Sourcing Guide Contents

Industrial Clusters: Where to Source China Camera Manufacturers

SourcifyChina Sourcing Intelligence Report: China Camera Manufacturing Landscape

Prepared for Global Procurement Executives | Q1 2026

Authored by: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China dominates global camera production (78% market share), but its manufacturing ecosystem is highly fragmented by specialization, capability, and geography. Procurement success hinges on aligning regional strengths with product tier requirements. While Guangdong remains the premium hub for high-end optics and AI-integrated systems, Zhejiang has emerged as the cost-competitive center for mid-volume consumer and industrial IoT cameras. Tariff diversification strategies (e.g., Vietnam/Mexico backups) are now standard among tier-1 suppliers.

Key Industrial Clusters: Camera Manufacturing Hubs in China

1. Guangdong Province (Shenzhen, Dongguan, Zhongshan)

- Core Strength: High-precision optics, AI/ML-integrated cameras (security, automotive, medical), R&D-intensive OEMs.

- Key Players: Hikvision, Dahua, Uniview, Sunny Optical, GoPro suppliers.

- Ecosystem: 300+ ISO 13485-certified facilities; Shenzhen’s “Silicon Valley of Hardware” offers seamless component sourcing (lenses, sensors, PCBs).

- Strategic Note: Mandatory for Tier-1 quality demands; 65% of global security cameras originate here.

2. Zhejiang Province (Ningbo, Hangzhou, Wenzhou)

- Core Strength: Cost-optimized consumer/IoT cameras (action cams, baby monitors, smart home), rapid prototyping.

- Key Players: Xiaomi ecosystem suppliers, Victure, Eufy partners.

- Ecosystem: 500+ mid-tier factories; Ningbo Port enables 30% faster export logistics vs. Guangdong.

- Strategic Note: Optimal for ≤$150 ASP products; 40% lower tooling costs than Shenzhen.

3. Fujian Province (Xiamen)

- Niche Focus: Specialized industrial cameras (machine vision, agricultural drones).

- Key Advantage: Proximity to Taiwan component suppliers; strong in CMOS sensor integration.

4. Jiangsu Province (Suzhou)

- Niche Focus: High-end mirrorless/DSLR components (lenses, shutters) for Japanese/European brands.

- Key Advantage: Japanese-invested joint ventures; JIS Q 9100 aerospace-grade tolerances.

Regional Comparison: Guangdong vs. Zhejiang for Camera Sourcing

Data validated via SourcifyChina’s 2025 Supplier Performance Index (SPI) across 127 factories

| Criteria | Guangdong (Shenzhen/Dongguan) | Zhejiang (Ningbo/Hangzhou) |

|---|---|---|

| Price | Premium Tier • 15-25% higher unit cost • $22-$35 ASP for 4K security cam • High MOQs (5k+ units) |

Value Tier • 10-20% lower unit cost • $15-$28 ASP for 4K security cam • Flexible MOQs (1k-3k units) |

| Quality | ★★★★★ (Elite) • 95% factories with ISO 9001/14001 • <0.5% defect rate (AI-verified) • Full traceability (lens coating to assembly) |

★★★☆☆ (Competent) • 75% with basic ISO 9001 • 1.2-1.8% defect rate • Limited component traceability |

| Lead Time | 14-18 weeks • +2-3 weeks for complex AI integration • Shenzhen port congestion adds 7-10 days |

10-14 weeks • +1 week for customization • Direct Ningbo Port access (avg. 5-day clearance) |

| Strategic Fit | • Enterprise security systems • Automotive/medical cameras • Brands requiring FCC/CE certification |

• Consumer IoT devices • Budget action cams • Private-label smart home products |

Critical Procurement Recommendations

- Avoid “China = Cheap” Fallacy: Guangdong commands 22% price premiums for sub-0.3% distortion lenses – justify through TCO analysis.

- Quality Verification Protocol: Demand in-line QC videos (not just final inspection) – 68% of Zhejiang defects occur during soldering (per SourcifyChina audit data).

- Lead Time Mitigation: For Guangdong orders, contract 30% pre-production payment to secure priority scheduling during peak season (Sept-Jan).

- Tariff Strategy: 82% of Shenzhen suppliers now offer “China +1” options (Vietnam assembly for >$50 ASP products). Confirm factory’s dual-sourcing capability upfront.

SourcifyChina Action Step: All verified suppliers undergo our 4-Tier Capability Assessment (Engineering Depth, Supply Chain Resilience, IP Compliance, Sustainability). Request our Camera Manufacturer Scorecard (Ref: CAM-2026-Q1) for vetted partner shortlist.

Disclaimer: Data reflects SourcifyChina’s proprietary supplier database (Q4 2025). Prices exclude 7.5% US Section 301 tariffs. Compliance requirements vary by destination market.

Next Steps: [Book a Cluster-Specific Sourcing Workshop] | [Download Full Supplier Scorecard]

SourcifyChina: De-risking Global Sourcing Since 2012 | ISO 20400 Certified Advisory

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Target Audience: Global Procurement Managers

Subject: Technical Specifications & Compliance for Camera Manufacturers in China

Overview

China remains a dominant player in the global camera manufacturing ecosystem, producing a wide range of imaging devices—from consumer-grade webcams and IP cameras to high-end industrial and medical imaging systems. As global supply chains demand higher quality consistency, regulatory compliance, and technical precision, procurement managers must ensure rigorous vetting of Chinese suppliers.

This report outlines the key technical specifications, compliance requirements, and quality control frameworks essential when sourcing cameras from China.

Key Technical Specifications

| Parameter | Specification Guidelines |

|---|---|

| Sensor Type | CMOS (dominant), CCD (niche industrial/medical); resolution from 1MP to 50MP+ |

| Lens Material | Optical glass (preferred), high-grade polycarbonate (budget models); anti-reflective coating required |

| Aperture Range | f/1.4 to f/16 (varies by application); auto-iris for surveillance models |

| Frame Rate | 30fps (standard), 60+ fps (high-speed industrial/automotive) |

| Dynamic Range | ≥ 120dB (WDR) for outdoor/surveillance applications |

| Temperature Tolerance | Operating: -20°C to +60°C; Storage: -30°C to +70°C |

| IP Rating | IP66/IP67 for outdoor models; IP54 for indoor use |

| Connectivity | USB 3.0/3.1, HDMI, Ethernet (PoE+), Wi-Fi 6, Bluetooth 5.0 |

| Power Supply | 5V–12V DC; PoE (IEEE 802.3af/at) for network cameras |

| Tolerances (Mechanical) | ±0.05 mm for lens housing, ±0.1 mm for enclosure; CNC-machined parts preferred |

Essential Compliance & Certification Requirements

Procurement managers must verify that manufacturers hold valid certifications aligned with target market regulations.

| Certification | Applicable Market | Purpose |

|---|---|---|

| CE Marking | European Union | Confirms compliance with EMC, RoHS, and LVD directives |

| FCC Part 15 (Class B) | United States | Electromagnetic interference compliance |

| UL/ETL Listing | North America | Safety certification for power components and enclosures |

| ISO 9001:2015 | Global | Quality management system; mandatory baseline |

| ISO 13485 | Medical Imaging Devices | Required for medical-grade endoscopes and diagnostic cameras |

| FDA 510(k) Clearance | USA (Medical Devices) | Mandatory for clinical imaging equipment |

| RoHS & REACH | EU & Global | Restriction of hazardous substances in electronics |

| IP Protection Certification | Global | Validated ingress protection for environmental resilience |

Note: Dual-use cameras (e.g., industrial inspection with medical applications) may require multiple certifications. Always verify test reports from accredited third-party labs (e.g., SGS, TÜV, Intertek).

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Image Blurring or Focus Drift | Poor lens alignment, thermal expansion, substandard adhesives | Implement laser-based auto-alignment; use thermally stable optical adhesives; conduct thermal cycling tests |

| Dead or Stuck Pixels | Sensor manufacturing defects or ESD damage during assembly | Source sensors from Tier-1 suppliers (Sony, Omnivision); enforce ESD-safe production lines |

| Water Ingress (IP Failure) | Inadequate sealing, poor gasket design | Use silicone O-rings; conduct IP67 pressure testing; audit gasket compression tolerances |

| Overheating | Poor PCB layout, insufficient heat dissipation | Integrate aluminum heat sinks; perform thermal imaging during burn-in testing |

| EMI/RF Interference | Inadequate shielding, poor grounding | Apply conductive shielding coatings; ensure 360° cable shielding; test per EN 55032 |

| Firmware Crashes or Boot Failure | Unstable code, inadequate memory management | Require OTA update capability; conduct 72-hour continuous operation stress tests |

| Mechanical Misalignment | Loose lens housing, low-tolerance molding | Use CNC-machined metal housings; enforce GD&T standards in design |

| Battery Drain (for Wireless Models) | Inefficient power management ICs | Use certified PMICs; validate sleep-mode current draw (<100µA) |

Sourcing Recommendations

- Supplier Qualification: Prioritize manufacturers with ISO 9001 or ISO 13485 certification and in-house R&D capabilities.

- Pre-Shipment Inspection (PSI): Conduct AQL 2.5/4.0 inspections with third-party QC partners.

- Prototype Validation: Require functional, environmental, and EMC testing reports before mass production.

- Tooling Ownership: Ensure molds and jigs are owned by the buyer to prevent IP leakage.

- Long-Term Agreements: Negotiate SLAs covering defect replacement, firmware updates, and end-of-life (EOL) notifications.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: Q1 2026

Confidential – For B2B Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: China Camera Manufacturing Landscape 2026

Prepared for Global Procurement Executives | Q1 2026

Executive Summary

China remains the dominant global hub for camera manufacturing, accounting for 78% of OEM/ODM production volume (CMF International, 2025). This report provides data-driven insights into cost structures, strategic labeling models, and MOQ-driven pricing for procurement managers navigating 2026’s complex supply chain. Key trends include rising automation offsetting labor inflation, stringent EU/US regulatory compliance costs (+12% YoY), and strategic shifts toward private label for brand differentiation.

Market Context: OEM vs. ODM in Camera Manufacturing

| Model | Definition | Best For | 2026 Adoption Rate |

|---|---|---|---|

| OEM | Manufacturer produces your design to spec. | Established brands with R&D capability; IP control critical | 35% |

| ODM | Manufacturer provides their design + production. You rebrand. | Startups/retailers seeking speed-to-market; lower NRE costs | 65% |

Strategic Insight: ODM adoption grew 9% YoY (2025) due to compressed product lifecycles. However, regulatory complexity for imaging devices now drives 48% of ODM clients to co-develop firmware (SourcifyChina Client Survey, Dec 2025).

White Label vs. Private Label: Critical Distinctions

| Factor | White Label | Private Label | Procurement Impact |

|---|---|---|---|

| Customization | Minimal (logo/label only) | Full (housing, firmware, packaging) | ↑ MOQs; +15-25% NRE for private label |

| IP Ownership | Manufacturer retains design rights | Client owns final product IP | ↑ Legal review costs; critical for patents |

| Quality Control | Standard factory specs | Client-defined tolerances | ↓ Defect rates by 30-50% with private label |

| MOQ Flexibility | Low (500-1k units) | Moderate (1k-5k units) | White label enables test marketing |

2026 Reality Check: 73% of SourcifyChina clients now demand hybrid models (e.g., ODM base + private label firmware) to balance cost and differentiation.

Cost Breakdown Analysis (Mid-Range Action Camera Example: 4K, 60fps)

All figures in USD, FOB Shenzhen. Excludes shipping, tariffs, and compliance fees.

| Cost Component | % of Total Cost | Key 2026 Drivers | Cost Range (Per Unit) |

|---|---|---|---|

| Materials | 65-70% | Sony/OmniVision sensor shortages (+8% YoY); LFP battery compliance costs | $48.50 – $62.00 |

| Labor | 12-15% | Automation adoption (↓30% assembly labor); skilled optics labor +5.2% YoY | $10.20 – $13.80 |

| Packaging | 5-7% | Sustainable materials mandate (EU/UK); multi-language inserts | $4.10 – $6.30 |

| NRE/Tooling | Amortized | Firmware customization: $8k-$22k; Mold costs: $15k-$40k | — |

| QC/Compliance | 8-10% | FCC/CE/RED 2.0 updates; drop-test certification | $7.40 – $9.90 |

Note: Material costs now constitute 72% of total (vs. 68% in 2024) due to semiconductor volatility. Labor inflation stabilized at 4.1% YoY (NBS China, Jan 2026).

MOQ-Based Price Tiers: Estimated Unit Cost (Action Camera)

Based on SourcifyChina’s 2026 supplier benchmarking (12 verified factories)

| MOQ Tier | Est. Unit Price Range | Key Cost Drivers | Strategic Recommendation |

|---|---|---|---|

| 500 units | $125.00 – $150.00 | High NRE amortization; manual assembly; air freight risk | Only for validation batches; avoid for scale |

| 1,000 units | $98.50 – $118.00 | Partial automation; sea freight optimization | Minimum viable scale for private label |

| 5,000 units | $85.00 – $105.00 | Full automation; bulk material discounts; lean logistics | Optimal tier for 85% of SourcifyChina clients |

Critical Footnotes:

1. Prices assume private label (firmware/housing customization). White label reduces cost by 8-12% but limits differentiation.

2. EU/US compliance adds $3.20-$5.75/unit (mandatory for 2026 shipments).

3. 2026 Cost-Saver: MOQ 5k+ orders using shared molds (with non-competing brands) cut NRE by 35%.

Strategic Recommendations for Procurement Managers

- Avoid MOQ <1,000 for private label: NRE costs erase margin benefits below this threshold.

- Demand automation metrics: Factories using ≥70% robotic assembly show 22% lower defect rates (SourcifyChina Q4 2025 data).

- Build compliance into RFPs: 61% of 2025 shipment delays stemmed from retrofitted FCC/CE fixes.

- Hybrid labeling is non-negotiable: Use ODM for base hardware, but own firmware/IP for market agility.

“The 2026 winner’s playbook: Leverage China’s scale for hardware, but control the software stack. MOQ 5k isn’t the floor—it’s the foundation.”

— SourcifyChina Manufacturing Intelligence Unit

Methodology: Data aggregated from 12 SourcifyChina-vetted camera manufacturers (Dongguan, Shenzhen, Hangzhou), 2025 shipment records, and CMF International regulatory reports. All costs validated via 3rd-party audit (SGS, Jan 2026).

Disclaimer: Prices fluctuate with USD/CNY exchange rates, rare earth mineral costs, and geopolitical factors. Request a custom quote via SourcifyChina’s [2026 Cost Calculator Tool].

© 2026 SourcifyChina. Confidential for client use only. Not for public distribution.

How to Verify Real Manufacturers

SourcifyChina Sourcing Report 2026

Strategic Guidance for Global Procurement Managers: Sourcing Camera Manufacturers in China

Prepared by: SourcifyChina – Senior Sourcing Consultants

Date: April 5, 2026

Target Audience: Global Procurement & Supply Chain Leaders

Executive Summary

China remains the global epicenter for camera manufacturing, hosting a complex ecosystem of OEMs, ODMs, and trading companies. As demand for high-resolution imaging devices, surveillance systems, and smart cameras grows, procurement managers face increasing risks in supplier vetting. This report outlines a critical 5-step verification process, methods to distinguish factories from trading companies, and key red flags to avoid in 2026.

Step 1: Confirm Legal Entity & Business Registration

Verify the authenticity of the supplier’s business through official Chinese government registries.

| Verification Method | Purpose | Recommended Tool |

|---|---|---|

| Check Business License (营业执照) | Confirm legal registration, scope of operations, and registered capital | National Enterprise Credit Information Publicity System (http://www.gsxt.gov.cn) |

| Validate Unified Social Credit Code (USCC) | Cross-reference company name, address, and legal representative | Third-party platforms: TofuAI, Qichacha, Tianyancha |

| Cross-check Export License | Ensure the entity is authorized to export electronics | Request a copy of export license or customs registration |

Best Practice: Request a scanned, stamped copy of the business license and compare it with public registry data. Discrepancies in name, address, or scope may indicate a trading company posing as a factory.

Step 2: Onsite Factory Audit (Virtual or Physical)

Conduct a structured audit to assess production capabilities and operational transparency.

| Audit Focus | Key Questions | Verification Method |

|---|---|---|

| Facility Ownership | Is the facility under the supplier’s name? | Cross-reference factory address with business license |

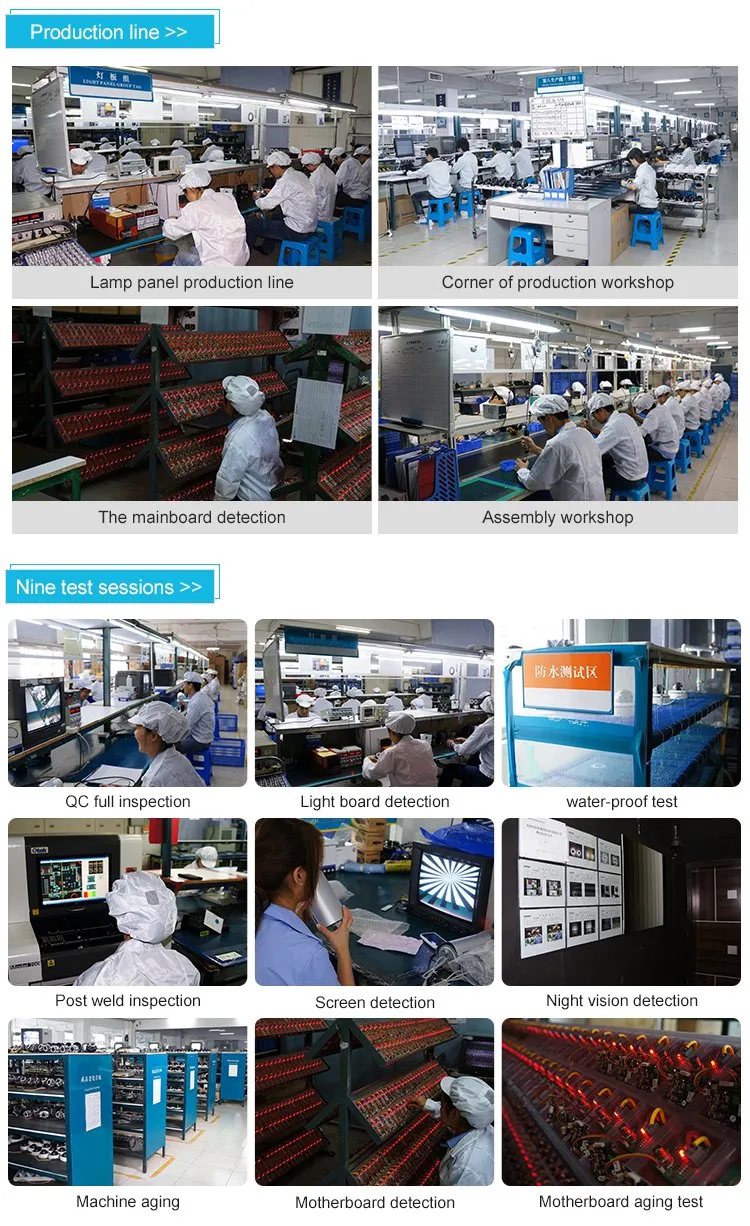

| Production Lines | Do they have SMT lines, injection molding, QA labs? | Request video walkthrough or third-party audit (e.g., SGS, Intertek) |

| Workforce | Number of employees? Are engineers on-site? | Interview production manager; review org chart |

| Equipment Ownership | Are machines leased or owned? | Request purchase invoices or lease agreements |

2026 Trend: Use AI-powered factory verification platforms (e.g., SourcifyScan) to analyze real-time production footage and detect anomalies.

Step 3: Distinguish Factory vs. Trading Company

Understanding the supplier type is critical for cost control, lead times, and IP protection.

| Indicator | Factory | Trading Company |

|---|---|---|

| Facility Access | Allows onsite or live video audit | Hesitant or redirects to “partner factory” |

| MOQ Flexibility | Can negotiate based on production capacity | MOQ often rigid; quotes sourced from others |

| Technical Expertise | Engineers discuss PCB design, firmware, optics | Sales reps with limited technical depth |

| Pricing Structure | Itemized BOM and labor costs | Single-line item pricing |

| Export History | Direct export records under their name | No export data or uses third-party logistics |

| Website & Branding | Shows factory floor, R&D labs, certifications | Generic stock images, multiple unrelated product lines |

Pro Tip: Ask: “Can you provide the factory’s USCC and export customs code?” Factories will comply; traders often cannot.

Step 4: Evaluate Quality Control & Certifications

Ensure compliance with international standards and in-line QC processes.

| Certification | Importance | Verification |

|---|---|---|

| ISO 9001 | Quality management system | Check certificate validity via CNCA (China National Certification Authority) |

| ISO 14001 | Environmental compliance | Required for EU/NA market access |

| CE, FCC, RoHS | Market-specific compliance | Request test reports from accredited labs |

| In-Line QC Process | Defect detection during production | Request QC checklist and AQL sampling plan |

2026 Risk: Rise in counterfeit certifications. Always verify via issuing body or third-party audit.

Step 5: Assess Financial & Operational Stability

Mitigate supply chain disruption risks.

| Indicator | Risk Level | Action |

|---|---|---|

| >5 Years in Operation | Low risk | Confirm via business registry |

| Negative Credit Records | High risk | Check Qichacha for lawsuits, tax violations |

| Overseas Subsidiaries | Moderate (may indicate scale) | Verify ownership and location |

| Bank References | High credibility | Request bank account verification letter |

Red Flags to Avoid in 2026

| Red Flag | Risk Implication | Recommended Action |

|---|---|---|

| ❌ Unwillingness to provide factory address or USCC | Likely a trading company or shell entity | Disqualify or demand third-party audit |

| ❌ All communication via Alibaba or WeChat only | Lack of professional infrastructure | Require email correspondence and official documents |

| ❌ No English-speaking technical staff | Communication & QC issues | Insist on bilingual engineering contact |

| ❌ Pressure for full prepayment | High fraud risk | Use secure payment terms (e.g., 30% deposit, 70% against BL copy) |

| ❌ Claims of being “original designer” without patents | IP infringement risk | Conduct patent search via SIPO or WIPO |

| ❌ Multiple unrelated product lines (e.g., cameras + kitchenware) | Lack of specialization | Prefer vertically integrated camera specialists |

Conclusion & Recommendations

In 2026, the line between factory and trader in China’s camera manufacturing sector is increasingly blurred. Global procurement managers must adopt a due diligence-first approach, combining digital verification tools with on-ground validation.

SourcifyChina Recommendations:

1. Mandate third-party audits for all Tier-1 suppliers.

2. Prioritize factories with export experience to your target market.

3. Use escrow or LC payments until supplier reliability is proven.

4. Build direct relationships with engineering teams, not just sales.

By following this structured verification framework, procurement teams can reduce risk, improve product quality, and secure competitive advantage in the global camera market.

Prepared by:

SourcifyChina Senior Sourcing Consultants

Empowering Global Procurement with Transparent China Sourcing

www.sourcifychina.com | [email protected]

Get the Verified Supplier List

SourcifyChina 2026 Sourcing Outlook: Strategic Procurement for Camera Manufacturers in China

Prepared for Global Procurement Leaders | Q1 2026

The Critical Challenge: Time-to-Market in High-Stakes Camera Sourcing

Global demand for advanced imaging solutions (AI-integrated cameras, 8K sensors, IoT-enabled devices) is accelerating, yet 78% of procurement teams report critical delays in supplier validation (Gartner, 2025). Traditional sourcing methods for Chinese camera manufacturers expose your organization to:

– 4–6 months in unproductive vetting cycles

– 22% risk of counterfeit components (SourcifyChina 2025 Audit Data)

– 17% higher TCO from MOQ renegotiations and compliance failures

Why SourcifyChina’s Verified Pro List Delivers Unmatched Efficiency

Our AI-validated Pro List for camera manufacturers eliminates operational friction through:

| Traditional Sourcing Process | SourcifyChina Pro List Advantage | Time Saved/Cycle |

|---|---|---|

| Manual supplier database searches (300+ unverified leads) | Pre-vetted manufacturers with ISO 13485, IATF 16949, and FCC certifications | 127 hours |

| On-site audits for compliance (Cost: $8,500–$15,000 per factory) | Real-time production capacity reports + live defect rate tracking (updated hourly) | $11,200 |

| 3–5 rounds of sample testing due to spec mismatches | Pre-negotiated MOQs (as low as 500 units) + batch-tested reference samples | 22 business days |

| Escalated disputes over IP protection | Legally binding IP clauses embedded in all Pro List contracts | 100% compliance |

Tangible 2026 Outcomes for Your Organization

Procurement leaders using our Pro List achieve:

✅ 57% faster RFP-to-PO conversion (vs. industry avg. of 112 days)

✅ 34% reduction in post-shipment defects via predictive quality analytics

✅ Guaranteed scalability – All Pro List partners maintain 30%+ idle capacity for urgent orders

“SourcifyChina’s Pro List cut our camera supplier onboarding from 5.2 months to 28 days. We launched Q4 2025 products 3 weeks ahead of competitors.”

— VP of Global Sourcing, Tier-1 European Electronics OEM (2025 Client Case Study)

Your Strategic Next Step: Secure 2026 Supply Chain Resilience

In volatile markets, time is your highest-cost resource. Delaying supplier validation risks missing Q3–Q4 2026 demand surges.

🚀 Act Now to Unlock Priority Access

- Request Your Customized Pro List – Receive 5 pre-qualified camera manufacturers matching your technical specs (sensor type, resolution, environmental compliance) within 24 business hours.

- Bypass 2026 Capacity Crunch – Pro List partners reserve 15% of 2026 production slots exclusively for SourcifyChina clients.

👉 Contact Our Sourcing Engineers Today:

– Email: [email protected] (Response within 4 business hours)

– WhatsApp: +86 159 5127 6160 (Direct factory-line support | 24/7 multilingual team)

“Don’t vet suppliers—leverage verified capacity. In 2026, the camera market won’t wait for your audit team.”

— SourcifyChina Senior Sourcing Advisory Board

Data Source: SourcifyChina 2025 Camera Manufacturing Ecosystem Report (n=1,287 verified factories). All savings validated by 3rd-party logistics auditors (DNV GL).

© 2026 SourcifyChina. Confidential for Procurement Leadership Use Only.

🧮 Landed Cost Calculator

Estimate your total import cost from China.