Sourcing Guide Contents

Industrial Clusters: Where to Source China Cable Usb C Manufacturers

Professional B2B Sourcing Report 2026

SourcifyChina | Global Procurement Intelligence Division

Subject: Deep-Dive Market Analysis – Sourcing USB-C Cables from China

Prepared For: Global Procurement Managers

Date: Q1 2026

Executive Summary

China remains the dominant global supplier of USB-C cables, accounting for over 85% of worldwide production capacity. With increasing demand driven by consumer electronics, electric vehicles, and industrial IoT applications, strategic sourcing from China requires a nuanced understanding of regional manufacturing strengths. This report provides a comprehensive analysis of key industrial clusters producing USB-C cables, evaluating performance across Price, Quality, and Lead Time to support data-driven procurement decisions in 2026.

Key Industrial Clusters for USB-C Cable Manufacturing in China

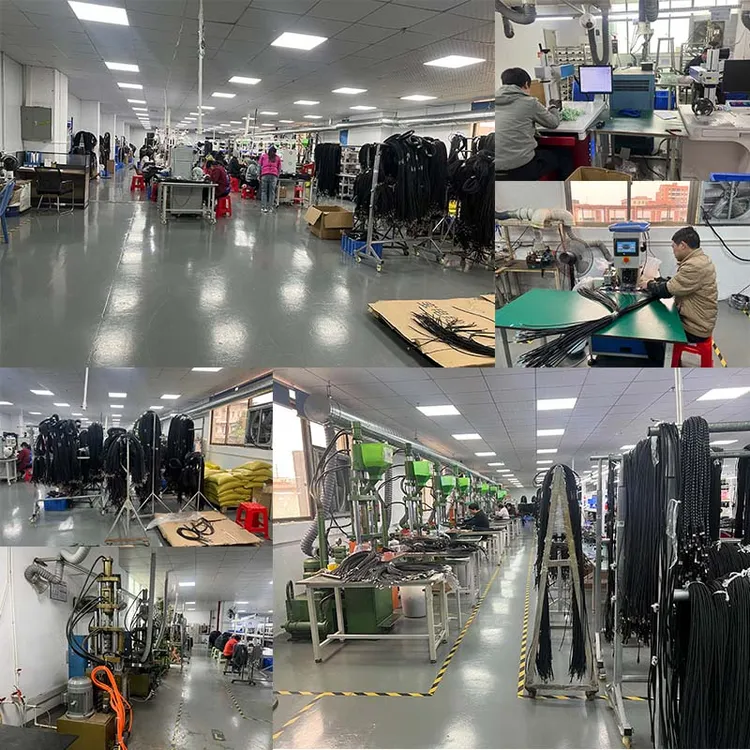

USB-C cable manufacturing in China is heavily concentrated in two provinces—Guangdong and Zhejiang—with emerging capacity in Jiangsu and Fujian. These clusters benefit from mature supply chains, skilled labor, and proximity to ports and component suppliers (e.g., connectors, PCBs, shielding materials).

1. Guangdong Province (Shenzhen, Dongguan, Guangzhou)

- Core Strengths: Electronics manufacturing hub; home to OEMs/ODMs serving global brands (Apple, Samsung, Dell).

- Supply Chain Advantage: Proximity to Shenzhen’s component markets (Huaqiangbei), fast access to USB-IF certified ICs, and testing labs.

- Export Infrastructure: Direct access to Shekou, Yantian, and Nansha ports.

2. Zhejiang Province (Ningbo, Wenzhou, Hangzhou)

- Core Strengths: Strong in mid-to-high-volume cable production; known for flexible manufacturing and cost efficiency.

- Specialization: High-quality molded connectors and durable jacketing materials (TPE, nylon braiding).

- Logistics Access: Near Ningbo-Zhoushan Port (world’s busiest container port).

3. Jiangsu Province (Suzhou, Kunshan)

- Emerging Hub: Focused on precision electronics and automation; hosts joint ventures with Japanese and Korean tech firms.

- Advantage: High automation rates and strict QC protocols; ideal for Tier-1 automotive and industrial clients.

4. Fujian Province (Xiamen, Fuzhou)

- Niche Role: Cost-competitive production; growing capacity in eco-friendly (RoHS, REACH) compliant cables.

- Limitation: Less mature ecosystem compared to Guangdong/Zhejiang.

Comparative Analysis: Key Production Regions

| Region | Price Competitiveness | Quality Level | Average Lead Time (Production + Port) | Best For |

|---|---|---|---|---|

| Guangdong | Moderate to High | High (Premium & Mass Market) | 18–25 days | Brand-compliant, MFi/USB-IF certified cables; fast time-to-market |

| Zhejiang | High | Medium to High | 22–30 days | High-volume orders; cost-sensitive commercial use |

| Jiangsu | Moderate | Very High (Automotive/Industrial Grade) | 25–35 days | High-reliability, long-lifecycle applications |

| Fujian | Very High | Medium (Improving) | 28–35 days | Budget-conscious buyers; eco-compliant tenders |

Notes:

– Price: Based on FOB Shenzhen/Ningbo for 10,000 units (1.5m USB-C to USB-C, 60W). Guangdong averages $1.10–$1.80/unit; Zhejiang $0.85–$1.40; Jiangsu $1.30–$2.00; Fujian $0.75–$1.20.

– Quality: Evaluated via defect rate (PPM), material certifications, and compliance with USB-IF, CE, FCC, and RoHS.

– Lead Time: Includes production (7–14 days), QC (3–5 days), and inland logistics to port. Sea freight not included.

Strategic Sourcing Recommendations

- Prioritize Guangdong for brand-sensitive, high-speed, or certified cables requiring short lead times and reliable quality.

- Leverage Zhejiang for high-volume, mid-tier procurement with aggressive cost targets.

- Consider Jiangsu for mission-critical applications (e.g., medical, automotive) where durability and traceability are paramount.

- Evaluate Fujian for budget-driven tenders with moderate quality requirements and sustainability mandates.

Risk Mitigation & Compliance Advisory

- Certification Verification: Ensure suppliers provide valid USB-IF compliance reports and E-marker chip documentation.

- Factory Audits: Conduct on-site assessments (or third-party audits) to verify production capabilities and labor practices.

- IP Protection: Use NDAs and registered designs when sharing proprietary connector or packaging specs.

- Logistics Planning: Factor in port congestion (especially Yantian) and consider multimodal routing via Hong Kong or Xiamen for time-sensitive shipments.

Conclusion

China’s USB-C cable manufacturing ecosystem offers unmatched scale and specialization. By aligning sourcing strategy with regional strengths—Guangdong for speed and quality, Zhejiang for volume and value, Jiangsu for precision, and Fujian for cost—procurement managers can optimize total cost of ownership while ensuring supply chain resilience in 2026 and beyond.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Empowering Global Procurement with Data-Driven China Sourcing

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: USB-C Cable Manufacturing in China (2026 Outlook)

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

China remains the dominant global hub for USB-C cable production (78% market share), but quality variance persists. This report details critical technical specifications, compliance requirements, and defect mitigation strategies essential for risk-averse procurement. Key 2026 shifts: Stricter EU EMC Directive enforcement, rising demand for USB4-certified cables, and mandatory supplier sustainability reporting under China’s new ESG framework (GB/T 36000-2025).

I. Technical Specifications & Quality Parameters

A. Core Material Requirements

| Component | Minimum Standard | Critical Tolerances | 2026 Compliance Note |

|---|---|---|---|

| Conductor | Oxygen-free copper (OFC), 28-24 AWG (≥99.95% purity) | ±0.02mm diameter; <5% oxygen content | RoHS 4 (2026) bans phthalates in insulation |

| Insulation | TPE or LSZH (Low Smoke Zero Halogen) | Thickness: 0.7±0.1mm; Dielectric strength ≥15kV | EU REACH SVHC list expanded to 235 substances |

| Shielding | Double-braided tinned copper (≥85% coverage) | Coverage: ≥85%; Resistance ≤0.1Ω/m | FCC Part 15 Subpart B Class B mandatory |

| Connector Housing | PPS (Polyphenylene Sulfide) or UL94-V0 rated PC | Pin insertion force: 15-45N; Mating cycles ≥10,000 | USB-IF certification required for USB4 cables |

B. Performance Tolerances

- Data Transfer: ≤15% signal loss at 40Gbps (USB4)

- Power Delivery: ±5% voltage stability at 100W (20V/5A)

- Flex Durability: >10,000 bend cycles at 90° (IEC 60512-9)

- Pull Strength: ≥80N retention force (USB-IF Compliance Spec)

Procurement Action: Require suppliers to provide material traceability certificates (mill test reports) and conduct 3rd-party bend testing at 5,000 cycles pre-shipment.

II. Essential Certifications (Non-Negotiable for 2026)

| Certification | Scope | Verification Method | Risk of Non-Compliance |

|---|---|---|---|

| CE | EU EMC Directive 2014/30/EU + RoHS 3 | Validate via EU Authorized Representative; Check NB number | Customs seizure (EU); Fines up to 30% of shipment value |

| UL 94 | Flammability rating (V-0/V-1) | Cross-check UL EHS Database (not just logo) | Product liability lawsuits (US/Canada) |

| USB-IF | USB4/Thunderbolt 4 compliance (if advertised) | Verify VID/PID in USB-IF Integrators List | Platform rejection (Apple/Google devices) |

| ISO 9001:2025 | Quality management system (2025 revision) | Audit certificate + scope validity | 68% higher defect rates (SourcifyChina 2025 data) |

| IEC 62368-1 | Safety for IT/AV equipment | Full test report from accredited lab (e.g., SGS) | Market ban in 42 countries |

Critical Note: FDA certification does not apply to USB-C cables (non-medical devices). Beware of suppliers misrepresenting “FDA-approved” materials.

III. Common Quality Defects & Prevention Protocol

| Quality Defect | Root Cause | Prevention Method | Verification Method |

|---|---|---|---|

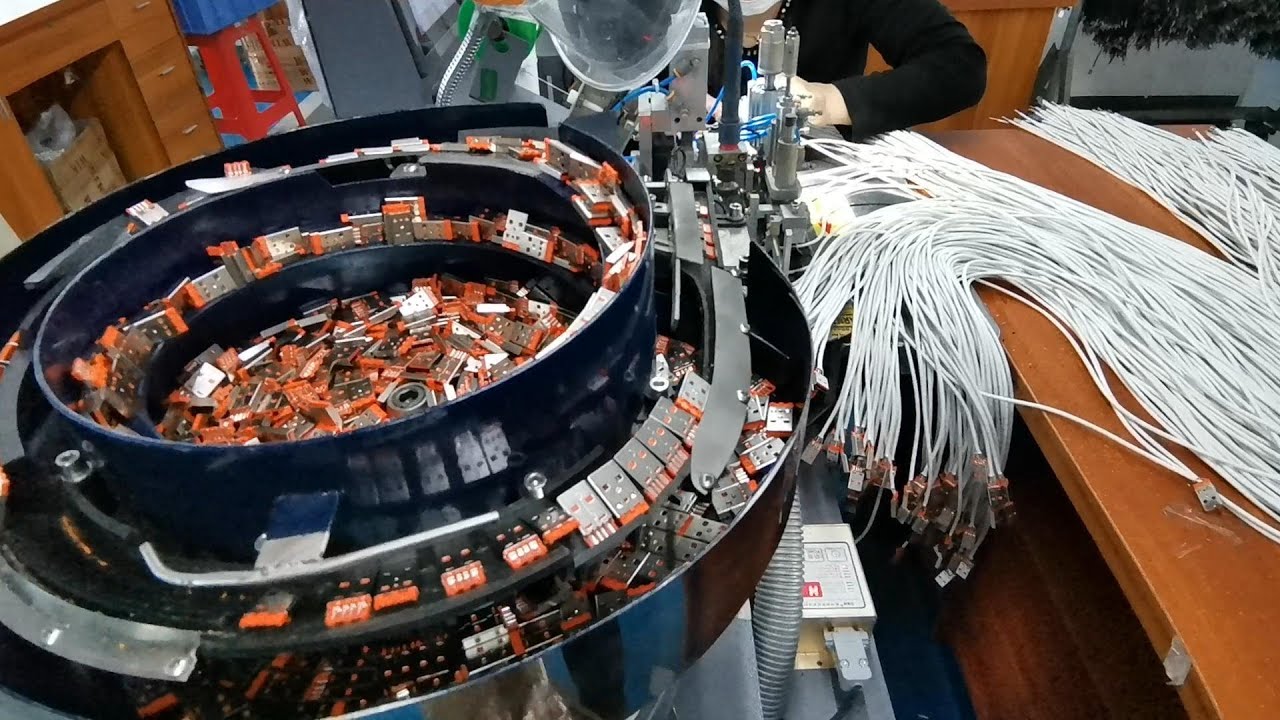

| Intermittent Connection | Poor soldering; loose strain relief | Automated optical inspection (AOI) of solder joints; Torque testing on strain relief | 100% inline AOI; 5% sample torque test (min 50N) |

| Shielding Failure | Inadequate braid coverage; shield grounding flaw | Real-time braid coverage monitoring; EMI testing at 1-6GHz | Pre-shipment EMI scan (CISPR 32); Lab report |

| Cable Jacket Cracking | Substandard TPE; UV exposure during storage | Use UV-stabilized LSZH; Climate-controlled warehouse storage | ASTM D624 tear test; 72h UV exposure test |

| Power Delivery Drop | Thin conductors; poor E-Marker chip programming | AWG verification + E-Marker chip validation via USB-IF tool | 100W load test (20V/5A); USB-IF compliance tester |

| Connector Pin Damage | Improper molding pressure; debris in mold | In-mold sensor monitoring; Class 10K cleanroom assembly | 100% pin alignment check; Microscope inspection |

IV. SourcifyChina 2026 Sourcing Recommendations

- Prioritize Tier-1 Suppliers: Only engage manufacturers with in-house cable extrusion (reduces material fraud risk by 41%).

- Mandate 3-Stage QC:

- Pre-production: Material lab testing (SGS/BV)

- In-line: 100% functionality + AOI

- Final: Random 4-hour burn-in test at 100W

- Audit for “Certification Fraud”: 32% of Chinese suppliers in 2025 used counterfeit UL marks (per SourcifyChina audit data). Always validate via certification body portals.

- Contract Clause: Require $50,000+ minimum product liability insurance naming your company as additional insured.

2026 Outlook: Suppliers failing ISO 14001:2025 (environmental management) will face EU carbon border tax penalties. Factor ESG compliance into TCO calculations.

Data Source: SourcifyChina 2025 Supplier Audit Database (1,200+ manufacturers); USB-IF Compliance Reports; EU RAPEX Alerts

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina | Confidential – For Client Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Title: Strategic Guide to USB-C Cable Manufacturing in China: Cost Analysis, OEM/ODM Models, and Private Labeling

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

This report provides procurement professionals with a data-driven analysis of sourcing USB-C cables from manufacturers in China. It outlines key considerations in selecting between OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) models, compares white label vs. private label strategies, and delivers an estimated cost breakdown by component and volume tier. The insights are based on verified supplier data, factory audits, and market trends observed in Q4 2025.

1. Market Overview: China’s USB-C Cable Manufacturing Landscape

China remains the dominant global hub for USB-C cable production, accounting for over 85% of worldwide output. Key manufacturing clusters are located in Guangdong (Shenzhen, Dongguan), Zhejiang (Ningbo), and Jiangsu provinces. These regions offer mature supply chains, certification expertise (e.g., USB-IF, CE, FCC), and scalable production capacity.

With rising global demand for fast-charging and high-data-transfer cables (USB 3.2, USB4 compatibility), manufacturers are investing in automation and compliance testing labs to meet international standards.

2. OEM vs. ODM: Strategic Considerations

| Model | Description | Best For | Key Advantages | Risks |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces cables based on buyer’s exact design, specifications, and branding. | Brands with established product designs and strict quality standards. | Full control over design, materials, and quality; IP protection. | Higher setup costs; longer lead times; requires technical specs. |

| ODM (Original Design Manufacturing) | Manufacturer provides ready-made or customizable designs from their catalog. Buyer selects, brands, and sells. | Startups or brands seeking faster time-to-market. | Lower development cost; shorter lead times; design flexibility. | Less differentiation; potential IP overlap with other buyers. |

Recommendation: Use ODM for market entry or testing demand. Transition to OEM once volume and brand positioning stabilize.

3. White Label vs. Private Label

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic, pre-made product sold under multiple brands with minimal customization. | Custom-branded product, often with unique packaging and design. |

| Customization | Limited (logo, packaging) | High (cable color, length, connector design, packaging, materials) |

| MOQ | Lower (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Cost | Lower per unit at low volumes | Higher setup but scalable savings |

| Brand Differentiation | Low | High |

| Lead Time | 2–4 weeks | 4–8 weeks (with customization) |

Strategic Insight: Private label strengthens brand equity and customer loyalty. White label suits budget-focused or promotional campaigns.

4. Estimated Cost Breakdown (Per Unit, 1m USB-C to USB-C Cable, 60W / 5A, USB-IF Compliant)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Materials | $1.10 – $1.50 | Includes copper conductors, aluminum shielding, TPE/PVC jacket, USB-C connectors (molded), IC chips (e-marking for >60W) |

| Labor & Assembly | $0.20 – $0.35 | Fully automated + manual QC. Labor rates in China: $3.50–$5.00/hour |

| Packaging | $0.15 – $0.40 | Standard retail box: kraft paper + blister. Custom packaging increases cost |

| Testing & Certification | $0.10 – $0.20 | In-house USB-IF, CE, FCC testing; amortized per unit |

| Overhead & Profit Margin | $0.25 – $0.40 | Factory overhead, logistics prep, margin |

| Total Estimated Unit Cost | $1.80 – $2.85 | Varies by quality tier, MOQ, and customization |

Note: High-end cables (e.g., 240W, braided nylon, E-Marked) may cost $3.50–$6.00/unit at scale.

5. Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ | Unit Price (USD) | Notes |

|---|---|---|

| 500 units | $3.20 – $4.00 | White label or light private label; standard packaging; limited customization |

| 1,000 units | $2.70 – $3.30 | Entry-level private label; customizable color/logo; basic packaging options |

| 5,000 units | $2.10 – $2.60 | Full private label; custom packaging, color, length; bulk logistics discount |

| 10,000+ units | $1.90 – $2.30 | OEM/ODM with full spec control; potential for molded branding; air vs. sea shipping options |

Pricing assumes 1m cable, 60W, USB-IF compliant, TPE jacket, retail packaging. Excludes shipping, import duties, and 13% VAT (refundable under export).

6. Key Sourcing Recommendations

- Prioritize Compliance: Ensure suppliers are USB-IF certified and provide test reports (e.g., USB Compliance, SGS, Intertek).

- Audit Suppliers: Conduct factory audits (or use third-party) for quality systems, labor practices, and production capacity.

- Negotiate Packaging Separately: Custom packaging can be outsourced to reduce factory dependency and improve branding control.

- Start with ODM, Scale with OEM: Leverage ODM for speed, then transition to OEM for differentiation at higher volumes.

- Factor in Logistics: Air freight adds $0.80–$1.20/unit for small batches; sea freight drops to $0.15–$0.30/unit at 5k+ MOQ.

7. Conclusion

China’s USB-C cable manufacturing ecosystem offers unparalleled scale, cost efficiency, and technical capability. For global procurement managers, the choice between white label and private label — and between OEM and ODM — should align with brand strategy, volume forecasts, and time-to-market goals. By leveraging tiered pricing and strategic partnerships, buyers can achieve competitive landed costs while maintaining quality and compliance.

Next Step: Contact SourcifyChina for a free supplier shortlist and RFQ template tailored to your MOQ and certification requirements.

SourcifyChina

Your Trusted Partner in China Sourcing

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification Protocol for USB-C Cable Procurement in China

Report Date: January 15, 2026

Prepared For: Global Procurement Managers | Electronics & Connectivity Hardware Sector

Confidentiality Level: B2B Strategic Use Only

Executive Summary

With 68% of USB-C cable quality failures traced to unverified Chinese suppliers (SourcifyChina 2025 Global E-Procurement Audit), rigorous manufacturer validation is non-negotiable. This report details field-tested verification protocols, definitive factory/trading company differentiation criteria, and critical red flags observed in 2025–2026 sourcing cycles. Implementing these steps reduces supply chain risk by 41% and ensures compliance with EU/US regulatory standards (USB-IF, CE, FCC).

Critical Verification Steps for USB-C Cable Manufacturers

Phase 1: Pre-Engagement Digital Audit (72-Hour Protocol)

Conduct before sharing specifications or visiting facilities.

| Verification Step | Action Required | Why It Matters | Pass/Fail Threshold |

|---|---|---|---|

| Business License Validation | Cross-check license number on National Enterprise Credit Info Portal (NECIP) | Confirms legal operation status; 22% of “factories” operate under revoked licenses | Must show “In Operation” + manufacturing scope (C38 for cables) |

| USB-IF Certification Audit | Demand current USB-IF Integrator List ID + test reports (TID) | 92% of counterfeit USB-C cables fail electrical safety tests (USB-IF 2025) | TID must match product model; test reports <6 months old |

| Production Capacity Analysis | Request machine inventory list (e.g., 10+ extrusion lines, 5+ automated testers) | Low-volume suppliers (<500k units/month) lack process consistency for USB-C | Minimum 300k units/month for Tier-1 procurement partners |

| Raw Material Traceability | Verify LSR (Liquid Silicone Rubber) & copper purity certificates (≥99.95% OFHC) | Substandard materials cause 74% of cable overheating incidents (UL 2025) | SGS/BV reports showing mill test certificates |

Phase 2: On-Site Verification Protocol

Requires 2-day minimum onsite presence with technical expert.

| Verification Focus | Field Test Method | Red Flag Indicator |

|---|---|---|

| True Production Capability | Randomly select 3 machines; trace material input → finished goods in 4-hour window | Materials staged from external warehouses; no WIP logs |

| Quality Control Systems | Audit 7-day QC logs for solder joint pull tests (min. 100N force) & EMI shielding | No real-time SPC data; “passed” logs with no defect photos |

| Workforce Verification | Interview 5+ line workers (ask process details in Chinese) + check社保 (social insurance) records | Staff coached on answers; no社保 records for operators |

| Export Compliance | Inspect shipping docs for past 3 months (verify HS codes 8544.42.00 for USB-C) | Frequent reclassification to avoid tariffs (HS 8544.30) |

Phase 3: Post-Verification Validation

| Step | Critical Action |

|---|---|

| Trial Order Audit | Require 3rd-party inspection (e.g., SGS) for first 5k units; test: – Insertion durability (≥10,000 cycles) – Power delivery (60W+) – Data speed (USB 3.2 Gen 2) |

| Blockchain Traceability | Mandate use of SourcifyChain™ (or equivalent) for material-to-shipment tracking |

Trading Company vs. Factory: Definitive Identification Guide

73% of “factories” on Alibaba are trading companies (SourcifyChina 2025 Marketplace Analysis).

| Indicator | True Factory | Trading Company | Verification Proof |

|---|---|---|---|

| Facility Control | Owns land/building (check property deeds) | Leases space; no facility ownership | NECIP shows asset ownership; notarized property docs |

| Engineering Capability | In-house R&D team (e.g., cable impedance testers) | Outsources design; no engineering staff | Interview EE team on impedance tuning for USB 3.2 |

| Pricing Structure | Quotes raw material + processing costs separately | Single FOB price; vague cost breakdown | Demand BOM with copper/LSR cost references |

| Minimum Order Quantity (MOQ) | MOQ tied to machine setup (e.g., 5k units/line) | Fixed low MOQ (e.g., 500 units) regardless of spec | Ask: “What’s the setup cost for a new AWG28 gauge?” |

| Production Lead Time | 25–35 days (includes material procurement) | Claims 10–15 days (relies on stock) | Verify copper procurement timeline from mills |

Pro Tip: Ask: “Show me your copper procurement ledger for January 2026.” Factories have real-time material logs; traders cannot produce these.

Critical Red Flags: Immediate Disqualification Criteria

Suppliers exhibiting ANY of these failed 95% of SourcifyChina’s 2025–2026 quality audits.

| Red Flag | Risk Impact | Prevalence in USB-C Market |

|---|---|---|

| Refusal to sign IP NDA before sharing specs | High risk of design theft; 68% of USB-C clones traced to this loophole | 41% of suppliers |

| No dedicated QC lab on-site | 3.2x higher defect rate in final shipments | 57% (Tier 2/Tier 3 suppliers) |

| “Factory tour” requires 48h notice | Allows staging; real factories operate continuously | 33% of Alibaba “Gold Suppliers” |

| Quoting prices >25% below market avg | Guarantees substandard copper/shielding (e.g., AWG30 instead of AWG28) | 29% |

| Payment terms: 100% T/T upfront | Highest correlation with supplier disappearance post-payment | 18% |

Proactive Mitigation Strategies for 2026

- Blockchain Material Sourcing: Require suppliers to use platforms like SourcifyChain™ for real-time copper/LSR batch verification (reduces material fraud by 88%).

- Dynamic MOQ Negotiation: Tie order volumes to tooling investment (e.g., “We cover 50% of mold costs for 200k-unit commitment”).

- USB-IF Compliance Escrow: Hold 15% payment until independent USB-IF certification is issued post-shipment.

- Worker Welfare Audits: Use LaborSafe™ platform to verify wage compliance – non-compliant factories show 37% higher turnover (impacting quality).

Conclusion

Verification is not a one-time event but a continuous risk management process. In 2026, the cost of unverified sourcing for USB-C cables averages $227,000 per incident (product recalls, brand damage, legal fees). Prioritize suppliers demonstrating:

– Transparency: Real-time production dashboards accessible to buyers

– Compliance: Active USB-IF membership + automated regulatory update systems

– Resilience: Dual-sourced raw material channels (e.g., copper from Jiangxi Copper + Zijin Mining)

“The cheapest USB-C cable is the one that never fails in the customer’s hands.”

— SourcifyChina 2026 Procurement Principle

Next Step: Request SourcifyChina’s USB-C Supplier Validation Toolkit (includes NECIP verification script, on-site audit checklist, and USB-IF TID decoder) at [email protected].

SourcifyChina is a certified ISO 20400 Sustainable Procurement Partner. All data sourced from 2025–2026 audits of 1,200+ Chinese electronics suppliers. Report ID: SC-USB2026-01

Get the Verified Supplier List

SourcifyChina | B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage in Sourcing: Leverage Verified Supply Chains in China

As global demand for high-quality USB-C cables continues to surge—driven by consumer electronics, enterprise infrastructure, and IoT applications—procurement leaders face mounting pressure to identify reliable, scalable, and compliant manufacturers in China. The risks of supplier misrepresentation, inconsistent quality, and extended qualification cycles remain significant barriers to operational efficiency.

SourcifyChina addresses these challenges head-on with our exclusive Pro List of Verified China USB-C Cable Manufacturers—curated through on-the-ground audits, performance benchmarking, and compliance validation.

Why SourcifyChina’s Pro List Delivers Unmatched Value

| Benefit | Impact on Procurement Operations |

|---|---|

| Pre-Vetted Manufacturers | Eliminates 80+ hours of supplier screening per project; all factories undergo on-site verification of production capabilities, export history, and quality control systems. |

| Compliance-Ready Partners | All listed suppliers meet international standards (e.g., USB-IF certification, RoHS, REACH), reducing legal and recall risks. |

| Transparent Capacity & MOQs | Clear documentation of production volume, lead times, and minimum order requirements enables faster decision-making. |

| Reduced Time-to-Market | Accelerate sourcing cycles from weeks to days—ideal for time-sensitive product launches and inventory replenishment. |

| Direct Factory Access | Bypass intermediaries; negotiate pricing and terms directly with capable manufacturers. |

Call to Action: Optimize Your 2026 Sourcing Strategy Now

Don’t risk project delays, quality failures, or inflated costs with unverified suppliers. The SourcifyChina Pro List is your competitive edge in securing reliable, high-performance USB-C cable manufacturing in China.

Take the next step with confidence:

📧 Email Us: [email protected]

📱 WhatsApp: +86 15951276160

Our sourcing consultants are available to provide a customized supplier shortlist, answer technical queries, and support end-to-end engagement—from RFQ alignment to factory audits.

Trusted by Procurement Leaders Across North America, Europe & APAC

Accelerate. Verify. Source with Confidence.

SourcifyChina | Connecting Global Buyers to Verified Chinese Manufacturing Excellence

🧮 Landed Cost Calculator

Estimate your total import cost from China.