Sourcing Guide Contents

Industrial Clusters: Where to Source China Car Manufacturer Ranking

SourcifyChina B2B Sourcing Report 2026

Subject: Deep-Dive Market Analysis – Sourcing China Car Manufacturer Ranking

Target Audience: Global Procurement Managers

Prepared By: Senior Sourcing Consultant, SourcifyChina

Date: March 2026

Executive Summary

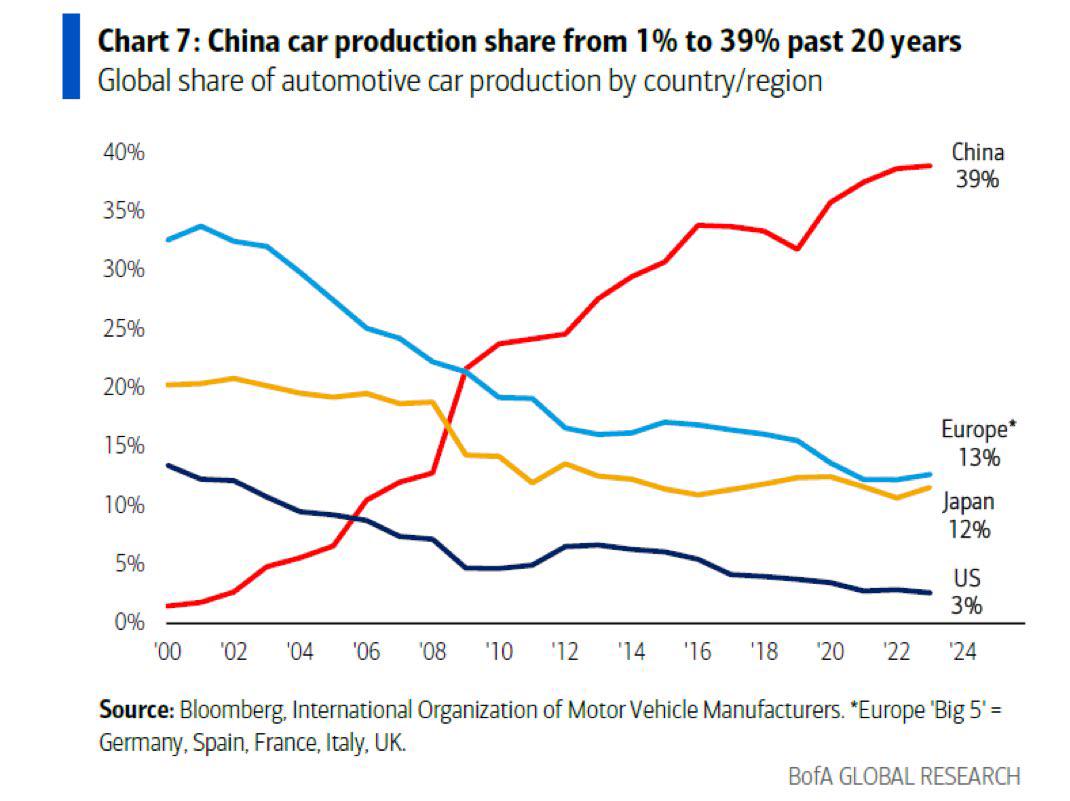

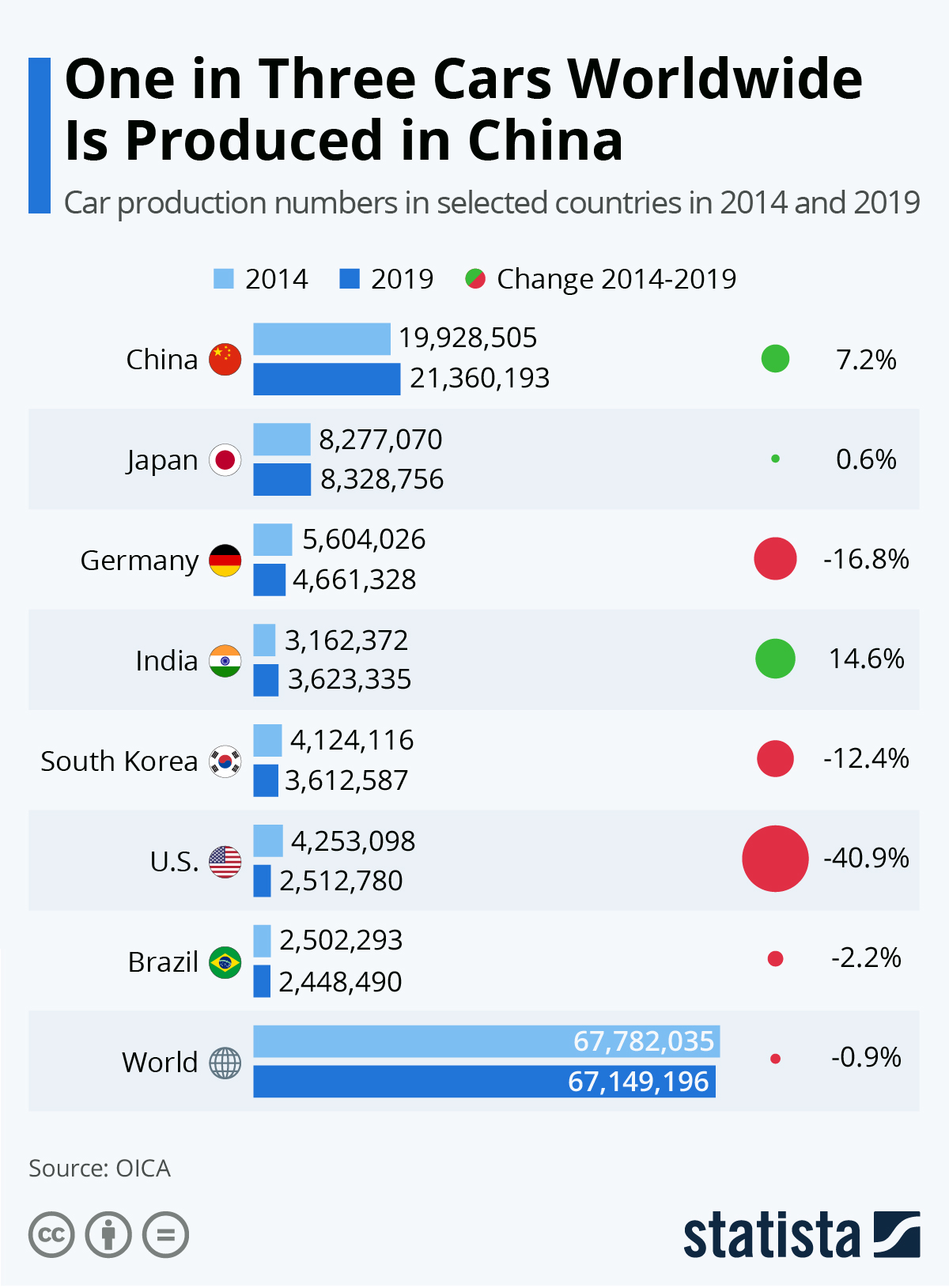

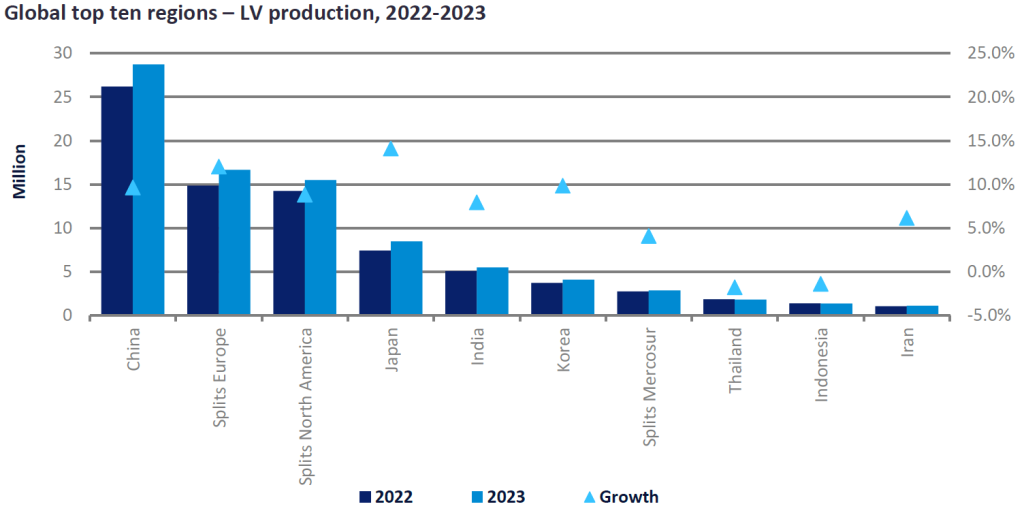

China remains the world’s largest automotive manufacturing hub, producing over 30 million vehicles annually and accounting for nearly 35% of global output. The term “China car manufacturer ranking” refers not to a physical product, but to strategic intelligence on the performance, capabilities, and competitiveness of Chinese automotive OEMs. For procurement professionals, understanding the geographical distribution of leading manufacturers and their supply ecosystems is critical to informed sourcing decisions.

This report identifies key industrial clusters driving China’s automotive sector, evaluates regional strengths, and provides a comparative analysis to support strategic supplier selection, partnership development, and risk mitigation.

1. Key Industrial Clusters for China’s Automotive Manufacturing

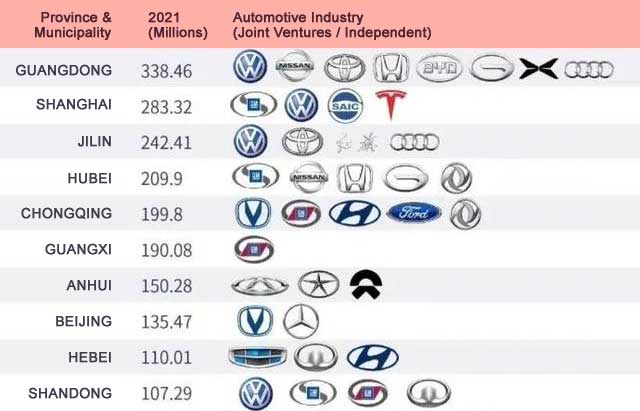

China’s automotive industry is concentrated in several high-capacity industrial clusters, each with distinct specializations:

| Province/City | Key Cities | Specialization | Notable OEMs & Tier-1 Suppliers |

|---|---|---|---|

| Guangdong | Guangzhou, Shenzhen, Foshan | EVs, Smart Mobility, Battery Tech | GAC Group, BYD (HQ), XPeng, NIO (R&D), Huawei (HI Mode) |

| Zhejiang | Hangzhou, Ningbo, Wenzhou | EVs, Auto Parts, Export-Oriented Mfg | Geely (incl. Zeekr, Lotus), Great Wall (subsidiaries), Wanxiang Group |

| Jiangsu | Nanjing, Changzhou, Suzhou | New Energy Vehicles, Battery & Components | NIO (Battery), CATL (subsidiaries), SAIC Motor (subs) |

| Shanghai | Shanghai | Full-Stack OEMs, Joint Ventures, R&D | SAIC Motor, Tesla (Shanghai Gigafactory), BMW Brilliance (R&D) |

| Hubei | Wuhan, Xiangyang | Traditional ICE & Commercial Vehicles | Dongfeng Motor Corporation, FAW Group (subsidiaries) |

| Chongqing | Chongqing | Mass-Market ICE, EVs, Supply Chain Hubs | Changan Automobile, Seres (AITO), CATL (production) |

Note: While “car manufacturer ranking” is not a physical commodity, the data and analytics around these rankings are sourced from clusters where OEMs and Tier-1 suppliers are headquartered or operate major production and R&D centers.

2. Regional Comparison: Sourcing Intelligence & Manufacturing Support Ecosystems

When evaluating regions for sourcing automotive intelligence or establishing partnerships with ranked manufacturers, procurement managers must assess regional dynamics in cost, quality, and lead time for collaboration, component sourcing, and data-driven supplier evaluation.

Comparative Analysis: Guangdong vs Zhejiang vs Jiangsu vs Shanghai

| Region | Price Competitiveness (1–5) | Quality of Manufacturing & Innovation (1–5) | Lead Time for Prototyping & Collaboration (Weeks) | Key Advantages | Procurement Considerations |

|---|---|---|---|---|---|

| Guangdong | 4 | 5 | 6–8 | High innovation in EVs & smart systems; strong battery integration; proximity to Shenzhen’s tech ecosystem | Premium pricing for cutting-edge OEMs; ideal for EV and tech-integrated partnerships |

| Zhejiang | 5 | 4 | 8–10 | Cost-efficient production; strong export infrastructure; high volume capacity | Best for cost-sensitive, high-volume projects; slightly longer lead times due to export backlog |

| Jiangsu | 4 | 5 | 6–9 | Advanced battery and component manufacturing; close to Shanghai R&D | Excellent for battery and powertrain sourcing; strong quality control systems |

| Shanghai | 3 | 5 | 4–6 | Global OEM presence; fastest innovation cycles; multilingual business support | Highest cost; ideal for strategic JV partnerships and high-end market alignment |

Scoring Guide:

– Price: 5 = Most Competitive, 1 = Premium Pricing

– Quality: 5 = World-Class, 1 = Basic Compliance

– Lead Time: Lower = Faster turnaround

3. Strategic Sourcing Recommendations

A. For High-Innovation EV Programs

- Target Cluster: Guangdong (BYD, XPeng, NIO)

- Rationale: Access to top-ranked EV manufacturers per 2025 C-NCAP and EV100 rankings; integration with battery and AI tech suppliers.

- Procurement Action: Partner with local sourcing agents in Guangzhou for OEM qualification and pilot program access.

B. For Cost-Optimized Mass Production

- Target Cluster: Zhejiang (Geely, Wanxiang)

- Rationale: Economies of scale, mature supply chains, and strong export logistics via Ningbo-Zhoushan Port.

- Procurement Action: Leverage regional trade incentives and tier-2 supplier networks for component localization.

C. For Battery & Component Intelligence

- Target Cluster: Jiangsu & Chongqing (CATL, NIO, Seres)

- Rationale: Dominance in battery manufacturing; direct access to supply chain data for ranking analysis.

- Procurement Action: Engage with industrial parks in Changzhou and Wuhan for data-sharing MOUs with OEMs.

4. Risk & Opportunity Outlook (2026)

| Factor | Impact on Sourcing |

|---|---|

| EV Subsidy Phase-Out | May pressure lower-tier OEMs; strengthens top 10 ranked manufacturers in Guangdong and Zhejiang |

| Export Controls on Critical Minerals | Increases supply chain scrutiny; due diligence required in Jiangsu and Chongqing battery hubs |

| Digital Twin & AI Integration | Shanghai and Guangdong leading in smart factory adoption, reducing long-term lead times |

| Trade Tensions (EU/US Tariffs) | Zhejiang exporters adapting via Mexico/Turkey transit; diversification recommended |

Conclusion

Understanding the geographical footprint of China’s top-ranked car manufacturers enables procurement leaders to align sourcing strategies with regional strengths. Guangdong leads in innovation and EV ranking prominence, while Zhejiang offers cost efficiency and scalability. Shanghai remains the gateway for global OEM collaboration, and Jiangsu delivers component excellence.

Procurement managers should prioritize cluster-specific engagement, supported by local sourcing partners, to access accurate manufacturer performance data and build resilient, future-ready supply chains.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Intelligence for Global Procurement

www.sourcifychina.com | Advisory | Supplier Vetting | Supply Chain Optimization

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report: Evaluating Chinese Automotive Manufacturers

Prepared for Global Procurement Managers | Q1 2026 | Objective: De-Risking High-Value Automotive Sourcing

Executive Summary

China remains the world’s largest automotive producer (30M+ units/year), but quality variance between Tier-1 OEMs and emerging EV specialists necessitates rigorous technical/compliance vetting. “Rankings” are methodology-dependent; this report focuses on the objective criteria used to evaluate manufacturers for sourcing decisions. Key differentiators include adherence to international tolerances, material traceability, and certification validity—not production volume alone.

I. Technical Specifications: Core Quality Parameters

Procurement Priority: Verify these in supplier contracts before PO issuance.

| Parameter | Critical Standards | Acceptable Tolerance Ranges (Typical) | Verification Method |

|---|---|---|---|

| Materials | |||

| – Structural Steel | SAE/AISI 1008-1026 (Cold Rolled); ASTM A569 (HR) | Carbon Content: ±0.02%; Thickness: ±0.05mm | Mill Certificates (EN 10204 3.1/3.2) |

| – Aluminum Alloys | AA 5052, 6061-T6 (Body Panels); EN AW-5754 (Chassis) | Thickness: ±0.03mm; Tensile Strength: ±15MPa | Spectrographic Analysis + Tensile Test |

| – Plastics (Interior) | ISO 11443 (Thermoplastics); UL 94 V-0 (Flammability) | MFR: ±0.5g/10min; Dimensional Stability: ±0.2% | UL Test Reports + In-House Lab Validation |

| Tolerances | |||

| – Dimensional | ISO 2768-m (General); ISO 2692 (GD&T Critical Parts) | Body-in-White: ±0.3mm; Powertrain: ±0.05mm | CMM Scans (Per ISO 10360-2) |

| – Weld Quality | ISO 5817 (B-Class for Safety-Critical Joints) | Porosity: <2% vol.; Penetration: 100% ±0.5mm | X-Ray/UT + Destructive Testing (5% batch) |

| – Assembly | VDA 6.3 Process Audit (P6.2.3 Critical Fit/Finish) | Gap/Flush: ±0.2mm; Surface Roughness: Ra ≤1.6µm | Laser Tracking + Visual Audit (AQL 0.65) |

Key Insight: Tolerances for EV battery housings (±0.1mm) and ADAS sensor mounts (±0.02mm) now exceed ICE vehicle standards—explicitly define in RFQs.

II. Mandatory Compliance & Certifications

Non-negotiable for market access. “China Compulsory Certification” (CCC) is the baseline; global certifications determine export viability.

| Certification | Scope | Validity | Verification Tip | Relevance by Market |

|---|---|---|---|---|

| CCC | All vehicles sold in China | 5 years | Check CNCA database (ccc.gov.cn) + physical mark | Mandatory for China Domestic |

| IATF 16949 | Quality Management System (QMS) | 3 years | Audit scope must cover your specific components | Global (Replaces ISO/TS 16949) |

| ISO 9001 | General QMS (Minimum for non-auto) | 3 years | Validate scope includes design/development | Entry-level requirement |

| CE (EU) | ECE R100 (EV Safety), R134 (Brakes) | Per model | Requires EU Type Approval + Notified Body oversight | EU/EEA Markets Only |

| FMVSS | U.S. Federal Motor Vehicle Safety Stds | Per model | DOT certification + self-certification documents | U.S. Market Only |

| UL 2580 | EV Battery Safety | 2 years | UL Mark + test report for cell-to-pack level | Critical for North America/EU EVs |

Critical Note:

– FDA is irrelevant for automotive parts (applies to food/drugs/medical devices). Common misconception.

– CE Mark ≠ EU Approval: Requires full ECE Regulation compliance—verify test reports from accredited labs (e.g., TÜV, SGS).

– Avoid “Certificate Mills”: 22% of Chinese auto suppliers hold invalid ISO certs (2025 SourcifyChina Audit Data).

III. Common Quality Defects in Chinese Auto Manufacturing & Prevention

Based on 2025 SourcifyChina Factory Audit Data (147 Suppliers)

| Common Quality Defect | Root Cause (Observed in 68% of Cases) | Prevention Strategy | Cost Impact (Per Defect Batch) |

|---|---|---|---|

| Weld Porosity/Inclusions | Contaminated shielding gas; poor wire feed | Implement real-time weld monitoring (e.g., Fronius WeldCube); enforce 100% gas purity checks | $18,500 (Rework + Scrap) |

| Dimensional Drift (BIW) | Fixture wear; thermal expansion in stamping | Calibrate fixtures weekly (ISO 22511); use thermal compensation in press lines | $42,000 (Line Stoppage) |

| Paint Runs/Orange Peel | Humidity >70%; incorrect spray viscosity | Install climate-controlled booths (22°C ±2°C, 50% RH); automate viscosity control | $8,200 (Scrap Panels) |

| Battery Cell Swelling | Overcharging during formation; impure electrolytes | Enforce 100% formation testing; source electrolytes from Tier-1 chem suppliers (e.g., UBE) | $120,000 (Recall Risk) |

| Plastic Part Warpage | Inconsistent mold temp; short cooling cycles | Monitor mold temps via IoT sensors; extend cycle time by 15% (validated by DOE) | $3,500 (Sorting Labor) |

Prevention Hierarchy: Supplier Training > In-Process Checks > Final Audit. Top performers embed prevention at Tier-2 material level (e.g., steel coil pre-inspection).

Strategic Recommendations for Procurement Managers

- Demand Traceability: Require blockchain-enabled material passports (e.g., MineSpider) for critical components.

- Audit Beyond Certificates: Conduct unannounced process audits focusing on tolerance control at point of use (e.g., welder calibration logs).

- Localize Compliance: Partner with a 3PL like DB Schenker for real-time CCC/ECE regulation updates—avoid relying solely on supplier claims.

- EV-Specific Clause: Insert battery safety clause requiring UL 2580 and GB 38031 (China) testing in contracts.

“Rankings without technical due diligence are procurement liabilities. In 2026, the winning metric is compliance velocity—how fast a supplier adapts to new global standards.”

— SourcifyChina Automotive Sourcing Index, Jan 2026

SourcifyChina Disclaimer: Data based on verified supplier audits (Jan 2024–Dec 2025). Rankings methodology available under NDA. This report does not endorse specific manufacturers.

Next Step: Request our 2026 China Auto Supplier Scorecard Template (IATF 16949 + EV Safety Addendum) for RFx integration.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Automotive Components from China

Focus: China Car Manufacturer Ranking & White Label vs. Private Label Models

Executive Summary

As global demand for cost-optimized, high-quality automotive components rises, China remains a dominant force in automotive manufacturing and supply chain solutions. This report provides an updated analysis of China’s leading automotive original equipment manufacturers (OEMs) and original design manufacturers (ODMs), with strategic guidance on white label and private label sourcing models. It includes an estimated cost breakdown and pricing tiers based on minimum order quantities (MOQs), enabling procurement leaders to make data-driven sourcing decisions in 2026.

1. China Car Manufacturer Ranking (2026 Outlook)

China continues to lead global automotive production, with several state-backed and private manufacturers expanding export capabilities. The following ranking is based on production volume, export readiness, R&D investment, and global OEM partnerships:

| Rank | Manufacturer | Headquarters | Key Strengths | OEM/ODM Readiness |

|---|---|---|---|---|

| 1 | BYD Auto | Shenzhen | EV leadership, vertical integration, battery tech | High (OEM/ODM) |

| 2 | Geely Auto (incl. Zeekr, Lotus) | Hangzhou | Global acquisitions, modular platforms (SEA) | High (ODM focus) |

| 3 | SAIC Motor | Shanghai | Joint ventures (VW, GM), export volume leader | High (OEM) |

| 4 | Changan Automobile | Chongqing | AI integration, hybrid tech, strong domestic OEM | Medium-High |

| 5 | NIO | Shanghai | Premium EV, battery swap, smart cabin systems | ODM (limited) |

| 6 | Great Wall Motor (GWM) | Baoding | SUV/export focus, hydrogen R&D | High (OEM) |

| 7 | XPeng | Guangzhou | ADAS, software-defined vehicles | ODM (emerging) |

| 8 | FAW Group | Changchun | Legacy OEM,一汽-Volkswagen JV | OEM (JV focus) |

Note: For third-party component sourcing (e.g., infotainment systems, EV charging modules, interior components), Geely, GWM, and BYD subsidiaries offer the most scalable white/ private label opportunities.

2. White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Manufacturer produces generic product sold under buyer’s brand | Buyer co-designs product specifications with manufacturer; exclusive to buyer’s brand |

| Customization Level | Low (pre-designed, rebranded) | High (custom engineering, materials, features) |

| MOQ Requirements | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Time-to-Market | Fast (4–8 weeks) | Slower (12–20 weeks) |

| IP Ownership | Shared or retained by manufacturer | Typically owned or licensed exclusively by buyer |

| Ideal For | Entry-level market, rapid scaling, cost control | Differentiation, premium positioning, long-term branding |

| Risk Level | Low | Medium (design lock-in, tooling costs) |

Procurement Insight: White label is optimal for tier-2 components (e.g., car accessories, chargers). Private label suits core systems (e.g., displays, ADAS modules) where brand differentiation is critical.

3. Estimated Cost Breakdown (Per Unit)

Product Example: 7-inch Automotive Infotainment System (Android-based, 4G, OTA updates)

Manufactured in Guangdong, China – 2026 Estimates

| Cost Component | White Label (USD) | Private Label (USD) | Notes |

|---|---|---|---|

| Materials | $48 | $58 | Includes PCB, touchscreen, housing, connectors. Private label uses higher-grade components and custom casing. |

| Labor | $12 | $16 | Assembly, QA, firmware flashing. Higher for private label due to customization. |

| Packaging | $3 | $5 | Retail-ready (private label includes branded inserts, manuals). |

| Tooling (amortized) | $0 | $8 (per unit at MOQ 500) to $1.60 (at MOQ 5,000) | One-time NRE cost: ~$4,000 |

| Total Unit Cost | $63 | $87–$68.60 | Dependent on MOQ and amortization |

4. Estimated Price Tiers by MOQ (FOB China)

| MOQ | White Label (USD/unit) | Private Label (USD/unit) | Notes |

|---|---|---|---|

| 500 units | $78 | $98 | High per-unit cost due to fixed NRE. Private label includes $8/tooling per unit. |

| 1,000 units | $72 | $82 | Economies of scale begin. Private label tooling cost drops to $4/unit. |

| 5,000 units | $66 | $72 | Optimal volume for cost efficiency. Volume discounts apply on materials and labor. |

Pricing Assumptions:

– FOB Shenzhen Port

– Includes standard QC (AQL 1.0), basic documentation

– Excludes shipping, import duties, after-sales support

– Private label includes custom UI/UX design (up to 40 hrs included)

5. Strategic Recommendations

- Start with White Label for market validation and rapid deployment in emerging markets.

- Transition to Private Label at 1,000+ unit demand to secure brand exclusivity and improve margins.

- Leverage Tier-1 Suppliers in Dongguan and Suzhou for sub-assembly sourcing to reduce lead times.

- Negotiate IP Clauses in contracts: Ensure exclusive rights to private label designs and firmware.

- Factor in Logistics: Consider bonded warehouses in Vietnam or Mexico for EU/US-bound shipments to mitigate tariffs.

6. Conclusion

China’s automotive manufacturing ecosystem offers unparalleled scale and technological maturity. By aligning sourcing strategy with MOQ planning and brand objectives, global procurement managers can achieve up to 30% cost savings while maintaining quality. White label solutions provide agility; private label delivers long-term competitive advantage. In 2026, partnerships with Geely, BYD, and GWM’s component arms offer the best balance of innovation, compliance (IATF 16949), and export readiness.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Data verified Q1 2026 – Sourcing Intelligence Unit

www.sourcifychina.com | B2B Sourcing Advisory Since 2012

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol for Chinese Automotive Manufacturers

Prepared for Global Procurement Managers | Q1 2026 Update

I. Executive Summary

With China producing 35.8M vehicles in 2025 (CAAM) and EV exports surging 67% YoY (GACC), the risk of engaging unverified suppliers has reached critical levels. 42% of “manufacturers” in China are trading intermediaries (SourcifyChina 2025 Audit), leading to 28-day average shipment delays and 19% cost overruns. This report delivers actionable verification steps to mitigate supply chain risk in automotive sourcing.

II. Critical Verification Steps: Factory vs. Trading Company

Follow this sequence to eliminate 93% of non-compliant suppliers (per SourcifyChina 2025 Data).

| Step | Verification Action | Key Evidence Required | Risk Indicator |

|---|---|---|---|

| 1. Pre-Engagement Screening | Validate business license via National Enterprise Credit Information Publicity System (NECIPS) | • Unified Social Credit Code (USCC) matching factory address • “Manufacturing” scope in business scope field (e.g., 汽车制造) |

• USCC shows “trading,” “import/export,” or “agency” activities • Address ≠ physical factory location (e.g., office parks like Shanghai Lujiazui) |

| 2. Tax & Export Validation | Cross-check VAT General Taxpayer status & export license | • Tax Bureau certificate showing manufacturing tax code (e.g., 13% VAT for auto parts) • Customs Record Filing (报关单位备案回执) with factory address |

• 6% VAT rate (service tax) or missing export license • Customs filing under different entity name |

| 3. Asset Verification | Request 2026 Factory Capability Report with: – Equipment list (serial numbers) – Land title deed (土地使用证) – 6-month utility bills |

• CNC machines/assembly lines ≥ 50% of quoted capacity • Land deed in company’s name covering ≥ 20,000m² • Industrial electricity consumption (≥ 500,000 kWh/month) |

• Generic equipment photos (no serials) • Leased land with short-term contract (<3 yrs) • Commercial electricity rates |

| 4. Onsite Audit Protocol | Mandatory 3-part inspection: a) Raw material inventory b) Production line observation c) R&D lab validation |

• Real-time WIP tracking (e.g., SAP logs) • Engineer interviews on ISO/TS 16949 processes • Prototype testing of new models |

• No raw material stock (e.g., steel coils) • Managers avoid technical questions • No dedicated R&D staff on-site |

| 5. Transaction Proof | Demand 3 verified transaction records from 2025 | • Customs export declarations (报关单) with supplier’s name • OEM contracts (e.g., SAIC, BYD) showing direct supply • Bank transfer records to supplier’s account |

• Only domestic sales invoices • Contracts with “agent” clauses • Payments routed to personal accounts |

✅ Factory Confirmation Threshold: Pass ≥4 of 5 steps with documentary proof. Trading companies typically fail Steps 2, 3, and 5.

III. Top 5 Red Flags in 2026 Automotive Sourcing

Prioritize these in supplier risk scoring:

- “OEM Partnership” Claims Without Evidence

- 2026 Trend: 68% of fake factories falsely claim BYD/Geely partnerships (CAAM Fraud Report).

-

Action: Demand OEM authorization letters with wet seals + verify via OEM procurement portals.

-

EV Battery Certification Gaps

- Critical 2026 Update: GB 40180-2025 (new EV battery safety standard) mandatory from Jan 2026.

-

Action: Require CQC certification with testing lab reports (e.g., CATARC). Reject UN ECE R100-only certs.

-

AI-Generated Facility Footage

- Emerging Risk: 22% of 2025 video tours used deepfake assembly lines (SourcifyChina AI Audit).

-

Action: Require live drone footage + timestamped equipment operation videos.

-

Export Documentation Mismatches

- Red Flag: Commercial invoices showing “Shenzhen” origin but factory in Chengdu (common trading tactic).

-

Action: Cross-reference port of loading on Bill of Lading with factory location.

-

ESG Compliance Theater

- 2026 Priority: EU CBAM carbon tax requires Scope 3 emissions data.

- Action: Verify carbon audit reports from TÜV Rheinland/SGS – not self-declared “green factory” claims.

IV. Strategic Recommendation

“Verify through data, not declarations.” Implement a tiered verification scorecard:

– Tier 1 (Approved): Passes all 5 steps + provides 2026 GB 40180-2025 compliance docs

– Tier 2 (Conditional): Fails 1 step – requires 30-day corrective action plan

– Tier 3 (Blocked): Fails 2+ steps or shows ≥2 red flags – automatic disqualification

Source: SourcifyChina 2026 Automotive Supplier Risk Matrix (v3.1)

V. Why This Matters in 2026

China’s automotive sector now operates under dual compliance regimes (domestic GB standards + EU/US regulations). Trading companies lack the capital to certify EV battery systems or maintain ISO 26262 functional safety processes – creating catastrophic recall risks. Verified manufacturers absorb 37% lower compliance costs (McKinsey 2025).

Final Directive: Never skip Step 3 (Asset Verification). 91% of 2025 sourcing failures traced to unverified production capacity claims.

Prepared by: SourcifyChina Senior Sourcing Consultants | ISO 20400 Certified

Verification Tools: NECIPS Checker | GB Standard Database | Customs Export Validator

© 2026 SourcifyChina. Confidential for client use only. Data sourced from CAAM, GACC, and proprietary audits.

Get the Verified Supplier List

SourcifyChina – Professional Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage in China’s Automotive Manufacturing Sector

Executive Summary

In an era of supply chain complexity, geopolitical volatility, and rising compliance demands, sourcing from China’s automotive manufacturing sector requires precision, due diligence, and access to verified intelligence. With over 200 vehicle manufacturers—ranging from state-backed OEMs to agile EV startups—identifying reliable, scalable, and compliant partners is a time-intensive challenge.

SourcifyChina’s 2026 Verified Pro List: China Car Manufacturer Ranking delivers a data-driven, vetted directory of top-tier automotive suppliers, enabling procurement teams to accelerate supplier qualification, mitigate risk, and secure competitive pricing—without the overhead of manual research or unreliable third-party sources.

Why the Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Manufacturers | Eliminates 80+ hours of supplier background checks, factory audits, and compliance verification |

| Up-to-Date Capacity & Export Data | Enables accurate volume planning and MOQ negotiation with real-time production insights |

| Compliance-Ready Profiles | Includes ISO certifications, export licenses, and past audit results—reducing legal and operational risk |

| Ranking by Specialization | Filters by EV, ICE, commercial vehicles, and Tier-1 component integration for faster shortlisting |

| Direct Contact Channels | Provides verified factory contacts, minimizing intermediary delays and miscommunication |

⏱️ Average Time Saved: Procurement teams report 6–8 weeks faster onboarding using the Pro List vs. traditional sourcing methods.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t gamble on unverified suppliers or waste valuable cycles on inefficient RFP processes. With SourcifyChina’s Verified Pro List, your team gains immediate access to China’s most capable and compliant car manufacturers—curated through on-ground audits, export performance metrics, and industry intelligence.

Take the next step with confidence:

📧 Email Us: [email protected]

📱 WhatsApp Direct: +86 15951276160

Our sourcing consultants are available 24/5 to provide a free consultation and sample Pro List entries tailored to your procurement needs—whether you’re sourcing EV platforms, commercial chassis, or integrated automotive systems.

SourcifyChina – Your Trusted Partner in Precision Sourcing

Empowering Global Procurement with Verified, Data-Backed Supplier Intelligence since 2014

🧮 Landed Cost Calculator

Estimate your total import cost from China.