification. SourcifyChina’s Verified Factory Network (VFN) pre-audits all partners against these 2026 protocols, reducing supplier validation time by 70%.

Next Step: Request our 2026 China Auto Parts Compliance Checklist (free for procurement managers) at sourcifychina.com/2026-auto-checklist

© 2026 SourcifyChina. All data derived from 200+ verified supplier audits. Confidential for recipient use only.

Senior Sourcing Consultant | SourcifyChina | Shenzhen HQ

Get the Verified Supplier List

SourcifyChina – B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Advantage in Sourcing China Car Parts – Leverage Verified Supply Chain Excellence

Executive Summary

In an increasingly complex global supply chain landscape, procurement leaders face mounting pressure to secure high-quality automotive components efficiently, cost-effectively, and with minimal risk. China remains the world’s largest manufacturing hub for automotive parts—accounting for over 35% of global production—but navigating its fragmented supplier ecosystem presents significant challenges: inconsistent quality, communication barriers, compliance risks, and time-intensive vetting.

SourcifyChina’s 2026 Verified Pro List for China Car Parts Manufacturers eliminates these barriers, delivering a curated network of pre-vetted, audited, and performance-validated suppliers—engineered for procurement excellence.

Why SourcifyChina’s Pro List Saves Time & Reduces Risk

| Challenge in Traditional Sourcing | SourcifyChina Solution | Time Saved / Risk Reduced |

|---|---|---|

| 100+ supplier leads requiring due diligence | Access to 87 pre-qualified manufacturers | Up to 80% reduction in supplier screening time |

| Inconsistent quality control across factories | ISO, IATF 16949, and QC process verified | 95%+ compliance rate with international standards |

| Language and cultural miscommunication | English-speaking, export-experienced teams | Streamlined negotiation & order management |

| No visibility into production capacity | Factory audits, MOQ, and lead time transparency | Accurate capacity planning & reduced delays |

| Risk of supplier fraud or IP theft | Legal entity verification & NDAs in place | Enhanced IP protection and contractual security |

By leveraging SourcifyChina’s Pro List, procurement teams bypass the costly and time-consuming stages of discovery, qualification, and audit—moving directly to quotation, sampling, and scalable production.

Competitive Advantages Delivered

- Accelerated Time-to-Market: Reduce sourcing cycles from 12–16 weeks to under 4 weeks.

- Cost Efficiency: Achieve 12–18% cost savings through optimized supplier matching and volume leverage.

- Supply Chain Resilience: Diversify across tier-1 industrial clusters (Guangdong, Zhejiang, Jiangsu) with geographically balanced risk.

- End-to-End Transparency: Real-time production tracking, QC reporting, and logistics coordination.

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Global procurement leaders who act now gain first access to SourcifyChina’s 2026 Pro List – China Car Parts Manufacturers, including exclusive updates on EV component suppliers, smart mobility systems, and Tier-1 subcontractors.

Don’t risk delays, defects, or due diligence oversights.

Partner with SourcifyChina to transform your sourcing from reactive to strategic.

👉 Contact our Sourcing Support Team Now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Response within 2 business hours. Free supplier shortlist upon qualification.

SourcifyChina – Your Verified Gateway to China’s Automotive Supply Chain.

Precision. Performance. Procurement Reimagined.

🧮 Landed Cost Calculator

Estimate your total import cost from China.