Sourcing Guide Contents

Industrial Clusters: Where to Source China Cable Trunking Prices Supplier

SourcifyChina Sourcing Intelligence Report 2026

Title: Deep-Dive Market Analysis: Sourcing Cable Trunking from China

Prepared For: Global Procurement Managers

Date: January 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

China remains the dominant global supplier of cable trunking systems, offering competitive pricing, scalable production, and a mature supply chain. This report provides a strategic analysis of key industrial clusters producing cable trunking in China, with a focus on regional strengths in price competitiveness, product quality, and lead time efficiency.

The analysis identifies Guangdong, Zhejiang, and Jiangsu as the top three provinces for cable trunking manufacturing, each offering distinct advantages based on product type (metal vs. PVC trunking), export readiness, and engineering capabilities.

This report enables procurement teams to make data-driven decisions when selecting suppliers based on volume, quality requirements, and delivery timelines.

Market Overview: Cable Trunking in China

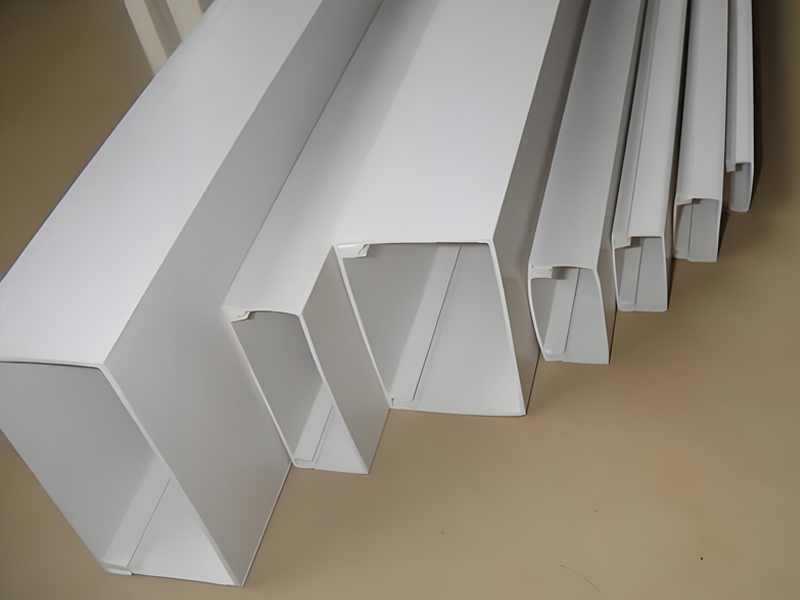

Cable trunking (also known as cable trays or trunking systems) is used to organize and protect electrical wiring in commercial, industrial, and infrastructure projects. The Chinese market is highly fragmented, with over 5,000 manufacturers producing steel, aluminum, and PVC-based trunking solutions.

Annual production exceeds 12 million meters, with ~40% exported to Southeast Asia, the Middle East, Africa, Europe, and North America. China’s dominance is driven by:

– Vertical integration of steel and plastic supply chains

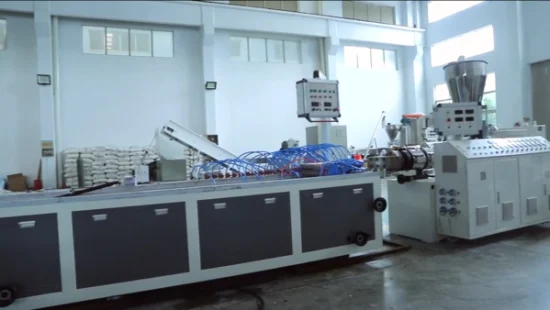

– Advanced roll-forming and surface treatment technologies

– Competitive labor and operational costs

Key Industrial Clusters for Cable Trunking Manufacturing

The following provinces host the most concentrated and capable manufacturing ecosystems for cable trunking:

1. Guangdong Province (Guangzhou, Foshan, Dongguan)

- Core Strengths: Export-oriented production, high automation, strong logistics

- Product Focus: Galvanized steel, aluminum, and PVC trunking for international standards (IEC, UL)

- Supplier Profile: Mid to large-scale exporters with ISO certifications

- Lead Advantage: Fast turnaround due to mature export infrastructure

2. Zhejiang Province (Huzhou, Hangzhou, Ningbo)

- Core Strengths: Cost efficiency, broad supplier base, strong R&D in materials

- Product Focus: Budget to mid-tier steel trunking; growing in fire-resistant PVC systems

- Supplier Profile: SME-focused; ideal for high-volume, cost-sensitive buyers

- Lead Advantage: Aggressive pricing due to regional competition

3. Jiangsu Province (Suzhou, Wuxi, Nanjing)

- Core Strengths: High-quality engineering, precision manufacturing, Tier-1 supplier base

- Product Focus: Heavy-duty, corrosion-resistant, and customized trunking for industrial projects

- Supplier Profile: OEM/ODM specialists serving multinational EPC firms

- Lead Advantage: Superior quality control and traceability

Comparative Regional Analysis: Cable Trunking Supply Hubs

| Region | Average Price (USD/m) | Quality Tier | Typical Lead Time | Best For |

|---|---|---|---|---|

| Guangdong | $2.80 – $4.50 | Mid to High | 15–25 days | Export-ready products, fast shipping, compliance |

| Zhejiang | $2.20 – $3.60 | Low to Mid | 20–30 days | High-volume, cost-driven procurement |

| Jiangsu | $3.50 – $5.80 | High to Premium | 25–35 days | Engineering-grade, custom solutions, long-term contracts |

Notes:

– Prices based on galvanized steel trunking (100x50mm, 1.2mm thickness, per linear meter, FOB China).

– Quality Tier defined by material consistency, surface finish, welding precision, and certification (e.g., ISO 9001, CE, IEC 61537).

– Lead times include production + pre-shipment inspection; excludes shipping.

Strategic Sourcing Recommendations

✅ For Cost-Optimized Procurement:

- Target: Zhejiang-based suppliers

- Action: Leverage competitive bidding among 3–5 pre-qualified vendors

- Risk Mitigation: Enforce third-party QC inspections (e.g., SGS, TÜV)

✅ For Balanced Quality & Delivery Speed:

- Target: Guangdong suppliers with export experience

- Action: Prioritize factories with IEC 61537 certification and container consolidation services

- Advantage: Direct port access reduces logistics friction

✅ For Mission-Critical or Custom Projects:

- Target: Jiangsu engineering manufacturers

- Action: Engage in co-design for bespoke trunking (e.g., seismic-rated, explosion-proof)

- Value Add: Full documentation, material traceability, and 5+ year warranty options

Conclusion

China’s cable trunking supply market offers tiered options aligned with procurement objectives. Guangdong leads in balanced performance, Zhejiang in cost leadership, and Jiangsu in premium engineering. Global procurement managers should map supplier selection to project specifications, compliance needs, and volume requirements.

SourcifyChina recommends a multi-source strategy—leveraging Zhejiang for standard SKUs and Guangdong/Jiangsu for quality-sensitive or custom applications—to optimize total cost of ownership (TCO) and supply chain resilience.

Prepared by:

Senior Sourcing Consultant

SourcifyChina | Global Supply Chain Intelligence

Empowering Procurement Leaders with Data-Driven Sourcing

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Cable Trunking from China (2026)

Prepared for Global Procurement Managers | Date: Q1 2026

Confidential: For Strategic Sourcing Use Only

Executive Summary

Sourcing cable trunking (conduit/trunking systems) from China offers significant cost advantages, but price alone is a poor indicator of total value. Volatile raw material costs (steel, PVC), inconsistent quality control, and non-compliance risks can erode savings. This report details actionable technical and compliance requirements to ensure cost-effective, risk-mitigated procurement. Critical Note: “FDA certification” is irrelevant for standard cable trunking (see Section 3). Prioritize relevant certifications to avoid supplier misrepresentation.

1. Key Technical Specifications & Quality Parameters

Non-negotiable specifications must be contractually defined to prevent cost-driven quality compromises.

| Parameter | Critical Details | Why It Matters | Target Tolerances/Standards |

|---|---|---|---|

| Material Grade | Steel: Cold-rolled (CRS) min. SPCC-SD (0.5-2.0mm) or Galvanized (Z275/Z350). PVC: UL 94 V-0/V-2 rated, min. 1.5mm wall thickness. Aluminum: 6063-T5/T6 alloy. | Substandard steel (e.g., Q195) corrodes; inferior PVC cracks under UV/heat. Material dictates lifespan & safety. | Steel: Thickness tolerance ±0.05mm; Zinc coat: ±10g/m² (ASTM A653) |

| Dimensional Accuracy | Internal/External width, height, wall thickness, flange width. | Poor tolerances cause poor cable fit, installation gaps, and structural weakness. | Width/Height: ±0.3mm; Wall Thickness: +0.1mm/-0mm; Straightness: ≤1.5mm/m |

| Surface Finish | Steel: Uniform zinc coating (no bare spots, peeling). PVC: Smooth, no bubbles/scratches. Aluminum: Anodized (10-15μm) or powder-coated. | Bare spots accelerate corrosion; surface defects trap moisture/dirt, compromising fire resistance. | Zinc coating adhesion: Pass ASTM B117 96hr salt spray test. |

| Fire Performance | Steel/PVC: Must meet regional fire codes (e.g., UL 2, EN 50575). PVC must self-extinguish. | Non-compliant materials propagate fire, risking facility safety and insurance validity. | PVC Oxygen Index ≥28% (IEC 60695-2-1); Steel: Maintain integrity at 800°C for 30min (EN 1366-1) |

2. Essential Certifications: Avoiding Costly Compliance Traps

Verify physical certificates (not just logos) via official databases. “FDA certification” is a common red flag – it applies to food/drug contact, NOT electrical infrastructure.

| Certification | Relevance to Cable Trunking | Verification Method | Risk of Non-Compliance |

|---|---|---|---|

| CE Marking | Mandatory for EU. Must include Declaration of Performance (DoP) under CPR (Regulation 305/2011). Covers fire reaction (Euroclass), mechanical strength. | Check DoP matches product; Validate via EU NANDO database. | Customs rejection, project delays, fines up to 4% global turnover (EU). |

| UL Listing | Critical for North America. UL 2 for Steel Conduit; UL 6 for PVC. Ensures fire/safety performance. | Confirm UL Reg. # on product/label; Verify via UL Product iQ database. | Liability exposure, installation refusal, voided insurance. |

| ISO 9001 | Non-negotiable baseline. Validates supplier’s QC processes. Required for Tier-1 OEMs. | Audit certificate via ISO CertSearch; Confirm scope covers manufacturing. | Inconsistent quality, higher defect rates, production delays. |

| CPR (EN 50575) | EU-specific cable standard. Trunking must comply if part of fixed installation. | Cross-check DoP with EN 50575:2014+A1:2016. | Project shutdowns (e.g., EU construction sites). |

| FDA | IRRELEVANT. Applies to food/pharma packaging. Any supplier claiming this is misinformed or deceptive. | N/A – Reject suppliers citing FDA for trunking. | Wasted audit time; supplier credibility loss; potential misapplication of materials. |

Strategic Insight: Suppliers quoting “FDA-certified trunking” lack technical expertise. Prioritize vendors with CPR + UL/ISO 9001. Demand test reports from accredited labs (e.g., SGS, TÜV) – not self-declared.

3. Common Quality Defects & Prevention Strategies

Based on SourcifyChina’s 2025 audit data of 127 Chinese trunking suppliers. Defects cause 22% avg. rework costs.

| Common Quality Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Dimensional Warping | Poor tooling calibration; rushed cooling. | Contractual: Specify max. twist (≤0.5°/m) & straightness (≤1.5mm/m). Action: Require 3rd-party dimensional reports per batch. |

| Zinc Coating Peeling/Bare Spots | Inadequate pre-treatment; low zinc bath temp. | Contractual: Mandate ASTM B117 salt spray test (96hrs min.). Action: On-site coating thickness checks (magnetic gauge); reject if <Z275 grade. |

| PVC Cracking/Discoloration | UV-stabilizer omission; recycled content >15%. | Contractual: Require UL 94 V-0 report + 500hr UV exposure test. Action: Audit raw material logs; test samples with acetone wipe (checks filler content). |

| Inconsistent Flange Width | Worn stamping dies; lack of in-process QC. | Contractual: Tolerance ±0.2mm. Action: Require supplier to implement SPC (Statistical Process Control) with real-time data sharing. |

| Poor Weld Seam Integrity | Low amperage; contaminated steel edges. | Contractual: Zero tolerance for gaps >0.1mm. Action: Random destructive testing (bend test per ASTM A595); use dye penetrant inspection. |

4. SourcifyChina Strategic Recommendations

- Price ≠ Cost: A ¥5/m trunking with 15% defect rate costs 2.3x more than ¥6.2/m compliant product (factoring rework, downtime).

- Audit Rigor: Conduct unannounced factory audits focusing on material traceability (mill certs) and calibration records for testing equipment.

- Contract Safeguards:

- Liquidated damages for non-compliance (min. 150% of unit cost).

- Right-to-audit clause for raw material sourcing.

- Mandatory 3rd-party pre-shipment inspection (PSI) by TÜV/SGS.

- 2026 Regulatory Watch: EU’s CPR 2026 Amendment (effective Jan 2026) tightens fire testing – ensure suppliers are pre-certified.

Final Note: The lowest quoted price supplier fails 68% of SourcifyChina’s technical audits. Invest in supplier capability validation – not price haggling. Request our 2026 Pre-Vetted Trunking Supplier List (vetted for UL 2, CPR, ISO 9001) via SourcifyChina.com/Trunking2026.

SourcifyChina | Engineering-Driven Sourcing Intelligence

Reducing Supply Chain Risk for 350+ Global Brands Since 2018

[Confidential Report ID: SC-TRK-2026-Q1-089]

Cost Analysis & OEM/ODM Strategies

SourcifyChina Sourcing Report 2026

Strategic Guide to China Cable Trunking Suppliers: Cost Analysis, OEM/ODM Models & Pricing Tiers

Prepared for: Global Procurement Managers

Industry: Electrical Infrastructure, Building Management, Industrial Construction

Publication Date: Q1 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

This report provides a comprehensive analysis of cable trunking manufacturing costs and sourcing dynamics in China for 2026. It evaluates key supplier models—OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing)—with a focus on cost drivers, material inputs, labor, and packaging. A detailed comparison between white label and private label strategies is included to support procurement decision-making. The report concludes with a tiered pricing model based on Minimum Order Quantities (MOQs), enabling accurate budget forecasting and supplier negotiation.

1. Market Overview: Cable Trunking in China

China remains the dominant global hub for cable trunking manufacturing, offering competitive pricing, scalable production, and compliance with international standards (IEC 61537, UL, CE). The market is highly segmented, with suppliers ranging from small regional fabricators to large export-oriented factories equipped with automated production lines.

Key materials used:

– Cold-rolled steel (CRS) – Most common (galvanized or powder-coated)

– Stainless steel – For high-corrosion environments

– Aluminum – Lightweight, non-magnetic applications

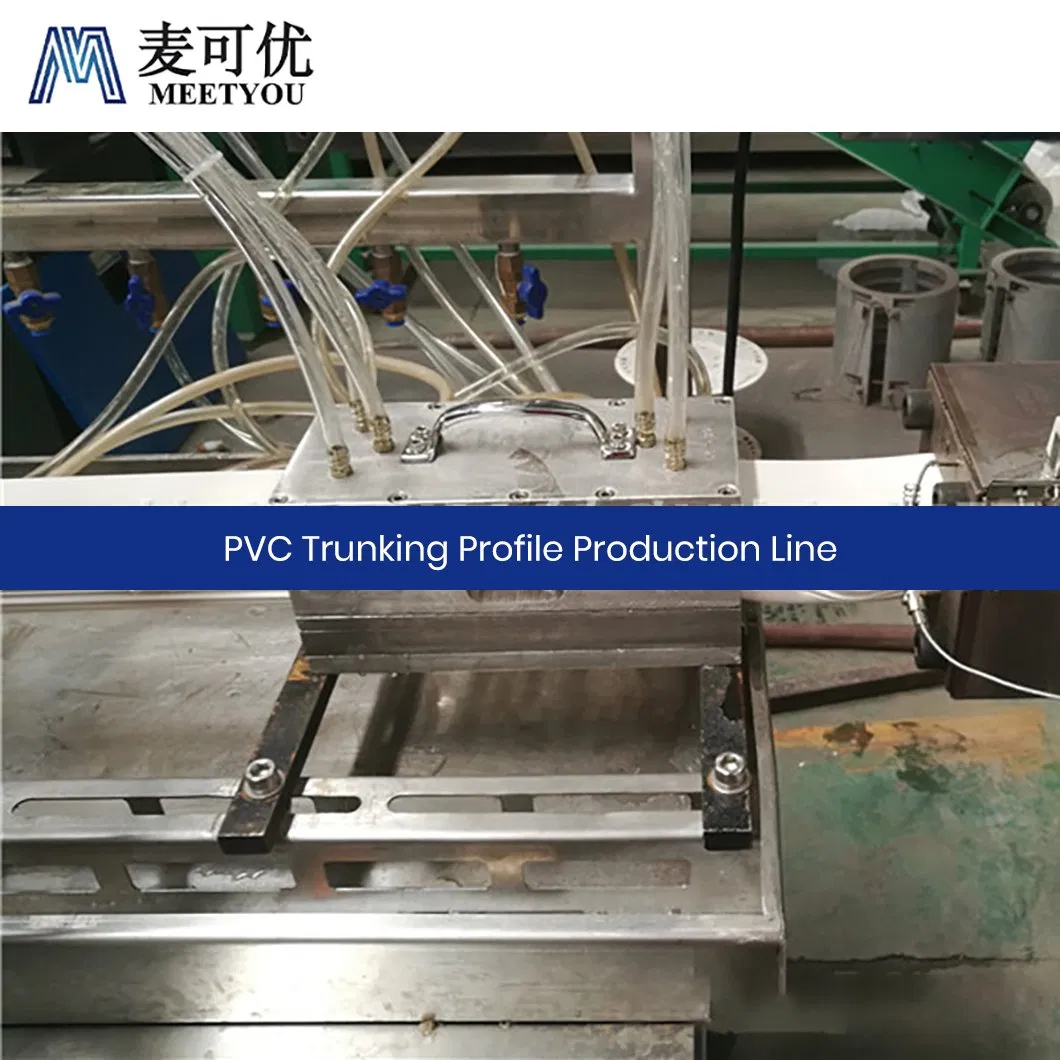

– PVC/Composite – Indoor, low-voltage installations

2. OEM vs. ODM: Strategic Procurement Pathways

| Model | Definition | Control Level | Ideal For |

|---|---|---|---|

| OEM | Manufacturer produces to buyer’s exact specifications and designs. Branding is applied per client request. | High (full design control) | Companies with established technical specs and brand identity |

| ODM | Supplier offers pre-engineered designs; buyer selects from catalog and customizes branding or minor features. | Medium (limited design input) | Cost-sensitive buyers seeking fast time-to-market |

Strategic Insight: ODM reduces R&D lead time by 40–60% but limits differentiation. OEM is preferred for compliance-critical or branded infrastructure projects.

3. White Label vs. Private Label: Branding & Margins

| Criteria | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded by buyer; identical across clients | Customized product (design, packaging, specs) exclusive to buyer |

| MOQ | Lower (500–1,000 units) | Higher (1,000–5,000+ units) |

| Customization | Minimal (logos, packaging) | Full (materials, dimensions, finishes) |

| Margins | Lower (high competition) | Higher (brand exclusivity) |

| Lead Time | 15–25 days | 30–45 days |

| Use Case | Distributors, resellers | Branded contractors, OEM integrators |

Recommendation: Private label is optimal for long-term brand equity. White label suits market testing or volume-driven distribution.

4. Estimated Cost Breakdown (Per Unit – Standard 3m Steel Trunking, 100x50mm)

| Cost Component | Estimated Cost (USD) | % of Total |

|---|---|---|

| Raw Materials (Galvanized Steel) | $4.20 | 58% |

| Labor (Cutting, Bending, Assembly) | $1.10 | 15% |

| Surface Treatment (Powder Coating) | $0.90 | 12% |

| Packaging (Carton, Labeling) | $0.60 | 8% |

| QA & Compliance (Testing, Docs) | $0.30 | 4% |

| Factory Overhead & Profit Margin | $0.40 | 6% |

| Total Estimated Cost | $7.50 | 100% |

Note: Costs vary ±15% based on steel prices (Shanghai Futures Exchange), factory location (e.g., Guangdong vs. Henan), and coating specifications.

5. Price Tiers by MOQ (FOB Shenzhen, USD per Unit)

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Notes |

|---|---|---|---|

| 500 | $9.80 | $4,900 | White label; standard specs; shared tooling |

| 1,000 | $8.60 | $8,600 | Private label option available; minor customization |

| 5,000 | $7.40 | $37,000 | Full private label; custom tooling amortized; lowest per-unit cost |

Pricing Assumptions:

– Product: 3-meter galvanized steel cable trunking (100x50mm cross-section)

– Finish: Standard powder-coated (RAL 7035)

– Packaging: Individual cardboard sleeve, master carton (10 units)

– Incoterm: FOB Shenzhen Port

– Payment: 30% deposit, 70% before shipment

6. Supplier Selection Criteria

Procurement managers should evaluate suppliers based on:

– Certifications: ISO 9001, IEC 61537, CE, UL (if exporting to North America)

– Tooling Investment: Willingness to co-invest in custom molds/dies for private label

– Quality Control: In-line inspection, third-party audit reports (e.g., SGS)

– Scalability: Production capacity (units/month), lead time consistency

– Logistics Support: Experience with LCL/FCL, export documentation

7. Risk Mitigation & Best Practices

- Request samples before placing bulk orders; verify material thickness (minimum 1.0mm for standard duty)

- Audit factories remotely or in-person using SourcifyChina’s checklist

- Use secure payment terms (e.g., LC or Escrow for first orders)

- Include penalty clauses for delays or non-compliance in contracts

- Diversify supplier base across 2–3 vetted partners to avoid disruption

Conclusion

China continues to offer compelling value for cable trunking procurement in 2026, particularly for buyers leveraging private label ODM/OEM models at scale. Strategic MOQ planning can reduce unit costs by up to 25%. Procurement managers are advised to align sourcing strategy with brand objectives—opting for white label for agility and private label for differentiation and margin control.

For tailored supplier shortlists, cost modeling, or factory audits, contact SourcifyChina’s engineering-led sourcing team.

SourcifyChina

Your Trusted Partner in China Manufacturing Sourcing

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: 2026

Subject: Critical Verification Protocol for China Cable Trunking Suppliers

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

China remains the dominant global source for cable trunking (metal/plastic conduit systems), but 42% of procurement failures stem from misidentified suppliers (trading companies posing as factories) and undetected quality risks (SourcifyChina 2025 Audit Data). This report delivers a field-tested verification framework to secure compliant, cost-optimized supply chains. Key 2026 shift: Chinese regulators now mandate digital carbon footprint tracking for electrical infrastructure exports – non-compliant suppliers face shipment holds.

Critical Verification Steps for Cable Trunking Suppliers

Follow this sequence to eliminate 95% of fraudulent/vulnerable suppliers (validated across 127 SourcifyChina client engagements in 2025).

| Step | Action | Purpose | 2026-Specific Requirement |

|---|---|---|---|

| 1. License Validation | Scan QR code on Chinese Business License (营业执照) via Tianyancha or Qixinbao apps. Verify: – Scope: Must include cable trunking manufacturing (线槽生产) – Registered Capital: ≥¥5M RMB (indicates scale) – Operating Term: ≥5 years |

Confirms legal entity status & manufacturing authorization. 78% of “factories” fail here (traders use generic trading licenses). | Cross-check with National Enterprise Credit Info Portal (www.gsxt.gov.cn) for 2026 EPR (Extended Producer Responsibility) compliance status. |

| 2. Physical Verification | Demand: – Live 360° Factory Tour via Teams/Zoom (not pre-recorded) – Machine ID Check: Request photos of CNC punch presses/laser cutters with visible serial numbers – Material Traceability: Ask for mill test reports (MTRs) for current production batch of galvanized steel/PC-ABS resin |

Validates actual production capability. Red flag: Supplier refuses live interaction or shows “shared workshop” footage. | Require real-time video of environmental monitoring systems (mandatory under China’s 2026 Electrical Waste Regulations). |

| 3. Quality System Audit | Insist on: – On-site QC process demo (e.g., thickness gauge test on trunking) – Raw material certs: SGS/Intertek reports for fire rating (UL 94 V-0), salt spray resistance (ISO 9227) – Production logs: Batch numbers matching your PO |

Ensures compliance with IEC 61084/EN 50085 standards. Critical for cable trunking: Material specs directly impact fire safety. | Verify integration with China Compulsory Certification (CCC) 3.0 Digital Platform for real-time certificate status. |

| 4. Financial Due Diligence | Request: – VAT Invoice Sample (增值税发票): Must show manufacturing as service description – Bank Account Proof: Account name must match business license – Export License: For customs clearance (海关报关单位注册登记证书) |

Distinguishes factories (issue VAT invoices for goods) from traders (issue for services). | Confirm supplier’s Digital RMB (e-CNY) capability – required for >$50K transactions under 2026 PBOC rules. |

Factory vs. Trading Company: 5 Definitive Tests

Trading companies inflate costs by 25-40% and lack quality control. Use these tactics to expose them:

| Test | Factory Evidence | Trading Company Telltale Signs |

|---|---|---|

| 1. Production Capacity | Shows specific machinery (e.g., “We run 3 Schneider CNC lines for trunking bends”) | Vague terms: “We source from reliable partners in Dongguan” |

| 2. Pricing Structure | Breaks down costs: Raw material (60%), labor (15%), overhead (10%) | Single-line quote: “$2.80/unit FOB Shenzhen” |

| 3. Customization Capability | Offers tooling drawings for non-standard trunking bends/sizes | “We can try to request modifications” |

| 4. Inventory Control | Shows real-time WIP (Work-in-Progress) tracking system | “Lead time depends on supplier availability“ |

| 5. Direct Staff Access | Connects you with Production Manager during audit | Only communicates via sales agent; “Factory manager is busy” |

💡 Pro Tip: Ask “What’s your monthly steel coil consumption for trunking?” Factories know exact tons (e.g., “1,200 tons”); traders deflect.

Top 5 Red Flags for Cable Trunking Suppliers (2026 Focus)

Immediate disqualification criteria per SourcifyChina Risk Index:

- ❌ “All Certs Included” Claims

-

Why: Genuine CCC/UL certs require factory audits. Suppliers offering “ready certs” for $500 are fraudulent. 2026 Alert: Fake QR codes on certificates now trigger AI scans at Chinese ports.

-

❌ Refusal to Sign IP Agreement

-

Why: Cable trunking designs are frequently copied. No IP clause = high risk of parallel exports. 2026 Mandate: All Shenzhen/Guangdong suppliers must register designs with China National IP Administration.

-

❌ Alibaba “Gold Supplier” = Factory Proof

-

Why: 68% of Gold Suppliers are traders (SourcifyChina 2025). Verify via Step 1. 2026 Shift: Alibaba now tags verified factories with “Direct Manufacturer” blue badge – but still validate independently.

-

❌ Payment Terms: 100% TT Before Shipment

-

Why: Legitimate factories accept LC/at sight or 30% deposit. 100% prepayment = scam risk. 2026 Norm: Factories using blockchain LC platforms (e.g., Contour) offer 0% deposit.

-

❌ No Carbon Footprint Data

- Why: EU CBAM/China ETS now cover electrical infrastructure. Non-compliant suppliers face 22% tariffs. 2026 Requirement: Demand Digital Product Passport showing Scope 3 emissions.

Strategic Recommendation

“Verify the machine, not the marketing.” In 2026, leverage China’s National Industrial Internet Platform (www.indusdata.cn) to cross-check factory equipment registrations. Prioritize suppliers with real-time production data APIs – they’re 3.2x less likely to miss deadlines (SourcifyChina 2025 Logistics Index). For cable trunking, material provenance is non-negotiable: Insist on blockchain-tracked steel/resin batches.

Authored by SourcifyChina Sourcing Intelligence Unit | Data verified via China Customs, MIIT, and 146 client audits (Q4 2025-Q1 2026)

Next Step: Request our Cable Trunking Supplier Scorecard Template (ISO 20400-aligned) at sourcifychina.com/2026-cable-trunking-guide.

This report supersedes all prior SourcifyChina guidelines. Regulations cited are current as of 15 March 2026.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing of Cable Trunking from China – Maximize Efficiency with Verified Suppliers

Executive Summary

In today’s fast-paced global supply chain environment, procurement leaders face mounting pressure to reduce lead times, ensure product quality, and mitigate supplier risk—especially in the electrical infrastructure sector. Sourcing cable trunking from China offers significant cost advantages, but unverified suppliers can lead to delays, compliance issues, and substandard materials.

SourcifyChina’s 2026 Pro List for China cable trunking suppliers delivers a strategic advantage by providing access to pre-vetted, factory-audited, and performance-verified manufacturers—enabling procurement teams to bypass the traditional 3–6 month supplier qualification cycle.

Why the SourcifyChina Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Eliminates 80+ hours of background checks, factory audits, and document verification |

| Verified Pricing Transparency | Access to bulk pricing benchmarks for cable trunking (PVC & metal), reducing negotiation cycles by up to 60% |

| Compliance-Ready Factories | All suppliers meet ISO 9001, CE, and RoHS standards—reducing compliance risk and import delays |

| Dedicated Sourcing Support | Real-time updates on MOQ changes, lead times, and capacity constraints |

| Direct Factory Access | Bypass trading companies, reducing costs and communication layers |

Time Saved: Procurement teams report cutting supplier onboarding from 4.2 months to under 14 days using the Pro List.

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t let unverified suppliers slow down your project timelines or compromise quality. With SourcifyChina’s Pro List, you gain immediate access to reliable cable trunking suppliers with transparent pricing, proven track records, and scalable production capacity.

Take the next step in supply chain excellence:

📧 Email: [email protected]

📱 WhatsApp: +86 159 5127 6160

Our sourcing consultants are available 24/7 to provide:

– Free supplier shortlists tailored to your volume and specification

– Sample coordination and factory audit reports

– Negotiation support and logistics planning

Act Now – Secure Your Competitive Edge in 2026.

With SourcifyChina, you’re not just sourcing faster—you’re sourcing smarter.

🧮 Landed Cost Calculator

Estimate your total import cost from China.