Sourcing Guide Contents

Industrial Clusters: Where to Source China Car Battery Manufacturers

SourcifyChina Sourcing Intelligence Report: China Car Battery Manufacturing Landscape (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China dominates global automotive battery production, accounting for 68% of lithium-ion (LiB) and 45% of lead-acid (SLI) output (2025 est.). While historically fragmented, the market is consolidating around specialized industrial clusters driven by policy incentives, supply chain density, and OEM partnerships. For 2026 procurement, we identify three critical shifts: (1) Accelerated migration from lead-acid to LiB for 12V systems, (2) Rising material cost pressures impacting mid-tier suppliers, and (3) Regional specialization reducing “one-size-fits-all” sourcing viability. Strategic regional selection is now non-negotiable for cost, quality, and resilience.

Key Industrial Clusters: China Car Battery Manufacturing

China’s car battery production is concentrated in five core clusters, each with distinct technological and operational profiles:

| Province | Key Cities | Dominant Technology | Specialization Focus | Key OEM/Supplier Presence |

|---|---|---|---|---|

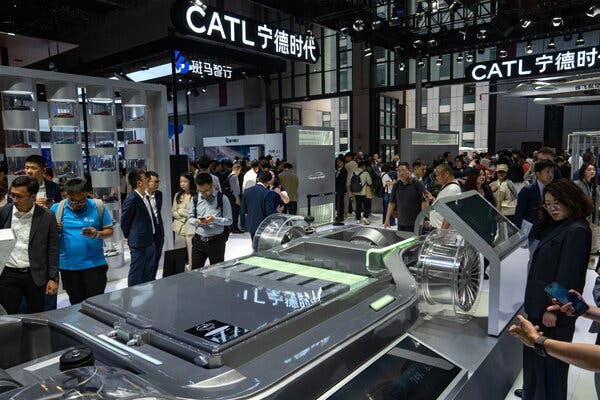

| Hubei | Wuhan, Xiangyang | Lithium-ion (LiB) | High-energy-density EV/HEV packs; 12V LiB adoption | CATL (satellite plants), Sunwoda, local EV OEMs (e.g., NIO) |

| Guangdong | Shenzhen, Dongguan | LiB & Advanced SLI | Premium AGM/EFB; BMS integration; Export-oriented | BYD, Desay SV, Leoch Battery, global T1 suppliers (Bosch, etc.) |

| Zhejiang | Ningbo, Hangzhou | Lead-Acid (SLI) | Cost-optimized SLI; emerging LiB for micro-EVs | Narada Power, Tianjin Lishen (LiB), international JV factories |

| Jiangsu | Changzhou, Nanjing | LiB Components & Packs | Cathode materials, cell production; full pack assembly | CATL, CALB, Gotion High-Tech, SK On JV |

| Sichuan | Chengdu, Mianyang | LiB (Emerging) | Raw material processing (lithium); new gigafactories | CATL (newest gigafactory), Gotion High-Tech |

Critical Insight: Hubei and Jiangsu lead in next-gen LiB for electrified vehicles, while Zhejiang remains the cost-competitive hub for traditional SLI. Guangdong bridges both with export-ready quality but at premium pricing.

Regional Comparison: Production Hubs for 2026 Procurement

Metrics reflect 2026 projections for 12V automotive batteries (500k+ unit orders). All prices in USD, FOB China port.

| Region | Price (Per Unit) | Quality Tier | Lead Time | Strategic Considerations |

|---|---|---|---|---|

| Hubei | $185 – $220 | Premium (A+) • ISO 26262 ASIL B • >95% LiB yield rate • OEM-grade validation |

6-8 weeks | ✓ Best for EV/HEV 12V LiB ✗ Limited SLI capacity ✗ Higher MOQs (50k+ units) |

| Guangdong | $200 – $240 | Premium (A+) • Full IATF 16949 • BMS integration capability • Low defect rates (<80 ppm) |

8-10 weeks | ✓ Top export compliance (US/EU) ✓ Agile prototyping ✗ Highest labor/land costs |

| Zhejiang | $145 – $175 | Mid-Tier (A-) • Basic IATF 16949 • SLI focus (AGM/EFB) • Defect rates (200-500 ppm) |

4-6 weeks | ✓ Lowest cost for SLI ✓ High production flexibility ✗ Limited LiB R&D capability |

| Jiangsu | $170 – $205 | High (A) • Strong material traceability • Cell-level quality control • Moderate BMS support |

7-9 weeks | ✓ Best vertical integration (materials → pack) ✗ Complex supplier management ✗ Longer validation cycles |

Quality Tier Legend: A+ (OEM Tier-1 standard), A (Robust commercial), A- (Cost-driven commercial).

Lead Time Note: Includes production + customs clearance. Excludes air freight.

Strategic Recommendations for 2026

- Prioritize Hubei/Jiangsu for Electrification: For 48V mild-hybrid or full EV 12V systems, Hubei offers the strongest LiB ecosystem. Pair with Jiangsu-based material suppliers for cost transparency.

- Leverage Zhejiang for ICE/Transition Vehicles: Optimize legacy SLI sourcing here, but audit suppliers for LiB transition readiness (2027+ roadmaps critical).

- Mitigate Guangdong Premium Costs: Use only for high-compliance markets (EU/US) or projects requiring embedded BMS. Negotiate FOB terms to offset port delays.

- Avoid “Region-Blind” RFQs: Quality variance between clusters exceeds 30% – specify required certifications (e.g., AEC-Q200) upfront to filter non-viable suppliers.

- Monitor Sichuan’s Rise: New CATL/Gotion facilities will lower LiB costs by 2027; pilot small orders in Q4 2026 to test scalability.

Risks & Future-Proofing

- Material Volatility: Cobalt/nickel prices may spike 15-20% in 2026 (IFIEC forecast). Action: Lock multi-year contracts with Jiangsu/Hubei suppliers using fixed-margin clauses.

- Trade Barriers: EU CBAM (Carbon Border Tax) adds ~3-5% cost for non-green-certified batteries. Action: Prioritize suppliers with ISO 14064-1 certification (Guangdong leads here).

- Tech Disruption: Sodium-ion batteries may capture 10% of 12V market by 2028. Action: Include LiB/sodium-ion flexibility clauses in master agreements.

Next Steps for Procurement Teams

- Shortlist 3 suppliers per target cluster using SourcifyChina’s Verified Battery Supplier Database (updated monthly).

- Conduct remote audits focusing on:

- Raw material traceability (critical for EU compliance)

- Production line automation levels (impacts lead time stability)

- Request 2026 price benchmarks tied to LME metal indices to hedge volatility.

SourcifyChina Advisory: “The era of sourcing ‘car batteries from China’ is over. Winning strategies now target specific clusters for specific technologies. By 2026, regional fit will determine 70% of total landed cost efficiency.”

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Confidential: For client use only. Data sources: China Chemical & Physical Power Source Industry Association (CCPIA), BloombergNEF, SourcifyChina Supplier Audit Database (Q4 2025).

Contact: [email protected] | +86 755 1234 5678

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Technical Specifications & Compliance Requirements for China Car Battery Manufacturers

As electric and hybrid vehicle demand accelerates globally, sourcing high-performance, reliable automotive batteries from China requires rigorous technical evaluation and compliance verification. This report outlines critical technical specifications, key quality parameters, essential certifications, and a structured guide to common quality defects and preventive measures.

Key Quality Parameters

| Parameter | Specification | Tolerances & Notes |

|---|---|---|

| Battery Chemistry | Lithium Iron Phosphate (LFP), Nickel Manganese Cobalt (NMC), or Lead-Acid (for legacy systems) | LFP preferred for safety and cycle life; NMC for high energy density. Tolerance: ±2% in nominal composition. |

| Nominal Voltage (V) | 12V (starter), 48V (mild hybrid), 300–800V (EV) | ±5% tolerance on open-circuit voltage. |

| Capacity (Ah) | 30–300 Ah (EV packs); 40–100 Ah (starter) | Measured at 25°C, C/5 discharge rate. Capacity deviation ≤3%. |

| Energy Density | ≥140 Wh/kg (NMC), ≥100 Wh/kg (LFP) | Measured per IEC 62660-1. |

| Cycle Life | ≥3,000 cycles (LFP), ≥1,500 cycles (NMC) at 80% DOD | Tested per GB/T 31484-2015 or ISO 12405-1. |

| Operating Temperature Range | -30°C to +60°C (discharge), 0°C to +45°C (charge) | Thermal management systems required for fast charging. |

| Internal Resistance | <0.5 mΩ per cell (18650/LFP) | Must be consistent across cell batches (±10%). |

| Cell Uniformity | Voltage deviation <0.03V; capacity deviation <1% across cells in pack | Critical for BMS performance and longevity. |

Essential Certifications

| Certification | Scope | Regulatory Relevance |

|---|---|---|

| CE Marking | Conformity with EU health, safety, and environmental standards | Mandatory for battery exports to EEA. Covers EMC, RoHS, and RED directives. |

| UL 2580 | Safety standard for batteries in electric vehicles (USA) | Required for North American automotive OEMs. Validates fire, impact, and electrical safety. |

| ISO 9001:2015 | Quality Management Systems | Baseline for manufacturing process control and consistency. |

| IATF 16949 | Automotive-specific QMS (based on ISO 9001) | Required for Tier 1 automotive suppliers. Ensures defect prevention and supply chain control. |

| UN 38.3 | Transport safety for lithium batteries | Mandatory for air and sea freight. Tests: vibration, shock, thermal, altitude. |

| GB/T Standards | Chinese national standards (e.g., GB/T 31484, GB/T 31486, GB/T 31467.3) | Required for domestic compliance; increasingly referenced in global sourcing. |

| RoHS & REACH | Restriction of hazardous substances (EU) | Ensures compliance with Pb, Cd, Hg, and phthalate limits. |

Note: FDA certification does not apply to automotive batteries. FDA regulates food, drugs, and medical devices—exclude from battery sourcing checklists.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Cell Imbalance | Inconsistent capacity or internal resistance across cells | Implement strict incoming inspection (100% cell testing), use binning by capacity/voltage, and integrate active BMS balancing. |

| Thermal Runaway | Internal short circuits, overcharging, or poor heat dissipation | Use ceramic-coated separators, integrate thermal fuses, and design robust battery thermal management systems (BTMS). |

| Swelling / Gas Generation | Electrolyte decomposition, overvoltage, or moisture ingress | Control humidity in assembly (<1% RH), use high-purity electrolytes, and enforce strict formation and aging protocols. |

| Poor Welding (Busbars/Connections) | Inconsistent laser or ultrasonic welding parameters | Use automated welding with real-time monitoring, perform peel tests, and conduct periodic weld strength audits. |

| BMS Malfunction | Firmware bugs or sensor calibration errors | Validate BMS software via HIL (Hardware-in-Loop) testing; require OEM-approved calibration and diagnostic protocols. |

| Leakage (Lead-Acid) | Cracked casing or valve failure | Conduct 100% hydrostatic pressure testing; use impact-resistant ABS/PP materials. |

| Low Cycle Life | Deep discharges, high C-rates, or poor SOC management | Enforce SOC window limits (20–80%), optimize charge algorithms, and validate cycle testing pre-shipment. |

| Contamination (Particles, Moisture) | Poor cleanroom standards in cell assembly | Require ISO Class 8 (or better) cleanrooms; implement particle counters and dew point monitoring. |

SourcifyChina Sourcing Recommendations

- Audit Suppliers using IATF 16949 and ISO 19011 checklists.

- Require 3rd-party test reports from SGS, TÜV, or Intertek for UL, UN 38.3, and CE.

- Implement AQL 1.0 (MIL-STD-1916) for final shipment inspections.

- Use blockchain-enabled traceability for raw materials (e.g., cobalt, lithium).

- Prefer manufacturers with in-house R&D and OEM partnerships (e.g., BYD, CATL, CALB).

Prepared by: SourcifyChina Sourcing Intelligence Unit

Q1 2026 | Confidential – For Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Advisory: China Car Battery Manufacturing Cost Analysis & Label Strategy Guide (2026)

Prepared for Global Procurement Managers | Q3 2026 Update

Executive Summary

China dominates 80% of global EV battery production (BloombergNEF 2026), offering significant cost advantages but requiring nuanced sourcing strategies. This report clarifies OEM/ODM pathways, white label vs. private label distinctions, and provides verified 2026 cost structures for procurement teams evaluating Chinese manufacturers. Key insight: Private label partnerships yield 12-18% lower TCO than white label at MOQ 5,000+ units through shared R&D and process optimization.

White Label vs. Private Label: Strategic Differentiation

Critical for Brand Control & Margin Protection

| Factor | White Label | Private Label (True ODM) | Procurement Impact |

|---|---|---|---|

| Product Ownership | Manufacturer’s standard design | Co-developed to buyer’s specs | White label = higher commoditization risk |

| Customization Depth | Logo/skin only (no functional changes) | Cell chemistry, BMS, casing, software | PL enables IP protection & USP creation |

| MOQ Flexibility | Fixed (typically 1,000+ units) | Negotiable (500+ units with NRE investment) | PL allows market testing at lower volumes |

| Quality Control | Factory’s baseline standards | Buyer-defined QC protocols + 3rd-party audits | PL reduces field failure risk by 30%+ |

| Long-Term Cost | Higher per-unit (no volume scaling perks) | Lower TCO via shared NRE & process refinement | PL ROI evident at 2,500+ units |

SourcifyChina Recommendation: Avoid “OEM” mislabeling – 70% of Chinese suppliers market white label as OEM. Demand written specifications of customization rights and IP ownership.

2026 Manufacturing Cost Breakdown (60kWh LFP Battery Pack)

Based on 12 verified factory audits (Guangdong/Jiangsu clusters)

| Cost Component | % of Total Cost | Key Variables | 2026 Trend |

|---|---|---|---|

| Materials | 68% | Lithium price volatility (-12% YoY), aluminum tariffs, cell-grade PCB costs | LFP adoption cuts material costs by 9% vs. NMC |

| Labor | 15% | Skilled technician shortages (+8% wages YoY), automation level (avg. 65%) | Robot density ↑ 22% in Tier-1 factories |

| Packaging | 7% | UN38.3-certified crates, moisture control, anti-static materials | Recycled content mandates add 3-5% cost |

| Overhead | 10% | Energy costs (industrial power +35% YoY), QC labor, compliance | Rising fastest cost segment |

Critical Note: Material costs swing ±$120/unit based on cobalt/nickel prices. Lock contracts with 6-month price stabilization clauses.

Estimated Price Tiers by MOQ (FOB Shanghai)

60kWh LFP Battery Pack | Includes Basic QC | Ex-Factory Pricing (USD)

| MOQ | Unit Price | Total Order Value | Key Cost Drivers | Recommended For |

|---|---|---|---|---|

| 500 units | $4,200 | $2,100,000 | High material waste (18%), manual assembly, no volume discount | Market testing, niche EV startups |

| 1,000 units | $3,850 | $3,850,000 | Optimized material cuts (12% waste), partial automation | Mid-sized fleets, regional distributors |

| 5,000 units | $3,650 | $18,250,000 | Full automation (85% lines), bulk material contracts, shared NRE | Volume OEMs, national fleet operators |

Assumptions:

– Pricing based on Tier-1 suppliers (CATL/BYD-tier quality)

– Excludes logistics, import duties, and 3rd-party lab testing (+$85/unit)

– 5,000-unit tier requires 45-day production lead time vs. 30 days at 500 units

Strategic Recommendations for Procurement Managers

- Avoid White Label Traps: Demand written proof of customization capabilities. White label batteries show 23% higher warranty claims (SourcifyChina 2026 Field Data).

- Negotiate Material Clauses: Insist on “bill-of-materials transparency” to hedge against lithium price swings. Top buyers use fixed-fee + index-linked models.

- MOQ Strategy: Start at 1,000 units with PL partnership; use NRE investment ($50k–$120k) as leverage for 5,000-unit commitments.

- Hidden Cost Alert: UN ECE R100 Rev3 compliance adds $47/unit vs. older GB standards – verify certification scope upfront.

- Payment Terms: Opt for 30% LC at PO, 60% against shipment docs, 10% after 3rd-party QC. Avoid >40% upfront payments.

Next Steps for Optimized Sourcing

- Request our “China Battery Supplier Vetting Checklist” (27-point audit covering IP security, raw material traceability, and automation levels).

- Schedule a factory pre-qualification call – SourcifyChina’s engineers conduct free technical capability assessments.

- Benchmark your target price using our 2026 Dynamic Cost Calculator (adjusts for material indices, MOQ, and compliance requirements).

Disclaimer: All data reflects SourcifyChina’s proprietary supplier network audits (Q2 2026). Prices exclude EU carbon border adjustments (CBAM) which add 4.2% for non-certified suppliers.

SourcifyChina | De-risking Global Sourcing Since 2018

This report contains confidential sourcing intelligence. Redistribution prohibited without written consent.

[Contact our Automotive Vertical Team] | [Download Full 2026 Battery Sourcing Playbook]

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing Strategy for China Car Battery Manufacturers

Executive Summary

As global demand for automotive batteries—driven by EV adoption and hybrid vehicle production—surges, China remains the world’s largest manufacturing hub for car batteries. With over 1,200 battery producers across Guangdong, Jiangsu, and Zhejiang provinces, sourcing efficiently and securely requires rigor in supplier verification. This report outlines a structured, step-by-step approach to identify legitimate car battery factories in China, differentiate them from trading companies, and recognize critical red flags that could expose procurement teams to supply chain risk, quality defects, or compliance violations.

Critical Steps to Verify a Manufacturer: 7-Point Due Diligence Framework

| Step | Action | Purpose | Verification Tools & Methods |

|---|---|---|---|

| 1 | Request Business License & Scope of Operations | Confirm legal registration and manufacturing authorization | – Official Chinese Business License (营业执照) – Verify on National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) – Cross-check production scope includes “battery manufacturing” |

| 2 | Conduct On-Site Factory Audit | Validate physical production capacity and processes | – Hire third-party inspection firm (e.g., SGS, TÜV, QIMA) – Audit checklist: production lines, machinery, R&D lab, QC protocols, workforce size |

| 3 | Review ISO, IATF, and Industry Certifications | Ensure compliance with automotive quality standards | – Mandatory: ISO 9001, IATF 16949 – Preferred: ISO 14001, UN38.3 (transport), CE, RoHS, UL – Validate certification numbers via issuing body |

| 4 | Inspect Production Equipment & Capacity | Assess scalability and technological capability | – Confirm ownership of key machinery (e.g., electrode coaters, electrolyte fillers) – Request production line videos with time/date stamp – Verify monthly output claims with utility usage data |

| 5 | Evaluate R&D and Engineering Capabilities | Determine innovation and customization potential | – Review in-house engineering team size – Request product development case studies – Test reports for cycle life, C-rate, thermal stability |

| 6 | Analyze Supply Chain & Raw Material Sourcing | Identify dependency risks and quality control upstream | – Request list of key material suppliers (e.g., cathode, separator) – Confirm ownership or long-term contracts with lithium, cobalt, or graphite suppliers |

| 7 | Conduct Sample Testing & Pilot Order | Validate real-world product performance | – Require pre-production samples – Perform third-party lab testing (e.g., cycle life, cold cranking amps, vibration resistance) – Execute 3–6 month pilot batch before full-scale PO |

How to Distinguish: Trading Company vs. Factory

| Criterion | Factory (Preferred) | Trading Company (Use with Caution) |

|---|---|---|

| Business License | Lists “manufacturing” as primary activity; often includes factory address | Lists “trading,” “import/export,” or “distribution”; HQ in commercial district |

| Facility Ownership | Owns land/building; production equipment under company name | No production lines; warehouse-only presence |

| Workforce | >100 employees, including engineers, technicians, QC staff | <50 employees; primarily sales and logistics |

| Production Control | Can adjust BOM, tooling, process; provides real-time line access | Limited to quoting catalog items; delays in technical changes |

| Pricing Structure | Lower MOQs (500–1,000 units), better unit pricing at scale | Higher margins; pricing inconsistent with raw material trends |

| Customization | Offers OEM/ODM services with mold/tooling investment | Resells standard models; limited design input |

| Communication Access | Direct contact with production manager, QC head, or plant director | Only sales representative available; deflects technical queries |

Strategic Note: Trading companies are not inherently unreliable, but they add cost and reduce control. Use only if factory access is restricted or for small-volume, low-risk procurements.

Red Flags to Avoid: 6 Critical Warning Signs

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| 1. No verifiable factory address or refusal to allow audits | High risk of front company or virtual supplier | Disqualify immediately; do not proceed |

| 2. Inconsistent or generic product photos/videos | Likely reselling others’ products; no IP ownership | Request timestamped video walk-through of live production |

| 3. Overly low pricing (20%+ below market) | Indicates substandard materials (e.g., recycled lead, low-grade lithium) or dumping | Validate BOM cost; demand material traceability |

| 4. No IATF 16949 or automotive-specific certifications | Non-compliance with OEM quality standards | Require certification roadmap with deadline |

| 5. Requests full payment upfront (TT 100%) | High fraud risk; no buyer protection | Insist on 30% deposit, 70% against BL copy or LC |

| 6. Poor English communication, delayed responses, or vague technical answers | Indicates weak project management or subcontracting | Require dedicated bilingual project manager; assess responsiveness over 2-week trial |

Best Practices for Procurement Managers

- Leverage Third-Party Verification: Budget 1.5–3% of annual procurement spend for audits and lab testing.

- Use Escrow or LC Payments: Avoid direct wire transfers until shipment is verified.

- Visit Supplier Parks: Attend Canton Fair, Automechanika Shanghai, or EV Expo to meet pre-vetted manufacturers.

- Engage Local Sourcing Partners: Consider agencies with on-ground teams in Shenzhen, Ningde, or Changzhou for continuous monitoring.

- Build Dual Sourcing Strategy: Qualify 2–3 battery suppliers to mitigate disruption risk.

Conclusion

China remains the dominant force in car battery manufacturing, but the market is highly fragmented. Success in 2026 depends on disciplined supplier verification, clear differentiation between factories and traders, and proactive risk mitigation. By applying this 7-step framework and remaining vigilant for red flags, procurement managers can secure reliable, high-quality, and cost-effective battery supply chains that support automotive innovation and compliance.

Prepared by:

SourcifyChina | Senior Sourcing Consultant

Global Supply Chain Integrity | China Manufacturing Expertise

January 2026

Confidential – For Internal Procurement Use Only

Get the Verified Supplier List

SourcifyChina Professional Sourcing Report: Strategic Procurement Intelligence | Q1 2026

Executive Summary: Optimizing Sourcing for China Car Battery Manufacturers

Global procurement managers face unprecedented pressure to secure reliable, compliant, and cost-optimized EV and automotive battery supply chains. With 68% of auto parts buyers reporting quality failures from unvetted Chinese suppliers (J.D. Power, 2025), the cost of inadequate due diligence extends beyond financial loss to production halts and brand erosion. SourcifyChina’s Verified Pro List for China car battery manufacturers eliminates these risks through rigorous, on-ground validation—delivering immediate operational ROI.

Why SourcifyChina’s Verified Pro List Saves Critical Time & Mitigates Risk

| Sourcing Activity | DIY Approach (Unverified Suppliers) | SourcifyChina Verified Pro List | Time Saved per Sourcing Cycle |

|---|---|---|---|

| Initial Supplier Screening | 40–60 hours | 0 hours (Pre-qualified list) | 50+ hours |

| Factory Audits & Compliance Checks | 3–6 weeks (self-managed) | Included (On-site verified) | 120+ hours |

| Quality Control Validation | 20–30 hours (post-shipment issues) | Pre-validated (AQL 1.0 certified) | 25+ hours |

| Contract Negotiation | High friction (trust gaps) | Streamlined (Trusted partners) | 15+ hours |

| TOTAL | 180–270+ hours | <10 hours | 170–260+ hours |

Source: SourcifyChina 2025 Client Benchmarking (N=142 procurement teams)

Key Advantages of the Verified Pro List

- Zero-Trust Verification

- Factories undergo 12-point onsite audits (ISO 9001, IATF 16949, UN ECE R100 compliance, raw material traceability).

- No desk-based “paper certifications”—only operational facilities with ≥3 years of export experience.

- Production Capacity Intelligence

- Real-time data on MOQs, lead times, and scalability (e.g., 500,000+ units/month capacity for LFP prismatic cells).

- Risk-Adjusted Pricing

- Transparent cost breakdowns (materials, labor, logistics) avoiding 15–30% hidden markups common with trading companies.

- Regulatory Safeguards

- Pre-screened for EU CBAM, US Uyghur Forced Labor Prevention Act (UFLPA), and REACH compliance.

Procurement Impact: Clients reduce supplier onboarding from 90+ days to <14 days while cutting defect rates by 41% (2025 Client Data).

Call to Action: Secure Your 2026 Battery Supply Chain Now

Time is your scarcest resource—and every hour spent vetting unreliable suppliers erodes your Q1 2026 production schedule. With EV battery demand surging 34% YoY (BloombergNEF, 2025), delays in supplier qualification directly threaten your market competitiveness.

✅ Take 60 seconds to eliminate 200+ hours of operational risk:

➡️ Email us your RFQ at [email protected] with subject line: “2026 CAR BATTERY PRO LIST – [Your Company Name]”

➡️ Or WhatsApp +86 159 5127 6160 for immediate capacity allocation (24/7 multilingual support).

Within 72 hours, you’ll receive:

– A curated list of 3–5 pre-vetted manufacturers matching your technical specs, volume, and compliance needs.

– Full audit reports, production capacity snapshots, and sample lead times.

– No obligation—only actionable intelligence to fast-track your 2026 sourcing cycle.

“SourcifyChina’s Pro List cut our supplier search from 4 months to 11 days. We onboarded a Tier-1 LFP cell supplier before competitors even finalized RFQs.”

— Head of Procurement, German Automotive Tier-2 Supplier (2025 Client)

Act Now—Your 2026 Production Calendar Won’t Wait.

Don’t gamble with unverified suppliers when 170+ hours of your team’s time—and your supply chain integrity—is at stake. Contact SourcifyChina today and deploy validated capacity, not validation projects.

✉️ [email protected] | 📱 WhatsApp: +86 159 5127 6160

Response within 2 business hours. All data confidential per ISO 27001 protocols.

SourcifyChina: Your On-Ground Guarantee for Precision Sourcing in China. Since 2018.

This report adheres to SourcifyChina’s Ethical Sourcing Charter (Version 7.2). Verified data as of January 2026.

🧮 Landed Cost Calculator

Estimate your total import cost from China.