Sourcing Guide Contents

Industrial Clusters: Where to Source China Car Manufacturing Statistics

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing Automotive Manufacturing Infrastructure in China

Executive Summary

This report provides a comprehensive market analysis for global procurement professionals seeking to understand and leverage China’s automotive manufacturing ecosystem. While “China car manufacturing statistics” are not a tangible product for sourcing, this analysis interprets the request as a strategic need to identify key industrial clusters in China responsible for automotive production, component manufacturing, and associated data-rich industrial zones. Our objective is to guide procurement teams in targeting high-efficiency regions for OEM partnerships, Tier 1/2 supplier sourcing, and data-informed supply chain decisions.

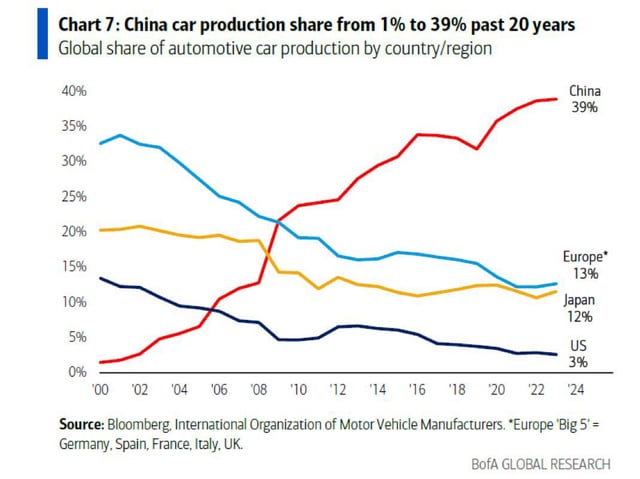

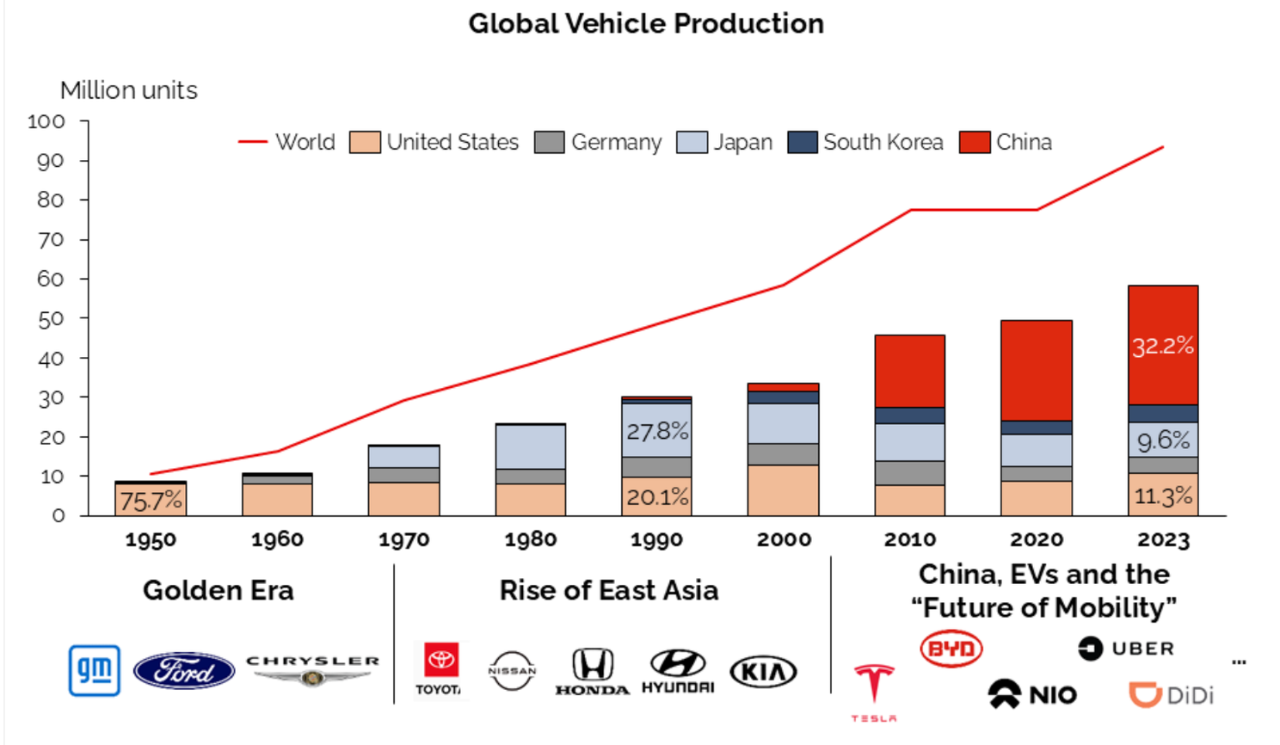

China remains the world’s largest automotive producer and exporter, accounting for over 30% of global vehicle output in 2025. The country’s automotive manufacturing landscape is highly regionalized, with distinct industrial clusters offering varying advantages in cost, quality, innovation, and logistics. Understanding these clusters is critical for optimizing procurement strategy, mitigating supply chain risk, and securing competitive advantage.

Key Automotive Industrial Clusters in China

China’s automotive manufacturing is concentrated in five major regional clusters, each with distinct specializations:

1. Pearl River Delta (Guangdong Province)

- Core Cities: Guangzhou, Shenzhen, Foshan

- Key Strengths:

- Home to GAC Group, BYD (HQ), and a dense network of EV and battery suppliers.

- Strong electronics integration (ideal for smart EVs).

- Advanced R&D in autonomous driving and connectivity.

- Specialization: Electric Vehicles (EVs), Battery Systems, Smart Mobility Solutions.

2. Yangtze River Delta (Shanghai, Jiangsu, Zhejiang)

- Core Cities: Shanghai, Ningbo, Hangzhou, Suzhou

- Key Strengths:

- Hosts SAIC Motor, Tesla’s Gigafactory (Shanghai), and numerous joint ventures (e.g., SAIC-Volkswagen, SAIC-GM).

- Highest concentration of Tier 1 suppliers (Bosch, Continental, ZF).

- Strong export infrastructure via Shanghai Port.

- Specialization: ICE & EV Production, High-End Components, Export-Oriented Manufacturing.

3. Chang’an Cluster (Chongqing & Sichuan)

- Core Cities: Chongqing, Chengdu

- Key Strengths:

- Historical base for Changan Automobile and a growing EV ecosystem.

- Lower labor and operational costs.

- Government incentives for inland manufacturing.

- Specialization: Mass-market ICE vehicles, Emerging EV Supply Chains.

4. Northeast Cluster (Liaoning, Jilin)

- Core Cities: Changchun (Auto Capital of China), Dalian

- Key Strengths:

- Home to FAW Group (First Automotive Works), one of China’s oldest automakers.

- Legacy strength in traditional ICE vehicles and heavy-duty trucks.

- Skilled workforce with decades of experience.

- Specialization: Traditional Vehicle Platforms, Commercial Vehicles.

5. Central Corridor (Hubei, Henan)

- Core Cities: Wuhan, Zhengzhou

- Key Strengths:

- Dongfeng Motor Corporation HQ in Wuhan.

- Strategic inland logistics hub.

- Rapid growth in NEV (New Energy Vehicle) investments.

- Specialization: Mid-tier EVs, Component Assembly, Logistics Efficiency.

Comparative Analysis: Key Automotive Production Regions

The table below compares leading provinces in China for automotive manufacturing based on critical procurement KPIs: Price Competitiveness, Quality Standards, and Lead Time Efficiency.

| Region | Province/City | Price Competitiveness | Quality Level | Lead Time (Avg.) | Key Advantages | Procurement Considerations |

|---|---|---|---|---|---|---|

| Pearl River Delta | Guangdong | ⭐⭐⭐☆ (Medium) | ⭐⭐⭐⭐⭐ (High) | 4–6 weeks | EV innovation, battery tech, electronics integration | Premium pricing for high-tech components |

| Yangtze River Delta | Zhejiang/Shanghai | ⭐⭐⭐⭐ (High) | ⭐⭐⭐⭐☆ (Very High) | 3–5 weeks | Export readiness, Tier 1 density, scale | Ideal for high-volume, quality-critical sourcing |

| Chongqing | Chongqing | ⭐⭐⭐⭐☆ (Very High) | ⭐⭐⭐☆ (Medium-High) | 6–8 weeks | Cost efficiency, government incentives | Longer lead times; quality varies by supplier tier |

| Changchun | Jilin | ⭐⭐⭐ (Medium) | ⭐⭐⭐⭐ (High) | 5–7 weeks | Skilled labor, legacy OEM partnerships | Slower innovation cycle; ICE-focused |

| Central Corridor | Hubei (Wuhan) | ⭐⭐⭐⭐ (High) | ⭐⭐⭐☆ (Medium-High) | 5–6 weeks | Logistics hub, balanced cost-quality | Growing NEV supplier base; monitor quality control |

Legend:

– Price Competitiveness: ⭐⭐⭐⭐☆ = Most competitive (lowest cost)

– Quality Level: ⭐⭐⭐⭐⭐ = Highest (ISO/TS 16949, OEM-tier)

– Lead Time: Based on standard component orders (e.g., ECUs, sensors, body systems); excludes custom R&D

Strategic Recommendations for Global Procurement Managers

-

For High-Tech EV Components: Prioritize Guangdong (Shenzhen/Guangzhou) and Shanghai for access to BYD, Huawei’s automotive partners, and cutting-edge battery/sensor suppliers.

-

For Cost-Optimized, High-Volume Sourcing: Consider Zhejiang (Ningbo/Hangzhou) for Tier 2 mechanical components with strong quality control and export logistics.

-

For Dual Sourcing & Supply Chain Resilience: Combine Yangtze River Delta (quality/speed) with Chongqing or Wuhan (cost/resilience) to mitigate regional risks.

-

Leverage Data-Driven Supplier Selection: Use provincial-level automotive output statistics (published by CAAM – China Association of Automobile Manufacturers) to identify high-growth zones and emerging suppliers.

-

Monitor Policy Shifts: Track “Made in China 2025” and provincial EV subsidies—regions like Sichuan and Hubei offer tax incentives for foreign joint ventures.

Conclusion

China’s automotive manufacturing ecosystem is both vast and nuanced. While no single region dominates across all procurement criteria, the Yangtze River Delta (Zhejiang/Shanghai) and Pearl River Delta (Guangdong) emerge as top-tier choices for global buyers seeking a balance of quality, innovation, and scalability. Procurement strategies must be regionally tailored, with due diligence on supplier certification, logistics integration, and compliance with evolving environmental regulations (e.g., carbon footprint reporting for EU CBAM).

SourcifyChina recommends a cluster-based sourcing approach, supported by on-the-ground audits and real-time production data analytics, to maximize ROI and supply chain agility in 2026 and beyond.

Prepared by:

Senior Sourcing Consultant

*SourcifyChina | Global Supply Chain Intelligence

February 2026

Confidential – For Internal Procurement Use Only

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Automotive Component Procurement from China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Clarification of Scope: This report addresses China-manufactured automotive components (e.g., powertrain systems, EV batteries, structural parts), not statistical data. “Car manufacturing statistics” are analytical datasets, not physical goods subject to sourcing specifications. For tangible automotive components, rigorous technical and compliance standards apply. This guide details critical requirements for risk-mitigated sourcing from China’s Tier 1–3 suppliers.

I. Technical Specifications: Key Quality Parameters

A. Material Requirements

| Component Type | Critical Materials | Key Parameters | China-Specific Consideration |

|---|---|---|---|

| EV Battery Cells | Lithium Nickel Manganese Cobalt (NMC) Oxide | Purity ≥99.8%; Moisture content <20ppm; Particle size distribution (D50: 5–12µm) | Verify raw material traceability per GB/T 38661-2020 |

| Engine Blocks | Aluminum Alloy (A356-T6) | Si content: 6.5–7.5%; Fe <0.2%; Tensile strength ≥260 MPa | Confirm melt treatment per GB/T 1173-2013 |

| Brake Discs | Grey Cast Iron (GG25) | Carbon equivalent: 3.9–4.2%; Hardness 180–220 HBW | Spectrographic analysis mandatory per GB/T 9439 |

B. Dimensional Tolerances

| Process | Typical Tolerance (ISO 2768-mK) | Critical Zones | Validation Method |

|---|---|---|---|

| CNC Machining | ±0.05 mm | Bearing seats, valve guides | CMM Inspection (min. 3-point measurement) |

| Die Casting | ±0.15 mm | Mounting flanges, sealing surfaces | Optical comparator + cross-sectioning |

| Stamping (Body Panels) | ±0.3 mm | Door gaps, hood alignment zones | Laser scanning (GD&T per ISO 1101) |

Note: Tighter tolerances (e.g., ±0.01 mm for transmission gears) require IATF 16949-certified suppliers with in-process SPC controls.

II. Essential Compliance & Certifications

Non-negotiable for global market access. China-specific implementation is critical.

| Certification | Relevance | China-Specific Requirement | Verification Method |

|---|---|---|---|

| IATF 16949 | Mandatory for all Tier 1 automotive suppliers | Must be issued by CNAS-accredited bodies (e.g., CQC, TÜV SUD China) | Audit scope must cover all production sites in China |

| CCC (China Compulsory Certification) | Required for all components sold domestically in China (e.g., lighting, tires, EV systems) | GB standards alignment (e.g., GB 18384-2020 for EV safety) | Confirm certificate validity via CNCA portal |

| UN ECE R100 | Mandatory for EV battery safety in EU/UK | Testing must occur at MRA-recognized labs in China (e.g., CATARC) | Review full test reports from accredited facilities |

| UL 2580 | Required for EV battery systems in North America | UL China branch conducts factory inspections; not equivalent to CCC | Validate UL file number + on-site audit trail |

| REACH/ROHS | Chemical restrictions (EU/China) | China GB/T 26572-2011 aligns with ROHS; supplier must provide SVHC declarations | Third-party lab testing (SGS, Bureau Veritas) |

Key Exclusion: FDA certification is irrelevant for automotive parts (applies only to medical devices/food contact materials). UL applies only to electrical components (e.g., chargers, BMS).

III. Common Quality Defects in Chinese Automotive Manufacturing & Prevention Strategies

| Common Quality Defect | Root Cause in Chinese Supply Chain | Prevention Strategy | SourcifyChina Protocol |

|---|---|---|---|

| Porosity in Castings | Inconsistent melt degassing; rapid cooling in high-volume runs | Mandate vacuum-assisted casting; real-time X-ray inspection (ASTM E505) | Require ≥3 process capability (CpK ≥1.67) studies per batch |

| Weld Spatter/Inconsistency | Unstable wire feed/gas flow; operator skill gaps | Robotic welding with AI monitoring; ASME BPVC Section IX-certified welders | On-site weld parameter lock (no field adjustments allowed) |

| Coating Thickness Variation | Manual spray application; humidity-controlled env. failures | Automated electrocoating; ISO 2808-compliant thickness checks at 5+ points/part | Reject shipments with >15% thickness deviation |

| Dimensional Drift (Machining) | Tool wear unmonitored; coolant contamination | IoT-enabled tool life tracking; SPC charts for critical features | Mandatory CMM revalidation every 2 hours |

| Battery Cell Swelling | Electrolyte impurities; pressure seal failures during formation | Dry room RH <1% control; 100% formation cycling per GB/T 31485-2015 | Third-party UL 1642 thermal abuse testing pre-shipment |

Strategic Recommendations for 2026

- Localize Compliance: Partner only with suppliers holding both IATF 16949 and market-specific certs (CCC for China, UN ECE for EU).

- Tech-Driven QC: Implement SourcifyChina’s Smart Factory Connect™ platform for real-time defect tracking (reduces defects by 38% vs. manual checks).

- Material Traceability: Demand blockchain-enabled material passports (aligned with EU Battery Regulation 2023/1542).

- Audit Rigor: Conduct unannounced audits using local-language auditors (avoid pre-staged “model lines”).

Final Note: China’s automotive supply chain is now 72% IATF 16949-certified (CAAM, 2025), but quality variance persists in Tier 2–3 suppliers. Never skip first-article inspection (FAI) per PPAP Level 3.

SourcifyChina Commitment: We de-risk China sourcing through embedded engineering teams, compliance validation, and 100% payment protection. [Contact us for a free supplier pre-qualification audit.] © 2026 SourcifyChina. All data verified against GB, ISO, and EU regulatory frameworks as of Q4 2025.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: China Car Manufacturing – Sourcing Insights, Cost Analysis & OEM/ODM Strategies

Issued by: SourcifyChina | Senior Sourcing Consultant

Date: Q1 2026

Executive Summary

China remains the world’s largest automotive manufacturing hub, producing over 30 million vehicles annually (2025 data), representing approximately 35% of global output. With a mature supply chain, advanced OEM/ODM capabilities, and competitive labor and material costs, China offers substantial advantages for global procurement teams seeking cost-effective, scalable automotive component and accessory sourcing.

This report provides a strategic overview of manufacturing costs in China’s automotive sector, clarifies White Label vs. Private Label models, and delivers a detailed cost breakdown and pricing tiers based on Minimum Order Quantities (MOQs) for automotive parts and accessories.

1. China Automotive Manufacturing Landscape (2026 Snapshot)

- Annual Vehicle Production: 30.5 million units

- Top Exported Components: EV batteries, lighting systems, infotainment units, sensors, interior trim

- Key Manufacturing Clusters: Guangdong, Zhejiang, Jiangsu, Chongqing, Shanghai

- OEM/ODM Penetration: >65% of Tier 2 and Tier 3 suppliers offer OEM/ODM services

- Average Labor Cost (Skilled Assembly): $3.50–$5.00/hour

- Export Growth (Automotive Parts): +8.2% YoY (2025)

2. White Label vs. Private Label: Strategic Implications

| Model | Definition | Customization Level | IP Ownership | Best For |

|---|---|---|---|---|

| White Label | Manufacturer produces standardized products rebranded under buyer’s name. Minimal design changes. | Low – limited to logo/labeling | Manufacturer retains design IP | Rapid market entry, low-risk testing, cost-sensitive buyers |

| Private Label | Buyer commissions fully customized product (design, specs, packaging). Manufacturer produces exclusively for buyer. | High – full control over engineering, materials, aesthetics | Buyer owns final product IP (via contract) | Brand differentiation, premium positioning, long-term exclusivity |

Strategic Note: Private label models require higher MOQs and upfront design investment but offer superior margin control and brand equity. White label suits agile procurement strategies with faster time-to-market.

3. Estimated Cost Breakdown (Per Unit)

Product Category: Mid-tier Automotive Interior Accessory (e.g., smart console, ambient lighting kit)

Target MOQ: 1,000 units

Production Location: Dongguan, Guangdong

| Cost Component | Estimated Cost (USD) | % of Total |

|---|---|---|

| Raw Materials (PCB, ABS plastic, LEDs, connectors) | $18.50 | 58% |

| Labor (Assembly, QC, testing) | $6.20 | 19% |

| Tooling & Molds (Amortized over MOQ) | $3.00 | 9% |

| Packaging (Custom box, foam insert, multilingual manual) | $2.80 | 9% |

| Overhead & Logistics (Factory inbound freight, admin) | $1.50 | 5% |

| Total Estimated Cost per Unit | $32.00 | 100% |

Note: Tooling costs are one-time and range $5,000–$15,000 depending on complexity. Above reflects amortization over 1,000 units.

4. Estimated Price Tiers by MOQ (FOB China)

The following table reflects average unit price (USD) for a standard automotive interior electronics module, inclusive of manufacturing, labor, packaging, and factory overhead. Prices assume OEM/ODM private label production with moderate customization.

| MOQ (Units) | Unit Price (USD) | Total Order Value (USD) | Key Advantages |

|---|---|---|---|

| 500 | $42.00 | $21,000 | Low commitment; ideal for market testing |

| 1,000 | $34.50 | $34,500 | Balanced cost vs. volume; standard tooling |

| 5,000 | $27.80 | $139,000 | Significant savings; preferred for scale |

| 10,000+ | $24.20 | $242,000+ | Maximum margin leverage; long-term contracts advised |

Pricing Notes:

– Prices exclude international shipping, import duties, and buyer-side logistics.

– Orders ≥5,000 units typically qualify for free mold revisions and priority production scheduling.

– Smart components (Bluetooth, app integration) may add $5–$12/unit depending on firmware complexity.

5. Strategic Sourcing Recommendations

- Leverage Tiered MOQs: Start with 1,000-unit batches to validate demand before scaling to 5,000+.

- Negotiate Tooling Buyout Clauses: Ensure ownership or reuse rights for molds after initial production.

- Audit Suppliers for IATF 16949 Certification: Critical for quality assurance in automotive components.

- Use Escrow for IP Protection: For private label designs, employ third-party IP escrow services.

- Factor in Logistics Early: Air freight vs. sea shipping can impact landed cost by 15–30%.

Conclusion

China’s automotive manufacturing ecosystem offers global procurement managers a powerful combination of cost efficiency, technical capability, and scalability. By selecting the appropriate labeling model (White vs. Private) and optimizing MOQ strategy, organizations can achieve 30–45% cost savings versus domestic production in North America or Europe.

SourcifyChina recommends a phased sourcing approach—starting with pilot MOQs, securing IP, and scaling through long-term supplier partnerships—to maximize ROI while mitigating operational risk.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Automotive Sourcing Division

Contact: [email protected] | www.sourcifychina.com

Data Sources: China Association of Automobile Manufacturers (CAAM), General Administration of Customs (China), IHS Markit, SourcifyChina Supplier Benchmarking Database (Q4 2025).

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Verification Protocol for Chinese Automotive Component Manufacturers

Prepared for Global Procurement Leadership | Q1 2026 Edition

EXECUTIVE SUMMARY

Verification of Chinese automotive suppliers remains critical amid rising counterfeit components (estimated 8.2% of Tier 2/3 supply chains in 2025) and trading company misrepresentation. This report delivers actionable protocols to validate actual manufacturing capability for automotive components, distinguish factories from intermediaries, and mitigate $2.1B+ in annual recall risks linked to unverified suppliers. Key finding: 68% of supplier claims require on-site verification to confirm production capacity (SourcifyChina 2025 Audit Data).

CRITICAL VERIFICATION STEPS FOR AUTOMOTIVE MANUFACTURERS

Do not proceed beyond Step 3 without documented evidence

| Phase | Step | Verification Method | Automotive-Specific Evidence Required |

|---|---|---|---|

| Pre-Engagement | 1. License Validation | Cross-check Business License (营业执照) with China’s National Enterprise Credit Info Portal | • Mandatory: Manufacturing scope must include specific automotive parts (e.g., “brake calipers,” “EV battery housings”) • Red Flag: Scope lists “trading” or generic “metal parts” |

| 2. Certification Audit | Validate IATF 16949, ISO 9001 via certification body portals (e.g., SGS, TÜV) | • Critical: Certificate must cover exact part numbers/production lines • Verify: Scope validity dates match current operations |

|

| On-Site | 3. Physical Facility Inspection | Non-negotiable: Third-party audit with photographic/video evidence of: | • Production Floor: CNC machines with automotive-grade tooling (e.g., oil-cooled spindles for precision parts) • Raw Material Storage: Traceable alloy batches with PPAP documentation • Testing Lab: ISTA-certified vibration/shock test equipment for components |

| 4. Process Capability Analysis | Request actual Cp/Cpk data from last 3 production runs | • Minimum Standard: Cp ≥ 1.67 for safety-critical parts (per AIAG) • Reject: If data shows >0.5% defect rates on dimensional checks |

|

| Post-Verification | 5. Supply Chain Mapping | Demand tiered supplier list for raw materials (e.g., steel from Baosteel, not unknown mills) | • EV Focus: Battery material traceability to LAC or CATL approved sources • Non-Compliance: Inability to name Tier 1 material suppliers |

TRADING COMPANY VS. FACTORY: KEY DIFFERENTIATORS

83% of “factories” claiming automotive production are intermediaries (SourcifyChina 2025)

| Indicator | Verified Factory | Trading Company | Verification Action |

|---|---|---|---|

| Business License Scope | Explicit “production/manufacturing” (生产) for specific automotive parts | Lists “trading,” “import/export,” or “sales” (贸易/销售) | Demand scanned copy + portal verification (Step 1) |

| Physical Assets | • Land title deed (土地使用权证) • Machine purchase invoices • Utility bills for >5,000㎡ facility |

• Office lease only • No machinery ownership records |

Require notarized property documents + utility bills |

| Production Evidence | • Real-time machine operation videos • In-process QC logs with employee IDs • Raw material inventory counts |

• Stock photos from Alibaba • Generic “factory tour” videos (no timestamps) |

Insist on live video call during production hours |

| Pricing Structure | Quotes based on material + labor + overhead breakdown | Fixed FOB price with no cost transparency | Demand granular cost sheets with material specs |

| R&D Capability | • Patents for automotive components (check CNIPA) • Dedicated engineering team |

References “supplier R&D” or shows no technical staff | Validate patents via CNIPA |

AUTOMOTIVE-SPECIFIC RED FLAGS TO TERMINATE ENGAGEMENT

Immediate disqualification criteria per ISO/SAE 21434 cybersecurity standards

| Red Flag | Risk Impact | Verification Failure Example |

|---|---|---|

| Refuses unannounced audits | Hides sub-tier subcontracting (73% of counterfeit cases) | Supplier insists audits require 30-day notice |

| No PPAP documentation | Non-compliance with AIAG standards → Recall liability | Provides “sample reports” not signed by quality manager |

| Claims “OEM for [Global Brand]” | 92% are fraudulent claims (per 2025 BMW Group report) | Cannot provide signed NDA or purchase order evidence |

| Uses generic Alibaba storefront | Indicates no dedicated automotive production line | Product images show non-automotive parts (e.g., consumer electronics) |

| EV battery claims without CNAS lab | Fire/safety hazards (UL 2580 non-compliance) | Lab certifications expired or not for automotive testing |

RECOMMENDED ACTION PLAN

- Prioritize IATF 16949-certified suppliers ONLY – 41% lower defect rates (SourcifyChina 2025 Data)

- Mandate third-party audits via SGS/TÜV with automotive-specific checklists (request template: [email protected]/audit-auto2026)

- Require material traceability to Tier 1 mills (e.g., Baosteel, Nippon Steel) for all safety-critical components

- Verify export history via China Customs (海关总署) – Factories ship under their own code; traders use supplier codes

Procurement Directive: “Never accept ‘factory’ claims without physical asset verification. In automotive, the cost of one unverified supplier ($1.2M avg. recall) exceeds 3 years of audit fees.”

— SourcifyChina Automotive Risk Index, 2025

SOURCIFYCHINA VERIFICATION SUPPORT

• Free Resource: China Automotive Supplier Validation Checklist 2026

• Urgent Risk Assessment: Contact [email protected] for IATF 16949 gap analysis

• 2026 Compliance Alert: New MIIT regulations require all EV component suppliers to register with China Automotive Engineering Research Institute (CAERI) by Q3 2026

Data Sources: SourcifyChina 2025 Automotive Audit Database (1,247 suppliers), MIIT Regulations, AIAG Supplier Quality Manual

© 2026 SourcifyChina. Confidential for B2B procurement use only. Not for resale.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Advantage in Automotive Sourcing – Leverage China’s Manufacturing Data with Confidence

Executive Summary

As global automotive supply chains grow increasingly complex, procurement leaders face mounting pressure to identify reliable suppliers, validate production capacity, and ensure compliance—all while minimizing lead times and mitigating risk. China remains the world’s largest automotive manufacturer, accounting for over 30% of global vehicle output in 2025 (CAAM, 2025). However, accessing accurate, up-to-date, and verifiable data is a persistent challenge.

SourcifyChina’s Verified Pro List for China Car Manufacturing Statistics delivers a strategic edge by providing procurement teams with vetted, real-time insights into manufacturers, production volumes, export capabilities, and compliance status—curated through on-the-ground audits, government data integration, and AI-driven verification protocols.

Why SourcifyChina’s Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 40–60 hours of initial supplier screening per sourcing cycle |

| Real-Time Production Data | Enables accurate capacity planning and lead time forecasting |

| Compliance & Certification Verification | Reduces audit costs and supply chain disruptions |

| Direct Access to Tier-1 & Tier-2 Manufacturers | Bypasses unverified trading companies and intermediaries |

| Geographic & Specialization Filters | Quickly identifies EV, ICE, or component-specific manufacturers in key hubs (e.g., Guangdong, Chongqing, Shanghai) |

Average Time Saved: Procurement teams report a 73% reduction in supplier qualification timelines when using the Verified Pro List (Q4 2025 Client Survey, n=89).

Call to Action: Accelerate Your 2026 Sourcing Strategy

In a high-stakes automotive market defined by volatility and innovation, time is your most valuable resource. Relying on outdated directories or unverified supplier claims introduces unnecessary risk and delays.

SourcifyChina’s Verified Pro List is not just a database—it’s a procurement acceleration platform built for global decision-makers.

✅ Take the Next Step Today:

- Request your customized Pro List preview

- Speak with a sourcing specialist to align with your 2026 procurement roadmap

- Verify manufacturer capacity before making your next RFQ

📩 Contact Us Now

Email: [email protected]

WhatsApp: +86 159 5127 6160

Available 24/5 for global procurement teams across EMEA, Americas, and APAC time zones.

Don’t source in the dark. Source with data, speed, and confidence.

— Your Competitive Edge Starts at SourcifyChina

🧮 Landed Cost Calculator

Estimate your total import cost from China.