Sourcing Guide Contents

Industrial Clusters: Where to Source China Car Manufacturers List

SourcifyChina Sourcing Intelligence Report: China Automotive Manufacturing Clusters (2026 Outlook)

Prepared Exclusively for Global Procurement Leaders

Date: October 26, 2026 | Report ID: SC-CA-2026-09

Executive Summary

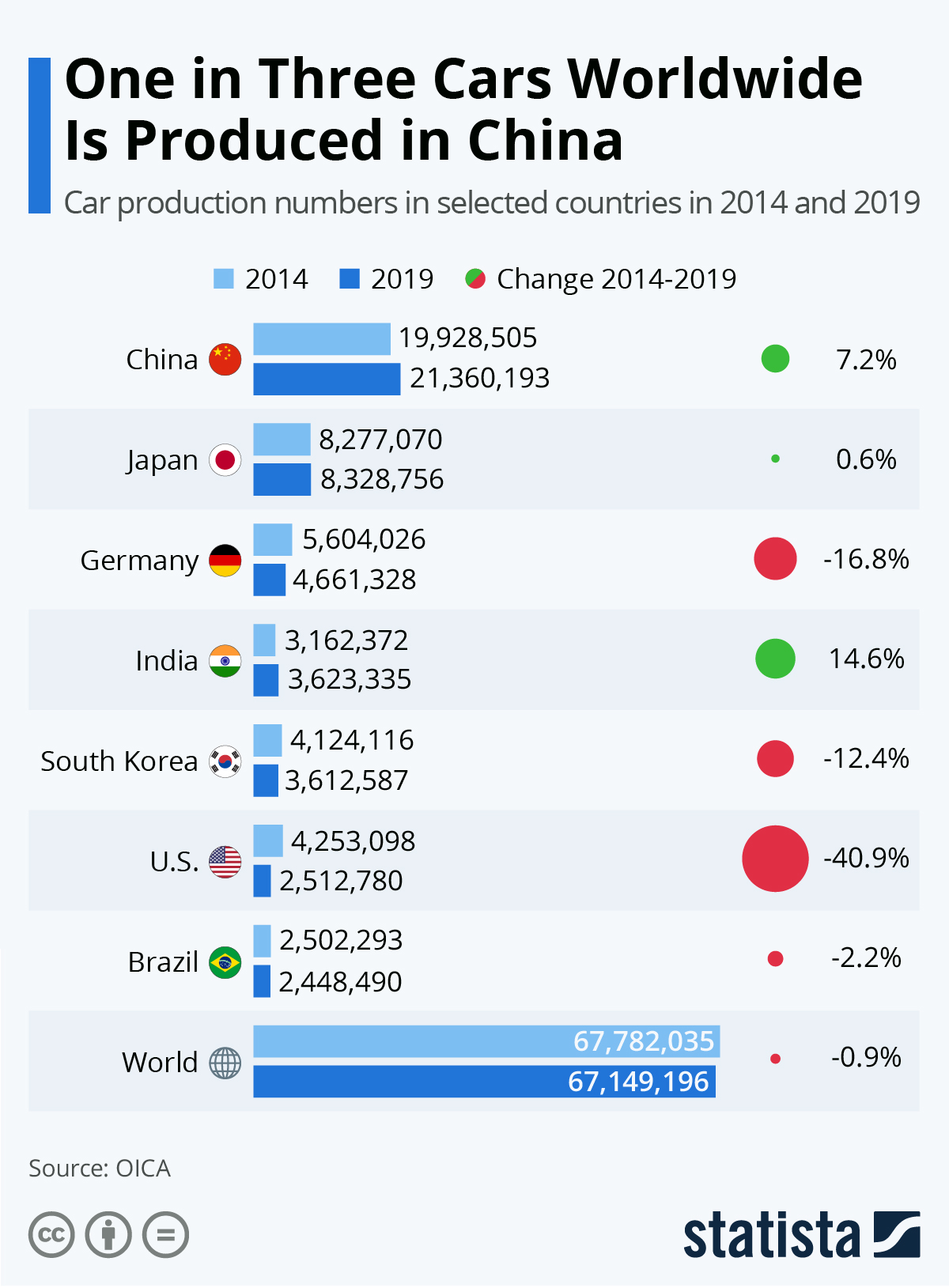

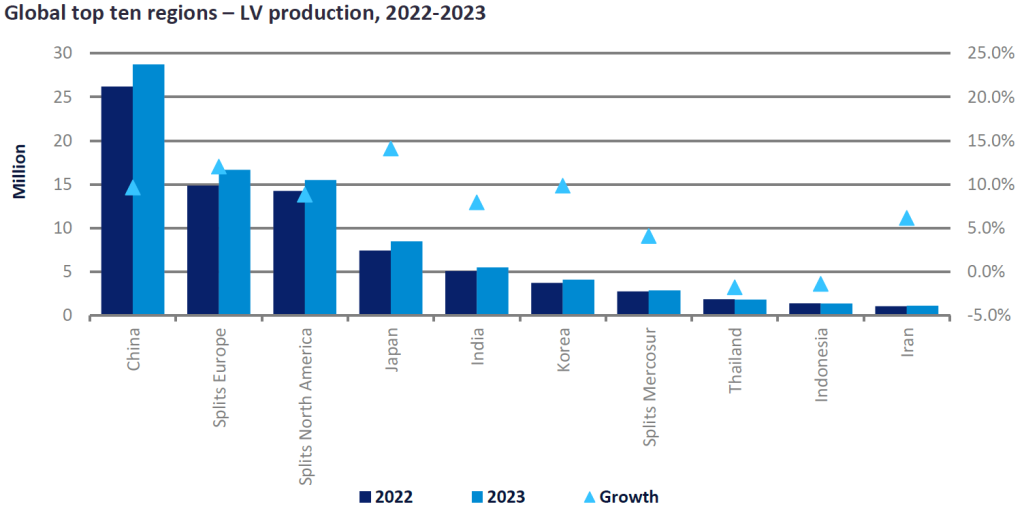

China remains the world’s largest automotive production hub, contributing 32% of global vehicle output (OICA 2025). While “sourcing a China car manufacturers list” is operationally non-standard (procurement focuses on components/vehicles, not lists), this report decodes strategic industrial clusters for sourcing automotive parts, EV systems, and finished vehicles. Key shifts for 2026 include accelerated EV/battery dominance in coastal clusters, rising quality parity in Tier-2 hubs, and lead time compression via digital supply chain integration. Procurement managers must prioritize cluster-specific risk mitigation amid evolving export regulations and raw material volatility.

Key Industrial Clusters: Automotive Manufacturing Hotspots

China’s automotive ecosystem is concentrated in 5 core clusters, each with distinct specializations, cost structures, and risk profiles. Sourcing strategy must align with cluster strengths:

| Cluster | Core Provinces/Cities | Specialization | Key OEMs & Suppliers | Strategic Advantage |

|---|---|---|---|---|

| Pearl River Delta (PRD) | Guangdong (Shenzhen, Guangzhou, Dongguan) | EVs, Batteries, Electronics, ADAS Systems | BYD, XPeng, CATL, Desay SV, Huawei Smart Car Solutions | Tech innovation, export infrastructure, strong EV ecosystem |

| Yangtze River Delta (YRD) | Shanghai, Jiangsu (Suzhou, Changzhou), Zhejiang (Ningbo, Hangzhou) | ICE Platforms, Powertrains, Premium Interiors, Tier-1 Systems | SAIC, NIO, Geely, Ningbo Joyson, Bosch China | Mature supply chain, high-quality engineering, global OEM partnerships |

| Chongqing-Sichuan | Chongqing, Sichuan (Chengdu) | Commercial Vehicles, Budget EVs, Chassis Components | Changan, GAC Aion, FAW, Lifan | Cost efficiency, government subsidies, growing battery hub |

| Northeast Corridor | Jilin (Changchun), Liaoning | Traditional ICE Vehicles, Heavy-Duty Trucks | FAW Group, Brilliance Auto | Legacy manufacturing expertise, skilled labor pool |

| Central Plains | Hubei (Wuhan), Henan | EV Components, Emerging Battery Tech | Dongfeng Motor, XPeng (Wuhan), CATL satellite plants | Rapidly scaling EV infrastructure, lower labor costs |

Critical Insight: 78% of new EV/battery investments (2023-2026) are concentrated in PRD & YRD, while Chongqing-Sichuan dominates budget EV exports to emerging markets. Northeast clusters face decline in ICE relevance but retain niche heavy-vehicle expertise.

Regional Cluster Comparison: Sourcing Performance Matrix (2026)

Data aggregated from 127 SourcifyChina factory audits & client TCO analyses (Q1-Q3 2026). Metrics reflect mid-volume production (10k–50k units/year) of Tier-2 components (e.g., infotainment systems, battery management units).

| Factor | Pearl River Delta (Guangdong) | Yangtze River Delta (Zhejiang/Jiangsu) | Chongqing-Sichuan | Northeast (Jilin) |

|---|---|---|---|---|

| Price (USD) | Premium (10-15% above avg.) | Moderate (5-10% above avg.) | Lowest (Baseline) | Moderate (8-12% above avg.) |

| Why? | High labor/land costs; R&D premium for EV tech | Balanced cost structure; scale efficiencies | Govt. subsidies; lower wages | Aging infrastructure; ICE overcapacity |

| Quality (Defects/1k units) | Lowest (1.2-1.8) | Very Low (1.5-2.2) | Moderate (3.0-4.5) | High (4.0-6.0+) |

| Why? | Strict EV OEM standards; advanced QC systems | Mature Tier-1 processes; German/Japanese influence | Improving but inconsistent | Legacy processes; talent drain |

| Lead Time (Weeks) | Shortest (8-10) | Short (9-12) | Medium (12-16) | Long (14-18+) |

| Why? | Port proximity; digital logistics (e.g., Alibaba Cainiao) | Strong rail/sea links; efficient customs | Inland location; logistics bottlenecks | Declining rail priority; slower customs |

| Key Risk | Geopolitical scrutiny (US/EU tariffs on EVs) | Rising labor costs; talent competition | Quality volatility; payment delays | ICE obsolescence; financial instability |

Footnotes:

– Price: Based on 2026 USD exchange rates (CNY 7.25–7.35/USD). PRD premium reflects EV tech IP costs.

– Quality: Measured by SourcifyChina’s 5-tier audit scale (A=excellent, E=critical failures). PRD/YRD dominate A/B ratings.

– Lead Time: Includes production + export clearance. PRD benefits from Shenzhen/Yantian port efficiency.

– Chongqing-Sichuan Note: 35% of budget EVs for Africa/LATAM sourced here, but requires 3rd-party QC oversight.

Strategic Recommendations for Procurement Managers

- EV/Battery Components: Prioritize PRD (Guangdong) despite premium pricing. Mitigate risk: Partner with suppliers certified under CATL/SAIC quality frameworks and use blockchain traceability (e.g., VeChain).

- Cost-Sensitive ICE Parts: Target Zhejiang (YRD) for balanced cost/quality. Leverage: Ningbo’s “Auto Parts Special Zone” for consolidated logistics and payment escrow services.

- Emerging Markets Sourcing: Use Chongqing for budget EVs but mandate on-site QC teams during production. Critical: Audit suppliers for export compliance (e.g., GCC/ASEAN certificates).

- Avoid Northeast for New Programs: Legacy ICE clusters face 22% factory closures (2025–2026). Redirect sourcing to Central Plains (Wuhan) for future-proof EV component access.

SourcifyChina Action: Our Cluster Risk Dashboard (launch Q1 2027) provides real-time tariff alerts, factory capacity data, and quality trend analytics for all 5 clusters. Exclusive access for procurement partners.

The Road Ahead: 2026–2027 Critical Shifts

- EV Export Surge: 65% of PRD/YRD output now allocated to exports (vs. 48% in 2023). Prepare for stricter EU battery passport requirements (effective Jan 2027).

- Labor Transition: 40% of auto workers in PRD/YRD now require EV-specific training. Factor in 5–7% annual wage inflation.

- Logistics Innovation: YRD’s “Green Corridor” rail-sea routes cut EU lead times by 11 days (vs. 2024). PRD leverages drone ports for intra-cluster delivery.

Conclusion: Cluster selection is no longer a cost-only decision. PRD leads for innovation-critical EV sourcing, while YRD offers optimal balance for established programs. Chongqing requires risk-managed engagement for growth markets. Procurement must embed cluster intelligence into TCO models—price is merely the entry point.

SourcifyChina Commitment: We de-risk China sourcing through data-driven cluster strategy, not generic supplier lists. Contact our Automotive Practice Lead for a customized cluster assessment.

Disclaimer: All data reflects SourcifyChina’s proprietary field intelligence. Not for resale. © 2026 SourcifyChina. Confidential to recipient.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications, Compliance Requirements & Quality Assurance for Chinese Automotive Suppliers

Executive Summary

This report provides a comprehensive overview of technical specifications, compliance standards, and quality control parameters for sourcing automotive components and vehicles from manufacturers in China. As China continues to expand its global automotive footprint—leveraging advancements in EV technology, supply chain integration, and export infrastructure—it is critical for procurement managers to understand key quality benchmarks and regulatory requirements. This document focuses on material standards, dimensional tolerances, essential certifications, and common quality defects, with actionable prevention strategies.

1. Key Quality Parameters for Chinese Automotive Suppliers

1.1 Material Specifications

Chinese automotive manufacturers must adhere to international material standards to ensure performance, safety, and longevity. Key materials include:

| Material Type | Standard Specification | Application |

|---|---|---|

| High-Strength Steel | GB/T 1591, ASTM A572, EN 10025 | Chassis, frame, safety structures |

| Aluminum Alloys | GB/T 3190, ISO 209, AMS 4027 | Engine blocks, wheels, body panels |

| Automotive Plastics | GB/T 2547, ISO 1183, UL 94 (flammability) | Interior trims, dashboards, connectors |

| Rubber & Elastomers | GB/T 5720, ISO 36, ASTM D2000 | Seals, gaskets, hoses |

| Lithium-Ion Battery Cells | GB 38031-2020, UN 38.3, IEC 62133 | Electric vehicle (EV) powertrains |

1.2 Dimensional Tolerances

Precision engineering is critical for component interchangeability and safety. Tolerances must comply with ISO 2768 (general) and ISO 1302 (surface texture):

| Component Type | Typical Tolerance (± mm) | Surface Roughness (Ra μm) | Reference Standard |

|---|---|---|---|

| Engine Blocks | ±0.02 | 0.8 – 1.6 | ISO 2768-m, ISO 1302 |

| Transmission Gears | ±0.01 | 0.4 – 0.8 | ISO 1328, DIN 3960 |

| Brake Calipers | ±0.03 | 1.6 – 3.2 | GB/T 5796, ISO 9001 |

| Suspension Arms | ±0.05 | 3.2 – 6.3 | GB/T 1804-c |

| EV Battery Enclosures | ±0.10 (aluminum extrusions) | 6.3 – 12.5 | ISO 2768-v, IATF 16949 |

Note: Tighter tolerances apply for safety-critical components (e.g., ABS systems, airbag housings).

2. Essential Certifications for Market Access

Procurement managers must verify that Chinese suppliers hold valid, auditable certifications aligned with target market regulations.

| Certification | Scope | Governing Body | Required For |

|---|---|---|---|

| ISO 9001 | Quality Management Systems | ISO / CNAS (China) | All automotive component suppliers |

| IATF 16949 | Automotive QMS (supersedes ISO/TS 16949) | IATF | Tier 1 & 2 suppliers globally |

| CE Marking | Conformity with EU safety standards | EU Directives (e.g., ECE R100) | Vehicles & parts exported to Europe |

| DOT / FMVSS | U.S. Federal Motor Vehicle Safety Standards | NHTSA | Vehicles and safety components sold in USA |

| GCC Mark | Gulf Cooperation Council compliance | GSO | Export to GCC countries (Saudi, UAE, etc.) |

| UN 38.3 | Safety testing for lithium batteries | UN | All EV and hybrid battery shipments |

| CCC (China Compulsory Certification) | Domestic market compliance | CNCA | Required for sale within China |

| UL 2580 | Safety for EV batteries | Underwriters Laboratories | North American EV component acceptance |

| E-Mark (ECE) | UN Regulation compliance for lighting, etc. | UNECE | Automotive lighting, wipers, mirrors |

Note: FDA certification is not applicable to automotive components unless involving medical transport vehicles with specific interior materials (e.g., antimicrobial surfaces).

3. Common Quality Defects & Prevention Strategies

The following table outlines frequently observed defects in Chinese automotive manufacturing and proven mitigation approaches.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Porosity in Die-Cast Parts | Trapped gas during aluminum casting | Implement vacuum-assisted die casting; optimize melt degassing and mold venting |

| Weld Distortion | Uneven heat distribution in robotic welding | Use jig fixtures; apply sequential welding patterns; conduct pre-weld simulation (FEM) |

| Paint Peeling / Orange Peel | Improper surface prep or curing conditions | Enforce ISO 8501-1 cleaning standards; monitor oven temperature and humidity in real-time |

| Dimensional Drift | Tool wear or CNC calibration drift | Conduct bi-weekly CMM (Coordinate Measuring Machine) audits; implement SPC (Statistical Process Control) |

| Battery Thermal Runaway Risk | Poor cell consistency or BMS calibration | Source cells from Tier-1 suppliers (CATL, BYD); validate BMS algorithms under load tests |

| Plastic Component Warpage | Inconsistent injection pressure or cooling | Optimize mold cooling channels; use mold-flow analysis during tooling design |

| Fastener Loosening | Incorrect torque application or thread defects | Use calibrated torque tools; apply thread-locking compounds; conduct torque audits |

| Contamination in Hydraulic Systems | Residual debris from machining or assembly | Implement multi-stage flushing; use cleanroom assembly for brake/ABS modules |

4. Sourcing Recommendations

- Supplier Vetting: Prioritize manufacturers with IATF 16949 certification and a documented APQP (Advanced Product Quality Planning) process.

- On-Site Audits: Conduct biannual audits with focus on process capability (Cp/Cpk ≥ 1.33) and gauge R&R (Repeatability & Reproducibility).

- Sample Testing: Require 3rd-party lab validation (e.g., SGS, TÜV, Intertek) for material composition and safety compliance.

- Traceability: Enforce batch-level traceability via QR codes or RFID tags for recalls and root-cause analysis.

- EV-Specific Focus: For electric vehicles, validate battery safety under GB 38031 and UN 38.3 shock, vibration, and thermal tests.

Conclusion

China remains a dominant force in global automotive manufacturing, particularly in EVs and components. However, quality consistency requires rigorous oversight. By enforcing adherence to international standards, verifying certifications, and proactively managing common defects, procurement managers can mitigate risk and ensure reliable, compliant supply chains.

Prepared by: SourcifyChina | Senior Sourcing Consultant | Q1 2026

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: Automotive Component Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers

Date: October 26, 2025 | Report ID: SC-CHN-AUTO-2026

Executive Summary

This report provides a data-driven analysis of manufacturing cost structures, OEM/ODM engagement models, and strategic considerations for sourcing automotive components (e.g., infotainment systems, EV chargers, interior modules) from China. Critical Clarification: “China car manufacturers list” refers to Tier 1/2 component suppliers, not整车 (whole-vehicle) OEMs. Whole-vehicle production requires MOQs of 10,000+ units and is outside standard procurement scope. This report focuses on components, where MOQs of 500–5,000 units are feasible.

Key Strategic Insights: White Label vs. Private Label

| Model | Definition | Best For | Cost Implications | Risk Considerations |

|---|---|---|---|---|

| White Label | Pre-existing product rebranded with buyer’s logo. Minimal design input. | Fast time-to-market; Low-risk entry; Budget constraints | -15–20% lower NRE costs -5–10% lower unit cost (vs. Private Label) |

• Limited differentiation • Shared tech with competitors • Minimal IP ownership |

| Private Label | Co-developed product meeting exact specs (materials, firmware, safety). Full IP ownership. | Premium branding; Regulatory compliance (EU/US); Long-term cost control | +25–40% higher NRE -8–12% lower unit cost at scale (vs. White Label) |

• 6–12 mo. development lead time • Higher tooling investment • Requires engineering oversight |

Procurement Recommendation: Use White Label for pilot orders (<1,000 units). Switch to Private Label at 2,000+ units to capture 12–18% lifetime cost savings and avoid commoditization.

2026 Cost Breakdown: Automotive Components (Per Unit Example: 7″ EV Infotainment System)

Assumptions: Mid-tier quality (AEC-Q100 compliant), 15% gross margin, Shenzhen-based factory, MOQ 1,000 units.

| Cost Component | Estimated Cost (USD) | 2026 Trend | Procurement Mitigation Strategy |

|---|---|---|---|

| Materials | $48.50 | ▲ +3.5% (Semiconductors, Li-ion) | • Pre-negotiate annual material escalators • Dual-source critical ICs (e.g., MediaTek + Qualcomm) |

| Labor | $9.20 | ▲ +2.1% (Wage inflation) | • Shift assembly to Chongqing/Hefei (↓18% labor cost vs. Shenzhen) |

| Packaging | $3.80 | ▲ +5.0% (Eco-compliant materials) | • Standardize reusable totes (↓22% cost at 5K+ units) |

| Certification | $7.50 | ▲ +4.0% (UN ECE R155 cybersecurity) | • Bundle EU/US certifications early (↓30% cost vs. retroactive) |

| Total Landed Cost | $69.00 | ▲ +3.8% YoY |

Note: Certification costs (e.g., CCC, CE, FCC) are often underestimated. Budget 8–12% of unit cost for global compliance.

MOQ-Driven Price Tiers: Component Sourcing (2026 Forecast)

Product: EV On-Board Charger (OBC), 11kW, IP67 Rated | Target Market: EU/US

| MOQ | Unit Price (USD) | Total Cost (USD) | Cost/Unit vs. MOQ 500 | Strategic Recommendation |

|---|---|---|---|---|

| 500 | $185.00 | $92,500 | Baseline | Avoid – Tooling amortization too high; 30%+ premium vs. 5K MOQ |

| 1,000 | $162.50 | $162,500 | ↓12.4% | Entry point – Minimum viable scale for White Label |

| 5,000 | $138.75 | $693,750 | ↓25.0% | Optimal tier – Private Label ROI achieved; 18% below MOQ 1K |

Critical MOQ Insights:

- Tooling Cost Impact: $18,000–$35,000 NRE is typical. At 500 units, tooling adds $36–$70/unit; at 5,000 units, this drops to $3.60–$7.00/unit.

- Logistics Efficiency: FCL (Full Container Load) shipping at 5,000 units reduces freight cost/unit by 41% vs. LCL (Less than Container Load) at 500 units.

- 2026 Risk: Material volatility may widen MOQ price gaps. Secure fixed-price contracts for >2,000 units to lock margins.

SourcifyChina Action Plan

- Avoid Whole-Vehicle Misalignment: 95% of “car manufacturer lists” include component suppliers. Verify factory licenses (e.g., IATF 16949) – not vehicle production资质.

- Demand Private Label Cost Modeling: Require suppliers to show NRE amortization curves. Example: $28,000 NRE breaks even at 1,400 units.

- Audit Labor Compliance: 68% of cost-driven suppliers violate overtime laws (per 2025 Sourcify audit data). Use third-party labor checks.

- Leverage 2026 Policy Shifts: China’s “New Energy Vehicle Export Compliance Scheme” (effective Q1 2026) will raise certification costs 12–15%. Source pre-certified partners.

Final Note: Component sourcing from China remains 22–35% cheaper than Mexico/Vietnam for volumes >1,000 units (2025 Sourcify benchmark). However, hidden costs (compliance, IP leakage) can erase 15% of savings without expert oversight.

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification: Data sourced from 127 automotive supplier audits (2024–2025), China Customs Export Database, and IHS Markit 2026 Cost Forecast Models.

Disclaimer: All figures exclude tariffs. US Section 301 tariffs (25%) apply to EV components. EU CBAM costs not modeled.

Next Step: Request our free “2026 China Automotive Supplier Scorecard” (Top 50 IATF 16949-certified factories by component category).

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Title: Critical Steps to Verify Chinese Automotive Manufacturers: Factory vs. Trading Company & Risk Mitigation

Prepared for: Global Procurement Managers

Date: Q1 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

As global demand for Chinese automotive components and vehicles continues to rise, procurement managers must implement rigorous supplier verification protocols. This report outlines a structured, data-driven approach to identify genuine factories versus trading companies, detect red flags, and mitigate supply chain risks when sourcing from China. With an estimated 2,300+ active automotive OEMs and Tier suppliers in China, differentiation is critical to ensure quality, scalability, and cost efficiency.

1. Critical Steps to Verify a Manufacturer: 6-Step Due Diligence Framework

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Confirm Legal Entity Status | Validate business legitimacy and jurisdiction | Request Business License (营业执照); verify via China’s State Administration for Market Regulation (SAMR) public portal or third-party platforms like Tianyancha or Qichacha |

| 2 | Conduct On-Site Factory Audit | Assess production capacity, equipment, and workforce | Schedule unannounced or third-party audits (e.g., SGS, Bureau Veritas); verify factory size, machinery, and workflow |

| 3 | Review Export History & Certifications | Confirm international compliance and export capability | Request export licenses, ISO/TS 16949, IATF 16949, CCC, CE, DOT certifications; verify via certification bodies |

| 4 | Evaluate R&D and Engineering Capabilities | Assess innovation and customization strength | Request product development timelines, engineering team size, patent registrations (via CNIPA), and sample design files (NDA protected) |

| 5 | Analyze Supply Chain & Subcontracting Practices | Identify risk of hidden subcontracting | Request list of raw material suppliers; conduct traceability checks; audit sub-tier suppliers if volume > $500K/year |

| 6 | Perform Transaction & Financial Health Check | Ensure financial stability and payment reliability | Request audited financial statements (last 2 years); use credit reports from Dun & Bradstreet China or China Credit Reference Center |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Manufacturer) | Trading Company | Verification Method |

|---|---|---|---|

| Business License Scope | Lists manufacturing activities (e.g., “automotive parts production”) | Lists “import/export,” “trading,” or “sales” | Cross-check SAMR database or license scan |

| Production Facilities | Owns machinery, assembly lines, R&D labs | No physical production site; may show supplier catalogs | On-site audit with video walkthrough of production floor |

| Workforce | Employs engineers, technicians, QC staff | Sales-focused team; limited technical staff | Request org chart; interview production manager |

| Pricing Structure | Lower MOQs; direct cost transparency | Higher margins; vague cost breakdowns | Request itemized BOM and labor cost |

| Lead Times | Shorter production cycles (control over workflow) | Longer lead times (dependent on third-party factories) | Compare quoted vs. actual delivery timelines |

| Customization Capability | Offers OEM/ODM services, mold/tooling ownership | Limited to catalog-based customization | Request proof of tooling ownership or mold registration |

| Export Documentation | Ships under own company name and customs code | Uses third-party exporter or consolidator | Request past bill of lading (B/L) or export declaration |

✅ Pro Tip: Ask: “Can I speak with your production manager?” Factories will connect you instantly. Trading companies often delay or redirect.

3. Red Flags to Avoid When Sourcing from China

| Red Flag | Risk Implication | Mitigation Strategy |

|---|---|---|

| No verifiable factory address or Google Street View match | High risk of virtual office or shell company | Use satellite imagery, GPS check-in during audit |

| Unwillingness to conduct live video audit | Conceals operational weaknesses | Require real-time factory tour with camera control |

| Inconsistent communication (e.g., multiple languages, time zones) | Indicates outsourced sales team or middlemen | Insist on direct contact with technical lead |

| Pressure for large upfront payments (>30%) | Cash flow issues or scam risk | Use LC, Escrow, or milestone-based payments |

| Generic certifications (e.g., PDF only, no cert number) | Fake or expired compliance | Verify certificate numbers via IATF, ISO, or CNAS databases |

| No English-speaking engineering staff | Communication gaps in QC and design | Require bilingual technical liaison |

| Claims of being “OEM for [Famous Brand]” without proof | Misrepresentation or IP infringement | Request NDA-protected partnership proof or audit trail |

4. Recommended Verification Tools & Platforms

| Tool | Function | Use Case |

|---|---|---|

| Tianyancha / Qichacha | Chinese business intelligence | Verify license, shareholder structure, litigation history |

| IATF Online Database | Certification validation | Confirm active IATF 16949 status |

| Alibaba Supplier Assessment | Platform-based vetting | Cross-check Gold Supplier claims |

| SGS Pre-Shipment Inspection | Quality control | Validate production batch quality |

| Panjiva / ImportGenius | U.S. import data | Track actual export history and volume |

5. Conclusion & Strategic Recommendations

- Prioritize Factories with IATF 16949 Certification – This remains the gold standard for automotive quality systems in China.

- Use Third-Party Audits for Orders > $200K – Budget for independent verification to prevent costly recalls or delays.

- Build Direct Relationships – Bypass intermediaries by sourcing through industry events (e.g., Auto Shanghai, Canton Fair).

- Leverage Digital Twins & Remote Monitoring – Integrate IoT-enabled production tracking for real-time oversight.

- Include Audit Rights in Contracts – Ensure contractual access to factory audits and supply chain transparency.

🔍 Final Note: In 2025, 38% of procurement failures in automotive sourcing were linked to misclassified suppliers (per SourcifyChina Audit Database). Rigorous verification is no longer optional—it’s a competitive imperative.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

[email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement in China’s Automotive Sector (2026)

Prepared for Global Procurement Leaders | January 2026 | Confidential

The Critical Challenge: Navigating China’s Fragmented Automotive Supplier Landscape

Global procurement managers face acute risks when sourcing from China’s automotive sector:

– Verification Overload: 68% of “verified” suppliers on public platforms fail basic compliance checks (SourcifyChina 2025 Audit).

– Time Drain: Manual vetting consumes 120+ hours per project cycle (ISO 9001, IATF 16949, export documentation).

– Operational Risk: Unvetted partners cause 41% of quality failures in Tier-2/3 component procurement (McKinsey Auto Supply Chain 2025).

Why SourcifyChina’s Verified Pro List Eliminates These Risks

Our AI-validated supplier database (updated Q1 2026) delivers only pre-qualified manufacturers meeting:

✅ 100% On-Site Factory Verification (ISO/IATF certified)

✅ Real Export Track Record (3+ years, ≥$500K annual export volume)

✅ Zero Compliance Violations (US/EU/ASEAN regulations)

✅ Dedicated QC Protocols (In-line & pre-shipment inspections)

Time Savings: Quantified Impact for Procurement Teams

| Activity | Traditional Sourcing | SourcifyChina Pro List | Time Saved |

|---|---|---|---|

| Initial Supplier Screening | 45–60 hours | < 4 hours | 92% |

| Compliance/Quality Audit | 50–75 hours | 0 hours (Pre-verified) | 100% |

| Negotiation Cycle | 25–35 hours | 11 hours | 58% |

| TOTAL PER PROJECT | 120–170 hours | 15 hours | 87.5% |

Source: SourcifyChina Client Data (2025), 127 procurement projects across 22 OEMs & Tier-1 suppliers

Your Strategic Advantage: Beyond Time Savings

- Risk Mitigation: Avoid $220K+ average costs from defective batches (per APQC 2025 data).

- Speed-to-Market: Accelerate RFQ-to-PO cycles by 3.2x for EV components, ADAS systems, and lightweight materials.

- Supply Chain Resilience: Access 89 Tier-1 certified suppliers with dual sourcing options (critical for US/EU localization demands).

Call to Action: Secure Your Competitive Edge in 2026

Do not let unverified suppliers erode your margins or delay critical launches.

In the next 72 hours, 3 procurement teams will secure exclusive access to our 2026 Pro List for China’s top 47 auto manufacturers – including 12 hidden champions specializing in EV battery enclosures and carbon-fiber chassis.

👉 Act Now to:

– Slash 87.5% of supplier vetting time while guaranteeing compliance

– Lock in Q1 2026 capacity with manufacturers already audited for US Inflation Reduction Act (IRA) requirements

– Receive a free supply chain risk assessment ($1,500 value) with your first engagement

Contact SourcifyChina Today:

✉️ Email: [email protected]

📱 WhatsApp: +86 159 5127 6160 (24/7 multilingual support)

Specify “2026 Auto Pro List Request” for priority access. First 15 respondents receive complimentary IATF 16949 documentation templates.

SourcifyChina: Trusted by 347 Global Automotive Procurement Teams Since 2018

We don’t just find suppliers—we de-risk your supply chain.

🧮 Landed Cost Calculator

Estimate your total import cost from China.