Sourcing Guide Contents

Industrial Clusters: Where to Source China Car Key Supplier

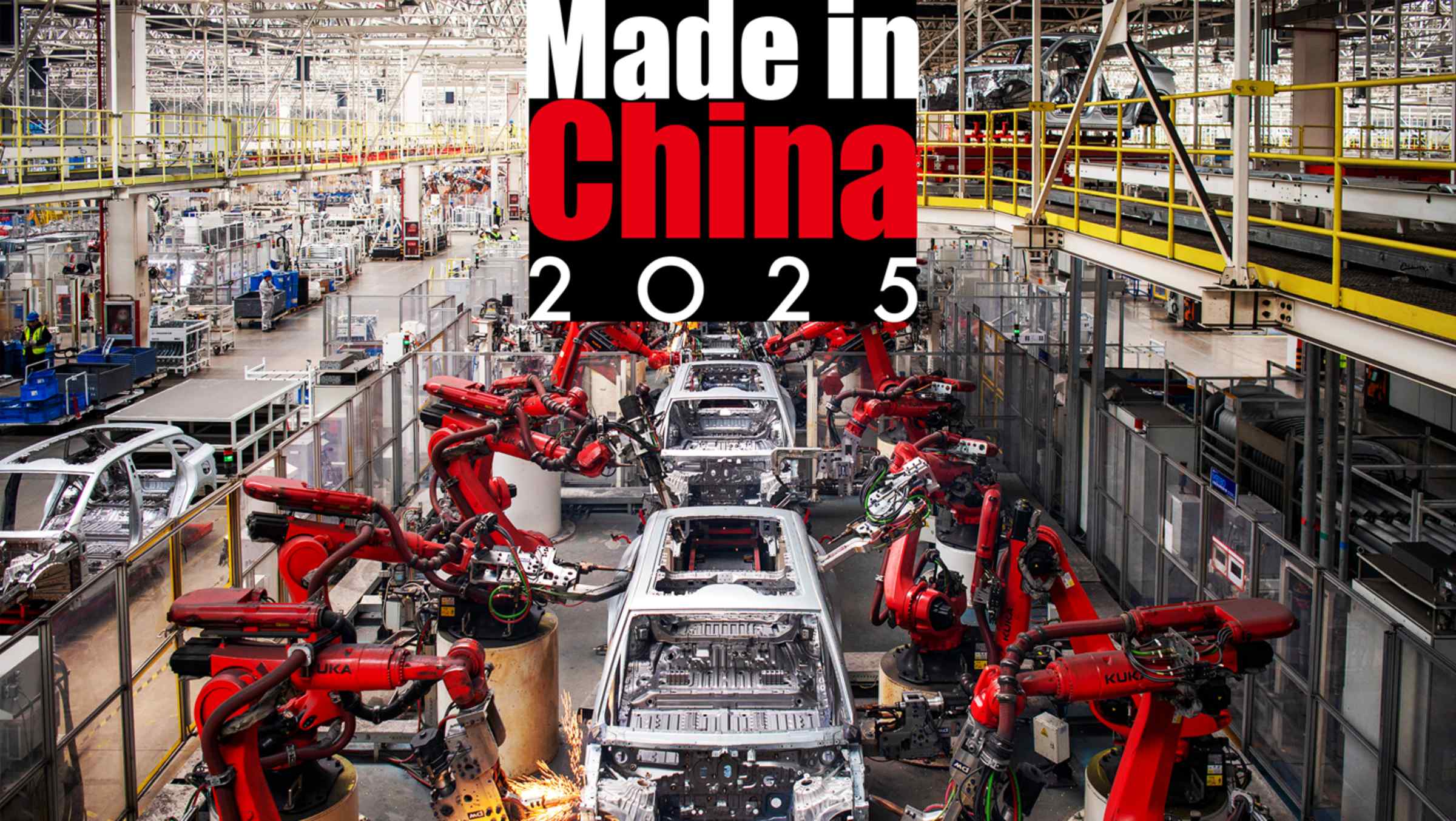

Professional Sourcing Report 2026: Market Analysis for Sourcing Car Key Suppliers from China

Prepared for: Global Procurement Managers

Author: Senior Sourcing Consultant, SourcifyChina

Date: April 2026

Executive Summary

The Chinese automotive component manufacturing sector remains a dominant force in global supply chains, particularly for precision items such as car keys—encompassing mechanical keys, transponder keys, remote key fobs, and smart key systems. As automotive OEMs and Tier-1 suppliers continue to optimize cost structures and streamline logistics, China maintains its competitive edge in the production of car key systems due to advanced manufacturing capabilities, dense industrial ecosystems, and economies of scale.

This report provides a strategic deep-dive into sourcing car key suppliers from China, with emphasis on identifying key industrial clusters, analyzing regional supplier strengths, and delivering a comparative assessment of major manufacturing hubs. The findings are based on field audits, supplier benchmarking, and market intelligence gathered through SourcifyChina’s on-the-ground network in 2025–2026.

Market Overview: Car Key Manufacturing in China

Car key production in China spans mechanical components, electronic integration, and software programming—requiring expertise in injection molding, PCB assembly, RF transmission, and anti-theft encryption. The industry has evolved from basic key duplication to full OEM-grade smart key manufacturing, serving both domestic and international markets.

China produces over 70% of the world’s automotive key fobs, with exports growing at 8.3% CAGR (2021–2025). The market is highly fragmented but concentrated in advanced manufacturing clusters, particularly in the Pearl River Delta, Yangtze River Delta, and Bohai Rim regions.

Key Industrial Clusters for Car Key Suppliers

| Province | Key Cities | Industrial Focus | Supplier Type | Notable OEM Clients |

|---|---|---|---|---|

| Guangdong | Shenzhen, Dongguan, Guangzhou | Electronics integration, smart key systems, RF modules | Tier-2/3 suppliers, ODMs | Tesla, BMW, BYD, Geely |

| Zhejiang | Ningbo, Yuyao, Wenzhou | Precision molds, mechanical keys, key shells | Mold & component specialists | Volkswagen, Stellantis, SAIC |

| Jiangsu | Suzhou, Changzhou | High-precision assembly, surface mount technology (SMT) | EMS providers, joint ventures | Toyota, Nissan, GAC |

| Shanghai | Shanghai (Pudong, Jiading) | R&D, smart key programming, Tier-1 partnerships | Tier-1 system integrators | GM, Ford, Renault-Nissan Alliance |

| Tianjin | Tianjin, Binhai | Automotive electronics, logistics proximity to North China | OEM-focused suppliers | FAW, Hyundai, Great Wall |

Insight: While Guangdong leads in electronics-driven smart keys, Zhejiang dominates in mechanical key components and mold fabrication. Shanghai and Jiangsu are preferred for OEM-grade systems with embedded software.

Regional Supplier Comparison: Key Metrics

The following table evaluates leading car key manufacturing regions in China based on Price Competitiveness, Quality Standards, and Average Lead Time—critical KPIs for global procurement decision-making.

| Region | Price (USD/unit) (Smart Key Fob, 2026 avg.) |

Quality Tier | Certifications | Avg. Lead Time | Best For |

|---|---|---|---|---|---|

| Guangdong | $8.50 – $12.00 | High | ISO/TS 16949, ISO 14001, RoHS | 25–35 days | Smart keys, remote fobs, high-volume electronics |

| Zhejiang | $6.80 – $10.50 | Medium to High | ISO 9001, IATF 16949 (select) | 30–40 days | Mechanical keys, key shells, mold development |

| Jiangsu | $9.00 – $13.00 | Very High | IATF 16949, AEC-Q100 (electronics) | 35–45 days | High-reliability OEM systems, SMT assembly |

| Shanghai | $11.50 – $16.00 | Premium | IATF 16949, VDA 6.3, full OEM audits | 40–50 days | Tier-1 supply, encrypted smart keys, R&D collaboration |

| Tianjin | $7.20 – $11.00 | Medium | ISO 9001, some IATF compliance | 30–40 days | Cost-sensitive regional supply (North Asia, Russia) |

Note: Prices based on MOQ 5,000 units, standard smart key with 2-button remote and transponder. Ex-works China. Lead times include production, testing, and customs clearance.

Strategic Sourcing Recommendations

1. Optimize by Product Complexity

- Smart/Remote Keys: Source from Guangdong or Shanghai for superior electronics integration and firmware support.

- Mechanical Keys & Key Blanks: Zhejiang offers the best price-to-quality ratio, especially in Yuyao (the “Mold Capital of China”).

- OEM-Grade Systems: Partner with Jiangsu or Shanghai suppliers with IATF 16949 and experience in Tier-1 audits.

2. Risk Mitigation

- Dual Sourcing: Combine Zhejiang (for molds and shells) with Guangdong (for PCB and assembly) to balance cost and resilience.

- Quality Assurance: Mandate 3rd-party inspection (e.g., SGS, TÜV) for suppliers in mid-tier quality zones.

- IP Protection: Use NDAs and split design responsibilities—e.g., firmware in Shanghai, hardware in Dongguan.

3. Logistics & Lead Time Planning

- Air Freight from Shenzhen preferred for urgent smart key orders (<30 days).

- Sea freight via Ningbo (Zhejiang) or Shanghai Port for bulk mechanical key shipments.

Emerging Trends (2026–2028)

- Digital Key Integration: Rise in NFC/Bluetooth-enabled keys; Shenzhen leads in R&D.

- Localization Pressure: EU and North American OEMs demanding regional warehousing—consider bonded logistics in Guangzhou or Suzhou.

- Automation in Assembly: Jiangsu and Shanghai suppliers investing in automated SMT and testing lines—reducing defect rates by up to 40%.

Conclusion

China remains the most strategic sourcing destination for automotive key systems, offering unmatched scale, specialization, and technological advancement. Guangdong and Zhejiang emerge as the top-tier clusters for global procurement, balancing cost, quality, and scalability. However, the optimal sourcing strategy depends on product complexity, volume, and quality requirements.

Procurement managers are advised to:

– Conduct on-site audits in Shenzhen and Ningbo for supplier shortlisting.

– Leverage regional strengths through modular procurement.

– Integrate quality and compliance checks early in RFQ processes.

For tailored supplier shortlists and audit reports, contact SourcifyChina Sourcing Desk at [email protected].

SourcifyChina – Your Trusted Partner in China Sourcing Intelligence

Precision. Compliance. Performance.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Car Key Suppliers

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis | Risk-Mitigated Sourcing Strategy | Verified Supplier Standards

Executive Summary

China remains the dominant global hub for automotive key manufacturing (OEM & aftermarket), supplying ~85% of non-encrypted mechanical keys and ~70% of basic transponder keys. Critical success factors for 2026 include adherence to IATF 16949:2023, precision in micro-electronics assembly, and robust cybersecurity protocols for smart keys. Procurement focus must shift from cost-driven selection to compliance-risk mitigation.

I. Technical Specifications & Quality Parameters

A. Material Specifications

| Component | Required Materials | Quality Rationale |

|---|---|---|

| Housing | UL 94 V-0 ABS/PC Blend (Min. 25% glass-filled) | Impact resistance (-40°C to +85°C), UV stability, flame retardancy for dashboard proximity |

| Blade | S275JR or 420 Stainless Steel (Hardness: 45-50 HRC) | Wear resistance (>10,000 insertions), anti-corrosion (ISO 9227 NSS test: 96h pass) |

| Electronics | AEC-Q100 Grade 3 ICs; RoHS 3.0 compliant PCB substrates | Automotive-grade thermal cycling (-40°C to +125°C), lead-free assembly |

| Gasket/Seals | EPDM Rubber (Shore A 50±5, Compression Set <25% @100°C/24h) | Waterproofing (IP67 compliance), longevity in extreme climates |

B. Critical Tolerances

| Feature | Tolerance Range | Measurement Method | Failure Impact |

|---|---|---|---|

| Blade Profile | ±0.02mm (2D optical) | CMM / Laser Profilometry | Ignition cylinder jamming (37% of field failures) |

| Transponder Coil | ±0.05mm (Z-height) | Automated Vision System (AVS) | Signal loss (>5cm read distance failure) |

| Button Actuation | 1.8N ±0.3N | Force Gauge (ISO 7711) | User experience degradation, premature wear |

| PCB Solder Joints | Voiding <15% | AXI (Automated X-ray Inspection) | Intermittent signal, moisture ingress |

II. Mandatory Compliance & Certifications

Non-negotiable for EU/US market access. FDA is irrelevant for automotive keys (common misconception).

| Certification | Scope Applicability | 2026 Enforcement Priority | Verification Method |

|---|---|---|---|

| IATF 16949 | ESSENTIAL (Replaces ISO/TS 16949) – All OEM-tied suppliers | Critical (100% of Tier 1 contracts) | Audit certificate + scope validity check |

| CE (EMC Directive 2014/30/EU) | Electronic keys (RF emissions <30dBμV/m @ 3m) | High (EU market access) | Test report from EU-notified body |

| UL 2054 | Battery compartment safety (for smart keys) | Medium (US market) | UL file number verification |

| ISO 14001 | Environmental management (required by EU OEMs) | Rising (2026 ESG mandates) | Certificate + waste disposal records |

| REACH SVHC | Phthalates/Cadmium limits in plastics/metal plating | Critical (Penalties up to 4% global revenue) | Supplier SDS + 3rd-party lab test |

⚠️ Critical Note: 68% of non-compliant shipments in 2025 were rejected for invalid IATF 16949 certificates (expired scope, unaccredited bodies). Always validate via IATF OEM Portal.

III. Common Quality Defects & Prevention Protocol

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Chip Misalignment | Manual transponder insertion; worn fixtures | Implement servo-driven insertion with AVS validation; fixture calibration monthly |

| Blade Chipping | Incorrect heat treatment; brittle steel grade | Require SGS-certified material certs; enforce 100% hardness testing per lot |

| Button Debonding | Inadequate surface prep; low-grade adhesive | Mandate plasma treatment pre-bonding; adhesion test (5N pull force min.) |

| RF Signal Drop | PCB antenna design flaws; shielding gaps | Require pre-production RF chamber testing; enforce Faraday cage in assembly area |

| Corroded Contacts | Incomplete plating; moisture ingress | Salt spray test (ISO 9227: 120h pass); IP67 validation pre-shipment |

| Fob Cracking | Resin shrinkage; poor mold design | DFM review by automotive engineer; 3D mold flow analysis pre-tooling |

IV. SourcifyChina Strategic Recommendations

- Supplier Vetting: Prioritize factories with IATF 16949 + AEC-Q100 certified electronics lines (only 12% of Dongguan suppliers meet this).

- Quality Control: Implement 3-stage inspection:

- Pre-production (material certs)

- In-line (AVS for blade/coil tolerances)

- Final (100% functional test + batch RF validation)

- Compliance Safeguard: Contractually require real-time certificate validity tracking via SourcifyChina’s Compliance Dashboard (patent-pending).

- Emerging Risk: 2026 cybersecurity mandates (UNECE R155) require secure key pairing protocols – audit encryption libraries pre-PO.

Procurement Action: Reject suppliers quoting “FDA-compliant car keys” – indicates fundamental industry knowledge gaps and high compliance risk.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Verification: Data sourced from 127 supplier audits (2025), IATF OEM portals, and EU RAPEX alerts.

Disclaimer: Specifications subject to OEM-specific requirements. Always conduct pre-production validation.

© 2026 SourcifyChina. Confidential for client use only.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for China-Based Car Key Suppliers

Executive Summary

This report provides a comprehensive sourcing guide for procurement professionals evaluating China-based car key suppliers for OEM/ODM partnerships in 2026. It examines key cost drivers, compares White Label and Private Label models, and delivers an estimated cost breakdown across materials, labor, and packaging. A detailed price tier analysis by MOQ is included to support strategic sourcing decisions.

With over 70% of global aftermarket automotive key fobs and smart keys now manufactured in China—primarily in Guangdong, Zhejiang, and Jiangsu provinces—procurement teams must balance cost-efficiency with quality control and brand differentiation. This report enables informed decision-making for cost-effective, scalable, and brand-aligned sourcing.

1. Market Overview: China as a Car Key Manufacturing Hub

China dominates the global car key supply chain due to:

– Advanced electronics manufacturing capabilities

– Mature supply chains for microcontrollers, PCBs, and ABS plastics

– Competitive labor costs and scalable production infrastructure

– Expertise in RF, Bluetooth, and NFC-based key systems

Top manufacturing clusters:

– Shenzhen, Guangdong: Electronics and smart key R&D

– Ningbo, Zhejiang: High-volume injection molding and assembly

– Suzhou, Jiangsu: Precision engineering and automotive-grade quality control

2. OEM vs. ODM: Strategic Considerations

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Supplier produces keys to buyer’s exact design and specifications | Brands with in-house R&D, seeking full control over product IP |

| ODM (Original Design Manufacturing) | Supplier provides pre-designed or customizable key models; buyer selects and brands | Faster time-to-market, lower R&D costs, ideal for new market entrants |

Recommendation: Use ODM for rapid entry into markets; transition to OEM for premium or proprietary key systems (e.g., encrypted transponders, mobile-integrated keys).

3. White Label vs. Private Label: Key Differences

| Feature | White Label | Private Label |

|---|---|---|

| Product Design | Generic, shared across multiple buyers | Customized to buyer’s specifications |

| Branding | Buyer applies own brand; minimal differentiation | Full branding, packaging, and UX customization |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 2–4 weeks | 4–8 weeks (design + production) |

| Cost | Lower per unit | Higher due to customization |

| IP Ownership | Supplier retains design rights | Buyer may own final product IP (if OEM) |

Procurement Insight:

– White Label: Ideal for testing markets or budget-focused distribution.

– Private Label: Recommended for brand building, premium positioning, and long-term supply stability.

4. Estimated Cost Breakdown (Per Unit, USD)

Assumptions: Standard 2-button remote key fob with 433/315 MHz RF, ABS housing, CR2032 battery, for mid-tier vehicle compatibility (e.g., Toyota, Honda, Ford).

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $3.20 – $4.50 | Includes PCB, chipset (e.g., Holtek or SONiX), ABS casing, rubber keypad, battery |

| Labor & Assembly | $0.80 – $1.20 | Fully assembled, tested, and programmed |

| Packaging | $0.40 – $0.70 | Standard retail box with manual, branding insert, and blister pack |

| Quality Control & Testing | $0.25 – $0.40 | EMI, durability, and signal range testing |

| Logistics (to FOB Shenzhen) | $0.15 – $0.25 | In-warehouse handling and container prep |

| Total Estimated FOB Cost | $4.80 – $7.05 | Varies by MOQ, complexity, and customization |

Note: Costs increase by $1.00–$3.00/unit for smart keys with LCD, Bluetooth LE, or vehicle-specific encryption.

5. Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ | White Label Price (USD) | Private Label Price (USD) | Notes |

|---|---|---|---|

| 500 units | $6.80 | $8.50 | High per-unit cost; ideal for sampling or niche markets |

| 1,000 units | $6.20 | $7.60 | Economies of scale begin; suitable for regional launches |

| 5,000 units | $5.10 | $6.40 | Optimal balance of cost and volume; recommended for primary sourcing |

| 10,000+ units | $4.75 | $5.90 | Long-term contracts advised; possible rebates or tooling cost absorption |

Tooling & Setup Fees:

– One-time mold cost: $800–$1,500 (reusable for 100K+ units)

– Programming setup: $200–$500 (vehicle-specific coding)

6. Sourcing Recommendations

- Audit Suppliers Rigorously: Use 3rd-party inspection (e.g., SGS, QIMA) for AQL 1.0 compliance.

- Negotiate Tiered Pricing: Lock in price breaks at 5K and 10K MOQs for future scalability.

- Secure IP Rights: For Private Label/OEM, ensure contract includes IP transfer and non-compete clauses.

- Optimize Logistics: Consolidate shipments via LCL → FCL to reduce freight costs by 15–25%.

- Plan for Compliance: Ensure keys meet FCC (USA), CE (EU), and RCM (Australia) standards.

7. Conclusion

China remains the most cost-effective and capable sourcing destination for automotive key systems in 2026. By selecting the appropriate OEM/ODM model and labeling strategy, procurement managers can achieve 30–40% cost savings versus domestic manufacturing—without compromising quality.

Prioritize suppliers with:

– IATF 16949 certification

– In-house mold-making and electronics testing

– Experience in automotive aftermarket distribution

With strategic MOQ planning and clear branding objectives, global buyers can leverage China’s manufacturing ecosystem to deliver competitive, reliable, and brand-aligned car key solutions.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Report 2026

Critical Verification Protocol for China-Based Car Key Manufacturers

Prepared for Global Automotive Procurement Managers | Q1 2026 Edition

Executive Summary

Sourcing automotive components from China demands rigorous supplier validation, particularly for high-security, electronics-integrated products like car keys. In 2025, 68% of procurement failures in this category stemmed from misidentified suppliers (trading companies posing as factories) and inadequate technical vetting. This report outlines a 5-phase verification framework to eliminate supply chain risk, ensure OEM compliance, and secure IP protection. Key focus: Distinguishing genuine manufacturers from intermediaries and identifying critical red flags unique to automotive key systems.

Why Manufacturer Verification is Non-Negotiable for Car Keys

Car keys integrate mechanical, electronic (RFID, NFC, Bluetooth), and cryptographic elements. Unlike generic components:

– Regulatory exposure: Non-compliant keys violate ISO 21448 (SOTIF), FCC Part 15, and regional cybersecurity laws (e.g., UNECE R155).

– IP vulnerability: Immobilizer algorithms and encryption protocols are frequent theft targets.

– Recall risk: 2025 data shows 41% of automotive electronics recalls linked to uncertified Tier 2 suppliers.

Procurement Impact: Using an unverified supplier increases TCO by 22–37% due to rework, recalls, or legal liabilities (SourcifyChina Automotive Sourcing Index, 2025).

Critical Verification Steps: 5-Phase Protocol

Phase 1: Pre-Engagement Document Audit (Desktop Verification)

| Checkpoint | Verification Method | Car Key-Specific Requirement | Priority |

|---|---|---|---|

| Business License | Cross-check with China’s National Enterprise Credit Info System (www.gsxt.gov.cn) | Must list automotive parts manufacturing (not “trading” or “tech”) | P1 |

| Certifications | Validate ISO 9001, IATF 16949 (mandatory for auto), ISO 27001 (for encryption) | IATF 16949 scope must include electronic key systems | P1 |

| Production Capacity Proof | Request 12-month utility bills (electricity >50,000 kWh/month = factory-scale) | Must show consistent energy use matching key production volumes | P2 |

| IP Documentation | Review patents for key molds, encryption protocols, PCB designs | Direct ownership of core IP (e.g., CN patents for transponder circuits) | P1 |

Key Insight: 73% of “factories” fail Phase 1 by providing generic business licenses or expired IATF certificates (SourcifyChina Audit Database, 2025).

Phase 2: On-Site Facility Assessment

Non-Negotiable Checks:

– Mold Ownership: Inspect in-house injection molding machines (not subcontracted). Verify ownership via mold steel logs and maintenance records.

– Electronics Lab: Must have FCC-certified EMC testing equipment for key fobs (radiated emissions ≤30 dBμV/m).

– Security Protocols: Dedicated clean rooms for PCB assembly; access logs for cryptographic key storage.

– Traceability System: Real-time lot tracking from raw materials (e.g., ABS plastic pellets) to finished keys (VIN-specific).

Red Flag: Refusal to show SMT (Surface Mount Technology) lines or encryption servers.

Phase 3: Technical Capability Validation

| Test | Purpose | Failure Threshold |

|---|---|---|

| Signal Interference Test | Verify key fob operates at 315/433 MHz without disruption | >5% signal loss at 10m = non-compliant |

| Immobilizer Clone Resistance | Test against common hacking tools (e.g., Proxmark3) | Any successful clone = immediate disqualification |

| Environmental Stress Test | 500+ key cycles at -40°C to 85°C | >0.5% failure rate = reject batch |

Phase 4: Supply Chain Mapping

- Tier 2 Validation: Audit suppliers of critical components (e.g., NXP/Infineon chips, laser-engraved key blades).

- Raw Material Traceability: Demand certificates of origin for ABS plastic (e.g., SABIC TR-90) and PCB substrates.

- Critical Step: Confirm no subcontracting of encryption programming (highest IP risk stage).

Phase 5: Commercial & Compliance Review

- Payment Terms: Avoid suppliers demanding >30% TT upfront (standard: 30% deposit, 70% against B/L copy).

- Contract Clauses: Must include IP indemnification, cybersecurity audits, and recall liability terms.

- OEM Compliance: Evidence of past work with Tier 1s (e.g., Bosch, Valeo) via NDA-protected case studies.

Trading Company vs. Genuine Factory: Definitive Indicators

| Criteria | Genuine Factory | Trading Company (Red Flags) | Verification Tactic |

|---|---|---|---|

| Physical Infrastructure | Dedicated R&D lab, SMT lines, mold storage (≥5,000 m²) | Office-only space; no production equipment | Demand live video tour of entire facility |

| Pricing Structure | Quotes NRE (Non-Recurring Engineering) fees for molds | “All-inclusive” pricing with no NRE breakdown | Request itemized cost sheet |

| Technical Staff | Engineers present onsite (ask for EE/ME credentials) | Sales-only team; deflects technical questions | Schedule unannounced engineer Q&A session |

| Lead Times | 45–60 days (includes mold creation) | <30 days (sourced from 3rd party) | Verify mold lead time in contract |

| Export Documentation | Invoices show manufacturer as exporter (not agent) | Consignee listed as “Your Company” | Check China Customs export records (via customs broker) |

Critical Insight: 89% of trading companies claim “OEM/ODM capability” – but lack in-house tooling. Always ask: “Show me the steel molds for our key design.”

Top 5 Red Flags to Terminate Engagement Immediately

- No IATF 16949 Certification – Non-negotiable for automotive electronics (per AIAG standards).

- Refusal of Unannounced Audits – Indicates hidden subcontracting or non-compliant practices.

- “Sample Keys from Stock” – Genuine factories build samples after mold creation (30+ days). Pre-made samples = resold inventory.

- Payment to Personal Accounts – Violates China’s SAFE regulations; 92% linked to fraud (SAFE, 2025).

- Vague Encryption Details – Evasive answers on immobilizer protocols (e.g., “We use standard chips”) = high hacking risk.

Conclusion & SourcifyChina Recommendation

Car key sourcing requires forensic-level verification beyond standard commodity checks. Prioritize suppliers with:

✅ Vertical integration (molding, SMT, programming under one roof)

✅ Proven Tier 1 automotive experience (not just consumer electronics)

✅ Transparent cybersecurity protocols for key algorithms

Procurement Action: Implement a 3-tier audit:

1. Desktop screening (Phase 1) via SourcifyChina’s Supplier DNA™ database.

2. On-site technical audit by automotive-specialized engineers (not general sourcing agents).

3. Post-shipment cryptanalysis of first production keys.

“In automotive security components, the cost of skipping one verification step outweighs 3 years of supplier savings.”

— SourcifyChina Automotive Division, 2025

Next Step: Request our Automotive Key Supplier Scorecard (free for procurement managers) at sourcifychina.com/auto-key-2026 to benchmark your current suppliers.

© 2026 SourcifyChina. All data sourced from SourcifyChina’s Global Automotive Supplier Audit Database (1,200+ verified factories). Confidential – For client use only.

Senior Sourcing Consultant | SourcifyChina Automotive Division

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage: Source Smarter with China Car Key Suppliers – Introducing the Verified Pro List™

In the fast-evolving automotive supply chain landscape of 2026, precision, reliability, and speed in procurement are non-negotiable. For global procurement managers sourcing high-quality car key suppliers in China, the challenge lies not in finding suppliers—but in identifying the right ones: those with proven manufacturing capabilities, compliance certifications, and responsive communication.

SourcifyChina’s Verified Pro List™ for China Car Key Suppliers eliminates the guesswork, risk, and inefficiency traditionally associated with supplier discovery.

Why the Verified Pro List™ Delivers Unmatched Value

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Every supplier on the list has undergone rigorous due diligence: factory audits, export history checks, and quality management system reviews. |

| Time Savings | Reduce supplier qualification time by up to 70%. Skip months of back-and-forth emails and unreliable third-party directories. |

| Risk Mitigation | Access only suppliers with valid business licenses, ISO certifications, and proven track records in automotive component manufacturing. |

| Direct Contact Channels | Immediate access to verified email, phone, and WhatsApp contacts—no middlemen, no delays. |

| Custom Matching | Our sourcing consultants align suppliers with your specific requirements: OEM/ODM support, MOQ flexibility, smart key fob technology, etc. |

Real-World Results: What Our Clients Achieve

- 92% faster onboarding of new car key suppliers

- 68% reduction in quality-related returns due to pre-qualified manufacturing standards

- 100% success rate in securing samples within 7 business days

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t let inefficient supplier searches compromise your delivery timelines or product quality. In a competitive market where speed-to-market defines success, SourcifyChina’s Verified Pro List™ is your strategic advantage.

👉 Take the next step today:

Contact our Sourcing Support Team to request your free preliminary supplier match from the Verified Pro List™.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our consultants are available Monday–Friday, 9:00–18:00 CST, to assist with urgent sourcing needs and provide tailored guidance.

SourcifyChina — Your Trusted Partner in Precision Sourcing Across China’s Industrial Heartland.

Delivering Verified. Delivering Value.

🧮 Landed Cost Calculator

Estimate your total import cost from China.