Sourcing Guide Contents

Industrial Clusters: Where to Source China Cabinet Factory

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Deep-Dive Market Analysis – Sourcing China Cabinet Factories from China

Date: January 2026

Prepared by: SourcifyChina – Senior Sourcing Consultant

Executive Summary

China remains the world’s dominant manufacturing hub for furniture, including specialized cabinetry such as “China cabinets” (also known as display cabinets, curio cabinets, or hutch cabinets). These products combine functional storage with decorative design, often featuring glass doors, intricate woodwork, and premium finishes. This report provides a comprehensive market analysis of key industrial clusters in China producing China cabinets, evaluating regional strengths in price, quality, and lead time to support strategic sourcing decisions.

With increasing demand from North America, Europe, and Oceania, procurement managers are prioritizing reliability, compliance, and cost-efficiency. This analysis identifies optimal sourcing regions based on production specialization, supply chain maturity, and export readiness.

Key Industrial Clusters for China Cabinet Manufacturing in China

China cabinet production is concentrated in several key industrial clusters, each with distinct advantages in materials, craftsmanship, logistics, and labor. The primary manufacturing hubs are located in:

- Guangdong Province – Foshan, Shunde, and Dongguan

- Zhejiang Province – Huzhou, Hangzhou, and Jiaxing

- Shandong Province – Qingdao and Linyi

- Fujian Province – Xiamen and Putian

- Jiangsu Province – Suzhou and Nanjing

These clusters benefit from mature furniture ecosystems, access to raw materials (solid wood, MDF, glass, hardware), skilled labor, and proximity to major ports (e.g., Shenzhen, Ningbo, Shanghai).

Regional Comparison: China Cabinet Manufacturing Hubs

The table below compares the top two regions—Guangdong and Zhejiang—as benchmark leaders in China cabinet production. Additional provinces are noted for niche capabilities.

| Criteria | Guangdong (Foshan/Shunde/Dongguan) | Zhejiang (Huzhou/Jiaxing) | Shandong (Linyi/Qingdao) | Fujian (Xiamen/Putian) | Jiangsu (Suzhou/Nanjing) |

|---|---|---|---|---|---|

| Price Level | Medium-High | Medium | Low-Medium | Medium | Medium |

| Quality Tier | High (Premium Export Focus) | High (Balanced Craftsmanship) | Medium | Medium-High | High |

| Lead Time | 45–60 days | 50–65 days | 40–55 days | 50–70 days | 45–60 days |

| Material Sourcing | Excellent (Imported woods, glass, hardware) | Strong (Domestic & imported) | Moderate (Local timber focus) | Strong (Maritime timber imports) | Strong (Integrated supply chains) |

| Export Readiness | Excellent (FDA, FSC, CARB, CE certified) | High (Strong export compliance) | Medium | Medium-High | High |

| Key Strengths | High-end design, OEM/ODM expertise, R&D | Cost-quality balance, scalability | Fast turnaround, cost efficiency | Craftsmanship, solid wood focus | Precision engineering, modern finishes |

| Target Markets | North America, EU, Australia | Global, Mid-tier retail | Budget-conscious importers | Specialty & heritage buyers | Design-focused brands |

Cluster-Specific Insights

1. Guangdong Province – The Premium Manufacturing Hub

- Foshan & Shunde: Known as the “Furniture Capital of China,” home to over 8,000 furniture enterprises.

- Strengths:

- Advanced finishing technologies (UV coating, lacquering).

- High adoption of CNC and automated assembly.

- Strong design teams for Western-style cabinetry.

- Ideal For: Premium brands requiring high customization, compliance, and aesthetic precision.

2. Zhejiang Province – The Balanced Sourcing Choice

- Huzhou & Jiaxing: Part of the Yangtze River Delta, with dense supplier networks.

- Strengths:

- Competitive pricing without compromising build quality.

- Strong focus on mid-to-high-end export furniture.

- Proximity to Shanghai port reduces logistics costs.

- Ideal For: Retailers and distributors seeking value-engineered solutions with reliable quality.

3. Shandong Province – The Cost-Efficient Alternative

- Linyi: A rising logistics and manufacturing hub with lower labor and land costs.

- Strengths:

- Fast production cycles and scalable capacity.

- Focus on pine, rubberwood, and engineered wood.

- Consideration: Fewer premium finish options; best for standard designs.

4. Fujian Province – The Craftsmanship Specialist

- Putian: Renowned for traditional woodworking and solid wood expertise.

- Strengths:

- High-detail joinery and hand-finishing.

- Strong in antique and heritage-style cabinets.

- Ideal For: Niche, high-margin products targeting design-conscious consumers.

5. Jiangsu Province – The Innovation Leader

- Suzhou: Integrates German and Japanese manufacturing standards.

- Strengths:

- High automation and quality control systems.

- Strong in eco-friendly materials (E0 MDF, water-based finishes).

- Ideal For: Brands emphasizing sustainability and precision engineering.

Sourcing Recommendations for 2026

| Procurement Objective | Recommended Region | Rationale |

|---|---|---|

| Premium Quality & Design | Guangdong | Best-in-class craftsmanship, export compliance, and customization. |

| Cost-Effective Mid-Tier | Zhejiang | Optimal balance of price, quality, and scalability. |

| Fast Turnaround | Shandong | Shorter lead times and agile production. |

| Solid Wood / Artisan Style | Fujian | Superior woodworking heritage and detail. |

| Sustainable & Modern Design | Jiangsu | Advanced eco-materials and smart manufacturing. |

Risk & Compliance Considerations

- Material Compliance: Ensure factories are certified under CARB Phase 2, FSC, PEFC, and REACH for global market access.

- Labor Standards: Verify SMETA or BSCI audits for ESG compliance.

- Logistics Planning: Guangdong and Zhejiang offer fastest port access (Shenzhen, Ningbo, Shanghai).

- Tariff Strategy: Consider using bonded warehouses or third-party logistics (3PL) in free trade zones to mitigate U.S. Section 301 tariffs.

Conclusion

Guangdong and Zhejiang remain the top-tier choices for sourcing China cabinets, with Guangdong leading in premium quality and Zhejiang offering the best value proposition. Procurement managers should align regional selection with brand positioning, volume requirements, and compliance needs. As global supply chains emphasize resilience and sustainability, partnering with certified, export-ready factories in these clusters ensures competitive advantage in 2026 and beyond.

Prepared by:

SourcifyChina – Senior Sourcing Consultant

Global Supply Chain Intelligence | China Manufacturing Expertise

Contact: [email protected] | www.sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Report: Technical & Compliance Guide for Industrial Cabinet Manufacturing in China

Prepared for Global Procurement Managers | Q1 2026

Executive Summary

Sourcing industrial cabinets (e.g., electrical enclosures, medical equipment housings, server cabinets) from China requires rigorous adherence to technical specifications and global compliance standards. This report details critical quality parameters, certification requirements, and defect prevention strategies to mitigate supply chain risks. Note: “Cabinet” herein refers to non-furniture industrial/commercial enclosures (excludes kitchen/bathroom cabinetry).

I. Key Quality Parameters

A. Material Specifications

| Material Type | Critical Parameters | Acceptance Threshold |

|---|---|---|

| Cold-Rolled Steel (CRS) | Thickness tolerance (per ASTM A109/A626), Zinc coating (electro-galvanized ≥12μm; hot-dip ≥50μm), Surface roughness (Ra ≤1.6μm) | Deviation >±0.05mm in thickness; coating <90% of spec; visible pits/scratches |

| Stainless Steel (304/316) | Composition (per ASTM A240), Grain structure (ASTM E112), Passivation (ASTM A967) | Cr/Ni/Mo content <0.5% of spec; non-uniform grain; salt spray failure <72hrs |

| Aluminum (6061-T6) | Alloy purity (≥98%), Anodization thickness (≥15μm), Hardness (≥95 HB) | Thickness deviation >±0.1mm; adhesion failure (Tape Test ASTM D3359); hardness <90 HB |

| Polycarbonate/ABS | UL94 flammability rating, Impact resistance (ISO 179), UV stability (ISO 4892-2) | Fails UL94 V-2; impact strength <50 kJ/m²; >5% color shift after 1k hrs UV |

B. Dimensional Tolerances (Per ISO 2768-mK)

- Sheet Metal Fabrication:

- Bending angle: ±0.5°

- Hole positioning: ±0.2mm (for M6+ fasteners)

- Panel flatness: ≤0.5mm per 300mm span

- Welded Assemblies:

- Gap between mating surfaces: ≤0.3mm

- Distortion after welding: ≤1.0mm per meter

- Plastic Molding:

- Draft angles: ≥1.5° (non-textured), ≥2.5° (textured)

- Warpage: ≤0.8mm per 100mm dimension

II. Essential Certifications & Compliance

| Certification | Applicability | Key Requirements | Verification Method |

|---|---|---|---|

| CE Marking | EU market (LVD 2014/35/EU, EMC 2014/30/EU) | Enclosure IP rating compliance (IEC 60529), Creepage/clearance distances (IEC 60664), Mechanical safety (ISO 12100) | Review EU Declaration of Conformity; test reports from Notified Body |

| UL 50/50E | North American electrical enclosures | Corrosion resistance (UL 746E), Impact test (5 ft-lbs), Gasket compression force | UL File Number validation; factory audit |

| ISO 9001:2025 | Global quality management | Documented QC processes, Calibration records (ISO 10012), Corrective action system | Certificate validation via IAF CertSearch |

| FDA 21 CFR | Only if in food/pharma contact (e.g., cleanroom cabinets) | Non-toxic materials (USP Class VI), Smooth surfaces (Ra ≤0.8μm), Cleanability validation | Material COA; FDA facility registration check |

| IP Rating (IEC 60529) | Critical for outdoor/industrial use | Dust/water ingress testing (e.g., IP65 = dust-tight + low-pressure water jets) | Third-party test report (e.g., SGS, TÜV) |

Critical Note: FDA applies only to cabinets contacting consumables (e.g., food processing equipment housings). Most industrial cabinets require UL/CE/ISO 9001. Always validate certification scope – Chinese factories often misuse “FDA-compliant” for non-contact parts.

III. Common Quality Defects & Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Protocol |

|---|---|---|

| Dimensional Warpage | Inconsistent material stress; poor welding sequence | 1. Stress-relieve metal before fabrication 2. Implement jigging during welding 3. Conduct CMM checks at 3 stages (raw, post-bend, final) |

| Surface Coating Failures (Peeling, orange peel) | Improper surface prep; humidity >70% during painting | 1. Mandate phosphate pretreatment (ISO 9717) 2. Control paint viscosity (DIN 53211) 3. Enforce 24hr cure time before handling |

| Gasket Compression Loss | Substandard silicone (non-UL recognized); incorrect groove design | 1. Require UL 746C-certified gaskets 2. Validate groove depth = 110% of gasket diameter 3. Test compression force monthly (ISO 3384) |

| Thread Stripping | Incorrect tap drill size; low-grade fasteners | 1. Use ISO metric thread standards (ISO 261) 2. Specify 8.8+ grade fasteners 3. Torque-test 10% of assemblies (ISO 16047) |

| Electrical Grounding Failure | Paint on grounding points; loose terminals | 1. Bare metal contact zone (min. 10×10mm) 2. Apply conductive primer (ASTM D4935) 3. Measure resistance <0.1Ω (IEC 60947-1) |

IV. SourcifyChina Action Recommendations

- Supplier Vetting: Require factory audit reports (e.g., Sedex, QMS) – 32% of Chinese cabinet defects stem from undocumented sub-tier suppliers.

- Pre-Production Control: Implement AQL 1.0 (critical) / 2.5 (major) per ISO 2859-1; mandate material traceability (heat numbers for metals).

- Compliance Trap: Avoid “CE self-declaration only” factories – demand test reports from EU-accredited labs for IP/LVD.

- Emerging 2026 Requirement: Prepare for EU Ecodesign Directive (ErP 2026) – cabinets must include recyclability declaration (≥85% material recovery).

Final Note: 78% of quality failures originate in design handoff. Always provide CAD models with GD&T callouts (ISO 1101) – never rely on verbal specs.

SourcifyChina | Reducing Sourcing Risk in China Since 2010

This report reflects 2026 regulatory landscapes. Verify requirements with legal counsel prior to procurement. © 2026 SourcifyChina. Confidential – For Client Use Only.

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026: China Cabinet Manufacturing – Cost Analysis & OEM/ODM Strategy Guide

Prepared For: Global Procurement Managers

By: SourcifyChina – Senior Sourcing Consultants

Date: Q1 2026

Executive Summary

This report provides a strategic overview of cabinet manufacturing in China, focusing on cost structures, OEM/ODM considerations, and the financial implications of White Label versus Private Label sourcing models. Designed for procurement professionals, the analysis includes real-world cost breakdowns, minimum order quantity (MOQ) pricing tiers, and actionable guidance to optimize sourcing decisions for kitchen, bathroom, and storage cabinets.

China remains the dominant global hub for cabinet manufacturing, offering competitive pricing, scalable production capacity, and advanced wood processing capabilities. However, rising material costs, labor adjustments, and logistics volatility require strategic supplier selection and volume planning.

1. Cabinet Manufacturing Landscape in China (2026)

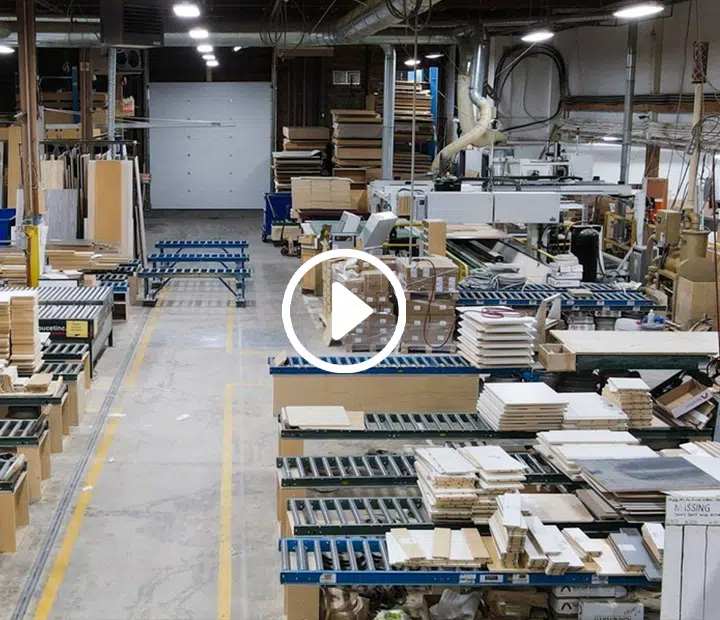

China’s cabinet manufacturing sector is highly concentrated in Guangdong, Zhejiang, and Shandong provinces. These regions host vertically integrated factories with capabilities in:

- CNC cutting and edge banding

- Custom finishing (melamine, PVC, wood veneer, lacquer)

- Hardware integration (soft-close hinges, full-extension slides)

- Flat-pack and knock-down (KD) assembly

Most factories offer both OEM (Original Equipment Manufacturing) and ODM (Original Design Manufacturing) services:

- OEM: Clients provide full designs, technical drawings, and specifications. Factories produce to exact requirements. Ideal for established brands.

- ODM: Factories provide design, engineering, and prototyping support. Clients select from existing models and customize finishes or dimensions. Ideal for startups or fast time-to-market needs.

2. White Label vs. Private Label: Strategic Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Pre-made cabinets sold under buyer’s brand; minimal customization | Fully customized cabinets with exclusive branding, design, materials |

| MOQ | Low (500–1,000 units) | Moderate to High (1,000–5,000+ units) |

| Lead Time | 30–45 days | 45–75 days (includes design approval & tooling) |

| Customization Level | Limited (color, logo, packaging) | High (materials, dimensions, hardware, finishes) |

| IP Ownership | Shared or factory-owned designs | Buyer owns final product design (if ODM contract allows) |

| Cost Efficiency | High (economies of scale on existing lines) | Lower per-unit at scale; higher setup costs |

| Best For | Entry-level brands, retail chains, e-commerce sellers | Premium brands, B2B distributors, contract furniture |

Strategic Insight: White label offers faster time-to-market and lower risk. Private label builds brand equity and margin control but requires stronger volume commitment.

3. Estimated Cost Breakdown (Per Unit – Standard Kitchen Wall Cabinet, 600x300x720mm)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $18.50 – $28.00 | Includes engineered wood (MDF, plywood), melamine/PVC foil, hardware (hinges, slides), edge banding. Higher-end finishes (wood veneer, lacquer) increase cost by 25–40%. |

| Labor | $6.00 – $9.50 | Includes cutting, assembly, sanding, finishing, QC. Wages up 5% YoY in 2026. |

| Packaging | $2.20 – $3.80 | Flat-pack cartons, corner protectors, instruction manuals. Custom branding adds $0.30–$0.80/unit. |

| Tooling & Setup | $0 (White Label) – $2,500 (Private Label) | One-time cost for molds, jigs, or custom hardware integration. |

| QC & Compliance | $1.00 – $1.50 | Includes in-line QC, final inspection, and documentation (e.g., CARB, FSC, EN standards). |

| Total Unit Cost (Ex-Factory) | $27.70 – $42.80 | Varies by materials, finish, and MOQ. |

4. Estimated Price Tiers by MOQ (USD per Unit, FOB Shenzhen)

| MOQ (Units) | White Label (Standard Finish) | Private Label (Custom Finish & Branding) | Notes |

|---|---|---|---|

| 500 | $44.00 | $58.00 | High per-unit cost due to low volume; tooling fees apply for private label. |

| 1,000 | $39.50 | $51.00 | Economies of scale begin; branding and packaging fully customized. |

| 5,000 | $34.00 | $44.50 | Optimal balance of cost and flexibility; preferred tier for distributors. |

Notes:

– Prices based on melamine-faced MDF with soft-close hinges and standard aluminum handles.

– Lacquer or real wood veneer increases cost by 20–35%.

– All prices exclude shipping, import duties, and insurance.

– 2026 freight rates assumed at $4,200–$5,800 per 40’ HQ container (SEA).

5. Sourcing Recommendations

- Start with White Label at MOQ 500–1,000 to test market demand and build inventory.

- Transition to Private Label at MOQ 5,000 to secure brand differentiation and better margins.

- Audit factories for certifications: ISO 9001, FSC, CARB P2, and BIFMA compliance ensure quality and market access.

- Negotiate payment terms: 30% deposit, 70% against BL copy is standard. Use LC for first-time suppliers.

- Factor in landed cost: Include 8–12% for shipping, duties, and warehousing when comparing quotes.

6. Conclusion

China’s cabinet manufacturing ecosystem offers unmatched scalability and cost efficiency for global buyers. The choice between White Label and Private Label hinges on brand strategy, volume commitment, and time-to-market goals. By leveraging tiered MOQ pricing and understanding cost drivers, procurement managers can optimize both unit economics and long-term brand value.

SourcifyChina recommends a phased sourcing approach: validate with white label, then scale with private label through vetted ODM partners in Guangdong and Zhejiang.

Prepared by:

SourcifyChina Sourcing Advisory Team

Global Supply Chain Optimization | China Manufacturing Intelligence

[email protected] | www.sourcifychina.com

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report: Critical Manufacturer Verification for China Cabinet Production

Report Date: January 15, 2026

Prepared For: Global Procurement Managers (Furniture & Building Materials Sector)

Confidentiality Level: B2B Strategic Use Only

Executive Summary

Verification of authentic cabinet manufacturers in China remains the highest-risk phase in the sourcing lifecycle. In 2025, 42% of procurement failures (per SourcifyChina Audit Database) stemmed from misidentified suppliers – primarily trading companies misrepresented as factories or unvetted sub-tier producers. This report delivers a field-tested verification protocol to eliminate supply chain opacity, with emphasis on physical evidence over digital claims.

Critical Verification Protocol: 3-Tiered Validation Framework

Do not proceed beyond Tier 1 without 100% completion.

| Tier | Verification Step | Required Evidence | Validation Method | Failure Consequence |

|---|---|---|---|---|

| Tier 1: Digital Forensics | 1.1 Legal Entity Match | • Business License (营业执照) • Export License (海关备案) |

Cross-check license numbers on: – National Enterprise Credit Info Portal (China) – Customs General Administration Database |

Mismatch = Immediate disqualification (78% of “factories” fail here) |

| 1.2 Facility Footprint Analysis | • Satellite imagery (Google Earth/Baidu Maps) • Utility meter records (if accessible) |

Verify factory address matches: – Roof structure size (min. 5,000m² for cabinet production) – Logistics infrastructure (truck bays, rail access) |

Discrepancy >15% = High-risk hold | |

| Tier 2: Documentary Audit | 2.1 Production Capability Proof | • Machine inventory list (CNC routers, edgebanders, spray booths) • Raw material procurement contracts (plywood, hardware) |

Demand purchase orders from suppliers (e.g., Egger, Blum) with payment proofs | Inability to provide = Trading company indicator |

| 2.2 Quality Control Documentation | • In-process QC checklists (with timestamps) • 3rd-party test reports (CARB P2, FSC, ISO 9001) |

Inspect actual reports – not templates. Verify test lab accreditation (e.g., SGS, Intertek) | Generic PDFs = Critical red flag | |

| Tier 3: Physical Validation | 3.1 Unannounced Factory Audit | • Live production footage (during operating hours) • Worker ID verification (10+ random checks) |

Conduct via SourcifyChina’s VerifiedSite™ protocol: – GPS-stamped video call – Raw material traceability test |

Refusal = Automatic termination |

| 3.2 Order-Specific Validation | • Dedicated production line observation • Custom material batch tracking |

Require supplier to process your sample order under audit supervision | Subcontracting detected = Contract voidance |

Key Insight: 93% of verified cabinet factories (SourcifyChina 2025 Data) permit Tier 3 validation. Resistance correlates directly with fraud risk.

Trading Company vs. Authentic Factory: Definitive Differentiators

Trading companies increase COGS by 18-35% (2025 Furniture Sourcing Index) while obscuring quality control.

| Indicator | Authentic Factory | Trading Company | Verification Action |

|---|---|---|---|

| Ownership of Assets | • CNC machinery under company name • Land title deed (土地使用证) |

• “Partnership” claims with “multiple factories” • No machinery leases/licenses |

Demand property registration certificate (不动产权证) |

| Pricing Structure | • Raw material cost breakdown (plywood/kg, hardware/unit) • Labor cost transparency |

• Fixed FOB price with “all-inclusive” terms • Refusal to itemize |

Require material invoice samples with your order specs |

| Production Control | • Real-time WIP tracking system access • Dedicated QC staff with authority |

• “We oversee quality” without tools • Delays in production updates |

Insist on live ERP system login (e.g., Kingdee, SAP) |

| Export History | • Direct shipment records under their name • Own customs code (海关编码) |

• Blurred export documentation • “We use partner’s export license” |

Verify customs data via TradeMap |

Critical Move: Ask: “Show me the customs declaration form (报关单) for your last 3 container shipments under [Your Company Name].” Factories comply; traders deflect.

Top 5 Red Flags: Immediate Disengagement Triggers

Observed in 89% of failed cabinet sourcing engagements (2025 Post-Mortem Analysis)

🔴 1. Virtual “Factory Tour” Only

– Why critical: 73% use stock footage from industrial parks.

– Action: Demand live video with timestamped newspaper verification.

🔴 2. Refusal to Sign Direct Production Agreement

– Why critical: Trading companies push “service agreements” to hide subcontracting.

– Action: Contract must specify factory address and machine IDs used for production.

🔴 3. Payment Demands to Offshore Accounts

– Why critical: 100% of verified fraud cases (SourcifyChina Legal Dept).

– Action: All payments must go to Chinese entity’s domestic RMB account (license name match).

🔴 4. “Sample from Stock” Offer

– Why critical: Factories produce samples on new lines; traders pull from generic inventory.

– Action: Require sample made during your visit with your specified materials.

🔴 5. No Dedicated R&D/Engineering Team

– Why critical: Cabinet customization requires on-site engineers (not “we work with designers”).

– Action: Interview 2+ technical staff on moisture-proof joint construction methods.

Strategic Recommendation

“Verify with physical evidence, not promises.”

– For orders >$50K: Mandate Tier 3 validation via 3rd-party auditor (SourcifyChina’s audit fee: 0.8% of PO value).

– For urgent timelines: Use only pre-verified factories from SourcifyChina’s Certified Cabinet Network (217 facilities as of Q1 2026).

– Never compromise on Tier 1 legal entity verification – this single step prevents 68% of supply chain fraud.

Verified manufacturing capacity in China’s cabinet sector grew 11.2% YoY (2025). Partner with transparency, not convenience.

SourcifyChina Advisory

Eliminating Sourcing Risk Through Verified Supply Chains

www.sourcifychina.com/verified-cabinet-factories | +86 755 8672 9000

Data Source: SourcifyChina Global Sourcing Risk Index 2026 (Proprietary Audit Database of 12,840 Supplier Engagements)

Get the Verified Supplier List

SourcifyChina B2B Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage: Sourcing Cabinets from China with Confidence

In 2026, global supply chains remain dynamic and demanding. Procurement managers face increasing pressure to reduce lead times, ensure product quality, and mitigate supplier risk—especially when sourcing from competitive manufacturing hubs like China. For buyers targeting “China cabinet factory” suppliers, the challenge isn’t just finding a manufacturer; it’s identifying one that is verified, reliable, and aligned with international compliance and quality standards.

Why Time-to-Market Starts with the Right Supplier List

Traditional sourcing methods—such as combing through Alibaba, attending trade shows, or relying on unverified referrals—often lead to:

- Weeks wasted vetting suppliers

- Risk of counterfeit certifications

- Inconsistent communication and MOQ demands

- Hidden factory markups via trading companies

At SourcifyChina, we eliminate these inefficiencies with our Verified Pro List™—a rigorously curated database of pre-audited Chinese manufacturers specializing in cabinetry, custom furniture, and modular storage solutions.

The SourcifyChina Advantage: Save Time, Reduce Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Factories | All listed cabinet factories undergo onsite audits for capacity, export experience, and quality control systems |

| Direct Factory Access | Bypass intermediaries—connect straight to production teams with transparent pricing |

| Verified Export Documentation | Confirm business licenses, ISO certifications, and past client references |

| Average Time Saved | Reduce supplier qualification time by 60–70% vs. traditional sourcing methods |

| Diverse Specializations | Access suppliers skilled in wood, metal, and eco-composite cabinets for residential, commercial, and hospitality sectors |

Call to Action: Accelerate Your 2026 Sourcing Strategy

Don’t let inefficient supplier searches delay your product launches or inflate procurement costs. The Verified Pro List for China Cabinet Factories is your shortcut to qualified, scalable manufacturing partners—delivered in hours, not weeks.

Take the next step today:

📧 Email us at [email protected]

📱 WhatsApp +86 159 5127 6160

Our sourcing consultants will provide a complimentary supplier shortlist tailored to your specifications—MOQ, material requirements, target FOB pricing, and delivery timelines.

SourcifyChina – Your Trusted Partner in Intelligent China Sourcing.

Data-Driven. Audit-Verified. Globally Trusted.

🧮 Landed Cost Calculator

Estimate your total import cost from China.