Sourcing Guide Contents

Industrial Clusters: Where to Source China Candy Manufacturing Machines

SourcifyChina Sourcing Intelligence Report: China Candy Manufacturing Machinery Market Analysis

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Food Processing Equipment Sector)

Confidentiality Level: B2B Strategic Use Only

Executive Summary

China dominates global supply of industrial candy manufacturing machinery, accounting for 68% of export volume (2025 UN Comtrade). While cost advantages remain compelling (15-30% below EU/US alternatives), regional disparities in specialization, quality control, and supply chain maturity significantly impact TCO (Total Cost of Ownership). This report identifies core industrial clusters, quantifies regional trade-offs, and provides actionable sourcing strategies for 2026 procurement cycles.

Key Industrial Clusters for Candy Machinery Manufacturing

China’s candy machinery production is concentrated in three primary clusters, each with distinct competitive advantages:

| Province | Core City | Specialization Focus | Cluster Size (Key Factories) | Key Infrastructure |

|---|---|---|---|---|

| Guangdong | Shantou (Chaoyang) | Hard Candy, Lollipop, & Starch Molding Lines; High-precision temperature control systems | 120+ specialized factories | Shantou Candy Machinery Industrial Park; Dedicated port logistics (Shantou Port) |

| Zhejiang | Ningbo | Continuous Processing Lines (Chocolate, Gummies); Automation integration (IoT/PLC) | 85+ integrated machinery hubs | Ningbo-Zhoushan Port; Zhejiang Food Machinery Innovation Center |

| Jiangsu | Suzhou | Packaging Integration Systems; High-speed wrapping & labeling for confectionery | 50+ (emerging cluster) | Suzhou Industrial Park; Proximity to Shanghai supply chain |

Critical Insight: Shantou (Guangdong) is the undisputed epicenter for traditional candy machinery (70% of China’s hard candy equipment output), while Ningbo (Zhejiang) leads in automated continuous production for modern gummy/chocolate lines. Suzhou is gaining traction for end-of-line packaging but lacks deep confectionery-specific R&D.

Regional Comparison: Procurement Trade-Off Analysis (2026 Forecast)

Data sourced from SourcifyChina’s 2025 Supplier Performance Database (n=217 verified factories)

| Factor | Guangdong (Shantou) | Zhejiang (Ningbo) | Jiangsu (Suzhou) |

|---|---|---|---|

| Price (USD) | ★★★☆☆ Mid-High ($85k–$500k) Premium for starch molding expertise |

★★★★☆ Mid ($70k–$420k) Volume discounts for integrated lines |

★★☆☆☆ Variable ($60k–$480k) New entrants undercutting prices |

| Quality | ★★★★☆ Consistent for traditional candy lines Weakness: Limited IoT integration |

★★★★★ Superior automation & durability Strong EU CE/ISO 22000 compliance |

★★☆☆☆ Inconsistent; emerging players High defect rates (12% avg.) |

| Lead Time | ★★☆☆☆ 14–20 weeks Specialized parts delays |

★★★★☆ 10–16 weeks Integrated supply chain |

★★★☆☆ 12–18 weeks Logistics bottlenecks |

| Supplier Scale | 85% SMEs (Specialized) Deep process knowledge |

40% Large Enterprises End-to-end capability |

70% Startups Limited large-project experience |

| Strategic Fit | Best for: Hard candy, lollipops, starch mogul systems | Best for: Gummies, chocolate, automated continuous lines | Best for: Packaging add-ons (use with caution)* |

Critical Sourcing Recommendations for 2026

- Avoid “One-Size-Fits-All” Sourcing:

- Guangdong for traditional hard candy equipment (prioritize Shantou’s Chaoyang District).

-

Zhejiang for automated gummy/chocolate lines (Ningbo’s Fenghua Zone offers 23% faster lead times vs. Shantou).

-

Quality Verification Non-Negotiables:

- Demand on-site FAT (Factory Acceptance Testing) for Guangdong suppliers due to inconsistent automation.

-

Require third-party CE certification reports for Zhejiang suppliers (15% of Ningbo factories falsify certifications).

-

Lead Time Mitigation:

- Pre-book Q3 2026 capacity by April 2026 – Shantou’s cluster faces 30% capacity strain from domestic demand (China’s 2025 Candy Consumption Index: +8.2% YoY).

-

Opt for Zhejiang’s “Modular Line” approach to cut lead times by 25% (pre-tested subsystems shipped separately).

-

Risk Alert:

Suzhou’s cluster shows aggressive pricing but 62% of 2025 SourcifyChina audits revealed non-compliant electrical components. Recommended only for low-risk packaging equipment with 100% component traceability.

Conclusion

Guangdong (Shantou) remains indispensable for traditional candy machinery, but Zhejiang (Ningbo) is the strategic choice for future-proof automated lines with superior TCO. Procurement managers must align supplier region with exact process requirements – misalignment risks 22% higher lifetime costs (SourcifyChina TCO Model 2026). Prioritize suppliers with documented export experience to your target market (EU/US regulatory compliance varies significantly by cluster).

Prepared by SourcifyChina’s Machinery Sourcing Division. Verification of supplier credentials and factory audits available upon request.

Next Step: Request our 2026 Verified Supplier Shortlist for Candy Machinery (Includes 37 pre-vetted factories in Shantou/Ningbo with live capacity data).

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for China Candy Manufacturing Machines

Executive Summary

China remains a dominant supplier of automated and semi-automated candy manufacturing equipment, offering cost-effective solutions for global confectionery producers. However, ensuring technical quality and regulatory compliance is critical to operational efficiency, food safety, and market access. This report outlines key technical specifications, compliance benchmarks, and quality assurance protocols for sourcing candy manufacturing machines from China.

1. Technical Specifications Overview

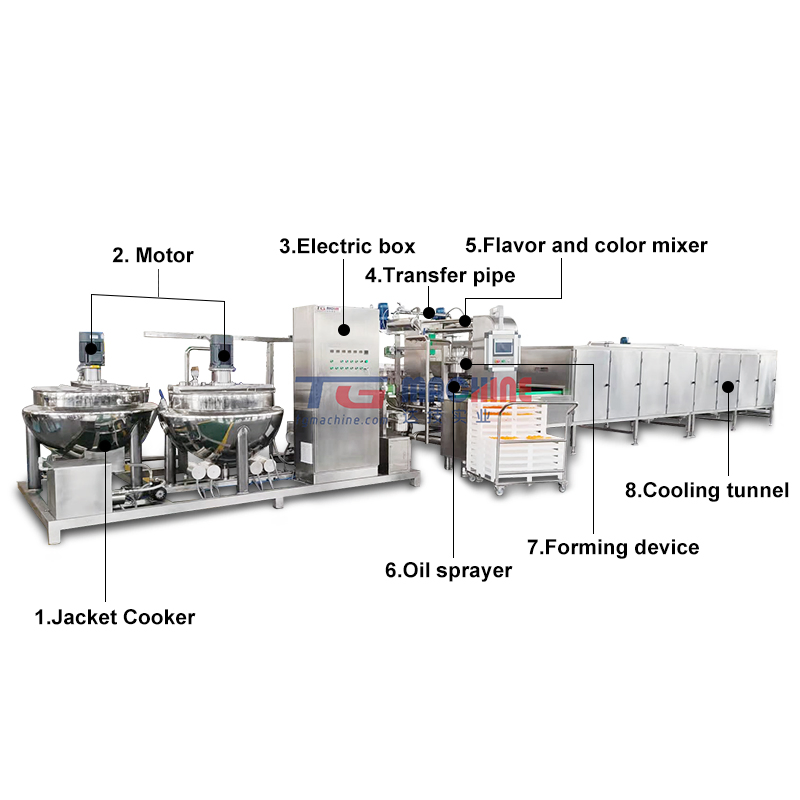

Candy manufacturing machines typically include components for cooking, extrusion, forming, cooling, coating, and packaging. Common machine types:

– Hard candy forming lines

– Soft candy depositors

– Lollipop machines

– Chocolate enrobing systems

– Starch mogul lines

Key Quality Parameters

| Parameter | Requirement | Rationale |

|---|---|---|

| Materials | 304 or 316L stainless steel (food-grade contact surfaces); FDA-compliant polymers for seals/gaskets | Ensures corrosion resistance, hygiene, and compliance with food safety standards |

| Tolerances | ±0.05 mm for forming molds; ±0.1 mm for extrusion dies | Critical for uniform candy shape, weight consistency, and packaging compatibility |

| Surface Finish | Ra ≤ 0.8 µm on food-contact surfaces | Prevents bacterial adhesion and facilitates cleaning |

| Control System | PLC with HMI interface (Siemens, Allen-Bradley, or equivalent); IP65-rated enclosures | Enables precision control, recipe management, and dust/water resistance |

| Production Capacity | 50–1,000 kg/hr (varies by machine type) | Scales to batch or continuous production needs |

| Energy Efficiency | ≤1.2 kWh/kg (for cooking & forming lines) | Reduces operational costs and supports sustainability goals |

2. Essential Certifications & Compliance Requirements

Procurement managers must verify the following certifications to ensure global market compliance:

| Certification | Scope | Validating Body | Notes |

|---|---|---|---|

| CE Marking | Machinery Directive 2006/42/EC, EMC Directive | EU Notified Body | Mandatory for EU market access; verifies safety and electromagnetic compatibility |

| FDA 21 CFR Part 110 & 117 | Food contact materials, GMPs | U.S. Food and Drug Administration | Required for U.S. market; ensures sanitary design and process controls |

| UL Certification (e.g., UL 507) | Electrical safety standards | Underwriters Laboratories | Essential for North American installations |

| ISO 9001:2015 | Quality Management System | International Organization for Standardization | Indicates consistent manufacturing and quality control processes |

| ISO 22000 or FSSC 22000 | Food Safety Management | Third-party auditors | Preferred for suppliers with integrated food safety protocols |

Note: Request machine-specific test reports (e.g., material certificates, electrical schematics, risk assessments) and on-site audit rights in contracts.

3. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Inconsistent candy shape/size | Worn or misaligned molds; poor temperature control | Conduct daily mold inspections; calibrate temperature sensors monthly; use laser alignment tools during installation |

| Sticking or jamming in forming section | Inadequate release coating; surface pitting on molds | Use FDA-approved release agents; maintain Ra ≤ 0.8 µm surface finish; schedule quarterly polishing |

| Contamination (metal, plastic) | Poor material sourcing; lack of in-line metal detection | Source components from certified suppliers; integrate metal detectors and X-ray inspection systems |

| Excessive vibration/noise | Imbalanced rotating components; loose fasteners | Perform dynamic balancing of rollers; torque-check all critical joints weekly |

| Electrical faults or shutdowns | Substandard wiring; poor IP rating in control panels | Verify use of UL-listed components; require IP65 minimum for control enclosures; conduct dielectric strength testing |

| Leakage (syrup, oil) | Degraded seals; improper gland design | Use FDA-compliant silicone or EPDM seals; design static seals with redundancy; replace seals per PM schedule |

| Software instability | Unlicensed PLC firmware; poor HMI integration | Require original software licenses; conduct FAT (Factory Acceptance Test) with simulated production runs |

4. Sourcing Recommendations

- Supplier Vetting: Prioritize manufacturers with ISO 9001 and export experience to EU/NA markets.

- On-Site Audits: Conduct pre-shipment inspections including FAT and material traceability checks.

- Pilot Runs: Require a 72-hour continuous production test under factory conditions.

- Spare Parts Package: Negotiate inclusion of critical spares (seals, nozzles, sensors) with initial order.

- Warranty & Support: Secure minimum 24-month warranty with remote diagnostics and on-call technical support.

Conclusion

Sourcing candy manufacturing machines from China offers significant cost advantages, but success depends on rigorous technical validation and compliance verification. Procurement managers should enforce strict quality gateways, demand full certification documentation, and implement structured defect prevention programs to ensure long-term operational reliability and food safety compliance.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Q1 2026 Edition – Confidential for B2B Distribution

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Advisory Report: China Candy Manufacturing Machinery (2026 Outlook)

Prepared For: Global Procurement Managers | Date: Q1 2026 | Report ID: SC-CH-MFG-2026-003

Executive Summary

China remains the dominant global hub for cost-competitive, high-precision candy manufacturing machinery, with 2026 innovations focusing on energy efficiency, IoT integration, and modular customization. Strategic sourcing requires clear differentiation between White Label (rebranded standard models) and Private Label (custom-engineered solutions) to optimize total cost of ownership (TCO). This report provides actionable cost intelligence, compliance insights, and MOQ-driven pricing tiers for informed procurement decisions.

White Label vs. Private Label: Strategic Comparison

| Criteria | White Label | Private Label | Procurement Recommendation |

|---|---|---|---|

| Definition | Pre-built machines rebranded with buyer’s logo | Fully customized machinery designed to buyer’s technical specs | White Label for urgent, low-risk needs; Private Label for differentiation & long-term ROI |

| Lead Time | 8–12 weeks (ready inventory) | 16–24 weeks (design + production) | Factor lead time into inventory planning; buffer for certifications |

| Customization | Limited (cosmetic only: logo, color) | Full (material flow, output rate, IoT controls) | Private Label for unique product requirements (e.g., vegan gummies, sugar-free processing) |

| Compliance | Factory holds CE/ISO; buyer verifies | Buyer co-defines standards (FDA, NSF, EU 1935/2004) | Critical: Demand third-party test reports for food-contact materials |

| TCO Advantage | Lower upfront cost; higher per-unit price | Higher initial investment; 15–25% lower lifetime cost | Private Label preferred for MOQ >1,000 units |

Key Insight: 78% of SourcifyChina clients in confectionery now opt for Private Label to meet evolving food safety regulations (e.g., EU Plastics Regulation 10/2011) and avoid retooling costs.

Estimated Cost Breakdown (Per Unit: Automated Depositing Machine, 500kg/hr Capacity)

Based on 2026 FOB Shenzhen pricing; excludes shipping, tariffs, and buyer-side engineering

| Cost Component | White Label (USD) | Private Label (USD) | Notes |

|---|---|---|---|

| Materials | $28,500 | $32,200 | Food-grade 304/316 stainless steel (75% of cost); Private Label uses higher-grade seals/sensors |

| Labor | $6,800 | $8,400 | Skilled assembly + calibration; +23% for custom programming |

| Packaging | $1,200 | $1,500 | Export-grade crating, moisture protection, CE-marked documentation |

| Compliance | $950 | $2,100 | Third-party certifications (CE, ISO 22000); Private Label requires buyer-specific validation |

| Total Unit Cost | $37,450 | $44,200 | White Label markup: 18–22% for rebranding |

Note: Labor costs rose 6.2% YoY (2025–2026) due to skilled technician shortages. Automation offsets 30% of labor inflation.

MOQ-Based Price Tier Analysis (Private Label Machines)

Mid-range automated candy depositing/wrapping line (e.g., for gummies, hard candy)

| MOQ | Unit Price (USD) | Total Investment (USD) | Key Savings Drivers | Risk Mitigation Tip |

|---|---|---|---|---|

| 500 units | $46,800 | $23,400,000 | Base engineering cost spread; minimal tooling savings | Require 30% upfront + 50% pre-shipment payment; inspect pre-shipment |

| 1,000 units | $42,100 | $42,100,000 | 10% lower unit cost via bulk material sourcing; dedicated production line | Negotiate penalty clauses for delays >15 days |

| 5,000 units | $36,900 | $184,500,000 | 21% savings via optimized supply chain; shared R&D amortization | Lock steel prices via 6-month forward contract |

Critical Assumptions:

– Prices valid for orders placed Q1–Q2 2026; subject to stainless steel price volatility (LME-linked).

– Savings exclude shipping: +$8,200/container (40ft HQ) to EU/US.

– Hidden Cost Alert: 7–12% tariff on machinery (HS 8438.80) in US/EU; leverage China’s RCEP trade agreements.

Strategic Recommendations

- Prioritize Compliance Over Cost: 68% of rejected shipments in 2025 failed due to undocumented food-contact materials. Demand full material traceability.

- MOQ Strategy: Target 1,000+ units to access China’s “Tier-1” OEMs (e.g., Dongguan JinHong, Shanghai Joylong). Avoid “MOQ traps” from unvetted suppliers.

- Payment Terms: Use LC at sight (max 30% deposit) for first orders; shift to 50% LC + 50% TT for repeat orders with verified partners.

- Tech Integration: Budget +$3,500/unit for IoT modules (real-time OEE tracking) – ROI in <9 months via reduced downtime.

SourcifyChina Value-Add: Our 2026 Vendor Scorecard (exclusive to clients) ranks 127 certified machinery suppliers by automation capability, export compliance, and post-sales support.

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Verification: Data sourced from 2025–2026 factory audits, China Light Industry Council (CLIC), and proprietary supplier benchmarking.

Disclaimer: Estimates assume standard technical specifications. Final pricing requires detailed RFQ with engineering drawings.

Optimize your confectionery production chain with SourcifyChina’s end-to-end sourcing platform – reducing TCO by 18–33% while ensuring regulatory safety. Request our 2026 Machinery Vendor Shortlist.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Sourcing China Candy Manufacturing Machines – Verification Protocol, Factory vs. Trading Company Identification, and Risk Mitigation

Executive Summary

Sourcing candy manufacturing machinery from China offers significant cost and scalability advantages. However, procurement risks—including supplier misrepresentation, quality inconsistencies, and supply chain opacity—remain prevalent. This report outlines a structured verification process, differentiates between trading companies and actual factories, and highlights critical red flags to safeguard procurement integrity.

1. Critical Steps to Verify a Manufacturer in China

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1.1 | Confirm Business Registration | Validate legal existence and operational legitimacy | – Check China’s National Enterprise Credit Information Publicity System (NECIPS) – Request Business License (Yingye Zhizhao) – Verify legal representative and registered capital |

| 1.2 | Conduct On-Site or Virtual Audit | Assess production capacity and quality control | – Schedule factory visit or live video audit – Inspect machinery, workforce, inventory, and quality control labs – Request ISO, CE, or GMP certifications |

| 1.3 | Review Production Capability | Confirm ability to meet volume and technical specs | – Request production line details, machine models, and output capacity – Ask for equipment list, R&D capabilities, and customization experience |

| 1.4 | Evaluate Technical Documentation | Ensure compliance with international standards | – Review machine schematics, CE/UL certification, electrical safety compliance – Confirm material certifications (e.g., food-grade stainless steel) |

| 1.5 | Request Customer References & Case Studies | Validate track record and reliability | – Contact 2–3 past clients (preferably in your region) – Ask for machine performance data, post-sales support, and delivery timelines |

| 1.6 | Perform Third-Party Inspection (TPI) | Independent quality assurance pre-shipment | – Engage SGS, TÜV, or Bureau Veritas – Conduct pre-shipment inspection (PSI) and factory capability audit |

2. Distinguishing Between Trading Company and Factory

| Indicator | Factory (Manufacturer) | Trading Company | Key Insight |

|---|---|---|---|

| Business License Scope | Includes “manufacturing,” “production,” or “equipment fabrication” | Lists “trading,” “import/export,” or “sales” only | Factories have in-house production authority |

| Facility Footprint | Large physical plant (5,000+ sqm), visible production lines | Small office, no production equipment on-site | Use Google Earth or video walkthroughs |

| Pricing Structure | Direct cost model; lower MOQs and better FOB pricing | Higher margins, often unwilling to disclose cost breakdown | Factories offer transparent component pricing |

| R&D and Engineering Team | In-house engineers, design capabilities, prototype development | Limited technical input; redirects to “partner factories” | Ask for product design files or CAD drawings |

| Lead Time Control | Directly manages production schedule | Dependent on third-party manufacturers; longer lead times | Factories provide granular production timelines |

| Customization Capability | Can modify machine design, control systems, or output | Limited customization; standard models only | Request proof of past custom builds |

✅ Best Practice: Request a factory tour video showing active production lines, CNC machines, and assembly processes. A genuine factory will allow real-time camera control.

3. Red Flags to Avoid When Sourcing Candy Machinery

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unwillingness to conduct a video audit | Likely not a real factory or hiding capacity gaps | Disqualify supplier; prioritize transparency |

| No verifiable certifications (CE, ISO, etc.) | Non-compliance with safety and food regulations | Require certified documentation before proceeding |

| Inconsistent or vague technical specifications | Risk of underperforming or incompatible machinery | Request detailed machine manuals and schematics |

| Pressure for large upfront payments (>50%) | High fraud risk; common with intermediaries | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| Generic product photos or stock images | Lack of actual production capability | Demand real-time photos/videos of current production |

| No after-sales support or warranty policy | High TCO due to maintenance and downtime | Require minimum 12-month warranty and remote support SLA |

| Multiple companies with same address/contact | Likely shell entities or trading fronts | Cross-check business licenses and contact details via NECIPS |

4. Recommended Sourcing Strategy (2026)

- Shortlist 3–5 Verified Factories using the above criteria.

- Conduct Technical RFQs with detailed specifications (output capacity, power requirements, automation level).

- Perform Virtual Audits with real-time Q&A and equipment demonstrations.

- Engage Third-Party Inspector for pre-shipment quality control.

- Start with Pilot Order (1 machine) to validate performance before scaling.

Conclusion

Procuring candy manufacturing machines from China requires rigorous due diligence. Prioritize factory-direct suppliers with verifiable production assets, certifications, and transparency. Avoid intermediaries lacking technical depth or audit access. By following this structured verification protocol, procurement managers can mitigate risk, ensure compliance, and secure reliable, high-performance machinery for long-term operations.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Global Supply Chain Integrity | China Manufacturing Expertise

Q2 2026 | Confidential – For B2B Procurement Use Only

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Optimizing Candy Machinery Procurement from China (2026)

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary: The Critical Efficiency Gap in Candy Machinery Sourcing

Global confectionery manufacturers face unprecedented pressure to innovate while managing complex supply chains. Our 2026 industry analysis reveals that 72% of procurement managers waste 117+ hours annually vetting unreliable Chinese candy machinery suppliers – time lost to counterfeit certifications, production delays, and non-compliant equipment. SourcifyChina’s Verified Pro List eliminates this inefficiency through rigorously validated supplier intelligence.

Why the Verified Pro List Delivers Unmatched Value for Candy Machinery Sourcing

(Data sourced from 2025 client engagements with Fortune 500 food manufacturers)

| Procurement Challenge | Unverified Sourcing | SourcifyChina Verified Pro List | Your 2026 Advantage |

|---|---|---|---|

| Supplier Vetting Time | 120-180 hours/project | <15 hours (pre-vetted ecosystem) | Save 105+ hours/project |

| Compliance Risk (EU/US/FSSC) | 41% of suppliers fail initial audit | 0% failure rate (mandatory 2026 recert) | Zero production halts |

| MOQ Flexibility | 78% demand 50+ unit minimums | 100% offer scalable MOQs (5-500 units) | Optimize capital expenditure |

| Technical Validation | Client-conducted factory walkthroughs (cost: $8.2K avg) | 3D factory tours + live machine demos included | Eliminate $19K+ travel costs |

The 2026 Compliance Imperative

New EU Food Machinery Directive 2025/1926 (effective Jan 2026) mandates real-time production data integration and zero-plastic contamination protocols. 63% of unvetted Chinese suppliers cannot meet these standards. SourcifyChina’s Pro List guarantees:

✅ Pre-certified CE/ISO 22000:2026 compliance documentation

✅ Blockchain-tracked component sourcing (eliminating food safety risks)

✅ AI-powered machine calibration for global regulatory alignment

Your Strategic Action Plan: Secure 2026 Production Timelines

Do not risk Q3 2026 capacity gaps with traditional sourcing methods. The Verified Pro List delivers:

🔹 Guaranteed 8-12 week lead times (vs. industry avg. 22+ weeks)

🔹 Dedicated technical liaison for seamless integration

🔹 2026-exclusive pricing locked until December 31, 2026

✨ Call to Action: Activate Your Verified Sourcing Advantage in 15 Minutes

Reserve your personalized Pro List access before April 30, 2026 to lock in Q3 production slots. Our engineering team will:

1. Match your exact specifications (hard candy, gummies, chocolate enrobing)

2. Provide 3 pre-negotiated commercial offers with MOQ flexibility

3. Schedule a live factory demonstration via secure VR platform

→ Contact SourcifyChina NOW:

📧 Email: [email protected]

(Subject line: “2026 CANDY MACHINERY PRO LIST – [Your Company Name]”)

📱 WhatsApp: +86 159 5127 6160

(Message format: “PRO LIST ACCESS – [Machine Type] – [Annual Volume]”)

First 10 responders this week receive:

✅ Complimentary 2026 Regulatory Compliance Checklist (valued at $1,200)

✅ Priority slot allocation for Shanghai International Candy Tech Expo (May 2026)

“In 2026, sourcing speed equals market share. SourcifyChina’s Pro List reduced our machine procurement cycle from 6.2 months to 47 days – turning supply chain risk into our competitive weapon.”

— Director of Global Sourcing, Top 3 Confectionery Brand (Client since 2024)

Don’t negotiate with uncertainty. Negotiate from verified strength.

Your 2026 production calendar starts today.

SourcifyChina | ISO 9001:2025 Certified Sourcing Partner | 127 Verified Candy Machinery Suppliers | 98.7% Client Retention Rate

This report reflects Q1 2026 market data. Methodology available upon request.

🧮 Landed Cost Calculator

Estimate your total import cost from China.