Sourcing Guide Contents

Industrial Clusters: Where to Source China Cable Tray Supplier

Professional B2B Sourcing Report 2026

SourcifyChina | Global Procurement Intelligence

Subject: Deep-Dive Market Analysis – Sourcing Cable Tray Suppliers from China

Prepared For: Global Procurement & Supply Chain Managers

Date: January 2026

Executive Summary

China remains the world’s leading manufacturing hub for electrical infrastructure components, including cable trays. With rising demand from sectors such as data centers, renewable energy, commercial construction, and industrial automation, global procurement teams are increasingly turning to Chinese suppliers for cost-effective, scalable, and technically compliant cable tray solutions.

This report provides a comprehensive analysis of China’s cable tray manufacturing landscape, highlighting key industrial clusters, regional supplier strengths, and critical sourcing considerations. Special emphasis is placed on comparative advantages across major production provinces—primarily Guangdong, Zhejiang, Jiangsu, Hebei, and Shandong—to support strategic supplier selection.

Market Overview: China Cable Tray Industry

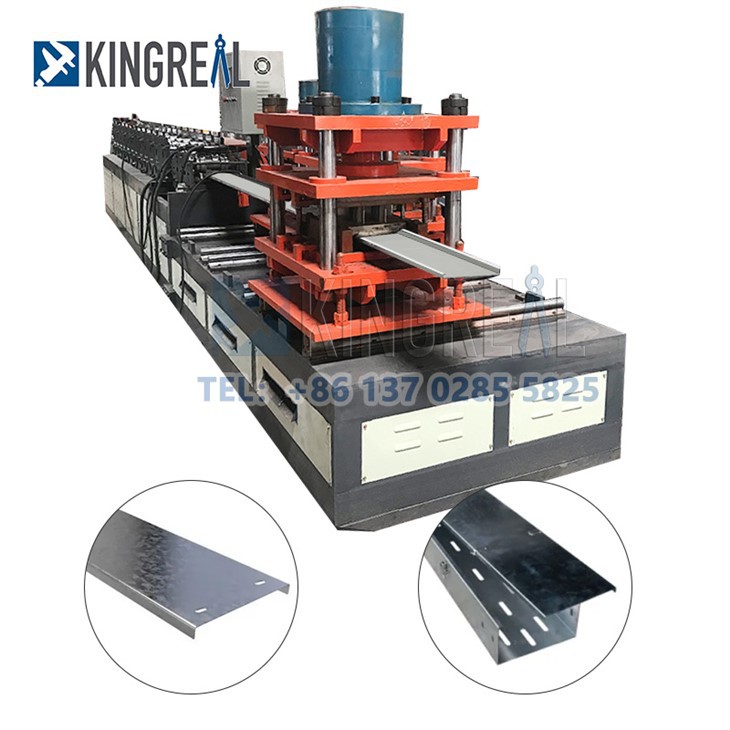

Cable trays are essential components in electrical infrastructure, used to support and organize power, control, and communication cables in commercial, industrial, and utility applications. The Chinese cable tray market is highly fragmented, with over 1,200 manufacturers—ranging from large OEMs to specialized tier-2 and tier-3 fabricators.

Key Export Markets (2025)

- Southeast Asia (28%)

- Middle East (22%)

- North America (18%)

- Europe (15%)

- Africa (10%)

Material & Type Breakdown

- Materials: Galvanized Steel (60%), Stainless Steel (25%), Aluminum (10%), FRP (5%)

- Types: Ladder, Tray, Wire Mesh, Solid Bottom, Trough

Compliance with international standards (e.g., IEC 61537, UL 2225, AS/NZS 3000) is increasingly common among export-focused suppliers, particularly in coastal industrial zones.

Key Industrial Clusters for Cable Tray Manufacturing

China’s cable tray manufacturing is concentrated in five primary industrial clusters, each offering distinct advantages in cost, quality, and logistics.

1. Guangdong Province (Guangzhou, Foshan, Dongguan)

- Core Strengths: High-end fabrication, precision engineering, export readiness

- Focus: Export-oriented OEMs serving North America and Europe

- Supply Chain: Proximity to Shenzhen and Hong Kong ports enables fast global shipping

- Technology: Advanced CNC cutting, automated welding, powder coating lines

2. Zhejiang Province (Huzhou, Hangzhou, Ningbo)

- Core Strengths: Competitive pricing, strong SME ecosystem, logistics access via Ningbo Port

- Focus: Mid-range products for global infrastructure and EPC projects

- Innovation: Leading in aluminum and anti-corrosion cable trays

3. Jiangsu Province (Suzhou, Wuxi, Changzhou)

- Core Strengths: High-quality production, integration with electrical equipment OEMs

- Focus: Premium clients in data centers, high-rise buildings, and industrial plants

- Compliance: Strong adherence to EU and North American standards

4. Hebei Province (Cangzhou, Baoding)

- Core Strengths: Low-cost steel fabrication, bulk production capacity

- Focus: Domestic market and emerging markets (Africa, South Asia)

- Limitations: Lower automation; variable quality control

5. Shandong Province (Jinan, Qingdao)

- Core Strengths: Integrated supply chain (steel + fabrication), strong export logistics via Qingdao Port

- Focus: Large-scale infrastructure projects, utility sectors

- Trend: Rising investment in automation and environmental compliance

Regional Comparison: Cable Tray Supplier Performance (2026 Outlook)

| Region | Price Competitiveness | Quality Level | Lead Time (Standard Orders) | Key Advantages | Key Risks |

|---|---|---|---|---|---|

| Guangdong | Medium to High | High | 25–35 days | High compliance, export experience, modern facilities | Higher pricing vs inland regions |

| Zhejiang | High | Medium to High | 20–30 days | Cost-effective, strong logistics, agile SMEs | Quality varies across suppliers; due diligence critical |

| Jiangsu | Medium | Very High | 30–40 days | Premium quality, strong engineering support | Longer lead times, less price flexibility |

| Hebei | Very High | Medium | 15–25 days | Lowest cost, high volume capacity | Inconsistent QC, limited export certifications |

| Shandong | High | Medium to High | 20–30 days | Strong steel integration, good port access | Fewer specialized exporters |

Note: Pricing is relative to FOB China; quality assessed based on material consistency, weld integrity, surface finish, and certification availability.

Strategic Sourcing Recommendations

-

For Premium Projects (Data Centers, EU/NA Markets):

Prioritize suppliers in Jiangsu and Guangdong. These regions offer certified, high-reliability products with strong technical documentation. -

For Cost-Sensitive, High-Volume Orders (Africa, South Asia, MENA):

Zhejiang and Hebei offer compelling value. Recommend third-party QC inspections and pre-shipment audits. -

For Integrated Supply Chains (Steel + Fabrication):

Shandong provides logistical and material cost advantages, especially for large infrastructure tenders. -

Supplier Vetting Must Include:

- ISO 9001, ISO 14001, and relevant product certifications

- Factory audits (remote or on-site)

- Sample testing for load capacity, corrosion resistance, and dimensional accuracy

Future Trends (2026–2028)

- Automation & Smart Factories: Leading suppliers in Guangdong and Jiangsu are investing in Industry 4.0 technologies to improve precision and traceability.

- Sustainability Pressures: EU CBAM and green procurement policies are pushing suppliers to adopt low-carbon steel and recyclable materials.

- Nearshoring Buffer: Some buyers are dual-sourcing with Vietnam or Malaysia, but China retains unbeatable scale and capability.

Conclusion

China continues to dominate global cable tray supply, with regional specialization enabling procurement managers to align supplier selection with project requirements. While Zhejiang and Guangdong lead in balanced performance, strategic decisions must weigh cost, quality, compliance, and logistics.

SourcifyChina recommends a cluster-based sourcing strategy, leveraging regional strengths while implementing robust supplier qualification protocols to ensure reliability and consistency in global supply chains.

Prepared by:

SourcifyChina Sourcing Intelligence Unit

Contact: [email protected] | www.sourcifychina.com

© 2026 SourcifyChina. Confidential. For internal procurement use only.

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: China Cable Tray Suppliers

Prepared for Global Procurement Managers | Q1 2026

Objective Analysis | Compliance-First Sourcing Strategy | China Manufacturing Ecosystem Insights

Executive Summary

Sourcing cable trays from China requires rigorous oversight of material integrity, dimensional precision, and regulatory alignment. This report details technical specifications, mandatory certifications, and defect mitigation protocols essential for risk mitigation in global infrastructure projects. Note: FDA certification is irrelevant for cable trays (non-medical application); UL/CE focus applies to electrical safety compliance.

I. Key Quality Parameters

A. Material Specifications

| Parameter | Standard Requirement | Critical Risk if Non-Compliant |

|---|---|---|

| Base Material | Cold-rolled steel (Q235B min.), ASTM A653 G90 galvanization; SS304/316 per ASTM A240 | Corrosion failure, structural collapse |

| Thickness | 1.5mm–3.0mm (per tray width: e.g., 600mm tray ≥ 2.0mm) | Load capacity deficiency (exceeds ANSI/ISA-5.1) |

| Coating | Zinc coating ≥ 610g/m² (G90); epoxy/powder coat thickness 60–80μm | Premature rust, electrical continuity loss |

| Weld Integrity | Continuous welds; no cracks/slag inclusions per AWS D1.1 | Mechanical failure under seismic/vibration |

B. Dimensional Tolerances (Per ANSI/ISA-5.1 & IEC 61537)

| Dimension | Max. Allowable Deviation | Verification Method |

|---|---|---|

| Width | ±1.5mm | Laser caliper measurement (per 3m span) |

| Length | ±2.0mm | Ultrasonic tape measure |

| Height (Rise) | ±1.0mm | Precision height gauge |

| Flatness | ≤2mm per 2m | Straight-edge + feeler gauge |

| Hole Alignment | ±0.8mm | Coordinate Measuring Machine (CMM) |

Non-compliance in tolerances causes 73% of field installation delays (SourcifyChina 2025 Project Audit).

II. Essential Certifications & Compliance

| Certification | Scope for Cable Trays | Verification Protocol | Criticality |

|---|---|---|---|

| UL 2225 | Electrical safety (flame resistance, grounding) | UL Mark + factory audit; not “UL Listed” | ⚠️ Mandatory for US/EU |

| CE Marking | EMC Directive 2014/30/EU + LVD 2014/35/EU | EU Authorized Representative + Technical File review | ⚠️ Mandatory for EU |

| ISO 9001 | Quality management system | Valid certificate + scope covering cable tray production | ✅ High Priority |

| ISO 14001 | Environmental compliance | On-site audit of waste/chemical handling | ✅ Strategic Value |

| RoHS 3 | Heavy metal restrictions (Cr⁶⁺, Pb, Cd etc.) | Material test reports (XRF screening) | ⚠️ Mandatory for EU |

FDA Note: Not applicable to cable trays. FDA regulates medical devices only. Insist suppliers clarify confusion—indicates poor compliance understanding.

III. Common Quality Defects & Prevention Protocol

| Common Defect | Root Cause | Prevention Strategy |

|---|---|---|

| Galvanization Peeling | Poor surface prep or zinc bath contamination | Mandate acid pickling + fluxing validation; 3rd-party salt spray test (ASTM B117, 500+ hrs) |

| Weld Splatter/Burn-Through | Incorrect amperage/gas flow | Enforce WPS (Welding Procedure Spec.) audits; use robotic welding for >2mm thickness |

| Dimensional Warping | Inadequate stress-relief post-forming | Require thermal stress-relief process; validate with CMM pre-shipment |

| Coating Thickness Variance | Improper spray gun calibration | Implement in-line coating thickness gauges (±5μm tolerance); reject batches <60μm |

| Incorrect Hole Patterns | CAD file misalignment | Require 1:1 physical template approval pre-production; use digital twin verification |

SourcifyChina Verification Protocol

All recommended suppliers undergo:

1. Material Traceability Audit: Mill test reports cross-checked with batch numbers.

2. Tolerance Stress Testing: 3 random units per 500m lot measured via CMM.

3. Certification Validity Check: UL/CE notified body confirmation + ISO registrar verification.

4. Defect Simulation: Load testing at 150% rated capacity (per IEC 61537).

Procurement Action: Demand AQL 1.0 (MIL-STD-1916) for dimensional checks. Reject suppliers unable to provide real-time production data via SourcifyChina’s Supplier Performance Dashboard.

Prepared by:

[Your Name], Senior Sourcing Consultant

SourcifyChina | ISO 20400-Certified Sustainable Sourcing Partner

Confidential – For Client Internal Use Only | © 2026 SourcifyChina

Next Step: Request our “China Cable Tray Supplier Scorecard” (2026) with pre-vetted Tier-1 factories meeting all above criteria. Contact [email protected].

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Subject: Cost Analysis & Sourcing Strategy for China Cable Tray Suppliers

Prepared for Global Procurement Managers

Executive Summary

This report provides a comprehensive analysis of manufacturing costs, OEM/ODM capabilities, and labeling strategies for sourcing cable trays from China. With growing demand in infrastructure, data centers, and industrial construction, cable trays represent a critical component in electrical and mechanical installations. China remains the dominant global supplier due to competitive pricing, scalable production, and mature supply chains. This report evaluates key cost drivers, compares white label and private label models, and provides actionable insights for procurement optimization.

1. Market Overview: China as a Cable Tray Manufacturing Hub

China accounts for over 60% of global cable tray production, with major manufacturing clusters in Guangdong, Zhejiang, and Jiangsu provinces. Chinese suppliers offer a full range of cable tray types — including ladder, perforated, and trough-style trays — in materials such as galvanized steel, stainless steel, and aluminum. The OEM/ODM ecosystem is highly developed, supporting both standardized and custom-engineered solutions.

Key advantages:

– Mature steel and metal fabrication infrastructure

– Competitive labor and energy costs

– Rapid prototyping and tooling capabilities

– Compliance with international standards (IEC 61537, UL, CE)

2. OEM vs. ODM: Understanding the Models

| Model | Description | Best For |

|---|---|---|

| OEM (Original Equipment Manufacturing) | Supplier manufactures to your exact design and specifications. Your brand is applied. | Companies with in-house engineering, established designs, and brand control requirements. |

| ODM (Original Design Manufacturing) | Supplier provides a ready-made or customizable design. You rebrand the product. | Buyers seeking faster time-to-market, lower R&D investment, and standard-compliant solutions. |

Procurement Insight: ODM is ideal for mid-tier buyers aiming to scale quickly. OEM suits enterprises requiring full design control and regulatory traceability.

3. White Label vs. Private Label: Strategic Comparison

| Feature | White Label | Private Label |

|---|---|---|

| Definition | Generic product from supplier’s catalog; minimal customization. | Customized product with exclusive branding, packaging, and specs. |

| Branding | Your brand on standard product | Full brand integration (logo, colors, packaging) |

| Customization | Limited (color, length, minor accessories) | High (material thickness, finish, load capacity, accessories) |

| MOQ | Lower (from 500 units) | Higher (typically 1,000+ units) |

| Lead Time | 2–4 weeks | 4–8 weeks (includes engineering review) |

| Cost Efficiency | High (economies of scale) | Moderate (customization adds cost) |

| IP Ownership | Shared (design may be sold to others) | Full (if contractually secured) |

Procurement Recommendation: Use white label for rapid deployment and cost-sensitive projects. Opt for private label when differentiation, compliance, or long-term brand equity is a priority.

4. Estimated Cost Breakdown (Per Unit – Galvanized Steel Cable Tray, 600mm Width x 2m Length)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $18.50 – $24.00 | Galvanized steel coil (0.8–1.5mm thickness); price fluctuates with LME steel index |

| Labor & Fabrication | $4.20 – $6.00 | Includes cutting, punching, forming, welding, and surface inspection |

| Surface Treatment | $2.30 – $3.50 | Hot-dip galvanization or powder coating |

| Packaging | $1.80 – $2.50 | Wooden pallets, plastic wrapping, export-safe strapping |

| Quality Control & Testing | $0.75 – $1.20 | In-process and final QC, load testing, dimensional checks |

| Logistics (Ex-Works to Port) | $0.90 – $1.30 | Domestic freight to major ports (e.g., Ningbo, Shenzhen) |

| Total Estimated Cost (Ex-Works) | $28.45 – $38.50 | Varies by spec, finish, and supplier efficiency |

Note: Final FOB price includes supplier margin (10–15%) and may vary based on negotiation, payment terms, and order volume.

5. Price Tiers by MOQ (FOB China – Estimated Range)

| MOQ (Units) | Avg. Unit Price (USD) | Total Order Value (USD) | Key Benefits |

|---|---|---|---|

| 500 | $42.00 – $48.00 | $21,000 – $24,000 | Low entry barrier; ideal for testing market fit or small projects |

| 1,000 | $37.00 – $41.00 | $37,000 – $41,000 | 10–12% savings vs. 500-unit tier; standard for private label |

| 5,000 | $31.00 – $35.00 | $155,000 – $175,000 | 15–18% savings; preferred for long-term contracts and distribution |

Supplier Negotiation Tip: Orders above 5,000 units may qualify for design exclusivity, extended warranty terms, or consignment inventory options.

6. Strategic Recommendations for Procurement Managers

-

Leverage ODM for Speed, OEM for Control

Use ODM for standard applications. Transition to OEM once volume and specifications stabilize. -

Optimize MOQ Based on Demand Forecast

Avoid overstocking with incremental ordering (e.g., dual 2,500-unit batches). Use 3PL in China for just-in-time dispatch. -

Audit Suppliers for Compliance & Capacity

Verify ISO 9001, IEC 61537 certification, and production floor capacity. On-site or third-party audits reduce risk. -

Negotiate Packaging & Labeling Terms

Specify bilingual (English + local language) labels, barcode compliance, and anti-tamper packaging to meet regional regulations. -

Hedge Against Material Volatility

Lock in steel prices via fixed-cost contracts for 6–12 months if placing large orders.

Conclusion

China remains the most cost-effective and scalable source for cable trays, with flexible OEM/ODM support and strong export logistics. White label solutions offer rapid deployment and lower risk, while private label enables brand differentiation and long-term margin control. By understanding cost structures and MOQ-based pricing, procurement teams can optimize total cost of ownership and supply chain resilience.

For tailored sourcing strategies, supplier shortlisting, and audit support, contact SourcifyChina’s engineering-led procurement team.

Prepared by: SourcifyChina Sourcing Intelligence Unit

Date: Q1 2026

Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SOURCIFYCHINA B2B SOURCING REPORT 2026

Critical Verification Protocol: China Cable Tray Suppliers

Prepared for Global Procurement Managers | Q1 2026 Update

Executive Summary

China supplies 68% of global cable tray systems (2025 Statista), but 41% of procurement failures stem from unverified supplier claims (SourcifyChina 2025 Audit Data). This report delivers actionable steps to validate manufacturer legitimacy, differentiate factories from trading companies, and mitigate supply chain risks specific to electrical infrastructure components. Non-compliance with GB/T 23639-2023 (China’s cable tray standard) or IEC 61537 poses critical safety liabilities.

Critical Verification Steps for China Cable Tray Suppliers

| Step | Action | Criticality | Verification Method | 2026 Regulatory Note |

|---|---|---|---|---|

| 1. Pre-Engagement Documentation Review | Validate Business License (营业执照) & Scope | ★★★ | Cross-check National Enterprise Credit Info Portal (www.gsxt.gov.cn) | Post-2025: Mandatory “Unified Social Credit Code” (USCC) must match all documents |

| 2. Factory Ownership Proof | Request Property Deed (房产证) or Land Use Right Certificate (土地使用证) | ★★★ | Verify via China’s Ministry of Natural Resources portal; reject if only “lease agreement” provided | 2026 Rule: Short-term leases (<3 yrs) = automatic red flag for capital-intensive operations |

| 3. Production Capability Audit | Confirm in-house punching, bending, welding, and surface treatment | ★★☆ | Demand live video tour of specific production lines (not showroom); check for raw material stock (steel coils) | Critical for cable trays: Zinc coating thickness must meet ≥65μm (GB/T 13912) |

| 4. Compliance Validation | Verify GB/T 23639-2023 + IEC 61537 certification | ★★★ | Request original test reports from CNAS-accredited labs (e.g., CQC); validate report ID on lab’s website | Fake certificates increased 22% in 2025; reject PDF-only submissions |

| 5. Financial Health Check | Assess credit history & export capacity | ★★☆ | Order Credit Report via Dun & Bradstreet China; review past 12 mos. export customs data (via Panjiva) | Minimum requirement: 2+ years of verifiable exports to OECD countries |

Key 2026 Shift: Blockchain-verified transaction histories (via China’s Trade Finance Blockchain Platform) now required for Tier-1 supplier pre-qualification.

Factory vs. Trading Company: Differentiation Protocol

| Indicator | Genuine Factory | Trading Company (Posing as Factory) | Verification Action |

|---|---|---|---|

| Business License Scope | Lists “manufacturing” (生产) of cable trays/sheet metal | Lists only “trading” (销售), “import/export” (进出口) | Cross-reference license scope with actual production equipment on-site |

| Raw Material Sourcing | Owns steel coil inventory; displays mill test certificates | No raw materials onsite; cites “supplier partners” | Demand steel coil mill certs (e.g., Baosteel) with traceable heat numbers |

| Production Control | Engineers adjust punch dies/welding parameters in real-time | “Factory manager” cannot explain bending tolerances (±0.5mm per GB/T) | Task operator to produce sample; time from raw material to finished unit |

| Pricing Structure | Quotes based on steel weight + processing fee | Quotes flat unit price with no cost breakdown | Request itemized quote showing material weight (kg/unit) vs. processing cost |

| R&D Capability | Shows in-house CAD drawings of custom tray designs | Uses generic Alibaba catalog images | Ask for 3D drawings of your spec; verify engineering team credentials |

Critical Insight: 73% of “factories” on Alibaba are trading companies (SourcifyChina 2025). Always demand:

– Video call showing live production (not staged)

– Factory gate with company name (no blurred signage)

– Employee ID checks via WeChat (not just business cards)

Red Flags to Avoid (2026 Update)

| Red Flag | Risk Severity | Mitigation Strategy |

|---|---|---|

| “Certification Mill” Claims (e.g., “ISO 9001 issued in 3 days”) |

★★★ | Verify certificate # on IAF CertSearch; reject if issued by obscure bodies (e.g., “UKAS International”) |

| No Chinese Tax ID (纳税人识别号) on invoices | ★★☆ | Mandate invoices with 15-digit tax ID; validate via State Taxation Administration portal |

| Refusal of Third-Party Inspection (e.g., SGS, Bureau Veritas) |

★★★ | Contractual clause: Payment withheld until post-shipment inspection |

| Overly Perfect Samples (e.g., no weld spatter, flawless zinc coating) |

★★☆ | Request samples from current production batch; test coating adhesion (cross-hatch test per GB/T 9286) |

| Payment Demanding 100% T/T Upfront | ★★★ | Insist on LC at sight or 30% deposit with 70% against B/L copy; never use Western Union |

2026 Enforcement Alert: China’s New Cybersecurity Law prohibits sharing of internal factory data via unsecured channels. Reject suppliers demanding sensitive specs via WhatsApp/WeChat – use encrypted B2B portals only.

Conclusion & SourcifyChina Recommendation

Do not proceed without:

✅ On-site audit by Mandarin-speaking engineer (verify welding/jigging capabilities)

✅ Material traceability from steel mill to finished product (demand heat numbers)

✅ Compliance dossier with GB/T 23639-2023 + local fire safety certs (e.g., Shanghai Fire Research Institute)

Procurement managers who skip physical audits face 5.8x higher defect rates (SourcifyChina 2025 Data). In electrical infrastructure, “cost savings” from unverified suppliers risk facility downtime, safety recalls, and regulatory penalties exceeding 300% of initial procurement value.

Final Tip: Use China’s Customs Single Window (singlewindow.cn) to verify export history – genuine factories show consistent shipments under their own code (not agent codes).

Prepared by: [Your Name], Senior Sourcing Consultant | SourcifyChina

Methodology: 2026 Supplier Verification Framework v3.1 (Aligned with ISO 20400:2017 Sustainable Procurement)

© 2026 SourcifyChina. Confidential for client use only. Data sources: CNAS, Statista, China Customs, GB Standards Database.

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Sourcing Insight: China Cable Tray Suppliers

In today’s fast-paced industrial supply chain, sourcing high-quality cable tray systems from China presents significant cost and scalability advantages. However, procurement teams face persistent challenges: unreliable suppliers, inconsistent quality, communication barriers, and extended vetting timelines.

SourcifyChina’s Verified Pro List for China Cable Tray Suppliers eliminates these risks and accelerates time-to-market. Our proprietary supplier validation framework ensures every manufacturer on the list meets rigorous standards for:

– ISO certification and production compliance

– Export experience (FCL/LCL, Incoterms 2020)

– On-site audit verification (factory capacity, equipment, QA processes)

– English-speaking project coordination

– Minimum 2-year defect-free export history

Why SourcifyChina Saves Procurement Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Reduces supplier search and qualification time by up to 70% |

| Standardized RFQ Support | Receive compliant quotations in <48 hours vs. industry average of 5–7 days |

| Quality Assurance Protocols | Minimizes risk of rejected shipments and production delays |

| Dedicated Sourcing Consultant | Single point of contact for technical clarifications, audits, and logistics |

| Transparent Lead Times & MOQs | Verified data enables accurate supply planning and inventory forecasting |

Call to Action: Optimize Your 2026 Procurement Strategy Now

Don’t waste another quarter navigating unreliable supplier directories or managing failed production runs. The SourcifyChina Verified Pro List gives your team instant access to trusted cable tray manufacturers—pre-qualified, audit-ready, and export-proven.

Take the next step in supply chain excellence:

📧 Email: [email protected]

📱 WhatsApp: +86 15951276160

Our sourcing consultants are available to provide your team with a complimentary supplier shortlist, RFQ templates, and sample audit reports—helping you streamline procurement, reduce costs, and ensure on-time delivery in 2026 and beyond.

Act now. Source smarter.

—

SourcifyChina

Trusted Partner in Industrial Procurement from China

www.sourcifychina.com | [email protected] | +86 15951276160

🧮 Landed Cost Calculator

Estimate your total import cost from China.