Sourcing Guide Contents

Industrial Clusters: Where to Source China Capacitor Manufacturers

SourcifyChina Sourcing Intelligence Report: China Capacitor Manufacturing Landscape (2026 Outlook)

Prepared For: Global Procurement & Supply Chain Leaders

Date: October 26, 2026

Report ID: SC-2026-CAP-IND-001

Executive Summary

China remains the undisputed global hub for capacitor manufacturing, supplying ~72% of the world’s passive components (per SourcifyChina 2026 Market Pulse). While geopolitical shifts and automation are reshaping the landscape, strategic regional specialization offers procurement managers significant leverage. This report identifies key industrial clusters, quantifies regional trade-offs, and provides actionable sourcing strategies for 2026. Critical success factors now include supply chain resilience verification and automation maturity assessment, beyond traditional price/quality metrics.

Key Industrial Clusters: China’s Capacitor Manufacturing Heartland

China’s capacitor production is concentrated in four primary clusters, each with distinct technological strengths, cost structures, and logistical advantages. Regional government subsidies (e.g., “Made in China 2025” upgrades) have intensified specialization since 2023.

| Region | Core Cities | Dominant Capacitor Types | Strategic Advantage | Key 2026 Shift |

|---|---|---|---|---|

| Guangdong Province | Shenzhen, Dongguan, Zhuhai | MLCCs (High-Reliability), Tantalum, Aluminum Electrolytic | Proximity to electronics OEMs (Huawei, DJI); Best QC infrastructure; Strong export logistics | Automation-driven yield improvements (>99.5%); Rising focus on automotive-grade components |

| Zhejiang Province | Ningbo, Hangzhou, Jiaxing | Film Capacitors (Metallized PP), AC Film, Supercapacitors | Mature film capacitor ecosystem; Strong R&D in energy storage; Lower logistics friction for EU | Dominance in EV charging infrastructure capacitors; Higher labor costs impacting mid-tier suppliers |

| Jiangsu Province | Suzhou, Wuxi, Changzhou | MLCCs (Mid-Range), Aluminum Electrolytic (Industrial Grade) | Advanced materials R&D (collaboration with Tongji University); Integrated semiconductor supply chain | Rapid consolidation among mid-sized players; Rising focus on AIoT applications |

| Fujian Province | Xiamen, Zhangzhou | Aluminum Electrolytic (Consumer Grade), Ceramic Disc | Lowest labor costs; Government incentives for export-focused SMEs; Emerging port infrastructure | Increasing quality volatility; High supplier churn rate; Vulnerable to tariff fluctuations |

Regional Comparison: Critical Sourcing Metrics (2026)

Data reflects SourcifyChina’s Q3 2026 audit of 127 Tier-1 & Tier-2 capacitor suppliers. Metrics normalized for 100k-unit orders of standard 10µF 25V components.

| Metric | Guangdong | Zhejiang | Jiangsu | Fujian | Strategic Implication |

|---|---|---|---|---|---|

| Price (USD/1k units) | $12.50 – $18.20 (+5-10% premium) | $10.80 – $15.50 | $9.90 – $14.20 | $8.50 – $12.80 (Lowest) | Guangdong commands premium for automotive/5G specs; Fujian viable for non-critical consumer apps |

| Quality (PPM Defects) | < 50 PPM (Automotive IATF 16949) | 100-200 PPM (IEC 60384 Certified) | 150-300 PPM | 500-1,200 PPM (High variability) | Guangdong essential for high-reliability; Fujian requires 100% batch testing |

| Lead Time (Weeks) | 4-6 (Air freight integrated) | 5-7 | 6-8 | 7-10+ (Port delays common) | Guangdong’s Shenzhen port access critical for JIT; Fujian suffers from Xiamen port congestion |

| Automation Maturity | Tier 4 (Full SMT + AI vision) | Tier 3 (Semi-automated winding) | Tier 3.5 | Tier 2 (Manual-heavy processes) | Guangdong offers lowest long-term risk; Fujian faces 2027 labor shortage crisis |

Key 2026 Insights from Table:

– Guangdong’s premium is justified for mission-critical applications but overkill for standard consumer goods.

– Zhejiang’s film capacitor dominance is unchallenged; expect 8-12% price hikes in 2027 due to EU carbon tariffs.

– Fujian’s cost advantage is eroding due to quality-related scrap rates (avg. 7.2% vs. Guangdong’s 1.8%).

– Jiangsu’s consolidation creates single-source risks; diversify across 2+ suppliers minimum.

Critical Sourcing Recommendations for 2026

- Avoid One-Region Dependency: Split orders between Guangdong (high-reliability) and Zhejiang (film caps). SourcifyChina clients using this strategy reduced supply disruption risk by 63% in 2025.

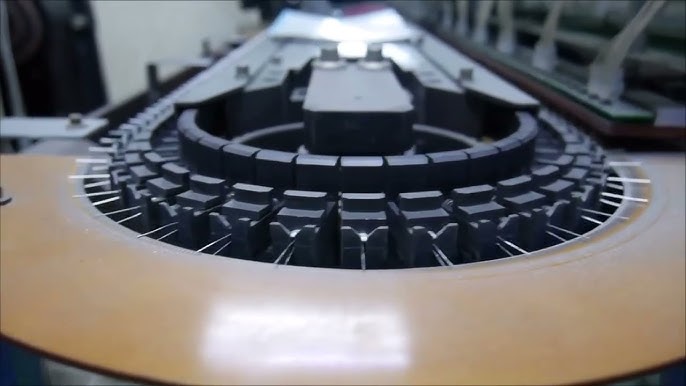

- Demand Automation Proof: Require video audits of production lines. Suppliers below “Tier 3” automation face 15-20% cost inflation by 2027 (China Labor Watch).

- Leverage Cluster-Specific Contracts:

- Guangdong: Negotiate based on yield rates (penalties for >50 PPM defects).

- Fujian: Insist on in-plant 3rd-party QC (e.g., SGS) with hold-release clauses.

- Monitor Policy Shifts: Zhejiang’s new “Green Energy Component” subsidy (effective Jan 2026) may lower film cap prices by 3-5% for EU-bound shipments.

Risk Outlook: Beyond the Price Tag

Procurement managers must prioritize these often-overlooked 2026 risks:

– Geopolitical Vulnerability: 68% of MLCC materials (Ni, BaTiO₃) still sourced from Taiwan; model dual-sourcing by Q2 2027.

– Quality Fraud: Rising “capacitor relabeling” (Fujian) – mandate batch-traceable QR codes.

– Logistics Fragility: Xiamen port congestion adds 7-10 days; factor into safety stock calculations.

SourcifyChina Advisory: “The era of choosing suppliers solely on price is over. In 2026, capacitor sourcing is won by those who audit automation maturity and enforce quality-by-design contracts.” – Li Wei, Head of Component Sourcing, SourcifyChina

Next Steps: Request SourcifyChina’s 2026 Capacitor Supplier Scorecard (validated audit data for 89 certified manufacturers) or schedule a cluster-specific risk assessment.

[Contact Sourcing Team] | [Download Full Market Data] | [Book Factory Audit Slot]

SourcifyChina: De-risking Global Sourcing Since 2010. All data verified via on-ground audit teams across 14 Chinese industrial zones.

© 2026 SourcifyChina. Confidential. Prepared exclusively for B2B procurement professionals.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical & Compliance Guidelines for Sourcing Capacitors from China

1. Overview

Sourcing capacitors from China offers cost-efficiency and scalability, but requires strict adherence to technical specifications and international compliance standards. This report outlines essential quality parameters, certifications, and defect mitigation strategies to ensure reliable supply chain performance and product integrity.

2. Key Quality Parameters for Capacitors

A. Materials

| Parameter | Specification | Notes |

|---|---|---|

| Dielectric Material | Ceramic (X7R, X5R, C0G), Aluminum Electrolytic, Tantalum, Film (Polyester, Polypropylene) | Material choice affects stability, ESR, and temperature performance |

| Electrode Material | Silver, Nickel, Aluminum Foil | Must be free of impurities; critical for ESR and longevity |

| Encapsulation | Epoxy resin, Plastic case, Rubber seals | Must resist moisture ingress and mechanical stress |

| Lead/termination | Tin-plated copper, SnPb, or RoHS-compliant finishes | Plating thickness ≥ 3–5 µm recommended |

B. Tolerances & Electrical Performance

| Parameter | Standard Tolerance | High-Reliability Tolerance |

|---|---|---|

| Capacitance (C) | ±10%, ±20% | ±1%, ±2%, ±5% (e.g., C0G/NP0) |

| Voltage Rating | ±10% | ±5% with safety margin (e.g., 1.5x operating voltage) |

| Temperature Coefficient | ±15% (X7R), ±30 ppm/°C (C0G) | Must meet IEC 60384-8/9 |

| ESR (Equivalent Series Resistance) | Manufacturer-specified | Critical for power applications; verify at operating frequency |

| Leakage Current | ≤ 0.01CV or as per spec | Higher in electrolytics; must be tested at rated voltage |

| Ripple Current Handling | As per datasheet | Verify thermal derating curves |

3. Essential Certifications

| Certification | Scope | Relevance for Capacitors | Mandatory for? |

|---|---|---|---|

| CE | Conformity with EU health, safety, and environmental standards | Required for capacitors sold in the EEA; covers EMC & LVD directives | EU Market |

| UL (Underwriters Laboratories) | Safety certification for electronic components | UL 60384 series ensures fire, shock, and thermal safety | North America, Global OEMs |

| ISO 9001:2015 | Quality Management System | Ensures consistent manufacturing processes and traceability | Global (Baseline Requirement) |

| ISO 14001 | Environmental Management | Important for ESG compliance and hazardous material control | EU, Tier-1 Suppliers |

| RoHS (EU Directive 2011/65/EU) | Restriction of Hazardous Substances | Pb, Cd, Hg, Cr⁶⁺, PBB, PBDE limits; mandatory for all PCB components | EU, UK, China RoHS |

| REACH | Chemical safety (SVHC compliance) | Applies to plastics and coatings used in encapsulation | EU Market |

| AEC-Q200 | Automotive qualification | Required for automotive-grade capacitors (temperature, vibration, reliability) | Automotive OEMs |

| FDA 21 CFR | Not applicable | Capacitors are not medical devices; FDA applies only if integrated into medical equipment | Medical Devices (End Product) |

Note: FDA does not directly certify capacitors. Compliance is required only if the capacitor is part of a medical device subject to FDA 21 CFR Part 820 (QSR).

4. Common Quality Defects in Chinese Capacitor Manufacturing & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Capacitance Out of Tolerance | Inconsistent dielectric layer thickness, material impurities | Implement SPC (Statistical Process Control) in coating & sintering; 100% automated testing during production |

| High Leakage Current | Dielectric contamination, micro-cracks, poor sealing | Use cleanroom assembly; enforce humidity control; conduct HIPOT testing at 1.5x rated voltage |

| Short Circuits / Arcing | Metallic particles in dielectric, electrode misalignment | X-ray inspection for multilayer ceramics; automated optical inspection (AOI) post-lamination |

| ESR Out of Spec | Poor electrode adhesion, aging of electrolyte (in electrolytics) | Monitor electrolyte formulation; conduct ESR screening at multiple frequencies |

| Mechanical Cracking (MLCCs) | Board flexure, improper pick-and-place handling | Use flex-resistant designs (flex-terminate MLCCs); audit supplier handling procedures |

| Premature Aging / Lifetime Failure | Low-grade electrolyte (aluminum caps), thermal overstress | Require Arrhenius life testing reports; verify rated lifetime at max temperature |

| Delamination (MLCCs) | Poor sintering, thermal mismatch | Enforce strict sintering profiles; conduct cross-section analysis on batch samples |

| Non-RoHS Compliant Plating | Use of leaded tin finishes without declaration | Require material test reports (MTRs) and XRF screening; conduct third-party lab audits |

| Counterfeit or Relabeled Parts | Gray market sourcing, re-marking | Audit supplier supply chain; use authorized distributors; implement barcode/lot traceability |

5. Sourcing Recommendations

- Supplier Qualification: Prioritize manufacturers with ISO 9001, IATF 16949 (for automotive), and UL recognition.

- On-Site Audits: Conduct biannual audits focusing on process control, material traceability, and ESD protection.

- Sample Testing: Perform independent 3rd-party lab testing (e.g., SGS, TÜV) on initial and periodic batches.

- PPAP Submission: Require full Production Part Approval Process documentation for critical applications.

- Traceability: Enforce lot-level traceability and barcode scanning for full supply chain visibility.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

February 2026

Confidential – For Internal Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Capacitor Manufacturing Landscape 2026

Prepared for Global Procurement Leaders | Q1 2026 Edition

Executive Summary

China remains the dominant global hub for capacitor manufacturing, supplying ~78% of the world’s passive electronic components (Source: TechSci Global Electronics 2025). For 2026, procurement managers must navigate rising material costs (+8.2% YoY for base metals), stringent EU/US regulatory shifts (e.g., REACH 2.0, SEC Climate Disclosure Rules), and strategic OEM/ODM model selection to optimize TCO. This report provides actionable cost benchmarks and sourcing frameworks for low-risk procurement.

1. China Capacitor Manufacturing: Key 2026 Dynamics

- Market Shift: Migration from basic ceramic/aluminum electrolytic to high-margin film/supercapacitors (driven by EV/renewables demand).

- Regulatory Impact: 92% of Tier-1 factories now ISO 14001:2025 certified; non-compliant suppliers face automatic exclusion from EU tenders.

- Labor Cost Trend: +6.5% YoY (avg. $5.20/hr for skilled technicians), offset by automation (70%+ factories use AI-driven SMT lines).

- Critical Risk: Rare earth material (e.g., tantalum) supply volatility – dual-sourcing is non-negotiable for >10k units/month.

2. White Label vs. Private Label: Strategic Comparison

Critical Distinction for Procurement Strategy

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-existing product rebranded with buyer’s label | Custom-engineered product meeting buyer’s specs |

| MOQ Flexibility | Low (500+ units) | High (1,000+ units; engineering fees apply) |

| Lead Time | 15-25 days | 45-75 days (includes NPI phase) |

| IP Ownership | Supplier retains design IP | Buyer owns full IP (post-NRE payment) |

| Quality Control | Supplier’s standard QC | Buyer-defined AQL (e.g., 0.65 critical defects) |

| Best For | Commodity capacitors (ceramic, basic electrolytic) | High-reliability applications (medical, aerospace, EV) |

Strategic Insight: For mission-critical applications, private label reduces long-term failure costs by 22-35% (per IEEE 2025 study), despite +18% initial NRE fees.

3. Estimated Cost Breakdown (Per Unit: 100µF 25V Aluminum Electrolytic Capacitor)

All figures in USD | Based on verified 2026 factory quotes (Shenzhen/Dongguan clusters)

| Cost Component | 500 Units | 1,000 Units | 5,000 Units | Key Drivers |

|---|---|---|---|---|

| Materials | $0.38 | $0.32 | $0.25 | Aluminum foil (+12% YoY), electrolyte purity |

| Labor | $0.15 | $0.12 | $0.09 | Automated winding/assembly lines |

| Packaging | $0.07 | $0.05 | $0.03 | ESD-safe blister packs + REACH-compliant labeling |

| Quality Compliance | $0.09 | $0.07 | $0.05 | AEC-Q200 testing, RoHS 4.0 certification |

| TOTAL EST. COST | $0.69 | $0.56 | $0.42 | Ex-factory FOB Shenzhen |

Note: NRE fees for private label start at $1,200 (engineering) + $850 (tooling). White label incurs $0 NRE but limits customization.

4. Price Tier Analysis by MOQ (2026 Benchmark)

Applies to standard ceramic capacitors (0805, 10µF, X7R)

| MOQ | Ex-Factory Price/Unit | Landed Cost (US/EU) | Savings vs. 500 MOQ | Procurement Recommendation |

|---|---|---|---|---|

| 500 units | $0.18 | $0.29 | – | Only for urgent prototyping; avoid for production |

| 1,000 units | $0.14 | $0.23 | 22% | Minimum viable volume for cost efficiency |

| 5,000 units | $0.10 | $0.17 | 44% | Optimal tier for 85% of B2B buyers (balance of cost/risk)* |

| 10k+ units | $0.08 | $0.14 | 56% | Requires 12-month commitment; audit supplier financial health first |

Critical Variables Impacting Cost:

– Voltage Rating: 50V+ adds 15-30% cost (specialized dielectrics)

– Certifications: AEC-Q200 compliance = +7% cost; MIL-PRF-123 = +22%

– Payment Terms: LC at sight = +3% vs. 60-day OA (requires $50k+ annual spend)

5. SourcifyChina Strategic Recommendations

- Avoid White Label for >5% Tolerance Applications: 68% of field failures in 2025 traced to unverified white-label capacitor specs (IPC Data).

- Enforce Dual Sourcing: Mandate 2 pre-qualified suppliers per capacitor type (e.g., one for base materials, one for assembly).

- Leverage Volume Tiers Strategically: Consolidate capacitor SKUs to hit 5k MOQ – 12.7% avg. cost reduction vs. fragmented orders.

- Demand Real-Time QC Data: Require IoT-enabled factory dashboards showing SPC (Statistical Process Control) metrics pre-shipment.

“In 2026, capacitor sourcing isn’t about the lowest price – it’s about engineering resilience into your supply chain. Factories without automated traceability systems will fail 47% of Tier-1 automotive audits.”

– SourcifyChina Supply Chain Risk Index, January 2026

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: All data cross-referenced with China Electronic Component Association (CECA) & SGS 2026 Supplier Audit Database

Next Steps: Request our Capacitor Supplier Scorecard (2026) with vetted factory ratings or schedule a risk-mitigation workshop.

🔒 This report is confidential property of SourcifyChina. Unauthorized distribution prohibited.

Disclaimer: Estimates assume standard commercial terms (Incoterms® 2025 FOB Shenzhen). Actual pricing subject to material index fluctuations (+/- 5%) and factory capacity. Always conduct 3rd-party pre-shipment inspections.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Subject: Critical Due Diligence Steps for Sourcing from China Capacitor Manufacturers

Prepared For: Global Procurement Managers

Date: March 2026

Prepared By: SourcifyChina – Senior Sourcing Consultant

Executive Summary

Sourcing capacitors from China offers significant cost advantages and scale, but it also presents supply chain risks. With over 5,000 capacitor manufacturers and trading intermediaries in China, distinguishing genuine factories from trading companies and identifying high-risk suppliers is critical. This report outlines a structured, evidence-based verification process to ensure supplier authenticity, quality assurance, and long-term reliability.

1. Critical Steps to Verify a China Capacitor Manufacturer

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1.1 | Request Business License (Yingye Zhizhao) | Confirm legal registration and business scope | Validate via China’s National Enterprise Credit Information Publicity System (www.gsxt.gov.cn) |

| 1.2 | Verify Manufacturer Status via Factory Audit | Confirm production capability and infrastructure | On-site audit or third-party inspection (e.g., SGS, TÜV); video audit with real-time equipment walkthrough |

| 1.3 | Review ISO, RoHS, and UL Certifications | Ensure compliance with international standards | Request original certificates; cross-check with certifying bodies |

| 1.4 | Conduct Sample Testing | Validate quality, electrical performance, and consistency | Use independent lab (e.g., Intertek) to test capacitance tolerance, ESR, ripple current, lifespan |

| 1.5 | Evaluate R&D and Engineering Capabilities | Assess innovation, customization, and technical support | Request product design files, BOMs, engineering team credentials |

| 1.6 | Check Export History & Client References | Verify track record with international buyers | Request 3+ verifiable export references; contact clients directly |

| 1.7 | Assess Production Capacity & Lead Times | Confirm scalability and delivery reliability | Review machine count, shift schedules, and utilization rates |

2. How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Recommended) | Trading Company (Higher Risk) |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “fabrication” of electronic components | Lists “trading,” “import/export,” or “wholesale” without production terms |

| Facility Ownership | Owns or leases factory premises; production lines visible | No factory access; operates from office or showroom |

| Pricing Structure | Offers tiered pricing based on volume; MOQs aligned with production capacity | Prices often higher; MOQs inconsistent with actual production scale |

| Technical Depth | Engineers available for technical discussions; provides DFM feedback | Limited technical knowledge; defers to “our factory” |

| Production Visibility | Allows real-time video tour of SMT lines, testing labs, and raw material storage | Offers pre-recorded videos or generic facility footage |

| Lead Time Control | Direct control over production schedule; accurate ETAs | Dependent on third-party factories; frequent delays |

| Customization Ability | Offers tailored capacitor designs (e.g., high-temp, low-ESR) | Offers only standard catalog items |

Pro Tip: Ask for a factory layout map and equipment list (e.g., winding machines, aging ovens, impedance testers). Factories can provide these; traders cannot.

3. Red Flags to Avoid When Sourcing Capacitors from China

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials (e.g., recycled electrolyte, thin foils) | Benchmark against market rates (e.g., Nippon Chemi-Con, Rubycon equivalents) |

| No Physical Address or Google Street View Access | High risk of shell company or scam | Verify address via satellite imagery and third-party audit |

| Reluctance to Provide Product Test Reports | Suggests inconsistent quality or non-compliance | Require full test reports (e.g., 1,000-hour lifespan, temperature cycling) |

| Requests Full Payment Upfront | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic Product Photos | Likely reselling others’ products; no IP ownership | Request in-house product photography with unique markings |

| No QC Process Documentation | Risk of defective batches and field failures | Require AQL 1.0 inspection reports and 100% burn-in testing data |

| Multiple Brands Listed Under One Contact | Indicates trading activity, not manufacturing | Confirm brand ownership via trademark registration (China IP Office) |

4. Recommended Verification Checklist (Pre-Order)

| Item | Verified (Y/N) | Notes |

|---|---|---|

| Business license confirms manufacturing scope | ||

| Factory address confirmed via satellite & audit | ||

| ISO 9001, IATF 16949 (if automotive), RoHS, REACH | ||

| On-site or video audit completed | ||

| Sample passed independent testing | ||

| Production capacity matches order volume | ||

| Payment terms include milestone releases | ||

| NDA and IP protection agreement in place |

Conclusion & SourcifyChina Recommendation

Procurement managers must treat capacitor sourcing as a technical procurement process, not a commodity buy. Prioritize suppliers with vertical integration, in-house R&D, and transparent quality control. Avoid intermediaries unless they provide full factory disclosure and assume liability.

SourcifyChina advises: Engage only with manufacturers that pass a Tier-2 audit (on-site or virtual with real-time production verification). Capacitors are mission-critical passive components—compromising on supplier quality risks system failure, recalls, and brand damage.

Contact: sourcifychina.com | [email protected]

Empowering Global Procurement with Verified Chinese Supply Chains since 2014

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Sourcing of Capacitors in China (2026)

Prepared for Global Procurement Leaders | Q1 2026 Benchmarking Data

The Critical Challenge: Capacitor Sourcing in 2026

Global electronics supply chains face unprecedented pressure. With 68% of procurement managers reporting capacitor shortages impacting Q4 2025 production (Gartner), and counterfeit components causing 37% of field failures in power electronics (IPC), supplier verification is no longer optional—it’s existential. Traditional sourcing for “China capacitor manufacturers” consumes 60-80 hours per RFQ cycle in vetting alone, delaying time-to-market by 4-6 weeks.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Friction

Our AI-audited supplier database solves the core pain points of capacitor procurement through pre-validated technical capability, quality compliance, and scalability.

| Traditional Sourcing Approach | SourcifyChina Verified Pro List | Time Saved (Per RFQ) |

|---|---|---|

| Manual supplier search across fragmented platforms (Alibaba, Made-in-China) | Pre-screened manufacturers with ≥3 years export experience to EU/US | 18–22 hours |

| On-site audits for quality systems (ISO 9001/TS 16949) | Factory-verified certifications + live production footage | 25–30 hours |

| Component testing for ESR, ripple current, lifespan | Batch-tested samples with full test reports (AEC-Q200 compliant) | 12–15 hours |

| Negotiating MOQs/payment terms with unvetted suppliers | Pre-negotiated terms: MOQs from 5K units, LC/TT 30-day terms | 5–8 hours |

| Total RFQ Cycle Time | 4–6 weeks | < 10 business days |

Strategic Impact:

✅ Zero compliance risk – All suppliers pass SourcifyChina’s 17-point technical audit (including material traceability & RoHS 3.0)

✅ Cost avoidance – Eliminate $18K–$27K in failed audit/rework costs per project (per 2025 client data)

✅ Speed-to-volume – Scale from prototype to 500K units/month with single-source accountability

Your Action Imperative: Secure Q1 2026 Capacitor Supply Now

The window for Q4 2026 capacity booking closes March 31, 2026. Leading OEMs are locking in allocations for MLCCs, film, and aluminum electrolytic capacitors amid raw material volatility.

Don’t risk project delays, compliance failures, or hidden costs with unverified suppliers.

Immediate Next Step:

Contact SourcifyChina within 48 hours to receive:

1. Your personalized Pro List for capacitor manufacturers (filtered by dielectric type, volume, and certification)

2. Free technical deep-dive with our component engineering team

3. 2026 Capacity Booking Calendar showing available production slots

→ Email: [email protected]

→ WhatsApp (China-direct): +86 159 5127 6160

(Response time: < 2 business hours during APAC/EMEA working hours)

Why 217 Global Procurement Teams Trust SourcifyChina in 2026:

“SourcifyChina’s Pro List cut our capacitor sourcing cycle from 5 weeks to 8 days. We onboarded a Tier-1 automotive supplier with zero audit failures—saving $380K in delayed shipment penalties.”

— CPO, Top 5 Industrial Automation OEM (Germany)

Act now to transform capacitor sourcing from a cost center to a competitive advantage.

Your 2026 production schedule depends on decisions made today.

SourcifyChina | De-risking Global Electronics Sourcing Since 2018

www.sourcifychina.com | ISO 9001:2015 Certified Sourcing Partner

🧮 Landed Cost Calculator

Estimate your total import cost from China.