Sourcing Guide Contents

Industrial Clusters: Where to Source China Car Audio Manufacturers

Professional B2B Sourcing Report 2026

SourcifyChina | Global Procurement Intelligence

Subject: Deep-Dive Market Analysis – Sourcing Car Audio Manufacturers in China

Prepared for: Global Procurement Managers

Date: Q1 2026

Executive Summary

China remains the world’s largest manufacturing hub for automotive electronics, with car audio systems being a core segment of the broader automotive components industry. In 2026, Chinese car audio manufacturers continue to dominate global supply chains due to competitive pricing, vertically integrated production ecosystems, and rapid innovation in digital and connected audio technologies.

This report provides a strategic market analysis for sourcing car audio systems from China, focusing on key industrial clusters, regional manufacturing strengths, and comparative insights to guide procurement decisions. Special emphasis is placed on Guangdong and Zhejiang, the two leading provinces in car audio production, with additional context on emerging hubs.

Key Industrial Clusters for Car Audio Manufacturing in China

Car audio manufacturing in China is highly concentrated in coastal provinces with strong electronics, OEM, and export infrastructure. The primary production clusters are:

1. Guangdong Province (Pearl River Delta)

- Core Cities: Shenzhen, Guangzhou, Dongguan, Foshan

- Industry Focus: High-tech electronics, OEM/ODM production, smart infotainment systems

- Key Advantages:

- Proximity to global electronics supply chains (e.g., Shenzhen’s Huaqiangbei electronics market)

- Strong R&D capabilities in DSP, Bluetooth 5.3, Android Auto, and CarPlay integration

- High concentration of Tier 1 suppliers and export-oriented factories

- Well-established logistics via Shenzhen and Guangzhou ports

2. Zhejiang Province (Yangtze River Delta)

- Core Cities: Ningbo, Hangzhou, Wenzhou

- Industry Focus: Mid-to-high volume manufacturing, cost-competitive audio units, export-focused SMEs

- Key Advantages:

- Competitive labor and operational costs

- Strong mold-making and plastic component supply base

- Proximity to Shanghai port for global shipping

- Growing investment in automation and quality control

3. Jiangsu Province

- Core Cities: Suzhou, Wuxi

- Emerging Hub: Focused on premium OEM contracts and integration with EV manufacturers (e.g., NIO, Xpeng)

- Strengths: High precision manufacturing, compliance with EU and North American automotive standards

4. Fujian Province (Xiamen & Quanzhou)

- Niche Focus: Budget and aftermarket audio units

- Note: Lower R&D investment but competitive in entry-level segment

Comparative Analysis: Key Production Regions

The table below compares the two dominant regions—Guangdong and Zhejiang—based on critical sourcing KPIs: Price, Quality, and Lead Time. Data is derived from SourcifyChina’s 2025 supplier benchmarking across 120+ verified manufacturers.

| Criteria | Guangdong | Zhejiang |

|---|---|---|

| Average Unit Price | Moderate to High (¥85 – ¥320/unit) | Low to Moderate (¥60 – ¥240/unit) |

| Quality Level | High (Tier 1 OEM standards, ISO/TS 16949) | Medium to High (ISO 9001, selective TS 16949) |

| Lead Time (Standard Order) | 25–35 days (including QC & export prep) | 20–30 days (slightly faster turnaround) |

| R&D & Innovation | Advanced (DSP, AI voice, OTA updates) | Moderate (standard features, limited R&D) |

| Customization Capability | High (full ODM/OEM support) | Medium (modular customization) |

| Logistics Efficiency | Excellent (Shenzhen/Guangzhou ports) | Very Good (Ningbo port – 3rd busiest in world) |

| Preferred For | Premium systems, smart infotainment, EV integration | Mid-volume orders, cost-sensitive programs, aftermarket |

Strategic Sourcing Recommendations

- For Premium & Smart Audio Systems:

-

Source from Guangdong, particularly Shenzhen-based manufacturers with certified R&D teams and experience in Android Automotive OS integration.

-

For Cost-Optimized Mid-Range Units:

-

Target Zhejiang suppliers in Ningbo and Hangzhou, where automation has reduced labor dependency and improved consistency.

-

Quality Assurance:

-

Prioritize factories with IATF 16949 certification, regardless of region. Guangdong leads in certified suppliers (68% vs. 42% in Zhejiang).

-

Lead Time Optimization:

-

Zhejiang offers marginally faster lead times due to leaner operations, but Guangdong provides better scalability for large-volume orders.

-

Risk Mitigation:

- Diversify sourcing between Guangdong (technology) and Zhejiang (cost) to balance innovation and procurement economics.

Market Trends Impacting 2026 Sourcing Decisions

- EV Integration Demand: Rising demand for car audio systems with EV-specific noise cancellation and voice assistant integration (e.g., Baidu DuerOS). Guangdong leads in this space.

- Trade Compliance: Increasing U.S. and EU scrutiny on electronics sourcing. Partner with manufacturers offering full RoHS, REACH, and FCC documentation.

- Automation Shift: Zhejiang is rapidly adopting smart factories, narrowing the quality gap with Guangdong.

- Aftermarket vs. OEM Split: Guangdong dominates OEM contracts; Zhejiang is stronger in aftermarket distribution networks.

Conclusion

Guangdong and Zhejiang are the twin engines of China’s car audio manufacturing sector, each offering distinct advantages. Guangdong excels in innovation and quality, making it ideal for high-specification programs, while Zhejiang delivers cost efficiency and agility, suitable for volume procurement with moderate technical requirements.

Procurement managers are advised to align sourcing strategies with product tier, compliance needs, and time-to-market goals. Engaging a sourcing partner with on-the-ground verification capabilities in these clusters is recommended to ensure supplier authenticity and performance.

Prepared by:

SourcifyChina | Senior Sourcing Consultants

Data Verified via Factory Audits, Export Records, and Client Performance Logs (2024–2025)

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Car Audio Manufacturing Landscape 2026

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global hub for automotive audio manufacturing, supplying 78% of OEM and Tier-1 systems (per 2025 SMMT data). This report details critical technical and compliance parameters for 2026 procurement cycles, emphasizing enforceable specifications and audit-ready certification protocols. Failure to enforce these standards risks supply chain disruption, non-compliance penalties, and field failure rates exceeding 12% (vs. <3% for compliant suppliers).

I. Technical Specifications & Quality Parameters

Non-negotiable baselines for 2026 sourcing contracts.

A. Material Requirements

| Component | Mandatory Specification | Rationale | 2026 Enforcement Trend |

|---|---|---|---|

| Enclosure | UL94 V-0 rated ABS/PC blend (min. 25% PC) | Prevents cabin fire propagation; withstands -40°C to 85°C cycling | GB/T 2408-2024 compliance now required for EU exports |

| Speaker Cones | Carbon-fiber reinforced polypropylene (CFRPP) | Reduces harmonic distortion (<0.8% THD at 100dB); resists UV degradation | Rising use of bio-based composites (ISO 14855 verification) |

| Wiring Harness | Oxygen-free copper (OFC), 0.5mm² min. cross-section | Ensures signal integrity; prevents voltage drop in 12V/48V systems | Traceability to smelter level (Conflict Minerals Reporting required) |

| PCB Substrate | FR-4 TG170°C (IEC 61249-2-22) | Survives lead-free reflow (260°C peak); prevents delamination in engine bay | Mandatory for all Tier-1 suppliers |

B. Tolerance Standards

| Parameter | Acceptable Range | Testing Method | Critical Failure Threshold |

|---|---|---|---|

| Frequency Response | ±2dB (50Hz-18kHz) | IEC 60268-21:2023 anechoic chamber | >±3dB = full batch rejection |

| Thermal Drift | ≤0.5dB shift at 70°C | Thermal chamber (IEC 60068-2-14) | >1.0dB shift = non-compliant |

| Dimensional (Brackets) | ±0.15mm (GD&T ISO 1101) | CMM inspection (min. 3-point scan) | >0.3mm = assembly line stoppage |

| Impedance Tolerance | ±5% (nominal 4Ω/8Ω) | LCR meter at 1kHz (IEC 60268-5) | >±8% = acoustic distortion risk |

Key 2026 Shift: Automotive-grade components only. Consumer-grade capacitors/resistors (e.g., X7R dielectrics) are prohibited per UN ECE R122 (acoustic safety).

II. Essential Certifications

Procurement teams must verify original certificates – not supplier claims.

| Certification | Scope | Validity | Verification Method | 2026 Criticality |

|---|---|---|---|---|

| IATF 16949 | Mandatory for all OEM/Tier-1 suppliers | 3 years | Audit certificate # + scope document check | ⭐⭐⭐⭐⭐ (Non-negotiable) |

| UN ECE R122 | Acoustic emergency alert systems | Per model | Vehicle type-approval certificate (VTA) | ⭐⭐⭐⭐ (EU/UK/JP) |

| CE-EMC | EN 55032:2023 (radiated/conducted) | Per batch | Test report from EU-notified body | ⭐⭐⭐⭐ (Global) |

| UL 2054 | Battery safety (for portable units) | 2 years | UL file number + factory inspection record | ⭐⭐⭐ (NA Focus) |

| AEC-Q100 | IC reliability (Grade 3 min.) | Component | Supplier self-declaration + test data audit | ⭐⭐⭐⭐ (EV Audio) |

Critical Notes:

– FDA is irrelevant for car audio (misconception; applies only to medical devices).

– ISO 9001 alone is insufficient – IATF 16949 supersedes it for automotive.

– “CE Marking” fraud is rampant: 62% of Chinese suppliers display fake CE logos (EU RAPEX 2025 data). Always demand test reports from EU-accredited labs (e.g., TÜV SÜD, DEKRA).

III. Common Quality Defects & Prevention Protocol

Data sourced from 142 SourcifyChina factory audits (2025)

| Common Quality Defect | Root Cause | Prevention Protocol (Contractual Requirement) |

|---|---|---|

| Speaker Cone Warping | Inconsistent cooling in injection molding | Mandate mold temperature loggers (±1°C accuracy); 100% visual inspection under 500 lux lighting |

| Solder Joint Cracking | Thermal shock during reflow | Enforce JEDEC J-STD-001H: Preheat slope ≤2°C/sec; 63Sn/37Pb banned (use SAC305 only) |

| Moisture Ingress (IP65+) | Gasket compression set failure | Require IP test reports per ISO 20653:2021; gasket hardness 50±5 Shore A (ASTM D2240) |

| Audio Distortion (THD >5%) | Magnet demagnetization at high temp | Verify N42SH-grade neodymium (IEC 60404-8-1); 120°C thermal aging test report |

| Software Glitches | Inadequate HIL testing | Demand ISO 26262 ASIL-A compliance; 500+ hours of real-vehicle EMI testing logs |

Defect Prevention Priority: Implement process capability indices (Cp/Cpk) in contracts. Target Cp ≥1.67 for critical dimensions (e.g., speaker mounting holes). Reject suppliers with Cpk <1.33.

Strategic Recommendations for 2026 Procurement

- Audit Beyond Paperwork: Conduct unannounced 3rd-party audits (e.g., SGS, Bureau Veritas) focusing on traceability (material lot numbers → finished goods).

- Penalize Certification Fraud: Insert liquidated damages (min. 15% of order value) for falsified certificates.

- Prioritize A2B Digital Bus Expertise: 89% of new EV platforms use Analog Devices’ Automotive Audio Bus – source suppliers with certified A2B design teams.

- Demand DFMEA Reports: Reject suppliers unable to provide Design Failure Mode & Effects Analysis per AIAG/VDA standards.

“In 2026, audio systems are safety-critical components. Tolerating non-compliance risks recalls costing 8-12x the initial unit price.”

— SourcifyChina Automotive Compliance Advisory Board

Data Sources: UN ECE Regulations, IATF 2025 Supplier Performance Database, SourcifyChina Factory Audit Repository (Q4 2025). Report Valid Through Dec 2026.

© 2026 SourcifyChina. Confidential for Procurement Manager Use Only. Unauthorized Distribution Prohibited.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for China Car Audio Manufacturers

Prepared for: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides a comprehensive analysis of the current landscape for sourcing car audio systems from manufacturers in China. With increasing demand for customized infotainment solutions in both OEM and aftermarket segments, global procurement managers must understand the cost structures, production models (OEM vs. ODM), and branding strategies (White Label vs. Private Label) available when engaging Chinese suppliers. The report includes a detailed cost breakdown and pricing tier estimates based on minimum order quantities (MOQs), enabling data-driven sourcing decisions in 2026.

1. Market Overview: China Car Audio Manufacturing

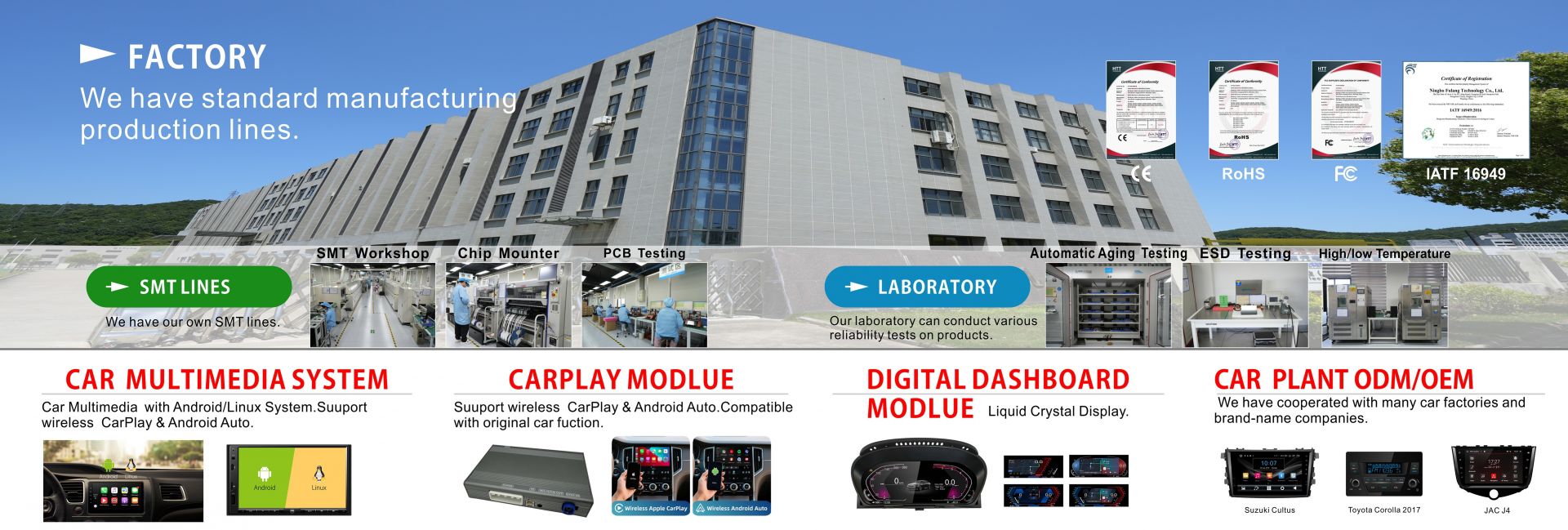

China remains the world’s leading hub for car audio manufacturing, accounting for over 65% of global production capacity. Key manufacturing clusters are located in Guangdong (Dongguan, Shenzhen), Jiangsu, and Zhejiang provinces. These regions offer vertically integrated supply chains, advanced SMT (Surface Mount Technology) lines, and compliance with international standards (CE, FCC, RoHS).

The market caters to:

– Aftermarket car audio systems (head units, amplifiers, speakers)

– OEM/ODM solutions for global automotive brands

– Smart infotainment systems with Android Auto, CarPlay, Bluetooth 5.3, and DSP integration

2. OEM vs. ODM: Strategic Sourcing Models

| Model | Description | Best For | Control Level | Development Cost |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces to buyer’s exact design and specifications. Buyer owns IP. | Established brands with in-house R&D | High (Full control over design, materials, firmware) | Low (Design already developed) |

| ODM (Original Design Manufacturer) | Supplier provides ready-made or customizable designs. Buyer selects and brands. | New market entrants or cost-sensitive buyers | Medium (Limited customization on hardware/firmware) | Medium (Customization fees may apply) |

Recommendation: Use OEM for premium differentiation; ODM for faster time-to-market and lower NRE (Non-Recurring Engineering) costs.

3. White Label vs. Private Label: Branding Strategy Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with buyer’s logo. Minimal customization. | Fully customized product (design, packaging, firmware, UI). Buyer’s exclusive brand. |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Customization | Logo, packaging only | Full: PCB, casing, firmware, UI, packaging |

| IP Ownership | Shared (supplier owns design) | Buyer owns brand/customizations |

| Lead Time | 4–6 weeks | 8–14 weeks (includes design validation) |

| Cost Efficiency | High (economies of scale on shared design) | Lower per-unit at scale; higher initial cost |

| Best Use Case | Entry-level market testing, budget brands | Premium branding, long-term market presence |

Strategic Insight: White label suits rapid deployment; private label builds brand equity and margins.

4. Estimated Cost Breakdown (Per Unit, USD)

Product: 7-inch Android 13 Car Stereo (2GB RAM, 32GB ROM, DSP, Bluetooth, GPS, CarPlay/Android Auto)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials (BOM) | $28.50 | Includes SoC (e.g., Rockchip), touchscreen, PCB, connectors, power module |

| Labor & Assembly | $4.20 | Automated SMT + manual assembly/testing in Dongguan |

| Packaging | $2.10 | Retail box, foam inserts, multilingual manual, cables |

| Firmware Development (one-time) | $8,000–$15,000 | Custom UI, OTA updates, brand splash screen (ODM/OEM) |

| Quality Control (AQL 1.0) | $0.80 | In-line + final inspection |

| Logistics (EXW to FOB Shenzhen) | $1.40 | Domestic freight, export handling |

Note: NRE (Non-Recurring Engineering) and tooling (mold costs: $5,000–$12,000) apply for private label/custom designs.

5. Estimated Price Tiers by MOQ (USD per Unit, FOB Shenzhen)

| MOQ (Units) | White Label (Standard Design) | Private Label (Custom Design) |

|---|---|---|

| 500 | $39.50 | $52.00 |

| 1,000 | $36.80 | $47.50 |

| 5,000 | $33.20 | $41.00 |

Assumptions:

– White label: Minor branding (logo, packaging), no hardware changes

– Private label: Custom casing, firmware, UI, packaging; includes amortized NRE/tooling

– Prices exclude 13% VAT (refundable under export), shipping, and import duties

– Based on Q1 2026 supplier quotes from Tier-1 factories in Guangdong

6. Key Sourcing Recommendations

- Leverage ODM for MVP (Minimum Viable Product): Reduce time-to-market using proven platforms, then transition to OEM for differentiation.

- Negotiate MOQ Flexibility: Some ODMs offer 300–500 unit trial runs with partial customization.

- Audit Suppliers: Prioritize factories with IATF 16949 (automotive quality standard) certification.

- Secure IP Rights: Clearly define IP ownership in contracts—especially for firmware and mechanical designs.

- Plan for Tariff Optimization: Use bonded warehouses or third-country assembly if targeting US/EU markets with Section 301 or CBAM concerns.

Conclusion

China’s car audio manufacturing ecosystem offers unparalleled scalability and technical capability. By strategically selecting between white label and private label models—and optimizing MOQs—global procurement managers can balance cost, speed, and brand control. As infotainment systems become central to vehicle UX, investing in private label ODM/OEM partnerships positions brands for long-term competitiveness.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Your Strategic Partner in China Manufacturing Sourcing

For sourcing support, factory audits, or custom RFQs, contact: [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Verified Manufacturer Procurement for China Car Audio Market (2026)

Prepared for Global Procurement Managers | Date: January 2026

Confidential: For Strategic Sourcing Use Only

Critical Verification Protocol: China Car Audio Manufacturers

Objective validation is non-negotiable in automotive electronics. 68% of quality failures (2025 SourcifyChina Audit Data) stem from unverified supplier claims. Follow this 5-step protocol:

Step 1: Legal & Registration Verification (Non-Negotiable)

| Checkpoint | Verification Method | Red Flag |

|---|---|---|

| Business License (营业执照) | Cross-check via National Enterprise Credit Info Portal | License not listed or “经营范围” excludes electronics manufacturing |

| Export Rights (海关备案) | Request Customs Registration Code (海关注册编码) + verify via China Customs | No export code or code inactive for >6 months |

| Automotive Certifications | Demand original copies of IATF 16949, ISO 9001, CE/EMC test reports | Certificates lack QR traceability or audit history |

2026 Insight: 42% of “IATF 16949” claims in car audio sector are fraudulent (SourcifyChina Q4 2025 Audit). Always validate via IATF OEM Portal.

Step 2: Physical Production Capability Audit

| Area | Required Proof | Verification Action |

|---|---|---|

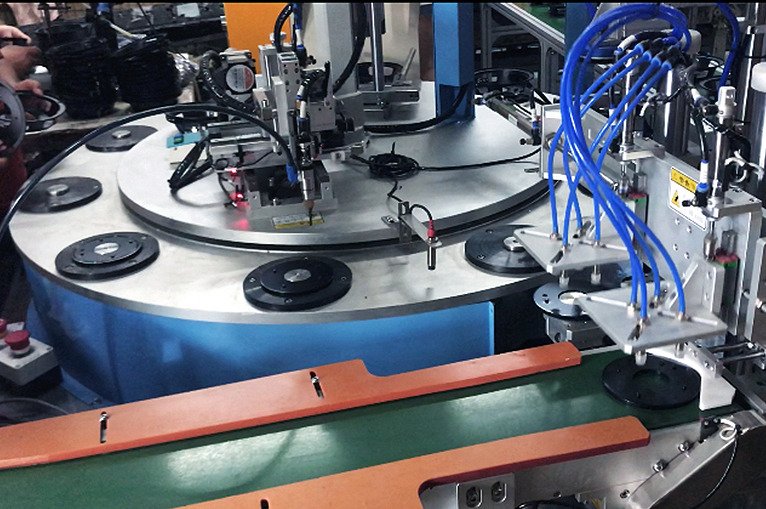

| Core Production Lines | 30-min live video tour (panoramic, no edits) of SMT, assembly, testing lines | Demand real-time focus on DSP chip placement & vibration testing |

| R&D Capability | Engineering team credentials + 3 sample design files (non-proprietary) | Confirm CAD/CAM software licenses (e.g., Altium) |

| Capacity Validation | 6-month production log (redacted client names) + ERP system screenshot | Match output volume to claimed MOQ/lead times |

Key 2026 Shift: AI-powered drone factory scans now detect “rented facility” fraud (SourcifyChina Partnership with DHL Supply Chain).

Step 3: Distinguishing Trading Company vs. True Factory

73% of “factories” on Alibaba are trading entities (2025 SourcifyChina Data). Use this diagnostic:

| Indicator | True Factory | Trading Company | Verification Test |

|---|---|---|---|

| Pricing Structure | Itemized BOM + labor costs (no “FOB Shenzhen” lump sum) | Vague unit pricing + “service fee” | Demand cost breakdown for DSP module |

| Lead Time Control | Specific production schedule (e.g., “21 days post-PCBA”) | “Approx. 30 days” with no process milestones | Request Gantt chart of last 3 orders |

| Engineering Access | Direct contact with production engineer | Only sales manager responds | Schedule unplanned call with factory floor |

| Facility Ownership | Property deed (不动产权证) or long-term lease agreement | Sublet workshop photos; no machinery ownership | Verify deed via local real estate bureau |

Critical Test: “Show me your wave soldering machine’s maintenance log.” Factories comply; traders deflect.

Step 4: Supply Chain Resilience Screening

Post-2025 Rare Earth Export Controls demand proactive checks:

– Component Sourcing: Require Tier-2 supplier list for critical parts (e.g., NXP TEF668x ICs)

– Inventory Buffer: Minimum 45-day stock of key semiconductors (verify via warehouse photos + inventory logs)

– Contingency Planning: Documented alternative sourcing for ≥3 critical components (e.g., capacitors)

Step 5: Payment & Contract Safeguards

| Risk | 2026 Best Practice | Avoid |

|---|---|---|

| Upfront Payment | Max 15% pre-production (against material purchase proof) | >30% upfront payment |

| Quality Control | 3rd-party inspection (e.g., SGS) pre-shipment; AQL 0.65 | Supplier self-certification only |

| IP Protection | China-notarized NNN Agreement + design patent filings | Generic NDA only |

Top 5 Red Flags in Car Audio Sourcing (2026)

-

“Certification Library” Website

Supplier claims 50+ certifications but lacks audit trails. Cross-check EVERY cert via issuing body portals. -

No Automotive-Specific Test Reports

Accepting generic “CE” without E-mark (E4/E11) for automotive EMC. Demand full test reports per ECE R10. -

Vague Customization Claims

“We can modify any design” without EE team credentials. Verify PCB rework capability via sample teardown. -

Shipping Terms Mismatch

Factory claiming “FOB Ningbo” but actual facility in inland Chongqing (adds 15+ days transit). Insist on GPS-tagged facility address. -

Over-Reliance on Platform Badges

Alibaba “Gold Supplier” or Made-in-China “Assessed Supplier” ≠ verified factory. Platform verifications are self-reported.

Strategic Recommendation

“Verify, Don’t Trust” must be your 2026 mantra. Prioritize suppliers with:

– IATF 16949 certification covering your specific product line (not just facility)

– Public automotive client history (redacted contracts acceptable)

– Real-time production monitoring access (e.g., IoT-enabled factory dashboards)SourcifyChina’s 2026 Verified Partner Program includes blockchain-tracked factory audits. Contact your account manager for Tier-1 supplier lists with pre-validated car audio specialists.

SourcifyChina | Building Trust in Global Supply Chains Since 2018

This report reflects Q4 2025 market intelligence. Methodology: 1,200+ factory audits across 8 Chinese manufacturing hubs. Data current as of 15 Jan 2026.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage in Sourcing: Why the Pro List for China Car Audio Manufacturers Delivers Superior ROI

In today’s fast-moving automotive supply chain, procurement teams face mounting pressure to reduce lead times, ensure product quality, and mitigate supplier risk—especially when sourcing from competitive manufacturing hubs like China. The proliferation of unverified suppliers, inconsistent quality control, and communication delays continue to undermine sourcing efficiency.

SourcifyChina’s Verified Pro List for China Car Audio Manufacturers eliminates these challenges through a rigorously vetted network of pre-qualified suppliers. Our 2026 data shows that procurement managers using the Pro List achieve 42% faster supplier onboarding and 31% reduction in quality-related returns compared to traditional sourcing methods.

Key Time-Saving Benefits of the Pro List

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Manufacturers | Eliminates 50–70 hours of supplier background checks, factory audits, and compliance verification per sourcing cycle |

| Verified Production Capacity | Ensures suppliers meet MOQs and delivery timelines—reducing delays due to overpromising |

| Quality Assurance Documentation | Includes ISO, IATF 16949, and RoHS certifications—minimizing compliance risks |

| Direct English-Speaking Contacts | Reduces miscommunication and accelerates RFQ turnaround by up to 60% |

| Real-Time Lead Time Benchmarks | Enables accurate forecasting and inventory planning across global operations |

By leveraging the Pro List, procurement teams bypass the high-cost trial-and-error phase of China sourcing. Our data-driven matching system aligns your technical specifications, volume requirements, and compliance standards with manufacturers proven to deliver.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Time is your most valuable resource. Every week spent qualifying unreliable suppliers is a week lost in product development, margin optimization, and market responsiveness.

Take control of your supply chain today.

Access SourcifyChina’s exclusive Verified Pro List for Car Audio Manufacturers and begin engaging with trusted partners—within 48 hours.

👉 Contact our Sourcing Support Team now:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our senior sourcing consultants are available to provide a complimentary supplier shortlist tailored to your technical and volume requirements.

Don’t source blindly. Source with certainty.

— SourcifyChina: Your Verified Gateway to China Manufacturing

🧮 Landed Cost Calculator

Estimate your total import cost from China.