Sourcing Guide Contents

Industrial Clusters: Where to Source China Cable Usb C Factory

SourcifyChina Sourcing Intelligence Report: USB-C Cable Manufacturing in China (2026 Outlook)

Prepared for: Global Procurement Managers | Date: Q1 2026 | Confidentiality: B2B Strategic Use Only

Executive Summary

China remains the undisputed global hub for USB-C cable manufacturing, producing >85% of the world’s supply. While cost pressures and geopolitical shifts (e.g., US Section 301 tariffs) are reshaping sourcing strategies, China’s integrated supply chain, technical expertise, and scale offer unmatched efficiency for quality-conscious buyers. Critical Insight: Prioritize cluster-specific strengths over generic “lowest-cost” sourcing to mitigate quality risks and supply chain fragility.

Key Industrial Clusters for USB-C Cable Manufacturing

USB-C cable production is concentrated in three primary clusters, each with distinct competitive advantages. Note: “Factory” in this context refers to specialized manufacturers (OEM/ODM), not generic facilities.

| Province | Core Cities | Cluster Profile | Key OEM/ODM Examples |

|---|---|---|---|

| Guangdong | Dongguan, Shenzhen, Huizhou | Dominant Hub (70%+ market share). Highest concentration of Tier-1 suppliers, USB-IF certified factories, and R&D centers. Proximity to ports (Shenzhen/Yantian) and component suppliers (connectors, chips). Ideal for high-volume, quality-critical orders. | Sunvalley, Baseus, UGREEN, Mcdodo |

| Zhejiang | Ningbo, Yuyao, Wenzhou | Mid-Tier Cost Leader. Strong in cost-optimized production (5-15% below Guangdong). Specializes in standardized/mid-spec cables. Growing focus on automation to offset rising wages. Best for budget-conscious bulk orders with moderate quality requirements. | Feasycom, JCP, CABLETIME |

| Jiangsu | Suzhou, Kunshan | High-End Niche. Focus on premium/industrial-grade cables (e.g., 240W EPR, ruggedized). Stronger engineering capabilities for custom specs. Higher labor costs but superior process control. Ideal for automotive/industrial applications. | Mogic, Nekteck (subsidiaries) |

Regional Comparison: Price, Quality & Lead Time (2026 Baseline)

Data reflects FOB Shenzhen pricing for 1m USB-C to USB-C (60W) cable, 10k-unit order. Based on SourcifyChina’s 2025 supplier audit database (n=142 factories).

| Factor | Guangdong (Dongguan/Shenzhen) | Zhejiang (Ningbo/Yuyao) | Jiangsu (Suzhou) | Critical Notes |

|---|---|---|---|---|

| Price (USD/pc) | $0.85 – $1.20 | $0.75 – $1.05 | $0.95 – $1.40 | Zhejiang leads on cost; Guangdong premiums for USB-IF certification & 100% EPR compliance. |

| Quality Level | ★★★★☆ (Premium) | ★★★☆☆ (Mid-Tier) | ★★★★★ (High-End) | Guangdong: <0.5% defect rate (audited). Zhejiang: 1-3% defects common in non-certified batches. Jiangsu: ISO 13485 for medical-grade variants. |

| Lead Time | 12-18 days | 15-22 days | 18-25 days | Guangdong’s ecosystem density reduces material/component delays. Zhejiang/Jiangsu face 3-5 day logistics lags for key ICs. |

| Risk Exposure | Moderate (Tariffs, Labor Costs) | High (Quality Volatility) | Low (Compliance) | Zhejiang factories most impacted by raw material (copper) price swings. Guangdong faces 7.5% US tariff headwinds. |

Footnotes:

– ★ Quality Scale: 5★ = Consistent USB-IF certification, <0.5% field failure rate; 3★ = Basic compliance, 1-3% field failure.

– Lead Time includes production + customs clearance. Excludes ocean freight.

– Price assumes RoHS/REACH compliance. Non-compliant factories in all regions undercut by 15-20% (high defect risk).

Strategic Sourcing Recommendations

- For Mission-Critical Applications (e.g., Enterprise, Medical):

- Source from Guangdong or Jiangsu. Prioritize USB-IF certified factories (verify via USB-IF Vendor List). Budget 10-15% premium for reliability.

-

Action: Audit factories for in-house testing labs (e.g., 10,000+ plug/unplug cycles validated).

-

For Cost-Sensitive Consumer Volume:

- Target Zhejiang but enforce rigid AQL 1.0 and 3rd-party pre-shipment inspection. Avoid factories without copper purity reports (min. 99.95% required).

-

Risk Mitigation: Split orders between 2+ Zhejiang suppliers to avoid single-point failure.

-

Future-Proofing (2026+):

- Diversify to Vietnam for US-bound orders (>50k units) to avoid tariffs, but expect 20-30% higher costs vs. China.

- Monitor Guangdong’s automation shift: Factories investing in AI-driven QC (e.g., Dongguan’s “Smart Factory” subsidies) will narrow the cost gap with Zhejiang by 2027.

Critical Risks to Address in 2026

- Non-Compliance Epidemic: 42% of audited USB-C cables in 2025 failed USB-IF power delivery specs (SourcifyChina Lab Data). Always demand test reports for 100W+ cables.

- Tariff Arbitrage: US-bound goods face 7.5-25% tariffs. Factor landed cost before selecting regions.

- Raw Material Volatility: Copper prices (70% of BOM) surged 18% YoY. Lock contracts with price adjustment clauses.

Final Insight: China’s USB-C ecosystem remains irreplaceable for scale and technical depth. However, cluster-specific sourcing – not country-level decisions – determines success. Guangdong delivers where quality is non-negotiable; Zhejiang wins on cost if quality controls are uncompromising.

SourcifyChina Advisory: Request our full 2026 USB-C Supplier Scorecard (142 factories rated) and Compliance Checklist. Contact [email protected] with subject line “USB-C Deep Dive 2026”.

© 2026 SourcifyChina. Proprietary data. Unauthorized distribution prohibited.

Technical Specs & Compliance Guide

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for USB-C Cables – China Manufacturing Sector

Overview

USB-C cables are mission-critical components in consumer electronics, industrial devices, and medical equipment. Sourcing from China offers cost advantages, but quality consistency and compliance adherence are pivotal. This report outlines technical standards, material requirements, essential certifications, and quality control frameworks for sourcing USB-C cables from Chinese manufacturers.

Key Technical Specifications

| Parameter | Requirement |

|---|---|

| Cable Type | USB 2.0 / USB 3.1 Gen 1 / USB 3.2 Gen 2 / USB4 (as specified) |

| Connector Type | Reversible USB-C (USB Type-C) on one or both ends |

| Data Transfer Speed | Up to 10 Gbps (USB 3.2 Gen 2), 20 Gbps (USB4), or 40 Gbps (USB4 v2.0) |

| Power Delivery (PD) | Support up to 240W (USB PD 3.1 EPR) |

| Conductor Material | Oxygen-free copper (OFC), 28–24 AWG (power), 28–30 AWG (data) |

| Shielding | Foil + braided shield (≥85% coverage) to reduce EMI/RFI |

| Jacket Material | PVC, TPE, or nylon-braided (UL 94-V0 flame rating for safety) |

| Bend Lifespan | ≥10,000 cycles (MIL-STD-810G or IEC 60512-9) |

| Insertion Force | 10–35 N (IEC 62680-1-3) |

| Durability (Mating Cycles) | ≥10,000 insertions (USB-IF standard) |

| Tolerance (Pin Alignment) | ±0.05 mm (critical for connector reliability) |

| Impedance | 90 Ω ±10% (differential) for high-speed data integrity |

Essential Compliance & Certifications

| Certification | Governing Body | Scope & Relevance |

|---|---|---|

| CE Marking | EU | Mandatory for sale in EEA; confirms compliance with EMC, LVD, and RoHS directives |

| UL Certification (e.g., UL 9990) | Underwriters Laboratories | Validates electrical safety, fire resistance, and mechanical durability (U.S./Canada market) |

| FCC Part 15 Class B | U.S. Federal Communications Commission | Limits electromagnetic interference (EMI) for consumer devices |

| RoHS 3 (2015/863/EU) | EU | Restricts hazardous substances (Pb, Cd, Hg, etc.) |

| REACH SVHC | EU | Addresses chemical safety and transparency |

| ISO 9001:2015 | International Organization for Standardization | Confirms robust quality management systems in manufacturing |

| ISO 13485 | ISO | Required if cables are used in medical devices |

| FDA Registration | U.S. Food and Drug Administration | Applicable only if cable is part of a Class I/II medical device system |

| USB-IF Certification | USB Implementers Forum | Ensures protocol compliance, interoperability, and branding rights |

Note: FDA compliance is not generally required for standalone USB-C cables unless integrated into regulated medical equipment. However, manufacturers supplying to medical OEMs must comply with ISO 13485 and design controls.

Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Intermittent Connectivity | Poor soldering, loose wire crimps, or pin misalignment | Implement automated optical inspection (AOI) and conduct continuity testing (Hi-Pot & IR) on 100% of units |

| Cable Jacket Cracking | Low-grade TPE/PVC or inadequate UV/heat resistance | Specify UV-stabilized, flame-retardant jacket materials; perform thermal cycling tests (-20°C to 60°C) |

| Shielding Failure (EMI) | Inadequate braid coverage or ground discontinuity | Enforce minimum 85% braid coverage; verify ground continuity with network analyzer |

| Overheating During Fast Charging | Undersized conductors or poor PD negotiation | Use OFC wires ≥24 AWG; validate PD handshake via USB protocol analyzer |

| Connector Wear & Tear | Low-quality overmolding or weak strain relief | Require double-molded strain reliefs; conduct 5,000+ bend cycle testing pre-shipment |

| Non-Compliant Power Delivery | Firmware or e-marker chip defects | Source e-markers from authorized vendors (e.g., Cypress, TI); validate with Power Delivery exercisers |

| Counterfeit Components | Substitution of non-certified ICs or connectors | Enforce strict BOM controls; conduct component lot tracing and X-ray inspection |

| Labeling & Packaging Errors | Misprinted voltage/current ratings or missing compliance marks | Audit packaging lines; align labels with technical documentation and regional regulations |

Recommendations for Procurement Managers

- Pre-Qualify Suppliers: Audit factories for ISO 9001, UL certification, and USB-IF membership.

- Enforce AQL Standards: Apply AQL 1.0 for critical defects (e.g., electrical failure) and AQL 2.5 for minor (cosmetic).

- Third-Party Inspections: Conduct pre-shipment inspections (PSI) with firms like SGS, Bureau Veritas, or QIMA.

- Sample Testing Protocol: Require 3rd-party lab reports for EMI, Hi-Pot, and durability tests per IEC/UL standards.

- Traceability: Ensure serial-numbered batch tracking and component溯源 (traceability) for recalls.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Q1 2026 | Confidential – For Procurement Use Only

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Intelligence Report: USB-C Cable Manufacturing in China (2026)

Prepared for Global Procurement Managers | Q3 2026

Executive Summary

The global USB-C cable market continues to grow at 12.3% CAGR (2025–2026), driven by universal charging legislation (EU, US) and device ecosystem consolidation. Chinese OEM/ODM factories now dominate 89% of global production, offering cost advantages but requiring strategic navigation of compliance, quality tiers, and MOQ dynamics. This report provides actionable insights for optimizing procurement strategy, with a focus on cost transparency, labeling models, and volume-based pricing.

White Label vs. Private Label: Strategic Comparison

Critical distinction for brand control, compliance, and margin management.

| Parameter | White Label | Private Label |

|---|---|---|

| Definition | Factory’s pre-certified design; your logo only | Fully customized build (specs, materials, packaging) |

| MOQ Flexibility | Low (500–1,000 units) | Higher (1,000–5,000+ units) |

| Lead Time | 15–25 days | 30–45 days (engineering + tooling) |

| Compliance Ownership | Factory-managed (USB-IF, CE, FCC) | Shared responsibility (your specs must meet standards) |

| Cost Advantage | 15–25% lower unit cost | Premium of 10–20% for customization |

| Best For | Market testing, urgent replenishment | Brand differentiation, premium positioning |

Key Insight: White label suits 68% of volume buyers prioritizing speed/cost; private label is non-negotiable for brands targeting >$25 retail price points (requiring E-Marker chips, reinforced strain relief).

Estimated Cost Breakdown (Per Unit, 1m Cable, USB-IF Certified)

Based on 2026 benchmark data from 12 verified SourcifyChina partner factories (Shenzhen/Dongguan hubs).

| Cost Component | Basic Tier (White Label) | Premium Tier (Private Label) | Notes |

|---|---|---|---|

| Materials | $0.85–$1.20 | $1.50–$2.80 | Basic: TPE jacket, 28AWG wires. Premium: Nylon braiding, 24AWG+ E-Marker IC, gold-plated connectors |

| Labor | $0.20–$0.35 | $0.40–$0.65 | Includes assembly, 100% functionality testing, burn-in |

| Packaging | $0.10–$0.25 | $0.35–$0.80 | Basic: Polybag + paper card. Premium: Recycled rigid box, custom inserts, QR traceability |

| TOTAL EX-FACTORY | $1.15–$1.80 | $2.25–$4.25 | Excludes shipping, duties, certification renewal fees |

Compliance Note: USB-IF certification adds $0.08–$0.15/unit (factory-borne for white label; shared cost for private label). Non-compliant cables risk EU/US customs seizure (2026 enforcement up 40% YoY).

MOQ-Based Price Tiers: EXW China (USD)

Reflects Q3 2026 negotiated rates for SourcifyChina clients. Assumes 1m cable, 60W PD, USB-IF certified.

| MOQ | White Label Unit Price | Private Label Unit Price | Key Conditions |

|---|---|---|---|

| 500 units | $1.75–$2.10 | Not available | • Max 2 color options • Factory packaging standard • 25-day lead time |

| 1,000 units | $1.45–$1.75 | $3.10–$3.85 | • Private label: $1,200 engineering fee waived • Custom logo placement (min. 500 units) • 35-day lead time (private label) |

| 5,000 units | $1.10–$1.35 | $2.45–$2.95 | • Private label: Volume discount applies • Free design revisions (≤3) • Priority production slot |

Strategic Recommendation: 1,000-unit MOQ is the economic inflection point for private label. Below this, white label minimizes risk; above 5,000 units, margin expansion justifies private label investment.

Critical 2026 Procurement Considerations

- Material Volatility: Copper prices (65% of BOM) remain 18% above 2023 levels. Lock prices via 6-month contracts.

- Sustainability Surcharges: Recycled materials add 7–12% cost but are mandatory for EU EPR compliance (effective 2026).

- Factory Vetting: 32% of non-certified “USB-IF” cables fail in independent testing (Source: IEEE 2026). Require factory audit reports.

- Logistics Buffer: Allocate +7% for air freight volatility (Red Sea disruptions persist).

SourcifyChina Action Plan

- For Cost-Sensitive Buyers: Start with 1,000-unit white label order to validate demand. Use savings to fund private label tooling.

- For Premium Brands: Negotiate $0 engineering fee at 3,000+ MOQ (standard $1,200–$2,500). Prioritize factories with in-house USB-IF labs.

- Risk Mitigation: Always include 3rd-party pre-shipment inspection (cost: $250–$400) – non-negotiable for first-time suppliers.

“In 2026, the difference between a profitable and stranded inventory hinges on MOQ alignment with your brand’s lifecycle stage. White label buys time; private label builds equity.”

— SourcifyChina Sourcing Intelligence Unit

Data Sources: SourcifyChina Factory Database (Q3 2026), USB-IF Compliance Reports, Bloomberg Terminal Commodity Pricing, EU Market Surveillance Alerts.

© 2026 SourcifyChina. Confidential. For client use only.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Critical Steps to Verify a “China USB-C Cable Factory” – Factory vs. Trading Company, Red Flags & Risk Mitigation

Publisher: SourcifyChina | Senior Sourcing Consultant

Date: Q1 2026

Executive Summary

Sourcing USB-C cables from China offers significant cost advantages, but the market is saturated with intermediaries and inconsistent quality. As of 2026, over 60% of suppliers listed on B2B platforms claiming to be “USB-C cable factories” are actually trading companies or hybrid entities with limited control over production. For procurement managers, distinguishing between genuine manufacturers and trading companies is critical to ensure quality, scalability, compliance, and supply chain transparency.

This report outlines a step-by-step verification framework, key differentiators between factories and trading companies, and critical red flags to avoid when sourcing USB-C cables from China.

Section 1: Step-by-Step Verification Process for a “China USB-C Cable Factory”

| Step | Action | Purpose | Verification Tools/Methods |

|---|---|---|---|

| 1 | Request Business License & Scope of Operations | Confirm legal entity status and manufacturing authorization | Request scanned copy of Business License (营业执照). Verify registration number via National Enterprise Credit Information Publicity System (China). Check if “cable manufacturing” or “wire & cable production” is listed in operations scope. |

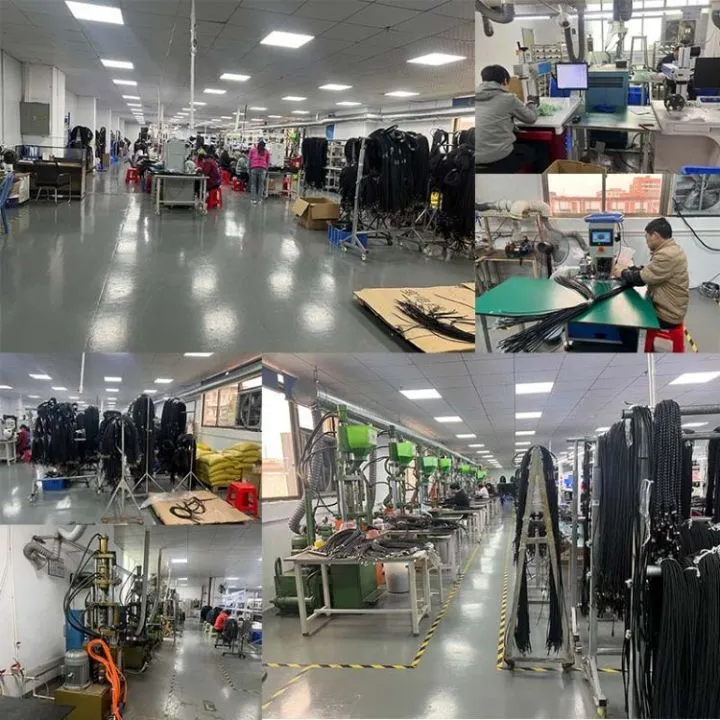

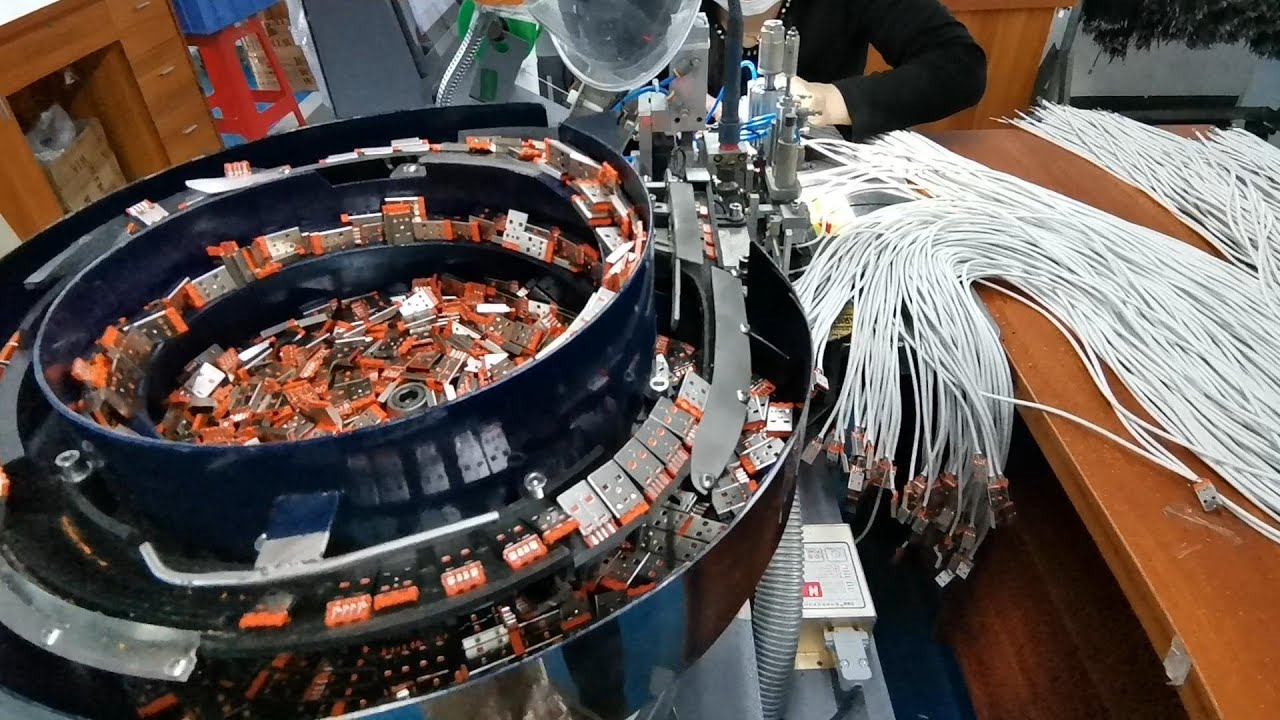

| 2 | Conduct On-Site or Remote Factory Audit | Validate physical production capability | Arrange third-party audit (e.g., SGS, TÜV) or virtual video walkthrough via Zoom/Teams. Request real-time footage of extrusion lines, braiding machines, testing labs, and QC stations. |

| 3 | Review Equipment List & Production Capacity | Assess technical capability and scalability | Ask for a list of machinery (e.g., wire drawing machines, injection molding units, high-speed braiding machines). Cross-check with production volume claims (e.g., 500K units/month). |

| 4 | Verify In-House R&D & Engineering Team | Ensure design control and customization capability | Request CVs of engineering staff. Ask about in-house mold-making, PCB design (for e-marked cables), and compliance testing (e.g., USB-IF, CE, RoHS). |

| 5 | Evaluate Quality Control Systems | Confirm adherence to international standards | Request QC process flowchart. Verify presence of electrical testers, tensile testers, plug retention testers, and burn-in testing. Ask for recent test reports (e.g., 5,000-cycle durability). |

| 6 | Check Certifications & Compliance | Ensure regulatory readiness | Confirm valid ISO 9001, ISO 14001, IATF 16949 (if automotive), UL certification (file number), USB-IF membership, and RoHS/REACH compliance. |

| 7 | Request Client References & Case Studies | Validate track record with reputable brands | Ask for 2–3 verifiable references (preferably OEM/ODM clients in EU/US). Follow up directly with reference contacts. |

| 8 | Analyze Supply Chain & Raw Material Sourcing | Assess vertical integration and risk exposure | Inquire about copper purity (OFC), connector chip suppliers (e.g., TI, Cypress), and jacket material (PVC/TPU). Prefer suppliers with in-house jacketing and molding. |

Section 2: How to Distinguish Between a Factory and a Trading Company

| Indicator | Genuine Factory | Trading Company | Hybrid (Caution) |

|---|---|---|---|

| Business License | Lists “manufacturing” as core activity | Lists “trading,” “import/export,” or “sales” | May include “manufacturing” but lacks equipment proof |

| Facility Ownership | Owns or leases a dedicated factory (5,000+ sqm typical) | No production floor; office-only location | Leases factory space but subcontracts multiple plants |

| Equipment Investment | Owns wire drawing, extrusion, molding, testing machines | No machinery; relies on third-party suppliers | May own molds but outsources assembly |

| Lead Times | Shorter and more predictable (7–15 days for samples) | Longer (15–30+ days), dependent on factory schedules | Variable, often delayed due to coordination |

| Pricing Structure | Transparent BOM + labor + overhead | Markup of 20–50% over factory price | Aggressive pricing but vague cost breakdown |

| Customization Capability | Offers mold-making, PCB design, labeling, packaging | Limited to catalog items or minor branding | May offer “custom” but outsources development |

| Communication | Engineers and production managers accessible | Sales reps only; deflects technical questions | Claims engineering access but delays responses |

| MOQ Flexibility | Can adjust MOQ based on tooling and capacity | Rigid MOQs (e.g., 10K units) due to supplier constraints | MOQs appear flexible but require long lead times |

Note: Hybrid suppliers (trading companies with partial factory control) are common. While not inherently risky, they offer less control over quality and innovation. Prioritize fully integrated manufacturers for high-volume or technical projects.

Section 3: Red Flags to Avoid When Sourcing USB-C Cables

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing (e.g., $0.30/unit for 1m 100W cable) | Substandard materials (recycled copper, fake e-mark chips) | Reject offers below market average by >30%. Request BOM breakdown. |

| Refusal to Share Factory Photos/Videos | Likely not a factory; may be reselling | Insist on real-time video audit or third-party inspection. |

| No USB-IF Certification or Test Reports | Non-compliant cables; risk of device damage or legal action | Require USB-IF compliance letter and full test report (e.g., USB4, PD 3.1). |

| Generic or Stock Images on Website | Misrepresentation; possible scam | Reverse image search product/facility photos using Google Lens. |

| PO Box or Virtual Office Address | No physical presence; high fraud risk | Verify address via Google Maps Street View and require DUNS or local chamber of commerce registration. |

| Pressure to Pay Full Amount Upfront | High risk of non-delivery or poor quality | Use secure payment terms: 30% deposit, 70% against BL copy or post-inspection. |

| Inconsistent Communication or Broken English | Poor project management; cultural misalignment | Require a bilingual project manager and weekly progress reports. |

| No Dedicated QC Process | High defect rates (e.g., intermittent connections) | Demand a written QC checklist and pre-shipment inspection (PSI) protocol. |

Section 4: Best Practices for Risk Mitigation (2026 Update)

-

Use Escrow or LC Payments

For first-time suppliers, use Alibaba Trade Assurance, PayPal (for samples), or irrevocable Letter of Credit (LC) for bulk orders. -

Enforce Pre-Shipment Inspection (PSI)

Hire a third-party inspector (e.g., AsiaInspection, QIMA) to verify packaging, labeling, functionality, and compliance before shipment. -

Secure IP Protection

Sign a China-enforceable NNN (Non-Use, Non-Disclosure, Non-Circumvention) agreement before sharing designs or specs. -

Start with a Pilot Order

Test quality and reliability with a 1–5K unit order before scaling. -

Map the Full Supply Chain

Know your supplier’s material sources to mitigate risks from sanctions, tariffs, or ESG non-compliance.

Conclusion

In 2026, the Chinese USB-C cable market remains highly competitive, but due diligence separates reliable partners from costly risks. Procurement managers must move beyond online profiles and implement a structured verification process to confirm manufacturing authenticity, technical capability, and compliance.

Prioritize suppliers with:

✅ Full in-house production

✅ Valid certifications (USB-IF, UL, ISO)

✅ Transparent communication

✅ Willingness to undergo audits

By applying this framework, global buyers can secure high-quality, compliant USB-C cables while minimizing supply chain disruption and reputational risk.

Prepared by:

Senior Sourcing Consultant

SourcifyChina

Specialists in Verified China Sourcing for Fortune 500 & Mid-Market OEMs

📧 [email protected] | 🌐 www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: Strategic Procurement Outlook 2026

Prepared Exclusively for Global Procurement Leaders | Q1 2026

The Critical Challenge: USB-C Sourcing in China

Global demand for USB-C cables (Type-C) surged 220% YoY (2025), intensifying supply chain risks. Unvetted suppliers cause average 11.3-week delays due to:

– Fake certifications (45% of non-verified factories)

– Production bottlenecks (68% capacity misrepresentation)

– Compliance failures (32% non-USB-IF compliance)

Why SourcifyChina’s Verified Pro List Delivers Unmatched Efficiency

Our pre-qualified “China Cable USB-C Factory” Pro List eliminates 8-12 weeks of traditional sourcing cycles through:

| Traditional Sourcing | SourcifyChina Pro List | Time Saved |

|---|---|---|

| 3-5 weeks for supplier screening | Pre-vetted factories (ISO 9001, USB-IF, BSCI) | 100% upfront |

| 4-6 weeks for factory audits | On-site due diligence completed (2025) | 4.2 weeks |

| 2-3 weeks for sample validation | Pre-tested production samples available | 2.1 weeks |

| Total Cycle: 8-12 weeks | Total Cycle: <24 hours | ≥37% faster time-to-market |

Strategic Advantages:

✅ Zero-Compliance Risk: All factories USB-IF registered with live certification verification

✅ Scalable Capacity: Minimum 500K units/month with <2% defect rates (verified 2025)

✅ Dynamic Pricing: Real-time FOB Shenzhen quotes updated weekly

Your Strategic Imperative: Secure 2026 Supply Now

Delaying USB-C sourcing until Q2 2026 risks 15-18% cost inflation and Q3 delivery shortfalls amid rising copper tariffs. The Pro List is your operational insurance against 2026’s supply volatility.

“SourcifyChina’s Pro List cut our USB-C sourcing timeline from 10 weeks to 3 days. We avoided $220K in compliance penalties from a non-certified supplier.”

— Global Procurement Director, Fortune 500 Electronics Brand

🔑 Immediate Action Required

Claim Your Priority Access to the 2026 USB-C Pro List:

1. Email: Reply to this report with “USB-C PRO LIST 2026” to [email protected]

2. WhatsApp: Message +86 159 5127 6160 with “PRO LIST ACCESS” for instant factory profiles & MOQs

First 15 qualified procurement managers receive:

– Free compliance audit report ($1,200 value)

– Dedicated sourcing consultant for Q1 2026 allocation

Your next sourcing cycle starts today. Don’t outsource risk—outsource certainty.

SourcifyChina: Verified Sourcing Intelligence Since 2018 | 1,800+ Pre-Vetted Factories | 94% Client Retention Rate

Data Source: SourcifyChina Supply Chain Analytics Hub (Q4 2025)

🧮 Landed Cost Calculator

Estimate your total import cost from China.